Applied Materials Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Applied Materials Bundle

Curious about Applied Materials' product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges, offering a strategic overview.

To truly harness this information and make informed decisions, dive into the full BCG Matrix. It provides the detailed quadrant placements and actionable insights needed to optimize your investment and product strategies.

Unlock the complete picture and gain a competitive edge by purchasing the full BCG Matrix report today.

Stars

Applied Materials is strategically positioned to capitalize on the explosive growth in AI and high-performance computing, as its specialized equipment is indispensable for producing the advanced chips powering these technologies. The company projects a significant ramp-up in its Gate-All-Around (GAA) technology, forecasting revenues to surge from $2.5 billion in 2024 to $5 billion in 2025, highlighting a key area of future expansion.

Applied Materials' Leading-Edge Foundry and Logic Equipment falls squarely into the Stars category of the BCG Matrix. The company is a critical supplier for the manufacturing of the most advanced semiconductor nodes, including 3nm and 2nm. This strategic positioning allows Applied Materials to capture significant growth as the demand for these cutting-edge chips escalates.

The semiconductor industry's relentless push towards smaller, more powerful chips directly benefits Applied Materials. With major players like TSMC aiming for 2nm mass production by late 2025, the revenue generated from Applied Materials' Semiconductor Systems segment is expected to see a substantial uplift. This segment is crucial for the company's overall performance, reflecting the high demand for its advanced equipment.

Applied Materials is a powerhouse in deposition equipment, a crucial process for building the intricate layers on semiconductor wafers. Their strong hold in this area is a major reason for their overall market leadership in wafer fabrication equipment (WFE).

The WFE market itself is experiencing robust expansion, with projections indicating continued upward momentum. Applied Materials' significant share in deposition, a foundational technology within this growing market, directly fuels their competitive edge and revenue streams.

Sym3 Magnum Etch System and eBeam Technology

The Sym3 Magnum etch system, launched in February 2024, has quickly become a star performer for Applied Materials, generating over $1.2 billion in revenue. This indicates robust market demand for its advanced patterning capabilities, positioning it strongly within the BCG matrix.

Applied Materials' eBeam technologies complement the Sym3 Magnum by offering unparalleled nanoscale defect detection. This technological synergy provides a significant competitive edge, particularly in the expanding Wafer Fab Equipment (WFE) and foundry markets.

- Sym3 Magnum Revenue: Exceeded $1.2 billion since its February 2024 launch.

- eBeam Technology Advantage: Delivers nanoscale defect detection accuracy.

- Market Position: Strong growth potential in WFE and foundry segments.

New Platforms for Heterogeneous Integration and Advanced Packaging

Applied Materials is actively developing new platforms for heterogeneous integration and advanced packaging. Their Vistara platform and expansion of the EPIC innovation platform, including a new collaboration model, are key to this strategy. These efforts aim to speed up the market entry of energy-efficient computing and pave the way for future chip designs using 3D architectures and heterogeneous integration.

The company’s focus on advanced packaging is crucial for enabling more complex chip designs. In 2024, the semiconductor industry continued to see significant investment in advanced packaging solutions, with market research firms projecting substantial growth in this segment. For instance, some analysts estimated the advanced packaging market to reach over $70 billion by 2027, driven by demand from AI, high-performance computing, and mobile devices.

- Vistara Platform: Designed to address the complexities of heterogeneous integration.

- EPIC Innovation Platform: Expanded to foster collaboration in advanced chip packaging.

- Market Growth: Advanced packaging market projected for strong growth, exceeding $70 billion by 2027.

- Key Drivers: AI, high-performance computing, and mobile device demand fueling packaging innovation.

Applied Materials' Leading-Edge Foundry and Logic Equipment are firmly positioned as Stars in the BCG Matrix. The company's indispensable role in producing advanced chips for AI and high-performance computing, coupled with its strong market share in deposition equipment, drives significant revenue growth.

The Sym3 Magnum etch system, launched in February 2024, has already generated over $1.2 billion, underscoring its star status. Furthermore, Applied Materials' focus on heterogeneous integration and advanced packaging, supported by platforms like Vistara, taps into a rapidly expanding market projected to exceed $70 billion by 2027.

| Product/Segment | BCG Category | Key Growth Drivers | 2024 Revenue Impact (Est.) | Future Outlook |

|---|---|---|---|---|

| Leading-Edge Foundry & Logic Equipment | Stars | Demand for AI/HPC chips, advanced nodes (3nm, 2nm) | Significant contribution to Semiconductor Systems segment | Continued strong growth, driven by technology transitions |

| Sym3 Magnum Etch System | Stars | Advanced patterning capabilities | >$1.2 billion since Feb 2024 launch | High demand, reinforcing market leadership |

| Deposition Equipment | Stars | Foundational technology for WFE market growth | Core revenue driver for WFE segment | Sustained growth as WFE market expands |

| Advanced Packaging Solutions (Vistara, EPIC) | Stars | Heterogeneous integration, AI/HPC demand | Emerging revenue stream, strategic focus | Rapid expansion, exceeding $70 billion market by 2027 |

What is included in the product

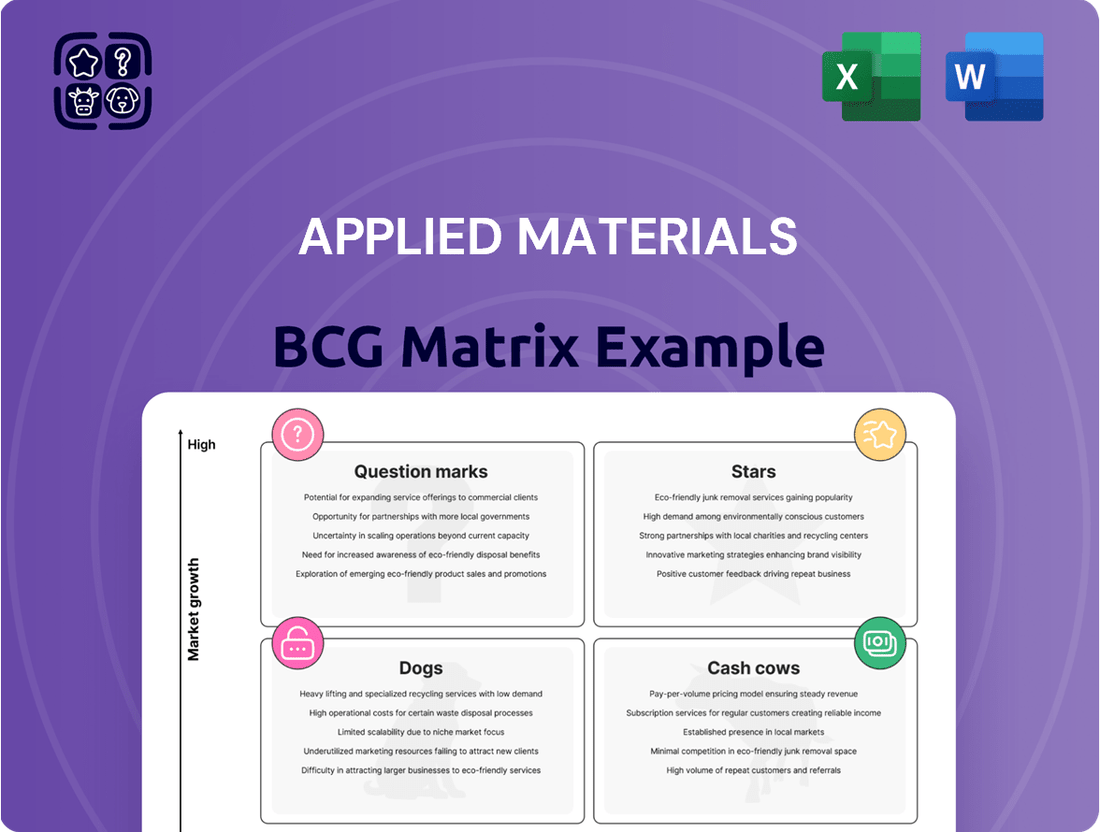

This BCG Matrix overview for Applied Materials analyzes its business units based on market growth and share.

It provides strategic recommendations for investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

A clear, visual representation of Applied Materials' business units, identifying strategic priorities and resource allocation needs.

Cash Cows

Applied Global Services (AGS) is a standout performer for Applied Materials, showcasing impressive growth. In 2024, this segment experienced a robust revenue increase of 8.6% compared to the previous year, making it the company's highest-growth area.

AGS focuses on delivering integrated solutions designed to enhance equipment and fab performance. A key strength lies in its substantial recurring revenue, with more than two-thirds of its service income derived from subscription-based models.

This consistent revenue stream provides a stable and profitable foundation for Applied Materials. It effectively balances the inherent cyclical nature of the company's core equipment sales, contributing significantly to overall financial resilience.

Applied Materials boasts a broad wafer fabrication equipment (WFE) portfolio, covering almost every stage of semiconductor manufacturing. This extensive range solidifies its position as a leading player in the industry. For instance, in fiscal year 2023, Applied Materials reported net sales of $26.5 billion, demonstrating the sheer scale of its operations and market penetration.

While ASML has recently taken the lead in overall WFE revenue, Applied Materials continues to hold substantial market share across its many product categories. This diversified presence across the WFE landscape ensures a steady stream of cash flow from a broad and loyal customer base. The company's ability to serve multiple segments of the semiconductor production process makes it a resilient cash cow.

Applied Materials' established semiconductor systems for mature nodes, such as those at 28nm and above, are vital. These systems are indispensable for sectors like consumer electronics, industrial automation, and the automotive industry, underscoring their persistent demand.

While the growth trajectory for mature nodes may not match cutting-edge advancements, they constitute a robust, high-market-share segment for Applied Materials. This stability stems from the enduring and widespread application of these chips across numerous critical technologies, ensuring consistent revenue streams.

Core Deposition and Etch Technologies

Applied Materials' core deposition and etch technologies are critical, underpinning nearly all semiconductor fabrication beyond the most cutting-edge nodes. These foundational processes are the bedrock of the industry, ensuring their position as cash cows.

The extensive installed base of this equipment, coupled with ongoing demand for upgrades and essential services, translates into predictable and substantial revenue streams for Applied Materials. In fiscal year 2023, Applied Materials reported that its Semiconductor Systems segment, which heavily features deposition and etch, generated $21.06 billion in net sales.

- Established Market Dominance: Core deposition and etch are essential steps in every chipmaking process, giving Applied Materials a wide reach.

- Recurring Revenue Streams: Sales of new equipment are complemented by lucrative service contracts and upgrade opportunities.

- Consistent Profitability: The mature nature of these technologies ensures stable margins and reliable cash flow generation.

Extensive Intellectual Property and Market Leadership in Materials Engineering

Applied Materials' extensive intellectual property and market leadership in materials engineering position it firmly as a Cash Cow within the semiconductor equipment industry. The company’s relentless commitment to R&D, evidenced by its significant patent filings, translates directly into a commanding market share in critical segments like deposition and etch technologies.

This technological edge allows Applied Materials to achieve substantial profit margins. For instance, in fiscal year 2023, the company reported revenue of $26.5 billion, underscoring its robust market presence. Their leadership in advanced materials engineering ensures high demand for their sophisticated equipment, solidifying their Cash Cow status.

- Strong Intellectual Property: Applied Materials holds a vast portfolio of patents in materials engineering, protecting its innovations.

- Market Dominance: The company leads in key semiconductor manufacturing processes, ensuring consistent revenue streams.

- High Profit Margins: Technological leadership enables premium pricing and strong profitability, characteristic of a Cash Cow.

- Consistent Revenue Generation: Demand for their specialized equipment remains high, providing a stable financial foundation.

Applied Materials' core deposition and etch technologies represent significant cash cows. These foundational processes are essential for nearly all semiconductor manufacturing, ensuring consistent demand and a stable revenue base. The company's established market dominance in these areas, coupled with a large installed base and ongoing service needs, generates predictable and substantial cash flow.

The Semiconductor Systems segment, which heavily features deposition and etch, is a prime example. In fiscal year 2023, this segment alone generated $21.06 billion in net sales. This strong performance highlights the enduring profitability and market penetration of these critical technologies for Applied Materials.

The company's leadership in advanced materials engineering further solidifies its cash cow status. This technological edge allows for premium pricing and high profit margins, as seen in their overall robust financial performance. Applied Materials' extensive intellectual property in these areas protects its market share and ensures continued revenue generation.

| Segment | FY2023 Net Sales (Billions USD) | Key Cash Cow Characteristics |

|---|---|---|

| Semiconductor Systems (includes deposition & etch) | $21.06 | Essential processes, market dominance, recurring service revenue, high margins |

| Applied Global Services (AGS) | N/A (Growth 8.6% in FY24) | Recurring revenue (2/3 subscription), stable foundation, balances cyclicality |

Preview = Final Product

Applied Materials BCG Matrix

The preview you see is the exact Applied Materials BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked analysis. This document has been meticulously prepared by industry experts to provide actionable insights into Applied Materials' product portfolio, allowing for immediate integration into your strategic planning. You can confidently expect the same professional formatting and comprehensive data that you are currently viewing, ready for immediate download and use in presentations or internal discussions.

Dogs

US export controls have significantly impacted Applied Materials' operations in China, particularly affecting its Applied Global Services (AGS) segment. The company anticipates a revenue loss of approximately $400 million in fiscal year 2025 due to these restrictions.

The sales of 200mm equipment in China are also directly curtailed by these trade limitations. Consequently, while China remains a crucial market, demand and market share for these specific Applied Materials offerings are experiencing a downturn.

Within Applied Materials' Display and Adjacent Markets segment, legacy display technologies with declining market share can be categorized as dogs. While the overall segment showed robust revenue growth in Q2 2025, it represented a modest 3.28% of total FY2024 revenue.

These older display technologies, if not actively innovating or finding new market niches, face challenges due to their low penetration in mature or contracting sub-markets, making them potential candidates for the dog quadrant of the BCG matrix.

Certain non-AI driven chip manufacturing equipment, particularly those focused on segments like CPUs, could be considered a Dog in Applied Materials' BCG Matrix. The semiconductor industry saw a notable slowdown in demand for these specific chips in 2023, impacting equipment manufacturers.

If Applied Materials' offerings in these particular non-AI segments are not cutting-edge or do not hold a dominant market share, the company might experience declining sales and profitability for this equipment. For instance, while the broader semiconductor equipment market showed resilience, specific segments catering to declining consumer electronics demand faced headwinds.

Older, Less Adaptable Semiconductor Equipment Generations

Older, less adaptable semiconductor equipment generations, when viewed through the lens of the BCG matrix, typically fall into the Dogs category. This is because as the industry pushes towards ever-smaller feature sizes and more intricate chip designs, equipment that cannot be upgraded or adapted to these new processes quickly becomes outdated. For instance, legacy lithography systems not supporting EUV (Extreme Ultraviolet) lithography, a key technology for advanced nodes, would struggle to find buyers in leading-edge foundries.

These products face a shrinking market as fabrication plants (fabs) invest in newer, more capable machinery to remain competitive. Consequently, they exhibit low growth potential and a declining market share. By the end of 2024, the demand for equipment supporting sub-7nm process nodes is projected to dominate, leaving older generations with significantly reduced opportunities.

- Obsolescence Risk: Equipment unable to support advanced processes like EUV or GAA (Gate-All-Around) transistors faces rapid obsolescence.

- Market Share Decline: As leading fabs upgrade, the market for older, less versatile equipment contracts significantly.

- Low Growth Potential: Without the ability to adapt to new technology nodes, these products offer minimal future growth prospects.

- Focus on Niche Markets: Survival for these "dogs" often means catering to less demanding, legacy technology segments or specific aftermarket repair services.

NAND Memory Equipment in Periods of Low Investment

NAND memory equipment, within the context of Applied Materials' BCG Matrix, can be characterized as a potential Dog during periods of subdued industry investment. The NAND market is known for its cyclical nature, and while there might be broader market upticks, specific segments can experience downturns. For instance, Applied Materials saw its DRAM segment sales decline by a double-digit percentage year-over-year in fiscal year 2024, indicating a challenging environment for memory-related equipment.

When the NAND market faces low investment or an oversupply situation, the demand for specialized manufacturing equipment naturally wanes. In such scenarios, Applied Materials' NAND memory equipment could be positioned as a low-growth, low-market-share product. This classification stems from the reduced capital expenditure by memory manufacturers, directly impacting the sales volume of new fabrication tools.

- Cyclical Market Dynamics: The NAND memory sector is inherently cyclical, with investment levels fluctuating based on supply-demand balances.

- FY2024 Performance Indicators: Applied Materials' DRAM segment experienced a significant year-over-year sales decrease in FY2024, reflecting broader challenges in the memory equipment market.

- Low Investment Impact: During periods of reduced capital expenditure by NAND manufacturers, demand for related equipment, including that from Applied Materials, is expected to be low.

- Potential BCG Classification: Consequently, NAND memory equipment could be categorized as a Dog in the BCG Matrix, signifying low growth and potentially low market share within Applied Materials' portfolio during these downturns.

Within Applied Materials' portfolio, products categorized as Dogs typically represent segments with low market growth and low relative market share. These are often older technologies or those facing intense competition and declining demand. For instance, legacy display technologies and certain non-AI focused semiconductor equipment can fall into this quadrant. The company's fiscal year 2024 revenue of $23.74 billion highlights the vastness of its operations, within which these Dog products represent areas of strategic divestment or minimal investment.

| Product Category | BCG Quadrant | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Legacy Display Technologies | Dog | Low | Low | Divest or reposition |

| Non-AI Chip Mfg. Equipment (Specific Segments) | Dog | Low | Low | Minimize investment, focus on niche |

| Older Lithography Systems (Non-EUV) | Dog | Low | Low | Phased out, focus on aftermarket |

| NAND Memory Equipment (During Downturns) | Dog | Low | Low | Monitor market, potential divestment |

Question Marks

Emerging solar PV manufacturing equipment segments, like those for perovskite and tandem cells, are poised for substantial growth. The overall solar PV manufacturing equipment market is expected to expand at a compound annual growth rate of 23.1% between 2025 and 2034, indicating significant opportunities.

Applied Materials, a dominant player in semiconductor technology, holds a strong position in established solar PV equipment. However, its market share in these nascent, high-potential areas might still be developing, presenting a classic question mark scenario in a BCG matrix.

These new segments require considerable R&D and capital investment. Capturing significant market share will necessitate strategic focus and potentially acquisitions to build expertise and manufacturing capacity rapidly.

Applied Materials is investing heavily in next-generation advanced packaging technologies like sub-micron hybrid bonding and 3D multi-tier stacking. These cutting-edge areas, while still in development, represent significant future growth potential for the company. For instance, the advanced packaging market is projected to reach $100 billion by 2030, with these emerging technologies being key drivers.

Applied Materials' expansion of its joint lab with CEA-Leti in June 2025 highlights a strategic push into specialty chips, a sector with substantial long-term growth prospects. This move signals a commitment to fostering innovation in areas like advanced sensors and AI accelerators, which are key drivers of future semiconductor demand.

However, the market for equipment catering to these nascent specialty chip applications is currently quite limited. While the potential is vast, the immediate revenue generation from these developing segments is likely to be modest, positioning these initiatives within the Question Mark quadrant of the BCG Matrix as they strive for market penetration and scale.

New Geographic Market Entries

Applied Materials' strategic expansion into new geographic markets, such as its planned Global Business Services (GBS) office in Costa Rica opening in 2025, positions it to tap into emerging semiconductor ecosystems. This move into Latin America, a region with a nascent but growing tech sector, is characteristic of a company entering a new market with a low initial market share.

The company's approach aligns with the BCG matrix's 'Question Mark' category, where investments are made in markets with high growth potential but currently low market share. This strategy aims to cultivate future leadership positions as these regions mature and their demand for advanced semiconductor manufacturing solutions increases.

Key considerations for this entry include:

- Market Potential: Assessing the long-term growth trajectory of the semiconductor industry within Latin America, driven by factors like increasing digitalization and government support for technology hubs.

- Competitive Landscape: Understanding existing players and potential new entrants in the target geographic market to identify opportunities for differentiation.

- Operational Feasibility: Evaluating the infrastructure, talent pool, and regulatory environment in Costa Rica to ensure successful establishment and operation of the GBS office.

Early Adoption Phases of Revolutionary AI-Specific Tools

Even within the rapidly expanding AI chip sector, Applied Materials' cutting-edge tools, engineered for next-generation AI chip designs, might still be navigating their initial adoption stages. These advanced solutions necessitate significant capital expenditure for both their creation and seamless integration with customer workflows.

While these tools are aimed at a market poised for substantial growth, their current market penetration is likely modest as they work to scale and gain wider customer acceptance. For instance, the demand for advanced packaging solutions, critical for AI chips, is projected to reach $100 billion by 2030, highlighting the potential but also the early-stage nature of specialized equipment.

- Early Adoption Challenges: New AI-specific tools require significant upfront investment for R&D and customer integration, impacting initial revenue streams.

- Market Potential vs. Current Share: Despite targeting a high-growth AI chip market, these revolutionary tools may have a low current market share as adoption scales.

- Investment in Future Architectures: Applied Materials is investing in tools for future AI chip designs, which are inherently in earlier stages of market penetration.

Applied Materials' investments in emerging technologies like perovskite solar cells and advanced AI chip packaging represent classic Question Marks. These areas exhibit high growth potential, estimated at a 23.1% CAGR for solar PV equipment through 2034, but the company's current market share is likely nascent.

Significant R&D and capital are required to capture market share in these developing segments, demanding strategic focus and potentially acquisitions. The advanced packaging market alone is projected to reach $100 billion by 2030, underscoring the future opportunity.

Applied Materials' expansion into new geographic markets, such as its 2025 Costa Rica GBS office, also fits the Question Mark profile. These regions offer high growth potential for semiconductors but currently have low market penetration for Applied Materials, requiring strategic investment to build future leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including company financial reports, industry growth rates, and competitor analysis, to provide a clear strategic overview.