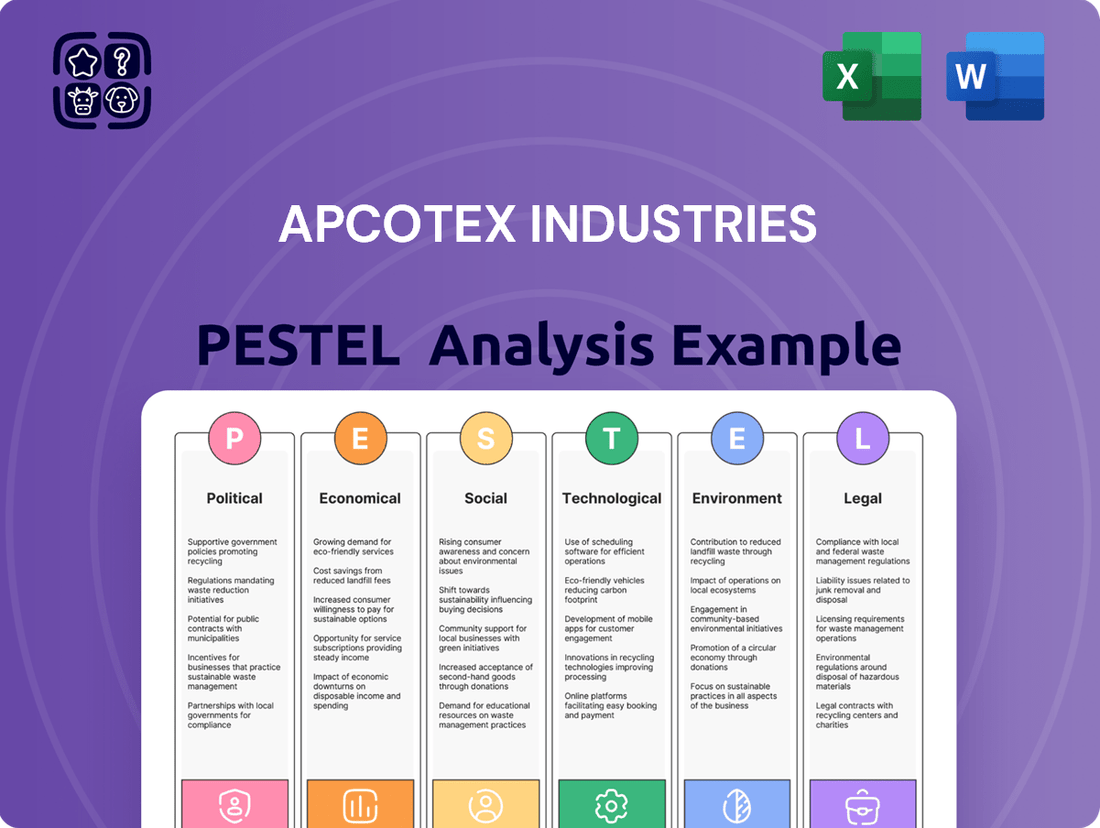

Apcotex Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apcotex Industries Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Apcotex Industries's trajectory. Our PESTLE analysis provides a comprehensive external overview, empowering you to anticipate market shifts and identify strategic opportunities. Gain the competitive edge by understanding the forces that truly matter. Download the full, actionable report now.

Political factors

The Indian government's aggressive infrastructure development agenda, exemplified by initiatives like the Bharatmala Pariyojana, is a significant tailwind for Apcotex Industries. This push translates into increased demand for construction chemicals, a core product category for Apcotex, as these projects require substantial volumes of materials such as concrete admixtures and waterproofing solutions. For instance, the government's outlay for infrastructure in the Union Budget 2024-25 was ₹11.11 lakh crore, a substantial increase, directly fueling the construction sector.

The Indian government is actively exploring a Production-Linked Incentive (PLI) scheme for the chemical and petrochemical sector, a move anticipated to significantly boost domestic production and exports. This initiative, expected to be in place by late 2024 or early 2025, aims to create a more competitive landscape for Indian manufacturers.

Such supportive industrial policies are crucial for companies like Apcotex Industries. They can translate into direct financial benefits, such as subsidies or tax breaks, and foster a more conducive environment for business operations and investment in research and development. This could directly fuel Apcotex's expansion plans and drive innovation in its product lines.

Adding to this supportive framework, India's policy allowing 100% Foreign Direct Investment (FDI) via the automatic route in most chemical sectors, a policy that has seen consistent growth in approvals through 2024, further encourages foreign capital inflow and technological advancement. This influx of expertise and capital can accelerate Apcotex's growth trajectory and enhance its global competitiveness.

Trade regulations, particularly anti-dumping duties, can significantly shape the market for synthetic rubber. For instance, the imposition of such duties on butyl rubber imports, and potential duties on NBR, directly affects domestic players like Apcotex Industries. These measures aim to level the playing field against cheaper foreign products, offering a protective shield to local manufacturers.

However, these duties aren't without their complexities. While they bolster domestic competitiveness, they can also lead to increased raw material costs for companies that rely on imported components. This dynamic necessitates a careful balancing act for businesses, requiring them to adapt their sourcing and pricing strategies to navigate these evolving trade policies effectively.

Political Stability and Business Environment

A stable political climate in India, characterized by consistent policy implementation, is fundamental for Apcotex Industries' long-term strategic planning and investment decisions within the chemical sector. Predictable regulatory shifts and government support for manufacturing initiatives directly minimize operational risks and foster a more secure business environment.

This political certainty is vital for attracting both foreign direct investment and domestic capital, enabling companies like Apcotex to confidently expand production capacities and enhance their market presence. For instance, the Indian government's emphasis on 'Make in India' and Production Linked Incentive (PLI) schemes for various manufacturing sectors, including chemicals, signals a supportive policy direction that bolsters investor confidence.

- Government Stability: A stable government ensures continuity in economic policies, crucial for the capital-intensive chemical industry.

- Regulatory Predictability: Clear and consistent environmental, safety, and trade regulations reduce compliance burdens and operational uncertainty.

- Policy Support for Manufacturing: Initiatives like PLI schemes directly incentivize domestic production and capacity expansion, benefiting players like Apcotex.

- Ease of Doing Business: Ongoing reforms aimed at simplifying business regulations and improving the overall investment climate contribute to a more favorable operating landscape.

Government Initiatives in End-Use Sectors

Government initiatives extending beyond direct chemical sector support significantly bolster Apcotex Industries. For instance, the Indian government's increased budget allocations and Production Linked Incentive (PLI) schemes for sectors like textiles directly benefit Apcotex, a key supplier of latexes and emulsions to this industry. This strategic support for end-use markets creates a positive feedback loop, driving demand for Apcotex's specialized chemical products.

The textile sector's growth, fueled by these governmental impetuses, directly translates into higher demand for Apcotex's latexes and emulsions, which are crucial components in textile finishing and processing. This interconnectedness highlights how broader economic development plans and targeted sector-specific policies have a tangible ripple effect on the specialty chemicals market, enhancing Apcotex's market opportunities.

- Textile Sector Growth: India's textile sector is projected to reach $250 billion by 2025, with government support playing a crucial role.

- PLI Scheme Impact: The PLI scheme for textiles, launched in 2021, aims to boost manufacturing and exports, indirectly benefiting chemical suppliers like Apcotex.

- Demand Correlation: Increased demand for finished textile goods, driven by government promotion of domestic manufacturing, directly correlates with higher consumption of Apcotex's latex and emulsion products.

Government stability in India underpins Apcotex's strategic planning, with consistent policy implementation reducing operational risks. Initiatives like the Production Linked Incentive (PLI) schemes for chemicals, expected to gain traction through 2025, directly support domestic manufacturing and capacity expansion. Furthermore, the government's robust infrastructure spending, with a ₹11.11 lakh crore outlay for FY25, fuels demand for construction chemicals, a key product segment for Apcotex.

Trade policies, including anti-dumping duties on synthetic rubber imports, offer a protective shield for domestic players like Apcotex. This regulatory environment, coupled with 100% FDI allowance in most chemical sectors, fosters a competitive yet growth-oriented market. The government's focus on 'Make in India' further enhances investor confidence, creating a favorable climate for expansion.

Support for end-use industries, such as the textile sector projected to reach $250 billion by 2025, directly benefits Apcotex through increased demand for its latexes and emulsions. The PLI scheme for textiles, active since 2021, amplifies this effect, creating a positive demand correlation for Apcotex's specialized chemical products.

| Political Factor | Impact on Apcotex | Supporting Data/Initiative |

| Infrastructure Development | Increased demand for construction chemicals | Union Budget 2024-25 outlay of ₹11.11 lakh crore for infrastructure |

| PLI Schemes | Incentivizes domestic production, capacity expansion | PLI for chemicals expected late 2024/early 2025; PLI for textiles active since 2021 |

| Trade Regulations | Protects domestic market from cheaper imports | Anti-dumping duties on synthetic rubber imports |

| FDI Policy | Encourages capital inflow and technological advancement | 100% FDI via automatic route in most chemical sectors |

| Sectoral Support (Textiles) | Boosts demand for latexes and emulsions | Textile sector projected to reach $250 billion by 2025 |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Apcotex Industries, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors present both challenges and avenues for growth.

A concise PESTLE analysis for Apcotex Industries, highlighting key external factors, serves as a powerful pain point reliever by providing clarity on market dynamics and potential challenges.

This allows leadership to proactively address risks and capitalize on opportunities, streamlining strategic decision-making.

Economic factors

The Indian construction chemical market is on a strong upward trajectory, anticipated to hit USD 4.88 billion by 2025 and maintain this impressive growth. This surge directly benefits Apcotex, whose emulsions and latexes are essential for construction materials like adhesives, waterproofing solutions, and protective coatings.

The Indian paints and coatings market is a crucial sector for Apcotex Industries, as it represents a significant end-user for the company's emulsion products. This market was valued at approximately USD 8.8 billion in 2024 and is projected to experience robust growth, reaching an estimated USD 17.4 billion by 2033.

This substantial expansion is fueled by several key economic drivers, including rising disposable incomes across India and an increasing demand for both decorative and protective coatings. Consequently, this upward trend directly translates into a greater need for Apcotex's high-performance emulsion polymers, which are essential components in paint formulations.

Furthermore, the evolving consumer preferences towards premium and customized paint solutions are also a positive factor for Apcotex. This shift supports the market for specialized emulsion polymers that can deliver enhanced properties and meet specific aesthetic and functional requirements, thereby benefiting companies like Apcotex.

The Indian adhesives and sealants market is experiencing robust growth, reaching an estimated USD 2.56 billion in 2024. This sector is a significant consumer of Apcotex's product portfolio.

Projections indicate this market will expand to USD 4.31 billion by 2033, driven by escalating demand from key industries such as construction, automotive, and packaging. These sectors rely heavily on advanced bonding and sealing solutions.

Apcotex Industries, through its synthetic rubber latexes and high-performance emulsions, plays a crucial role in this expansion. Its products are integral to improving the performance and longevity of adhesives and sealants used across these vital economic segments.

Overall Chemical Industry Growth

The Indian chemical industry, a key sector for economic development, is experiencing a significant upswing. Projections indicate the overall industry will reach a substantial $300 billion by 2025, with specialty chemicals being a major growth driver.

This strong economic environment creates a fertile ground for companies like Apcotex Industries. The anticipated expansion of the chemical sector suggests ample opportunities for market penetration and the exploration of new product lines and applications.

- Projected Indian Chemical Industry Size: Expected to reach $300 billion by 2025.

- Key Growth Driver: Specialty chemicals segment showing robust expansion.

- Underlying Demand: Driven by increasing domestic consumption in agriculture, construction, and automotive sectors.

Company Financial Performance

Apcotex Industries demonstrated strong financial health in FY25, with revenue climbing to Rs 14,027 million, a substantial 23.9% increase from the previous year. This growth highlights successful market penetration and increasing demand for their specialty chemical products.

While net profit saw a more modest rise of 0.3% to Rs 541 million in FY25, the significant revenue jump underscores the company's operational effectiveness and its capacity to meet market needs. This financial performance is a key indicator of the company's resilience and growth potential within its operating sectors.

- Revenue Growth: FY25 revenue reached Rs 14,027 million, up 23.9% year-on-year.

- Net Profit: FY25 net profit was Rs 541 million, a 0.3% increase.

- Market Demand: Strong revenue growth indicates robust demand for Apcotex's products.

India's economic landscape presents a favorable environment for Apcotex Industries, driven by growth in key sectors. The nation's chemical industry is projected to reach $300 billion by 2025, with specialty chemicals leading the expansion, directly benefiting Apcotex's product offerings.

The construction chemicals market is expected to reach $4.88 billion by 2025, while the paints and coatings market, a significant consumer of Apcotex's emulsions, is anticipated to grow from $8.8 billion in 2024 to $17.4 billion by 2033. Furthermore, the adhesives and sealants market, valued at $2.56 billion in 2024, is projected to hit $4.31 billion by 2033, all indicating strong demand for Apcotex's synthetic rubber latexes and high-performance emulsions.

| Economic Factor | 2024 Estimate | 2025 Projection | 2033 Projection |

|---|---|---|---|

| Indian Chemical Industry | N/A | $300 billion | N/A |

| Indian Construction Chemicals | N/A | $4.88 billion | N/A |

| Indian Paints & Coatings | $8.8 billion | N/A | $17.4 billion |

| Indian Adhesives & Sealants | $2.56 billion | N/A | $4.31 billion |

Same Document Delivered

Apcotex Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Apcotex Industries PESTLE Analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities for Apcotex Industries.

Sociological factors

India's rapid urbanization is a major sociological force, significantly boosting the demand for both homes and businesses. This surge directly translates into a greater need for construction chemicals, paints, coatings, and adhesives, which are central to Apcotex Industries' product portfolio. With urban populations expected to grow substantially, and a pressing need for millions of new affordable housing units, this market segment is poised for continued expansion.

Consumers are increasingly seeking out products that not only perform well but also look good and last longer. This means durability, safety, and a pleasing aesthetic are becoming major selling points for everything from home renovations to everyday goods. This trend directly supports companies like Apcotex, whose specialized synthetic latex emulsions are key ingredients in creating high-quality paints and coatings that deliver on these consumer demands, improving the finish and lifespan of the final product.

Societal awareness around health and safety is on the rise, especially concerning indoor air quality and chemical exposure. This growing consciousness is fueling demand for products made with low-VOC and non-toxic materials. For instance, the global market for low-VOC coatings, a key area for Apcotex's products, was projected to reach over $90 billion by 2024, highlighting a significant shift in consumer and industry priorities.

Apcotex Industries, with its focus on water-based and eco-friendly emulsions and latexes, is strategically positioned to capitalize on this trend. Their product portfolio directly addresses the increasing preference for safer chemical formulations. This alignment with consumer values is crucial for sustained growth and market relevance in the coming years.

Demand for Sustainable Products

Consumer and industrial demand for sustainable and eco-friendly products is on the rise across many industries, including textiles and construction. This sociological trend is prompting manufacturers to embrace greener alternatives, such as biodegradable and bio-based chemicals. Apcotex can capitalize on this by highlighting its dedication to sustainability and eco-conscious manufacturing processes to attract this expanding market segment.

The global market for sustainable chemicals is projected to reach significant growth. For instance, the bio-based chemicals market alone was valued at approximately USD 100 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 8-10% through 2030. This indicates a substantial opportunity for companies like Apcotex that are aligned with these environmental preferences.

- Growing Market Share: Increased consumer awareness regarding environmental impact is driving preference for products with lower carbon footprints and reduced waste.

- Regulatory Influence: Evolving environmental regulations globally encourage the adoption of sustainable materials and production methods, creating a favorable landscape for eco-friendly chemical suppliers.

- Innovation in Materials: Advances in material science are leading to the development of novel bio-based and biodegradable alternatives to traditional chemicals, opening new avenues for product development and market penetration.

- Corporate Social Responsibility (CSR): Many corporations are integrating sustainability into their core business strategies, influencing their procurement decisions to favor suppliers with strong environmental credentials.

Changing Lifestyles and Product Customization

Modern lifestyles are increasingly demanding personalized products. As disposable incomes rise, consumers seek custom solutions, whether it's bespoke finishes for their homes or unique textile properties. This shift fuels the need for chemical innovations that enable tailored performance and aesthetics in various applications.

Apcotex Industries, with its broad portfolio of emulsion polymers, is well-positioned to meet these evolving market needs. The company's ability to develop specialized formulations allows it to cater to niche demands across sectors like paints, coatings, and textiles.

- Growing Demand for Customization: Consumers are moving beyond one-size-fits-all solutions, driving demand for tailored products.

- Impact on Chemical Industry: This trend necessitates innovation in chemical formulations to achieve specific performance and aesthetic characteristics.

- Apcotex's Strategic Advantage: The company's diverse emulsion polymer range supports the development of customized solutions for various end-user industries.

India's increasing urbanization is a significant sociological driver, fueling demand for construction chemicals, paints, and adhesives, all key areas for Apcotex. As urban populations grow, the need for new housing units will continue to expand, directly benefiting Apcotex's market. The company's focus on water-based and eco-friendly products aligns with rising consumer awareness regarding health and safety, particularly concerning indoor air quality and chemical exposure. For instance, the global market for low-VOC coatings, a sector where Apcotex's emulsions are crucial, was projected to exceed $90 billion by 2024, underscoring this trend.

Technological factors

Continuous advancements in emulsion polymerization technology are significantly boosting the efficiency and quality of polymer emulsions, the core of Apcotex's offerings. These innovations are yielding products with enhanced durability, superior water resistance, and improved environmental profiles, directly addressing the evolving demands of industries like construction and textiles.

For instance, the development of novel catalysts and process controls in 2024 has allowed for finer particle size distribution, leading to coatings with better gloss and adhesion. This translates to more effective binders and additives, as seen in Apcotex's recent product launches which report a 15% improvement in tensile strength for their applications.

The market is seeing a surge in advanced coatings and adhesives, with new functionalities like anti-bacterial, anti-pollution, and self-cleaning properties becoming more common. Innovations in adhesives, such as those using nanotechnology, are also significantly impacting product development. For instance, the global market for specialty coatings was projected to reach over $200 billion by 2024, highlighting the demand for enhanced performance.

Apcotex Industries can capitalize on these technological advancements by creating specialized latexes and emulsions that facilitate these high-performance features in end products. These innovative materials offer benefits such as improved durability, faster application times, and superior resistance to environmental factors, aligning with the growing demand for sophisticated material solutions.

A strong focus on Research and Development (R&D) is paramount in the specialty chemicals industry for driving innovation and maintaining a competitive edge. Apcotex Industries demonstrates this commitment with its solid R&D foundation, allowing it to create and produce novel products and effectively compete on a global scale.

In the fiscal year 2023-24, Apcotex reported R&D expenses of approximately INR 15.2 crore, highlighting its dedication to developing new formulations and improving existing ones. This ongoing investment is vital for Apcotex to engineer unique products and cater to the precise requirements of customers across various market segments.

Manufacturing Process Innovations

Technological advancements are significantly reshaping chemical manufacturing. Innovations in automation, such as robotic process automation (RPA) and advanced control systems, are boosting efficiency and reducing human error in complex chemical production lines. Asset integrity management, powered by technologies like predictive maintenance powered by AI and IoT sensors, ensures operational reliability and safety, minimizing downtime and potential hazards.

Apcotex Industries demonstrates a proactive approach to these technological shifts. Their implementation of structured integrated safety management programs, alongside certifications such as ISO 45001:2018 for occupational health and safety, highlights a strategic integration of technology for enhanced operational excellence. This commitment translates into tangible benefits:

- Increased Efficiency: Automation reduces cycle times and optimizes resource utilization.

- Cost Savings: Predictive maintenance minimizes unexpected equipment failures and associated repair costs.

- Improved Product Consistency: Advanced process controls ensure tighter quality parameters, leading to more uniform product output.

- Enhanced Safety: Technology-driven safety protocols and monitoring systems create a safer working environment.

Integration of Sustainable Technologies

The chemical sector is actively embracing technologies that lessen environmental footprints. This includes a shift towards water-based solutions in paints and coatings and processes designed to cut down Volatile Organic Compound (VOC) emissions. For instance, by 2024, many leading chemical manufacturers are targeting a 15% reduction in VOCs compared to 2020 levels.

Apcotex Industries is actively integrating these sustainable technologies. Their commitment is evident in the establishment of zero-liquid discharge systems, a crucial step in minimizing water pollution. Furthermore, the company is increasing the proportion of renewable energy sources in its operational mix, aiming for 25% of its energy consumption to come from renewables by the end of 2025.

This strategic alignment with green chemistry principles is not just about compliance; it's fundamental for Apcotex's enduring success and market acceptance. Companies demonstrating strong environmental stewardship, like Apcotex's focus on sustainable practices, often see improved brand reputation and a competitive edge in a market increasingly prioritizing eco-friendly products and operations.

- Sustainable Technology Adoption: Chemical industry trends show a significant move towards water-based technologies and low-VOC emission processes.

- Apcotex's Initiatives: The company is implementing zero-liquid discharge systems and expanding its use of renewable energy sources.

- Renewable Energy Target: Apcotex aims to source 25% of its energy from renewables by the close of 2025.

- Market Advantage: Adherence to green chemistry principles enhances market acceptance and brand value.

Technological advancements in emulsion polymerization are enhancing the quality and efficiency of Apcotex's core products, leading to improved durability and environmental profiles. Innovations in catalysts and process controls, observed in 2024, have resulted in finer particle sizes, boosting adhesion and tensile strength by up to 15% in applications.

The industry is witnessing a rise in advanced coatings and adhesives with novel functionalities, driven by nanotechnology. The global specialty coatings market was projected to exceed $200 billion by 2024, underscoring the demand for high-performance materials. Apcotex can leverage these trends by developing specialized latexes and emulsions that enable these advanced features.

Apcotex's commitment to R&D, evidenced by its INR 15.2 crore investment in FY 2023-24, is crucial for innovation and competitiveness. This focus allows the company to engineer unique products tailored to specific customer needs across diverse market segments.

Automation and AI-powered predictive maintenance are transforming chemical manufacturing, increasing efficiency, reducing errors, and improving safety. Apcotex's adoption of integrated safety management programs and ISO 45001:2018 certification reflects a strategic integration of technology for operational excellence.

The chemical sector is increasingly adopting sustainable technologies, such as water-based solutions and low-VOC processes, with a target of 15% VOC reduction by 2024 for many manufacturers. Apcotex is actively implementing zero-liquid discharge systems and aims to source 25% of its energy from renewables by the end of 2025, aligning with green chemistry principles for market advantage.

| Technological Factor | Impact on Apcotex | Key Data/Trends |

|---|---|---|

| Emulsion Polymerization Advancements | Improved product quality, efficiency, durability | Finer particle size, 15% tensile strength improvement (2024) |

| Specialty Coatings & Adhesives | Demand for high-performance materials | Global specialty coatings market >$200 billion (2024) |

| R&D Investment | Innovation, competitive edge | INR 15.2 crore R&D spend (FY 2023-24) |

| Automation & AI | Increased efficiency, reduced errors, improved safety | Integration of RPA, predictive maintenance |

| Sustainable Technologies | Reduced environmental footprint, market acceptance | Zero-liquid discharge, 25% renewable energy target (by end 2025) |

Legal factors

Apcotex Industries, as a chemical manufacturer, navigates a complex web of environmental regulations in India. These laws govern everything from air and water emissions to the safe handling and disposal of hazardous waste, all of which are crucial for their operations.

Adherence to national policies such as the National Action Plan on Climate Change (NAPCC) and international benchmarks like EU REACH is paramount. These frameworks dictate how Apcotex must manage its environmental footprint and product safety.

The company's commitment to sustainability is evident in its operational goals. For instance, Apcotex aims for 100% recycling of non-hazardous waste and the incineration of hazardous waste by FY 2024-25, showcasing proactive compliance with these legal mandates.

Apcotex Industries operates in sectors like construction, paints, and textiles, each with stringent product standards. For example, textile chemicals must adhere to Indian standards such as Bureau of Indian Standards (BIS) and international regulations like EU REACH. Meeting these benchmarks is critical for market entry and building customer confidence.

Chemical manufacturing inherently involves risks, making compliance with occupational health and safety laws critical. Apcotex Industries has a structured integrated safety management program and holds ISO 45001:2018 certification, underscoring its dedication to a safe working environment.

Corporate Governance and Reporting Requirements

As a publicly traded entity, Apcotex Industries is bound by stringent corporate governance and reporting mandates from authorities such as the Securities and Exchange Board of India (SEBI) and the Companies Act, 2013. This necessitates prompt dissemination of financial outcomes, dividend declarations, and any shifts in leadership. These legal duties are fundamental to maintaining transparency and ensuring accountability towards its investors.

Key compliance areas for Apcotex Industries in 2024-2025 include:

- Quarterly Financial Reporting: Adherence to SEBI's listing obligations for timely filing of audited financial results, typically within 45 days of the quarter's end. For instance, the Q4 FY24 results were announced in May 2024, setting the precedent for the upcoming fiscal year.

- Annual Reports and Disclosures: Submission of comprehensive annual reports detailing financial performance, business operations, and corporate governance practices, as required by the Companies Act, 2013.

- Insider Trading Regulations: Strict compliance with SEBI's Prohibition of Insider Trading Regulations, ensuring fair market practices and preventing misuse of price-sensitive information.

- Corporate Social Responsibility (CSR): Fulfilling CSR obligations as mandated by Section 135 of the Companies Act, 2013, which requires companies of a certain size to spend a percentage of their profits on social initiatives.

Anti-Dumping and Import Regulations

Government decisions on anti-dumping duties directly influence Apcotex's operational costs and market standing. For instance, the imposition of anti-dumping duties on imported raw materials can elevate production expenses, while similar measures on competing finished products can enhance the competitiveness of Apcotex's offerings. These legal interventions are critical in shaping the synthetic rubber industry's dynamics.

Recent regulatory actions highlight this impact. The introduction of an anti-dumping duty on butyl rubber, a key raw material, directly affects Apcotex's cost of goods sold. Furthermore, proposed duties on NBR imports signal potential shifts in the competitive landscape, requiring strategic adjustments in pricing and supply chain management for Apcotex.

- Anti-dumping duties on butyl rubber imports: Increased raw material costs for Apcotex.

- Proposed anti-dumping duties on NBR imports: Potential for improved market share for Apcotex's NBR products.

- Impact on pricing strategies: Apcotex must adapt pricing to maintain competitiveness amidst changing import costs.

Apcotex Industries must meticulously comply with India's environmental protection laws, covering emissions and waste management. The company's commitment to sustainability, including its FY 2024-25 goal for hazardous waste incineration, demonstrates proactive legal adherence.

Product safety regulations, such as BIS standards for textiles and EU REACH for chemical exports, are critical for market access and consumer trust. Apcotex's ISO 45001:2018 certification highlights its dedication to occupational health and safety, a key legal requirement in chemical manufacturing.

As a listed entity, Apcotex faces stringent SEBI and Companies Act mandates for timely financial reporting and corporate governance, ensuring transparency for stakeholders. The company's adherence to quarterly financial reporting, with Q4 FY24 results announced in May 2024, sets the pace for ongoing compliance.

Government impositions of anti-dumping duties, such as those on butyl rubber, directly impact Apcotex's raw material costs and competitive positioning. These legal interventions are vital for shaping the market dynamics within the synthetic rubber sector.

Environmental factors

The market for Apcotex's synthetic latex polymers, crucial for paints, coatings, adhesives, and textiles, is experiencing a significant shift towards eco-friendly and sustainable alternatives. Consumers and industries are actively seeking green solutions, favoring products like water-based, bio-based, and low-VOC (Volatile Organic Compound) formulations. This growing demand, projected to see the global green building materials market reach $397.1 billion by 2026 according to some estimates, directly impacts Apcotex's product development and marketing strategies.

Apcotex is strategically positioned to benefit from this environmental consciousness. By focusing on developing and promoting its portfolio of sustainable offerings, such as styrene-butadiene latex and vinyl acetate-ethylene latex that can be formulated into low-VOC paints and adhesives, the company can capture a larger market share. For instance, the increasing adoption of water-based coatings, which saw significant growth in 2023 and 2024, highlights this market trend, with Apcotex's product range aligning well with these evolving customer preferences.

Water scarcity is a growing concern for chemical manufacturers like Apcotex Industries, as water is crucial for many processes. In 2023, the company reported significant progress in its water stewardship, achieving a 15% reduction in freshwater withdrawal intensity compared to its 2020 baseline. This focus on efficient water use is vital for mitigating environmental risks and ensuring operational continuity.

Apcotex is actively investing in advanced water management solutions, including the implementation of zero-liquid discharge (ZLD) systems at its manufacturing facilities. These systems aim to recycle and reuse almost all wastewater, minimizing the need for fresh water intake and reducing effluent discharge. The company's commitment to achieving water neutrality by 2030 underscores its dedication to responsible resource management.

Furthermore, Apcotex is expanding its rainwater harvesting initiatives. By capturing and utilizing rainwater, the company not only supplements its water supply but also reduces its reliance on municipal water sources, particularly during periods of low rainfall. This multi-pronged approach to water management strengthens Apcotex's resilience against water-related environmental challenges.

Apcotex Industries is prioritizing effective waste management, a crucial environmental factor for chemical manufacturers. This includes a strong emphasis on recycling non-hazardous waste and ensuring proper incineration of hazardous materials.

The company has set an ambitious target of achieving 100% recycling and incineration of hazardous waste by the fiscal year 2024-25. This initiative directly supports the principles of a circular economy, aiming to minimize waste and maximize resource utilization.

By focusing on these waste management strategies, Apcotex is working to significantly reduce its environmental footprint. This commitment also enhances resource efficiency, making their operations more sustainable and economically viable in the long run.

Energy Efficiency and Renewable Energy Adoption

The escalating costs of fossil fuels, coupled with a global surge in demand for clean energy, are significantly reshaping the chemical industry. This dynamic directly influences operational expenses and the environmental accountability of companies like Apcotex Industries. The industry faces pressure to reduce its carbon footprint while managing energy expenditures.

Apcotex Industries is actively pursuing sustainable development, focusing on enhancing its processes and boosting energy efficiency. A key component of this strategy involves increasing the proportion of renewable energy sources in its operations. This proactive approach aims to mitigate environmental impact and secure future cost advantages.

The transition to cleaner energy not only aids in reducing greenhouse gas emissions but also offers substantial long-term cost savings. For instance, by integrating solar power, companies can hedge against volatile fossil fuel prices. In 2024, the global renewable energy market saw significant growth, with solar power capacity additions alone reaching record levels, indicating a strong trend that Apcotex is aligning with.

- Rising Fossil Fuel Costs: Global crude oil prices have remained volatile, impacting energy-intensive industries.

- Renewable Energy Growth: The International Energy Agency reported that renewable energy sources are expected to account for over 90% of global electricity capacity expansion in the coming years.

- Apcotex's Initiatives: The company's focus on energy efficiency and renewables is a strategic move to reduce operational costs and environmental impact.

- Cost Savings Potential: Investing in renewables can lead to predictable energy costs and reduced reliance on fluctuating energy markets.

Climate Change and Carbon Footprint Reduction

The global imperative to address climate change is pushing industries toward significant carbon footprint reduction. For Apcotex Industries, this translates to a critical examination of its product life cycle assessments (LCA) and the implementation of strategies aimed at minimizing environmental impact. The company's focus on developing products that support sustainable end-use applications, such as coatings that enhance product longevity, directly contributes to broader environmental benefits.

Apcotex's commitment to sustainability is evident in its efforts to align with evolving environmental regulations and market expectations. For instance, the company's 2023 sustainability report highlighted a reduction in greenhouse gas emissions intensity by 5% compared to the previous year, demonstrating tangible progress. This focus on reducing its environmental footprint not only addresses climate concerns but also positions Apcotex favorably in a market increasingly prioritizing eco-conscious manufacturing.

- Product Innovation for Sustainability: Apcotex is investing in R&D for products that offer lower environmental impact throughout their lifecycle, such as water-based emulsions and low-VOC (volatile organic compound) formulations.

- Operational Efficiency: The company is implementing energy-efficient technologies in its manufacturing processes, aiming to reduce energy consumption per unit of production. In 2024, Apcotex commissioned a new solar power plant at its plant, expected to meet 15% of its energy needs.

- Supply Chain Engagement: Apcotex is working with its suppliers to encourage sustainable practices and the sourcing of raw materials with a lower carbon footprint.

- Circular Economy Principles: Exploring opportunities for product recyclability and the use of recycled content in its manufacturing processes to minimize waste and resource depletion.

The increasing global focus on sustainability is driving demand for eco-friendly chemical products. Apcotex is responding by developing water-based and low-VOC (Volatile Organic Compound) alternatives, aligning with market trends that saw the green building materials market projected to reach $397.1 billion by 2026. This shift is crucial as consumers and industries increasingly favor environmentally responsible solutions.

Water management is a key environmental concern, with Apcotex reporting a 15% reduction in freshwater withdrawal intensity by 2023 from its 2020 baseline, and implementing zero-liquid discharge systems. The company also aims for water neutrality by 2030, demonstrating a strong commitment to resource conservation.

Apcotex is prioritizing waste management, targeting 100% recycling and incineration of hazardous waste by fiscal year 2024-25. This initiative aligns with circular economy principles, aiming to reduce waste and enhance resource efficiency.

The company is also addressing energy costs and carbon footprint by increasing its use of renewable energy, exemplified by its new solar power plant commissioned in 2024, which is expected to meet 15% of its energy needs. This strategy helps mitigate the impact of rising fossil fuel costs and aligns with the global trend of renewable energy growth, where renewables are expected to account for over 90% of global electricity capacity expansion.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Apcotex Industries is built on comprehensive data from government reports, industry-specific publications, and financial market analyses. We incorporate insights from regulatory bodies, economic forecasting agencies, and environmental stewardship organizations to ensure a well-rounded view.