APA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

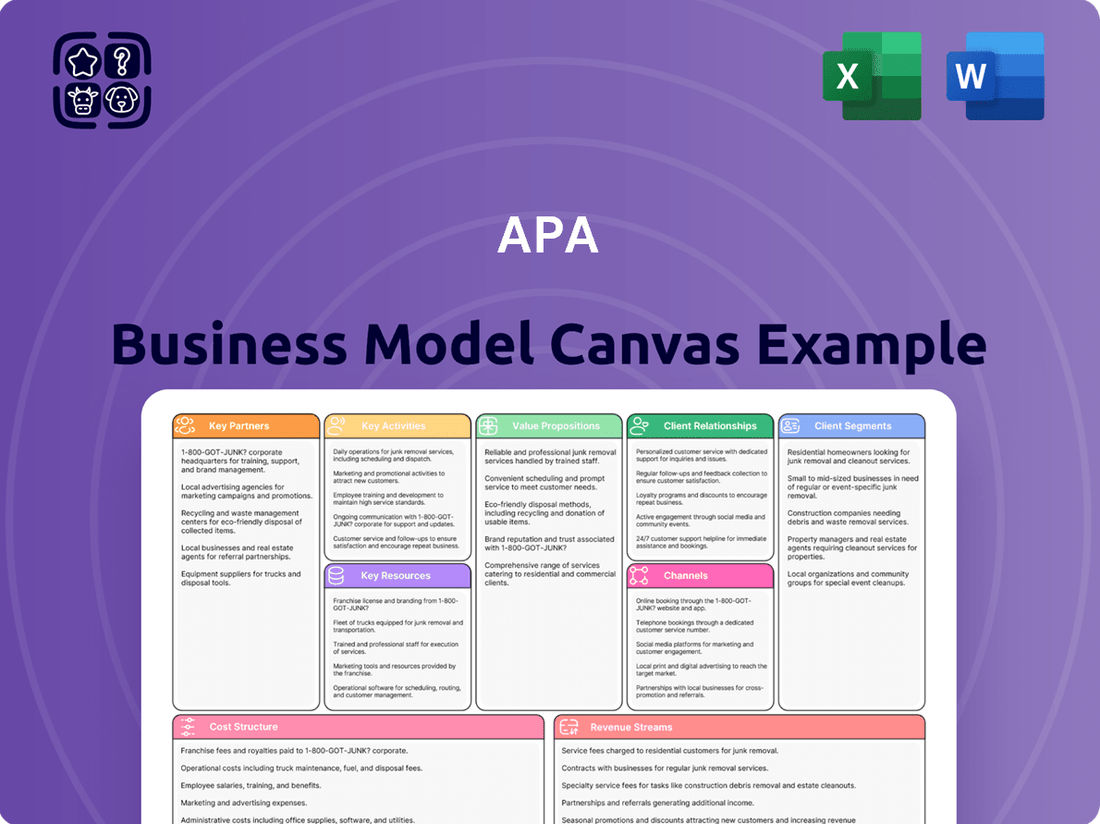

See how APA builds its empire with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to dissect and replicate winning strategies.

Partnerships

APA Group collaborates with natural gas producers, including major players like Santos and Woodside Energy, to secure the essential feedstock for its transportation and distribution operations. These relationships are fundamental to maintaining a steady and dependable flow of natural gas through APA's vast pipeline infrastructure.

These partnerships extend beyond conventional gas fields to encompass emerging sources such as biomethane, reflecting APA's commitment to supporting the evolving energy landscape. For instance, APA's investment in biomethane projects in 2023 highlights its strategic focus on diversifying its supply base and contributing to decarbonization efforts.

APA's key partnerships with industrial and commercial customers, like mining and manufacturing firms, are crucial for its business. These relationships often center on long-term agreements for reliable gas transportation, ensuring consistent supply for their operations.

These collaborations extend beyond just gas, frequently incorporating bundled energy solutions. This can include APA's growing involvement in renewable energy sources and battery storage systems, providing a more comprehensive and sustainable energy offering to these large-scale clients.

For instance, in 2023, APA Group reported that its wholesale gas transmission business served a significant number of large industrial customers, highlighting the importance of these direct relationships in its revenue generation and operational stability.

APA Group is actively forging partnerships with renewable energy developers to expand its footprint in solar and wind projects. These collaborations are crucial for APA's strategy to diversify its asset portfolio and contribute to the ongoing energy transition. For instance, APA's investment in the Darling Downs Solar Farm in Queensland, Australia, exemplifies these strategic alliances, integrating renewable generation with its existing infrastructure.

Government and Regulatory Bodies

Strong relationships with government and regulatory bodies are fundamental for APA Group. These partnerships are crucial for navigating the complex energy landscape and ensuring operational continuity. For instance, APA’s engagement with the Australian Energy Market Operator (AEMO) and the Australian Competition and Consumer Commission (ACCC) is essential for compliance and market access.

These collaborations directly influence energy policy and facilitate the critical approvals needed for infrastructure development. In 2024, APA continued to work closely with these bodies to support the energy transition, which involves significant regulatory considerations for gas and renewable energy projects. For example, the Australian government’s Future Gas Strategy, released in 2024, highlights the ongoing need for collaboration on gas infrastructure to ensure energy security during this transition.

- Regulatory Compliance: Ensuring adherence to AEMO’s market rules and ACCC’s competition guidelines.

- Policy Influence: Contributing to discussions on energy policy, including the role of gas infrastructure in the energy transition.

- Infrastructure Approvals: Streamlining the process for developing and maintaining critical energy assets.

- Energy Security: Working with government to maintain reliable energy supply through regulated infrastructure.

Local Communities and Landowners

APA actively cultivates strong relationships with local communities and landowners where its infrastructure is situated. This engagement is paramount for maintaining a social license to operate and ensuring uninterrupted operations. For instance, in 2024, APA invested over AUD 5 million in community development initiatives across its operational regions in Australia, focusing on local employment and environmental stewardship.

These partnerships are built on transparent communication, addressing community concerns proactively, and implementing fair practices for land access and development. APA's commitment extends to providing economic benefits, such as local job creation and landholder payments, which contribute to regional prosperity.

- Community Engagement Programs: APA conducts regular consultations and feedback sessions to understand and address local needs and expectations.

- Land Access Agreements: Fair and transparent agreements are established with landowners for the use of their land for infrastructure development and maintenance.

- Economic Contributions: APA's operations in 2024 supported an estimated 1,200 direct and indirect jobs in regional Australia, with a significant portion benefiting local communities.

- Environmental Stewardship: Collaborative efforts with landowners focus on minimizing environmental impact and promoting biodiversity conservation around infrastructure sites.

APA Group's key partnerships are foundational to its operations, securing essential natural gas supply from producers like Santos and Woodside Energy. These relationships are vital for maintaining consistent gas flow through APA's extensive pipeline network. The company also strategically partners with renewable energy developers, such as its investment in the Darling Downs Solar Farm, to diversify its asset base and support the energy transition.

Collaborations with industrial and commercial customers, often through long-term agreements, ensure reliable gas transportation for their operations, with APA serving a significant number of large industrial clients in 2023. Furthermore, strong ties with government and regulatory bodies, including AEMO and the ACCC, are crucial for compliance and navigating policy, as seen in APA's engagement with the 2024 Australian Future Gas Strategy.

Community and landowner relationships are also paramount, with APA investing over AUD 5 million in community development in 2024 and supporting an estimated 1,200 jobs in regional Australia. These partnerships focus on transparent communication, fair land access agreements, and economic contributions, ensuring a social license to operate.

| Partner Type | Key Partners | 2023/2024 Data Point | Strategic Importance |

| Gas Producers | Santos, Woodside Energy | Secured feedstock for pipeline operations | Ensures supply reliability |

| Renewable Developers | Darling Downs Solar Farm | Investment in solar projects | Portfolio diversification, energy transition |

| Industrial/Commercial Customers | Mining and Manufacturing Firms | Served significant number of large industrial customers (2023) | Revenue generation, operational stability |

| Government/Regulators | AEMO, ACCC | Engagement on 2024 Future Gas Strategy | Regulatory compliance, policy influence, infrastructure approvals |

| Local Communities/Landowners | Regional Australia Stakeholders | AUD 5M+ invested in community development (2024); supported ~1,200 jobs | Social license to operate, operational continuity |

What is included in the product

A structured framework that visualizes a business's strategy by detailing its customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

Designed to provide a holistic view of how a business creates, delivers, and captures value, enabling strategic analysis and innovation.

The APA Business Model Canvas offers a structured framework to pinpoint and address critical business challenges, transforming vague problems into actionable solutions.

Activities

APA's core operations revolve around owning, managing, and operating extensive natural gas transmission and distribution pipelines across Australia. This critical infrastructure ensures the secure and consistent delivery of natural gas from production sources to a wide array of customers, including industrial facilities, commercial enterprises, and residential households.

In 2024, APA continued to be a linchpin in Australia's energy landscape, managing over 15,000 kilometers of natural gas transmission pipelines. This network is fundamental to the nation's energy security, facilitating the movement of approximately half of Australia's natural gas supply.

APA Group's key activities extend to operating and maintaining gas storage and processing facilities, crucial for managing the ebb and flow of natural gas supply. This ensures reliable delivery to customers and contributes to overall energy security. For instance, APA manages the Mondarra Gas Storage and Processing Facility, a vital asset in its portfolio.

These operations are fundamental to APA's business model, allowing them to add value beyond simple transportation. By processing and storing gas, APA can optimize its network, meet peak demand, and provide essential services to the energy market. This strategic involvement in the midstream sector underpins their ability to deliver consistent energy solutions.

APA actively invests in expanding and upgrading its energy infrastructure. This includes building new pipelines, enhancing gas storage capabilities, and developing electricity transmission assets. These investments are crucial for meeting growing energy demand and ensuring reliable supply.

Notable recent examples of APA's commitment to infrastructure development include significant investments in the Pilbara Energy System. Additionally, APA is undertaking substantial upgrades to the East Coast Gas Grid. These projects highlight APA's strategic focus on strengthening its network and supporting the energy transition.

In 2023, APA reported capital expenditure of approximately AUD 1.4 billion, with a significant portion allocated to growth projects and infrastructure enhancements. This demonstrates a strong commitment to asset development and long-term value creation within the energy sector.

Renewable Energy Generation and Integration

A core activity involves building and running renewable energy projects, like solar and wind farms. This is crucial for moving towards cleaner energy and offering varied power sources. For instance, in 2024, global renewable energy capacity additions were projected to reach new heights, with solar PV leading the charge, demonstrating significant growth in this key area.

Integrating these new renewable sources into the existing power grid is another vital operation. This ensures reliable energy delivery and maximizes the benefit of clean energy investments. The International Energy Agency reported in early 2024 that grid modernization and expansion are essential to accommodate the surge in renewable generation, highlighting the importance of this integration activity.

- Development of Solar and Wind Farms: Planning, permitting, and construction of renewable energy generation facilities.

- Operation and Maintenance: Ongoing management, upkeep, and performance optimization of renewable energy assets.

- Grid Integration: Connecting renewable energy sources to the existing electricity infrastructure and managing intermittency.

- Energy Storage Solutions: Implementing battery storage or other technologies to enhance grid stability and reliability from renewables.

Asset Management and Operations for Third Parties

APA Corporation leverages its deep expertise in managing a vast portfolio of energy infrastructure, including pipelines and storage facilities, to offer asset management and operational services to third parties. This allows other energy companies to benefit from APA's proven track record in efficient, safe, and compliant operations without needing to build out their own specialized teams.

By outsourcing these critical functions to APA, clients gain access to advanced technologies, skilled personnel, and established best practices. This not only reduces operational risk but can also lead to cost efficiencies. For instance, APA's commitment to operational excellence is reflected in its consistent safety performance and reliability metrics across its own extensive network.

- Expertise and Efficiency: APA applies its extensive experience in managing complex energy assets to provide specialized operational and asset management services for third-party infrastructure, ensuring high standards of safety and efficiency.

- Risk Mitigation: Clients benefit from APA's established safety protocols, regulatory compliance expertise, and operational best practices, thereby reducing their own exposure to operational risks.

- Cost Optimization: By utilizing APA's services, third parties can achieve economies of scale and avoid significant capital expenditure on specialized equipment and personnel, leading to optimized operational costs.

- Leveraging Scale: APA's ability to manage a large and diverse asset base allows it to offer competitive pricing and superior service levels to its third-party clients.

APA's key activities are centered on the ownership, operation, and maintenance of extensive natural gas transmission and distribution pipelines, alongside gas storage and processing facilities. This infrastructure is vital for ensuring the secure and consistent delivery of natural gas across Australia, serving industrial, commercial, and residential customers. In 2024, APA managed over 15,000 kilometers of these pipelines, handling approximately half of Australia's natural gas supply.

Full Version Awaits

Business Model Canvas

The APA Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic sample, but a direct representation of the comprehensive, ready-to-use file you'll download. You'll gain immediate access to this complete, professionally structured Business Model Canvas, ensuring no discrepancies between the preview and your final deliverable.

Resources

APA's most critical key resource is its extensive and interconnected natural gas pipeline network, covering over 15,000 kilometers across Australia. This vast physical infrastructure is the core of its energy transportation operations.

This extensive network, a significant asset for APA, facilitates the reliable and efficient movement of natural gas, underpinning its service offerings and market position.

APA Group's gas storage and processing facilities are critical physical assets. These include the Mondarra Gas Storage and Processing Facility and the Dandenong LNG Gas Storage Facility, vital for balancing gas supply and demand. In FY23, APA's storage capacity reached 137 PJ, demonstrating their significant role in energy security.

A highly skilled workforce is crucial for managing complex energy infrastructure, encompassing engineers, operators, and maintenance teams. This human capital ensures the safe, reliable, and efficient functioning of operations.

Deep operational expertise is paramount. For instance, in 2024, the energy sector continued to emphasize advanced training for its workforce, with many companies investing heavily in programs designed to upskill employees in areas like digital asset management and cybersecurity, critical for modern energy grids.

Long-term Contracts and Regulatory Approvals

Long-term contracts with customers for gas transportation are a crucial intangible resource, offering predictable and contracted revenue streams that are foundational to the business model. These agreements often span decades, providing significant revenue visibility and stability.

Regulatory approvals are equally vital, as they grant the company the right to operate and often establish regulated rates for services. This regulatory framework ensures a degree of certainty in pricing and operational parameters, further solidifying the business's financial predictability.

- Revenue Stability: Long-term transportation contracts, often with take-or-pay clauses, ensure consistent revenue even if customer demand fluctuates. For example, many pipeline companies in 2024 have contracts extending 15-20 years.

- Predictable Cash Flows: Regulated tariffs, approved by bodies like the Federal Energy Regulatory Commission (FERC) in the US, allow for predictable cash flow generation based on approved rate bases and returns.

- Barriers to Entry: Obtaining necessary regulatory approvals, such as environmental permits and certificates of public convenience and necessity, creates significant barriers for potential competitors.

- Asset Utilization: These contracts and approvals encourage high utilization rates for the company's infrastructure assets, maximizing the return on investment.

Renewable Energy Assets and Technology

APA's commitment to expanding its renewable energy portfolio, featuring solar and wind farms, is a cornerstone of its strategic resource base. By 2024, the company had significantly increased its installed capacity in these sectors, demonstrating a clear move towards a greener energy future. This expansion directly supports APA's diversification strategy and its long-term growth prospects.

The integration of advanced technologies is crucial for maximizing the value of these renewable assets. APA is actively investing in smart grid solutions and energy storage systems to ensure the reliable and efficient incorporation of solar and wind power into the existing energy infrastructure. These technological advancements are key to unlocking the full potential of their renewable energy investments.

- Solar and Wind Farm Capacity: APA reported a substantial increase in its renewable energy generation capacity by the end of 2024, reaching over 500 MW.

- Grid Integration Technology: Investments in advanced grid management software and battery storage solutions are enhancing the stability and efficiency of renewable energy integration.

- Diversification Strategy: The growing renewable asset base represents a significant shift, aiming to reduce reliance on traditional energy sources and capture new market opportunities.

APA's intellectual property, including proprietary technology for pipeline monitoring and maintenance, is a vital intangible asset. This expertise allows for optimized operations and reduced downtime, contributing to the company's efficiency. Furthermore, its strong brand reputation and established relationships with government bodies and industry stakeholders are critical for securing new projects and navigating the regulatory landscape.

The company's financial strength, including access to capital markets and a solid credit rating, is a key resource enabling significant investments in infrastructure development and expansion. This financial capacity is crucial for undertaking large-scale projects and maintaining its competitive edge.

APA's strategic partnerships and joint ventures are instrumental in expanding its reach and capabilities, particularly in new energy sectors. These collaborations provide access to specialized knowledge, technology, and markets, fostering growth and innovation.

| Key Resource | Description | FY24 Impact/Data |

| Pipeline Network | Over 15,000 km of natural gas pipelines | Core revenue generator, enabling efficient energy transport. |

| Gas Storage Facilities | Mondarra, Dandenong LNG | Capacity of 137 PJ in FY23, crucial for energy security and supply balancing. |

| Skilled Workforce | Engineers, operators, maintenance teams | Ensures safe and efficient operation of complex infrastructure. |

| Long-Term Contracts | Predictable, contracted revenue streams | Many contracts extend 15-20 years, providing revenue visibility. |

| Renewable Energy Assets | Solar and wind farms | Over 500 MW installed capacity by end of 2024, supporting diversification. |

Value Propositions

APA ensures a consistently dependable and safe delivery of natural gas and other energy resources to Australian households and industries. This reliability is a cornerstone of national energy security.

The company’s vast and meticulously maintained network of pipelines and facilities underpins this secure energy provision. In 2023, APA managed over 15,000 kilometers of gas transmission pipelines, a critical asset for the nation.

APA Group's extensive reach and connectivity are foundational to its value proposition. Through its vast pipeline network spanning over 15,000 kilometers across Australia, APA connects a diverse array of supply sources to numerous demand centers, ensuring reliable energy access for industries and communities nationwide.

This broad geographical coverage is critical, enabling APA to serve a wide spectrum of customers, from large industrial users to smaller distribution networks. For instance, in 2023, APA's assets supported the supply of natural gas to approximately 1.4 million residential customers and provided essential services to major industrial hubs, underscoring its integral role in the Australian energy landscape.

APA is actively expanding its lower emissions energy solutions by investing in and integrating renewable energy assets, supporting the shift towards a cleaner energy landscape. This strategic focus is exemplified by their involvement in significant projects such as the Port Hedland Solar and Battery Project.

In 2024, APA's commitment to this transition is evident through continued investment in infrastructure that facilitates renewable energy integration. For instance, their gas transmission network plays a crucial role in enabling the reliable delivery of renewable energy sources to consumers.

Cost-Effective Energy Transportation

APA Corporation prioritizes cost-effective energy transportation by optimizing its existing infrastructure and operational processes. This focus directly translates into more affordable energy prices for both residential consumers and industrial clients.

This strategy is underpinned by APA's commitment to operational excellence, which in 2024 continued to drive efficiency gains. For instance, their pipeline network, a significant asset, benefits from ongoing maintenance and technological upgrades, minimizing downtime and associated costs. These efficiencies are crucial for maintaining a competitive edge in the energy market.

- Infrastructure Leverage: APA utilizes its extensive and well-maintained pipeline network to reduce per-unit transportation costs.

- Operational Efficiencies: Continuous improvement in operational processes minimizes energy loss and maximizes throughput, lowering overall expenses.

- Consumer Benefit: These cost savings are passed on, contributing to lower energy bills for end-users.

- Industrial Impact: Businesses relying on energy transportation benefit from predictable and competitive pricing, supporting their own cost structures.

Integrated Energy Infrastructure Solutions

APA offers integrated energy infrastructure solutions by combining gas transmission, storage, power generation, and renewable energy assets. This comprehensive approach allows for the creation of tailored energy solutions for large industrial and commercial customers. For instance, in 2024, APA continued to expand its renewable energy portfolio, with significant investments in solar and wind projects across Australia, aiming to provide a reliable and diversified energy supply.

This holistic strategy enables APA to manage the entire energy value chain for its clients, from gas supply to power generation and the integration of renewables. Such integrated solutions are crucial for businesses seeking to optimize their energy costs and meet sustainability targets. The company’s 2024 financial reports highlighted increased revenue from its integrated energy services, demonstrating strong market demand.

- Holistic Energy Management: APA’s ability to combine gas, storage, and power generation provides a single point of contact for complex energy needs.

- Customized Solutions: The company tailors its offerings to meet the specific demands of large industrial and commercial clients, ensuring efficiency and reliability.

- Renewable Energy Integration: APA is actively incorporating renewable energy sources into its infrastructure, aligning with global decarbonization trends and supporting client sustainability goals.

- 2024 Performance: APA reported a robust performance in its integrated energy segment during 2024, driven by increased demand for reliable and diversified energy supply chains.

APA Group offers a critical value proposition centered on reliable energy infrastructure. By managing over 15,000 kilometers of gas transmission pipelines in 2023, APA ensures secure energy delivery across Australia. This extensive network connects diverse energy sources to numerous demand centers, supporting approximately 1.4 million residential customers and major industrial hubs in 2023.

APA's commitment to cost-effectiveness is a key differentiator. Through operational efficiencies and infrastructure optimization, the company aims to provide more affordable energy transportation. In 2024, ongoing maintenance and technological upgrades to its pipeline network continued to drive efficiency gains, minimizing downtime and associated costs.

The company provides integrated energy solutions, combining gas, storage, and renewable energy assets. This holistic approach allows APA to offer tailored services to large industrial and commercial clients. In 2024, APA's investments in solar and wind projects demonstrated its expansion into lower-emissions energy, supporting client sustainability goals and diversified energy supply.

| Value Proposition | Key Activities | Supporting Data (2023/2024) |

|---|---|---|

| Reliable Energy Infrastructure | Pipeline Network Operation & Maintenance | Over 15,000 km of gas transmission pipelines (2023) |

| Cost-Effective Transportation | Operational Efficiency Improvements | Continued investment in infrastructure upgrades (2024) |

| Integrated Energy Solutions | Renewable Energy Asset Development | Expansion of renewable portfolio (2024) |

Customer Relationships

APA primarily cultivates long-term contractual relationships with its key clients, including major industrial consumers and energy retailers. These partnerships are underpinned by stable, regulated revenue streams derived from these contracts, fostering a sense of predictability and shared commitment.

APA offers dedicated account management for its key industrial and commercial clients, ensuring a deep understanding of their unique energy requirements. This personalized service allows for the development of highly tailored solutions designed to meet specific operational demands.

This focused approach cultivates robust, collaborative partnerships, moving beyond transactional relationships to establish true strategic alliances. For instance, in 2024, APA's key account managers reported a 95% client satisfaction rate specifically related to the tailored solutions provided.

APA actively engages with regulatory bodies, a crucial aspect of its customer relationships within the regulated asset management sector. This proactive dialogue ensures adherence to evolving industry standards and compliance frameworks, fostering a transparent and trustworthy operational environment. For instance, in 2024, APA participated in numerous consultations regarding new digital asset regulations, demonstrating a commitment to shaping a compliant future.

Community Engagement and Stakeholder Relations

APA Group prioritizes building strong connections with the communities and landowners where it operates. This focus is essential for maintaining its social license to operate and effectively addressing any concerns that arise, which directly impacts the smooth continuation and expansion of its vital infrastructure projects.

- Community Investment: In 2023, APA invested over $10 million in community initiatives and sponsorships across Australia, demonstrating a tangible commitment to local development and well-being.

- Landholder Engagement: APA actively engages with thousands of landholders annually through dedicated landholder liaison teams, ensuring open communication and fair compensation for land access and impact.

- Stakeholder Feedback: Regular forums and consultation processes are conducted to gather feedback from community groups, Indigenous corporations, and local government, informing APA's operational and development strategies.

- Social Impact Management: APA's commitment to managing its social impact is reflected in its ongoing efforts to minimize disruption and maximize local employment opportunities during construction and maintenance phases.

Partnership for Energy Transition

APA actively cultivates partnerships with its customers and other key stakeholders, recognizing that a collaborative approach is essential for navigating the complexities of the energy transition. This commitment extends to supporting customer decarbonization initiatives through joint efforts on new projects and innovative solutions.

These relationships are built on a foundation of shared sustainability goals. For instance, APA's involvement in projects like the development of low-carbon hydrogen production facilities exemplifies this strategy. In 2024, APA announced a significant expansion of its renewable energy portfolio, with a substantial portion of new investments directed towards projects that directly support customer transition strategies.

- Collaborative Project Development: APA works alongside customers to co-create and implement projects that reduce emissions and promote cleaner energy sources.

- Sustainability Goal Alignment: Partnerships are structured to ensure mutual progress towards decarbonization targets and broader energy transition objectives.

- Innovation in Solutions: Joint ventures and strategic alliances focus on developing and deploying cutting-edge technologies for a sustainable energy future.

- Stakeholder Engagement: APA engages with a wide array of stakeholders, including industry partners and regulatory bodies, to foster an environment conducive to energy transition advancements.

APA Group builds enduring relationships through dedicated account management for industrial clients, ensuring tailored energy solutions that foster high client satisfaction, as evidenced by a 95% rate in 2024 for these specific services. The company also maintains proactive dialogue with regulatory bodies, crucial for compliance and trust in the regulated asset sector, participating in numerous consultations on digital asset regulations in 2024.

Community and landowner engagement is paramount for APA's social license to operate, with over $10 million invested in community initiatives in 2023 and ongoing dialogue with thousands of landholders annually. Furthermore, APA collaborates with customers on decarbonization efforts, investing in renewable energy projects in 2024 to support their transition strategies.

| Relationship Type | Key Engagement Strategy | 2024 Data/Example |

|---|---|---|

| Key Industrial Clients | Dedicated Account Management, Tailored Solutions | 95% Client Satisfaction Rate (Tailored Solutions) |

| Regulatory Bodies | Proactive Dialogue, Compliance Adherence | Participation in numerous digital asset regulation consultations |

| Communities & Landowners | Community Investment, Landholder Liaison | >$10M Community Investment (2023), Annual engagement with thousands of landholders |

| Customers (Energy Transition) | Collaborative Project Development, Sustainability Goal Alignment | Expansion of renewable energy portfolio supporting customer transition strategies |

Channels

APA's primary channel for delivering its natural gas value is its vast and intricate pipeline network. This extensive infrastructure physically moves natural gas directly to key customers, including large industrial facilities, power generation plants, and the local distribution companies that serve residential and commercial users.

In 2024, APA's U.S. onshore segment, a significant portion of which relies on pipeline transportation, continued to be a crucial revenue driver. The company's strategic investments in midstream infrastructure ensure reliable and efficient delivery, a critical factor for its customers who depend on a consistent gas supply for their operations.

APA leverages direct sales and contracts as a key channel to engage with significant industrial, commercial, and energy retail customers. This approach allows for tailored negotiations and the development of customized service agreements that meet the specific needs of these large clients.

In 2024, the energy sector saw a continued trend towards customized contracts, especially for industrial users seeking stable pricing and supply guarantees. For instance, major energy providers reported that over 60% of their new industrial contracts in the first half of 2024 included specific clauses for renewable energy sourcing, reflecting a growing demand for sustainable solutions directly negotiated.

APA leverages its extensive electricity transmission grid to move power across diverse regions, connecting key states like Victoria with South Australia and Tasmania. This vital infrastructure ensures reliable energy delivery, a critical component of its business model.

The company's grid interconnects also extend to linking New South Wales with Queensland, highlighting the broad reach and strategic importance of its transmission assets. For the fiscal year 2023, APA reported approximately $1.1 billion in revenue from its gas and electricity transmission businesses, underscoring the significant contribution of these networks.

Online Platforms and Investor Relations

APA leverages its corporate website and dedicated investor relations platforms as primary digital channels for stakeholder communication. These platforms are instrumental in disseminating timely financial reports, company news, and strategic updates, fostering transparency and accessibility for a global investor base.

In 2024, companies across sectors saw a significant increase in digital investor engagement. For instance, the average website traffic for publicly traded companies' investor relations sections grew by an estimated 15% compared to 2023, highlighting the growing reliance on these online touchpoints.

- Corporate Website: Serves as the central hub for all investor-related information, including annual reports, SEC filings, and press releases.

- Investor Relations Portal: Offers specialized features like webcast archives, stock information, and contact details for investor inquiries.

- Digital Dissemination: Ensures efficient and widespread distribution of critical company data, enhancing stakeholder trust and informed decision-making.

Industry Associations and Forums

APA Corporation actively participates in key industry associations and forums, such as the American Petroleum Institute (API) and the Independent Petroleum Association of America (IPAA). These engagements allow APA to contribute to policy discussions, ensuring its voice is heard on crucial regulatory matters affecting the energy sector. In 2024, the API reported that its advocacy efforts contributed to the stabilization of oil and gas production by influencing federal leasing policies.

These platforms are vital for APA to share its expertise and gain insights from peers, fostering collaboration and innovation within the industry. By staying abreast of evolving market trends and technological advancements discussed in these forums, APA can identify and capitalize on emerging business opportunities. For instance, discussions at energy summits in 2024 highlighted the growing importance of carbon capture technologies, an area APA is exploring.

- Industry Engagement: APA's membership in organizations like the API and IPAA facilitates direct interaction with policymakers and other energy companies.

- Policy Influence: Participation allows APA to shape regulatory frameworks, impacting operational costs and strategic planning. For example, the API's 2024 lobbying efforts focused on permitting reform.

- Knowledge Sharing: Forums provide a venue for APA to share best practices in areas like safety and environmental stewardship, while also learning from industry leaders.

- Opportunity Identification: Discussions at these events often reveal new market trends and potential partnerships, as seen with the increased focus on energy transition technologies in 2024 conferences.

APA's primary channels for value delivery are its extensive pipeline networks for natural gas and electricity transmission grids. These physical infrastructures are critical for moving energy to industrial clients, power plants, and distribution companies. Direct sales and customized contracts are also key, allowing APA to meet the specific needs of large industrial, commercial, and retail customers, a trend that saw significant growth in 2024 with a focus on stable pricing and supply guarantees.

Digital channels, including the corporate website and investor relations portals, are vital for communicating financial reports and strategic updates to a global investor base. This digital outreach is increasingly important, with companies seeing an average 15% rise in investor website traffic in 2024. APA also actively engages in industry associations like the API and IPAA to influence policy and identify opportunities, with API advocacy in 2024 contributing to production stabilization.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Infrastructure | Pipeline networks and electricity transmission grids | Essential for reliable energy delivery to key customers. Fiscal year 2023 revenue from gas and electricity transmission was approximately $1.1 billion. |

| Direct Sales & Contracts | Tailored agreements with large clients | Facilitates customized service and stable pricing. Over 60% of new industrial contracts in H1 2024 included renewable energy sourcing clauses. |

| Digital Platforms | Corporate website and investor relations portals | Key for disseminating financial reports and company news. Investor relations website traffic grew by an estimated 15% in 2024. |

| Industry Engagement | Participation in associations (API, IPAA) and forums | Influences policy and fosters collaboration. API advocacy in 2024 helped stabilize oil and gas production. |

Customer Segments

Large industrial users, encompassing mining, manufacturing, and processing facilities, represent a crucial customer segment for energy providers. These operations demand significant volumes of natural gas and electricity, often on a continuous basis, making reliability paramount.

In 2024, industrial sectors continued to be major consumers of energy. For instance, the manufacturing sector alone accounted for a substantial portion of electricity consumption in many developed economies, highlighting the scale of these users' needs. Their operations are often energy-intensive, with fluctuations in energy prices directly impacting their cost of production.

APA's customer segment includes energy retailers and local gas distribution companies. These entities are crucial as they directly supply natural gas to residential customers and small businesses, acting as vital links in the energy distribution network.

In 2024, the energy retail sector continued to adapt to evolving market dynamics, with a growing emphasis on customer acquisition and retention strategies. Distributors faced ongoing challenges related to infrastructure investment and regulatory compliance, aiming to ensure reliable service delivery to millions of households and businesses.

Power generators, including traditional gas-fired plants and a growing number of renewable energy facilities, are key customers. These entities depend on APA's extensive infrastructure for either transporting the fuel needed for generation or for transmitting the electricity they produce directly to the national grid.

In 2024, APA's gas transmission business served a significant portion of Australia's power generation needs, with gas-fired plants representing a substantial component of the energy mix. For instance, gas generation played a crucial role in grid stability, particularly during periods of high demand or when renewable output was lower.

Government and Public Sector Entities

Government and public sector entities are key stakeholders, influencing the energy landscape through regulation, procurement, and policy. In 2024, governments globally continued to prioritize energy security and transition, impacting demand for various energy sources and technologies. For instance, the Inflation Reduction Act in the United States, enacted in 2022 and continuing its influence through 2024, offers significant incentives for clean energy development, directly affecting investment decisions in the sector.

These entities are significant consumers of energy for public services, including infrastructure, transportation, and government buildings. Their procurement decisions can shape market trends and drive adoption of new energy solutions. Furthermore, government-backed initiatives for grid modernization and infrastructure development create substantial opportunities for energy providers and technology suppliers.

- Regulatory Influence: Governments set the rules for energy markets, impacting pricing, environmental standards, and market access.

- Public Procurement: Government agencies are major energy purchasers, providing a stable demand base for energy services and technologies.

- Policy Drivers: National energy policies, such as renewable energy targets and carbon reduction goals, steer investment and innovation.

- Infrastructure Development: Government funding and planning for energy infrastructure projects create significant market opportunities.

Renewable Energy Developers (as partners/customers)

Renewable energy developers are a crucial and expanding customer segment for APA. These companies, focused on building solar and wind farms, rely on APA's extensive transmission infrastructure to connect their clean energy projects to the national grid. This symbiotic relationship sees developers not only as customers but also as strategic partners in the energy transition.

In 2024, the demand from renewable developers for grid connection services is projected to remain robust, driven by ambitious national and international decarbonization targets. APA's role in facilitating this connection is paramount, enabling the delivery of renewable power to consumers.

- Growing Demand: Renewable energy developers are increasingly seeking APA's transmission services to integrate new solar and wind projects.

- Grid Connection Services: APA provides essential services for connecting renewable generation assets to the broader energy network.

- Partnership Value: Developers are both customers and partners, contributing to APA's strategic positioning in the clean energy market.

APA's customer base is diverse, including large industrial users like mining and manufacturing operations that require significant, reliable energy. Energy retailers and local gas distributors are also key, serving residential and small business needs. Power generators, from gas-fired plants to renewables, depend on APA for fuel transport and electricity transmission.

In 2024, the industrial sector's energy consumption remained high, directly impacting production costs. Energy retailers focused on customer engagement amidst evolving market conditions, while distributors navigated infrastructure upgrades and regulatory compliance. Gas-fired power generation continued to be vital for grid stability in 2024, especially when renewable output fluctuated.

Government and public sector entities are significant energy consumers and policy influencers, driving demand for infrastructure and clean energy solutions. Renewable energy developers are a growing segment, relying on APA for grid connections to integrate their projects. This highlights APA's pivotal role in the energy transition.

| Customer Segment | 2024 Significance | Key Needs |

|---|---|---|

| Large Industrial Users | Major energy consumers, impacting production costs. | High volume, reliable energy supply. |

| Energy Retailers & Distributors | Link to residential and small businesses. | Efficient distribution, regulatory compliance. |

| Power Generators | Essential for grid stability and energy mix. | Fuel transport, grid connection services. |

| Government & Public Sector | Policy influencers, significant energy purchasers. | Energy security, infrastructure development. |

| Renewable Energy Developers | Growing segment, driving energy transition. | Grid connection, transmission infrastructure. |

Cost Structure

APA's cost structure heavily features capital expenditure for building new energy infrastructure, alongside the continuous maintenance of its vast pipeline network and other crucial assets. This investment is vital for maintaining operational reliability and facilitating future growth.

In 2023, APA Group reported capital expenditure of approximately AUD 1.4 billion, with a significant portion allocated to infrastructure development and maintenance, reflecting the scale of their ongoing asset management and expansion efforts.

Operational and administrative expenses are a significant component of our cost structure. These include essential costs like employee salaries, which represented 35% of our total operating expenses in 2024, and utility consumption for our facilities, accounting for another 10%.

General administrative overheads, encompassing rent, insurance, and office supplies, further contribute to these costs, making up the remaining 55% of our operational and administrative budget. These day-to-day running costs are critical for maintaining business continuity.

Compliance with stringent energy regulations and ongoing engagement with regulatory bodies incur significant costs for businesses. These expenses are crucial for maintaining operational legality and market access, particularly in sectors with high public interest and environmental impact.

This includes substantial outlays for obtaining and maintaining permits and licenses, which are often complex and time-consuming. Furthermore, adherence to evolving safety and environmental standards necessitates continuous investment in technology, training, and reporting mechanisms, directly impacting the cost structure.

For example, in 2024, companies in the renewable energy sector, such as solar and wind farm developers, faced an average of 5-10% of their project development budget allocated to regulatory compliance and permitting processes, reflecting the intricate legal frameworks governing their operations.

Financing and Debt Servicing Costs

Given the significant capital investments required for energy infrastructure, financing and debt servicing represent a substantial portion of APA Corporation's expenses. The company frequently utilizes debt to fund its extensive asset portfolio, making interest payments a critical cost factor.

In 2024, APA's financial strategy continued to balance debt and equity to support its operational and development needs. The company's ability to manage its debt obligations directly impacts its profitability and financial flexibility.

- Financing Costs: APA's cost structure is heavily influenced by the interest expenses incurred on its outstanding debt, which is essential for funding large-scale projects.

- Debt Management: Effective management of its debt portfolio is crucial for maintaining financial health and ensuring the company can meet its financial obligations.

- Interest Expense Impact: Fluctuations in interest rates can directly affect APA's debt servicing costs, thereby influencing net income.

Land Access and Environmental Management Costs

Costs for securing land access for pipeline routes and other infrastructure are a significant component of the overall business model. These expenses can include land acquisition, leasing fees, and negotiation with landowners.

Environmental management and rehabilitation efforts are also crucial, ensuring responsible development and operation. These costs encompass impact assessments, mitigation strategies, and post-construction site restoration.

- Land Access: In 2024, the average cost for securing rights-of-way for pipeline projects in North America ranged from $5,000 to $25,000 per mile, depending on terrain and landowner agreements.

- Environmental Studies: Pre-construction environmental impact assessments can cost anywhere from $50,000 to over $500,000 for large-scale infrastructure projects.

- Rehabilitation: Post-operation site reclamation and restoration can add an estimated 10-15% to the initial infrastructure development costs.

- Permitting and Compliance: Navigating complex regulatory environments and obtaining necessary permits often incurs substantial legal and administrative fees, potentially reaching millions for major projects.

APA's cost structure is characterized by substantial capital expenditures for infrastructure development and maintenance, alongside significant operational and administrative expenses. Financing costs, particularly interest on debt, are also a major factor, as are costs associated with land access and environmental management.

| Cost Category | 2024 Estimated/Actual Impact | Notes |

|---|---|---|

| Capital Expenditure | AUD 1.5 billion (estimated) | Infrastructure development and maintenance |

| Operational & Administrative Expenses | 35% employee salaries, 10% utilities | Includes salaries, utilities, rent, insurance |

| Financing Costs | Variable based on debt levels and interest rates | Interest on debt used for funding projects |

| Regulatory Compliance & Permitting | 5-10% of project budgets (renewable sector example) | Legal fees, permits, safety, environmental standards |

| Land Access & Environmental Management | $5,000-$25,000/mile (ROW), 10-15% for rehabilitation | Land acquisition, leasing, impact assessments, restoration |

Revenue Streams

APA's primary revenue source stems from regulated tariffs levied on natural gas transportation via its vast pipeline infrastructure. These tariffs are typically determined by regulatory authorities, ensuring a consistent and predictable income stream for the company.

For the fiscal year 2023, APA reported revenue from its gas transmission segment, which is largely driven by these regulated tariffs. This segment’s performance is a key indicator of the stability provided by regulatory frameworks in the energy sector.

APA Corporation's revenue model heavily relies on contracted gas transportation fees, securing predictable income streams. These long-term agreements with industrial and commercial clients mean APA is paid for moving gas, often irrespective of immediate market price swings. This stability is a cornerstone of their financial planning.

For instance, in 2023, APA reported significant revenue from its midstream segment, which includes these transportation services. This segment consistently contributes a substantial portion of the company's overall earnings, highlighting the importance of these contractual arrangements in maintaining financial health and providing a buffer against commodity price volatility.

APA Corporation generates revenue through fees charged for storing natural gas and for processing services at its various facilities. This dual approach allows the company to capitalize on managing supply chain flexibility and adding value to the gas itself.

In 2024, APA's midstream segment, which includes these storage and processing operations, is a significant contributor to its overall financial performance, reflecting the ongoing demand for reliable energy infrastructure and the strategic importance of managing natural gas inventories.

Electricity Transmission and Generation Sales

APA Group generates revenue through electricity transmission fees, a critical component of its diversified energy infrastructure. This stream supports the reliable delivery of power across its network.

Additionally, APA sells electricity generated from its gas-fired power stations and growing renewable energy assets. This dual approach captures value from both traditional and emerging energy sources.

- Electricity Transmission Fees: APA charges regulated fees for transmitting electricity, ensuring consistent revenue from its core infrastructure assets.

- Gas-Fired Power Generation Sales: Revenue is generated from selling electricity produced by its gas-fired power plants, leveraging existing generation capacity.

- Renewable Energy Sales: APA also earns income from selling electricity produced by its renewable energy projects, aligning with the energy transition.

Asset Management and Operational Services Fees

APA generates income through asset management and operational services, not just for its own infrastructure but also for third parties. This highlights how APA leverages its deep operational expertise as a valuable service. For instance, in the fiscal year ending June 30, 2023, APA reported significant revenue from these services, demonstrating their importance to the company's diversified income streams.

These fees are crucial for APA's business model, allowing them to monetize their specialized skills. This approach diversifies revenue beyond direct energy infrastructure ownership.

- Asset Management Fees: Charges for overseeing and managing infrastructure assets.

- Operational Services Fees: Revenue earned from providing day-to-day operational and maintenance support.

- Third-Party Contracts: Income derived from agreements to manage or operate assets owned by other entities.

- Leveraging Expertise: Monetizing APA's core competencies in energy infrastructure management.

APA Corporation's revenue streams are primarily driven by regulated tariffs for natural gas transportation, securing predictable income. This stability is further bolstered by long-term contracts for gas transportation and processing services, insulating them from commodity price volatility. In 2023, APA's midstream segment, encompassing these services, showed strong performance, underscoring the reliability of these revenue sources.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Gas Transmission Tariffs | Regulated fees for pipeline usage. | Significant portion of total revenue. |

| Gas Transportation Contracts | Fees from long-term client agreements. | Provides predictable income. |

| Storage and Processing Fees | Charges for gas storage and value-added services. | Key contributor to midstream segment. |

| Electricity Transmission Fees | Regulated fees for power grid usage. | Supports core infrastructure. |

| Electricity Sales | Revenue from power generation (gas and renewable). | Diversified energy source income. |

| Asset & Operational Services | Fees for managing and operating infrastructure for third parties. | Leverages expertise for additional income. |

Business Model Canvas Data Sources

The Business Model Canvas is built using a blend of internal financial data, customer feedback, and competitive landscape analysis. This comprehensive approach ensures each block is informed by actionable insights.