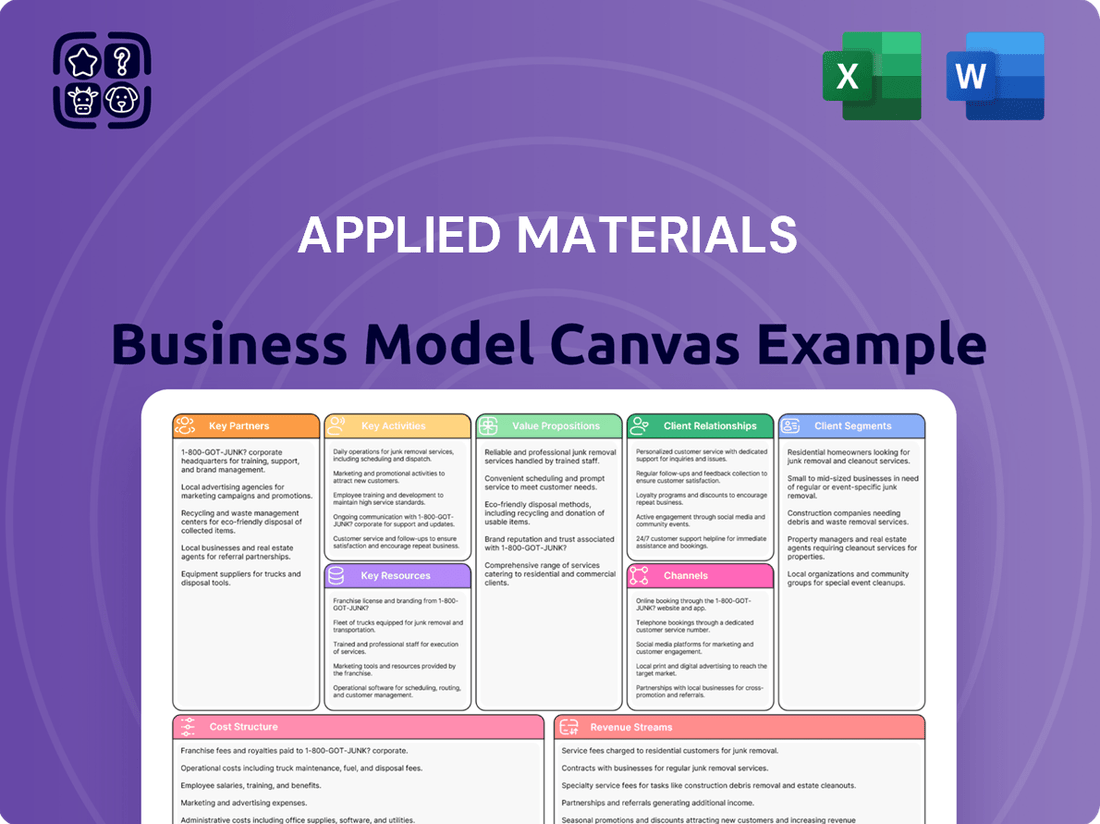

Applied Materials Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Materials Bundle

Unlock the strategic blueprint behind Applied Materials's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how the company innovates in semiconductor manufacturing, manages complex customer relationships, and generates revenue through essential equipment and services. Dive into the core components that drive their market leadership and gain actionable insights for your own business strategy.

Partnerships

Applied Materials actively cultivates strategic technology alliances with major semiconductor foundries and integrated device manufacturers (IDMs). These collaborations are crucial for co-developing advanced process technologies, ensuring their equipment aligns with future chip architectures and manufacturing complexities. For instance, their partnerships with companies like TSMC are vital for pushing the boundaries of chip manufacturing, as seen in the development of advanced nodes.

Applied Materials actively engages in Research and Development Collaborations with leading universities and research institutions globally. These partnerships are crucial for exploring fundamental science and cutting-edge materials engineering. For instance, in fiscal year 2023, the company invested $2.2 billion in R&D, a significant portion of which fuels these collaborative efforts.

These collaborations are designed to foster innovation and push the boundaries of materials science. By working with academic and research partners, Applied Materials ensures a robust pipeline of disruptive technologies that will shape future product development in the semiconductor and display industries. This strategic approach allows the company to stay ahead of technological curves and anticipate market needs.

Applied Materials relies heavily on a global network of component and raw material suppliers, crucial for building its advanced semiconductor manufacturing equipment. These partnerships are vital for securing specialized parts and high-purity materials, ensuring the quality and performance of their products.

In 2024, maintaining strong supplier relationships is paramount for supply chain stability. For instance, the semiconductor industry's ongoing demand for advanced materials like silicon wafers and specialized chemicals means Applied Materials must cultivate deep ties with key producers to guarantee consistent supply and competitive pricing.

Software and AI Solution Providers

Applied Materials partners with software and AI solution providers to bolster its offerings in advanced process control, factory automation, and data analytics, crucial for smart manufacturing environments. These alliances enable the seamless integration of cutting-edge software functionalities designed to fine-tune equipment performance and elevate customer production yields.

These collaborations are vital for developing sophisticated AI-driven algorithms that can predict equipment failures and optimize manufacturing processes in real-time. For instance, in 2024, the semiconductor industry's increasing reliance on AI for yield enhancement highlights the strategic importance of such partnerships.

- Integration of AI for Predictive Maintenance: Software partners provide AI models that analyze sensor data from Applied Materials' equipment, predicting potential issues before they impact production.

- Enhanced Process Optimization: Collaborations lead to software solutions that leverage machine learning to continuously adjust process parameters, improving wafer quality and throughput.

- Smart Factory Solutions: Partnerships facilitate the development of integrated software platforms that connect and manage multiple pieces of equipment, creating more efficient and automated manufacturing workflows.

- Data Analytics Capabilities: AI specialists contribute to advanced data analytics tools that extract actionable insights from the vast amounts of data generated by semiconductor manufacturing, driving continuous improvement.

Global Service and Support Network Partners

Applied Materials leverages a global service and support network, often partnering with local entities to ensure prompt equipment maintenance and rapid troubleshooting across diverse geographical markets. These collaborations are vital for maintaining high levels of customer satisfaction and maximizing equipment operational uptime for their clients in the semiconductor manufacturing industry.

These strategic alliances allow Applied Materials to offer localized expertise and on-the-ground support, which is critical for the complex machinery they supply. For instance, in 2023, Applied Materials reported that approximately 75% of its revenue came from outside North America, underscoring the necessity of a robust international support infrastructure.

- Local Service Providers: Partnering with regional specialists to offer immediate on-site support.

- Extended Reach: Expanding service capabilities into areas where direct presence might be less efficient.

- Customer Uptime: Ensuring minimal disruption for customers by providing swift and effective technical assistance.

- Global Footprint: Maintaining a consistent and high-quality service experience worldwide.

Applied Materials' key partnerships are foundational to its business model, enabling innovation and market reach. These include deep collaborations with semiconductor giants like TSMC for co-developing next-generation chip technologies, crucial for staying competitive in advanced nodes. The company also fosters R&D partnerships with universities, investing significantly in future breakthroughs; in fiscal year 2023, R&D spending reached $2.2 billion. Furthermore, alliances with software and AI providers are vital for enhancing its equipment with smart manufacturing capabilities, a trend accelerating in 2024 as the industry increasingly relies on AI for yield improvements.

What is included in the product

This Applied Materials Business Model Canvas provides a strategic overview of their operations, detailing customer segments, key partners, and their unique value propositions in serving the semiconductor and display industries.

It outlines the core activities, resources, and revenue streams that enable Applied Materials to drive innovation and maintain its leadership position in advanced materials engineering.

The Applied Materials Business Model Canvas acts as a pain point reliver by offering a clear, structured framework that simplifies complex strategic planning.

It allows teams to efficiently map out key business elements, identifying and addressing potential challenges or inefficiencies with a unified visual representation.

Activities

Applied Materials' commitment to Research and Development is a cornerstone of its business, driving innovation in materials engineering. In fiscal year 2023, the company reported R&D expenses of $2.7 billion, a significant investment aimed at developing next-generation semiconductor process technologies and advanced manufacturing equipment. This dedication ensures they remain at the forefront of industries demanding constant technological advancement.

Applied Materials designs, manufactures, and assembles highly complex and precise equipment essential for creating semiconductors, flat panel displays, and solar cells. This core activity demands advanced engineering capabilities, robust supply chain management, and stringent quality control to ensure the delivery of high-performance systems that drive innovation in these critical industries.

In fiscal year 2023, Applied Materials reported significant revenue from its equipment segments, reflecting the ongoing demand for advanced manufacturing solutions. The company's ability to produce these sophisticated machines, which can cost millions of dollars each, underscores its technical expertise and market leadership.

Applied Materials drives its business through robust global sales and marketing. This involves direct engagement with customers worldwide, showcasing how their materials engineering innovations solve complex manufacturing challenges. In fiscal year 2023, the company reported net sales of $26.7 billion, reflecting the broad reach of these efforts.

Key activities include presenting tailored solutions to a diverse customer base across semiconductor, display, and related industries. Participation in major industry trade shows and events is crucial for demonstrating product capabilities and fostering relationships. Applied Materials also emphasizes digital marketing and online resources to inform and attract potential clients.

Customer Service and Support

Applied Materials focuses heavily on customer service and support as a crucial business activity. This includes offering comprehensive post-sales services, essential maintenance, and timely upgrades to their sophisticated equipment. Technical support is paramount to ensure customers’ operations run smoothly and efficiently, minimizing downtime.

This dedication to support directly translates into strong, long-term customer relationships, fostering loyalty and repeat business. It's a significant contributor to the company's recurring revenue streams, demonstrating the value placed on ongoing customer success. For instance, in fiscal year 2023, Applied Materials generated $3.7 billion in service revenue, highlighting the financial impact of these activities.

- Post-Sales Service: Offering a full suite of services after the initial sale.

- Maintenance and Upgrades: Ensuring equipment remains operational and up-to-date.

- Technical Support: Providing expert assistance to resolve operational issues.

- Recurring Revenue: Generating consistent income through ongoing service agreements.

Supply Chain Management and Logistics

Applied Materials actively manages a sophisticated global supply chain. This involves sourcing diverse raw materials and specialized components from numerous international suppliers. The company's operations are designed to ensure these inputs are integrated effectively for manufacturing.

Efficient logistics are paramount for Applied Materials. This includes the intricate process of moving finished semiconductor manufacturing equipment, which are often large and complex, to customer sites across the globe. It also encompasses the timely delivery of critical spare parts to minimize customer downtime.

- Global Sourcing Network: Applied Materials relies on a vast network of suppliers for essential materials like silicon wafers, chemicals, and specialized components, ensuring a robust and diversified supply base.

- Manufacturing and Assembly: The company operates manufacturing facilities worldwide, orchestrating the assembly of intricate semiconductor equipment, adhering to stringent quality control measures.

- Worldwide Distribution: Applied Materials manages complex logistics for delivering its high-value, often oversized equipment to customers in key semiconductor manufacturing hubs globally.

- Aftermarket Support: Ensuring the availability and rapid delivery of spare parts and service technicians is a crucial aspect of their supply chain, directly impacting customer operational continuity.

Applied Materials' key activities revolve around innovation and production. This includes extensive research and development to engineer cutting-edge materials and manufacturing processes, alongside the design, manufacturing, and assembly of highly complex equipment for the semiconductor and display industries. Their global sales and marketing efforts ensure these solutions reach customers worldwide, supported by robust post-sales service and a sophisticated supply chain management system.

| Key Activity | Description | Fiscal Year 2023 Impact |

|---|---|---|

| Research & Development | Driving innovation in materials engineering and semiconductor process technologies. | $2.7 billion in R&D expenses. |

| Equipment Design & Manufacturing | Producing highly precise and complex machinery for semiconductor fabrication. | Significant revenue contribution from equipment sales. |

| Sales & Marketing | Engaging customers globally to showcase and sell advanced manufacturing solutions. | $26.7 billion in net sales. |

| Customer Support & Service | Providing post-sales services, maintenance, and technical assistance. | $3.7 billion in service revenue. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a generic sample, but a direct representation of the comprehensive analysis you will gain access to. Upon completing your order, you will instantly download this same, fully detailed Business Model Canvas, ready for your strategic application.

Resources

Applied Materials' intellectual property, including a substantial patent portfolio and trade secrets, is a critical resource. This IP protects their innovations in materials science and process engineering, underpinning their market leadership in semiconductor manufacturing equipment.

In 2023, Applied Materials held over 13,000 active patents globally, a testament to their continuous investment in research and development. This extensive IP shields their cutting-edge technologies, such as advanced deposition and etch processes, from competitors.

Applied Materials' competitive edge is built upon a foundation of highly skilled professionals. This includes engineers, scientists, and technicians with specialized knowledge in fields like materials science, physics, and electrical engineering. Their deep expertise is crucial for the company's innovation and product development.

This human capital is directly responsible for creating the advanced semiconductor manufacturing equipment that defines the industry. For instance, in fiscal year 2023, Applied Materials invested significantly in research and development, a clear indicator of their reliance on their skilled workforce to drive future technological advancements.

Applied Materials boasts a global network of advanced manufacturing plants and research and development centers. These facilities are the backbone of their operations, housing state-of-the-art cleanrooms and sophisticated testing equipment essential for creating their complex semiconductor manufacturing solutions.

In fiscal year 2023, Applied Materials invested significantly in its global infrastructure to support innovation and production. The company’s commitment to these facilities underscores their role in developing, refining, and scaling the production of cutting-edge equipment that drives the semiconductor industry forward.

Brand Reputation and Customer Relationships

Applied Materials' brand reputation, cultivated over decades, is a cornerstone of its business model, signifying reliability and innovation in materials engineering. This strong standing translates into a significant intangible asset, underpinning customer loyalty and market confidence.

The company's deep-seated relationships and established trust with major semiconductor manufacturers are critical. These long-term partnerships not only ensure consistent business but also facilitate crucial collaborative development efforts, driving future product advancements.

For fiscal year 2023, Applied Materials reported net sales of $26.5 billion, reflecting the continued demand for its advanced semiconductor manufacturing equipment, a testament to its brand strength and customer relationships.

- Brand Reputation: Decades of leadership in materials engineering foster trust and perceived value.

- Customer Relationships: Long-standing partnerships with key semiconductor players ensure recurring revenue and joint innovation.

- Financial Impact: Strong brand and relationships contributed to $26.5 billion in net sales for FY2023.

- Competitive Advantage: These intangible assets provide a significant barrier to entry for competitors.

Financial Capital

Applied Materials requires significant financial capital to fuel its innovation engine. In fiscal year 2023, the company invested $2.7 billion in research and development, a testament to its commitment to staying at the forefront of semiconductor technology.

This substantial financial backing is crucial for maintaining its extensive global manufacturing footprint and for strategically acquiring new technologies that enhance its product portfolio. For instance, its acquisition of Varian Semiconductor Equipment Associates in 2022 bolstered its ion implantation capabilities.

Furthermore, strong financial health allows Applied Materials to offer vital customer financing solutions, smoothing the path for its clients to adopt advanced manufacturing equipment. This financial flexibility underpins its ability to pursue continuous investment and execute strategic growth initiatives across the semiconductor industry.

- Research and Development Investment: $2.7 billion in FY2023.

- Strategic Acquisitions: Example: Varian Semiconductor Equipment Associates acquisition to enhance ion implantation technology.

- Customer Financing: Providing financial support to clients for equipment adoption.

- Global Operations: Funding and maintaining worldwide manufacturing and service networks.

Applied Materials' intellectual property, including a substantial patent portfolio and trade secrets, is a critical resource. This IP protects their innovations in materials science and process engineering, underpinning their market leadership in semiconductor manufacturing equipment. In 2023, Applied Materials held over 13,000 active patents globally, a testament to their continuous investment in research and development. This extensive IP shields their cutting-edge technologies, such as advanced deposition and etch processes, from competitors.

Applied Materials' competitive edge is built upon a foundation of highly skilled professionals. This includes engineers, scientists, and technicians with specialized knowledge in fields like materials science, physics, and electrical engineering. Their deep expertise is crucial for the company's innovation and product development. This human capital is directly responsible for creating the advanced semiconductor manufacturing equipment that defines the industry. For instance, in fiscal year 2023, Applied Materials invested significantly in research and development, a clear indicator of their reliance on their skilled workforce to drive future technological advancements.

Applied Materials boasts a global network of advanced manufacturing plants and research and development centers. These facilities are the backbone of their operations, housing state-of-the-art cleanrooms and sophisticated testing equipment essential for creating their complex semiconductor manufacturing solutions. In fiscal year 2023, Applied Materials invested significantly in its global infrastructure to support innovation and production. The company’s commitment to these facilities underscores their role in developing, refining, and scaling the production of cutting-edge equipment that drives the semiconductor industry forward.

Applied Materials' brand reputation, cultivated over decades, is a cornerstone of its business model, signifying reliability and innovation in materials engineering. This strong standing translates into a significant intangible asset, underpinning customer loyalty and market confidence. The company's deep-seated relationships and established trust with major semiconductor manufacturers are critical. These long-term partnerships not only ensure consistent business but also facilitate crucial collaborative development efforts, driving future product advancements. For fiscal year 2023, Applied Materials reported net sales of $26.5 billion, reflecting the continued demand for its advanced semiconductor manufacturing equipment, a testament to its brand strength and customer relationships.

Applied Materials requires significant financial capital to fuel its innovation engine. In fiscal year 2023, the company invested $2.7 billion in research and development, a testament to its commitment to staying at the forefront of semiconductor technology. This substantial financial backing is crucial for maintaining its extensive global manufacturing footprint and for strategically acquiring new technologies that enhance its product portfolio. For instance, its acquisition of Varian Semiconductor Equipment Associates in 2022 bolstered its ion implantation capabilities. Furthermore, strong financial health allows Applied Materials to offer vital customer financing solutions, smoothing the path for its clients to adopt advanced manufacturing equipment. This financial flexibility underpins its ability to pursue continuous investment and execute strategic growth initiatives across the semiconductor industry.

| Key Resource | Description | Fiscal Year 2023 Data/Impact |

|---|---|---|

| Intellectual Property | Patents and trade secrets protecting innovations in materials science and process engineering. | Over 13,000 active patents globally; shields advanced deposition and etch processes. |

| Human Capital | Highly skilled engineers, scientists, and technicians with specialized knowledge. | Crucial for innovation and product development; significant R&D investment reflects reliance on this workforce. |

| Physical Assets | Global network of advanced manufacturing plants and R&D centers. | State-of-the-art cleanrooms and testing equipment; significant infrastructure investment to support innovation and production. |

| Brand Reputation & Relationships | Decades of leadership, trust with key semiconductor manufacturers, and collaborative development. | Underpins customer loyalty and market confidence; contributed to $26.5 billion in net sales. |

| Financial Capital | Funds for innovation, global operations, and strategic acquisitions. | $2.7 billion invested in R&D; enables customer financing and strategic growth initiatives. |

Value Propositions

Applied Materials' value proposition centers on enabling customers to build the next generation of technology. They provide the essential materials engineering solutions that allow companies to create advanced semiconductors, vibrant displays, and efficient solar cells. This means customers can push innovation, like continuing to shrink transistors as predicted by Moore's Law, or developing revolutionary display technologies.

In 2024, the demand for these advanced technologies remained robust. Applied Materials reported significant growth, particularly in its semiconductor systems segment, driven by investments in leading-edge logic and memory. For instance, their equipment played a crucial role in enabling the production of chips with features smaller than 3 nanometers, a key benchmark for advanced roadmaps.

Applied Materials' value proposition centers on optimizing production efficiency and yield for its customers. Their advanced equipment and software solutions are engineered to dramatically boost manufacturing yields, minimize defects, and accelerate throughput in the chip, display, and solar industries. This focus directly benefits clients by lowering their production costs and enhancing profitability.

For instance, in the semiconductor sector, Applied Materials' innovations in process control and metrology are crucial. In 2024, the semiconductor industry faced ongoing challenges with supply chain complexities and the demand for increasingly sophisticated chips. Companies leveraging Applied Materials' integrated solutions reported an average reduction in critical process steps by up to 15% and a decrease in wafer scrap rates by as much as 10%, directly impacting their bottom line.

Applied Materials provides a wide array of equipment, services, and software, all designed to work together. This integrated approach simplifies complex manufacturing processes for their clients, ensuring everything runs smoothly.

For instance, in the semiconductor industry, Applied Materials' ability to offer end-to-end solutions, from deposition to etch and inspection, streamlines customer operations. This comprehensive offering was a key factor in their strong performance, with the company reporting net sales of $26.5 billion for fiscal year 2023, demonstrating the market's demand for integrated solutions.

Reducing Time-to-Market for New Products

Applied Materials significantly cuts down the time it takes for customers to bring new products to life. By offering advanced process technologies and fostering close collaboration, they enable clients to speed up the development and launch of their latest innovations.

This acceleration is vital in rapidly evolving tech sectors where being first to market can be a major competitive advantage. For instance, in the semiconductor industry, where product cycles are notoriously short, Applied Materials' solutions can shave months off development timelines.

- Accelerated Innovation Cycles: Customers can bring next-generation products to market faster, gaining a competitive edge.

- Reduced Development Costs: Streamlined processes and collaborative R&D minimize costly delays and iterations.

- Enhanced Market Responsiveness: Enables companies to quickly adapt to changing market demands and technological shifts.

Global Service and Expert Support

Applied Materials' global service network, staffed by highly skilled field engineers, ensures customers receive proactive maintenance and rapid troubleshooting. This commitment translates to maximized equipment uptime, a crucial factor for semiconductor manufacturers operating 24/7. In 2023, the company reported approximately $26.3 billion in revenue, underscoring the scale of its operations and the critical nature of its support services.

Customers rely on this expert support to optimize the performance of their complex manufacturing equipment, directly impacting yield and production efficiency. This deep technical expertise allows for swift issue resolution, minimizing costly downtime. For instance, the semiconductor industry, a core market for Applied Materials, experienced significant investment in new fabrication plants throughout 2024, increasing the demand for reliable service and support.

- Global Reach: Extensive network of service centers and field engineers worldwide.

- Expertise: Highly trained personnel specializing in semiconductor manufacturing equipment.

- Proactive Maintenance: Predictive analytics and scheduled servicing to prevent issues.

- Performance Optimization: Continuous tuning and upgrades to enhance equipment efficiency and output.

Applied Materials' value proposition is built on enabling customers to create the next generation of technology by providing essential materials engineering solutions. This allows companies to develop advanced semiconductors, displays, and solar cells, driving innovation and pushing the boundaries of what's possible.

In 2024, the company's semiconductor systems segment saw robust demand, fueled by significant customer investments in leading-edge logic and memory. Applied Materials' equipment was instrumental in enabling the production of chips with features smaller than 3 nanometers, a critical milestone for advanced technology roadmaps.

Applied Materials also focuses on optimizing production efficiency and yield for its clients. Their advanced equipment and software solutions are designed to boost manufacturing yields, reduce defects, and increase throughput across the semiconductor, display, and solar industries, ultimately lowering production costs and enhancing profitability for customers.

In 2024, companies utilizing Applied Materials' integrated solutions reported notable improvements, such as a reduction in critical process steps by up to 15% and a decrease in wafer scrap rates by as much as 10%. These efficiencies directly contributed to improved financial performance for their clients.

Applied Materials offers a comprehensive suite of equipment, services, and software that work in synergy, simplifying complex manufacturing processes for their customers and ensuring seamless operations.

This integrated approach was a key driver of the company's strong market position, with net sales reaching $26.5 billion in fiscal year 2023, highlighting the market's preference for end-to-end solutions that enhance operational efficiency.

The company significantly accelerates the time-to-market for new products by providing advanced process technologies and fostering close collaboration with clients.

This acceleration is crucial in fast-paced tech markets where speed to market is a significant competitive advantage, with Applied Materials' solutions capable of reducing development timelines by months in the semiconductor industry.

Applied Materials' global service network, backed by skilled field engineers, ensures maximum equipment uptime through proactive maintenance and rapid troubleshooting, which is vital for 24/7 operations.

In 2023, the company's revenue was approximately $26.3 billion, reflecting the extensive scale of its operations and the critical importance of its support services to customers, particularly in the burgeoning semiconductor sector which saw increased investment in new fabrication plants throughout 2024.

| Value Proposition Area | Key Benefit | 2024 Impact/Data Point |

|---|---|---|

| Enabling Next-Gen Technology | Creation of advanced semiconductors, displays, solar cells | Crucial for <3nm chip production |

| Optimizing Production Efficiency | Reduced costs, increased profitability | Up to 15% reduction in process steps, 10% decrease in wafer scrap rates |

| Integrated Solutions | Simplified manufacturing, streamlined operations | Supported $26.5 billion net sales in FY2023 |

| Accelerated Innovation | Faster time-to-market for new products | Reduces development timelines by months |

| Global Service & Support | Maximized equipment uptime, reliable operations | Supported ~$26.3 billion revenue in 2023; vital for 2024 fab investments |

Customer Relationships

Applied Materials cultivates enduring partnerships with its major clients via specialized account managers. These professionals are deeply attuned to each customer's unique requirements and overarching strategic objectives, ensuring a tailored and responsive service. This deep engagement builds significant trust and provides Applied Materials with invaluable insights into customer development pipelines.

Applied Materials frequently partners with major clients in joint development programs. These initiatives focus on co-engineering advanced solutions tailored for upcoming technology generations and novel product designs. For instance, in 2023, the company highlighted ongoing collaborations with leading semiconductor manufacturers to accelerate the development of next-generation chip technologies.

This deep collaboration ensures Applied Materials' products and services are precisely aligned with evolving customer needs and industry roadmaps. Such partnerships are crucial for staying at the forefront of innovation, as evidenced by the significant R&D investments made by both Applied Materials and its key partners to push technological boundaries.

Applied Materials provides robust technical support, including crucial on-site assistance and remote diagnostics, to ensure customers can maintain peak equipment performance. This support is vital for semiconductor manufacturers who rely on continuous operation.

Expert consulting services are also a cornerstone of their customer relationships, helping clients optimize complex process integration within their manufacturing lines. For instance, in 2023, the company’s services segment, which includes technical support and consulting, generated over $5 billion in revenue, highlighting its significance to their business model.

Customer Training and Education

Applied Materials offers extensive training programs designed to equip customer personnel with the skills needed for optimal equipment operation, routine maintenance, and mastering advanced process techniques. This focus on education ensures clients can fully leverage their investment in Applied Materials technology.

By empowering customers through these training initiatives, Applied Materials helps them enhance the efficiency and overall value derived from their sophisticated semiconductor manufacturing equipment. For instance, in fiscal year 2023, the company’s Global Services segment, which includes training and support, generated significant revenue, underscoring the importance of these customer relationships.

- Equipment Operation Mastery: Training covers the fundamental and advanced operational procedures for Applied Materials' cutting-edge equipment.

- Preventive Maintenance Skills: Customers learn essential maintenance protocols to ensure equipment longevity and minimize downtime.

- Advanced Process Optimization: Education focuses on optimizing process parameters to achieve higher yields and better device performance.

- Maximizing ROI: The ultimate goal is to enable customers to achieve the highest possible return on their investment through skilled operation and maintenance.

Strategic Partnerships and Alliances

Applied Materials goes beyond simple transactions by fostering deep strategic partnerships with key customers. These alliances often involve multi-year agreements and collaborative efforts in technology development. For instance, in 2024, the company continued to emphasize these relationships, which are crucial for driving innovation in semiconductor manufacturing.

These strategic alliances are not just about supply; they are about co-creation and shared risk. Applied Materials engages in joint ventures and technology-sharing initiatives, ensuring that its innovations are aligned with the future needs of its most significant clients. This approach was evident in their continued investment in advanced research and development programs with leading chipmakers throughout 2024.

- Long-Term Supply Agreements: Securing predictable revenue streams and customer commitment.

- Joint Ventures: Sharing resources and expertise for mutual benefit in new technology areas.

- Technology Sharing: Collaborating on R&D to accelerate innovation and market adoption.

Applied Materials' customer relationships are built on a foundation of deep collaboration and specialized support, ensuring clients can maximize the performance of complex semiconductor manufacturing equipment. This is achieved through dedicated account management, joint development programs, and robust technical assistance, fostering long-term, strategic partnerships crucial for innovation.

The company's commitment extends to comprehensive training and expert consulting, empowering customers to optimize their operations and achieve higher yields. These services are integral to the business model, as demonstrated by the significant revenue generated by the Global Services segment, which underscores the value placed on these customer engagements.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Dedicated Account Management | Specialized teams understanding unique client needs and strategic goals. | Fosters trust and provides insights into customer development pipelines. |

| Joint Development Programs | Collaborative engineering for next-generation technologies and products. | Accelerates innovation with leading semiconductor manufacturers. |

| Technical Support & Consulting | On-site assistance, remote diagnostics, and process optimization services. | Global Services segment revenue exceeded $5 billion in 2023, highlighting importance. |

| Customer Training | Programs for equipment operation, maintenance, and advanced process techniques. | Enhances customer efficiency and ROI on sophisticated equipment. |

| Strategic Alliances | Multi-year agreements and co-creation initiatives with key clients. | Drives innovation and aligns Applied Materials' R&D with future industry needs. |

Channels

Applied Materials relies on a dedicated direct sales force, comprising highly trained technical experts, to connect with its global clientele in the semiconductor, display, and solar industries. This direct engagement facilitates in-depth technical consultations and the development of tailored solutions for complex manufacturing challenges.

This approach enables Applied Materials to directly negotiate contracts and build strong, lasting relationships with key customers. For instance, in fiscal year 2023, the company reported net sales of $26.5 billion, underscoring the effectiveness of its sales channels in reaching and serving a broad customer base.

Applied Materials' global service network is a vital channel, comprising field service engineers and local offices strategically positioned near customer fabrication plants. This extensive network ensures prompt post-sales support, essential maintenance, and timely upgrades, directly impacting customer uptime and operational efficiency. In fiscal year 2023, Applied Materials reported over $20 billion in service revenue, underscoring the critical role of this channel in their business model.

Applied Materials' technology and demonstration centers are crucial for showcasing their cutting-edge equipment and fostering innovation. These global hubs allow customers to see advanced semiconductor manufacturing tools in action, ensuring they understand the capabilities firsthand. In fiscal year 2023, Applied Materials invested significantly in these centers, reflecting their importance in driving sales and customer partnerships.

These centers act as a vital bridge for co-development, enabling customers to test and refine new process technologies using Applied Materials' state-of-the-art equipment. This collaborative approach accelerates product development cycles and strengthens customer relationships. The company's commitment to these demonstration facilities underscores their strategy of providing tangible proof of performance and innovation.

Industry Conferences and Trade Shows

Applied Materials actively participates in premier industry gatherings like SEMICON West and SPIE Advanced Lithography. These events are crucial for demonstrating cutting-edge deposition and etch technologies, directly engaging with semiconductor manufacturers, and fostering relationships with key decision-makers. In 2023, SEMICON West saw over 6,000 attendees, providing a significant platform for lead generation and brand visibility.

These trade shows are instrumental in generating new business opportunities and understanding market trends. They allow Applied Materials to showcase innovations that address critical challenges in chip manufacturing, such as advanced packaging and AI-driven process optimization. The company’s presence at these events directly contributes to its sales pipeline and market intelligence gathering.

Key benefits derived from these channels include:

- Product Demonstration: Showcasing new equipment and process solutions to a targeted audience.

- Customer Engagement: Direct interaction with current and prospective clients to understand their needs and challenges.

- Lead Generation: Identifying and qualifying potential new customers for sales follow-up.

- Market Intelligence: Gathering insights on competitor activities and emerging industry trends.

Online Presence and Digital Engagement

Applied Materials utilizes its corporate website and investor relations portal as key digital touchpoints. These platforms serve to disseminate crucial information, educate stakeholders, and foster engagement with customers, investors, and the wider semiconductor industry.

The company actively develops digital content, including white papers, webinars, and case studies, to establish itself as a thought leader. This content not only informs but also builds brand recognition and loyalty within the highly technical semiconductor manufacturing sector.

- Website Traffic: Applied Materials’ corporate website consistently ranks among the top resources for semiconductor industry professionals seeking technical information and company updates.

- Digital Content Engagement: In 2024, the company reported a significant increase in downloads of its technical white papers and webinar attendance, indicating strong interest in its digital educational offerings.

- Investor Relations Portal: The investor relations section provides detailed financial reports, presentations, and news, crucial for maintaining transparency and attracting investment.

Applied Materials leverages a multi-faceted channel strategy, combining direct sales with a robust global service network and strategic industry engagement. This ensures comprehensive customer support and market penetration. Digital platforms further amplify their reach, disseminating technical expertise and fostering stakeholder relationships.

Customer Segments

Semiconductor manufacturers, including foundries like TSMC and integrated device manufacturers (IDMs) such as Intel and Samsung, represent a core customer segment. These companies are at the forefront of producing advanced logic, memory, and specialized chips essential for everything from smartphones to data centers.

In 2024, the global semiconductor market is projected to reach over $600 billion, with wafer fabrication equipment sales expected to see significant growth. Applied Materials' customers in this segment invest heavily in cutting-edge technology to maintain their competitive edge in a rapidly evolving industry.

Flat panel display manufacturers, including those building LCD and OLED screens for everything from smartphones to large-screen TVs, represent a core customer segment. These companies rely heavily on sophisticated equipment for crucial processes like thin-film transistor (TFT) array formation and the intricate assembly of display panels. In 2024, the global display market was projected to reach over $120 billion, highlighting the significant demand for the advanced manufacturing solutions Applied Materials provides to this sector.

Solar panel manufacturers are a crucial customer segment, encompassing companies that create photovoltaic (PV) cells and modules for the burgeoning renewable energy sector. These businesses rely heavily on advanced manufacturing equipment for critical processes like deposition and patterning to ensure efficient and high-quality solar cell production.

In 2024, the global solar market continued its robust expansion, with installations projected to reach new heights. This growth directly fuels demand for the sophisticated manufacturing technologies that Applied Materials provides to solar panel producers, enabling them to scale operations and improve product performance.

Original Equipment Manufacturers (OEMs)

Applied Materials' Original Equipment Manufacturer (OEM) customer segment includes companies that incorporate Applied Materials' advanced semiconductor manufacturing equipment, or critical sub-systems and components, into their own larger, integrated solutions. This segment, while smaller than direct semiconductor fab customers, is crucial for extending Applied Materials' technological reach and market penetration.

For instance, a company developing specialized testing equipment might integrate Applied Materials' metrology or inspection modules. This allows the OEM to offer a more comprehensive product without needing to develop those sophisticated technologies in-house. This symbiotic relationship leverages Applied Materials' core competencies in process control and equipment innovation.

- Niche Integration: OEMs integrate Applied Materials' specialized equipment or components into their broader manufacturing or testing systems.

- Extended Market Reach: This segment allows Applied Materials' technology to be embedded in solutions targeting markets beyond traditional semiconductor fabrication.

- Component Sales: A significant portion of this segment's revenue can be derived from the sale of high-value sub-systems and proprietary components.

- Strategic Partnerships: Applied Materials often forms strategic alliances with these OEMs to co-develop integrated solutions, enhancing value for the end-user.

Research and Development Institutions

Research and Development Institutions, including universities, national laboratories, and corporate R&D centers, represent a crucial, albeit smaller, customer segment for Applied Materials. These organizations focus on cutting-edge materials science and nanotechnology, utilizing Applied Materials' advanced equipment for their pioneering research and prototyping efforts. Their work often shapes future industry trends and demands, making them key influencers.

These institutions rely on Applied Materials for tools that enable breakthroughs in areas like advanced semiconductor fabrication, new material discovery, and next-generation device development. For example, university research labs often purchase specialized deposition and etching systems to explore novel materials with unique electronic or optical properties. In 2023, global R&D spending across all sectors saw continued growth, with a significant portion directed towards materials innovation, underscoring the importance of this segment.

- Universities: Academic institutions use Applied Materials' tools to train future engineers and scientists, fostering innovation in materials science and nanotechnology.

- National Laboratories: Government-funded research facilities leverage Applied Materials' equipment for fundamental scientific inquiry and the development of technologies with national strategic importance.

- Corporate R&D Centers: Private sector research arms utilize these tools for early-stage product development and to explore disruptive technologies, often collaborating with universities.

- Impact on Future Trends: The research conducted using Applied Materials' platforms directly influences the development of new products and manufacturing processes across various industries.

Applied Materials serves a diverse customer base, primarily focusing on semiconductor manufacturers like foundries and IDMs, as well as flat panel display and solar panel producers. These clients are heavily invested in advanced manufacturing to stay competitive, driving significant demand for Applied Materials' sophisticated equipment.

In 2024, the semiconductor industry's global market value is projected to exceed $600 billion, with substantial growth anticipated in wafer fabrication equipment sales. Similarly, the display market was projected to surpass $120 billion in 2024, reflecting strong demand for display manufacturing solutions.

The company also engages with Original Equipment Manufacturers (OEMs) who integrate Applied Materials' components into their own systems, expanding technological reach. Additionally, research and development institutions, including universities and national labs, utilize Applied Materials' advanced tools for groundbreaking materials science and nanotechnology research, influencing future industry directions.

Cost Structure

Applied Materials dedicates a substantial portion of its cost structure to Research and Development (R&D). This includes significant investments in compensating highly skilled scientists and engineers, acquiring and maintaining advanced laboratory equipment, and covering the material costs associated with developing groundbreaking technologies.

For fiscal year 2023, Applied Materials reported R&D expenses of $2.5 billion. This considerable outlay underscores the company's commitment to innovation and its strategy of maintaining a leading edge in the semiconductor manufacturing equipment industry through continuous technological advancement.

The Cost of Goods Sold (COGS) for Applied Materials is a significant component, directly reflecting the expenses incurred in producing their advanced semiconductor manufacturing equipment. This includes the cost of raw materials, such as silicon wafers and specialized chemicals, along with the intricate components that make up their complex machinery.

Manufacturing labor and factory overhead, encompassing depreciation of manufacturing facilities and utilities, also contribute substantially to COGS. Given the high-tech nature and precision required for their products, these direct costs represent a major expenditure for the company.

For fiscal year 2023, Applied Materials reported a Cost of Goods Sold of $17.6 billion, highlighting the immense scale of direct production expenses involved in their operations.

Sales, General, and Administrative (SG&A) expenses for Applied Materials are a significant component of their operational costs. These include salaries for their extensive sales and marketing teams, essential administrative staff, legal counsel, finance departments, and other vital overhead functions that keep the company running smoothly across its global footprint.

In fiscal year 2023, Applied Materials reported SG&A expenses of approximately $2.2 billion. These costs are crucial for maintaining strong customer relationships, driving market penetration, and supporting the complex corporate functions necessary for a company of its scale and reach in the semiconductor equipment industry.

Service and Support Operations Costs

Applied Materials incurs significant expenses in its Service and Support Operations. These costs are directly tied to delivering global customer service, deploying field engineers to customer sites, managing the logistics of spare parts, and providing essential technical support. These activities are crucial for maintaining customer satisfaction and ensuring the operational uptime of their complex equipment.

The financial burden of these operations is considerable, encompassing personnel salaries and benefits for a global support workforce, extensive travel expenses for field engineers, the costs associated with maintaining a robust inventory of spare parts, and the overhead of operating numerous service centers worldwide. For fiscal year 2023, Applied Materials reported that its service segment revenue was $6.61 billion, highlighting the scale of these operations and the associated cost structure.

- Personnel Costs: Salaries, wages, and benefits for a global team of service technicians, engineers, and support staff.

- Logistics and Inventory: Expenses related to managing spare parts inventory, warehousing, and global distribution networks.

- Travel and Field Operations: Costs incurred for travel, accommodation, and per diem for field engineers performing on-site service and maintenance.

- Service Center Operations: Overhead expenses for maintaining and operating service centers, including rent, utilities, and equipment.

Intellectual Property Maintenance and Licensing

Maintaining Applied Materials' extensive patent portfolio is a significant undertaking, involving substantial legal fees for filings, renewals, and expert consultations. These ongoing costs are crucial for protecting their technological innovations in areas like semiconductor manufacturing equipment. For instance, in fiscal year 2023, the company likely incurred millions in intellectual property (IP) management, a necessary investment to safeguard their competitive edge.

Beyond internal maintenance, Applied Materials may also incur costs related to licensing technologies from other entities to enhance their product offerings or to avoid potential infringement claims. Defending their IP rights through litigation or other legal avenues also represents a considerable expense. These expenditures are vital for ensuring the company can continue to operate and innovate without facing legal challenges to its core technologies.

- Patent Maintenance: Ongoing legal and administrative costs for filing, prosecuting, and maintaining a global patent portfolio.

- Licensing Fees: Payments for acquiring rights to use third-party technologies essential for product development.

- IP Defense: Expenses related to protecting intellectual property through legal actions, including litigation and enforcement.

Applied Materials' cost structure is heavily influenced by its substantial investments in Research and Development (R&D), with $2.5 billion allocated in fiscal year 2023. This reflects a strategic commitment to innovation in semiconductor manufacturing equipment. The Cost of Goods Sold (COGS) is also a major expense, totaling $17.6 billion in FY2023, covering raw materials and manufacturing complexities.

Sales, General, and Administrative (SG&A) expenses amounted to approximately $2.2 billion in FY2023, supporting global operations and customer relations. Furthermore, service and support operations represent a significant cost, crucial for customer satisfaction and equipment uptime, with the service segment generating $6.61 billion in revenue in FY2023.

| Cost Category | FY2023 Expense (Billions USD) | Significance |

| Research & Development (R&D) | $2.5 | Drives innovation and technological leadership. |

| Cost of Goods Sold (COGS) | $17.6 | Direct costs of producing advanced semiconductor equipment. |

| Sales, General & Administrative (SG&A) | ~$2.2 | Supports global operations, sales, and corporate functions. |

| Service & Support Operations | (Associated with $6.61B revenue) | Ensures customer satisfaction and equipment operational continuity. |

Revenue Streams

Applied Materials' core revenue originates from selling sophisticated semiconductor manufacturing equipment. This includes critical systems for deposition, etching, ion implantation, and process control, essential for creating advanced chips.

These sales represent significant capital investments for their customers, directly tied to the industry's cyclical spending patterns. For instance, in fiscal year 2023, Applied Materials reported total revenue of $26.5 billion, with equipment sales forming the bulk of this figure, reflecting strong demand for their advanced manufacturing solutions.

Applied Materials generates revenue by selling specialized equipment crucial for manufacturing flat panel displays, including LCD and OLED technologies. This segment also extends to equipment for emerging markets like flexible electronics, showcasing the company's strategic diversification beyond its core semiconductor business.

In fiscal year 2023, Applied Materials reported that its Display and Adjacent Markets segment generated approximately $3.3 billion in revenue. This represented a notable portion of the company's overall business, highlighting the significance of display manufacturing as a key revenue driver alongside its semiconductor equipment sales.

Applied Materials generates a substantial and growing recurring revenue from its services segment. This includes income from equipment maintenance contracts, sales of spare parts, and offerings like upgrades and consulting. This segment provides a stable financial base, less susceptible to fluctuations in new equipment orders.

In fiscal year 2023, Applied Materials reported that its Services segment revenue reached approximately $6.3 billion. This demonstrates the significant contribution of these offerings to the company's overall financial performance and highlights its importance as a reliable income source.

Software and Analytics Solutions

Applied Materials generates revenue through the licensing of sophisticated software and analytics. This includes advanced process control software, crucial for fine-tuning manufacturing processes, and factory automation software, which streamlines operations. These offerings extend value beyond the physical equipment.

The company also profits from data analytics solutions designed to boost equipment performance and overall manufacturing efficiency. This segment is vital as it provides ongoing value and insights to customers, differentiating Applied Materials’ offerings in the competitive semiconductor equipment market. For fiscal year 2023, Applied Materials reported total revenue of $26.5 billion, with a significant portion attributed to their integrated solutions which encompass software and services.

- Software Licensing: Revenue from granting access to process control and automation software.

- Data Analytics Services: Income generated from providing insights to optimize manufacturing.

- Value-Added Services: Software solutions enhance equipment performance and customer efficiency.

- Recurring Revenue Stream: Software and analytics contribute to a predictable revenue base.

Refurbished Equipment Sales and Subsystems

Applied Materials taps into revenue by offering refurbished equipment and specialized subsystems. This strategy is particularly beneficial for customers working with older technology nodes or requiring specific process steps where new equipment might be cost-prohibitive or unnecessary. It effectively extends the lifecycle of valuable assets and broadens the company's market appeal.

This segment allows Applied Materials to cater to a wider range of customer needs, including those in emerging markets or research institutions that may have budget constraints. By providing reliable, pre-owned equipment, they ensure continued access to advanced manufacturing capabilities.

- Refurbished Equipment Sales: Applied Materials can generate significant revenue by expertly restoring and reselling used semiconductor manufacturing equipment, extending its operational life and offering cost-effective solutions to clients.

- Subsystem and Component Sales: Revenue is also derived from selling specialized subsystems and individual components, crucial for maintaining and upgrading existing manufacturing lines, especially for legacy systems.

- Market Expansion: This approach allows Applied Materials to reach customers who might not be able to afford brand-new, state-of-the-art machinery, thereby expanding their overall market penetration and customer base.

Applied Materials' revenue streams are diverse, stemming from the sale of advanced semiconductor manufacturing equipment, which formed the majority of its $26.5 billion in revenue for fiscal year 2023. Complementing this, the company also generates substantial income from its services segment, which includes maintenance, spare parts, and upgrades, contributing approximately $6.3 billion in fiscal year 2023. Furthermore, revenue is derived from selling refurbished equipment and specialized subsystems, catering to a broader market segment.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approx.) |

|---|---|---|

| Equipment Sales | Sophisticated semiconductor and display manufacturing systems. | Majority of $26.5 billion total revenue. |

| Services | Maintenance, spare parts, upgrades, and consulting. | $6.3 billion |

| Refurbished Equipment & Subsystems | Sales of restored used equipment and specialized components. | Significant, though not separately itemized in total revenue figures. |

Business Model Canvas Data Sources

The Applied Materials Business Model Canvas is constructed using a blend of internal financial reports, market intelligence from industry analysts, and competitive landscape assessments. This multi-faceted approach ensures a robust and data-driven representation of the company's strategic framework.