Apcotex Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apcotex Industries Bundle

Apcotex Industries operates within a landscape shaped by moderate buyer power and the looming threat of substitutes, particularly in its specialty chemical segments. The intensity of rivalry is a significant factor, demanding continuous innovation and cost management to maintain market share.

The complete report reveals the real forces shaping Apcotex Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Apcotex Industries' primary raw materials, synthetic rubber latexes and high-performance emulsions, are derived from petrochemicals like styrene and butadiene monomers. The prices of these feedstocks are subject to significant global supply-demand shifts and geopolitical events, directly affecting Apcotex's manufacturing expenses and overall profitability. For instance, in 2023, crude oil prices, a major driver for these monomers, experienced considerable swings, impacting the cost base for companies like Apcotex.

The bargaining power of suppliers for Apcotex Industries is influenced by supplier concentration and product differentiation. If there are few suppliers for essential raw materials, or if these materials are unique, their power increases. While general petrochemical price fluctuations are noted, specific data on monomer supplier concentration for Apcotex isn't readily available, but a concentrated supplier base would indeed amplify their leverage.

Switching costs for Apcotex Industries when moving from one supplier to another for specialty chemicals are likely moderate to high. This is due to the stringent technical specifications and quality control measures inherent in the chemical industry. For instance, in 2023, the specialty chemical sector globally saw significant investment in R&D, highlighting the importance of precise formulations.

The process of qualifying a new chemical supplier involves rigorous testing and validation, which can translate into considerable time and financial expenditure for Apcotex. This investment in developing new supplier relationships, conducting thorough quality assurance checks, and recalibrating production processes directly elevates the bargaining power of existing suppliers. It makes frequent supplier changes economically and operationally less appealing for Apcotex.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Apcotex Industries' core business of synthetic latexes and emulsions could significantly amplify their bargaining power. This is a common dynamic in the chemical sector, where major raw material producers might explore downstream opportunities.

If suppliers possess the capability and motivation to enter the synthetic latex market directly, Apcotex could face increased competition or potential disruptions in raw material supply. For instance, a large petrochemical company supplying styrene or butadiene, key inputs for latex, might decide to produce the finished latex themselves.

- Increased Competition: Suppliers entering the market directly would create new competitive pressures for Apcotex.

- Supply Chain Control: Forward integration by suppliers allows them to control both raw material pricing and the final product market.

- Potential for Reduced Availability: Suppliers might prioritize their own integrated operations, potentially limiting supply to independent players like Apcotex.

Importance of Raw Materials to Apcotex's Product Quality

The quality of raw materials is absolutely critical for Apcotex Industries. Their synthetic rubber latexes and high-performance emulsions are used in demanding sectors like paper, paints, adhesives, and textiles, where even small variations can significantly affect the end product's performance. This means Apcotex must ensure a consistent supply of high-grade inputs.

This reliance on quality inputs gives their suppliers considerable leverage. Apcotex needs to maintain strong partnerships with suppliers who can consistently deliver the necessary specifications. This can sometimes mean accepting higher prices to guarantee the quality and reliability needed for their sensitive applications, thereby increasing the bargaining power of these suppliers.

- Apcotex's dependence on high-quality raw materials directly impacts its product performance in critical industries.

- The company's need for consistent, premium inputs strengthens the negotiating position of its suppliers.

- Maintaining relationships with reliable suppliers, even at a premium, is essential for Apcotex to avoid compromising its product quality.

The bargaining power of suppliers for Apcotex Industries is significant, primarily driven by the specialized nature of its key raw materials like styrene and butadiene monomers. These petrochemical derivatives are subject to global price volatility, as seen with crude oil price swings in 2023, directly impacting Apcotex's costs. Supplier concentration and the high switching costs associated with rigorous quality control and process recalibration further amplify this supplier leverage.

Apcotex's dependence on consistent, high-quality inputs for demanding applications in sectors like paints and textiles means they must maintain strong supplier relationships, often accepting higher prices for guaranteed reliability. This reliance on premium inputs inherently strengthens the negotiating position of their suppliers, making it challenging for Apcotex to drive down costs without compromising product integrity.

| Factor | Impact on Apcotex | Example/Data Point |

|---|---|---|

| Raw Material Dependence | High | Key inputs: Styrene, Butadiene Monomers |

| Price Volatility | Significant | Crude oil prices influenced monomer costs in 2023. |

| Switching Costs | Moderate to High | Rigorous testing and validation required for new suppliers. |

| Supplier Concentration | Potentially High | Limited readily available data, but concentrated markets increase supplier power. |

What is included in the product

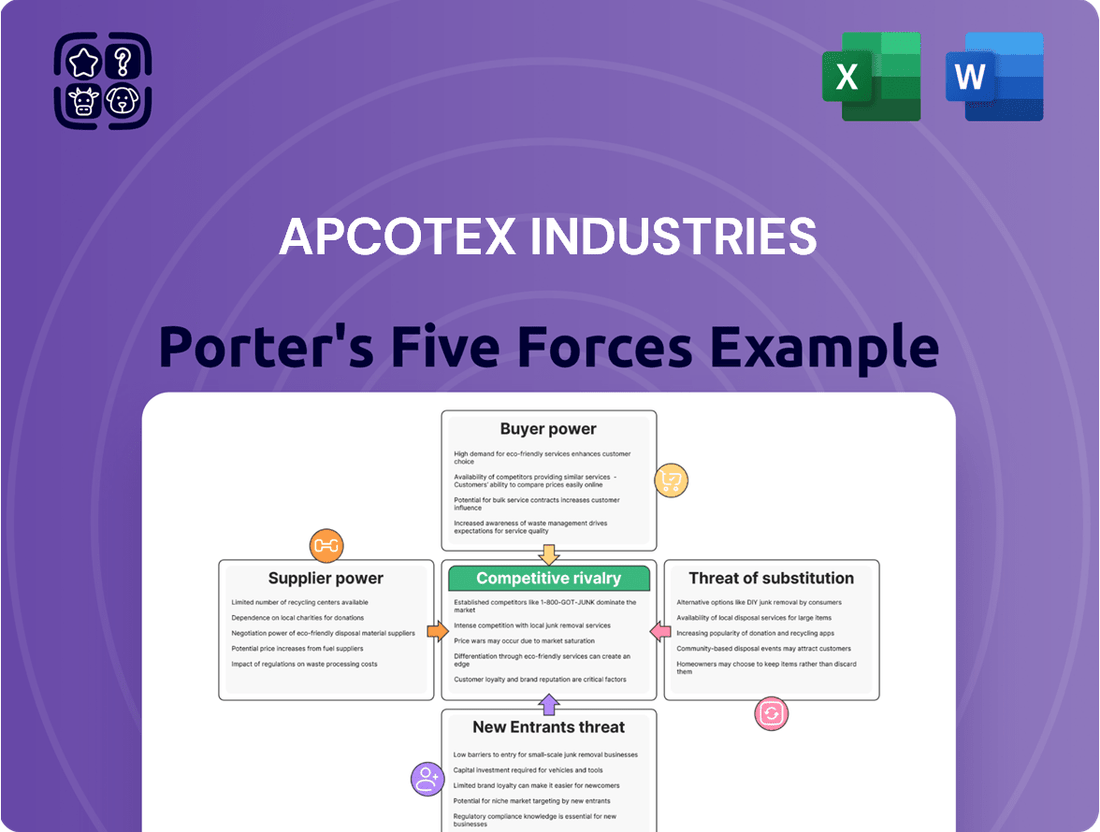

This analysis dissects Apcotex Industries' competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the synthetic latex and polymer sectors.

Instantly identify and mitigate competitive threats with a dynamic visual representation of Apcotex's Porter's Five Forces, simplifying complex market dynamics for strategic advantage.

Customers Bargaining Power

Apcotex Industries' diverse customer base, spanning sectors like paper, paints, adhesives, construction, and textiles, significantly dilutes the bargaining power of individual customers. This broad application means the company isn't overly dependent on any single industry or a few large clients, which is a key factor in managing customer leverage.

The demand for Apcotex's products is robust across multiple segments, including paper, construction, and tyre cords. This widespread demand further weakens the ability of any one customer group to exert significant pressure on pricing or terms, as there are always other avenues for sales.

Apcotex's polymer emulsions are critical components in their customers' formulations, acting as binders, coatings, and additives that significantly enhance final product performance. For example, these emulsions contribute to improved durability, water resistance, and eco-friendly characteristics in paints and coatings, making them indispensable. This essentiality limits customers' power to demand lower prices or switch suppliers without jeopardizing their own product quality and market competitiveness.

Customer switching costs are a significant factor for Apcotex Industries, particularly in sectors like paints, adhesives, and construction. Companies in these industries often invest heavily in re-formulating their products and conducting rigorous testing when adopting new chemical suppliers. This process can be time-consuming and expensive, creating a strong incentive for them to stick with established, reliable partners like Apcotex.

For instance, a paint manufacturer might need to re-validate the performance, durability, and regulatory compliance of their entire product line if they switch from Apcotex's synthetic latex. This technical inertia makes frequent supplier changes impractical, thereby enhancing Apcotex's customer retention and bargaining power.

Price Sensitivity of Customers

While Apcotex Industries' products enhance performance, customers in highly competitive downstream sectors, particularly those making bulk purchases, often exhibit significant price sensitivity. This means that even with superior product attributes, the final price remains a crucial decision-making factor.

A key challenge for Apcotex is maintaining price competitiveness against imports. Despite being an import substitute for roughly 45% of its product portfolio, the company faces pressure to align its pricing with international benchmarks, which can compress profit margins and impact revenue realizations.

This customer price sensitivity translates into a strong bargaining power, as buyers can leverage the availability of alternative suppliers or imported options to negotiate more favorable terms. Consequently, Apcotex must continuously balance its pricing strategy to remain attractive to its customer base without unduly sacrificing profitability.

- Price Sensitivity: Customers in competitive downstream industries are often price-sensitive, especially for large-volume orders.

- Import Competition: Apcotex must compete on price with imports, impacting its revenue even as an import substitute.

- Margin Pressure: Customer demands for competitive pricing can directly squeeze Apcotex's profit margins.

Customer Information and Industry Trends

Customers, particularly large industrial buyers, often have a good grasp of market prices, other available suppliers, and current industry trends. This knowledge can give them an edge when negotiating with Apcotex. For instance, in 2023, the specialty chemicals sector saw increased price sensitivity from major clients due to global economic shifts, making informed customers more assertive.

However, Apcotex Industries actively works to mitigate this through consistent investment in research and development and a strong emphasis on operational efficiencies. This strategy aims to deliver products and solutions that stand out for their quality and performance, not just their price point. By creating superior value, Apcotex can better address demands from well-informed customers.

- Informed Buyers: Customers often possess detailed market price information and knowledge of alternative suppliers.

- Apcotex's Counter-Strategy: R&D investment and operational efficiency focus on differentiation beyond price.

- Value Creation: Apcotex aims to offer superior products and solutions to counter informed customer demands.

- Industry Context: The specialty chemicals sector in 2023 experienced heightened price sensitivity from large clients.

While Apcotex Industries' diverse customer base and the essential nature of its polymer emulsions somewhat limit customer power, significant price sensitivity, particularly from large industrial buyers, remains a key factor. The company's need to compete with imports, even as an import substitute for about 45% of its portfolio, further pressures pricing and can squeeze profit margins. This means customers, armed with market knowledge, can exert considerable influence on terms and pricing, necessitating Apcotex's continuous focus on value differentiation beyond cost.

| Factor | Impact on Apcotex | Mitigation Strategy |

|---|---|---|

| Price Sensitivity of Large Buyers | High bargaining power, potential margin pressure | Focus on R&D for product differentiation, operational efficiencies |

| Import Competition | Need to match international pricing, revenue realization challenges | Leverage import substitution status, emphasize quality and reliability |

| Customer Market Knowledge | Informed negotiation, ability to leverage alternatives | Build strong customer relationships, offer superior technical support and solutions |

Same Document Delivered

Apcotex Industries Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Apcotex Industries, providing an in-depth examination of competitive forces within its operating environment. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool. You're looking at the actual document, meticulously prepared to offer actionable insights into Apcotex Industries' market position and competitive landscape.

Rivalry Among Competitors

Apcotex Industries operates within the Indian specialty chemicals sector, a market characterized by a diverse array of competitors, which naturally fuels competitive rivalry. This segmentation means Apcotex faces competition from both domestic and international players vying for market share.

The global synthetic latex polymers market, a key area for Apcotex, features significant players like Arkema, Wacker Chemie, Synthomer, and BASF. The presence of these large, established chemical giants, alongside other notable companies such as LG Chem, Celanese, and Dow, underscores the broad and intense competitive landscape Apcotex navigates.

The Indian polymer emulsion market is set for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 7.80% between 2025 and 2031. This growth is largely fueled by ongoing urbanization and substantial infrastructure development across the nation.

On a global scale, the synthetic latex polymers market is also demonstrating strong upward momentum, anticipated to grow at a CAGR of 5.5% from 2024 to 2029. Such healthy market expansion can, however, lead to intensified competitive rivalry as existing players and new entrants vie for a larger slice of this growing pie.

Apcotex Industries actively pursues product differentiation by offering a diverse portfolio of emulsion polymers and synthetic rubbers. This strategy aims to set its offerings apart in a competitive market.

The specialty chemicals industry, where Apcotex operates, is heavily reliant on innovation. Continuous investment in research and development is crucial for creating new products with superior characteristics, driving competitive advantage.

Companies that prioritize R&D for advancements in areas like adhesion, durability, and sustainability, alongside the development of specialized emulsions, are better positioned to capture market share. For instance, Apcotex's focus on high-performance products allows it to command premium pricing and build customer loyalty.

Exit Barriers and Industry Overcapacity

High fixed costs and specialized assets in chemical manufacturing create significant exit barriers. Companies often continue operating even in challenging markets to avoid substantial losses on idle capacity, intensifying competition. Apcotex, like its peers, likely faces this dynamic, where sunk costs encourage continued production.

Industry overcapacity, particularly exacerbated by global players, puts immense pressure on pricing. This can lead to a scenario where companies engage in competitive price cutting to maintain market share, even if it erodes profitability. The chemical sector has seen instances of oversupply impacting margins for established players.

For instance, reports in early 2024 indicated that certain specialty chemical segments experienced oversupply, leading to price pressures. This overcapacity can be driven by new capacity additions or shifts in global trade dynamics, such as increased exports from regions with lower production costs. Companies like Apcotex must navigate these pricing challenges to maintain healthy financial performance.

- High Fixed Costs: Significant investments in plant and machinery make exiting the chemical industry costly, forcing companies to remain operational.

- Specialized Assets: Assets designed for specific chemical processes have limited alternative uses, increasing the penalty for closure.

- Overcapacity Impact: Global oversupply, often fueled by aggressive export strategies, can lead to price wars and reduced profitability for all market participants.

- Dumping Concerns: In some instances, overcapacity can result in the dumping of products at below-market prices, further squeezing margins for domestic producers.

Import Competition and Price Sensitivity

Apcotex operates in a landscape where maintaining price competitiveness against imports is a constant hurdle. This pressure can directly impact the company's revenue per unit, or realizations. For instance, in 2023, the synthetic rubber industry in India saw significant import volumes, particularly from Southeast Asian countries, which often operate with lower production costs, putting downward pressure on domestic prices.

Fluctuations in currency exchange rates, such as the weakening of the Indian Rupee against the US Dollar, create a dual effect. While it increases the cost of imported raw materials for domestic producers like Apcotex, it simultaneously makes Indian-made products more attractive and cost-effective for international buyers, potentially boosting export opportunities.

The Indian market navigates a delicate equilibrium between relying on domestic manufacturing capabilities and the necessity of imports to meet demand. This dynamic significantly shapes local pricing strategies and fuels the intensity of competitive rivalry, as both domestic players and importers vie for market share.

- Price Pressure: Apcotex must contend with import pricing, which can compress profit margins.

- Currency Impact: A weaker Rupee can raise import costs but enhance export competitiveness.

- Market Dynamics: The balance between domestic production and imports dictates local pricing strategies.

Competitive rivalry within the Indian specialty chemicals sector, particularly for Apcotex Industries, is intense due to the presence of both large global players and numerous domestic companies. The synthetic latex polymers market, a key segment for Apcotex, sees competition from giants like Arkema, Wacker Chemie, and BASF, alongside other significant entities. This broad competitive base is further amplified by the projected growth in the Indian polymer emulsion market, expected to expand at a CAGR of 7.80% between 2025 and 2031, attracting more players and intensifying market share battles.

High fixed costs and specialized assets in chemical manufacturing create substantial exit barriers, compelling companies to continue operations even in challenging market conditions, thereby sustaining competitive pressure. Furthermore, global overcapacity, often driven by aggressive export strategies, leads to price wars and reduced profitability. For instance, early 2024 reports highlighted oversupply in certain specialty chemical segments, resulting in price pressures, a dynamic Apcotex must navigate.

Apcotex faces constant pressure from import pricing, particularly with significant import volumes seen in 2023 for synthetic rubber from Southeast Asian countries, impacting domestic prices. Currency fluctuations, like a weaker Indian Rupee, also play a role; while increasing raw material costs, they can boost export competitiveness. This interplay between domestic production and imports shapes local pricing strategies and intensifies rivalry.

| Key Competitors (Synthetic Latex Polymers) | Global Market Growth (2024-2029) | Indian Polymer Emulsion Market Growth (2025-2031) |

| Arkema, Wacker Chemie, Synthomer, BASF, LG Chem, Celanese, Dow | 5.5% CAGR | 7.80% CAGR |

SSubstitutes Threaten

The availability of natural rubber latex presents a significant threat of substitutes for synthetic rubber latex producers like Apcotex Industries. Natural rubber latex serves as a direct alternative in numerous applications, from gloves to adhesives, offering a competitive choice for consumers.

While synthetic rubber offers distinct performance characteristics, the growing interest in bio-based alternatives, including improved natural rubber processing or bio-synthetics, could further erode the market share of traditional synthetic products. For instance, the global natural rubber market was valued at approximately USD 30 billion in 2023, indicating substantial market presence.

Apcotex Industries' Nitrile Butadiene Latex (NB Latex) faces significant competitive pressure from alternative synthetic polymers such as Styrene Butadiene Rubber (SBR) and Thermoplastic Elastomers (TPEs). These substitutes often present compelling value propositions, either through more attractive pricing or specialized performance characteristics that can meet specific application needs.

Technological advancements in material science pose a significant threat of substitution for Apcotex's products. Ongoing research is yielding new or enhanced materials that can directly replace existing ones. For example, the paints and coatings sector, a key market for Apcotex, is seeing increased adoption of waterborne coatings, powder coatings, and bio-based resins, potentially reducing demand for traditional polymer emulsions.

Cost-Performance Trade-off of Substitutes

The threat of substitutes for Apcotex Industries is significantly influenced by the price-performance trade-off offered by alternative materials. If competitors can deliver similar or better performance at a reduced cost, Apcotex faces a considerable challenge.

Apcotex's strategy of focusing on high-performance and specialized emulsions allows it to command premium pricing. However, a substantial cost advantage from substitute products could undermine its market standing.

- Price Sensitivity: For applications where cost is a primary driver, readily available substitutes with a lower price point pose a direct threat.

- Performance Parity: If substitutes achieve performance levels comparable to Apcotex's offerings, the cost advantage becomes even more critical in customer decision-making.

- Innovation in Substitutes: Emerging materials or technologies that offer a superior price-performance ratio can rapidly shift market dynamics, impacting Apcotex's competitive landscape.

Customer Adoption of New Technologies

The willingness of Apcotex's diverse customer base, spanning sectors like paper, paints, adhesives, construction, and textiles, to adopt new technologies and substitute materials is a significant factor. If these industries quickly adopt alternatives, perhaps driven by regulatory mandates such as low-VOC requirements or superior performance benefits, it could affect Apcotex's sales volumes. For instance, the global paints and coatings market is projected to reach USD 207.3 billion by 2024, with a growing emphasis on sustainable solutions.

Apotex's proactive efforts in developing sustainable and eco-friendly formulations are crucial for mitigating the threat of substitutes. These initiatives aim to align with evolving industry demands and customer preferences for environmentally conscious products. By focusing on innovation in green chemistry, Apcotex can strengthen its market position against emerging alternatives.

- Customer industries' embrace of new technologies directly influences demand for Apcotex's products.

- Regulatory pressures, like low-VOC mandates, can accelerate the adoption of substitute materials.

- Apotex's R&D in sustainable formulations is key to countering the threat of substitution.

- The global paints and coatings market's growth highlights the importance of eco-friendly product development.

The threat of substitutes for Apcotex Industries is multifaceted, encompassing both natural and synthetic alternatives. Natural rubber latex, valued around USD 30 billion globally in 2023, directly competes in many applications. Furthermore, advancements in materials science are introducing new substitutes, such as bio-based resins and waterborne coatings in the paints sector, which is projected to reach USD 207.3 billion by 2024. Apcotex's strategy of focusing on specialized, high-performance emulsions aims to counter this by commanding premium pricing, though cost-sensitive applications remain vulnerable to lower-priced substitutes. The company's investment in sustainable formulations is a critical defense against evolving market demands and regulatory pressures favoring eco-friendly alternatives.

| Substitute Category | Key Examples | Market Relevance/Impact | Apcotex's Counter-Strategy |

|---|---|---|---|

| Natural Rubber Latex | Natural Rubber Latex | Significant market presence (USD 30 billion in 2023); direct competitor in various applications. | Focus on specialized synthetic properties and performance differentiation. |

| Alternative Synthetic Polymers | Styrene Butadiene Rubber (SBR), Thermoplastic Elastomers (TPEs) | Offer competitive pricing or specialized performance; pressure NB Latex market share. | Emphasis on high-performance and niche applications. |

| Advanced Materials & Technologies | Waterborne coatings, Powder coatings, Bio-based resins | Emerging in sectors like paints and coatings (USD 207.3 billion market by 2024); driven by sustainability and regulatory trends (e.g., low-VOC). | Development of sustainable and eco-friendly formulations; R&D in green chemistry. |

Entrants Threaten

The specialty chemicals sector, where Apcotex operates with products like synthetic rubber latexes, demands hefty investments. Setting up manufacturing plants, acquiring advanced machinery, and funding robust research and development are incredibly costly. For instance, in 2023, Apcotex invested significantly in expanding its production capacities, a clear indicator of the capital intensity involved.

These substantial upfront costs create a formidable barrier to entry for any new player. It’s not just about having a good idea; it’s about having the financial muscle to build and sustain operations. This high capital requirement effectively shields existing companies like Apcotex from a flood of new competitors.

Apcotex Industries, a key player in high-performance emulsions, leverages proprietary technology and a strong R&D focus. This specialization, along with intricate manufacturing processes, creates a substantial barrier for newcomers.

The specialty chemical sector is driven by constant innovation, meaning any new entrant must commit significant capital to research and development to create comparable products or purchase existing advanced technologies. For instance, in 2023, Apcotex reported a healthy R&D expenditure, underscoring the industry's commitment to innovation and the high cost of entry for competitors aiming to match their technological edge.

The chemical sector, particularly for companies like Apcotex, is heavily burdened by stringent environmental regulations and safety protocols. New competitors must navigate complex permitting processes and adhere to rigorous standards for handling potentially hazardous materials, which represents a significant cost and time barrier.

For instance, in 2024, the average cost for environmental compliance in the chemical manufacturing sector globally can range from 5% to 15% of operational expenses, depending on the specific chemicals handled. Apcotex's existing certifications in ISO 45001:2018 for occupational health and safety and Responsible Care demonstrate their established commitment to these high standards, making it more challenging for new, less experienced entrants to match their operational integrity and regulatory standing.

Established Distribution Channels and Customer Relationships

Apcotex Industries benefits from deeply entrenched distribution channels and strong, long-standing relationships with a wide array of customers across multiple sectors. This makes it difficult for new players to replicate the same reach and reliability.

New entrants face a significant hurdle in establishing comparable distribution networks and securing the trust of customers who prioritize proven suppliers for essential materials. Customer loyalty and stringent vendor qualification processes further solidify Apcotex's position, acting as substantial barriers to entry for aspiring manufacturers.

- Established Distribution Network: Apcotex has cultivated an extensive and efficient distribution system, crucial for timely delivery and market penetration.

- Customer Loyalty and Trust: The company enjoys high customer retention due to its consistent product quality and reliable service, making it challenging for new entrants to attract these established clients.

- Vendor Regulations: Many industries have strict vendor approval processes that new companies must navigate, a step Apcotex has already successfully completed with its existing customer base.

Economies of Scale and Experience Curve

Existing players like Apcotex Industries leverage significant economies of scale. This translates to lower per-unit costs in production, raw material procurement, and distribution networks, creating a substantial barrier for newcomers who would initially operate at a smaller, less efficient scale. For instance, in 2024, Apcotex's robust manufacturing capacity allows for optimized resource utilization, a feat difficult to replicate quickly.

The experience curve further solidifies this advantage. Over time, chemical manufacturers like Apcotex refine their processes, leading to improved efficiency, higher quality output, and reduced waste. New entrants would need considerable time and investment to climb this curve and match the operational sophistication and cost-effectiveness of established players.

- Economies of Scale: Apcotex benefits from bulk purchasing power and optimized production runs, leading to lower manufacturing costs per unit.

- Experience Curve Advantage: Decades of operational refinement have enabled Apcotex to achieve higher yields and better quality control, reducing production inefficiencies.

- Cost Disadvantage for New Entrants: Start-up companies would face higher initial capital expenditure and operational costs until they achieve comparable scale and process maturity.

- Price Competition Barrier: The cost advantage of incumbents makes it challenging for new entrants to compete effectively on price in the market.

The threat of new entrants for Apcotex Industries is significantly mitigated by high capital requirements for manufacturing, R&D, and regulatory compliance, alongside established distribution networks and customer loyalty. Economies of scale and experience curve advantages further deter potential competitors, making market entry challenging.

| Barrier Type | Description | Impact on New Entrants | Apcotex's Advantage |

|---|---|---|---|

| Capital Intensity | High costs for plants, machinery, and R&D. | Significant financial hurdle. | Established infrastructure and investment capacity. |

| Proprietary Technology & R&D | Specialized processes and innovation focus. | Difficulty matching technological edge. | Strong R&D expenditure (e.g., reported healthy R&D in 2023). |

| Regulatory Compliance | Stringent environmental and safety standards. | Costly and time-consuming to meet. | Existing certifications (ISO 45001:2018) and adherence to standards. |

| Distribution & Customer Relationships | Entrenched channels and strong client trust. | Challenging to replicate reach and reliability. | Proven track record and established vendor qualifications. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Initial cost disadvantage. | Optimized resource utilization in 2024 manufacturing. |

Porter's Five Forces Analysis Data Sources

Our Apcotex Industries Porter's Five Forces analysis is built upon data from company annual reports, investor presentations, and industry-specific market research reports. We also leverage information from financial news outlets and competitor websites to capture current market dynamics and competitive strategies.