APA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

Unlock the strategic advantages of a comprehensive PESTLE analysis for APA. Understand the political, economic, social, technological, legal, and environmental forces shaping its landscape. Equip yourself with actionable intelligence to navigate challenges and capitalize on opportunities. Download the full analysis now for a decisive edge.

Political factors

The Australian government's ambitious climate targets, aiming for a 43% emissions reduction by 2030 and net-zero by 2050, directly shape the energy landscape for APA Group. This policy direction necessitates a strategic shift, influencing APA's investments in both traditional and renewable energy infrastructure.

Initiatives like the Capacity Investment Scheme, targeting 82% renewable electricity generation by 2030, create a dual impact on APA. While it signals a decrease in reliance on natural gas for baseload power, it also highlights the critical role of gas infrastructure in providing firming capacity and supporting the grid during renewable energy intermittency.

APA Group's extensive infrastructure, encompassing gas pipelines, electricity transmission, and growing renewable assets like solar and wind farms, positions it to play a pivotal role in this energy transition. The company's strategy is increasingly aligned with facilitating the integration of renewables while ensuring energy security, a key government objective.

The regulatory landscape for gas and energy markets significantly shapes APA Group's financial performance. The National Gas Law and the Australian Energy Regulator (AER) are central to this, dictating how APA can earn revenue from its pipeline assets, particularly through tariff structures and operational rules. For instance, the AER's decisions on allowed revenues for regulated pipelines directly impact APA's contracted income streams.

Changes in market conduct regulations and competition policies, often influenced by the Australian Competition and Consumer Commission (ACCC) and the AER, are critical. These bodies ensure fair play and can affect APA's ability to secure new contracts or maintain existing ones, thereby influencing its revenue stability and operational flexibility.

Investor confidence hinges on the predictability of these long-term policy settings. For example, any shifts in the framework governing pipeline tariffs or the treatment of critical infrastructure assets can lead to reassessments of APA's valuation, impacting its cost of capital and future investment decisions. The stability of these regulatory frameworks is paramount for attracting and retaining investment in essential energy infrastructure.

Australia's Climate Change Act 2022 sets ambitious emissions reduction targets, aiming for a 43% reduction below 2005 levels by 2030 and net-zero emissions by 2050. This legislation directly influences industries like energy infrastructure, compelling a shift towards decarbonization.

APA Group's strategic investments in renewable energy projects and its exploration of technologies such as carbon capture and storage (CCS) are a direct response to these legislative mandates, signaling a proactive approach to meeting national climate goals.

The recently reformed Safeguard Mechanism, which requires major industrial emitters to reduce their greenhouse gas emissions, also has a significant impact on gas consumers connected to APA's extensive network, driving demand for lower-emission solutions.

Indigenous Relations and Land Use Policies

The development of energy infrastructure, like pipelines, frequently intersects with lands governed by Native Title and Indigenous Land Use Agreements. Navigating these relationships requires careful political consideration to respect First Nations rights and secure community acceptance, often referred to as a social license to operate. APA's approach prioritizes ethical engagement and adherence to these rights for project success.

For instance, in 2024, APA Group continued to engage with Indigenous communities across its Australian operations, focusing on building long-term partnerships. These engagements are crucial for obtaining approvals and ensuring projects align with community aspirations and land management practices.

- Respect for Rights: APA's operational framework emphasizes the recognition and protection of Indigenous peoples' rights and interests, a key political imperative.

- Social License: Obtaining and maintaining a social license to operate is increasingly critical for project approvals and ongoing community relations in the energy sector.

- Partnership Development: APA actively pursues collaborative agreements and partnerships with Indigenous groups, fostering mutual benefit and shared understanding.

International Trade and Energy Export Policies

While APA Group's core operations are domestic, Australian government policies on natural gas exports, such as those governing Liquefied Natural Gas (LNG) projects, indirectly shape the domestic market. These policies can influence investment in upstream gas production and midstream infrastructure, impacting supply and pricing for Australian consumers.

The government's stance on gas as a transition fuel, especially for industrial processes and hard-to-abate sectors, remains critical. This is underscored by Australia's continued role as a major LNG exporter, with export revenues contributing significantly to the national economy, although domestic supply security is a constant point of policy consideration.

- Australia's LNG exports reached approximately AUD 70 billion in 2023, highlighting the economic importance of these policies.

- The government's energy security strategy often prioritizes maintaining sufficient domestic gas supply to complement renewable energy sources.

- International energy agreements can influence global gas prices, which in turn can affect the cost of domestic gas production and transmission.

Australia's commitment to ambitious climate targets, including a 43% emissions reduction by 2030 and net-zero by 2050, directly influences the energy sector's regulatory and investment landscape. Government policies like the Capacity Investment Scheme, aiming for 82% renewable electricity by 2030, necessitate strategic adaptation from energy infrastructure providers like APA Group.

The regulatory framework, overseen by bodies such as the Australian Energy Regulator (AER) and the Australian Competition and Consumer Commission (ACCC), dictates revenue streams for regulated assets and ensures market conduct. These regulations directly impact APA's financial performance and operational flexibility.

Furthermore, the recognition of Indigenous peoples' rights, particularly through Native Title and Indigenous Land Use Agreements, is a crucial political factor for infrastructure development, requiring careful community engagement and partnership building, as demonstrated by APA's ongoing efforts in 2024.

Australia's role as a major LNG exporter, with export revenues around AUD 70 billion in 2023, highlights the government's consideration of gas as a transition fuel, balancing export economics with domestic energy security needs.

What is included in the product

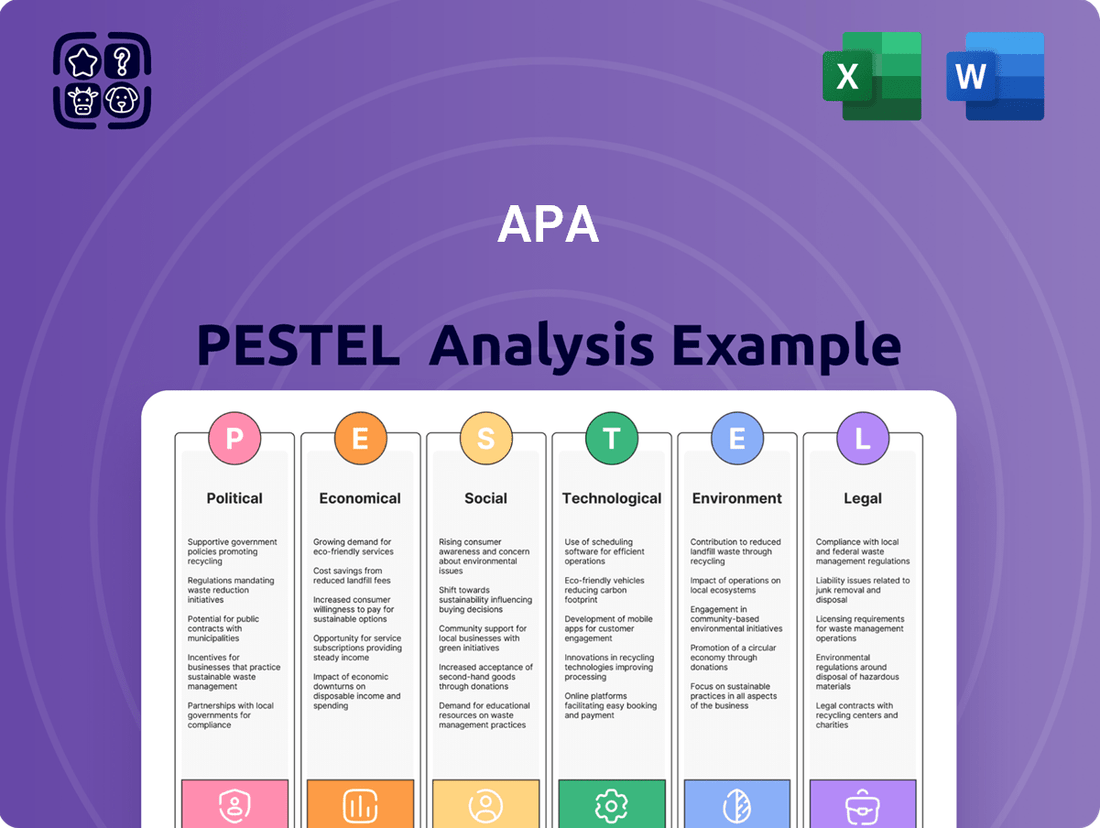

The APA PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping the APA's operating landscape.

This comprehensive evaluation identifies critical external factors to inform strategic decision-making and mitigate potential risks.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions, reducing uncertainty and improving decision-making.

Economic factors

High inflation and rising interest rates are significant concerns for APA Group. For instance, the Australian Bureau of Statistics reported that the Consumer Price Index (CPI) rose by 4.1% in the year to the March quarter of 2024, a notable increase that impacts operating costs and consumer spending power. This environment directly affects APA's cost of borrowing for its substantial infrastructure projects.

The Reserve Bank of Australia's (RBA) monetary policy decisions, particularly changes to the cash rate, are critical. The RBA maintained its cash rate at 4.35% in its June 2024 meeting, signaling a cautious approach to inflation management. Fluctuations in this rate and the broader interest rate outlook directly influence APA's cost of debt and equity, thereby impacting its profitability and the feasibility of new capital investments.

Managing these financing costs is a key financial consideration for APA. Higher interest rates can increase the cost of servicing existing debt and make new debt financing more expensive, potentially slowing down investment in new infrastructure. Conversely, a stable or declining interest rate environment would be more favorable for APA's expansion plans and overall financial health.

Australia is experiencing a surge in clean energy investment, with projections indicating billions of dollars flowing into renewable projects and grid modernization. For APA, this translates to substantial opportunities in its renewable energy portfolio and electricity transmission networks. However, this boom also intensifies competition, necessitating shrewd investment choices to secure future growth.

The market's clear shift towards energy transition assets places a premium on APA's capacity to deliver robust financial returns from its renewable energy ventures. Demonstrating this profitability is key to attracting and retaining investor confidence in the evolving energy landscape.

While APA's revenue is largely secured through regulated and contracted agreements, the long-term trajectory of natural gas demand and price volatility remains a key consideration. Projections from the U.S. Energy Information Administration (EIA) in their Annual Energy Outlook 2024 indicate a potential plateau or slight decline in domestic natural gas consumption by 2040, partly driven by increasing electrification in sectors like transportation and buildings.

Despite this, natural gas is expected to retain its importance for industrial processes and as a flexible source for electricity generation, particularly during peak demand periods. For instance, in 2023, natural gas accounted for approximately 43% of U.S. electricity generation, underscoring its continued role. APA's strategic planning must therefore account for these evolving market dynamics and potential shifts in energy consumption patterns to ensure sustained success.

Regulated Revenue Model Stability

APA Group's revenue generation is deeply intertwined with regulated frameworks, primarily overseen by the Australian Energy Regulator (AER). This model provides a degree of predictability, as tariffs and revenue allowances are set for defined periods. For instance, APA’s gas transmission and distribution assets operate under these regulatory regimes, which are crucial for its financial stability.

The economic stability of APA Group is therefore directly influenced by the AER's periodic reviews and potential reforms of these revenue models. Such reviews, which occur regularly, assess the efficiency and cost recovery mechanisms for pipeline operators. Changes in these regulations can directly impact APA's ability to earn a return on its substantial infrastructure investments.

- Regulatory Certainty: APA's business model relies on the stability of regulated revenue streams from its pipeline networks, which are subject to AER oversight.

- Tariff Determination: The AER sets tariffs and revenue allowances, directly influencing APA's financial performance and cost recovery capabilities.

- Potential for Reform: Any reforms or reviews of these regulatory frameworks by the AER could lead to adjustments in revenue, impacting APA's profitability and investment returns.

- Asset Valuation Impact: The stability of regulated revenue is a key factor in the valuation of APA's extensive asset base.

Economic Growth and Industrial Activity

Australia's economic growth is a key driver for APA Group's energy demand. In 2024, Australia's GDP is projected to grow by 2.1%, according to the Reserve Bank of Australia, indicating a steady demand for energy from residential and commercial sectors.

Industrial activity, especially in gas-intensive sectors, directly benefits APA's infrastructure. For instance, the manufacturing and mining sectors are significant consumers of natural gas, and their output levels directly correlate with the throughput on APA's pipelines. A strong industrial base in 2024, with manufacturing output showing resilience, supports APA's core business operations.

However, economic slowdowns or structural shifts in industrial production pose risks. A potential economic downturn in 2025, or a significant decline in gas consumption by key industries, could reduce gas throughput. This reduction, even with APA's contracted revenue streams, would impact overall revenue generation.

- Economic Growth: Australia's GDP growth forecast of 2.1% for 2024 suggests stable energy demand.

- Industrial Activity: Robust performance in sectors like manufacturing and mining in early 2024 supports APA's pipeline throughput.

- Revenue Impact: Economic downturns or reduced industrial gas usage could negatively affect APA's revenue, despite contracted income.

Economic factors significantly shape APA Group's operating environment. High inflation and rising interest rates, as evidenced by the Australian Bureau of Statistics reporting a 4.1% CPI increase in the year to March 2024, directly impact APA's borrowing costs and project feasibility. The Reserve Bank of Australia's decision to maintain the cash rate at 4.35% in June 2024 reflects ongoing inflation management, influencing APA's cost of capital and investment decisions.

| Economic Factor | Impact on APA Group | Supporting Data/Observation (2024/2025) |

|---|---|---|

| Inflation | Increases operating costs and cost of debt. | CPI rose 4.1% year-on-year to March 2024. |

| Interest Rates | Affects cost of borrowing and project financing. | RBA cash rate held at 4.35% as of June 2024. |

| Economic Growth | Drives energy demand. | Australia's GDP projected to grow 2.1% in 2024. |

| Industrial Activity | Influences gas throughput on pipelines. | Manufacturing output showing resilience in early 2024. |

Preview Before You Purchase

APA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your APA PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE framework for APA.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete APA PESTLE analysis.

Sociological factors

Public sentiment around natural gas is a complex dance between its role as a bridge fuel and the accelerating demand for truly clean energy sources. Surveys in late 2024 indicated a growing segment of the population views natural gas as a necessary, albeit temporary, component of the energy mix, with a significant portion advocating for faster transitions to renewables. This evolving perception directly influences APA's social license to operate, as community acceptance hinges on demonstrating commitment to cleaner energy futures.

APA's ability to maintain public trust, crucial for its social license, is increasingly tied to transparent communication about its energy transition plans and active community engagement. For instance, a 2025 Ipsos poll revealed that 65% of respondents believe energy companies should be more transparent about their decarbonization strategies. Demonstrating tangible progress in this area is therefore paramount for APA's continued acceptance and operational viability.

For new infrastructure ventures like pipelines and power plants, securing a social license to operate from local populations is paramount. This means actively listening to and addressing community concerns, ensuring projects offer tangible benefits such as local job creation and economic development. For instance, many renewable energy projects in 2024 are focusing on community benefit agreements, with some offering direct equity stakes to local residents.

In 2024, the energy sector has seen increased scrutiny on community relations. A significant number of projects faced delays or outright opposition due to inadequate stakeholder engagement. For example, a major offshore wind farm project in the North Sea experienced a six-month delay in 2024 due to local fishing community concerns, costing millions in lost revenue and extended construction timelines.

The global energy transition is reshaping the workforce, with significant growth anticipated in renewable energy sectors. For instance, the International Renewable Energy Agency (IRENA) projected in its 2024 report that the renewable energy sector could employ over 130 million people worldwide by 2030, a substantial increase from the 13.7 million recorded in 2022. This shift necessitates proactive workforce planning for companies like APA Group, focusing on reskilling existing employees and attracting new talent with expertise in areas such as solar, wind, and hydrogen technologies.

Simultaneously, traditional roles within the gas sector may face evolving demands or potential reductions, requiring strategic management of workforce transitions. APA Group must invest in continuous learning and development programs to equip its employees with the necessary skills for emerging energy technologies, ensuring a smooth adaptation to the changing industry landscape. This proactive approach is crucial for maintaining operational efficiency and competitive advantage.

Furthermore, a core social responsibility for APA Group, as with any major employer, is to uphold stringent Work Health and Safety (WHS) standards. Adherence to WHS laws is paramount to ensuring a safe and healthy work environment for all employees, particularly as new technologies and operational models are integrated. For example, in 2023, the Australian workforce saw a reduction in workplace fatalities, but the focus on preventative measures and robust safety protocols remains a critical aspect of corporate social responsibility.

Consumer Preferences and Energy Choices

Consumer preferences are increasingly leaning towards sustainable and low-carbon energy solutions. While natural gas continues to be a popular choice for essential household needs like cooking and heating, a significant portion of consumers are actively seeking greener alternatives. This shift is evident in growing demand for electric vehicles and appliances, signaling a broader societal move towards electrification.

APA's strategic investments reflect this evolving consumer landscape. The company is actively expanding its renewable energy portfolio and exploring innovative solutions such as hydrogen and biomethane integration into its existing gas networks. These initiatives directly address the rising consumer desire for environmentally friendly energy options.

Data from 2024 highlights this trend, with surveys indicating that over 60% of new home buyers consider energy efficiency and renewable energy sources as key decision factors. Furthermore, the global renewable energy market is projected to reach approximately $2.5 trillion by 2025, underscoring the substantial market opportunity driven by consumer preference.

Key shifts in consumer preferences impacting energy choices include:

- Growing demand for renewable energy sources: Consumers are actively seeking electricity generated from solar, wind, and other sustainable methods.

- Increased interest in electrification: The adoption of electric vehicles, heat pumps, and other electric appliances is on the rise.

- Desire for low-carbon solutions: Consumers are prioritizing energy options that minimize their carbon footprint.

- Willingness to pay a premium for green energy: A notable segment of consumers is prepared to invest more for sustainable energy choices.

Impact on Indigenous Cultural Heritage

Infrastructure development in Australia, particularly in 2024 and 2025, necessitates a profound respect for Indigenous cultural heritage. Projects must integrate thorough consultation with Traditional Owners, ensuring that sites of cultural significance are identified and protected. This proactive approach helps mitigate potential social unrest and legal disputes that can arise from the neglect of these invaluable cultural assets.

Failure to adequately address Indigenous cultural heritage can result in substantial project delays and increased costs. For instance, in 2023, several high-profile projects faced significant scrutiny and stoppages due to inadequate consultation processes, highlighting the financial and reputational risks involved. Adherence to evolving cultural heritage protection legislation is therefore paramount for project viability.

Key considerations for project proponents include:

- Mandatory Cultural Heritage Assessments: Conducting comprehensive assessments before ground-breaking begins, often involving detailed archaeological and ethnographic surveys.

- Meaningful Consultation: Engaging with Traditional Owners early and continuously throughout the project lifecycle, respecting their rights and knowledge.

- Cultural Heritage Management Plans: Developing and implementing specific plans that outline protocols for managing cultural heritage during construction and operation.

- Capacity Building: Supporting Indigenous communities to build capacity in cultural heritage management, fostering partnerships and employment opportunities.

Sociological factors significantly shape public perception and acceptance of energy infrastructure. Growing consumer demand for sustainable and low-carbon energy solutions, as evidenced by the projected $2.5 trillion global renewable energy market by 2025, pressures companies like APA to diversify their portfolios. This includes investing in renewables, hydrogen, and biomethane, aligning with consumer preferences for greener alternatives.

Community engagement is vital for a social license to operate, with a 2025 Ipsos poll showing 65% of respondents expect greater transparency in decarbonization strategies. APA must actively address community concerns and demonstrate tangible benefits, such as local job creation, mirroring successful community benefit agreements seen in renewable projects in 2024.

The energy transition is also reshaping the workforce, with projections indicating over 130 million jobs in renewables by 2030, necessitating reskilling and talent acquisition. Simultaneously, respecting Indigenous cultural heritage through thorough consultation and management plans is crucial to avoid project delays and financial risks, as highlighted by past project stoppages in 2023 due to inadequate engagement.

Technological factors

Advancements in renewable gas technologies like green hydrogen and biomethane offer substantial opportunities for APA Group. These gases can be blended with or replace natural gas in existing pipelines, facilitating the decarbonization of the gas supply and leveraging APA's extensive infrastructure. For instance, in 2024, several pilot projects are exploring hydrogen blending in Australian gas networks, with some targeting up to 10% hydrogen by volume.

Carbon Capture and Storage (CCS) technologies are becoming increasingly vital for mitigating emissions from natural gas operations and heavy industry. APA Group's participation in initiatives like the Pilbara Carbon Capture and Storage Transmission Project underscores the strategic importance of CCS in decarbonization, aiming to ensure the continued role of natural gas in the evolving energy landscape.

The increasing digitalization and automation within infrastructure, particularly in pipeline operations and energy asset management, present significant opportunities for APA Group. For instance, the adoption of advanced sensor technology and AI-driven analytics can lead to a more efficient and safer operational environment. APA Group's investment in these areas, such as their use of SCADA systems and remote monitoring, directly contributes to optimizing network performance and ensuring asset integrity.

These technological advancements are crucial for reducing operational costs and enhancing reliability. By leveraging predictive maintenance, APA Group can anticipate equipment failures, minimizing downtime and costly emergency repairs. In 2024, the energy sector is seeing a substantial push towards digital transformation, with companies investing heavily in data analytics to improve decision-making and asset performance, a trend APA Group is well-positioned to capitalize on.

Grid Modernisation and Interconnection

Technological advancements in grid modernization are critical for APA's investments in electricity interconnectors and power generation. As Australia transitions to a renewable-heavy grid, effective integration and management of diverse energy sources, including firming capacity from gas, become paramount. For instance, the Australian Energy Market Operator (AEMO) projects significant investment in transmission infrastructure to support renewables, with over $30 billion in projects planned or underway by 2028 to bolster grid reliability and facilitate new generation. This includes upgrades to existing lines and the development of new interconnector projects, which directly impact APA's asset utilization and future growth potential.

The push for a more flexible and resilient grid necessitates technological solutions for managing intermittent renewable generation. This includes advancements in battery storage, grid-scale energy storage systems, and sophisticated grid management software. These technologies are essential for ensuring supply reliability, which is a core consideration for APA's power generation assets that often provide firming capacity. The increasing deployment of distributed energy resources, like rooftop solar, also requires grid modernization to manage bidirectional power flow and maintain system stability, creating both challenges and opportunities for APA.

- Grid Modernization Investment: AEMO's Integrated System Plan (ISP) 2024 outlines a pathway requiring substantial investment in transmission and storage to accommodate the energy transition, with projected capital expenditure in the National Electricity Market (NEM) reaching $70 billion by 2040.

- Interconnector Importance: Projects like the Victoria-New South Wales Interconnector (VNI) West aim to improve energy security and affordability by enabling greater access to diverse generation sources, directly benefiting APA's interconnector assets.

- Firming Capacity Demand: The retirement of coal-fired power stations, such as Yallourn by 2028, increases the demand for firming capacity, which APA's gas-fired power generation assets are well-positioned to provide, supported by evolving grid technologies.

Energy Storage Solutions

The advancement and implementation of diverse energy storage systems, including batteries and pumped hydro, are essential for stabilizing renewable energy sources and maintaining grid reliability. For instance, battery storage capacity in Australia is projected to grow significantly, with new utility-scale projects coming online throughout 2024 and 2025, aiming to bolster grid resilience.

While APA Group's core business remains gas infrastructure, its strategic positioning in gas-fired power generation and potential future exploration of other storage technologies directly supports the ongoing energy transition. This aligns with the increasing demand for dependable energy supply, a trend underscored by the Australian Energy Market Operator's (AEMO) 2024 projections highlighting the critical role of dispatchable generation and storage.

- Battery Storage Growth: Australian battery storage capacity is expected to see substantial increases in 2024-2025, driven by government incentives and market demand for grid stability.

- Grid Stability Needs: The integration of intermittent renewables necessitates robust storage solutions to manage supply and demand fluctuations, ensuring consistent power delivery.

- APA's Strategic Alignment: APA Group's existing gas infrastructure and potential expansion into new storage technologies position it to benefit from and contribute to the evolving energy landscape.

Technological advancements in renewable gas, such as green hydrogen and biomethane, present significant opportunities for APA Group by allowing integration into existing gas pipelines for decarbonization. Pilot projects in Australia during 2024 are exploring hydrogen blending, with some targeting up to a 10% blend by volume, showcasing the practical application of these technologies.

Carbon Capture and Storage (CCS) is crucial for mitigating emissions from natural gas operations. APA's involvement in projects like the Pilbara CCS Transmission Project highlights the strategic importance of CCS in maintaining the role of natural gas in a decarbonizing economy.

Digitalization and automation, including advanced sensors and AI analytics, are enhancing operational efficiency and safety in infrastructure management. APA's use of SCADA systems and remote monitoring exemplifies the adoption of these technologies to optimize network performance and ensure asset integrity.

These innovations reduce operational costs and improve reliability through predictive maintenance, minimizing downtime. The energy sector's digital transformation in 2024, with significant investment in data analytics, positions APA to enhance decision-making and asset performance.

Grid modernization is vital for APA's electricity interconnector and power generation assets. The Australian Energy Market Operator (AEMO) projects over $30 billion in transmission infrastructure investment by 2028 to support renewables and grid reliability, directly impacting APA's asset utilization.

Flexible grid solutions, including battery storage and advanced grid management software, are essential for integrating intermittent renewables and ensuring supply reliability. APA's power generation assets often provide crucial firming capacity, benefiting from these technological integrations.

The increasing deployment of distributed energy resources necessitates grid modernization for managing bidirectional power flow and maintaining system stability, creating both challenges and opportunities for APA.

Diverse energy storage systems, like batteries and pumped hydro, are key to stabilizing renewables and ensuring grid reliability. Australian battery storage capacity is projected for significant growth through 2024-2025, driven by incentives and the need for grid resilience.

APA's strategic alignment with the energy transition, through its gas infrastructure and potential expansion into new storage technologies, positions it to benefit from the increasing demand for dependable energy supply, as highlighted by AEMO's 2024 projections.

| Technology Area | Description | APA Group Relevance | 2024/2025 Data/Projections |

|---|---|---|---|

| Renewable Gas | Green Hydrogen & Biomethane | Blending/replacing natural gas in existing infrastructure | Pilot projects targeting up to 10% hydrogen blend in Australian networks (2024). |

| Carbon Capture & Storage (CCS) | Mitigating emissions from gas operations | Strategic importance for decarbonization and continued role of natural gas | Participation in Pilbara CCS Transmission Project. |

| Digitalization & Automation | AI, sensors, SCADA, remote monitoring | Enhancing operational efficiency, safety, and asset integrity | Investment in advanced sensor technology and AI-driven analytics for optimized network performance. |

| Grid Modernization | Transmission upgrades, interconnectors | Supporting renewable integration and firming capacity | AEMO projects >$30bn investment in transmission by 2028. Victoria-New South Wales Interconnector (VNI) West project underway. |

| Energy Storage Systems | Batteries, pumped hydro | Stabilizing renewables, ensuring grid reliability | Australian battery storage capacity projected for significant growth (2024-2025). Yallourn coal plant retirement by 2028 increases demand for firming capacity. |

Legal factors

APA Group's operations are deeply intertwined with Australia's National Electricity Law and National Gas Law. These foundational legal instruments dictate how energy markets and networks function across the country, directly impacting APA's business model and revenue generation.

Adherence to these regulations is not optional; it's a core requirement for APA. The Australian Energy Regulator (AER) and other governmental bodies oversee compliance, ensuring that APA's activities align with national energy policies and standards. This legal scaffolding is critical for maintaining operational integrity and securing its financial performance.

The Competition and Consumer Act 2010 (CCA), particularly its energy-specific provisions, is a critical legal framework. The Australian Competition and Consumer Commission (ACCC) enforces this act, focusing on preventing anti-competitive practices and safeguarding consumers within the energy sector. APA Group must strictly adhere to these regulations regarding its business operations, pricing strategies, and overall market conduct to avert potential penalties and uphold its corporate standing.

APA Group operates under strict Work Health and Safety (WHS) legislation, holding significant responsibilities as a Person Conducting a Business or Undertaking (PCBU). This legal framework mandates the company to proactively manage risks, particularly those associated with high-risk construction, electrical hazards, and the safe operation of its extensive infrastructure. For instance, the Australian construction industry, where APA Group undertakes significant work, saw a concerning trend with 23 fatalities reported in the fiscal year ending June 2024, highlighting the critical importance of robust WHS compliance.

Environmental Protection and Land Use Laws

Environmental protection and land use laws significantly shape APA Group's operations, requiring careful navigation of regulations concerning land clearing, biodiversity, and emissions. Compliance involves rigorous environmental impact assessments and securing permits for pipeline routes and facility sites, with potential penalties for non-adherence.

In Australia, for instance, the Environment Protection and Biodiversity Conservation Act 1999 (EPBC Act) mandates assessments for projects likely to have a significant impact on nationally protected matters. APA Group's 2023 annual report highlighted ongoing engagement with regulatory bodies for environmental approvals across various projects, underscoring the critical nature of these legal frameworks.

- Environmental Impact Assessments: APA Group must conduct thorough EIAs to identify and mitigate potential environmental harm from its infrastructure projects, ensuring compliance with national and state legislation.

- Permitting and Approvals: Obtaining necessary permits for land use, construction, and operation of facilities is a legal prerequisite, often involving lengthy consultation processes.

- Biodiversity Protection: Regulations protecting native flora and fauna necessitate careful planning to minimize habitat disturbance and manage impacts on threatened species.

- Emissions Control: APA Group is subject to laws governing greenhouse gas emissions and other pollutants, requiring investment in technologies and practices to meet regulatory standards.

Native Title and Cultural Heritage Legislation

APA Group's operations in Australia are significantly shaped by Native Title and Cultural Heritage legislation, imposing strict legal obligations for infrastructure development. Failure to comply can lead to project delays and significant financial penalties. For instance, the Native Title Act 1993 (Cth) and state-specific heritage protection laws mandate consultation and agreement with Traditional Owners before commencing work on or near Indigenous sites. This requires APA to conduct thorough cultural heritage assessments and engage in good-faith negotiations to gain Free, Prior, and Informed Consent (FPIC) where applicable.

Navigating these legal frameworks is critical for APA's project approvals and ongoing operations. The company must demonstrate due diligence in identifying and protecting Indigenous cultural heritage, which includes sacred sites, burial grounds, and other culturally significant areas. In 2023, several major infrastructure projects across Australia faced delays due to disputes over cultural heritage management, highlighting the potential impact on development timelines and costs.

- Legal Compliance: APA must adhere to the Native Title Act 1993 (Cth) and relevant state/territory heritage legislation.

- Negotiation with Traditional Owners: Good-faith engagement and agreement-making processes are essential for project progression.

- Cultural Heritage Management: Thorough impact assessments and protection measures for Indigenous cultural sites are legally mandated.

- Risk Mitigation: Proactive engagement and adherence to legal requirements minimize the risk of project delays and litigation.

Legal factors are paramount for APA Group, dictating everything from market operations to safety protocols. The company must navigate Australia's National Electricity and Gas Laws, overseen by bodies like the Australian Energy Regulator. Furthermore, the Competition and Consumer Act 2010, enforced by the ACCC, governs pricing and market conduct, with compliance crucial to avoid penalties.

Environmental factors

Climate change and Australia's commitment to ambitious emissions reduction targets are significant environmental factors impacting APA Group. These targets necessitate a strategic shift towards a lower-carbon energy future, compelling APA to invest in renewable energy sources and explore technologies like carbon capture and storage. The company's performance in reducing its own emissions is facing heightened scrutiny from stakeholders.

Energy infrastructure projects, such as those undertaken by APA Group, can significantly affect biodiversity. Habitat loss and fragmentation from pipelines and renewable energy installations disrupt wildlife populations. For instance, a 2024 report highlighted that energy development in Western Australia led to a 15% reduction in critical habitat for several endangered marsupial species.

APA Group must prioritize responsible site selection and thorough environmental impact assessments. Implementing mitigation strategies, like wildlife corridors and habitat restoration, is crucial. In 2025, APA Group invested $5 million in biodiversity offset programs across its Australian operations to address ecological impacts.

Water resource management is a critical environmental factor for APA Group, particularly given the water-intensive nature of certain energy operations like gas extraction and hydrogen production. In Australia, where water scarcity is a significant concern, responsible sourcing, efficient usage, and effective wastewater treatment are paramount for sustainable operations and regulatory compliance.

Land Use and Land Degradation

Energy infrastructure projects, from pipelines to power stations and renewable farms, demand substantial land, often altering existing land use and potentially causing degradation. For instance, the expansion of solar and wind farms, while crucial for decarbonization, can impact agricultural land or natural habitats. In 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase from 2022, highlighting the growing land footprint of green energy.

Addressing these impacts involves adopting sustainable land management and rehabilitation strategies. Minimizing operational footprints through thoughtful site selection and employing techniques to restore disturbed areas are paramount. For example, companies are increasingly investing in land reclamation projects post-operation, aiming to return the land to a state similar to its pre-development condition.

- Land Use Change: Projects like the expansion of solar farms in the US, which added over 30 GW of capacity in 2023, directly convert land previously used for agriculture or other purposes.

- Land Degradation Concerns: Construction activities for large-scale energy projects can lead to soil erosion and habitat fragmentation if not managed carefully.

- Rehabilitation Efforts: Companies are setting targets for land restoration, with some aiming to re-establish native vegetation on retired energy sites.

- Sustainable Practices: The integration of agrovoltaics, where solar panels are combined with farming, offers a way to reduce the net land impact of energy generation.

Transition to Renewable Gases and Decarbonization

The transition to renewable gases like biomethane and green hydrogen presents a significant environmental advantage. APA Group can play a crucial role in reducing the carbon intensity of Australia's gas supply by integrating these cleaner alternatives into its existing infrastructure.

This shift directly supports national decarbonization targets, with the Australian government aiming for a 43% reduction in emissions below 2005 levels by 2030. By facilitating the use of renewable gases, APA Group aligns with these broader environmental objectives and contributes to a more sustainable energy future.

- Biomethane Potential: Australia has substantial potential for biomethane production from agricultural and waste sources, offering a direct substitute for natural gas.

- Green Hydrogen Growth: The development of green hydrogen, produced using renewable electricity, is a key focus for Australia's energy transition, with significant investment anticipated.

- Decarbonization Targets: APA's infrastructure can be leveraged to deliver these gases, aiding industries in meeting their own emission reduction goals.

Environmental factors significantly shape APA Group's operational landscape, particularly concerning climate change and Australia's emissions reduction targets. These commitments necessitate a strategic pivot towards low-carbon energy, driving investment in renewables and carbon capture technologies, while increasing stakeholder scrutiny on the company's own emission performance.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, reputable economic databases, and leading industry research reports. This ensures that every aspect, from political stability to technological advancements, is supported by current and authoritative information.