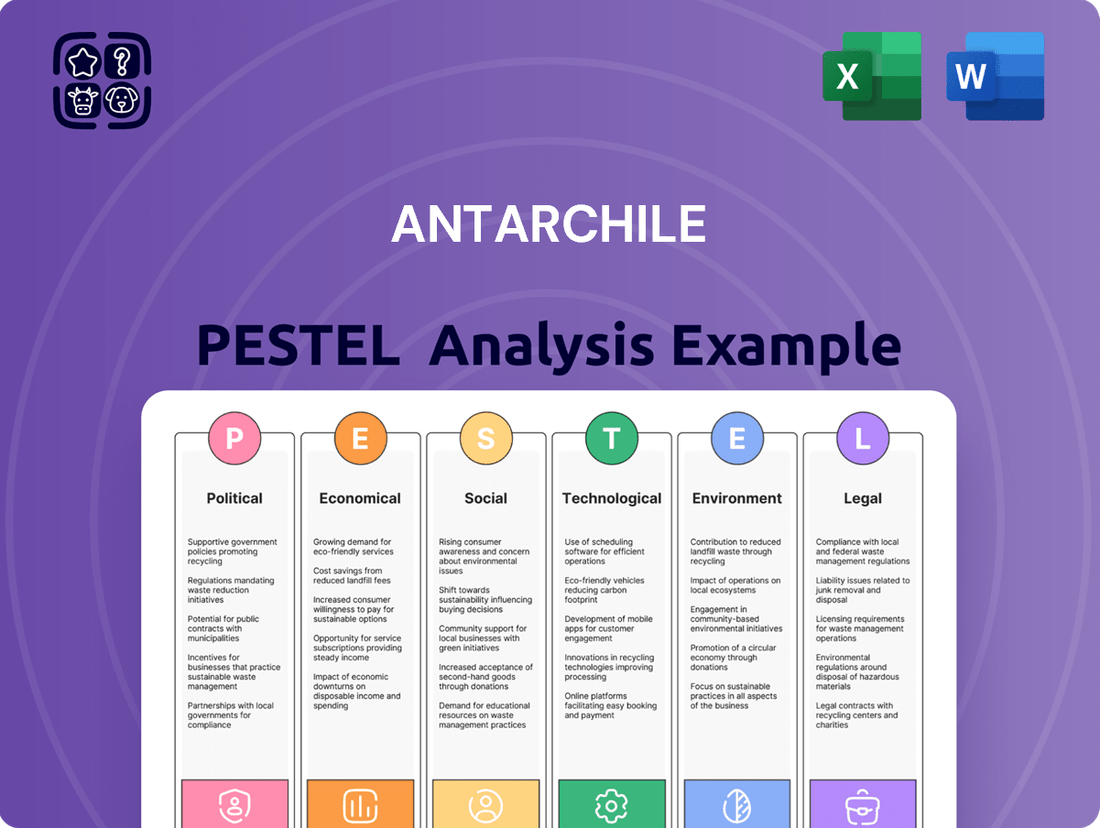

AntarChile PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AntarChile Bundle

Navigate the complex external environment impacting AntarChile. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. Gain a critical understanding of these forces to inform your investment decisions and strategic planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

AntarChile's operations are significantly influenced by the political climate in Chile. While the nation has navigated periods of constitutional reform, the results of the 2024 local elections and the approaching 2025 presidential election are anticipated to usher in a more stable, moderate political environment. This shift is expected to decrease policy unpredictability, a key factor for long-term business planning.

The Chilean government's focus on streamlining regulatory processes, particularly for mining projects, directly benefits companies like AntarChile. For instance, initiatives aimed at reducing permit processing times, which saw some delays in 2023, signal a proactive approach to fostering investment in vital industries. This governmental commitment to efficiency can translate into more predictable timelines and reduced operational friction for AntarChile's diverse portfolio.

Chile's regulatory landscape is undergoing significant shifts, particularly impacting sectors where AntarChile operates. The Energy Transition Law, effective from December 2024, is a key piece of legislation designed to fast-track investments in the nation's power grid and renewable energy infrastructure. This law is expected to create new opportunities for companies involved in energy generation and transmission.

Further reforms are targeting the mining industry, a crucial area for AntarChile's diversified interests. Amendments to existing mining laws are being introduced, alongside a concerted effort to streamline environmental assessment procedures. The government has set an ambitious target to reduce environmental approval times by 30-70%, a move intended to encourage new projects and investments within the sector.

Chile's trade policies, historically favoring open markets, have been a magnet for foreign direct investment, with FDI inflows reaching approximately US$17.2 billion in 2023. This openness significantly shapes AntarChile's operational landscape, particularly given Chile's reliance on commodity exports like copper, which accounted for over 50% of its export revenue in 2023.

The nation's global trade standing is intrinsically linked to international relations and trade dynamics. For instance, ongoing trade negotiations and geopolitical shifts directly impact the demand and pricing for key Chilean exports, influencing AntarChile's revenue streams.

The Chilean government's commitment to maintaining global competitiveness in mining, a sector crucial for AntarChile, involves regulatory streamlining. This is particularly relevant as global demand for critical minerals, essential for the energy transition, continues to surge, creating both opportunities and competitive pressures.

Fiscal and Monetary Policy

Chile's robust macroeconomic policy framework offers significant fiscal and monetary flexibility, which is beneficial for companies like AntarChile. This stability provides a predictable financial environment, allowing businesses to plan and invest with greater confidence.

The Central Bank of Chile has been actively easing its monetary policy. For instance, as of early 2024, the benchmark interest rate had seen reductions, aiming to stimulate economic activity by making borrowing cheaper. This easing can directly support consumption and investment growth, positively impacting demand for AntarChile's diverse range of products and services.

The Chilean government is committed to a path of gradual fiscal consolidation. A key aspect of this strategy is maintaining public debt below a predetermined ceiling, which was around 38% of GDP in recent years. This commitment to fiscal prudence reinforces financial stability and reduces the risk of economic shocks that could affect corporate performance.

- Fiscal Prudence: Chile's commitment to keeping public debt below 38% of GDP provides a stable financial backdrop.

- Monetary Easing: Reductions in the Central Bank's benchmark interest rate in early 2024 aim to boost consumption and investment.

- Economic Support: The combination of fiscal and monetary policies creates an environment conducive to business growth and investment.

Social Unrest and Government Response

Chile's experience with social unrest, notably in 2019, has shaped its political landscape. The government's subsequent democratic response, including the initiation of a constitutional rewrite, has been viewed as a stabilizing factor, helping to de-escalate tensions.

However, any resurgence of social unrest or significant shifts in public opinion could directly impact government policies. These policy changes might affect key areas for AntarChile, such as regulations on resource extraction, labor laws, and environmental protection standards. For instance, increased public demand for environmental sustainability could lead to stricter regulations on mining operations, a sector relevant to AntarChile's holdings.

- Government Stability: While the 2019 protests were significant, Chile's democratic institutions have largely weathered the storm, maintaining a relatively stable political environment for business operations.

- Policy Responsiveness: The government's willingness to address social demands through constitutional reform demonstrates a capacity to adapt policies, which could influence regulatory frameworks impacting AntarChile.

- Public Sentiment: Future shifts in public mood, potentially driven by economic conditions or perceived inequalities, could necessitate policy adjustments affecting sectors where AntarChile operates.

Chile's political landscape is characterized by a drive towards regulatory efficiency, particularly in mining and energy, benefiting companies like AntarChile. The upcoming 2025 presidential election is expected to solidify a more moderate political direction, reducing policy uncertainty for businesses. Government initiatives focused on streamlining environmental assessments aim to cut processing times by up to 70%, directly supporting investment in key sectors.

What is included in the product

This AntarChile PESTLE analysis dissects the critical external macro-environmental factors influencing the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting emerging threats and opportunities within AntarChile's operating landscape.

The AntarChile PESTLE Analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

Visually segmented by PESTEL categories, the AntarChile PESTLE Analysis allows for quick interpretation at a glance, relieving the pain of sifting through dense data.

Economic factors

Chile's economic outlook for 2024 and 2025 indicates robust growth, with projections typically falling between 2.1% and 2.6%. This positive trend is largely fueled by robust commodity exports, including key sectors like copper, lithium, and cellulose, alongside recovering real wages and a supportive monetary policy environment.

AntarChile, with its strategically diversified portfolio encompassing energy, forestry, fishing, and mining, is well-positioned to capitalize on this anticipated economic expansion. The company's broad exposure across these vital sectors allows it to benefit from the overall uplift in economic activity and demand for its core products and services.

Chile's inflation has been on a downward trend, a positive sign that has enabled the Central Bank to begin reducing its benchmark interest rate. This easing of monetary policy is anticipated to persist throughout 2024 and into 2025, making credit more accessible for both consumers and businesses, thereby fostering economic growth and investment. For instance, Chile's year-on-year inflation rate was reported at 4.0% in April 2024, down from 4.2% in March, signaling continued disinflationary pressures.

While the overall inflation outlook is favorable, certain temporary factors could introduce minor price fluctuations. The expiration of the electricity price freeze, for example, is expected to cause a modest uptick in energy costs in the near term. However, these are generally viewed as isolated events that are unlikely to derail the broader disinflationary path, with the Central Bank projecting inflation to reach its 2% target by mid-2025.

AntarChile's diverse portfolio, with significant holdings in forestry, fishing, and particularly mining via Empresas Copec's substantial copper and lithium interests, positions it directly in the path of global commodity price volatility. Fluctuations in the prices of these key resources can significantly impact AntarChile's revenue and profitability.

The outlook for minerals crucial to the green energy transition remains robust, signaling continued investment opportunities within Chile's mining sector. For instance, copper prices have shown resilience, with forecasts suggesting an average of $8,500 per ton for 2024, driven by demand from electric vehicles and renewable energy infrastructure.

Lithium prices, while experiencing some moderation from 2023 peaks, are still projected to remain elevated due to the surging demand for batteries in electric vehicles and energy storage systems. This sustained demand underpins the positive long-term growth prospects for AntarChile's lithium-related ventures.

Investment and Credit Conditions

Investment is showing signs of gradual improvement in Chile, bolstered by a more favorable credit and financial landscape. This positive trend is partly driven by government initiatives focused on simplifying and expediting permitting procedures for major undertakings, particularly within the crucial mining and energy sectors. These efforts are designed to attract and streamline substantial capital investments into the country.

Empresas Copec, a significant player in the Chilean economy, underscored this growing confidence by announcing considerable investment plans for 2024. This strategic move signals a positive outlook on the prevailing economic conditions and the potential for growth within the Chilean market.

- Government Streamlining: Efforts to reduce red tape in mining and energy project approvals are expected to unlock significant capital.

- Credit Conditions: Improving access to credit is a key enabler for increased investment activity across various sectors.

- Corporate Confidence: Empresas Copec's substantial 2024 investment plans reflect a strong belief in Chile's economic trajectory.

Labor Market Dynamics

Chile's labor market has demonstrated positive momentum, with the national unemployment rate steadily decreasing. For instance, by the end of 2024, the unemployment rate was projected to be around 7.5%, a notable improvement from previous periods. This trend suggests a more robust economy, which bodes well for companies like AntarChile.

Despite the overall improvement, persistent gender disparities in employment and wages remain a challenge. Additionally, the informal sector continues its downward trend, indicating a shift towards more formal and regulated employment, which can lead to greater economic stability and predictability.

A strengthening labor market is a significant advantage for AntarChile. It ensures access to a larger pool of skilled workers essential for operations and infrastructure development. Furthermore, increased employment and stable wages translate into higher consumer spending, boosting demand for energy services, a core business for AntarChile.

- Unemployment Rate Trend: Chile's unemployment rate saw a continued decline throughout 2024, nearing 7.5% by year-end.

- Gender Disparities: While improving, the gap in labor force participation and wage equality between genders persists.

- Informal Employment: The share of informal employment has been on a consistent decline, reflecting a move towards more formal economic structures.

- Economic Impact: A healthy labor market supports consumer demand, directly benefiting sectors like energy distribution that AntarChile operates in.

Chile's economic landscape for 2024-2025 is characterized by projected growth between 2.1% and 2.6%, driven by strong commodity exports like copper and lithium, alongside recovering wages and supportive monetary policy. AntarChile, with its diversified interests in energy, forestry, fishing, and mining, is strategically positioned to benefit from this expansion.

Inflation has been trending downwards, enabling interest rate reductions that are expected to continue through 2025, improving credit access and stimulating investment. Chile's year-on-year inflation was 4.0% in April 2024, signaling ongoing disinflationary trends, with the Central Bank targeting 2% by mid-2025.

The outlook for green energy transition minerals remains positive, with copper prices forecast to average $8,500 per ton in 2024, supporting AntarChile's mining ventures. Lithium prices, despite some moderation, are expected to stay elevated due to strong demand for batteries.

Investment is picking up, aided by government efforts to streamline permitting for mining and energy projects, attracting significant capital. Empresas Copec's substantial 2024 investment plans reflect growing confidence in Chile's economic trajectory.

Chile's labor market is strengthening, with unemployment projected around 7.5% by the end of 2024, ensuring a skilled workforce and boosting consumer spending, which benefits AntarChile's energy sector operations. However, gender employment disparities persist.

| Economic Indicator | 2024 Projection/Data | 2025 Outlook | Impact on AntarChile |

|---|---|---|---|

| GDP Growth | 2.1%-2.6% | Positive Growth Expected | Increased demand for energy, forestry, and mining products |

| Inflation Rate (YoY) | 4.0% (April 2024) | Targeting 2% by mid-2025 | Stable operating costs, improved consumer spending power |

| Copper Price | Avg. $8,500/ton | Continued Strength | Boosts revenue from mining operations |

| Unemployment Rate | ~7.5% (End of 2024) | Continued Decline Expected | Access to skilled labor, increased consumer demand |

What You See Is What You Get

AntarChile PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This AntarChile PESTLE Analysis provides a comprehensive overview of the external factors influencing the company's operations and strategy.

The content and structure shown in the preview is the same document you’ll download after payment. You will gain valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental aspects affecting AntarChile.

Sociological factors

Chile's population is projected to reach approximately 20 million by 2025, with a significant portion continuing to migrate towards urban centers. This ongoing urbanization directly impacts AntarChile's subsidiaries by shaping consumption patterns for essential goods like fuels and LPG, as well as a broader range of consumer products.

The increasing concentration of people in cities creates new distribution challenges and opportunities for AntarChile, requiring adaptable strategies to meet evolving urban demands for energy and retail goods. Simultaneously, understanding the distinct needs and access to services in rural areas remains crucial for comprehensive market penetration.

Consumer preferences are shifting significantly towards sustainability, impacting demand across various sectors. For example, the growing interest in electromobility, with global EV sales projected to reach over 13 million units in 2024, could reduce reliance on traditional fuels, a key area for companies like AntarChile. This trend necessitates a strategic pivot for businesses reliant on fossil fuels, encouraging diversification into greener alternatives.

AntarChile's investments in green technology and healthy frozen foods demonstrate an understanding of these evolving consumer lifestyles. The global market for plant-based foods, a segment aligning with healthy eating trends, is expected to continue its robust growth, potentially reaching over $74 billion by 2030. Such strategic moves position the company to capitalize on these conscious consumer choices, mitigating risks associated with traditional product lines.

AntarChile's operations in sectors like forestry, fishing, and mining mean public perception of its environmental and social impact is paramount. Negative views on sustainability or labor can directly harm its reputation and ability to operate, especially given increasing consumer and investor scrutiny in 2024 and 2025.

Maintaining a positive public image requires diligent corporate social responsibility. For instance, in 2024, companies in similar industries faced increased pressure to report on Scope 3 emissions, a trend likely to continue, impacting how AntarChile's supply chain is perceived.

Proactive community engagement and robust sustainability practices are therefore essential for AntarChile's long-term social license to operate. By 2025, we anticipate even greater demand for transparent reporting on biodiversity impact and ethical sourcing, directly influencing stakeholder trust.

Education and Workforce Skills

AntarChile's reliance on advanced technology in mining and energy demands a highly educated and skilled workforce. Chile's commitment to improving educational outcomes is evident, with tertiary education enrollment rates reaching approximately 57% in 2023, indicating a growing pool of potential talent. However, ensuring these graduates possess the specific digital transformation and renewable energy expertise needed by AntarChile's subsidiaries remains a key consideration.

Addressing potential skill gaps is crucial for maintaining operational efficiency and driving innovation. For instance, the mining sector, a core area for AntarChile, is increasingly integrating automation and data analytics, requiring workers proficient in these advanced fields. In 2024, the Chilean government announced initiatives to boost vocational training in emerging technologies, aiming to bridge such gaps and support industries like renewable energy, where AntarChile is also expanding.

- Tertiary Education Enrollment: Approximately 57% in 2023.

- Key Skill Demands: Digital transformation, data analytics, and renewable energy technologies.

- Government Initiatives: Focus on vocational training in emerging technologies for 2024.

Income Distribution and Social Equity

Chile continues to grapple with significant income distribution challenges, impacting social equity. Disparities in labor market participation, especially for women, remain a persistent issue, affecting overall purchasing power and consumer demand. For instance, in 2023, the female labor force participation rate stood at approximately 52%, compared to over 70% for men, highlighting a notable gap.

These socioeconomic inequalities can translate into social pressures that may influence business operations and the regulatory landscape. Businesses like AntarChile need to consider how these disparities affect their customer base and potential workforce. For example, a widening income gap could lead to increased demand for value-oriented products or services, while also potentially fueling calls for greater corporate social responsibility or government intervention.

- Persistent Income Inequality: Chile's Gini coefficient, a measure of income inequality, has seen fluctuations but remains a key indicator of the disparities present. In 2022, it was reported around 0.45, indicating a significant level of income concentration.

- Gender Disparities in Employment: The gender pay gap in Chile persists, with women earning, on average, less than men for comparable work. This impacts household incomes and overall economic participation.

- Consumer Spending Power: Uneven income distribution directly affects the purchasing power of different segments of the population, influencing demand for various goods and services offered by companies.

- Social Unrest Potential: High levels of inequality can contribute to social discontent, potentially leading to protests or policy changes that could affect the business environment.

Chile's demographic shifts, particularly urbanization, are reshaping consumer needs for AntarChile's energy and retail segments, creating both logistical hurdles and market opportunities. Consumer preferences are increasingly leaning towards sustainability, evidenced by the global surge in electric vehicle adoption, which could impact demand for traditional fuels.

Public perception of AntarChile's environmental and social practices is critical, especially as scrutiny on emissions and ethical sourcing intensifies through 2024 and 2025, necessitating robust corporate social responsibility efforts. The company's reliance on a skilled workforce for its technologically advanced operations in mining and energy is supported by Chile's growing tertiary education enrollment, though specific skill gaps in digital transformation and renewables need addressing.

Socioeconomic disparities, including a persistent gender gap in labor participation and income inequality, influence consumer spending power and can create social pressures that affect business operations and the regulatory environment for companies like AntarChile.

| Sociological Factor | 2023/2024/2025 Data Point | Implication for AntarChile |

|---|---|---|

| Urbanization | Population migration to urban centers continues. | Shapes demand for fuels, LPG, and consumer goods; impacts distribution strategies. |

| Consumer Preferences | Growing demand for sustainability and healthy options (e.g., plant-based foods). Global EV sales projected over 13 million in 2024. | Drives need for diversification into green technologies and healthy food segments; potential risk for fossil fuel reliance. |

| Public Perception & CSR | Increased scrutiny on environmental impact and labor practices. Pressure for Scope 3 emissions reporting in 2024. | Reputational risk; need for transparent reporting on biodiversity and ethical sourcing by 2025. |

| Workforce Skills | Tertiary education enrollment ~57% in 2023. Demand for digital transformation and renewable energy skills. | Need to address skill gaps through training; leverage government initiatives for vocational training in emerging tech (2024). |

| Income Inequality | Female labor force participation ~52% in 2023. Gini coefficient ~0.45 in 2022. | Affects purchasing power and demand; potential for social unrest and calls for greater corporate responsibility. |

Technological factors

Chile is leading the charge in the global energy transition, boasting impressive progress in solar power and battery storage. This commitment is underscored by the Energy Transition Law and substantial investments, all designed to speed up the adoption of clean electricity sources.

These technological shifts directly influence AntarChile's energy distribution businesses, Copec and Abastible. The company must adapt to integrating new energy carriers like green hydrogen and cater to the growing electrification trend, particularly within Chile's vital mining sector.

Technological advancements are significantly reshaping forestry and pulp production, focusing on sustainability and efficiency. Innovations in areas like drone-based forest monitoring and AI-driven yield optimization are becoming crucial. For instance, by 2024, the global forest monitoring technology market is projected to reach over $1.5 billion, highlighting the increasing reliance on tech for better resource management.

The implementation of new national forest certification standards, increasingly aligned with international regulations such as the EU Deforestation Regulation (EUDR), is driving demand for sophisticated technological solutions. These standards mandate enhanced traceability and precise geo-location data for forest products, pushing companies to invest in digital platforms and blockchain technology for compliance. This shift is expected to boost the market for forest traceability software, which was valued at approximately $300 million in 2023.

The Chilean mining sector is actively embracing modernization to boost efficiency and minimize its environmental footprint. This transformation involves integrating advanced technologies across extraction, processing, and safety protocols. For instance, the industry is increasingly adopting automation and digital solutions to streamline operations and enhance worker safety.

A significant aspect of this modernization is the push towards renewable energy. The Chilean mining industry is projected to source 96% of its energy from renewables by 2050, a substantial increase from current levels. This shift not only addresses environmental concerns but also offers long-term cost savings and operational stability.

Digital Transformation and Automation

AntarChile is actively embracing digital transformation and automation to streamline operations across its varied sectors. For instance, in its mining ventures, the company is exploring online permit platforms, aiming to reduce administrative burdens and speed up project approvals. This digital shift is projected to improve efficiency by an estimated 15-20% in administrative processes within the next two years.

Leveraging data analytics is another key technological driver for AntarChile. The company is implementing advanced analytics in its distribution and logistics arms to optimize routes, manage inventory more effectively, and predict demand with greater accuracy. This data-driven approach is expected to yield significant cost savings, potentially reducing operational expenses by up to 10% in its logistics divisions by the end of 2025.

The impact of these technological advancements extends to customer experience. By digitizing services and personalizing interactions through data insights, AntarChile aims to foster stronger customer relationships and improve service delivery across all its business units. This focus on digital enhancement is a strategic imperative for maintaining competitiveness in the evolving market landscape.

Key technological initiatives include:

- Development of online permit and application portals for mining operations.

- Implementation of AI-powered route optimization software in logistics.

- Expansion of data analytics capabilities for predictive maintenance in industrial sectors.

- Enhancement of e-commerce platforms for direct-to-consumer sales in retail segments.

Research and Development Investment

AntarChile's commitment to research and development is a cornerstone of its strategy for staying ahead in dynamic industries. In 2024, the company is expected to continue prioritizing investments in areas like renewable energy technologies and sustainable resource management. This focus allows AntarChile to proactively address emerging market demands and environmental regulations.

Key R&D initiatives for AntarChile in 2024-2025 are likely to span several of its core business segments. This includes exploring next-generation solar and wind power solutions, developing more efficient and environmentally friendly forestry harvesting methods, and researching advanced aquaculture techniques to improve yield and sustainability. Furthermore, optimizing mining extraction processes through technological innovation remains a critical R&D objective.

- Renewable Energy: Continued investment in solar and wind power research to enhance efficiency and grid integration.

- Sustainable Forestry: Focus on R&D for reduced-impact logging and reforestation technologies.

- Advanced Fishing: Exploration of innovative techniques for sustainable aquaculture and marine resource management.

- Mining Optimization: Development of new technologies to improve resource recovery and reduce environmental footprint in mining operations.

Technological advancements are a significant driver for AntarChile, particularly in energy, forestry, and mining. The company is leveraging digital transformation and data analytics to boost efficiency across its operations, aiming for up to a 20% improvement in administrative processes by 2026 through online platforms. The Chilean mining sector's commitment to renewable energy, targeting 96% by 2050, directly impacts AntarChile's energy distribution businesses.

Legal factors

Chile's mining sector operates under a robust legal framework, primarily governed by the Chilean Constitution, the Mining Concessions Act, and the Mining Code. These foundational laws establish the rules for mineral rights and exploration.

Significant legislative updates in January 2024 introduced amendments designed to stimulate mining activity and curb the practice of concession hoarding. These changes include extending the duration of exploration concessions, aiming to encourage more sustained investment in discovery.

Furthermore, the Mining Activity Royalty Act plays a crucial role by imposing a specific tax on mining sales, impacting the profitability and financial planning for companies operating in the sector. This royalty structure is a key consideration for any mining enterprise in Chile.

AntarChile's operations, especially in mining and forestry, are heavily influenced by Chile's stringent environmental laws. Key legislation like the Environmental Act and the Environmental Impact Assessment System Regulation mandates rigorous compliance, impacting project development and ongoing activities. For instance, in 2023, Chile continued efforts to refine its environmental permitting processes, aiming to shorten the historically lengthy timelines for mining projects, a sector crucial for AntarChile.

Chilean labor laws dictate crucial aspects of AntarChile's operations, including minimum wage, working hours, and the right to collective bargaining, all of which affect its diverse subsidiaries. As of early 2024, the national minimum wage stands at CLP 440,000 per month, a figure that directly influences payroll costs.

Recent labor market statistics from Chile's National Institute of Statistics (INE) for late 2023 and early 2024 show an unemployment rate hovering around 8%, with a slight uptick in formal employment. However, persistent gender pay gaps remain a concern, with women earning, on average, 15% less than men for comparable roles, a factor AntarChile must navigate in its hiring and compensation strategies.

Strict adherence to these regulations, including adherence to the Labor General Law (Código del Trabajo), is paramount for AntarChile to prevent costly legal disputes, potential fines, and to foster a stable and motivated workforce across its various business units.

Forestry and Fishing Regulations

AntarChile's forestry operations are governed by regulations designed to ensure responsible land use and timber harvesting. New national forest certification standards, implemented in 2024, are now aligned with international demands, such as the EU Regulation on Deforestation-Free Products (EUDR), which could impact export markets. These regulations aim to promote biodiversity and long-term forest health.

The fishing industry, where AntarChile holds a significant stake in Corpesca, is also heavily regulated. These rules focus on maintaining fish populations through strict quotas and enforcing sustainable fishing methods. For instance, Corpesca's operational permits are subject to ongoing review based on compliance with these environmental and resource management mandates, directly influencing its catch volumes and market access.

- Sustainable Forest Management: National certification standards, updated in 2024, now require adherence to principles that prevent deforestation and promote ecological balance, aligning with global trade expectations like the EUDR.

- Fishing Quotas and Sustainability: Regulations dictate annual catch limits for various species, with compliance monitored to prevent overfishing and ensure the long-term viability of marine ecosystems.

- Acquisition Scrutiny: Investments in fishing companies, like AntarChile's involvement with Corpesca, are subject to regulatory approval, ensuring that ownership structures do not compromise competition or sustainable practices.

- International Alignment: Chilean forestry regulations are increasingly harmonizing with international standards to facilitate trade, particularly with regions implementing stringent import rules based on environmental impact.

Competition Law and Antitrust

Chile's robust competition laws are designed to ensure a level playing field across all industries, a crucial consideration for a diversified holding company like AntarChile. These regulations are in place to prevent any single entity from gaining undue market power or engaging in practices that stifle competition.

As a significant player across multiple Chilean sectors, AntarChile must diligently comply with these antitrust provisions. This includes monitoring its market share and business practices to avoid any accusations of monopolistic behavior or collusion. The recent implementation of a new public procurement law in Chile, effective from 2024, is specifically intended to boost competition in government contracts, potentially impacting how AntarChile and its subsidiaries bid for public projects.

- Antitrust Compliance: AntarChile must navigate Chilean competition law to prevent anti-competitive practices across its diverse holdings.

- Market Power Scrutiny: Regulatory bodies actively monitor large conglomerates to ensure fair market competition.

- Public Procurement Law Impact: The 2024 public procurement law aims to increase competition in government tenders, a key area for many large corporations.

AntarChile's operations are shaped by Chile's comprehensive legal framework, particularly concerning mining, environmental protection, labor, and competition. Recent amendments in early 2024 to the Mining Concessions Act aim to stimulate activity by extending exploration concession durations, while the Mining Activity Royalty Act imposes a tax on sales, directly influencing profitability. Stricter environmental laws, like the Environmental Act, necessitate compliance for all projects, with ongoing efforts in 2023 to streamline permitting processes for mining. Labor laws dictate minimum wages, with the national minimum set at CLP 440,000 monthly as of early 2024, and gender pay gaps averaging 15% remain a consideration. Furthermore, competition laws and the new public procurement law effective 2024 are crucial for ensuring fair market practices and access to government contracts.

| Legal Area | Key Legislation/Regulation | Impact on AntarChile | Recent/Relevant Data (2023-2024) |

|---|---|---|---|

| Mining Law | Mining Concessions Act, Mining Code, Mining Activity Royalty Act | Governs mineral rights, exploration, and taxation; affects profitability. | Exploration concession duration extended (Jan 2024); Royalty is a % of sales. |

| Environmental Law | Environmental Act, Environmental Impact Assessment System Regulation | Mandates compliance for projects, impacting development and operations. | Efforts to shorten environmental permitting timelines for mining (2023). |

| Labor Law | Labor General Law (Código del Trabajo) | Dictates wages, working hours, collective bargaining; impacts payroll costs. | National minimum wage CLP 440,000/month (early 2024); Gender pay gap ~15%. |

| Competition Law | Antitrust Provisions | Ensures fair market practices; requires monitoring of market share and behavior. | New public procurement law (2024) aims to boost competition in government tenders. |

Environmental factors

Chile faces significant climate change impacts, including prolonged mega-droughts and an uptick in severe wildfires, directly threatening AntarChile's extensive forest assets. These environmental shifts also strain water resources crucial for the company's mining operations, highlighting a critical operational vulnerability.

The Chilean government's ambitious goal of achieving carbon neutrality by 2050 necessitates robust climate resilience planning. For AntarChile, this translates into a strategic imperative to adapt its business models and operational practices to mitigate climate-related risks and capitalize on emerging green opportunities.

AntarChile's forestry ventures face scrutiny regarding deforestation and the impact on biodiversity. The company's commitment to new forest stewardship standards, particularly in alignment with the European Union Deforestation Regulation (EUDR), underscores a critical need to prevent further deforestation and safeguard native forest ecosystems. For instance, a 2023 report indicated that Chile's forest sector contributes to carbon sequestration, but also highlighted areas where unsustainable practices could exacerbate biodiversity loss.

Chile is grappling with significant water scarcity, a challenge exacerbated by prolonged droughts that have historically impacted key industries like mining and agriculture. This environmental pressure directly affects AntarChile's operational capacity, particularly in its mining ventures which are inherently water-intensive. For instance, the Atacama Desert, a major mining hub, experiences extremely low rainfall, making water a precious commodity.

Efficient water management is therefore not just a best practice but a necessity for AntarChile's sustainability. The company must invest in advanced water recycling and desalination technologies to mitigate risks. Projections for 2024-2025 indicate continued arid conditions in many of the regions where AntarChile operates, potentially increasing the operational costs associated with water acquisition and treatment.

The long-term availability of water resources will likely shape AntarChile's future investment strategies, potentially steering development away from areas with critical water stress or demanding substantial upfront investment in water infrastructure. The Chilean government's policies on water rights and usage are also evolving, adding another layer of complexity to managing this vital resource.

Emissions and Pollution Control

AntarChile's diverse operations in energy, forestry, fishing, and mining inherently generate emissions and pollution. Chile's commitment to environmental protection, including a carbon tax and stringent emissions standards for coal-fired power plants, directly impacts these sectors. The nation's ambitious target of achieving 100% zero-emission electricity generation by 2050 compels companies like AntarChile to accelerate investments in cleaner technologies and actively reduce their environmental footprint across all business segments.

The Chilean government's push for decarbonization presents both challenges and opportunities for AntarChile. For instance, the energy sector faces pressure to transition away from fossil fuels, requiring significant capital allocation towards renewable energy sources. Similarly, forestry and mining operations must adopt more sustainable practices to mitigate their environmental impact and comply with evolving regulations.

- Chile's carbon tax, implemented in 2017, aims to incentivize emissions reductions across industries.

- The country has set a goal to reach 100% zero-emission electricity generation by 2050, driving investment in renewables.

- AntarChile's forestry division must manage land use and reforestation to offset carbon emissions.

- The fishing sector faces regulations related to water pollution and sustainable resource management.

Resource Depletion and Sustainability Practices

AntarChile's long-term success hinges on how it manages its resources, especially in its mining and fishing sectors. The risk of running out of key materials or overexploiting marine life is a significant environmental concern that requires proactive management.

To counter this, AntarChile is increasingly focused on adopting sustainable practices. This includes pursuing certifications for its forestry operations, adhering to strict fishing quotas to prevent overfishing, and implementing more efficient extraction methods in its mining activities. These steps are crucial for ensuring the company's operations remain viable for years to come.

- Forestry: In 2023, Chile's forest sector, a key area for AntarChile, saw exports reach approximately $6.1 billion, highlighting the economic importance of sustainable forest management and certification programs like FSC or PEFC.

- Fishing: Chile's fishing industry, a significant contributor to its economy, is increasingly regulated. For instance, the anchoveta catch, a vital resource, is managed through quotas to ensure population health, with total allowable catches adjusted annually based on scientific assessments.

- Mining Efficiency: The mining industry, particularly copper which Chile is a world leader in, is investing in water efficiency and cleaner energy. For example, major copper mines in Chile aim to reduce their water footprint by up to 30% by 2030 through technological advancements.

Chile's vulnerability to climate change, marked by severe droughts and wildfires, directly impacts AntarChile's forest assets and water-intensive mining operations. The nation's 2050 carbon neutrality goal mandates adaptation, pushing AntarChile towards greener practices to mitigate risks and seize new opportunities. The company's forestry division faces particular scrutiny regarding deforestation, necessitating adherence to new stewardship standards, especially concerning the EU Deforestation Regulation.

Water scarcity, amplified by ongoing droughts, poses a significant operational challenge for AntarChile's mining ventures, particularly in arid regions like the Atacama Desert. Investment in water recycling and desalination is critical, as projections for 2024-2025 suggest continued arid conditions, potentially increasing water management costs. Evolving water rights policies further complicate resource management.

AntarChile's diverse operations generate emissions, and Chile's environmental regulations, including a carbon tax and stringent emission standards, directly affect its energy, forestry, and mining sectors. The country's commitment to 100% zero-emission electricity generation by 2050 compels accelerated investment in cleaner technologies and a reduced environmental footprint across all business segments.

| Environmental Factor | Impact on AntarChile | Key Data/Initiative (2024-2025 Focus) |

| Climate Change & Water Scarcity | Threatens forest assets; strains water resources for mining. | Continued arid conditions projected for 2024-2025; focus on water recycling/desalination. |

| Decarbonization Goals | Requires transition to cleaner energy and sustainable practices. | Chile's 2050 carbon neutrality goal; 100% zero-emission electricity target by 2050. |

| Deforestation & Biodiversity | Scrutiny on forestry practices; need for compliance with EUDR. | Emphasis on forest stewardship and safeguarding native ecosystems. |

| Emissions & Pollution | Impacted by carbon tax and emissions standards. | Need to reduce environmental footprint across energy, forestry, and mining sectors. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AntarChile is built on a comprehensive blend of data, including Chilean government reports, international economic indicators from sources like the IMF and World Bank, and reputable industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.