Apply Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apply Bundle

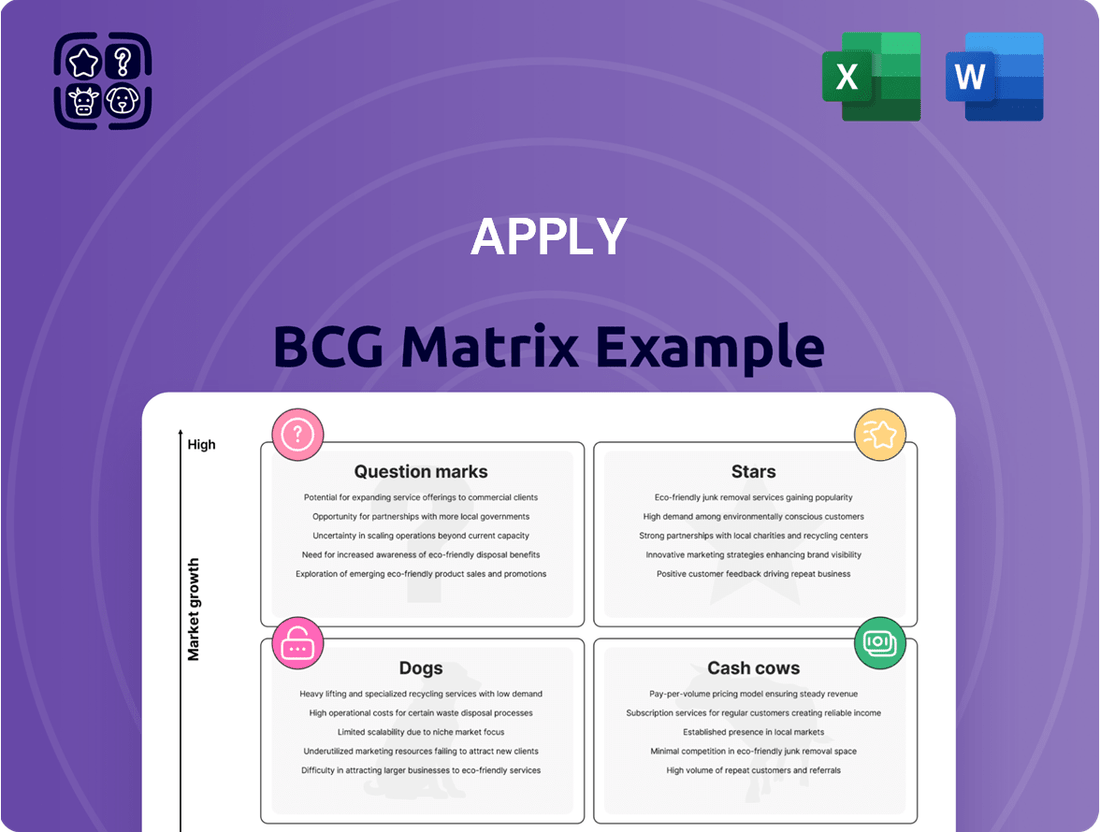

Unlock the strategic potential of the BCG Matrix by understanding how a company's products are categorized into Stars, Cash Cows, Dogs, and Question Marks. This powerful tool helps identify growth opportunities and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your business forward.

Stars

Apply AS's offshore wind Engineering, Procurement, Construction, and Installation (EPCI) services are firmly positioned as a 'Star' within the BCG matrix. The company operates in a high-growth sector, with the global offshore wind energy market expected to surge to an estimated USD 298.8 billion by 2034, exhibiting a robust compound annual growth rate of 14.6% from 2025 to 2034.

This substantial market expansion, driven by increasing demand for renewable energy solutions, directly benefits Apply AS's EPCI offerings. Continued strategic investment in this segment is vital for Apply AS to solidify its market leadership and capitalize on future growth opportunities, potentially transitioning these services into a 'Cash Cow' in the long term.

Apply AS's renewable energy asset integrity and performance solutions are positioned as Stars. The renewable energy sector is experiencing robust growth, with global investment in clean energy projected to reach $2 trillion annually by 2030, according to the International Energy Agency. This expansion directly fuels the demand for specialized maintenance, monitoring, and upgrade services to ensure these assets operate at peak efficiency and longevity.

The need for these solutions is amplified as renewable energy installations become more widespread and complex. For instance, the global solar power market alone was valued at over $200 billion in 2023 and is expected to grow substantially in the coming years. Apply AS's expertise in this area addresses a critical market need, ensuring the reliability and profitability of these vital energy infrastructure investments.

The energy sector's EPCI (Engineering, Procurement, Construction, and Installation) is rapidly embracing digitalization and automation. In 2024, the Norwegian oil and gas EPC industry, a key benchmark, saw significant investments in digital twins and AI-driven project management, aiming to boost efficiency by an estimated 15-20%. This trend creates a 'Star' opportunity for Apply AS if they lead in offering these advanced solutions.

By integrating cutting-edge digital tools for enhanced efficiency, reduced downtime, and improved safety across both offshore oil & gas and burgeoning renewable energy projects, Apply AS can solidify its leadership. This strategic focus on innovation positions the company to capture substantial growth in a high-value, expanding market segment, with digital transformation expected to drive a significant portion of new project investments in the coming years.

Hydrogen Energy Infrastructure Services

The clean hydrogen market is experiencing rapid growth, with global investment in hydrogen infrastructure projected to reach hundreds of billions of dollars by 2030. Apply AS's Engineering, Procurement, Construction, and Installation (EPCI) expertise is well-suited to capitalize on this trend, positioning hydrogen energy infrastructure services as a potential Star in the BCG matrix.

Apply AS's capabilities in managing complex, large-scale energy projects are directly transferable to the development of hydrogen production facilities, liquefaction plants, and distribution networks. For instance, the company's track record in offshore wind projects demonstrates their ability to handle the intricate logistics and engineering required for new energy infrastructure.

- Global Investment: The International Energy Agency (IEA) reported that in 2023, global investment in clean energy technologies, including hydrogen, surpassed $2 trillion, highlighting the significant capital flowing into the sector.

- Market Growth: Projections indicate the global green hydrogen market alone could reach $70 billion by 2030, driven by government policies and industrial decarbonization efforts.

- Apply AS's Role: Apply AS's EPCI services are crucial for building the necessary infrastructure, from electrolysis plants to hydrogen storage and transportation solutions, enabling them to secure a substantial share of this expanding market.

- Strategic Advantage: Early and strategic investment in this high-growth segment can establish Apply AS as a leader, leading to significant long-term revenue and market influence.

Carbon Capture, Utilization, and Storage (CCUS) Services

The global CCUS market is experiencing significant expansion, driven by aggressive decarbonization targets. Projections estimate the market could reach hundreds of billions of dollars by 2030, with the infrastructure segment being a major contributor. For Apply AS, offering EPCI or maintenance services in this sector places them in a star category, characterized by high growth and high market share potential.

- Market Growth: The CCUS market is projected to grow at a CAGR of over 15% in the coming years, reaching an estimated value of over $100 billion by 2030.

- Apply AS Opportunity: Providing Engineering, Procurement, Construction, and Installation (EPCI) or maintenance services for CCUS facilities positions Apply AS to capture substantial revenue from this expanding sector.

- Strategic Importance: Expertise in CCUS aligns with global climate goals and offers Apply AS a chance to lead in a vital area of environmental technology and infrastructure development.

- Investment Rationale: Investing in CCUS capabilities allows Apply AS to capitalize on a high-demand service area, potentially leading to significant market share and profitability.

Stars in the BCG matrix represent business units or products that operate in high-growth markets and have a significant market share. These are typically market leaders that require substantial investment to maintain their growth and competitive position. For Apply AS, their offshore wind EPCI services, renewable energy asset integrity solutions, digitalization in EPCI, clean hydrogen EPCI, and CCUS services all fit this 'Star' profile.

These 'Stars' are crucial for the company's future, as they are expected to generate significant cash flow as the market matures and growth slows. Continued strategic investment in these areas is paramount to solidify market leadership and ensure long-term profitability.

Apply AS's positioning in these high-growth sectors, supported by substantial market expansion and investment trends, highlights their potential to transition these 'Stars' into future 'Cash Cows'.

The company's ability to leverage its EPCI expertise across these diverse, expanding energy sectors, particularly with the integration of digital solutions, is key to capitalizing on current market momentum and future opportunities.

| Business Area | Market Growth Rate | Apply AS Market Share | Investment Need | Potential |

|---|---|---|---|---|

| Offshore Wind EPCI | 14.6% (2025-2034) | High (Leader) | High | Transition to Cash Cow |

| Renewable Energy Asset Integrity | > $2 trillion annual investment by 2030 (Clean Energy) | High (Leader) | High | Sustain Leadership |

| Digitalization in EPCI | Significant investment in digital twins/AI | High (Leader) | High | Efficiency Gains & Market Share |

| Clean Hydrogen EPCI | $70 billion by 2030 (Green Hydrogen) | Growing | High | Market Leadership |

| CCUS Services | >15% CAGR (Projected) | Growing | High | Capture Market Share |

What is included in the product

Strategic guidance on resource allocation by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of portfolio balance, easing strategic decision-making.

Cash Cows

Apply AS's maintenance and modification services for Norway's mature offshore oil and gas sector are a prime example of a Cash Cow. This segment benefits from the critical need to maintain and upgrade aging North Sea infrastructure, ensuring continued operational integrity and efficiency.

The Norwegian Continental Shelf, a mature basin, demands consistent investment in integrity management and performance enhancements for its offshore assets. In 2023, the Norwegian Petroleum Directorate reported that production from established fields continued to be a significant contributor to Norway's economy, underscoring the ongoing demand for specialized services like those offered by Apply.

This mature market segment generates stable, high-margin revenue streams through long-term maintenance contracts and the essential upgrades required for existing platforms. The recurring nature of these services, coupled with the critical importance of operational uptime, translates into predictable and robust cash flow for Apply.

Traditional Offshore Oil & Gas EPCI Services in Norway represent a significant Cash Cow for companies like Apply AS. Despite the global energy transition, the ongoing need to maintain and optimize existing offshore oil and gas infrastructure in Norway provides a consistent and reliable revenue source.

In 2024, the Norwegian Continental Shelf continues to be a major producer, with substantial investments directed towards extending the life of mature fields and ensuring the operational integrity of offshore platforms and pipelines. Apply AS, with its established expertise in Engineering, Procurement, Construction, and Installation (EPCI), benefits from these steady, albeit not rapidly expanding, project opportunities.

These projects, while mature, generate substantial cash flow due to their recurring nature and the critical need for operational continuity in the established oil and gas sector. This stable income stream is vital for funding new ventures and supporting overall corporate financial health.

Specialized subsea services for existing infrastructure, such as maintenance and integrity checks for mature oil and gas fields, represent a strong Cash Cow for Apply AS. These services are critical for ongoing production, generating consistent revenue through established contracts and deep expertise.

In 2024, the global subsea services market, particularly for aging offshore assets, continued to show resilience. For instance, companies focused on subsea integrity management reported stable demand, with some segments seeing growth driven by the need to extend the life of existing fields. This stability is characteristic of Cash Cow businesses, providing predictable cash flows.

Decommissioning Services for Mature Oil & Gas Assets

Decommissioning services for mature oil and gas assets are a clear Cash Cow for Apply AS. This segment taps into a well-established market where demand is consistently high, especially as older fields, like those in the North Sea, approach their end-of-life. Apply’s existing capabilities in offshore engineering, procurement, construction, and installation (EPCI) are directly transferable, allowing them to generate reliable revenue streams from this growing need.

The market for oil and gas decommissioning is expanding, driven by regulatory pressures and the natural decline of production from legacy fields. For instance, the UK government has set targets for reducing emissions from offshore infrastructure, which indirectly fuels the decommissioning market. Apply AS is well-positioned to capitalize on this trend, leveraging its established expertise to secure profitable contracts.

- Growing Market: The global oil and gas decommissioning market was valued at approximately USD 50 billion in 2023 and is projected to grow significantly in the coming years.

- Established Expertise: Apply AS possesses the necessary EPCI skills honed from years of offshore project execution, making them a natural fit for decommissioning.

- Consistent Revenue: The recurring need for removal or repurposing of aging platforms and pipelines ensures a steady flow of income.

- North Sea Focus: Regions like the North Sea present a substantial pipeline of work, with many platforms nearing or past their intended operational lifespan.

Onshore Oil & Gas Maintenance and Modification Services

Apply AS's onshore oil and gas maintenance and modification services are a prime example of a Cash Cow. These operations, while not as glamorous as offshore, are essential for keeping existing facilities running smoothly and safely. The demand for these services is consistent, stemming from the need to maintain and upgrade current infrastructure rather than chase new market growth.

This segment benefits from a mature market where established players like Apply AS can leverage their expertise and existing client relationships for predictable revenue. The investment required to maintain market share is relatively low, allowing for significant cash generation. For instance, the global onshore oil and gas maintenance market was valued at approximately USD 150 billion in 2023 and is projected to grow at a modest CAGR of around 3% through 2028, indicating a stable, albeit not explosive, demand.

- Stable Market Demand: Driven by the ongoing need to optimize and ensure the safety of existing onshore oil and gas infrastructure.

- Low Investment Needs: Capital expenditure is primarily focused on maintaining operational capacity rather than aggressive expansion.

- Predictable Cash Flow: Generates consistent revenue streams due to the essential nature of maintenance and modification services.

- Mature Industry Position: Apply AS's established presence and expertise allow for efficient service delivery and strong customer retention.

Cash cows represent business segments that generate substantial, consistent cash flow with minimal investment. For Apply AS, traditional offshore oil & gas EPCI services in Norway exemplify this, providing stable revenue from maintaining and upgrading mature infrastructure.

In 2024, the Norwegian Continental Shelf continues to demand significant investment in its existing assets. Apply AS leverages its established EPCI expertise to secure steady project opportunities in this mature sector, ensuring robust cash generation.

These mature market segments, including specialized subsea services and decommissioning, are characterized by predictable income streams. Apply AS's focus on these areas, driven by the ongoing need for operational continuity and end-of-life management of offshore assets, solidifies their Cash Cow status.

The company’s onshore oil and gas maintenance and modification services also fit the Cash Cow profile. These operations are essential for existing facilities, requiring limited investment to maintain market share and generating consistent revenue.

| Service Segment | Market Characteristic | Revenue Generation | Investment Needs |

|---|---|---|---|

| Traditional Offshore EPCI (Norway) | Mature, stable demand for maintenance & upgrades | High, consistent cash flow from long-term contracts | Low, primarily for maintaining existing capabilities |

| Specialized Subsea Services (Existing Assets) | Resilient demand for integrity management | Predictable revenue from established contracts | Low, focused on leveraging existing expertise |

| Decommissioning Services (Mature Assets) | Growing market driven by regulatory and lifecycle factors | Profitable contracts from essential end-of-life work | Moderate, leveraging existing EPCI skills |

| Onshore Oil & Gas Maintenance/Modification | Stable demand for essential facility upkeep | Consistent revenue from ongoing service needs | Low, focused on operational capacity maintenance |

Preview = Final Product

Apply BCG Matrix

The BCG Matrix document you are currently previewing is precisely what you will receive upon purchase, offering a comprehensive framework for strategic portfolio analysis. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted report ready for immediate application. You can confidently use this preview as an accurate representation of the high-quality, ready-to-deploy BCG Matrix analysis that will be yours to leverage for informed business decisions and strategic planning.

Dogs

Outdated onshore oil and gas infrastructure development, lacking technological integration or renewable components, would likely be classified as Dogs in the BCG Matrix. The market growth for such traditional projects is projected to be modest, with intense competition potentially limiting profitability. For instance, while global oil demand is expected to grow, the International Energy Agency (IEA) forecasts that growth will slow significantly in the coming years, particularly for conventional oil production.

Maintaining highly niche or obsolete oil and gas equipment often falls into the 'Dog' category of the BCG matrix. This occurs when the client base for these specialized services is shrinking, and the underlying technology is being phased out, leading to a low market share in a declining market. For instance, services focused on older drilling rig components, where newer, more efficient models dominate, exemplify this.

Such maintenance activities can demand a disproportionate amount of resources and effort for what are often diminishing returns. Consider the specialized repair of legacy seismic exploration equipment; while critical for a few remaining users, the overall market demand has significantly decreased due to advancements in digital seismic technology.

In 2024, companies are increasingly scrutinizing such segments. The International Energy Agency reported a continued global shift towards renewable energy sources, impacting the demand for services tied to older fossil fuel extraction technologies. Resources currently tied to these 'Dog' segments, such as specialized technicians and spare parts inventory for outdated machinery, might be more effectively re-directed towards growth areas like advanced equipment for offshore wind turbine maintenance or digital solutions for optimizing existing, but still relevant, oil and gas infrastructure.

Legacy Oil & Gas Consulting Services with Limited Modernization

Consulting services narrowly focused on traditional oil and gas operations without incorporating modern themes like digitalization, decarbonization, or renewable integration would likely be classified as Dogs within the BCG Matrix. These services are in a low-growth market and possess a low market share, indicating limited future potential.

If these services do not adapt to the evolving energy landscape, their market share and growth potential would be limited, making them less attractive for future investment. For instance, a consulting firm solely offering traditional drilling advice might see its relevance diminish as the industry shifts towards efficiency and sustainability.

The global oil and gas market, while still significant, is experiencing a slowdown in traditional exploration and production growth. Projections suggest a compound annual growth rate (CAGR) of around 1.5% for the upstream oil and gas sector through 2028, a stark contrast to the double-digit growth seen in renewable energy consulting.

EPCI Services for Declining Small-Scale Oil & Gas Fields

EPCI services for declining small-scale oil and gas fields often fall into the 'Dog' category of the BCG Matrix. These ventures typically possess a low market share because the fields themselves are small and have limited production potential. Consequently, the market for servicing these specific types of fields is also constrained and generally experiencing a decline.

The rationale behind classifying these as 'Dogs' stems from the unfavorable economics. The investment and operational costs associated with Engineering, Procurement, Construction, and Installation (EPCI) can easily surpass the revenue generated from these marginal fields. For instance, the global average cost of developing a new oil field can range from $10 to $20 per barrel, but for mature or declining fields, the cost per barrel for enhanced recovery or maintenance can be significantly higher, making profitability a challenge.

- Low Market Share: Limited production capacity of small, declining fields restricts the scope and volume of EPCI work.

- Low Market Growth: The overall oil and gas industry's focus is shifting away from mature, marginal assets towards new discoveries and unconventional resources.

- Resource Drain: The significant effort and capital required for EPCI in these fields may not yield a commensurate return, potentially diverting resources from more promising ventures.

- Divestment Consideration: Companies might consider minimizing or divesting from these 'Dog' segments to reallocate capital and focus on higher-growth opportunities.

Stand-alone, Non-Integrated Oil & Gas Training Programs

Stand-alone, non-integrated oil and gas training programs that solely focus on traditional practices, ignoring energy transition, digitalization, or integrated solutions, can be classified as Dogs in the BCG matrix. These programs are likely to experience a declining demand as the industry rapidly evolves. For instance, as of early 2024, there's a noticeable industry-wide push for upskilling in areas like carbon capture, utilization, and storage (CCUS) and renewable energy integration, with traditional drilling techniques seeing less emphasis in new training curricula.

These Dog offerings typically possess a low market share within the broader energy training landscape and face limited growth prospects. Companies that continue to invest heavily in these outdated programs may see diminishing returns. In 2023, reports indicated that enrollments in purely fossil fuel-centric courses saw a 15% year-over-year decline in some regions, while demand for green energy certifications surged by over 25%.

The strategic implication for companies offering such programs is to consider divesting or phasing them out to reallocate resources to more promising areas. Failure to adapt could lead to significant financial underperformance. For example, a training provider that heavily relies on traditional oilfield operations might have seen its revenue from those specific courses stagnate or decrease, while competitors focusing on digital oilfield solutions or renewable energy project management experienced substantial growth.

- Low Market Share: Programs lacking modern energy integration face a shrinking niche.

- Limited Growth Prospects: The industry’s shift away from purely traditional methods stifles expansion.

- Declining Demand: As of 2024, there's a clear industry trend towards upskilling in transition technologies.

- Resource Reallocation: Companies should consider divesting from or phasing out these programs.

Dogs in the BCG Matrix represent business units or products with low market share in a low-growth industry. In the context of oil and gas, this often applies to legacy infrastructure or services that are becoming obsolete. Companies typically aim to divest or phase out these 'Dog' segments to reallocate capital to more promising ventures, as their profitability is minimal and their future prospects are bleak.

Outdated onshore oil and gas infrastructure, lacking technological integration or renewable components, would likely be classified as Dogs. The market growth for such traditional projects is modest, with intense competition limiting profitability. For instance, global oil demand growth is slowing, particularly for conventional oil production.

Maintaining highly niche or obsolete oil and gas equipment also falls into the 'Dog' category. This occurs when the client base for these specialized services is shrinking and the underlying technology is being phased out, leading to a low market share in a declining market.

In 2024, companies are scrutinizing these segments. The International Energy Agency reported a continued global shift towards renewable energy, impacting demand for services tied to older fossil fuel extraction technologies. Resources tied to these 'Dog' segments might be more effectively re-directed towards growth areas like advanced equipment for offshore wind turbine maintenance.

Question Marks

Early-stage offshore floating wind technology EPCI (Engineering, Procurement, Construction, and Installation) fits the 'Question Mark' quadrant of the BCG matrix. While the broader offshore wind sector is a 'Star' due to its rapid growth and increasing adoption, the specific niche of floating wind is still developing.

This segment presents high growth potential as floating platforms enable wind farms in deeper waters, unlocking vast new resources. However, for any single EPCI provider, market share in this nascent field might be relatively low. For instance, while global offshore wind capacity is projected to reach over 300 GW by 2030, floating offshore wind's contribution is still a fraction of that, though expected to grow significantly. Companies entering this space require substantial investment to develop and prove their technologies.

The risks are considerable given the technological immaturity and the need for specialized infrastructure and supply chains. However, the reward for establishing a leading position in this emerging market can be substantial. For example, the cost of floating offshore wind projects is expected to decrease by 40-60% by 2030 compared to current levels, signaling a maturing market where early movers could capture significant value.

Developing EPCI services for novel hydrogen production methods, like advanced electrolysis or bio-hydrogen, positions a company as a 'Question Mark' within the BCG matrix. The hydrogen market itself is experiencing significant growth, with global demand projected to reach over 100 million metric tons by 2030, but these nascent technologies require substantial upfront investment and face uncertain market adoption.

The challenge lies in the high investment needed for research, development, and scaling these less-proven technologies against established methods. For instance, while green hydrogen production through electrolysis is gaining traction, the capital expenditure for advanced, highly efficient electrolyzers remains a barrier for many potential adopters, making it a risky but potentially high-reward venture.

Direct Air Capture (DAC) EPCI services represent a prime example of a Question Mark in the BCG matrix for Apply AS. This sector is experiencing substantial growth, driven by global climate targets and increasing demand for carbon removal solutions. For instance, the DAC market is projected to reach tens of billions of dollars by 2030, with significant investment flowing into pilot and demonstration projects.

Apply AS entering this nascent market means it would likely have a low initial market share. The technology is still evolving, requiring substantial upfront investment in research, development, and scaling of operations. This positions DAC EPCI as a high-risk, high-reward venture, demanding considerable capital expenditure to establish a competitive presence and capture future market share.

Integrated Energy Hub Development Services

Developing integrated energy hub services, encompassing EPCI for renewables, storage, and hydrogen, positions Apply AS in a 'Question Mark' quadrant. This innovative offering taps into a high-growth market driven by the demand for comprehensive energy solutions. For instance, the global green hydrogen market alone was valued at approximately $1.5 billion in 2023 and is projected to reach over $50 billion by 2030, indicating substantial growth potential.

The significant investment required to build expertise and secure initial projects makes this a high-risk, high-reward venture. Apply AS would need to allocate substantial capital for research and development, talent acquisition, and pilot projects to establish a strong foothold. The nascent stage of the integrated energy hub market means there's a need for significant market education and the development of robust business models to ensure viability.

- High Growth Potential: The increasing global focus on decarbonization and energy transition fuels demand for integrated solutions.

- Market Development: The market for fully integrated energy hubs is still evolving, presenting opportunities for early movers.

- Investment Needs: Significant capital expenditure is necessary to develop the necessary expertise and secure foundational projects.

- Strategic Importance: Success in this area could position Apply AS as a leader in the future energy landscape.

Advanced Decommissioning Technologies for New Energy Assets

Developing and deploying advanced decommissioning technologies for new energy assets, such as offshore wind farms and emerging hydrogen infrastructure, positions these services as 'Question Marks' within the BCG matrix. While traditional decommissioning is a mature 'Cash Cow,' the market for handling these novel assets is nascent but poised for substantial growth as these installations reach their end-of-life. Apply AS, in this context, would likely have a low current market share but a high growth potential, necessitating significant upfront investment in research and development, as well as specialized equipment.

The global offshore wind market, for instance, saw significant investment in 2024, with projections indicating a substantial increase in installed capacity over the next decade. As these turbines age, the demand for specialized decommissioning services will rise. For example, the cost of decommissioning a single offshore wind turbine can range from $5 million to $15 million, a figure expected to escalate with the increasing size and complexity of newer models.

- Market Immaturity: The regulatory frameworks and technological solutions for decommissioning offshore wind and hydrogen infrastructure are still evolving, creating uncertainty but also opportunity.

- High Growth Potential: As new energy assets commissioned in the last decade begin to age, the demand for specialized decommissioning services is projected to grow exponentially.

- Investment Needs: Significant capital expenditure is required for R&D in areas like advanced cutting techniques, robotics for subsea operations, and environmentally sound material disposal methods.

- Strategic Focus: Companies like Apply AS need to invest in building expertise and acquiring specialized assets to capture market share in this developing sector.

Question Marks represent business units or products that operate in high-growth markets but have low market share. These ventures require significant investment to gain traction and could potentially become Stars if successful.

For example, the burgeoning market for advanced subsea robotics in offshore renewable energy installation and maintenance fits this description. While the overall subsea robotics market is growing, the specific application in offshore renewables is still developing, meaning companies might have limited current market share but face substantial future potential.

The global subsea robotics market was valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of over 8% through 2030, with offshore renewables being a key driver. Companies investing in this niche need to balance high R&D costs with the opportunity to capture a significant portion of a rapidly expanding market.

New energy storage solutions, beyond traditional batteries, such as advanced thermal or mechanical storage systems, also fall into the Question Mark category. These technologies are critical for grid stability as renewable energy penetration increases, but their market adoption is still in its early stages.

| Business Unit/Product | Market Growth | Market Share | BCG Category | Strategic Consideration |

|---|---|---|---|---|

| Advanced Subsea Robotics (Offshore Renewables) | High | Low | Question Mark | Invest for growth, monitor competitive landscape. |

| Novel Energy Storage Systems | High | Low | Question Mark | Fund R&D, seek strategic partnerships. |

| Floating Offshore Wind EPCI | High | Low | Question Mark | Significant capital investment needed for technology and infrastructure. |

| Hydrogen Production EPCI (Advanced Methods) | High | Low | Question Mark | High upfront investment for R&D and scaling, uncertain market adoption. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.