Applied Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Materials Bundle

Applied Materials operates in a dynamic semiconductor equipment market, facing significant competitive rivalry and substantial buyer power from major chip manufacturers. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Applied Materials’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Applied Materials often depends on a limited number of suppliers for highly specialized components and advanced materials essential for its semiconductor manufacturing equipment. This reliance is particularly pronounced in cutting-edge areas like advanced lithography and deposition technologies, where only a few firms possess the necessary expertise and manufacturing capabilities. For instance, suppliers of critical EUV (Extreme Ultraviolet) lithography components, a key technology for next-generation chips, are highly concentrated, giving them substantial leverage.

The semiconductor equipment industry's structure means that a few key suppliers can wield significant influence over pricing and supply conditions. This concentration means Applied Materials, and its competitors, have fewer options when sourcing these specialized inputs. In 2023, the global market for semiconductor manufacturing equipment was valued at approximately $110 billion, with a significant portion of that value tied to these highly specialized, concentrated supply chains.

Switching suppliers for critical semiconductor manufacturing equipment, like that produced by Applied Materials, involves substantial costs and time. This is due to the intricate nature of the technology and the lengthy, rigorous qualification processes required to ensure compatibility and performance. These high switching costs inherently strengthen the bargaining power of Applied Materials' suppliers, making it difficult for them to change providers easily.

Suppliers holding proprietary technology, like those developing specialized chemicals or advanced deposition materials crucial for semiconductor fabrication, wield significant influence. Applied Materials' reliance on these unique inputs for its cutting-edge equipment means these suppliers can command higher prices or dictate terms. For instance, a supplier with a patent on a critical etching gas used in advanced node manufacturing for 2024 chip production would have substantial leverage.

Supplier's Importance to Applied Materials' Production

The bargaining power of suppliers for Applied Materials is significant, especially when considering the specialized components and services essential for advanced chip manufacturing. These critical inputs are often not easily substituted, giving suppliers leverage. For instance, in 2024, the demand for cutting-edge semiconductor equipment components remained robust, with lead times for certain advanced materials and precision-engineered parts extending, indicating strong supplier pricing power.

Disruptions or quality concerns from these key suppliers can have a cascading effect on Applied Materials' production capabilities and its ability to meet customer delivery schedules. This dependency highlights the suppliers' influence. Applied Materials' proactive approach to supply chain management, including diversifying its supplier base and fostering strong relationships, is a testament to mitigating this supplier power.

- Critical Components: Suppliers of specialized materials and precision-engineered parts for wafer fabrication equipment are vital.

- Supply Chain Impact: Disruptions from these suppliers directly affect Applied Materials' production output and delivery timelines.

- Supplier Relationship Management: Applied Materials actively works to ensure supply chain resilience through strategic supplier engagement.

- Market Conditions (2024): High demand for advanced semiconductor manufacturing technology in 2024 amplified the bargaining power of key component suppliers.

Potential for Forward Integration by Suppliers

The potential for suppliers to integrate forward into Applied Materials' equipment manufacturing, while theoretically possible, presents a very low threat. The semiconductor equipment industry is characterized by immense capital requirements and deeply entrenched customer relationships, creating formidable barriers to entry for any supplier contemplating such a move. For instance, the research and development spending for leading semiconductor equipment manufacturers like Applied Materials often runs into billions of dollars annually; in 2023, Applied Materials reported R&D expenses of approximately $1.7 billion.

This high capital intensity makes forward integration an exceptionally challenging proposition. Furthermore, Applied Materials' consistent investment in innovation and its robust, long-standing relationships with key semiconductor manufacturers significantly de-risk this theoretical threat. These established partnerships, built over decades, provide a crucial competitive moat that is difficult for any supplier to overcome, even with specialized technology.

- High Capital Intensity: The semiconductor equipment sector demands substantial upfront investment in R&D and manufacturing infrastructure, a barrier that limits supplier forward integration.

- Customer Relationships: Applied Materials maintains strong, decades-long relationships with leading chip manufacturers, creating loyalty and switching costs that deter supplier encroachment.

- Innovation Focus: Continuous investment in cutting-edge technology by Applied Materials further solidifies its market position, making it difficult for suppliers to replicate its offerings through integration.

- Barriers to Entry: The combined effect of capital, technology, and customer loyalty creates significant barriers that render supplier forward integration a highly improbable strategic move.

Applied Materials faces considerable supplier bargaining power due to its reliance on a concentrated group of specialized component providers. These suppliers often possess proprietary technology, such as critical materials for advanced lithography or deposition processes, giving them significant leverage in pricing and terms. For instance, in 2024, the robust demand for cutting-edge semiconductor manufacturing equipment amplified the pricing power of key component suppliers, leading to extended lead times for certain advanced materials.

The high switching costs associated with sourcing specialized semiconductor manufacturing equipment components further bolster supplier influence. The intricate nature of these technologies necessitates lengthy and rigorous qualification processes, making it difficult and expensive for Applied Materials to change providers. This dependency means suppliers can command higher prices or dictate terms, as demonstrated by suppliers holding patents on essential gases for advanced node manufacturing in 2024.

Disruptions or quality issues from these critical suppliers can have a significant ripple effect on Applied Materials' production and delivery schedules. This underscores the substantial influence these upstream partners wield. Applied Materials actively manages this by diversifying its supplier base and cultivating strong relationships to mitigate supplier power.

| Factor | Description | Impact on Applied Materials |

| Supplier Concentration | Few suppliers for specialized components (e.g., EUV lithography parts). | High leverage for suppliers, potentially impacting pricing and availability. |

| Proprietary Technology | Suppliers with unique patents or advanced manufacturing capabilities. | Enables suppliers to command premium prices and dictate terms. |

| Switching Costs | High costs and time for qualifying new suppliers of critical components. | Reduces Applied Materials' flexibility and strengthens supplier position. |

| Market Conditions (2024) | Strong demand for advanced semiconductor equipment. | Amplified supplier bargaining power and extended lead times. |

What is included in the product

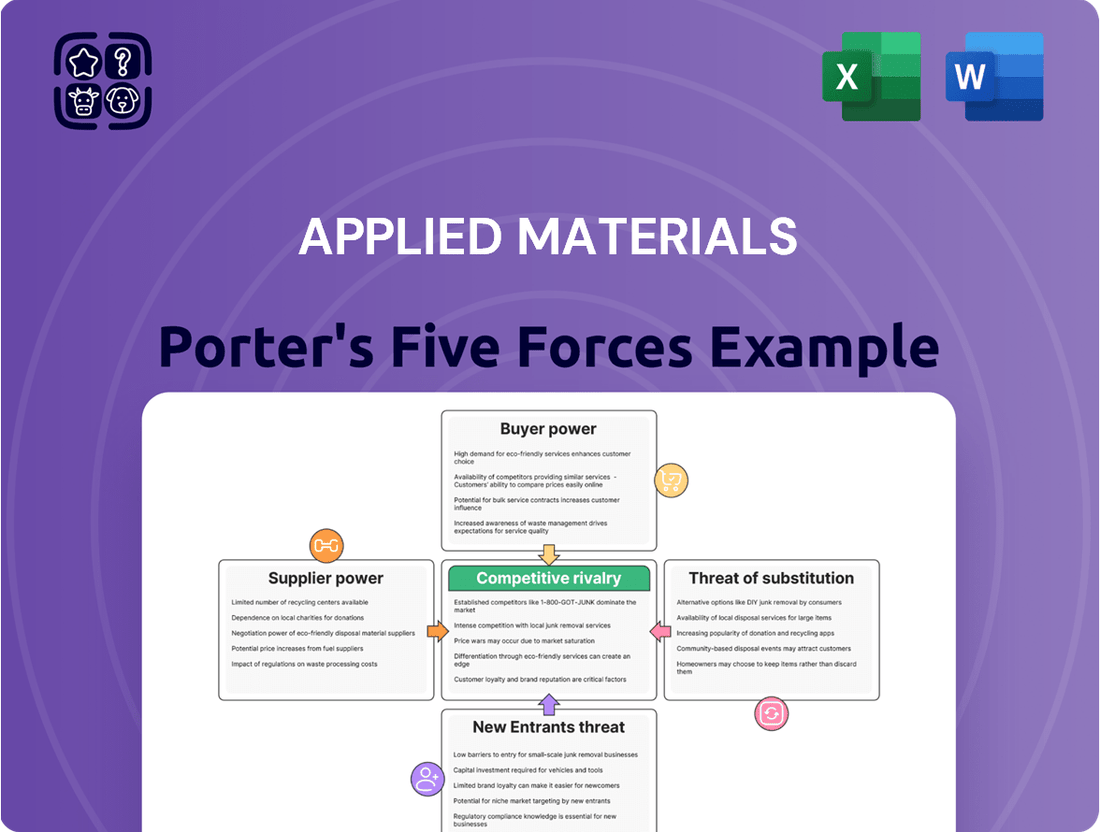

This analysis examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and threat of substitutes within the semiconductor equipment industry, specifically for Applied Materials.

Effortlessly visualize the competitive landscape with pre-built charts, making complex strategic pressures immediately apparent.

Customers Bargaining Power

Applied Materials' customer base is quite consolidated, primarily featuring major semiconductor manufacturers, flat panel display producers, and solar companies. Key clients include giants like TSMC, Intel, and Samsung, whose substantial purchasing volumes grant them significant leverage in negotiating prices and terms.

The geographic concentration of these large customers, particularly in Asia, further amplifies their bargaining power. This means Applied Materials faces considerable pressure from a select group of buyers who can significantly impact its revenue and profitability.

While large customers do wield significant influence, the high costs associated with switching semiconductor equipment suppliers offer Applied Materials a degree of protection. These costs can include extensive factory retooling, rigorous process re-qualification, and the risk of production interruptions, making it a substantial undertaking for customers to move to a competitor.

This inherent stickiness in customer relationships helps to temper the bargaining power of Applied Materials' clientele. Furthermore, the company's robust service agreements are designed to foster long-term customer loyalty and retention, reinforcing this mitigating factor.

The semiconductor industry's inherent cyclicality allows Applied Materials' customers to delay or scale back their capital equipment purchases. This decision-making is heavily influenced by prevailing market demand, existing inventory levels, and broader economic sentiment.

This customer flexibility directly affects Applied Materials' financial performance, leading to predictable swings in revenue and profitability. For instance, during periods of market oversupply or economic uncertainty, customers might defer upgrades, impacting sales of specific equipment categories.

Customer Demand for Advanced and Customized Solutions

Customers in the semiconductor industry, particularly those developing advanced chips for AI and high-bandwidth memory, consistently seek cutting-edge and highly specialized equipment. This relentless demand for innovation empowers them to negotiate for specific features and performance metrics from suppliers like Applied Materials.

Applied Materials' significant investments in research and development, often exceeding billions annually, are directly influenced by this customer push for tailored solutions. For instance, in fiscal year 2023, the company reported R&D expenses of $2.5 billion, a testament to the pressure to deliver customized technological advancements.

- Customer Leverage: The need for specialized chip production gives customers substantial bargaining power, allowing them to dictate equipment specifications.

- R&D Investment Driver: This demand forces Applied Materials to allocate significant resources to R&D to meet evolving technological requirements.

- Customization Costs: Providing tailored solutions often entails higher development and production costs for Applied Materials, which can impact margins.

In-house Production Capabilities of Customers

Some major semiconductor manufacturers do have internal capabilities for developing or producing certain equipment components. This can act as a limited alternative to relying solely on external suppliers like Applied Materials.

However, the highly specialized nature and significant scale of Applied Materials' advanced equipment often make it more practical and economical for customers to purchase externally. For instance, while a chipmaker might handle some internal tooling, the complex lithography or deposition systems are typically sourced from specialists.

This dynamic means that while the threat of in-house production exists, it's generally not a complete substitute for the sophisticated, integrated solutions offered by Applied Materials. Customers often find it more efficient to leverage Applied Materials' expertise and manufacturing scale rather than invest in building comparable, highly specialized capabilities themselves.

- Limited In-house Capabilities: While some large semiconductor firms can produce certain equipment parts internally, this is often not a full replacement for specialized external suppliers.

- Efficiency and Cost-Effectiveness: The high specialization and scale of Applied Materials' products generally make external procurement a more efficient and cost-effective option for customers.

- Focus on Core Competencies: Semiconductor manufacturers often prefer to focus their resources on chip design and fabrication rather than duplicating the complex equipment manufacturing capabilities of companies like Applied Materials.

Applied Materials' customers, primarily large semiconductor manufacturers, possess significant bargaining power due to their substantial purchasing volumes and the critical nature of the equipment they buy. This allows them to heavily influence pricing and product specifications, especially for cutting-edge technologies. For instance, major clients like TSMC and Intel are key drivers of Applied Materials' innovation pipeline, demanding tailored solutions for advanced chip manufacturing processes.

The high switching costs associated with semiconductor equipment, including retooling and process requalification, do provide Applied Materials with some customer stickiness. However, the industry's cyclical nature and the customers' ability to defer capital expenditures during downturns, as seen in potential slowdowns in 2024 due to global economic uncertainties, can still exert considerable pressure on suppliers.

While some customers may possess limited internal capabilities for equipment components, the highly specialized and integrated nature of Applied Materials' offerings generally makes external sourcing more practical and cost-effective. This reliance on specialized external suppliers helps to mitigate the direct threat of full vertical integration by customers, though it doesn't eliminate their overall bargaining leverage.

| Customer Type | Key Players | Bargaining Power Factors | Applied Materials' Mitigating Factors |

|---|---|---|---|

| Semiconductor Manufacturers | TSMC, Intel, Samsung | High volume, demand for cutting-edge tech, ability to defer purchases | High switching costs, strong service agreements, R&D investments |

| Flat Panel Display Producers | LG Display, BOE Technology | Significant capital investment, consolidation | Product differentiation, long-term contracts |

| Solar Companies | JinkoSolar, Trina Solar | Price sensitivity, volume purchasing | Technological leadership, integrated solutions |

Same Document Delivered

Applied Materials Porter's Five Forces Analysis

This preview shows the exact Applied Materials Porter's Five Forces analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the semiconductor equipment industry. You'll gain immediate access to this fully formatted document, enabling you to understand the industry's structure and strategic implications without any surprises. The insights provided are ready for your immediate use and decision-making.

Rivalry Among Competitors

The semiconductor equipment sector is characterized by high industry concentration, with a handful of major players dominating the market. Applied Materials, ASML, Lam Research, KLA, and Tokyo Electron collectively command a substantial share of global sales, fostering a competitive environment where innovation and market position are paramount.

This intense rivalry is particularly evident in the pursuit of advanced manufacturing technologies. Applied Materials, for instance, maintains a robust market position, especially within the critical deposition equipment segment, a key area for semiconductor fabrication.

The semiconductor equipment industry demands massive upfront investment in manufacturing facilities and continuous, substantial spending on research and development to stay ahead. This high cost structure means companies like Applied Materials need to sell a lot of equipment to cover their expenses and make a profit. For instance, in fiscal year 2023, Applied Materials reported R&D expenses of $2.4 billion, highlighting the industry's commitment to innovation.

This intense need for scale fuels fierce competition as players vie for market share and crucial customer contracts. The pressure to achieve high sales volumes often leads to aggressive pricing and strategic moves to secure a dominant position. Applied Materials' ongoing investment in facilities like its EPIC Center, designed to accelerate innovation in areas like advanced packaging, underscores this competitive dynamic and the drive to maintain technological leadership.

Competitive rivalry in the semiconductor equipment industry is intense, fueled by a relentless pursuit of technological innovation and product differentiation. Companies are locked in a race to develop equipment that enables the production of smaller, faster, and more energy-efficient microchips. This constant evolution demands significant R&D investment to stay ahead.

Applied Materials' strategic emphasis on materials engineering solutions and its development of new platforms, such as Vistara, are vital for maintaining its competitive standing. For instance, in fiscal year 2023, Applied Materials reported R&D expenses of $2.4 billion, underscoring its commitment to innovation in this dynamic market.

Global Market and Geopolitical Factors

The semiconductor industry operates on a global scale, making competitive rivalry inherently worldwide. Geopolitical factors, such as U.S. export controls impacting China, significantly shape market dynamics and strategic decisions for companies like Applied Materials.

These trade restrictions create complex challenges, influencing supply chains and market access. For instance, in 2023, U.S. restrictions on advanced chip technology exports to China led to significant adjustments in global semiconductor trade flows.

- Global Competition: Applied Materials faces intense competition from companies like ASML, Lam Research, and Tokyo Electron, all vying for market share in the advanced equipment sector.

- Geopolitical Influence: U.S. export controls, particularly those targeting China, directly impact market access and revenue potential for semiconductor equipment manufacturers.

- Supply Chain Disruptions: Geopolitical tensions can lead to disruptions in global supply chains, affecting the availability of raw materials and components essential for manufacturing semiconductor equipment.

- Market Diversification: Companies are increasingly focused on diversifying their customer base and manufacturing locations to mitigate risks associated with regional geopolitical instability.

Cyclicality of the Semiconductor Industry

The semiconductor industry is notoriously cyclical, experiencing boom and bust periods. This inherent volatility means that during downturns, competition intensifies as companies scramble for market share and fewer orders. Applied Materials, a key player in supplying equipment for chip manufacturing, feels this pressure acutely.

This cyclicality drives fierce competition, especially when demand softens. Companies must remain agile, often diversifying their offerings to mitigate the impact of these swings. For instance, Applied Materials has been strategically expanding its services segment, which provides a more stable revenue stream compared to its equipment sales, which are more directly tied to capital expenditure cycles.

- Cyclical Demand: The semiconductor market historically sees waves of high demand followed by significant slowdowns, impacting all industry participants.

- Intensified Rivalry: During industry downturns, companies like Applied Materials face increased pressure as they compete for a smaller pool of customer orders.

- Strategic Diversification: To counter cyclicality, companies are focusing on less volatile revenue sources, such as the services and software sectors.

- Applied Materials' Services Growth: In fiscal year 2023, Applied Materials reported that its services segment revenue increased, demonstrating a strategic move towards greater revenue stability.

Applied Materials operates in a highly concentrated market, facing formidable rivals like ASML, Lam Research, and Tokyo Electron. This intense rivalry is driven by the constant need for technological advancement, with companies investing heavily in R&D to develop cutting-edge semiconductor manufacturing equipment. For example, Applied Materials' R&D spending reached $2.4 billion in fiscal year 2023, reflecting the industry's commitment to innovation and differentiation.

The global nature of the semiconductor industry means competition is worldwide, further intensified by geopolitical factors such as U.S. export controls impacting market access. This dynamic forces companies to strategically diversify their customer base and manufacturing operations to mitigate risks and maintain market position.

The industry's cyclicality also fuels fierce competition, particularly during downturns when companies vie for fewer orders. Applied Materials, like its peers, navigates these cycles by focusing on areas like its services segment, which offers more stable revenue streams compared to the more volatile equipment sales.

| Competitor | Market Segment Focus | 2023 Revenue (Approx.) |

|---|---|---|

| ASML | Lithography Equipment | $27.6 billion |

| Lam Research | Deposition and Etch Equipment | $13.3 billion |

| Tokyo Electron | Deposition, Etch, and Coater/Developer Equipment | $15.5 billion |

| KLA Corporation | Process Control and Yield Management | $10.5 billion |

SSubstitutes Threaten

The threat of substitutes for Applied Materials' core semiconductor manufacturing equipment is remarkably low. For highly specialized processes in advanced wafer fabrication, such as extreme ultraviolet (EUV) lithography or complex etching, there are simply no direct alternatives that can deliver the required precision, throughput, and yield. Companies like Applied Materials invest billions in R&D to create these proprietary technologies, making it exceptionally difficult and costly for competitors to develop viable substitutes.

While not direct substitutes for semiconductor manufacturing equipment itself, fundamental changes in how chips are designed and produced pose a threat. For instance, a major shift from traditional 2D chip layouts to advanced 3D stacking or novel packaging techniques could reduce the need for certain legacy equipment. Applied Materials is proactively addressing this by investing in technologies like Gate-All-Around (GAA) transistors and High-Bandwidth Memory (HBM) solutions, ensuring their equipment portfolio evolves with industry demands.

The threat of substitutes for Applied Materials' equipment is relatively low, but the emergence of entirely new materials or manufacturing processes could disrupt the industry. For instance, advancements in 3D printing or novel semiconductor fabrication techniques might reduce the demand for certain types of deposition or etching equipment. However, Applied Materials’ significant investment in R&D, which reached $2.6 billion in fiscal year 2023, positions them to not only anticipate but also lead these technological shifts, often integrating them into their own offerings.

Customer In-house Development (Limited Scope)

While large chip manufacturers possess the capacity for some in-house tool development, this is generally confined to niche applications. For instance, a company might create a highly specialized etching process for a unique material. However, these internal efforts rarely encompass the broad spectrum of advanced fabrication equipment that Applied Materials provides. The sheer scale of research and development, coupled with the specialized expertise needed for cutting-edge semiconductor manufacturing, makes complete in-house substitution impractical for most players. In 2024, the semiconductor equipment market is projected to reach over $100 billion, underscoring the complexity and breadth of offerings that in-house development would need to replicate.

The threat of substitutes from customer in-house development, while present, remains limited in scope for Applied Materials.

- Limited Scope: In-house development by chip manufacturers typically addresses highly specific, proprietary needs rather than a broad replacement for Applied Materials' comprehensive product portfolio.

- R&D Investment Barrier: The substantial R&D expenditure and specialized expertise required to develop and maintain a full suite of advanced semiconductor manufacturing equipment act as a significant deterrent to widespread in-house substitution.

- Market Size Context: The global semiconductor equipment market's substantial size, estimated to exceed $100 billion in 2024, highlights the breadth of technology and innovation that in-house efforts would need to match.

- Focus on Core Competencies: Most chip manufacturers prioritize their core competencies in chip design and manufacturing, leaving the development of specialized fabrication tools to dedicated equipment suppliers like Applied Materials.

Software-Defined Manufacturing and Optimization

The rise of software-defined manufacturing and advanced optimization tools presents a potential threat of substitutes. Innovations in process control and simulation software can enhance the efficiency and extend the operational life of existing manufacturing equipment, potentially reducing the demand for new capital expenditures on physical machinery. For instance, advancements in AI-driven predictive maintenance software, which saw significant adoption in 2024 across various industrial sectors, can preemptively identify and address equipment issues, thereby minimizing downtime and the perceived need for immediate hardware replacements.

However, Applied Materials is strategically positioned to mitigate this threat by integrating sophisticated software solutions directly into its own product and service offerings. This approach allows the company to capitalize on the trend towards software-defined manufacturing rather than being undermined by it. By bundling advanced software for process optimization, simulation, and control with its physical equipment, Applied Materials enhances the value proposition of its core products. For example, in 2024, Applied Materials continued to emphasize its AI-powered software platforms designed to optimize semiconductor fabrication processes, offering customers improved yields and reduced cycle times, which directly counters the substitution threat from standalone software solutions.

- Software Integration: Applied Materials embeds advanced software into its equipment, turning a potential substitute into a complementary offering.

- Efficiency Gains: Software solutions can extend the life and improve the performance of existing hardware, a trend Applied Materials leverages through its integrated approach.

- AI in Manufacturing: The increasing use of AI for process control and predictive maintenance in 2024 highlights the growing importance of software in manufacturing efficiency.

- Value Proposition: By combining hardware with sophisticated software, Applied Materials enhances its overall value proposition to customers, addressing their needs for both physical and digital optimization.

The threat of substitutes for Applied Materials' advanced semiconductor manufacturing equipment is generally low due to the highly specialized nature of the technology. Direct substitutes are scarce because developing equipment for cutting-edge processes like EUV lithography requires immense R&D investment and proprietary expertise, making it a significant barrier for potential rivals. While fundamental shifts in chip design, such as 3D stacking, could alter equipment needs, Applied Materials actively invests in evolving technologies like GAA transistors to stay ahead.

The company's substantial R&D spending, which reached $2.6 billion in fiscal year 2023, is a key factor in mitigating substitute threats. This investment allows Applied Materials to not only develop new technologies but also to integrate advancements like AI-driven software into its offerings, enhancing equipment performance and customer value. This proactive approach ensures that even as the semiconductor equipment market, projected to exceed $100 billion in 2024, evolves, Applied Materials remains at the forefront, turning potential disruptions into opportunities.

Entrants Threaten

The semiconductor equipment industry demands substantial capital for research and development, state-of-the-art manufacturing facilities, and a worldwide support network. For instance, the development of advanced chip manufacturing tools often involves billions of dollars in R&D. This immense financial barrier significantly deters new companies from entering the market and challenging established leaders like Applied Materials.

The semiconductor equipment industry requires immense technological know-how and a robust intellectual property (IP) portfolio, acting as a significant deterrent to new players. Developing and manufacturing the sophisticated machinery used in chip fabrication demands deep expertise in materials science, engineering, and advanced manufacturing processes. Applied Materials, a leader in this space, boasts thousands of patents, safeguarding its innovations and creating a substantial hurdle for any potential entrant seeking to replicate its technological capabilities.

The semiconductor equipment industry presents a significant barrier to new entrants due to the exceptionally long customer qualification cycles, which can stretch for several years. Major semiconductor manufacturers, like Intel or TSMC, have extremely rigorous processes to vet new suppliers, demanding extensive testing and validation to ensure equipment reliability and performance. For instance, in 2024, a new supplier might spend upwards of three years just getting their equipment through the initial qualification stages with a single major customer.

These lengthy qualification periods, coupled with the deep, established relationships between existing suppliers and their key clients, create a formidable moat. Newcomers must not only develop cutting-edge technology but also invest heavily in building trust and demonstrating a proven track record of support and innovation over many years. This makes it incredibly challenging for new players to displace incumbents like Applied Materials, which has cultivated decades-long partnerships across the industry.

Economies of Scale and Experience Curve

Existing players in the semiconductor equipment industry, such as Applied Materials, possess substantial economies of scale. This allows them to spread high fixed costs across a larger production volume, leading to lower per-unit manufacturing, procurement, and research and development expenses. For instance, Applied Materials' extensive global manufacturing and supply chain network enables significant cost efficiencies that are difficult for newcomers to replicate.

New entrants face a considerable hurdle in matching these established cost advantages. Without the benefit of years of accumulated experience and the resulting learning curve efficiencies, startups would find it challenging to achieve comparable cost-effectiveness. This experience curve effect, honed over decades by industry leaders, translates into optimized processes and higher yields, further widening the gap.

- Economies of Scale: Applied Materials leverages its vast production capacity and global reach to achieve lower costs per unit in manufacturing and supply chain operations.

- Experience Curve: Decades of operational experience have allowed leading firms to refine processes, improve efficiency, and reduce costs through learning and optimization.

- R&D Investment: Significant and ongoing investment in research and development by incumbents creates a technological and cost barrier for new entrants attempting to compete on innovation and production efficiency.

- Procurement Power: Large-scale purchasing power grants established companies better terms with suppliers, reducing input costs compared to smaller, less experienced competitors.

Geopolitical Landscape and Trade Barriers

The current geopolitical climate, marked by increasing export controls and government incentives for domestic manufacturing, presents a significant hurdle for potential new entrants into the semiconductor equipment market. For instance, the US CHIPS and Science Act of 2022, alongside similar initiatives in Europe and Asia, aims to bolster local production, potentially restricting market access for foreign firms or increasing the cost and complexity of operations. This environment can favor localized players who can align with national industrial policies.

These trade dynamics can manifest as:

- Increased compliance costs: Navigating varying export regulations and tariffs adds financial and operational burdens for new entrants.

- Limited market access: Certain regions may impose restrictions on technology transfer or market entry for companies from specific countries, hindering global expansion.

- Government subsidies and support: National programs designed to encourage domestic semiconductor manufacturing can create an uneven playing field, favoring established local players or new entrants with strong government backing.

- Supply chain localization: A push towards more localized supply chains can make it harder for new entrants to establish reliable and cost-effective sourcing channels.

The threat of new entrants in the semiconductor equipment industry is generally low, primarily due to the immense capital requirements for R&D and manufacturing, coupled with the need for specialized technological expertise. Applied Materials, for example, invests billions annually in innovation, a sum prohibitive for most newcomers. Furthermore, the industry is characterized by long customer qualification cycles, often taking several years, which favors established players with proven track records and deep relationships.

Economies of scale and experience curve advantages also significantly deter new entrants. Leading companies like Applied Materials benefit from lower per-unit costs due to high production volumes and optimized processes developed over decades. For instance, in 2024, the cost of building a new fabrication plant can easily exceed $10 billion, a stark reminder of the capital intensity involved.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions needed for R&D, manufacturing facilities, and global support. | Extremely high, limiting entry to well-funded entities. |

| Technological Expertise & IP | Deep knowledge in materials science, engineering, and thousands of patents. | Significant hurdle to replicate innovation and product performance. |

| Customer Qualification Cycles | Rigorous, multi-year vetting process by semiconductor manufacturers. | Creates long lead times for revenue generation and requires sustained investment. |

| Economies of Scale & Experience Curve | Lower costs due to high volume production and optimized processes. | New entrants struggle to match cost efficiencies and pricing power. |

| Geopolitical Factors | Export controls, trade policies, and government incentives for domestic production. | Adds complexity, compliance costs, and potentially limits market access. |

Porter's Five Forces Analysis Data Sources

Our Applied Materials Porter's Five Forces analysis is built upon a foundation of verified data, including the company's annual reports, industry-specific market research from firms like Gartner and IDC, and public regulatory filings.

We supplement this with insights from financial databases such as Bloomberg and S&P Capital IQ, as well as trade publications and macroeconomic indicators to provide a comprehensive view of the competitive landscape.