APA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

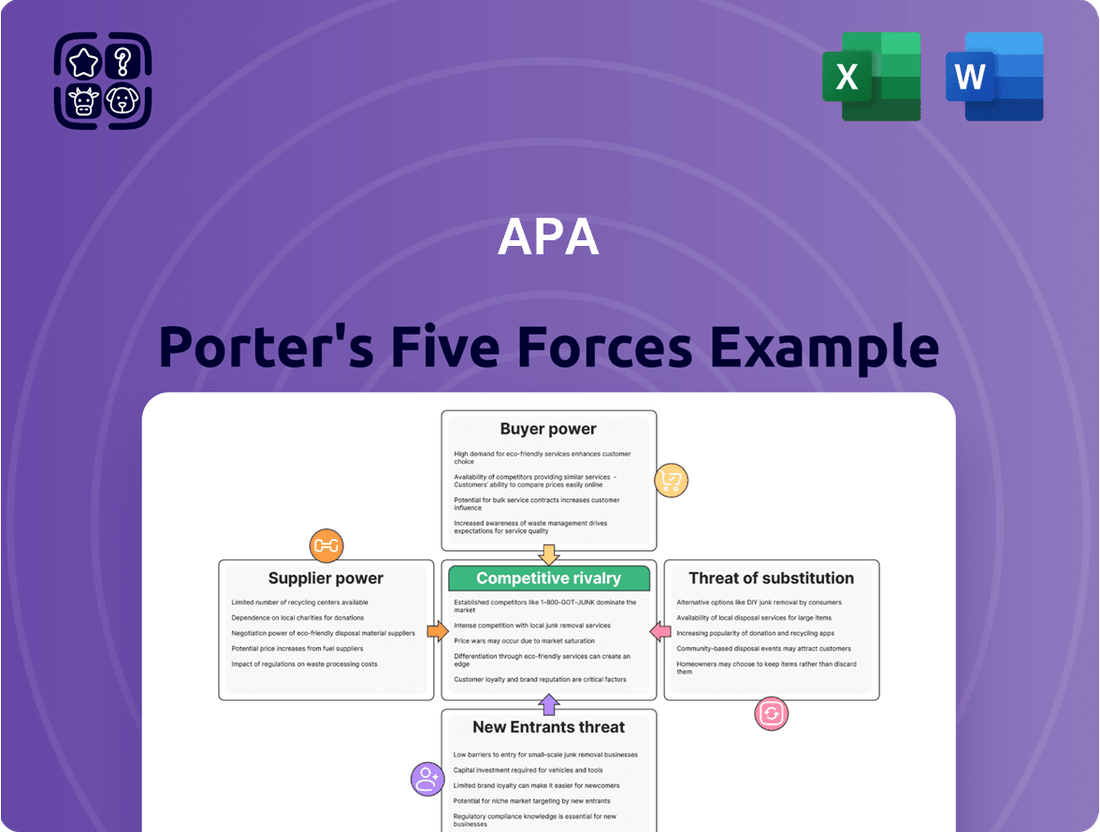

Understanding the competitive landscape is crucial for any business, and APA's industry is no exception. Our Porter's Five Forces Analysis dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. This framework provides a clear picture of the forces shaping APA's market.

The complete report reveals the real forces shaping APA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for APA Group is notably high, primarily due to the concentrated nature of its natural gas providers. Major energy producers like Woodside Energy and Santos are key suppliers, controlling significant Australian gas reserves and production capacity. This control is crucial as their output directly fuels APA's extensive pipeline network, the backbone of its operations.

In 2024, the reliance on these few, powerful suppliers means APA Group has limited options for sourcing gas. For instance, Woodside Energy reported substantial production volumes, underscoring its critical role. This dependence grants these suppliers considerable leverage in price negotiations and supply agreements, directly impacting APA's operational costs and profitability.

The Australian government's Future Gas Strategy highlights the critical need for ongoing investment in new gas supply to maintain energy security during the transition period. This policy directly bolsters the bargaining power of gas producers, who are essential suppliers to the nation's energy infrastructure.

For specialized equipment and services crucial to pipeline construction and renewable energy projects, APA Group may encounter a limited pool of qualified suppliers. This concentration in niche markets, particularly for proprietary or advanced technologies, can empower these suppliers with significant bargaining leverage.

In 2024, the global market for specialized pipeline welding equipment, for instance, is dominated by a few key manufacturers, allowing them to command premium pricing and dictate terms. Similarly, the development of advanced turbine technologies for wind farms often relies on a handful of engineering firms, giving them considerable sway over project costs and delivery schedules for companies like APA.

Supplier Power 4

While APA Group is a significant customer for gas producers needing to transport their product, the strong underlying demand for gas from domestic and industrial users gives producers considerable bargaining power. This is further strengthened by the substantial capital investment required for gas extraction and processing, which creates high barriers for new entrants into the supply market.

The capital-intensive nature of the gas industry means that existing producers have already sunk significant costs, making it difficult and expensive for new companies to enter. This situation often leads to a concentrated supplier base, allowing established producers to exert more influence over pricing and terms. For example, in 2023, the average capital expenditure for upstream oil and gas projects globally remained substantial, reflecting the ongoing investment needed to maintain and expand production capabilities.

The bargaining power of suppliers in the gas sector is influenced by several factors:

- Concentration of Suppliers: A limited number of large gas producers can collectively influence supply and pricing.

- Differentiation of Inputs: While natural gas is largely a commodity, specific quality or location advantages can differentiate suppliers.

- Switching Costs: For APA Group, switching gas suppliers can involve significant logistical and contractual hurdles, reinforcing the power of existing suppliers.

- Threat of Forward Integration: While less common in this specific context, the theoretical possibility of producers integrating downstream could alter the power dynamic.

Supplier Power 5

The bargaining power of suppliers in the gas sector remains substantial, particularly due to ongoing large-scale projects. For instance, significant investments are being made in areas like the Surat Basin and offshore regions to boost gas supply. These developments not only underscore the long-term commitment of gas producers but also reinforce their negotiating leverage for critical services like gas transmission.

These substantial capital expenditures, often running into billions of dollars, solidify the supply side's position. For example, projects aimed at increasing LNG export capacity from Australia, which commenced in the years leading up to 2025, represent multi-year commitments that enhance supplier influence. The sheer scale of these investments means suppliers are well-positioned to dictate terms.

- Significant Capital Investments: Large-scale gas projects require immense upfront capital, strengthening the negotiating position of the entities undertaking them.

- Long-Term Supply Commitment: Developments in regions like the Surat Basin signal a long-term outlook, providing suppliers with sustained market presence.

- Enhanced Negotiation Leverage: The strategic importance and scale of these projects grant gas producers greater power when negotiating transmission and other essential services.

The bargaining power of suppliers for APA Group is considerable due to the limited number of major natural gas producers in Australia. Key players like Woodside Energy and Santos control substantial reserves, giving them significant leverage in price and supply negotiations.

In 2024, APA's reliance on these few, powerful suppliers means it has limited alternatives, directly impacting operational costs. The high capital investment required for gas extraction also creates barriers to entry for new suppliers, further concentrating power among existing producers.

Specialized equipment and services for pipeline and renewable projects also face a concentrated supplier base. A few key manufacturers dominate niche markets, allowing them to dictate terms and pricing, as seen with specialized pipeline welding equipment in 2024.

| Supplier Type | Key Players | 2024 Market Dynamics | Impact on APA |

|---|---|---|---|

| Natural Gas Producers | Woodside Energy, Santos | Concentrated market, high production capacity | Significant leverage in pricing and supply agreements |

| Specialized Equipment | Key manufacturers of pipeline welding equipment | Dominated by a few firms, premium pricing | Higher capital costs for infrastructure projects |

| Renewable Energy Services | Advanced turbine technology firms | Limited number of engineering firms | Influence over project costs and delivery schedules |

What is included in the product

Analyzes the five competitive forces impacting APA's industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitute products.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, streamlining strategic planning.

Customers Bargaining Power

APA Group's buyer power is relatively low due to the regulated nature of its core energy infrastructure services. For instance, in the 2023 financial year, APA Group reported revenue of AUD 2.6 billion, with a significant portion coming from long-term contracts and regulated assets like gas pipelines. These regulated tariffs are often set by authorities, limiting individual customers' ability to negotiate prices.

Large industrial users and energy retailers, despite their significant gas consumption volumes, face a market where transmission and distribution tariffs are regulated. For instance, in Australia, the Australian Energy Regulator (AER) actively manages these tariffs, ensuring a balance between producer and consumer interests rather than allowing customers to wield unchecked bargaining power.

For unregulated services or new, bespoke infrastructure projects, major industrial customers or new power generation facilities seeking connection can exert significant bargaining power over APA. This is especially true if they represent a substantial new source of demand or require highly customized infrastructure solutions, potentially impacting APA's pricing and contract terms.

In 2024, APA's focus on securing long-term contracts for its gas transmission and storage assets, particularly with large industrial users and new energy projects, highlights this dynamic. For instance, securing anchor tenants for new pipeline developments often involves negotiating favorable terms to ensure project viability, directly reflecting customer bargaining power.

Buyer Power 4

In Australia's energy sector, the Australian Energy Regulator (AER) plays a crucial role in moderating buyer power by regulating pipeline access and pricing. This oversight limits the ability of pipeline owners to unilaterally increase costs, thereby safeguarding consumers. For instance, the AER's 2024 determination for the Dampier to Bunbury Natural Gas Pipeline established a weighted average cost of capital (WACC) that influences the prices pipeline operators can charge, directly impacting the bargaining power of their customers.

The AER's regulatory framework aims to ensure that customers, especially large industrial users, are not unduly disadvantaged by the monopolistic nature of pipeline infrastructure. By setting terms of service and price caps, the regulator empowers buyers by providing a degree of predictability and fairness in their dealings with pipeline providers. This intervention is particularly significant in markets where alternative transportation options are limited, as it prevents infrastructure owners from exploiting their market position.

Key aspects of the AER's influence on buyer power include:

- Price Controls: The AER sets revenue caps for regulated pipelines, directly influencing the prices customers pay for gas transportation.

- Access Arrangements: The regulator ensures that pipeline access is provided on fair and non-discriminatory terms, preventing preferential treatment.

- Customer Consultation: The AER actively engages with customer groups during its regulatory reviews, giving them a voice in pricing and service decisions.

- Dispute Resolution: The AER provides mechanisms for resolving disputes between pipeline customers and service providers, further strengthening the position of buyers.

Buyer Power 5

The bargaining power of customers for APA Group is generally considered moderate to low. While end-consumers, like households and small businesses, are numerous, they don't directly negotiate with APA for gas transportation. Instead, their influence is channeled through energy retailers and consumer advocacy groups. These intermediaries, and the regulatory frameworks in place, shape the terms of service rather than direct customer negotiation with APA.

For instance, in 2024, the Australian Energy Regulator (AER) continues to set price caps and service standards for gas transmission networks, limiting the ability of individual customers to exert direct pressure on APA's pricing. APA's extensive infrastructure and the essential nature of gas transportation mean that customers have few viable alternatives for accessing gas, further reducing their individual bargaining leverage.

- Limited Direct Negotiation: End-consumers do not directly negotiate gas transportation terms with APA Group.

- Aggregation through Intermediaries: Customer power is aggregated by energy retailers and consumer advocacy groups.

- Regulatory Influence: The Australian Energy Regulator's price caps and service standards significantly influence customer power.

- Few Alternatives: The essential nature of gas transportation and APA's infrastructure limit alternative options for customers.

APA Group's customer bargaining power is generally low, primarily due to the regulated nature of its core energy infrastructure services and the essential, often monopolistic, position of its pipelines. While large industrial users might have some leverage, especially for new projects, the Australian Energy Regulator (AER) plays a significant role in moderating this power through price controls and access arrangements. For example, the AER's 2024 determinations for key pipelines directly influence the tariffs customers pay, limiting individual negotiation capacity.

The limited availability of alternative gas transmission and distribution networks means customers have few choices, reducing their ability to demand lower prices or better terms. Even in 2024, APA's strategy of securing long-term contracts for new developments underscores the need to offer attractive terms to anchor customers, acknowledging their potential influence in specific scenarios.

The AER's oversight, including its 2024 decisions on revenue caps and service standards, ensures that customers are not exploited. This regulatory intervention empowers buyers by providing price predictability and fair access, especially critical where alternative infrastructure is scarce.

Customer bargaining power is further diminished as end-consumers do not directly negotiate with APA; their influence is channeled through energy retailers and regulatory bodies. This structure, combined with the essential nature of APA's services, keeps direct customer leverage minimal.

| Factor | Impact on APA Group | 2024 Relevance |

|---|---|---|

| Regulation (AER) | Lowers customer bargaining power via price caps | Continued AER price determinations in 2024 |

| Limited Alternatives | Reduces customer leverage | APA's infrastructure remains critical |

| Contractual Agreements | Can increase power for large/new customers | Securing anchor tenants for new projects in 2024 |

| End-Consumer Influence | Indirect via retailers/regulators | Ongoing regulatory oversight of retail pricing |

Same Document Delivered

APA Porter's Five Forces Analysis

The document you see here is the exact, professionally crafted APA Porter's Five Forces Analysis you will receive upon purchase. This preview showcases the comprehensive breakdown of competitive forces within your industry, allowing you to assess market attractiveness and strategic positioning. You're not just seeing a sample; you're viewing the complete, ready-to-use analysis that will be instantly available for your business needs.

Rivalry Among Competitors

Competitive rivalry in Australia's established gas transmission sector is relatively low due to immense capital requirements and the presence of significant, sunk infrastructure assets. The cost to construct new, competing national pipeline networks is prohibitively high, effectively creating a barrier to entry for new players and limiting direct competition among existing major owners.

APA Group's commanding presence in Australia's gas pipeline sector, managing roughly half of the domestic network, significantly dampens competitive rivalry. This vast, established infrastructure acts as a formidable barrier for new entrants, making it difficult and costly to replicate their existing network, especially on already serviced routes.

Competitive rivalry in the electricity transmission sector is intense, primarily centered on securing new infrastructure projects. This includes bids for expanding existing power grids, building new interconnections between regions, and developing transmission solutions for renewable energy sources and energy storage facilities. Companies are vying for lucrative contracts and the necessary regulatory approvals to undertake these growth initiatives, driving a competitive landscape.

Competitive Rivalry 4

The competitive rivalry within the energy infrastructure sector is heavily influenced by regulatory decisions. For instance, the Australian Energy Regulator (AER) plays a crucial role in shaping market dynamics and the commercial terms for infrastructure operations. A prime example is the AER's ruling on the South West Queensland Pipeline, which directly altered the competitive landscape for that specific asset.

These regulatory interventions can significantly impact profitability and investment attractiveness. For example, in 2024, the AER's final decision on the Transgrid transmission network, which allowed for a weighted average cost of capital (WACC) of 5.45%, has implications for future revenue streams and competitive positioning among regulated network providers.

- Regulatory Oversight: The AER's decisions on pricing, access, and service standards create a framework that dictates how energy infrastructure companies compete.

- Impact of Rulings: Decisions like the one concerning the South West Queensland Pipeline demonstrate how specific regulatory outcomes can directly alter competitive conditions.

- Financial Implications: The WACC allowed for regulated assets, such as Transgrid's 5.45% in 2024, directly affects the financial returns and thus the competitive intensity among network operators.

Competitive Rivalry 5

Competitive rivalry in Australia's energy infrastructure sector is significant, extending beyond direct pipeline competitors. Large players like Jemena and AusNet operate gas pipelines, but the competition also encompasses electricity transmission companies. This broader field vies for crucial investment capital and strategic advantages across the entire energy value chain.

While direct competition for specific gas pipeline projects might be limited, these infrastructure giants are in constant competition for investor attention and funding. For instance, in 2024, major energy infrastructure projects across Australia, including transmission and pipeline developments, attracted billions in capital. Companies like APA Group, Jemena, and AusNet are all seeking to secure their share of this investment to fund growth and maintain their market positions.

- Broader Competition: Energy infrastructure players like Jemena and AusNet compete with gas pipeline operators and electricity transmission companies.

- Capital Allocation: These companies compete fiercely for investment capital within the broader Australian energy market.

- Strategic Positioning: Competition extends to strategic positioning across the entire energy value chain, not just direct pipeline operations.

- Market Dynamics: In 2024, the energy infrastructure sector saw substantial capital flows, intensifying the rivalry for project development and funding.

Competitive rivalry in Australia's energy infrastructure sector is multifaceted. While direct competition in gas transmission is somewhat contained by high capital costs and existing infrastructure, the electricity transmission sector sees more vigorous competition for new projects. This rivalry extends to securing investment capital and strategic positioning across the entire energy value chain, involving both gas and electricity players.

The Australian Energy Regulator (AER) significantly shapes this competitive landscape through its decisions on pricing and service standards. For example, the AER's 2024 ruling on Transgrid's weighted average cost of capital (WACC) at 5.45% directly impacts the financial returns and competitive intensity for regulated network operators. These regulatory interventions can alter profitability and investment attractiveness, influencing how companies compete for market share and future projects.

| Sector | Nature of Rivalry | Key Factors Influencing Rivalry | 2024 Data/Context |

|---|---|---|---|

| Gas Transmission | Relatively Low (direct) | High capital requirements, sunk infrastructure, limited new entrants | APA Group's dominance (approx. 50% of network) |

| Electricity Transmission | Intense (project-based) | Securing new infrastructure projects, regulatory approvals, expansion bids | Competition for renewable energy transmission solutions |

| Overall Energy Infrastructure | Significant (capital & strategic) | Competition for investment capital, strategic positioning across value chain | Billions in capital for projects; AER's Transgrid WACC decision (5.45%) |

SSubstitutes Threaten

The most significant threat to APA Group's core gas infrastructure business stems from the accelerating national transition to renewable energy sources like solar and wind, coupled with battery storage. These alternatives are increasingly displacing gas-fired electricity generation and direct gas consumption across various sectors, impacting demand for traditional gas infrastructure.

Government policies are increasingly pushing for cleaner energy sources, directly impacting the threat of substitutes. For instance, Australia's Future Gas Strategy, while acknowledging gas's transitional role, clearly prioritizes a long-term shift towards alternatives like hydrogen and biomethane. This strategic direction actively encourages investment in these substitute fuels and the necessary infrastructure to support them, thereby intensifying the competitive pressure from these emerging energy options.

The increasing electrification of homes and industries, fueled by economic incentives and environmental commitments, directly diminishes the demand for natural gas. This shift is evident as consumers increasingly adopt rooftop solar panels and battery storage systems, significantly reducing their dependence on grid electricity, which often includes gas-fired power generation.

Threat of Substitution 4

While natural gas is currently vital for stabilizing renewable energy sources and for specific industrial processes that are difficult to decarbonize, its role in Australia's energy landscape is expected to diminish. This shift is driven by ongoing advancements and broader adoption of renewable technologies. For instance, in 2023, renewable sources accounted for a significant portion of Australia's electricity generation, a trend anticipated to continue.

The threat of substitutes for natural gas is growing, particularly from advancements in energy storage and green hydrogen. These alternatives offer potential solutions for grid stability and industrial applications, directly challenging natural gas's current market position. By 2024, investments in battery storage capacity in Australia have seen substantial increases, aiming to mitigate renewable intermittency.

- Advancing Renewable Technologies: Continued innovation in solar and wind power efficiency reduces reliance on gas for peak demand.

- Energy Storage Solutions: Developments in battery technology and other storage methods provide viable alternatives for grid stability.

- Green Hydrogen Potential: Emerging green hydrogen production offers a decarbonized substitute for industrial uses and potentially for firming capacity.

- Policy and Investment Shifts: Government policies and increasing private investment are favoring renewable energy and storage over natural gas.

Threat of Substitution 5

APA Group actively combats the threat of substitutes by broadening its energy offerings. In 2024, the company continued its substantial investments in renewable energy infrastructure, including solar and wind farms, alongside crucial battery storage projects. This strategic diversification into electricity transmission and renewables positions APA to capitalize on the evolving energy landscape, reducing reliance on traditional natural gas pipelines as a sole energy delivery mechanism.

This proactive approach is supported by significant financial commitments. For instance, APA Group has earmarked billions for renewable energy projects, aiming to increase its renewable generation capacity. This investment strategy directly addresses the potential for alternative energy sources to displace natural gas, ensuring APA remains competitive and relevant in a decarbonizing economy.

Key actions APA Group is taking include:

- Diversifying its energy portfolio beyond natural gas.

- Investing heavily in renewable energy assets like solar and wind farms.

- Expanding into battery storage solutions and electricity transmission.

- Positioning itself to benefit from the global energy transition.

The threat of substitutes for APA Group is significant, driven by the rapid advancement and adoption of renewable energy sources and energy storage technologies. These alternatives directly challenge the demand for traditional natural gas infrastructure.

The increasing viability of solar, wind, and battery storage, coupled with government policies promoting decarbonization, intensifies this threat. For example, Australia's National Energy Guarantee, while evolving, aims to integrate more renewables, indirectly impacting gas demand.

By 2024, investments in renewable energy and storage capacity in Australia have reached multi-billion dollar figures, signaling a clear market shift away from fossil fuels, including natural gas.

APA Group is actively mitigating this threat by diversifying into renewables and electricity transmission. In 2024, the company continued to invest in projects like the construction of wind farms and battery storage facilities, aiming to secure its future in a changing energy landscape.

| Energy Source | 2023 Australian Generation Share (Approx.) | Growth Trend | Substitute Threat Level |

|---|---|---|---|

| Solar | ~15% | High | High |

| Wind | ~12% | High | High |

| Battery Storage | Emerging | Very High | Medium to High |

| Natural Gas | ~20% | Stable to Declining | Medium |

Entrants Threaten

The threat of new entrants in the energy infrastructure sector, especially for large-scale natural gas pipelines, is significantly low due to exceptionally high capital requirements. Building new pipeline networks demands billions of dollars in upfront investment, a substantial hurdle that deters most potential new players.

For instance, the construction of a major natural gas pipeline can easily cost upwards of $1 billion, with some projects exceeding $5 billion. This immense financial commitment, coupled with the lengthy and complex regulatory approval processes, creates a formidable barrier to entry, effectively limiting the number of companies that can realistically compete.

New entrants in the energy sector face formidable barriers due to the intricate and lengthy regulatory approval processes. These often include rigorous environmental impact assessments, complex land access negotiations, and multiple approvals from various energy market regulators. For instance, in 2024, a new renewable energy project might spend upwards of two to three years navigating these stages, with associated costs easily reaching millions of dollars before even breaking ground.

Established players like APA Group benefit from significant economies of scale, an existing operational footprint across Australia, and deep-seated customer relationships. These advantages are difficult for new entrants to replicate, requiring substantial time and investment to achieve similar efficiencies and market penetration.

The capital-intensive nature of pipeline infrastructure, with projects often costing billions of dollars, acts as a substantial barrier. For instance, major gas transmission projects can easily exceed AUD 1 billion, making it a significant hurdle for new companies to enter the market.

Regulatory hurdles and the need for extensive approvals further deter new entrants. Navigating the complex web of state and federal regulations, environmental impact assessments, and land access agreements demands considerable expertise and resources, which new players may lack.

APA Group's market position, evidenced by its ownership of approximately AUD 26 billion in energy infrastructure assets as of 2024, demonstrates the scale of incumbent advantage. This extensive network and established operational capacity create a formidable barrier to entry for any aspiring competitor.

Threat of New Entrants 4

The threat of new entrants in the energy infrastructure sector is significantly dampened by the immense capital requirements and long development cycles. For instance, major energy infrastructure projects, like new pipelines or large-scale storage facilities, often have development and construction periods stretching over many years. This protracted timeline, coupled with inherent regulatory hurdles and substantial financial risks, naturally discourages new players who might be seeking more rapid returns on their investments.

The sheer scale of investment needed for new energy infrastructure is a major barrier. A new, 1,000-mile natural gas pipeline, for example, could easily cost billions of dollars in upfront capital. This financial commitment, combined with the extended payback periods, makes it difficult for smaller or less capitalized entities to enter the market and compete effectively with established players who have already amortized their initial investments.

Furthermore, the regulatory landscape presents a formidable challenge. Obtaining permits and approvals for energy infrastructure projects can be a complex and lengthy process, often involving multiple government agencies at federal, state, and local levels. For example, the permitting process for a new offshore wind farm can take upwards of five to ten years from initial concept to final approval, adding significant time and uncertainty to any new venture.

- High Capital Investment: Projects like LNG export terminals can cost $10 billion or more, creating a massive barrier to entry.

- Long Development Cycles: Energy infrastructure projects often take 5-10 years from planning to operation, deterring investors seeking quick profits.

- Regulatory Complexity: Navigating environmental reviews, land use permits, and safety regulations requires specialized expertise and significant time.

- Established Incumbents: Existing energy companies often possess significant operational experience, existing infrastructure networks, and strong relationships with suppliers and customers, making it hard for newcomers to compete.

Threat of New Entrants 5

The threat of new entrants for APA Group's core natural gas pipeline business is exceptionally low. Building a comparable national pipeline network requires massive capital investment, estimated in the billions of dollars, making it financially prohibitive for most new players. For instance, the construction costs for major energy infrastructure projects in Australia regularly exceed AUD $1 billion, a significant hurdle.

Regulatory approvals and environmental impact assessments are also lengthy and complex processes, often taking several years to navigate. APA Group benefits from established relationships with regulators and a deep understanding of the compliance landscape, which new entrants would need to replicate. Furthermore, securing land access rights and managing community relations for extensive pipeline corridors presents substantial operational challenges.

- High Capital Requirements: The sheer scale of investment needed to replicate APA's national pipeline infrastructure presents a significant barrier, often running into billions of dollars for new projects.

- Regulatory Hurdles: Navigating complex and time-consuming regulatory approvals and environmental assessments is a substantial deterrent for potential new entrants.

- Established Infrastructure: APA's existing, extensive network provides a significant competitive advantage in terms of reach, operational efficiency, and economies of scale.

- Limited Niche Opportunities: While smaller, localized renewable energy projects or distributed grid solutions might see new entrants, these do not directly threaten APA's core, large-scale natural gas transmission business.

The threat of new entrants in the energy infrastructure sector, particularly for large-scale natural gas pipelines, remains very low. This is primarily due to the immense capital required, with projects often costing billions of dollars. For example, a new major gas transmission line in Australia could easily surpass AUD 1 billion in construction costs.

Furthermore, the regulatory landscape presents significant challenges. Navigating complex environmental impact assessments, land access negotiations, and multiple approvals from various energy market regulators can take years. In 2024, new renewable projects often spent two to three years in these stages, incurring millions in costs before construction even begins.

Established players like APA Group benefit from substantial economies of scale, an existing infrastructure footprint, and deep customer relationships. As of 2024, APA Group managed approximately AUD 26 billion in energy infrastructure assets, a scale that is incredibly difficult and time-consuming for new entrants to replicate.

| Barrier Type | Description | Example Data (2024) | Impact on New Entrants |

| Capital Investment | Extremely high upfront costs for infrastructure development. | Major gas pipeline projects: AUD 1 billion+ | Prohibitive for most potential competitors. |

| Regulatory Approvals | Lengthy and complex processes involving multiple agencies. | Renewable project permitting: 2-3 years | Significant time and resource drain. |

| Economies of Scale | Incumbents leverage existing networks and operational efficiencies. | APA Group asset value: AUD 26 billion | Difficult for new entrants to match cost-effectiveness. |

| Development Cycles | Long lead times from planning to operation. | Offshore wind farm permitting: 5-10 years | Deters investors seeking rapid returns. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, industry-specific market research from firms like Gartner and Forrester, and government economic indicators. This ensures a comprehensive understanding of the competitive landscape.