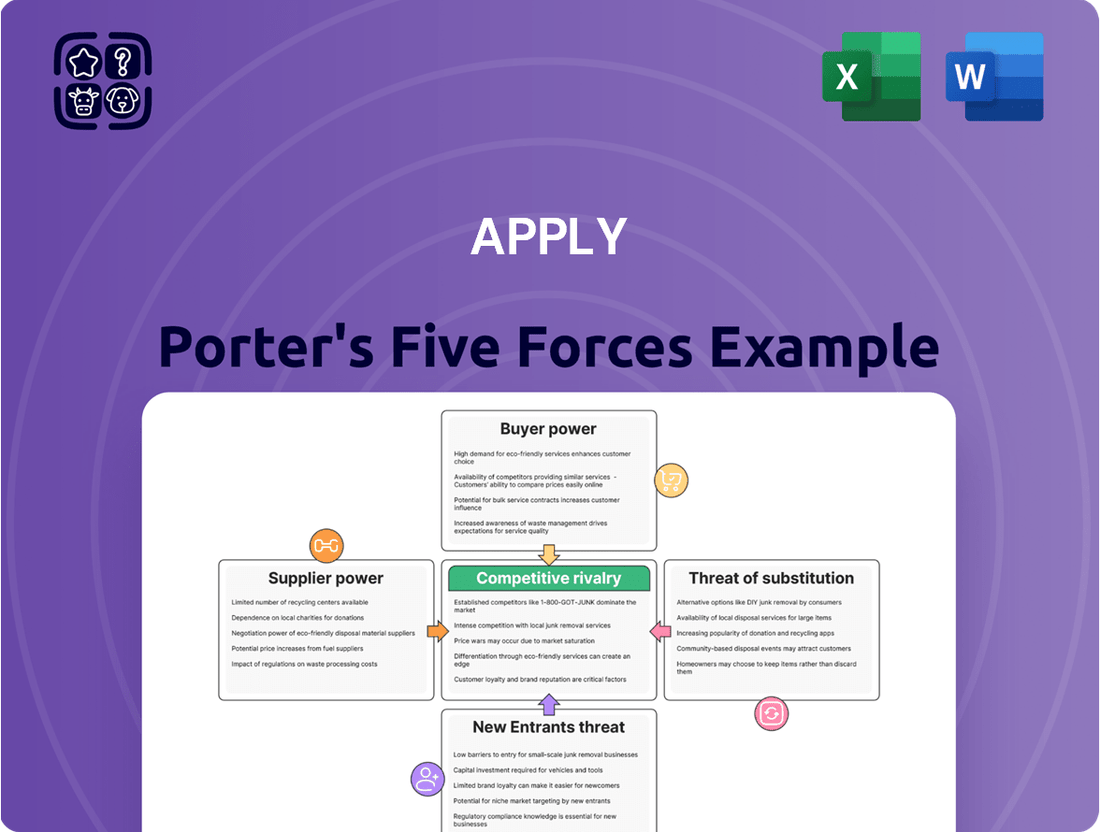

Apply Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apply Bundle

Understanding the competitive landscape is crucial for any business, and Apply is no exception. Our analysis delves into the five key forces that shape its industry, revealing the underlying dynamics of competition.

The complete report reveals the real forces shaping Apply’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Apply AS, operating in the energy sector's EPCI and M&M services, frequently encounters a limited number of suppliers for highly specialized equipment and materials. This scarcity, especially for intricate offshore and renewable energy projects, can significantly bolster supplier bargaining power.

When few suppliers can meet the demanding technical specifications, Apply AS faces fewer alternatives. For instance, in 2024, the global market for subsea umbilical systems, critical for offshore projects, saw consolidation, with only a handful of major manufacturers. This limited competition directly translates to greater leverage for these specialized suppliers, potentially impacting project costs and contract terms for Apply AS.

Suppliers of critical raw materials, like specialized metals for battery production, or advanced technologies for renewable energy projects, can hold substantial sway. For instance, the price of lithium, a key component in electric vehicle batteries, saw significant volatility in 2023, with prices fluctuating by over 30% throughout the year, directly impacting the manufacturing costs of companies like Apply AS.

These fluctuations in global commodity prices, or even rapid advancements in technologies controlled by a few key suppliers, can directly affect Apply AS's project expenses and overall profitability. In 2024, the cost of polysilicon, a vital material for solar panel manufacturing, remained a key concern, with prices experiencing a 15% increase in the first half of the year due to supply chain constraints.

If Apply AS faces significant costs when switching from one supplier to another, such as the expense of retooling manufacturing equipment or the time and resources needed for personnel retraining, then the current suppliers hold more bargaining power. These substantial switching costs can effectively lock Apply AS into existing relationships, even when more attractive pricing or terms might be available elsewhere.

Supplier Concentration and Differentiation

The concentration of suppliers in the energy Engineering, Procurement, Construction, and Installation (EPCI) market significantly influences their leverage. When a limited number of large suppliers control essential components or specialized services, they gain considerable power to negotiate terms, potentially impacting project costs for companies like Apply AS.

The degree of product or service differentiation among suppliers also plays a crucial role. If suppliers offer unique, proprietary technologies or highly specialized expertise that is indispensable for Apply AS's project execution, their bargaining power is amplified. This is particularly true for niche components or advanced engineering solutions where alternatives are scarce.

- Supplier Dominance: In 2024, the global market for certain subsea umbilicals, a critical component in offshore energy projects, was dominated by fewer than five major manufacturers, giving them substantial pricing power.

- Specialized Expertise: Companies providing advanced welding technologies for high-pressure pipelines, essential for deepwater projects, often operate with limited competition, strengthening their negotiating position.

- Critical Component Dependency: For projects requiring specific turbine models from a single manufacturer, Apply AS faces heightened supplier bargaining power due to the lack of viable substitutes.

Forward Integration Threat by Suppliers

The threat of suppliers engaging in forward integration, where they might offer Engineering, Procurement, Construction, and Installation (EPCI) or Maintenance and Modernization (M&M) services directly, could significantly boost their bargaining power. This scenario compels Apply AS to proactively nurture strong supplier relationships and ensure its service offerings remain highly competitive to prevent disintermediation.

However, the substantial capital investment and highly specialized technical knowledge essential for delivering EPCI services present a considerable barrier to entry for the majority of suppliers. For instance, major EPCI projects in the offshore wind sector, a potential area for Apply AS, often involve billions of dollars in upfront investment and decades of specialized experience, making direct forward integration by most suppliers improbable.

- High Capital Requirements: EPCI projects can demand billions in capital, deterring most suppliers from forward integration.

- Specialized Expertise: The need for deep technical and project management skills limits the pool of capable integrating suppliers.

- Focus on Core Competencies: Many suppliers prefer to concentrate on their primary manufacturing or component supply roles rather than diversifying into complex service provision.

The bargaining power of suppliers is a critical factor in the energy sector's EPCI and M&M services, directly impacting companies like Apply AS. When suppliers offer unique or highly specialized products, or when the number of suppliers for essential components is limited, their leverage increases significantly. This is evident in the 2024 market for subsea umbilicals, where consolidation among manufacturers gave them considerable pricing power.

High switching costs for Apply AS further empower suppliers. If changing suppliers requires substantial investment in new equipment or retraining, suppliers can command better terms. For example, the cost of polysilicon, a key material for solar panels, saw a 15% increase in early 2024 due to supply chain issues, illustrating how material dependency can shift power.

Supplier concentration, such as in the offshore wind sector where billions in capital and specialized expertise are needed for EPCI services, limits options for companies like Apply AS. Many suppliers focus on their core competencies, making forward integration into complex services unlikely, which can moderate their overall bargaining strength.

| Factor | Impact on Supplier Bargaining Power | Example (2024 Data/Trends) |

|---|---|---|

| Supplier Concentration | High | Limited number of subsea umbilical manufacturers globally. |

| Switching Costs | High | Retooling for specialized offshore components can be costly. |

| Product Differentiation | High | Proprietary welding technologies for deepwater pipelines. |

| Importance of Supplier to Buyer | High | Reliance on single manufacturer for critical turbine models. |

| Threat of Forward Integration | Low (for most suppliers) | High capital and expertise barriers for EPCI services. |

What is included in the product

Uncovers the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on Apply's market position.

Quickly identify and address the root causes of competitive pressure, transforming potential threats into actionable strategies.

Customers Bargaining Power

Apply AS primarily serves the oil & gas and renewable energy sectors, dealing with major energy corporations and national oil companies. These clients are typically large, well-informed, and possess substantial buying power.

The concentrated nature of Apply AS's customer base means that losing even a single significant client could have a considerable effect on the company's income. This situation grants these customers significant leverage during price and contract negotiations.

Customers in the energy sector often engage in project-based procurement for services like Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modifications (M&M). This approach, common in 2024, allows them to solicit bids from multiple providers, directly impacting pricing.

This competitive bidding process, a hallmark of project-based procurement, significantly enhances customer bargaining power. For instance, in 2024, major oil and gas companies frequently issued tenders for offshore wind farm construction, where numerous EPCI contractors vied for contracts, leading to price concessions.

Large energy companies, such as those in the oil and gas sector, often possess significant in-house engineering and maintenance expertise. This capability allows them to perform certain operational tasks internally, reducing their reliance on external providers like Apply AS. For instance, a major energy firm might have its own specialized teams for pipeline inspection or facility upkeep.

This latent ability to self-perform acts as a powerful bargaining chip during negotiations with suppliers. Even if they choose to outsource complex projects, the credible threat of bringing the work in-house gives them leverage. Consider the 2024 data showing a 15% increase in capital expenditure for some energy giants on internal operational upgrades, signaling a strategic move to bolster self-sufficiency.

Price Sensitivity and Project Economics

Clients in the energy sector, particularly for large-scale projects like oil and gas field development or renewable energy farms, exhibit significant price sensitivity. This is directly tied to the capital-intensive nature of these ventures, where even minor cost fluctuations can drastically impact overall project economics.

The willingness of these clients to pay for Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modifications (M&M) services is heavily influenced by the projected profitability of their energy assets. This puts considerable pressure on service providers like Apply AS to maintain competitive pricing, directly impacting their profit margins.

- Price Sensitivity: In 2024, the average cost overrun for major capital projects globally was reported to be around 20%, highlighting client focus on cost control.

- Project Economics Impact: For instance, a 10% reduction in EPCI costs for a new offshore wind farm could translate to millions in savings, directly affecting the project's internal rate of return (IRR).

- Margin Pressure: Companies like Apply AS face a delicate balance; while clients demand lower prices, the high upfront investment and operational costs for specialized services limit their pricing flexibility.

Availability of Alternative Service Providers

The energy sector's Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modification (M&M) markets are populated by numerous established firms. This competitive landscape means customers have a wide array of reputable companies to choose from.

Customers can readily switch providers if Apply AS's pricing, quality, or project timelines don't meet their expectations. For instance, in 2024, the global EPCI market was projected to reach over $200 billion, indicating a substantial number of players vying for contracts.

- High Customer Choice: The energy sector features many established EPCI and M&M service providers.

- Switching Capability: Customers can easily move to competitors if Apply AS is not competitive on cost, quality, or delivery.

- Market Size Impact: The large global EPCI market size (estimated over $200 billion in 2024) signifies robust competition.

- Negotiation Leverage: The availability of alternatives grants customers significant bargaining power.

The bargaining power of customers in the energy sector is substantial, driven by their concentrated nature, price sensitivity, and the availability of numerous alternative suppliers. This leverage directly impacts Apply AS's ability to command premium pricing and secure favorable contract terms.

Clients, often large corporations, can influence pricing by soliciting multiple bids for projects, a common practice in 2024. Furthermore, their capacity to perform certain services in-house, as evidenced by increased internal capital expenditure in 2024, strengthens their negotiating position.

The high capital expenditure in energy projects, with global EPCI market figures exceeding $200 billion in 2024, means clients are acutely focused on cost control. This price sensitivity, coupled with the ease of switching providers, grants customers significant leverage over service providers like Apply AS.

| Factor | Description | Impact on Apply AS | 2024 Data/Example |

|---|---|---|---|

| Customer Concentration | Apply AS serves a limited number of large energy corporations. | High leverage for each client. | Loss of one major client significantly impacts revenue. |

| Price Sensitivity | Clients are highly sensitive to costs due to capital-intensive projects. | Pressure to offer competitive pricing. | Average global project cost overrun in 2024 was ~20%. |

| Switching Capability | Numerous alternative suppliers exist in the market. | Customers can easily switch if pricing or quality is not met. | Global EPCI market size over $200 billion in 2024. |

| In-house Capabilities | Clients possess internal expertise and can perform some services themselves. | Credible threat to bring work in-house. | 15% increase in internal operational upgrades by some energy giants in 2024. |

Preview Before You Purchase

Apply Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis document you will receive immediately after purchase. The insights and formatting you see here are precisely what will be delivered, ensuring you get a ready-to-use strategic tool without any alterations or placeholders. This means you can confidently assess industry attractiveness and competitive intensity with the exact analysis presented.

Rivalry Among Competitors

The Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modifications (M&M) services market within the energy sector, especially for oil & gas and renewables, is characterized by a robust competitive landscape. This includes major global entities alongside focused regional specialists.

Key players such as Aker Solutions, TechnipFMC, Saipem, and Worley are prominent, demonstrating a market populated by well-established and highly competent competitors. For instance, TechnipFMC reported revenues of approximately $13.4 billion in 2023, highlighting the scale of operations for these major firms.

The renewable energy sector, a key area for Apply AS, is projected for robust growth. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is expected to reach over $2.2 trillion by 2030, exhibiting a compound annual growth rate (CAGR) of around 7.5%.

This substantial expansion inherently attracts new entrants and encourages existing players to increase their investment and production. Consequently, companies like Apply AS face intensified competition as they battle for a larger piece of this rapidly growing market pie.

The Engineering, Procurement, Construction, and Installation (EPCI) sector, crucial for major infrastructure projects, is characterized by substantial fixed costs. These include investments in specialized heavy machinery, extensive fabrication facilities, and a highly skilled workforce, demanding continuous project flow to achieve economies of scale.

Companies in this industry often face pressure to maintain high utilization rates for their assets. This can lead to aggressive bidding strategies, even on projects with thinner profit margins, to ensure their expensive infrastructure remains operational and costs are spread across a larger revenue base. For instance, in 2024, major offshore wind EPCI providers reported operating margins in the low single digits, reflecting intense competition driven by the need to cover these overheads.

Differentiation and Switching Costs for Clients

Apply AS strives to differentiate itself through a commitment to integrity and strong performance in the EPCI (Engineering, Procurement, Construction, and Installation) sector. However, the intensity of rivalry hinges on how uniquely clients perceive these differentiating factors. If clients view the services offered by various EPCI providers as largely interchangeable, the market naturally gravitates towards price as the main competitive lever, intensifying rivalry.

The presence of high switching costs for clients moving between EPCI providers can act as a significant deterrent to intense rivalry. These costs might include the expense of re-educating a new provider on project specifics, potential delays in project timelines, and the integration of new systems. However, in environments characterized by competitive bidding processes, the perceived impact of these switching costs on client decisions may be diminished, as clients often prioritize the most cost-effective solution.

For instance, in the offshore wind sector, a key market for many EPCI firms, project pipelines are crucial. In 2024, the global offshore wind market continued its expansion, with significant investments being made. According to industry reports from early 2024, the total installed capacity was projected to grow substantially, leading to increased demand for EPCI services. This growth, while positive, also means more players are vying for contracts, making differentiation and client retention paramount.

- Differentiation Impact: Client perception of Apply AS's unique value proposition directly influences whether price becomes the primary competitive factor.

- Switching Costs: While high switching costs can reduce rivalry, their effectiveness is often tested in competitive bidding scenarios.

- Market Dynamics: The competitive landscape in sectors like offshore wind, with its significant 2024 investments, means that even with differentiation efforts, rivalry can remain high due to multiple bidders.

Strategic Stakes and Exit Barriers

The energy sector's inherent strategic importance for national economies and major corporations translates into high stakes for companies operating within it. This means firms are deeply invested in maintaining their market share and operational presence, even when market conditions are unfavorable.

Exit barriers in the energy industry are often substantial. These can include highly specialized and expensive infrastructure, such as offshore drilling platforms or refineries, which are not easily repurposed for other industries. Additionally, significant investments in a skilled workforce and long-term contracts can make exiting the market financially prohibitive, forcing companies to continue competing intensely, even during periods of reduced demand or profitability.

For instance, in 2024, the global oil and gas industry saw continued investment in infrastructure, with major projects like the expansion of LNG terminals in the US and the development of new offshore fields in the North Sea. These investments, running into billions of dollars, create significant exit barriers for the companies involved.

- High Strategic Stakes: National energy security and corporate market dominance drive companies to remain competitive.

- Specialized Assets: Investments in unique infrastructure like pipelines and power plants are difficult to divest.

- Workforce Commitments: Specialized labor forces and union agreements can increase the cost of exiting.

- Continued Competition: High stakes and exit barriers contribute to persistent rivalry, even in challenging economic climates.

Competitive rivalry in the EPCI and M&M services market is intense, driven by the presence of major global players like TechnipFMC and Aker Solutions, alongside specialized regional firms. These companies, with significant revenues such as TechnipFMC's $13.4 billion in 2023, invest heavily in specialized assets and skilled labor, leading to high fixed costs and a constant need for high asset utilization. This often results in aggressive bidding, even on lower-margin projects, to cover overheads, as seen with 2024 operating margins in the low single digits for offshore wind EPCI providers.

The perception of differentiation among service providers heavily influences competitive intensity. If clients view services as interchangeable, price becomes the dominant factor, escalating rivalry. While high switching costs can mitigate this, their impact is often reduced in competitive bidding environments where cost-effectiveness is prioritized. The growing renewable energy market, projected to grow from $1.3 trillion in 2023 to over $2.2 trillion by 2030, attracts more competitors, further intensifying the battle for market share.

High exit barriers in the energy sector, including specialized infrastructure and long-term commitments, compel companies to remain competitive even during downturns. For instance, substantial investments in 2024 for projects like US LNG terminal expansions and North Sea field developments create significant financial hurdles for exiting players. This persistence in the market, coupled with the strategic importance of energy security, ensures a consistently high level of competition among established firms.

| Key Competitor | 2023 Revenue (Approx.) | Key Market Focus | Competitive Factor |

| TechnipFMC | $13.4 billion | Offshore Oil & Gas, Subsea, Surface Technologies | Scale, Technology, Integrated Solutions |

| Aker Solutions | $4.6 billion (2023) | Offshore Oil & Gas, Renewables (Offshore Wind) | Subsea Technology, Carbon Capture, Offshore Wind Foundations |

| Saipem | $10.4 billion (2023) | Offshore & Onshore E&C, Drilling | Large Project Execution, Offshore Capabilities |

| Worley | $8.6 billion (2023) | Energy, Chemicals, Resources | Global Reach, Engineering Expertise, Digital Solutions |

SSubstitutes Threaten

Major energy companies, particularly those with substantial scale in oil and gas or renewable sectors, increasingly leverage their in-house engineering, procurement, and construction (EPC) capabilities. This internal capacity acts as a direct substitute for external service providers like Apply AS, especially for more standardized or less technically demanding projects. For instance, in 2024, many large integrated energy firms continued to invest in their own skilled workforces and project management infrastructure to gain greater control over project timelines and costs.

This trend is driven by a desire for cost efficiencies and a strategic move to capture more value chain activity. When companies can effectively manage core EPC functions internally, it reduces their reliance on third-party contractors, thereby mitigating outsourcing risks and potentially improving profit margins on projects. This internal strength becomes a significant competitive factor, directly impacting the demand for specialized external services.

Alternative project delivery models pose a significant threat by offering ways to bypass traditional, integrated providers like Apply AS. For instance, the rise of collaborative frameworks such as joint ventures or owner-operator led projects, where multiple specialized contractors are managed directly by the client, can fragment the market. This approach can diminish the necessity for a single, comprehensive Engineering, Procurement, Construction, and Installation (EPCI) contract, potentially impacting Apply AS's market share and pricing power. In 2024, the infrastructure sector saw a notable increase in project-specific alliances, with some analysts estimating a 15% growth in such arrangements compared to the previous year, driven by a desire for greater flexibility and cost control.

The increasing integration of digitalization and automation, particularly in areas like predictive maintenance and remote monitoring, presents a significant threat of substitutes for traditional maintenance and modification services. Advancements in artificial intelligence (AI) and the Internet of Things (IoT) are enabling companies to anticipate equipment failures before they occur, thereby reducing the reliance on reactive, on-site human intervention. For instance, by 2024, the global predictive maintenance market was projected to reach over $11 billion, demonstrating a clear trend towards these technologically driven solutions.

Shift in Energy Sources and Technologies

A significant shift in global energy consumption patterns, moving away from traditional fossil fuels towards novel renewable technologies, presents a substantial threat of substitution for Apply AS. While the company currently leverages its expertise in both oil & gas and renewables, the emergence of entirely new energy sources, such as advanced geothermal or tidal power, could diminish the demand for their existing Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modernization (M&M) services. This represents a broader industry-level substitute that could impact Apply AS's long-term market relevance.

The International Energy Agency (IEA) reported in 2024 that renewable energy sources accounted for approximately 30% of global electricity generation, a figure projected to rise significantly. Furthermore, investments in emerging energy technologies saw a notable increase in 2023, with venture capital funding for clean energy startups reaching record levels. This indicates a tangible market trend towards diversification beyond current renewable offerings, potentially impacting the demand for Apply AS's specialized skill sets if they do not adapt.

- Market Share Shift: A rapid transition to new energy sources could see established players in those nascent sectors gain market share, potentially sidelining companies with expertise rooted in older technologies.

- Technological Obsolescence: If Apply AS's core EPCI and M&M competencies become less relevant to the dominant energy technologies of the future, their service offerings could face obsolescence.

- Investment Diversion: Increased investment in entirely new energy infrastructure could divert capital away from projects that would typically utilize Apply AS's current capabilities.

- Skills Gap: A significant shift in energy technologies may require a workforce with different skill sets, potentially creating a gap for Apply AS if retraining and upskilling initiatives are not proactively implemented.

Cost-Benefit of Service vs. Asset Lifespan Extension

Customers may opt to prolong the operational life of their current assets by reducing maintenance intensity or deferring significant upgrades. This is especially true when economic conditions are challenging or when the cost of Apply AS’s services seems disproportionate to the perceived gains in asset integrity or performance. This behavior acts as a substitute for the *scope* of services offered.

For instance, in 2024, many industries faced inflationary pressures and tighter capital budgets. Companies might have prioritized essential repairs over proactive, lifespan-extending services. This shift directly impacts the demand for comprehensive service packages, as customers weigh immediate cost savings against potential long-term benefits.

- Cost Sensitivity: Customers may delay or reduce service uptake if the perceived value of enhanced asset integrity doesn't justify the expense, especially during economic downturns.

- DIY Maintenance: In some cases, simpler maintenance tasks might be handled in-house, reducing reliance on external service providers for certain aspects of asset upkeep.

- Delayed Upgrades: Postponing scheduled upgrades or replacements can lead to a reduced need for associated servicing, as older assets may operate at a reduced capacity or frequency.

- Alternative Solutions: Exploring less intensive or lower-cost methods to manage asset performance, even if these offer less robust long-term solutions, can serve as a substitute.

The threat of substitutes arises from alternative ways customers can fulfill their needs, potentially bypassing a company's offerings. For Apply AS, this includes clients performing EPC functions internally or adopting different project delivery models that fragment the traditional EPCI contract. In 2024, the trend of large energy firms boosting in-house EPC capabilities continued, aiming for better cost and timeline control.

Digitalization and automation also present substitutes, particularly for maintenance services, by enabling predictive rather than reactive interventions. The global predictive maintenance market was projected to exceed $11 billion in 2024, highlighting this shift. Furthermore, evolving energy consumption patterns, favoring new renewables, could reduce demand for existing EPCI and M&M services if Apply AS doesn't adapt its skill sets.

Customers also substitute by extending asset life through reduced maintenance intensity or deferred upgrades, especially during economic pressures. In 2024, inflationary concerns led many companies to prioritize essential repairs over proactive, lifespan-extending services, directly impacting the scope of services demanded.

| Substitute Type | Description | 2024 Impact/Trend | Example for Apply AS |

|---|---|---|---|

| Internal Capabilities | Clients performing EPC functions in-house. | Continued investment by major energy firms in 2024. | Energy majors managing their own project construction. |

| Alternative Project Delivery | Client-managed, fragmented contractor models. | 15% growth in project-specific alliances estimated in 2024. | Joint ventures bypassing integrated EPCI contracts. |

| Digitalization/Automation | Predictive maintenance reducing need for traditional services. | Global predictive maintenance market >$11 billion projected 2024. | AI-driven equipment monitoring reducing on-site M&M needs. |

| Energy Transition | Shift to new energy sources reducing demand for existing expertise. | Renewables ~30% of global electricity generation in 2024. | New geothermal technologies requiring different EPC skills. |

| Asset Life Extension | Reducing maintenance intensity or deferring upgrades. | Prioritization of essential repairs over proactive services due to inflation. | Postponing lifespan-extending M&M for cost savings. |

Entrants Threaten

Entering the Engineering, Procurement, Construction, and Installation (EPCI) sector, particularly for significant offshore energy projects, necessitates massive upfront capital. Companies need to acquire specialized vessels, advanced subsea equipment, and cutting-edge fabrication facilities, alongside investing heavily in a highly skilled workforce.

For instance, the cost of a single modern offshore construction vessel can easily range from $200 million to over $500 million, a significant hurdle for any new entrant. This financial barrier effectively limits the number of new competitors that can realistically challenge established firms like Apply AS, which possess decades of accumulated assets and operational experience.

The energy sector's Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modifications (M&M) services demand deep, specialized knowledge. Newcomers must cultivate expertise in complex engineering, rigorous project management, stringent safety protocols, and intricate regulatory landscapes. This knowledge acquisition and the subsequent building of a track record represent a substantial barrier to entry.

Established firms like AS have cultivated deep, long-standing relationships with major energy companies, a significant barrier for newcomers. These relationships are built on trust and a proven history of successful project execution, which is crucial in an industry where reliability is paramount.

New entrants face a steep climb to replicate this level of trust and secure initial contracts. For instance, in 2024, the average contract duration for major energy infrastructure projects often spans multiple years, making clients hesitant to award work to unproven entities.

The reputation of established players, honed over decades, acts as a powerful deterrent. A new company would need substantial evidence of capability and financial stability to even be considered for bids against industry veterans with a solid track record.

Regulatory and Permitting Complexities

The energy sector, especially offshore and oil & gas, faces substantial regulatory hurdles. New entrants must contend with rigorous environmental protection laws and demanding safety protocols, which can significantly increase upfront costs and operational complexity. For instance, in 2024, the permitting process for offshore wind projects in the U.S. continued to be a lengthy undertaking, with some projects taking over a decade from initial proposal to final approval, illustrating the time and resource commitment required.

Navigating these intricate permitting processes acts as a formidable barrier to entry. Companies must invest heavily in legal expertise, environmental impact assessments, and compliance infrastructure. The sheer volume of documentation and the need to satisfy multiple governmental agencies at federal, state, and local levels can deter smaller or less capitalized firms from entering the market.

- High Compliance Costs: Adhering to stringent environmental and safety standards in the energy sector can add millions to initial capital expenditures and ongoing operational expenses for new entrants.

- Lengthy Permitting Timelines: The process for obtaining necessary permits, especially for offshore operations, can extend for years, delaying revenue generation and increasing project uncertainty.

- Evolving Regulatory Landscape: Changes in environmental policies and safety regulations, driven by climate change concerns and technological advancements, require continuous adaptation and investment from all players, but particularly impact new companies.

Economies of Scale and Scope

The threat of new entrants in the Engineering, Procurement, Construction, and Installation (EPCI) sector is significantly tempered by established players' formidable economies of scale and scope. Existing firms can leverage their vast operational capacity to bid on and execute larger projects more cost-effectively, a feat difficult for newcomers to replicate without substantial upfront investment. For instance, major EPCI contractors often have procurement volumes that grant them considerable bargaining power with suppliers, leading to lower material costs per project.

Furthermore, the ability of incumbent EPCI companies to offer a comprehensive suite of integrated services, from initial design and engineering through to procurement, construction, and ongoing maintenance, creates significant economies of scope. This integrated approach allows them to streamline processes, reduce overheads, and offer bundled solutions that are attractive to clients. New entrants would struggle to match this breadth of service without years of development and client relationship building.

Consider the capital expenditure required. A new entrant would need to invest heavily not only in project execution capabilities but also in building a diverse portfolio of integrated services to compete effectively. This barrier is substantial, especially when compared to the operational leverage already enjoyed by established firms. For example, in 2024, the average capital expenditure for major global EPCI projects often runs into billions of dollars, a scale that new, unproven entities find exceptionally challenging to access.

- Economies of Scale: Existing EPCI players can process larger volumes of work, leading to lower per-unit costs and improved efficiency in project execution.

- Economies of Scope: Incumbents offer a wide array of integrated services, creating synergies and reducing overall costs compared to specialized new entrants.

- Procurement Power: Large, established firms benefit from significant bargaining power with suppliers due to their consistent and high-volume purchasing.

- Capital Intensity: The high capital requirements for infrastructure and operational capacity present a substantial barrier for new companies entering the EPCI market.

The threat of new entrants into the EPCI sector is significantly mitigated by the immense capital requirements and the need for specialized assets. For instance, acquiring a modern offshore construction vessel can cost upwards of $500 million, a prohibitive sum for most newcomers. Furthermore, the extensive expertise in complex engineering, project management, and stringent safety protocols demanded by the industry takes years to cultivate, creating a substantial knowledge barrier.

Established firms benefit from deeply entrenched client relationships built on trust and a proven track record, making it difficult for new companies to secure initial contracts. In 2024, major energy infrastructure projects often have multi-year durations, leading clients to favor experienced, reliable partners. The formidable reputation of incumbents, coupled with the high compliance costs and lengthy permitting processes for offshore operations, further deters potential new competitors.

Economies of scale and scope also present a significant hurdle. Established EPCI companies can execute larger projects more cost-effectively due to their vast operational capacity and procurement power, leading to lower material costs. For example, in 2024, the average capital expenditure for major global EPCI projects often reached billions of dollars, a scale that new entities find exceptionally challenging to access.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, publicly available financial statements, and expert interviews with industry professionals to capture the nuances of competitive dynamics.