Anker Innovations Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anker Innovations Technology Bundle

Anker Innovations Technology navigates a dynamic market, facing moderate bargaining power from both buyers and suppliers due to its strong brand recognition and diverse product portfolio. The threat of new entrants is significant, as the consumer electronics industry has relatively low barriers to entry, while the threat of substitutes is also a key consideration with rapid technological advancements.

The complete report reveals the real forces shaping Anker Innovations Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Anker Innovations, a major player in consumer electronics, faces significant supplier power due to its reliance on specialized components. The consumer electronics industry, in general, depends heavily on a global network for essentials such as batteries, advanced semiconductors, and various raw materials.

When a few key suppliers control the market for these critical components, their ability to dictate terms, including pricing and delivery schedules, grows substantially. This concentration can translate into higher input costs or even disruptions in the supply chain for companies like Anker. For instance, the global semiconductor shortage that began in late 2020 and continued through 2023 significantly impacted numerous electronics manufacturers, leading to production delays and increased component prices.

Anker's manufacturing base, primarily located in China, further amplifies its exposure to the dynamics within that region's supply chain. Any shifts in production capacity, export policies, or material availability within China can directly affect Anker's operational efficiency and cost structure.

The ease with which Anker Innovations can switch suppliers significantly influences the bargaining power of those suppliers. If Anker has deeply integrated specific suppliers into its manufacturing processes, perhaps through custom-designed components or specialized tooling, the cost and effort required to transition to a new supplier would be substantial. This creates high switching costs, thereby strengthening the leverage of existing suppliers.

Anker's strategic focus on core charging products, like power banks and chargers, suggests a supply chain tailored to these specific needs. This specialization can lead to suppliers developing unique expertise or proprietary processes related to Anker's product requirements. Consequently, finding alternative suppliers capable of matching this specialized capability might be challenging and costly for Anker, further empowering their current suppliers.

If suppliers offer unique, patented, or highly specialized components crucial for Anker's innovative products, their bargaining power increases. This is particularly relevant for advanced technologies like AI components for smart devices or specialized battery cells for portable charging solutions.

Anker's substantial investment in research and development, especially in energy storage technologies, may necessitate reliance on suppliers providing highly specific and potentially proprietary components, thus enhancing supplier leverage.

Threat of Forward Integration by Suppliers

Suppliers could threaten Anker Innovations by integrating forward, essentially becoming direct competitors by manufacturing and selling their own consumer electronics. This would mean they'd be vying for the same customers Anker targets.

However, this threat is typically low for companies like Anker, which thrive on strong branding and established distribution networks in the consumer electronics space. Building a recognizable brand and securing shelf space or online visibility requires substantial investment and expertise that many component suppliers may not possess.

While most component suppliers are unlikely to make this leap, there's a possibility that very large, diversified manufacturers could explore this avenue. For instance, a major semiconductor or battery producer might see an opportunity to leverage their existing manufacturing capabilities and supply chain relationships to enter the finished product market, though this remains a niche concern for Anker.

- Low Threat of Forward Integration: The consumer electronics market demands significant investment in brand building and distribution, making it difficult for most suppliers to compete directly with established players like Anker.

- Potential for Large Manufacturers: Very large component manufacturers with extensive resources might consider forward integration, though this is not a widespread threat.

- Anker's Competitive Advantages: Anker's strength lies in its brand recognition and established sales channels, which are significant barriers to entry for potential supplier competitors.

Importance of Anker to Supplier's Business

Anker Innovations' substantial revenue, exceeding $3.65 billion in the trailing twelve months as of early 2024, positions it as a major client for many of its suppliers. This scale means that for a supplier, Anker likely represents a significant portion of their overall business. Consequently, suppliers become more reliant on Anker's continued patronage, which inherently weakens their bargaining power. If Anker were to reduce its orders or seek more favorable terms, a supplier heavily dependent on Anker would face considerable financial strain.

Conversely, if Anker is a relatively small customer for a very large supplier, the dynamic shifts. In such a scenario, the supplier’s dependence on Anker is minimal, granting them greater leverage in negotiations. They can afford to be less accommodating to Anker's demands, knowing that Anker's business is not critical to their own financial health. This asymmetry in dependence is a key determinant of bargaining power.

- Anker's significant revenue ($3.65B+ TTM as of early 2024) implies substantial order volumes for its suppliers.

- High dependence on Anker for a supplier reduces its bargaining power due to the risk of losing a major revenue stream.

- Suppliers with diversified customer bases and less reliance on Anker would possess stronger negotiation leverage.

- Anker's scale as a global electronics company allows it to negotiate more favorable terms with suppliers who view it as a key strategic partner.

Anker Innovations' reliance on specialized components, particularly in batteries and semiconductors, grants significant leverage to its suppliers. The concentrated nature of these markets, coupled with high switching costs for Anker due to component integration, amplifies supplier power. For instance, the global semiconductor shortage extending into 2023 demonstrated how supply constraints can dictate terms and increase costs for electronics manufacturers.

Suppliers' bargaining power is also influenced by the uniqueness of their offerings; proprietary or patented components crucial for Anker's innovative products give them an advantage. While Anker's substantial revenue of over $3.65 billion (TTM early 2024) makes it a key client for many, reducing supplier dependence on Anker, the inverse is true if Anker is a small customer for a large supplier, thereby increasing the supplier's leverage.

The threat of forward integration by suppliers into Anker's market is generally low, as building Anker's brand and distribution network requires substantial investment. However, very large, diversified manufacturers could potentially pose a threat, although this remains a niche concern for Anker given its established market position.

| Factor | Anker's Situation | Impact on Supplier Bargaining Power |

|---|---|---|

| Component Specialization | High reliance on specialized batteries, semiconductors | Increases power |

| Switching Costs | Deep integration, custom components | Increases power |

| Supplier Concentration | Few key suppliers for critical components | Increases power |

| Uniqueness of Offerings | Proprietary or patented components | Increases power |

| Anker's Revenue Size | $3.65B+ TTM (early 2024) | Decreases power (for suppliers reliant on Anker) |

| Supplier Dependence on Anker | Varies; high dependence weakens supplier | Decreases power (if supplier is dependent) |

| Forward Integration Threat | Generally low due to branding/distribution needs | Low impact |

What is included in the product

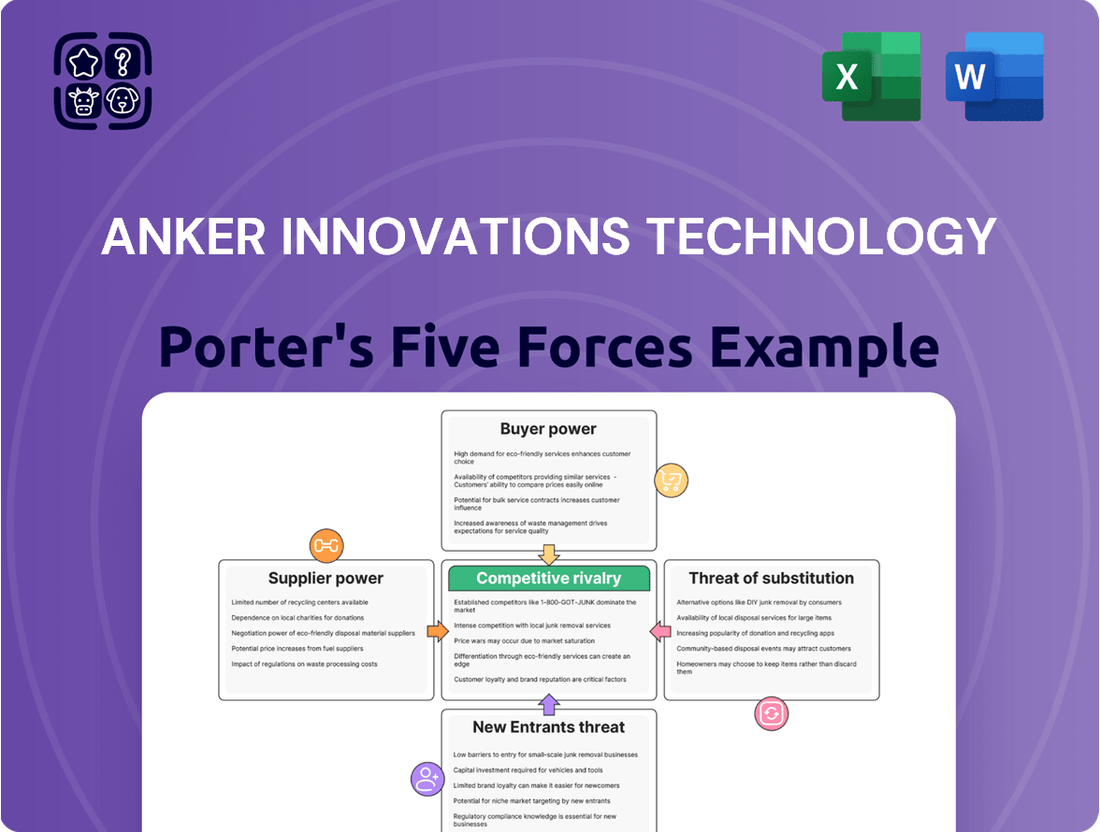

This analysis of Anker Innovations Technology dissects the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, providing strategic insights into its competitive environment.

Anker's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick, strategic decision-making.

Customers Bargaining Power

Customers in the consumer electronics space, particularly for items like portable chargers and audio gear, often exhibit price sensitivity. This is especially true when products become more standardized or commoditized. For instance, in 2023, the global portable power bank market saw significant competition on price.

Anker Innovations, however, has consistently demonstrated a strong ability to balance competitive pricing with a perceived high value, as evidenced by its robust gross margins. For example, Anker reported a gross profit margin of 42.9% in the first half of 2024, indicating they successfully navigate customer price sensitivity by offering quality and features that justify their pricing.

The sheer abundance of alternative brands and products in Anker's core markets, like portable charging, audio gear, and smart home devices, significantly bolsters customer bargaining power. For instance, the portable power bank market alone features hundreds of competitors, many offering comparable specifications at similar price points, making it easy for consumers to switch.

Customers today are incredibly informed, thanks to the internet. They can easily access online reviews, compare prices across different retailers, and scrutinize detailed product specifications. This wealth of readily available information significantly boosts their bargaining power when considering a purchase.

Anker Innovations' reliance on online retail as a primary sales channel means customers have even more access to this comparative data. For instance, a quick search in mid-2024 for Anker's popular portable chargers might reveal dozens of competitor products with detailed performance metrics and user feedback, allowing customers to pinpoint the best value and negotiate implicitly through their purchasing choices.

Switching Costs for Customers

For Anker Innovations Technology, the bargaining power of customers is significantly influenced by switching costs. For most of Anker's product categories, such as power banks, headphones, and smart home devices, these costs are notably low. Customers can readily transition to a competitor's offering without incurring substantial financial penalties or experiencing significant inconvenience.

This low barrier to switching directly enhances the power customers wield. For instance, in the competitive portable power market, a consumer looking for a new power bank can easily compare features and prices from brands like Anker, Belkin, or RAVPower. If Anker’s pricing or product features become less attractive, a customer can switch to another brand with minimal effort, thereby pressuring Anker to maintain competitive pricing and product innovation.

- Low Switching Costs: Customers can easily move between brands of power banks, headphones, and smart home devices without significant financial or convenience hurdles.

- Increased Customer Power: The ease of switching empowers customers to demand better pricing and product quality from Anker.

- Market Dynamics: In 2024, the consumer electronics market continues to be characterized by readily available alternatives, reinforcing the low switching cost environment for many of Anker's product lines.

Customer Concentration

Anker Innovations primarily sells to a vast global consumer market, largely through online channels and a network of distributors. This broad customer base means no single customer wields significant influence over Anker's pricing or terms.

The company's direct-to-consumer (DTC) strategy, particularly through its own website and platforms like Amazon, further disperses its customer relationships. In 2023, Anker reported that its largest single customer accounted for less than 10% of its total revenue, underscoring the low customer concentration.

- Low Customer Concentration: Anker's sales are spread across millions of individual consumers globally.

- Reduced Individual Bargaining Power: The absence of a dominant customer prevents any single entity from dictating terms.

- Online Sales Dominance: E-commerce platforms and Anker's own DTC channels facilitate a wide reach, diluting individual customer impact.

- Diversified Distribution: Relying on numerous distributors worldwide further limits the power of any one channel partner.

Anker Innovations faces a significant bargaining power from its customers due to the highly competitive consumer electronics landscape and the ease with which consumers can switch between brands. The proliferation of numerous brands offering similar portable chargers, audio devices, and smart home gadgets means customers have ample choices, often at comparable price points. This abundance directly translates into greater leverage for buyers, pressuring Anker to maintain competitive pricing and continuously innovate to retain customer loyalty.

The company's direct-to-consumer (DTC) model and reliance on online marketplaces like Amazon further amplify customer power by providing easy access to price comparisons, detailed reviews, and alternative product offerings. For instance, in 2024, a quick search for portable power banks revealed hundreds of competitors, many with specifications very similar to Anker's popular models. This transparency empowers consumers to make informed decisions, often choosing based on the best perceived value, which in turn forces Anker to be highly responsive to market demands and pricing pressures.

While Anker has managed to maintain strong gross margins, such as 42.9% in the first half of 2024, this is partly a testament to their success in mitigating customer bargaining power through brand loyalty and perceived value, rather than an absence of it. The low switching costs across most of Anker's product categories mean that customer power remains a critical factor, compelling the company to focus on delivering superior product quality and features to justify its pricing and fend off intense competition.

Preview Before You Purchase

Anker Innovations Technology Porter's Five Forces Analysis

This preview showcases the complete Anker Innovations Technology Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

Anker Innovations operates in a fiercely competitive consumer electronics arena. The market is crowded with a multitude of global and regional brands vying for market share across various product categories. For instance, in portable charging, Anker faces strong competition from giants like Xiaomi and Samsung, while the audio segment sees established players such as Bose and Sony.

The smart home device sector is particularly dynamic, with tech behemoths like Amazon, Apple, Google, and Samsung offering extensive product ecosystems. This broad and diverse competitive landscape significantly intensifies the rivalry Anker must navigate, demanding continuous innovation and strategic pricing to maintain its position.

The consumer electronics sector is experiencing healthy growth, with projections suggesting a compound annual growth rate (CAGR) between 2.8% and 6.6% from 2025 to 2034, depending on specific product categories. However, this expansion doesn't eliminate fierce competition, particularly in established markets like power banks where market share battles are common.

Anker Innovations demonstrated its competitive prowess in 2024 by achieving robust revenue growth, underscoring its capacity to thrive amidst this dynamic and often crowded marketplace.

Anker Innovations stands out by heavily investing in product differentiation across its diverse brand portfolio, including Anker, Soundcore, Eufy, and Nebula. This strategy focuses on delivering superior quality, cutting-edge innovation, and building a strong, trusted brand reputation among consumers.

The company's commitment to research and development is a key driver of its competitive edge. In 2023, Anker continued to launch numerous new products, many of which received industry awards, underscoring their technological advancements and user-centric design. This consistent stream of innovative offerings helps Anker capture market share and maintain strong customer loyalty in a crowded consumer electronics landscape.

Exit Barriers

Anker Innovations faces considerable competitive rivalry, partly due to high exit barriers within the consumer electronics sector. These barriers make it difficult and costly for companies to leave the market, even when facing low profitability. For instance, substantial investments in brand building and the establishment of robust supply chain networks create significant sunk costs.

These factors trap companies like Anker in the market, often leading to prolonged periods of intense competition as firms strive to maintain market share despite potentially diminished returns. In 2023, the global consumer electronics market was valued at over $1.1 trillion, indicating a large and attractive, yet highly competitive, landscape where exiting is not a simple decision.

The need to recoup significant investments in specialized manufacturing equipment and R&D further solidifies these exit barriers. Companies are often compelled to continue operations, driving down prices and increasing promotional activities to offset fixed costs, thereby intensifying the rivalry among existing players.

- High Brand Investment: Companies like Anker invest heavily in brand recognition and customer loyalty, making it difficult to divest these assets without substantial loss.

- Established Supply Chains: Long-term contracts and established relationships within global supply chains represent significant fixed costs and operational complexities that hinder easy exit.

- Specialized Assets: The consumer electronics industry often requires specialized manufacturing equipment and tooling, which have limited resale value outside the industry.

- R&D Commitments: Continuous investment in research and development to stay competitive means ongoing financial commitments that are hard to abandon abruptly.

Brand Identity and Loyalty

Anker Innovations benefits significantly from its robust brand identity and the resulting customer loyalty, especially within the portable charging market. This strong recognition acts as a substantial barrier against intense price wars, encouraging consumers to opt for Anker products based on trust and perceived quality rather than solely on cost. For instance, Anker consistently ranks high in consumer satisfaction surveys for power banks and charging accessories, demonstrating this loyalty.

This established brand equity directly influences competitive rivalry by reducing the pressure for Anker to engage in aggressive price reductions. Customers who are loyal to Anker are more likely to make repeat purchases, thereby insulating the company from the immediate impact of new entrants or competitors attempting to gain market share through lower pricing. This loyalty translates into more predictable sales volumes and a stronger market position.

- Brand Recognition: Anker is widely recognized for its reliable power banks and charging solutions, fostering trust among consumers.

- Customer Loyalty: A significant portion of Anker's customer base exhibits repeat purchasing behavior, valuing the brand's consistent quality.

- Reduced Price Sensitivity: Strong brand loyalty allows Anker to command premium pricing, mitigating direct competition based solely on price.

- Market Stability: Loyalty contributes to a more stable demand for Anker products, lessening the intensity of rivalry in its core segments.

Anker Innovations faces intense competition from numerous global and regional players in the consumer electronics market. The company's strategy of heavy investment in product differentiation and R&D, exemplified by numerous award-winning product launches in 2023, helps it stand out. Despite a growing market, estimated to be worth over $1.1 trillion globally in 2023, Anker's strong brand equity and customer loyalty, particularly in portable charging, mitigate the impact of price wars.

| Competitive Factor | Description | Anker's Position |

| Market Saturation | Crowded with many global and regional brands | High competition from players like Xiaomi, Samsung, Bose, Sony, Amazon, Apple, Google |

| Product Innovation | Continuous need for new and improved products | Strong R&D investment; frequent award-winning product launches in 2023 |

| Brand Loyalty | Customer preference for established, trusted brands | Significant customer loyalty, especially in power banks, reducing price sensitivity |

| Exit Barriers | Difficulty and cost for companies to leave the market | High due to investments in brand, supply chains, specialized assets, and R&D |

SSubstitutes Threaten

For portable charging, Anker faces substitutes like direct wall charging, car chargers, and even devices with significantly longer battery lives, reducing the need for external power. In 2023, the global power bank market was valued at approximately $10.5 billion, indicating a substantial market Anker operates within, but also highlighting the presence of numerous competitors offering these alternative charging methods.

In the audio space, Anker's portable speakers compete with the built-in speakers of smartphones and tablets, as well as the option of simply foregoing dedicated audio equipment altogether. The increasing quality of integrated device audio means a segment of consumers may not see the need for a separate Anker product.

Within the smart home sector, Anker's offerings are challenged by manual controls for appliances and less integrated, simpler home automation systems. As of early 2024, while smart home adoption continues to grow, a significant portion of households still rely on traditional methods for controlling their environment.

The threat of substitutes for Anker Innovations' products is significant when those substitutes offer a similar benefit at a lower cost. For instance, while Anker's portable power banks provide crucial on-the-go charging, readily accessible and often free wall outlets serve as a direct, albeit less portable, substitute. This price-performance trade-off is a key factor; if a substitute’s value proposition is strong and its price point is considerably lower, it directly erodes Anker's market share. In 2024, the increasing ubiquity of charging infrastructure in public spaces and workplaces further amplifies this threat.

Customer willingness to switch to alternatives for Anker's products, like portable power banks, hinges on factors such as convenience, cost savings, and the perceived value of those alternatives. If, for example, smartphone battery technology advances significantly, reducing the daily need for external charging, this would directly impact the demand for Anker's power banks.

The market for portable power solutions is dynamic. In 2023, the global portable power bank market was valued at approximately USD 10.5 billion, with projections indicating continued growth. However, advancements in device battery efficiency and the increasing availability of reliable public charging stations represent potential substitute threats that could dampen this growth.

Technological Advancements in Substitutes

Emerging technologies pose a significant threat to Anker's product lines. For instance, advancements in faster charging directly integrated into devices, or more efficient internal batteries, could reduce the demand for external power banks. Similarly, the development of advanced wireless power transfer solutions might make traditional charging cables and portable chargers less appealing.

Furthermore, improvements in smart home device interoperability could create more seamless, integrated alternatives to Anker's standalone charging and power solutions. As of early 2024, the global market for wireless charging is projected to reach over $30 billion, indicating a strong growth trajectory for these potentially substitutive technologies.

- Integrated Device Charging: Future smartphones and laptops with significantly longer battery life or ultra-fast internal charging capabilities could lessen reliance on external power banks.

- Advanced Wireless Power: Widespread adoption of long-range wireless charging or power-over-ethernet solutions could diminish the need for portable charging accessories.

- Smart Home Ecosystems: Enhanced interoperability within smart home platforms might offer centralized power management and charging, reducing the appeal of individual Anker devices.

Indirect Substitutes

Beyond direct product replacements, shifts in consumer behavior and lifestyle can introduce indirect substitutes for Anker Innovations' products. For instance, a global trend towards reduced travel, as seen during certain periods, could dampen demand for portable chargers and power banks, key revenue drivers for Anker. In 2023, global tourism expenditure, while recovering, remained below pre-pandemic levels in many regions, illustrating this potential impact.

Furthermore, a growing preference for simpler, less connected living environments might affect the adoption rates of smart home devices, another segment where Anker is expanding. If consumers opt for fewer smart gadgets, the need for complementary accessories like smart plugs or charging hubs could diminish. This behavioral shift represents a subtle yet significant substitute threat by altering the underlying demand for connected ecosystems.

The rise of alternative energy solutions or different approaches to power management could also serve as indirect substitutes. For example, increased adoption of solar-powered charging for personal devices or a shift towards longer-lasting, integrated device batteries could reduce reliance on external charging accessories. While still nascent, these trends could gradually erode market share for traditional portable power solutions.

Consider these indirect substitute influences:

- Reduced Travel: A decrease in leisure and business travel directly impacts the need for portable charging solutions.

- Simpler Lifestyles: A move away from smart home integration could lower demand for associated charging and power accessories.

- Energy Alternatives: Innovations in integrated device power or widespread adoption of solar charging could diminish the market for external power banks.

The threat of substitutes for Anker's products is substantial, particularly in portable charging where readily available wall outlets and advancements in device battery life offer alternatives. In 2024, the increasing density of public charging stations in urban areas and workplaces provides a convenient, often free, substitute for portable power banks. This accessibility directly challenges Anker's value proposition by reducing the perceived necessity of carrying an external power source.

In the audio segment, while Anker offers portable speakers, the improving quality of built-in smartphone speakers presents a direct substitute for consumers prioritizing portability and simplicity. For smart home devices, the threat comes from simpler, non-connected alternatives or enhanced interoperability within larger ecosystems that might reduce the need for Anker's specific hubs or chargers. The global smart home market, projected to exceed $150 billion by 2025, indicates significant competition and the potential for integrated solutions to displace standalone devices.

| Substitute Category | Anker Product Segment | Key Threat Factor | 2024 Market Context |

| Integrated Device Power | Portable Power Banks | Extended device battery life, ultra-fast internal charging | Continued R&D focus on battery efficiency by major device manufacturers. |

| Public Charging Infrastructure | Portable Power Banks | Ubiquity of free and accessible charging stations | Expansion of charging networks in retail, transport, and hospitality sectors. |

| Built-in Device Audio | Portable Speakers | Improving quality of smartphone and tablet speakers | Flagship smartphones in 2024 often feature stereo sound with notable bass. |

| Simpler Home Automation | Smart Home Devices | Preference for manual controls or less integrated systems | Consumer fatigue with complex setups and a desire for basic functionality. |

Entrants Threaten

Entering the consumer electronics arena, particularly with a broad range of products like Anker Innovations, demands significant upfront investment. Companies need substantial capital for research and development to innovate, establish robust manufacturing capabilities, and fund extensive marketing campaigns to build brand recognition and reach consumers globally. For instance, a new entrant might need to invest hundreds of millions of dollars just to establish a competitive manufacturing and distribution network in 2024.

Established players like Anker Innovations leverage significant economies of scale, especially in manufacturing and global distribution. This allows them to achieve lower per-unit costs, making it difficult for new entrants to compete on price. For instance, Anker's large production volumes in 2024 likely contributed to their ability to maintain competitive pricing for their extensive range of charging accessories and smart home devices.

Anker Innovations benefits from significant brand loyalty cultivated through its diverse product lines like Anker, Soundcore, Eufy, and Nebula. This strong customer recognition makes it difficult for new companies to gain traction. For instance, Anker's consistent positive customer reviews and repeat purchase rates, evidenced by its strong market share in portable power banks and wireless audio, present a substantial barrier.

Access to Distribution Channels

Anker Innovations Technology's reliance on its established online retail presence and existing global distribution network presents a significant barrier for potential new entrants. Successfully replicating this reach requires substantial investment in building brand recognition and securing shelf space, both physical and digital. In 2023, Anker reported net revenues of $1.6 billion, demonstrating the scale of operations needed to compete effectively.

New players must navigate the complexities of establishing their own robust online sales platforms and forging new distribution partnerships. This process is often time-consuming and capital-intensive, as established channels may already be saturated or have exclusive agreements. The cost of customer acquisition in the competitive consumer electronics market further amplifies this challenge.

- Established Online Presence: Anker leverages platforms like Amazon and its own website, requiring new entrants to invest heavily in e-commerce infrastructure and digital marketing.

- Global Distribution Network: Securing agreements with retailers and logistics providers worldwide is a complex and costly undertaking for newcomers.

- Brand Recognition and Trust: Anker's brand loyalty, built over years, makes it harder for new entrants to attract initial customers without significant marketing spend.

- Economies of Scale: Anker's large-scale production and distribution contribute to cost efficiencies that new entrants struggle to match initially.

Proprietary Technology and Patents

Anker's substantial commitment to research and development, underscored by its consistent recognition with numerous design awards, cultivates proprietary technologies and patents. This innovation moat creates significant barriers for potential new entrants, as replicating Anker's product performance and technological sophistication becomes a formidable challenge.

For instance, Anker's focus on advancements in charging efficiency and battery management, protected by a growing portfolio of patents, makes it difficult for newcomers to offer comparable products without substantial, time-consuming, and expensive R&D efforts. This intellectual property protection directly dampens the threat of new entrants by raising the cost and complexity of market entry.

- Proprietary Technology: Anker's R&D investment fuels the creation of unique technological solutions.

- Patent Portfolio: A robust patent portfolio safeguards Anker's innovations from imitation.

- High Barrier to Entry: Replicating Anker's performance requires significant R&D investment and time.

- Competitive Advantage: Patents provide a crucial competitive edge, deterring new market participants.

The threat of new entrants for Anker Innovations is moderate due to significant capital requirements for R&D, manufacturing, and marketing, coupled with established brand loyalty and economies of scale. For instance, Anker's 2023 net revenue of $1.6 billion highlights the scale needed to compete. New entrants face hurdles in replicating Anker's proprietary technology and patent portfolio, which requires substantial R&D investment and time to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for R&D, manufacturing, and marketing. | Deters smaller players from entering. |

| Brand Loyalty | Anker's established brands (Soundcore, Eufy) foster customer trust. | Makes customer acquisition costly for newcomers. |

| Economies of Scale | Anker's large production volumes lower per-unit costs. | New entrants struggle to match Anker's pricing. |

| Proprietary Technology & Patents | Anker's R&D leads to unique, protected innovations. | Replication is time-consuming and expensive. |

Porter's Five Forces Analysis Data Sources

Our Anker Innovations Technology Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Anker's annual reports, industry-specific market research from firms like Statista and Euromonitor, and competitor financial filings.

We leverage insights from global trade publications, economic databases, and consumer electronics industry reports to accurately assess the competitive landscape, supplier power, buyer bargaining, threat of new entrants, and substitutes.