Anker Innovations Technology SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anker Innovations Technology Bundle

Anker Innovations boasts strong brand recognition and a diverse product portfolio, but faces intense competition and supply chain vulnerabilities. Understanding these dynamics is crucial for navigating the consumer electronics market.

Want the full story behind Anker's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Anker Innovations has significantly broadened its product range, moving beyond its foundational portable charging devices. This expansion now encompasses popular audio gear under the Soundcore brand, smart home and security products through Eufy, and portable projectors via Nebula.

This diversification is a key strength, lessening the company's dependence on any single product line and opening doors to a larger customer segment. The success of this strategy is evident in Anker's impressive 41.1% year-over-year revenue growth recorded in 2024, highlighting the market's positive reception to its varied offerings.

Anker has cultivated a powerful brand identity, synonymous with dependable, high-quality consumer electronics. This strong reputation translates directly into a loyal customer base and significant trust in their products. In 2024, Anker reported revenue of RMB 247.1 billion, a testament to this brand strength.

Anker Innovations demonstrates a strong commitment to innovation, dedicating RMB 21.1 billion to research and development in 2024. This significant investment fuels the creation of advanced products like the AI-powered Anker SOLIX Solarbank 3 Pro and next-generation GaN chargers. Their relentless pursuit of new technologies, including over 1.7 billion yuan invested in energy storage, keeps them at the forefront of consumer electronics.

Robust Online Retail and Global Distribution Network

Anker Innovations Technology excels through its strong online retail presence and a well-established global distribution network. This allows them to efficiently reach consumers worldwide.

The company’s primary sales channel is online, with platforms like Amazon being crucial. They are also actively expanding into newer e-commerce avenues, such as TikTok Shop, demonstrating adaptability. This direct-to-consumer strategy, combined with strategic distribution partnerships, ensures broad market penetration and sales reach.

- Online Dominance: Anker leverages major e-commerce platforms for significant sales volume.

- Global Reach: A distributed network ensures product availability across international markets.

- Evolving Channels: Expansion into platforms like TikTok Shop highlights a forward-thinking sales approach.

Strong Financial Performance and Growth

Anker Innovations Technology has showcased impressive financial results, underscoring its market strength. In 2024, the company achieved a significant year-on-year revenue surge of 41.1%, reaching RMB 247.1 billion, accompanied by a net profit of RMB 21.1 billion. This robust financial health is a key strength, enabling continued investment in innovation and expansion.

The company's energy storage segment, in particular, has experienced explosive growth, with annual revenue exceeding RMB 3 billion, marking an exceptional 184% increase. This financial momentum provides a solid foundation for Anker to pursue further research and development, explore new market opportunities, and execute strategic growth plans effectively.

- Significant Revenue Growth: Anker's 2024 revenue of RMB 247.1 billion represents a 41.1% year-on-year increase.

- Healthy Profitability: The company reported a net profit of RMB 21.1 billion for the same period.

- Exceptional Segment Performance: The energy storage business achieved over RMB 3 billion in annual revenue, a 184% growth.

- Investment Capacity: Strong financials translate to ample capital for R&D, market expansion, and strategic initiatives.

Anker's diversified product portfolio, including Soundcore audio and Eufy smart home devices, significantly reduces reliance on any single product category. This strategic expansion, coupled with a strong brand reputation for quality, has fueled impressive financial performance. In 2024, Anker achieved a remarkable 41.1% year-over-year revenue growth, reaching RMB 247.1 billion, demonstrating broad market acceptance of its varied offerings.

The company's commitment to innovation is a core strength, evidenced by a substantial RMB 21.1 billion investment in research and development in 2024. This focus has led to the development of cutting-edge products and a significant presence in emerging markets like energy storage. Their energy storage segment alone saw revenue surge by 184% in 2024, exceeding RMB 3 billion, highlighting Anker's ability to capitalize on new technological trends.

| Key Strength | Description | 2024 Data Point |

|---|---|---|

| Product Diversification | Broadened product range beyond charging devices to audio, smart home, and projectors. | N/A (Qualitative Strength) |

| Brand Reputation | Strong brand identity associated with dependable, high-quality electronics. | RMB 247.1 billion in revenue. |

| Innovation Investment | Dedication to R&D for advanced product development. | RMB 21.1 billion invested in R&D. |

| Financial Performance | Robust revenue growth and profitability. | 41.1% YoY revenue growth; RMB 21.1 billion net profit. |

What is included in the product

Analyzes Anker Innovations Technology’s competitive position through key internal and external factors, detailing its brand recognition and product diversification against market competition and evolving consumer demands.

Offers a clear roadmap to leverage Anker's strengths and mitigate weaknesses, easing the burden of complex strategic planning.

Weaknesses

Anker Innovations Technology's significant dependence on online retail channels, while a key driver of its success, also presents a notable weakness. The e-commerce landscape is characterized by fierce competition, making it challenging to maintain visibility and market share without substantial ongoing investment.

This reliance exposes Anker to the risks associated with platform policy shifts and algorithm changes, which can directly impact sales performance and customer reach. The company's sales expenses, which climbed to RMB 2.115 billion in the first half of 2024, partly reflect the escalating costs associated with online promotions and platform fees, underscoring the financial pressure to stay competitive in the digital marketplace.

Anker operates within the fiercely competitive consumer electronics sector, facing established giants and agile newcomers alike. This intense rivalry, particularly in areas like portable power solutions and smart home gadgets, necessitates continuous innovation and aggressive pricing strategies to safeguard market share. The pressure to stay ahead can easily trigger price wars, potentially eroding profit margins if not navigated with strategic foresight.

Anker Innovations' heavy reliance on manufacturing and sales operations in China exposes it to significant supply chain vulnerabilities. Geopolitical tensions and potential trade disputes, particularly between China and Western nations, could lead to disruptions. For instance, in 2023, ongoing trade friction continued to create uncertainty for global manufacturers with extensive Chinese operations.

Potential for Product Recalls and Safety Concerns

Consumer electronics, particularly devices with batteries and charging capabilities, inherently carry risks of safety issues or malfunctions. This is a significant weakness for companies like Anker Innovations.

Anker Innovations faced a substantial product recall in early 2024, affecting over one million power banks due to fire risks. This incident highlights the potential for such events to severely damage brand reputation and lead to considerable financial costs associated with replacements, repairs, and customer compensation.

- Inherent Risks: The nature of battery-powered electronics means potential for overheating or malfunctions.

- Recall Impact: A recall of over 1 million power banks in early 2024 due to fire risk directly impacted Anker's reputation and finances.

- Cost of Malfunctions: Such recalls incur significant expenses for product replacement, logistics, and potential legal liabilities.

- Quality Control Necessity: Maintaining exceptionally stringent quality control processes is paramount to mitigate these risks.

Diversification Challenges and Resource Allocation

Anker's ambitious diversification efforts have presented significant challenges in resource allocation. By 2022, the company had to shutter ten product teams, a direct consequence of spreading resources too thinly across a broad spectrum of niche markets outside its core charging solutions. This situation highlights a critical need for Anker to refine its strategy to manage its extensive product portfolio more effectively and ensure capital is deployed efficiently across its various business segments.

The company's experience underscores the difficulty in maintaining focus and operational excellence when venturing into numerous new product categories simultaneously. For instance, while Anker has expanded into areas like robotics and smart home devices, the strain on resources became evident. This suggests that future strategic planning must prioritize a more concentrated approach, ensuring that each new venture receives adequate support and management attention to foster sustainable growth rather than dilute existing strengths.

- Resource Dilution: Attempts to enter numerous niche markets led to a thinning of resources, impacting the effectiveness of each product line.

- Strategic Re-evaluation: The closure of ten product teams by 2022 signaled a necessary strategic pivot towards better resource management.

- Focus Imperative: Anker must prioritize efficient allocation of capital and talent across its diverse product offerings to avoid past pitfalls.

Anker's extensive product portfolio, while a strength, also poses a weakness in terms of managing diverse product lines and ensuring consistent quality. The company's venture into numerous new categories has, at times, led to resource dilution, as evidenced by the closure of ten product teams by 2022. This indicates a challenge in maintaining focus and operational excellence across a broad range of offerings, necessitating a more concentrated strategic approach for efficient capital and talent deployment.

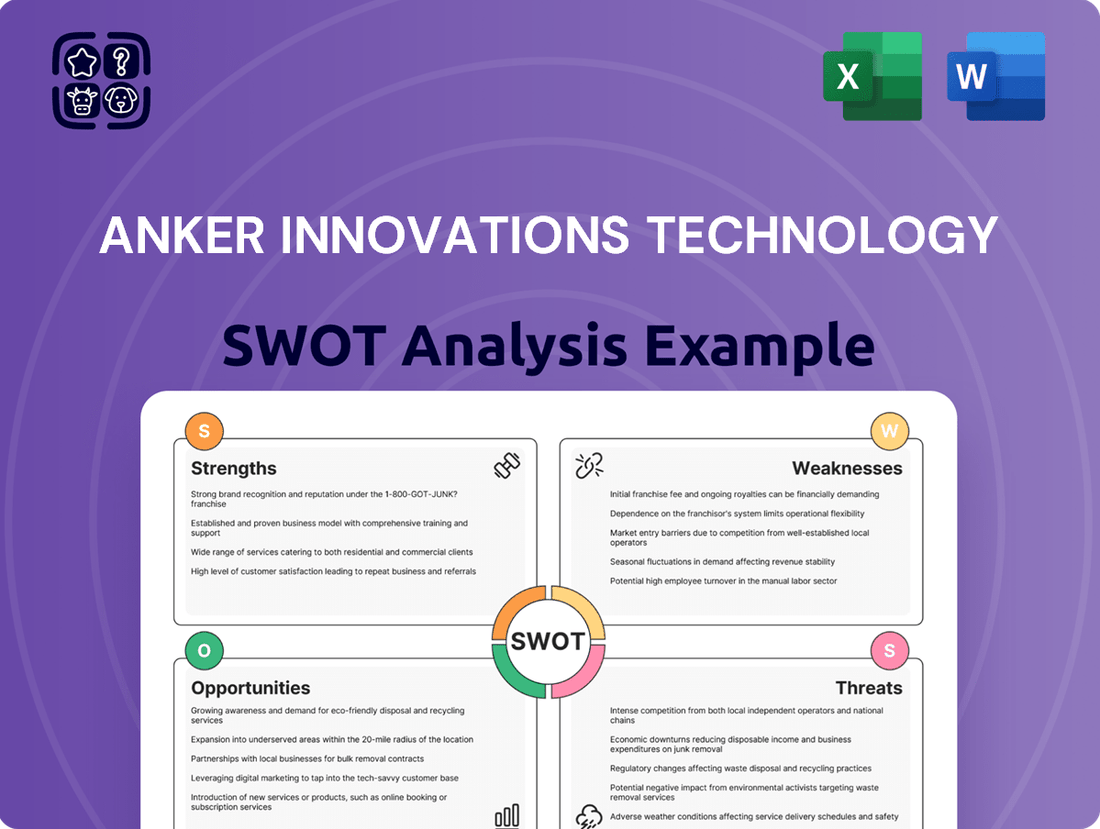

Preview Before You Purchase

Anker Innovations Technology SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality for Anker Innovations Technology.

The preview below is taken directly from the full SWOT report you'll get, offering a comprehensive look at Anker's Strengths, Weaknesses, Opportunities, and Threats.

Purchase unlocks the entire in-depth version, providing actionable insights into Anker Innovations Technology's strategic position.

Opportunities

The smart home and Internet of Things (IoT) market is booming, with projections indicating it will reach $147.62 billion by 2025 and surge to $292.36 billion by 2029. This represents a compound annual growth rate (CAGR) of approximately 17-18.6%.

Anker's Eufy brand is strategically positioned to benefit from this expansion, offering a range of smart lighting, security systems, and robot vacuums. The increasing consumer demand for AI-integrated and connected devices presents a significant opportunity for Eufy to capture market share.

The market for portable power and home energy storage is booming, with Anker SOLIX reporting an impressive 184% revenue surge in 2024, highlighting a strong demand for these solutions. This growth underscores a significant opportunity for Anker to expand its offerings in this dynamic sector.

Furthermore, the burgeoning portable electric vehicle (EV) charger market presents a fresh avenue for Anker to capitalize on its established charging technology expertise. This emerging segment is poised for substantial expansion, offering a new revenue stream.

Continued investment in innovation, particularly in areas like AI-driven energy management and enhanced battery technology, will be crucial. These advancements can unlock further growth potential and solidify Anker's position in the rapidly evolving energy storage landscape.

Emerging markets, particularly India and Southeast Asia, are experiencing robust growth in consumer electronics, fueled by an expanding middle class. Anker's established global localization strategy and distribution networks position it well to capitalize on this trend, enabling deeper market penetration and customer base expansion beyond its current strongholds.

Advancements in AI and 5G Integration

The consumer electronics landscape is being reshaped by the swift rollout of 5G and ongoing AI developments. Anker can capitalize on this by embedding AI more deeply into its smart home ecosystem, boosting automation and user interaction. Furthermore, leveraging 5G’s enhanced speed and reliability in its product line can pave the way for novel connected experiences.

By integrating AI and 5G, Anker can unlock new product categories and improve existing ones. For instance, AI-powered noise cancellation in audio devices or predictive battery management in power banks are tangible benefits. The global 5G infrastructure market is projected to reach over $600 billion by 2026, indicating a substantial opportunity for device manufacturers.

- AI-Enhanced User Experience: Anker can develop smarter charging solutions that learn user habits and optimize power delivery, improving device longevity and convenience.

- 5G-Enabled Connectivity: Faster data transfer speeds through 5G can enable real-time cloud syncing for Anker's smart devices, offering seamless control and data access.

- Innovative Product Development: The synergy between AI and 5G allows for the creation of 'phygital' products, bridging the physical and digital worlds, such as smart wearables with advanced health monitoring and instant data feedback.

Sustainability and Eco-Friendly Product Demand

Growing consumer and regulatory pressure for eco-friendly electronics presents a significant opportunity for Anker. Markets like Europe and North America are showing a clear preference for sustainable products. For instance, a 2024 report indicated that over 60% of consumers in these regions consider sustainability a key factor in their electronics purchases.

Anker can leverage this trend by prioritizing:

- Biodegradable Materials: Incorporating materials that break down naturally reduces electronic waste.

- Enhanced Recyclability: Designing products for easier disassembly and component recycling.

- Energy Efficiency: Developing power banks and chargers that consume less energy during use and charging.

By aligning with these global sustainability movements, Anker can attract environmentally conscious consumers and potentially gain a competitive edge in key markets. This focus on eco-friendly innovation could lead to increased brand loyalty and market share in the coming years.

Anker is well-positioned to capitalize on the expanding smart home and IoT market, which is projected to reach $147.62 billion by 2025 and $292.36 billion by 2029, with a CAGR of 17-18.6%. The company's Eufy brand, offering smart lighting and security, directly benefits from this growth. Additionally, Anker's SOLIX division saw an impressive 184% revenue surge in 2024, demonstrating strong demand in portable power and home energy storage, opening avenues for further expansion in this sector.

Threats

The consumer electronics sector, particularly for charging solutions, faces significant market saturation. This environment breeds intense price competition, putting pressure on companies like Anker to maintain profitability. For instance, in 2024, the global market for mobile phone chargers was estimated to be worth billions, with numerous players vying for market share, often through aggressive pricing strategies.

Anker's strategy of offering competitive pricing is effective, but the persistent downward pressure from a multitude of competitors can squeeze profit margins. This makes it increasingly difficult to command premium pricing for their innovative products, potentially impacting Anker's ability to invest in future research and development.

The consumer electronics sector is notorious for its swift technological evolution, meaning Anker's products can quickly become outdated. This necessitates continuous, substantial investment in research and development to stay competitive. For instance, the smartphone accessory market, a key area for Anker, saw a surge in demand for GaN (Gallium Nitride) charging technology in 2023-2024, making older charging solutions less appealing.

Failure to adapt rapidly to these shifts or anticipate changing consumer desires presents a significant threat. If Anker doesn't successfully integrate emerging technologies, like next-generation battery chemistries or advanced wireless charging standards expected to gain traction by 2025, it risks losing market share to more agile competitors.

Global supply chains are still facing significant risks from geopolitical events and trade disputes. For Anker, which relies heavily on overseas manufacturing and logistics, these disruptions can translate into higher operational costs and delays in getting products to market. For instance, the ongoing semiconductor shortages experienced in 2023 and early 2024 have impacted various electronics manufacturers, potentially affecting Anker's production schedules and inventory levels.

Data Privacy and Security Concerns in Smart Home Devices

Anker's growing Eufy smart home ecosystem, while a strength, also presents a significant threat related to data privacy and security. As more consumers adopt these connected devices, the potential for data breaches or perceived vulnerabilities escalates, directly impacting consumer trust and Anker's brand reputation. A single significant security incident could lead to substantial financial penalties from regulatory bodies and a sharp downturn in sales for its smart home division.

The increasing sophistication of cyber threats means Anker must continually invest in robust security measures to protect user data. For instance, reports in late 2023 and early 2024 highlighted potential vulnerabilities in some smart home devices across the industry, underscoring the constant need for vigilance. Failure to maintain state-of-the-art security could result in:

- Reputational Damage: Loss of consumer confidence can be difficult and costly to regain.

- Regulatory Fines: Stricter data protection laws, like GDPR and CCPA, carry significant penalties for non-compliance.

- Decreased Market Share: Competitors with stronger security track records could gain an advantage.

Counterfeit Products and Intellectual Property Infringement

Anker's strong brand recognition and widespread product adoption unfortunately make it a prime target for counterfeiters, especially on busy online platforms. The presence of these fake goods can significantly damage Anker's reputation, mislead customers, and directly reduce revenue. For instance, reports from various anti-counterfeiting organizations in 2023 indicated a substantial increase in fake electronics sold online, with Amazon alone taking down millions of infringing listings.

The continuous battle to safeguard intellectual property and tackle the global issue of counterfeiting presents a significant and ongoing threat. This challenge requires substantial investment in legal protections, monitoring technologies, and enforcement efforts across numerous jurisdictions.

- Brand Dilution: Fake products erode consumer trust and can lead to a perception of lower quality associated with the Anker brand.

- Sales Impact: Counterfeits directly steal market share and revenue from genuine Anker products.

- Consumer Deception: Buyers may unknowingly purchase inferior counterfeit items, leading to dissatisfaction and potential safety concerns.

- Enforcement Costs: Combating counterfeiting involves significant legal fees, investigation expenses, and technological investments.

Intense market saturation and aggressive pricing strategies from numerous competitors pose a significant threat to Anker's profitability, potentially squeezing margins and limiting R&D investment. The rapid pace of technological change in consumer electronics, particularly in areas like GaN charging and advanced battery technology expected by 2025, necessitates constant, substantial investment to avoid product obsolescence.

Geopolitical instability and trade disputes continue to disrupt global supply chains, leading to increased operational costs and delivery delays for Anker, which relies heavily on overseas manufacturing. Furthermore, Anker's growing Eufy smart home ecosystem faces substantial threats from data privacy concerns and cyber security vulnerabilities, which could lead to reputational damage, regulatory fines, and a loss of consumer trust.

The prevalence of counterfeit products, especially on online platforms, dilutes Anker's brand, deceives consumers, and directly impacts sales, requiring significant investment in intellectual property protection and enforcement.

SWOT Analysis Data Sources

This Anker Innovations Technology SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary, ensuring a data-driven and accurate strategic assessment.