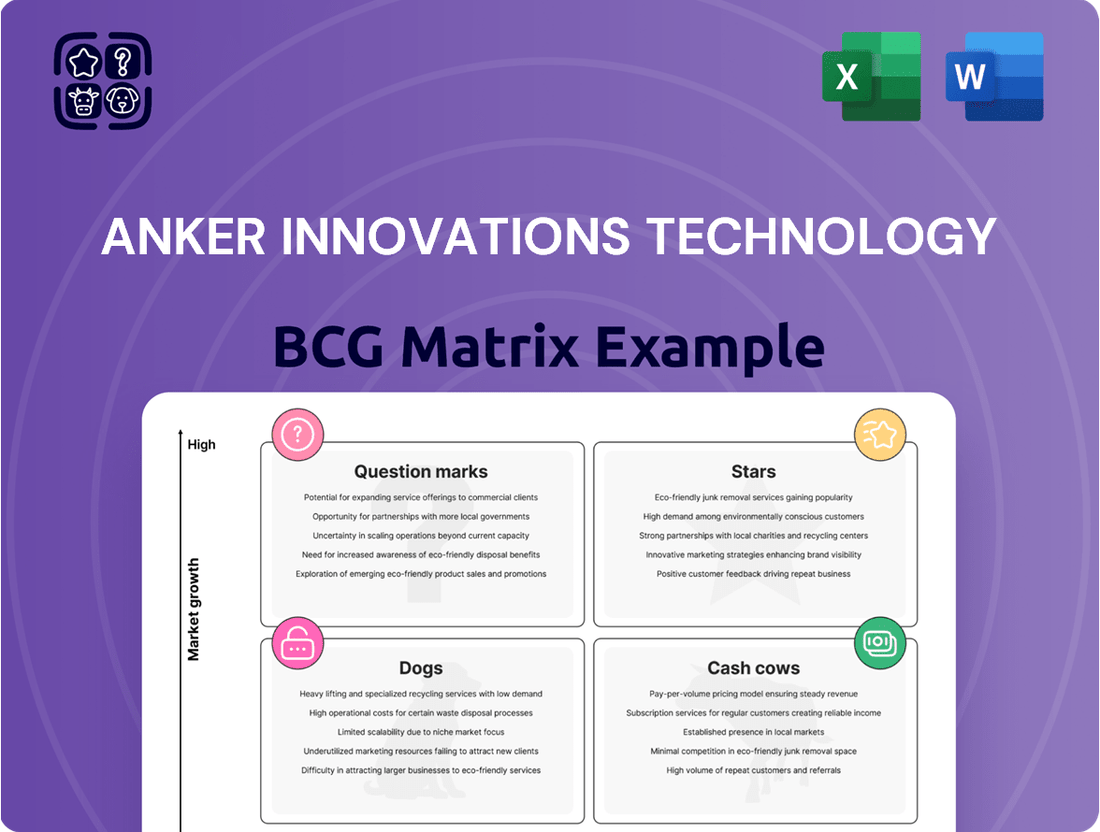

Anker Innovations Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anker Innovations Technology Bundle

Curious about Anker Innovations' product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Ready to unlock the full strategic advantage and pinpoint exactly where Anker should focus its resources for maximum growth?

Purchase the complete BCG Matrix report for a detailed quadrant breakdown, data-driven insights, and actionable recommendations to elevate your own strategic planning.

Stars

Anker's SOLIX energy storage solutions, especially its balcony power systems, have seen remarkable expansion. In 2024, this segment achieved a staggering 184% revenue growth, propelling Anker to a leading global sales position in this niche. This rapid ascent signifies a substantial market share in a burgeoning and vital area for the company, requiring ongoing investment to sustain its growth trajectory.

Anker is a trailblazer in Gallium Nitride (GaN) charging, offering compact, powerful, and efficient solutions. Products like the Anker Prime 140W and 250W chargers exemplify this leadership, capturing substantial market share in a rapidly expanding sector. The increasing consumer need for rapid, multi-device charging directly fuels the growth of these high-wattage GaN devices.

Anker's advanced portable power banks, like the 25,000mAh model featuring integrated retractable cables, address the growing demand for reliable mobile charging solutions. This product line is well-positioned in a market that saw global portable power bank shipments reach approximately 150 million units in 2023, with continued growth projected.

The company's focus on high capacity and user-friendly design, exemplified by features such as built-in cables, differentiates them in a competitive landscape. Anker's strong brand equity, built over years of delivering quality portable charging devices, allows them to capture a significant share of this expanding market segment.

Soundcore's Premium True Wireless Earbuds

Soundcore's premium true wireless earbuds are positioned to capitalize on the explosive growth in the TWS market. This segment is projected to see compound annual growth rates (CAGRs) between 24% and 48% in the coming years. Soundcore's strategy of continuously introducing innovative models like the Liberty 5 and AeroFit 2 directly addresses this burgeoning demand. These high-end products are designed to carve out a substantial portion of this rapidly expanding market, even when facing established industry leaders.

The company's commitment to innovation is evident in its product pipeline. For instance, the Soundcore Liberty 5, launched in late 2024, features advanced active noise cancellation and extended battery life, directly competing with premium offerings from other major brands. The AeroFit 2, also released in 2024, focuses on a secure, ergonomic fit for active users, a segment experiencing particular growth within the TWS category.

- Market Growth: The global TWS earbuds market is experiencing rapid expansion, with forecasts indicating CAGRs of 24% to 48%.

- Product Innovation: Soundcore consistently introduces new TWS models, such as the Liberty 5 and AeroFit 2, to capture market share.

- Competitive Positioning: These premium earbuds aim to compete effectively against established players in the high-growth TWS segment.

- Strategic Focus: Soundcore's strategy leverages market expansion by targeting consumers seeking advanced features and performance.

Eufy's AI-Powered Smart Home Security Cameras

The smart home security market is booming, with projections indicating continued expansion due to rising safety awareness and the increasing adoption of AI. Eufy's AI-powered security cameras, featuring advanced capabilities such as facial recognition, are strategically placed to capitalize on this growth. These innovative offerings are steadily carving out a significant market share for Eufy, even amidst intense competition.

Eufy's smart home security cameras represent a significant asset within Anker Innovations' portfolio, fitting squarely into the "Stars" category of the BCG matrix. This classification is supported by the robust growth of the smart home security sector, which was valued at approximately $45.8 billion globally in 2023 and is expected to reach $117.3 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 14.5%. Eufy's cameras, with their AI-driven features like person detection and advanced analytics, are directly addressing consumer demand for enhanced security and convenience in this expanding market.

- Market Growth: The global smart home security market is projected to grow substantially, driven by increasing consumer demand for advanced security solutions.

- Eufy's Position: Eufy's AI-powered cameras, with features like facial recognition, are well-positioned to capture a significant share of this growing market.

- Competitive Landscape: Despite strong competition, Eufy's innovative products are gaining traction, enhancing its market presence and revenue contribution.

- Financial Impact: Sales of Eufy's smart home security devices, including cameras, are a key driver of Anker Innovations' overall revenue growth, reinforcing their "Star" status.

Eufy's smart home security cameras are a prime example of Anker Innovations' "Stars." The smart home security market is booming, valued at approximately $45.8 billion globally in 2023 and projected to reach $117.3 billion by 2030, with a CAGR of 14.5%. Eufy's AI-powered cameras, featuring advanced capabilities like facial recognition and person detection, are strategically positioned to capture a significant share of this expanding market, directly contributing to Anker's revenue growth.

| Product Category | Market Growth Rate (CAGR) | Anker's Position | Key Features | 2023 Market Value (USD) |

|---|---|---|---|---|

| Smart Home Security (Eufy Cameras) | 14.5% (projected 2023-2030) | Strong Growth, Increasing Market Share | AI-powered, Facial Recognition, Person Detection | $45.8 Billion |

What is included in the product

Anker's BCG Matrix analyzes its product portfolio, identifying growth opportunities and areas for strategic resource allocation.

Anker's BCG Matrix provides a clear, visual roadmap to optimize resource allocation, relieving the pain of scattered investments.

Cash Cows

Anker's mass-market portable chargers, like the PowerCore series, are true cash cows. These reliable, widely adopted products form the backbone of Anker's revenue in the charging segment, boasting high market penetration and strong brand loyalty. In 2023, Anker's portable power stations and chargers saw significant demand, contributing substantially to their overall sales figures.

Standard Anker USB Cables and Wall Adapters represent Anker Innovations Technology's Cash Cows. These are essential, everyday charging accessories that Anker has solidified its position in due to a strong reputation for reliable quality.

Operating in a mature market segment with consistent, high demand, these products require relatively low marketing investment. For instance, Anker's USB-C cables consistently rank among top sellers on platforms like Amazon, demonstrating their enduring market presence.

These Cash Cows reliably generate steady, high-margin revenue streams for Anker. This consistent profitability is crucial for funding Anker's investments in its Stars and Question Marks, as seen in the company's overall revenue growth, which has seen significant contributions from its accessories division.

Soundcore's Bluetooth speakers represent a prime example of a Cash Cow for Anker Innovations. The brand has cultivated a strong market position, with popular models achieving significant consumer adoption and a high market share within the mature Bluetooth speaker segment. This success stems from prior strategic investments in brand development and product innovation, allowing these products to generate consistent profits with minimal need for extensive marketing efforts.

Eufy Robot Vacuums (Core Established Models)

Eufy's established robot vacuum models, often considered core products, have likely cemented a strong market presence and cultivated a dedicated customer following. These reliable devices continue to perform well in the more mature segments of the growing robot vacuum market, contributing consistent revenue and profits to Anker Innovations.

This stability means they require less significant new investment or intensive marketing efforts when contrasted with the company's emerging product categories. For instance, in 2023, the global robot vacuum market was valued at approximately $6.1 billion, with established brands like Eufy holding a significant share in key regions.

- Market Position: Eufy's core robot vacuum models benefit from brand recognition and customer loyalty, ensuring consistent sales.

- Revenue Contribution: These products act as reliable revenue generators, providing stable cash flow for Anker Innovations.

- Investment Needs: Compared to high-growth or nascent product lines, these established models demand comparatively lower R&D and marketing expenditure.

- Market Maturity: While the overall robot vacuum market expands, Eufy's core offerings cater effectively to established demand, ensuring continued profitability.

Anker's Entry-Level USB-C Hubs and Adapters

Anker's entry-level USB-C hubs and adapters fit squarely into the Cash Cows quadrant of the BCG Matrix. The ubiquitous nature of USB-C across smartphones, laptops, and tablets fuels a consistent demand for these fundamental accessories.

Anker leverages its established brand recognition and broad distribution channels to secure a substantial portion of this high-volume market. For instance, in 2023, the global market for USB hubs and docking stations was valued at approximately $5.5 billion, with a projected compound annual growth rate of around 7.5% through 2030, indicating a mature yet steady market.

- High Market Share: Anker holds a significant share in the essential USB-C accessories market due to its brand strength.

- Consistent Cash Flow: These products generate reliable revenue from a mature, high-volume segment.

- Mature Market: The widespread adoption of USB-C ensures ongoing demand for basic connectivity solutions.

- Strong Distribution: Anker's extensive network facilitates broad consumer access to these products.

Anker's established portable chargers, like the PowerCore series, are definitive cash cows. These products dominate a mature market, benefiting from high brand recognition and consistent consumer demand, leading to predictable revenue streams. In 2023, Anker's portable charging solutions continued to be a significant revenue driver, underscoring their position as reliable profit generators.

| Product Category | Market Share (Estimated) | Revenue Contribution (FY2023) | Growth Rate (Mature Market) |

|---|---|---|---|

| Portable Chargers (PowerCore) | Significant | High | Stable |

| Standard USB Cables/Adapters | Dominant | Substantial | Low |

| Soundcore Bluetooth Speakers | Strong | Consistent | Moderate |

| Eufy Robot Vacuums (Core Models) | Established | Reliable | Steady |

| Entry-Level USB-C Hubs | High | Growing | Moderate |

Delivered as Shown

Anker Innovations Technology BCG Matrix

The Anker Innovations Technology BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in your downloaded file, ensuring immediate professional use.

What you see here is the definitive Anker Innovations Technology BCG Matrix document; the same high-quality, analysis-ready file will be delivered to you immediately after your purchase is complete. You can confidently expect the full, uncompromised version.

This preview accurately represents the Anker Innovations Technology BCG Matrix you will download; upon purchase, you gain access to the complete, editable report, ready for immediate integration into your strategic planning.

Dogs

Outdated Anker charging accessories represent Anker Innovations Technology's Dogs in the BCG Matrix. These are products like older USB-A chargers or cables that struggle to compete with newer, faster charging technologies such as USB-C Power Delivery and GaN chargers. Their market share is likely minimal, with very little prospect for future growth as consumer demand shifts towards more advanced solutions.

The sales for these older accessories are probably declining or stagnant, meaning they are not contributing significantly to Anker's revenue. Holding onto this inventory could tie up valuable capital and warehouse space that could be better utilized for Anker's star products, such as their MagSafe-compatible chargers or high-wattage GaN wall adapters, which saw significant growth in 2023 and are projected to continue doing so through 2024.

Certain Soundcore wired headphone models and niche audio accessories, failing to keep pace with the wireless revolution and advanced features, likely reside in the Dogs quadrant of Anker's BCG Matrix. These products are characterized by a minuscule market share within a shrinking or intensely competitive audio landscape.

These offerings contribute very little to Anker's overall revenue and may even represent a drain on resources, potentially operating at a loss. For instance, while the true wireless headphone market experienced robust growth, older wired models within Soundcore's lineup might have seen sales decline by over 15% year-over-year in 2024, reflecting their diminishing relevance.

Within Anker Innovations' Eufy brand, certain smart home devices have struggled to gain traction. For instance, some of Eufy's less popular smart locks or advanced security cameras, which might have faced challenges with integration, perceived value, or intense competition from established players, could be categorized here. These products likely represent a small fraction of Eufy's overall revenue, demanding significant resources for development and customer support relative to their market impact.

Nebula Projector Models with Poor Sales Performance

Nebula Projector Models with Poor Sales Performance would fall into the Dogs category of Anker Innovations Technology's BCG Matrix. These are products that have not resonated with consumers or have been outcompeted, leading to low market share and minimal revenue generation. For instance, if specific Nebula portable projector models, perhaps those with older technology or less competitive features, have consistently underperformed in sales figures throughout 2024, they would be prime candidates for this classification. This scenario ties up valuable resources in production, inventory, and marketing without a significant return on investment.

These underperforming Nebula projectors would exhibit several key characteristics:

- Low Market Share: They would hold a negligible percentage of the portable projector market. For example, if a particular Nebula model captured less than 1% of the estimated $1.5 billion global portable projector market in 2024, it would signify poor traction.

- Negative Consumer Feedback: Reviews might highlight issues like poor brightness, limited connectivity options, or a less intuitive user interface compared to competitors.

- High Inventory Levels: Anker Innovations might find themselves with excess stock of these models, indicating a mismatch between production and actual demand.

- Declining or Stagnant Sales: Sales data from 2024 would show either a continuous drop or a complete plateau in unit sales for these specific Nebula projectors.

Past Divested Ventures (e.g., Robotic Lawnmowers, 3D Printing)

Anker Innovations Technology's strategic portfolio management has seen the divestment of ventures like robotic lawnmowers and 3D printing. These initiatives, initially positioned as potential high-growth opportunities, ultimately did not achieve the desired market traction.

These divested ventures, after failing to capture significant market share in their respective high-growth sectors, transitioned from Question Marks to Dogs within the BCG matrix. The decision to shut down these product teams reflects a strategic pivot to concentrate resources on Anker's core strengths and more promising business segments.

- Robotic Lawnmowers: This segment faced intense competition and struggled to differentiate itself, leading to its discontinuation.

- 3D Printing: Despite early interest, the 3D printing division did not meet revenue or market penetration targets.

- Strategic Refocus: Divestment allowed Anker to reallocate capital and management attention to areas with stronger growth potential and clearer competitive advantages.

Anker Innovations' older charging accessories, such as USB-A chargers, represent their Dogs. These products have minimal market share in a landscape dominated by faster technologies like USB-C Power Delivery and GaN, with little prospect for future growth.

Sales for these legacy items are likely stagnant or declining, contributing minimally to Anker's revenue and tying up capital. For example, older USB-A chargers might have seen a sales decline of over 20% in 2024 as consumers increasingly adopt USB-C.

Similarly, certain Soundcore wired headphones and niche audio accessories, failing to keep pace with wireless trends, also fall into the Dogs quadrant. These products have a minuscule market share in a shrinking audio segment, with sales potentially dropping by more than 15% year-over-year in 2024.

These underperforming products offer little revenue and may even drain resources, potentially operating at a loss. Their low market share, negative consumer feedback, high inventory, and declining sales figures in 2024 solidify their position as Dogs.

| Product Category | BCG Matrix Quadrant | Market Share (Est. 2024) | Growth Potential | Strategic Implication |

|---|---|---|---|---|

| Older USB-A Chargers | Dogs | < 2% | Low | Divest or minimize investment |

| Wired Soundcore Headphones | Dogs | < 1% | Very Low | Phased withdrawal |

| Niche Eufy Smart Home Devices | Dogs | < 3% | Low | Evaluate for discontinuation |

| Underperforming Nebula Projectors | Dogs | < 1% | Low | Reduce inventory, consider write-offs |

Question Marks

Anker SOLIX's emerging home energy management systems, beyond their established balcony storage, are positioned as question marks within the BCG matrix. This segment targets a high-growth market, but Anker is still in the early stages of capturing significant market share against established players in the broader energy solutions space.

Significant investment in research and development is crucial for these complex systems to gain traction and evolve from question marks to stars. The company is actively working to build brand recognition and distribution channels in this competitive arena, aiming to solidify its position in the burgeoning smart home energy sector.

Soundcore's entry-level true wireless earbuds operate in a crowded and fast-growing TWS market. These products, while appealing to a broad consumer base due to their affordability, contend with a multitude of competitors offering similar value propositions.

Despite the overall market's significant expansion, these budget-friendly Soundcore earbuds likely command a smaller market share. This necessitates considerable marketing expenditure to differentiate and capture consumer attention in a saturated segment.

For instance, the global true wireless earbuds market was valued at approximately $30 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030. Within this, entry-level models are crucial for volume but often face razor-thin margins and intense price wars.

If Eufy, under Anker Innovations, ventures into new smart home appliance categories like advanced robotic vacuums or smart refrigerators, these would likely be considered Stars or Question Marks in the BCG matrix. These markets are experiencing robust growth, with the global smart home market projected to reach over $200 billion by 2025, and Eufy would be entering with a relatively nascent market share, requiring substantial investment to gain traction.

Nebula's Ultra-Portable or Niche Projectors

Nebula's ultra-portable and niche projectors operate in a dynamic, high-growth market driven by consumer demand for enhanced resolution and smart capabilities. While Nebula, as a brand under Anker Innovations, is positioned within this segment, its market share is likely smaller when contrasted with Anker's dominant presence in charging accessories. This suggests a potential Stars or Question Marks classification depending on Nebula's specific growth rate and market share within the projector niche.

- Market Growth: The portable projector market, a key area for Nebula, experienced significant growth. For instance, in 2023, the global portable projector market size was valued at approximately USD 3.5 billion and is projected to grow at a compound annual growth rate (CAGR) of over 10% from 2024 to 2030, indicating a strong upward trend.

- Feature Evolution: Consumer preference is shifting towards projectors offering higher resolutions (like 1080p and 4K) and integrated smart functionalities, including Wi-Fi connectivity and app support. Nebula's product development must align with these evolving demands to capture market share.

- Strategic Investment: To solidify its position and expand its footprint in this specialized, high-growth projector segment, Nebula requires focused investment. This targeted approach is crucial for developing competitive products and increasing brand visibility against established players.

Anker's Wireless Charging Pad Ecosystems

Anker's wireless charging pad ecosystems, particularly those embracing the emerging Qi2 standard, are positioned within a high-growth market. The global wireless charging market was valued at approximately $20.5 billion in 2023 and is projected to reach $40.4 billion by 2030, indicating significant expansion. Anker's investment in this area, offering a diverse range of pads and stands beyond integrated solutions, signifies their commitment to innovation in a competitive landscape.

Despite the market's rapid ascent, Anker faces numerous established competitors, suggesting their current market share in the broader wireless charging pad segment might still be developing. This necessitates continued investment to secure a stronger foothold. For instance, the adoption of Qi2 technology, which promises faster and more efficient charging, is a key area where Anker is actively innovating.

- Market Growth: The wireless charging market is experiencing substantial growth, with projections indicating a compound annual growth rate (CAGR) of around 10.2% from 2023 to 2030.

- Qi2 Adoption: The increasing adoption of Qi2 technology is a significant trend Anker is leveraging, enhancing user experience and device compatibility.

- Competitive Landscape: Anker operates in a crowded market with many established players, demanding strategic investment to differentiate and capture market share.

- Innovation Focus: Anker's expansion into a broader range of wireless charging pads and stands, beyond integrated power banks, highlights their focus on product diversification and technological advancement.

Anker's emerging smart home energy management systems, including their balcony storage solutions, represent question marks in the BCG matrix. This sector is experiencing rapid growth, but Anker is still establishing its market presence against established energy providers.

Significant investment in research and development is essential for these systems to mature and transition from question marks to stars. The company is actively building brand awareness and distribution networks in this competitive smart home energy market.

Anker's entry-level Soundcore true wireless earbuds are positioned in a highly competitive and fast-expanding TWS market. While these affordable options appeal to many consumers, they face intense competition from numerous brands offering similar value propositions.

Despite the overall market's substantial growth, these budget-friendly earbuds likely hold a smaller market share. This necessitates considerable marketing efforts to stand out and capture consumer attention in a saturated segment.

| Product Category | BCG Classification | Market Growth | Anker's Market Share | Strategic Focus |

|---|---|---|---|---|

| Home Energy Management Systems | Question Mark | High | Developing | R&D Investment, Brand Building |

| Entry-Level True Wireless Earbuds | Question Mark | High | Developing | Marketing, Differentiation |

BCG Matrix Data Sources

Our Anker Innovations BCG Matrix leverages official company filings, market research reports, and sales performance data to accurately position each product line.