AntarChile SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AntarChile Bundle

AntarChile's strategic position is a complex interplay of robust infrastructure, diversified holdings, and potential market vulnerabilities. Understanding these internal strengths and external threats is crucial for navigating the competitive landscape.

Want the full story behind AntarChile's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AntarChile's core strength is its deeply diversified investment portfolio, primarily channeled through its significant stake in Empresas Copec S.A. This broad exposure spans critical Chilean industries including energy distribution, encompassing fuels, lubricants, and LPG, alongside substantial interests in forestry, fishing, and mining.

This strategic diversification across multiple sectors acts as a powerful buffer against industry-specific downturns, ensuring a more stable and resilient revenue stream. For instance, Empresas Copec reported consolidated net income attributable to owners of the parent of US$1.4 billion for the fiscal year ending December 31, 2023, showcasing the strength of its diverse operations.

AntarChile's financial strength is a significant advantage. For the full year ending December 31, 2024, Empresas Copec, a key subsidiary, reported a net income of US$1,111.16 million. This represents a notable increase compared to the prior year, underscoring the company's ability to generate substantial profits.

This robust financial performance is largely attributable to enhanced operational results across its core business segments, particularly in forestry and energy. These sectors have shown resilience and growth, contributing positively to the overall financial health of AntarChile.

AntarChile, through its subsidiary Empresas Copec, demonstrates significant leadership across several key industries. Arauco, its forestry division, is a global leader in wood pulp and panel production. In 2023, Arauco reported revenues of approximately US$4.7 billion, underscoring its substantial market presence and ongoing expansion efforts, including the major Sucuriú Project in Brazil aimed at increasing pulp production capacity.

Furthermore, Copec maintains a dominant position in Chile's fuel distribution market. As of early 2024, Copec held over 60% market share for gasoline sales in Chile. Abastible, another AntarChile subsidiary, is actively growing its liquefied petroleum gas (LPG) business, evidenced by its strategic international acquisitions in 2023 and 2024, expanding its reach beyond Chile.

Commitment to Sustainability and ESG

AntarChile, through its subsidiaries like Empresas Copec, demonstrates a robust dedication to sustainability and Environmental, Social, and Governance (ESG) principles. This commitment has been consistently recognized, with the company being included in the Dow Jones Sustainability Index Chile and MILA for five consecutive years up to 2023. Such sustained recognition highlights a deep-seated integration of sustainable practices across its operations.

The company's ESG focus translates into tangible actions and investments. These include significant capital allocation towards renewable energy solutions, aiming to diversify its energy portfolio and reduce its carbon footprint. Furthermore, AntarChile actively engages in critical environmental protection measures, such as advanced fire prevention strategies within its forestry operations, a key sector for Empresas Copec.

AntarChile is also actively exploring and implementing circular economy models. This approach seeks to minimize waste and maximize resource utilization, aligning with global trends towards more sustainable consumption and production patterns. These initiatives are not just about compliance but represent a strategic imperative for long-term value creation and resilience.

- Global Recognition: Inclusion in the Dow Jones Sustainability Index Chile and MILA for five consecutive years (up to 2023).

- Renewable Energy Investments: Significant capital allocation towards developing and integrating renewable energy sources.

- Forestry Sustainability: Implementation of advanced fire prevention and sustainable resource management in forestry operations.

- Circular Economy Initiatives: Active pursuit of models that reduce waste and enhance resource efficiency.

Strategic Investments and Expansion

AntarChile consistently pursues strategic investments aimed at boosting operational efficiency and broadening its market presence. A prime example is Arauco's substantial US$4.6 billion Sucuriú Project, designed to significantly expand cellulose production capacity. This initiative underscores the company's commitment to long-term growth in its core sectors.

Furthermore, Copec Voltex is actively establishing itself as a key player in the burgeoning electric vehicle charging infrastructure market. By investing in this area, AntarChile is positioning itself to capitalize on the global shift towards sustainable transportation solutions.

These forward-looking investments are crucial for AntarChile's strategy to secure future growth and maintain a leadership position across its diverse business portfolio.

- Araucu's Sucuriú Project: US$4.6 billion investment to increase cellulose production.

- Copec Voltex: Significant expansion in electric vehicle charging infrastructure.

- Market Positioning: Investments aimed at future growth and market leadership.

AntarChile's strengths are rooted in its diversified business model, anchored by its substantial stake in Empresas Copec. This diversification provides resilience, as seen in Empresas Copec's reported net income of US$1,111.16 million for the full year ending December 31, 2024, a notable increase from the previous year.

The company's leadership in key sectors is another significant strength. Arauco, its forestry arm, is a global leader in wood pulp and panels, generating approximately US$4.7 billion in revenue in 2023. Copec dominates Chile's fuel distribution with over 60% market share for gasoline sales as of early 2024.

AntarChile's commitment to sustainability, evidenced by its consistent inclusion in the Dow Jones Sustainability Index Chile and MILA up to 2023, is a growing competitive advantage. This focus is supported by strategic investments in renewable energy and circular economy initiatives.

The company's proactive investment strategy, such as Arauco's US$4.6 billion Sucuriú Project to boost pulp production and Copec Voltex's expansion into electric vehicle charging infrastructure, positions it for sustained future growth and market leadership.

| Subsidiary/Segment | Key Metric | Value/Status | Year |

|---|---|---|---|

| Empresas Copec | Consolidated Net Income | US$1.4 billion | FY 2023 |

| Empresas Copec | Net Income | US$1,111.16 million | FY 2024 |

| Arauco | Revenue | ~US$4.7 billion | 2023 |

| Arauco | Sucuriú Project Investment | US$4.6 billion | Ongoing |

| Copec | Chile Gasoline Market Share | >60% | Early 2024 |

| AntarChile | Dow Jones Sustainability Index Inclusion | 5 consecutive years | Up to 2023 |

What is included in the product

Delivers a strategic overview of AntarChile’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical challenges within AntarChile's operations.

Weaknesses

AntarChile's diverse portfolio still faces considerable risk from volatile global commodity prices, especially for key products like pulp and copper. While the company saw robust volumes in its forestry segment during 2024, a downturn in pulp prices, mirroring trends from earlier years, could significantly dent its profitability.

Wildfires present a significant threat to AntarChile's forestry operations, impacting raw material supply and potentially causing substantial financial damage. For instance, in 2023, Chile experienced some of its most devastating wildfires, highlighting the sector's vulnerability to climate-related events.

Furthermore, evolving environmental regulations in crucial markets, coupled with potential shifts in land use policies, introduce considerable uncertainty. These regulatory changes could increase operational costs or restrict access to certain timber resources, directly affecting AntarChile's profitability and strategic planning.

AntarChile's extensive operations, particularly in forestry, face significant risks from climate change. Events like severe droughts, unseasonal heavy rainfall, and increased forest fire frequency, which have impacted operations in past years, can directly disrupt production, damage assets, and negatively affect financial performance.

Challenges in the Fishing Sector

The fishing sector grapples with persistent issues like illegal, unreported, and unregulated (IUU) fishing. This practice not only depletes fish stocks but also undermines the economic viability of legitimate businesses. For instance, the Food and Agriculture Organization of the United Nations (FAO) estimated that IUU fishing accounts for a significant portion of global catches, leading to substantial economic losses for the legal fishing industry.

Furthermore, the industry is subject to considerable regulatory uncertainty. Ongoing debates surrounding fishing quotas and the potential for legal challenges from major fishing corporations in response to new legislative proposals create a volatile operating environment. This legislative flux can impact long-term investment and strategic planning for companies like AntarChile.

- Overexploitation: IUU fishing contributes to the unsustainable depletion of fish populations.

- Economic Instability: Illegal fishing practices create unfair competition and economic hardship for compliant operators.

- Regulatory Uncertainty: Evolving fishing quotas and potential legal disputes introduce significant risk.

- Market Access: Strict regulations and compliance requirements can sometimes limit market access for certain species or regions.

Geopolitical and Economic Instability in Operating Regions

AntarChile's diversification across South America exposes it to the inherent risks of regional economic downturns and political shifts. For instance, the economic performance of countries like Peru, where its subsidiaries have interests, can directly impact AntarChile's consolidated results. In 2023, several South American economies experienced inflationary pressures and slower growth, which could affect consumer spending and investment in sectors where AntarChile operates.

This geopolitical and economic instability can manifest in several ways:

- Fluctuating Demand: Economic slowdowns in operating regions can reduce consumer and business spending, directly impacting sales volumes for AntarChile's diverse portfolio of businesses.

- Increased Operational Costs: Currency devaluations or rising inflation in countries where subsidiaries are based can lead to higher import costs for raw materials and increased labor expenses.

- Regulatory and Political Uncertainty: Changes in government policies, taxation, or regulatory frameworks in any of the countries AntarChile operates within can create unpredictable operating environments and potentially impact profitability.

AntarChile's significant reliance on commodity prices, particularly for pulp and copper, leaves it vulnerable to global market fluctuations. For example, while pulp prices showed some resilience in early 2024, a projected slowdown in global demand for paper products could exert downward pressure, impacting profitability from its forestry segment.

The company's extensive forestry operations are inherently exposed to climate-related risks such as wildfires and droughts. Chile's 2023 wildfire season was particularly severe, causing significant damage to timber resources and underscoring the vulnerability of AntarChile's raw material supply chain.

Furthermore, AntarChile faces regulatory headwinds in its operating regions. Evolving environmental standards and potential changes to land use policies, especially concerning forestry, could increase compliance costs and limit access to vital resources, thereby affecting its long-term strategic planning and financial outlook.

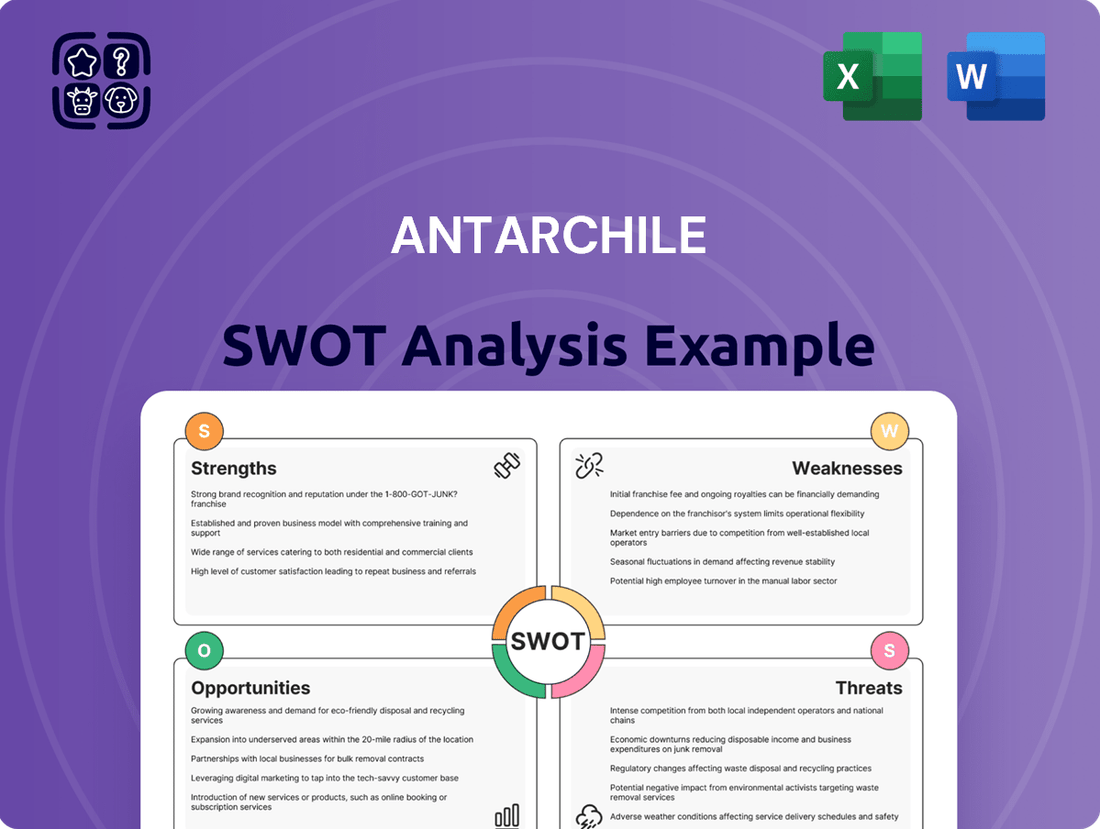

Preview the Actual Deliverable

AntarChile SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase, offering a clear glimpse into its professional structure and content.

This is a real excerpt from the complete AntarChile SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to leverage all insights.

You’re viewing a live preview of the actual AntarChile SWOT analysis file. The complete, detailed version becomes available immediately after checkout.

Opportunities

AntarChile, via Empresas Copec, is strategically positioned to benefit from the accelerating global and Chilean emphasis on renewable energy and electromobility. This sector is experiencing robust investment, with global renewable energy capacity expected to grow significantly in the coming years, driven by climate targets and technological advancements.

Copec Voltex’s expanding network of electric vehicle charging stations across Chile directly taps into the burgeoning electromobility market. This expansion is crucial as Chile aims to increase its electric vehicle fleet, supported by government incentives and a growing consumer interest in sustainable transportation options.

Furthermore, Abastible-Tec's commitment to sustainable energy solutions, including the distribution of LPG and exploration into other cleaner energy sources, aligns with broader market trends. The company's efforts in providing more environmentally friendly energy alternatives present a substantial avenue for continued growth and market leadership.

The global market for sustainable forest products is experiencing robust growth, presenting a significant opportunity for AntarChile's forestry division, Arauco. Chile’s forestry exports, which reached approximately USD 5.8 billion in 2023, are expected to continue this upward trend, driven by international demand for eco-friendly materials.

Arauco's commitment to certifications such as the Forest Stewardship Council (FSC) can further bolster its market position. For instance, FSC-certified products often command premium pricing and are preferred by environmentally conscious consumers and businesses, enhancing competitiveness in key markets like Europe and North America.

Furthermore, the strategic management of Chile's extensive second-growth forests offers a sustainable and reliable source of timber. This not only supports increased export volumes but also aligns with global efforts towards responsible resource utilization, potentially opening new avenues for value-added products.

Chile's mining sector is poised for a significant upswing, with projections indicating substantial investment in copper and lithium production through 2025. For AntarChile, a company with existing mining interests, this recovery presents a prime opportunity to leverage increased output and capitalize on improving market dynamics.

The Chilean government has identified mining as a key driver for economic growth, with planned investments in infrastructure and technology to support this expansion. AntarChile is well-positioned to benefit from these national initiatives, potentially enhancing its operational efficiency and market share.

Expansion into New Geographies and Markets

AntarChile actively pursues international expansion and market diversification as a core growth strategy. This is evident in recent strategic moves, such as Abastible's acquisition of Gasib in Spain and Portugal. This acquisition significantly broadens AntarChile's global reach, establishing it as a notable international competitor in the energy distribution sector.

The company's expansion efforts are designed to leverage its expertise in diverse markets, seeking out new revenue streams and reducing reliance on any single region.

- Abastible's acquisition of Gasib in Spain and Portugal signifies a direct push into new European markets.

- This move aims to position AntarChile as a significant international player in the liquefied petroleum gas (LPG) sector.

- Expansion into new geographies helps diversify revenue sources and mitigate risks associated with operating in a single market.

Technological Advancements and Innovation

AntarChile's embrace of technological advancements presents significant opportunities for growth and efficiency. By investing in and adopting cutting-edge solutions across its varied business units, the company can streamline operations, reduce costs, and foster the creation of innovative products and services.

In the mining sector, for instance, technology is crucial for navigating environmental challenges. Advanced automation and data analytics are helping Chilean mining operations, which are a significant part of the national economy, to improve safety and productivity amidst increasingly complex geological conditions and climate variability. For example, the adoption of autonomous haulage systems has shown potential to increase truck utilization by up to 20% in some mining contexts.

Similarly, in aquaculture, technological innovation is a key driver of expansion. Modern fish farming techniques, including advanced feed management systems and disease monitoring technologies, are enhancing yield and sustainability. Chile's salmon farming industry, a global leader, is increasingly leveraging AI-powered systems for early detection of health issues, aiming to reduce losses and improve overall output. In 2024, investments in precision aquaculture technologies were projected to rise, reflecting this trend.

- Enhanced Operational Efficiency: Implementing AI and automation in mining can boost productivity and reduce operational expenditures.

- Climate Resilience in Mining: Technological solutions are vital for overcoming environmental and climate-related challenges in resource extraction.

- Aquaculture Growth: Advancements in fish farming technology, such as improved health monitoring and feed optimization, are driving expansion in the aquaculture sector.

- New Product Development: Innovation spurred by technology can lead to the creation of novel products and services across AntarChile's diverse portfolio.

AntarChile is well-positioned to capitalize on the global shift towards renewable energy and electromobility, with Copec Voltex expanding its EV charging network across Chile. This aligns with Chile's national goals to increase its electric vehicle fleet, supported by government incentives and growing consumer demand for sustainable transport. The company’s focus on cleaner energy sources, like LPG through Abastible-Tec, further strengthens its market presence in an increasingly eco-conscious market.

Threats

AntarChile operates in sectors highly susceptible to shifts in governmental policy. For instance, in 2024, Chile continued discussions around reforms to its fisheries law, potentially impacting the operational scope and profitability of companies like AntarChile's fishing subsidiaries by favoring smaller-scale operations.

Furthermore, the mining industry, a significant area for AntarChile, faces ongoing scrutiny regarding environmental regulations and royalty structures. Anticipated changes in mining royalty frameworks in 2025 could increase operational costs and necessitate adjustments to investment strategies, directly affecting AntarChile's financial performance in this key sector.

Growing environmental concerns and social opposition, particularly against large-scale industrial activities like forestry, mining, and aquaculture, pose a significant threat to AntarChile. For instance, in 2024, Chile experienced increased public scrutiny over its mining sector's water usage, a concern that could extend to AntarChile's diverse operations.

Protests against fishing quotas and demands for more stringent environmental regulations, as seen in various Latin American coastal communities in late 2024, could directly impact AntarChile's aquaculture and fishing businesses. Such opposition can result in operational disruptions, costly legal battles, and damage to the company's public image, potentially affecting market access and investor confidence.

A looming global economic slowdown presents a significant threat to AntarChile. This downturn could dampen demand for its products, particularly those reliant on international markets. For instance, the forestry sector, a key part of AntarChile's business, often sees reduced demand during global recessions, impacting sales volumes and potentially leading to lower prices.

Ongoing trade tensions, especially between major economic powers like China and the United States, further exacerbate this risk by creating demand uncertainty. These geopolitical frictions can disrupt supply chains and introduce volatility into commodity prices, directly affecting AntarChile's export revenues. For example, tariffs or trade barriers could make AntarChile's products less competitive in crucial international markets.

Increased Competition and Market Saturation

AntarChile operates in sectors like energy distribution and forestry, which are showing signs of maturity and potential saturation. This environment naturally invites heightened competition, potentially squeezing profit margins for all players. For AntarChile, this means a constant need to innovate and optimize operations to hold onto its market position.

The Chilean energy distribution market, for instance, has seen significant investment and development over the years, leading to a more crowded landscape. Similarly, while forestry remains a strong sector, certain segments are reaching their growth limits. This competitive pressure was evident in the 2024 financial reports, where some energy distribution subsidiaries reported modest revenue growth compared to previous periods, signaling the impact of market saturation.

- Market Saturation: Mature energy distribution and forestry segments face limited organic growth opportunities.

- Margin Pressure: Increased competition can lead to price wars, impacting profitability.

- Innovation Imperative: Continuous investment in efficiency and new services is crucial to maintain market share.

Supply Chain Disruptions

AntarChile's broad international supply chain presents a significant vulnerability. Events like geopolitical instability, severe weather, or unexpected logistical snags can easily interrupt the flow of goods. For instance, in early 2024, disruptions in the Red Sea led to increased shipping times and costs for many global companies, a risk AntarChile also faces.

These disruptions directly impact the availability of crucial raw materials and components. Furthermore, they can drive up transportation expenses and cause delays in getting finished products to market. Such issues can erode profit margins and affect customer satisfaction, as seen with the widespread supply chain challenges impacting the automotive sector throughout 2023 and into 2024.

- Geopolitical Risks: Trade wars or regional conflicts can restrict access to key suppliers or transit routes.

- Natural Disasters: Earthquakes, floods, or pandemics can halt production or cripple transportation networks.

- Logistical Bottlenecks: Port congestion, labor shortages in trucking, or customs delays can significantly slow down operations.

- Cost Volatility: Fluctuations in fuel prices and shipping rates directly impact the cost of goods.

AntarChile faces significant threats from evolving regulatory landscapes, particularly concerning environmental policies and resource management. For example, in 2024, Chile's ongoing discussions about fisheries law reforms could restrict the operational scope of its fishing subsidiaries, while anticipated changes to mining royalty structures in 2025 may increase costs and necessitate strategic adjustments.

Intensifying environmental concerns and potential social opposition to industrial activities, such as mining and forestry, pose another considerable threat. Public scrutiny over water usage in Chile's mining sector in 2024 highlights this risk, which could extend to AntarChile's diverse operations, potentially leading to disruptions and reputational damage.

A global economic slowdown and ongoing trade tensions are also significant external threats. Reduced demand for products, especially in the forestry sector, and potential trade barriers could negatively impact AntarChile's export revenues and market competitiveness, as seen with the broader impact of global economic uncertainty in 2024.

SWOT Analysis Data Sources

This SWOT analysis for AntarChile is built upon a foundation of robust data, incorporating official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.