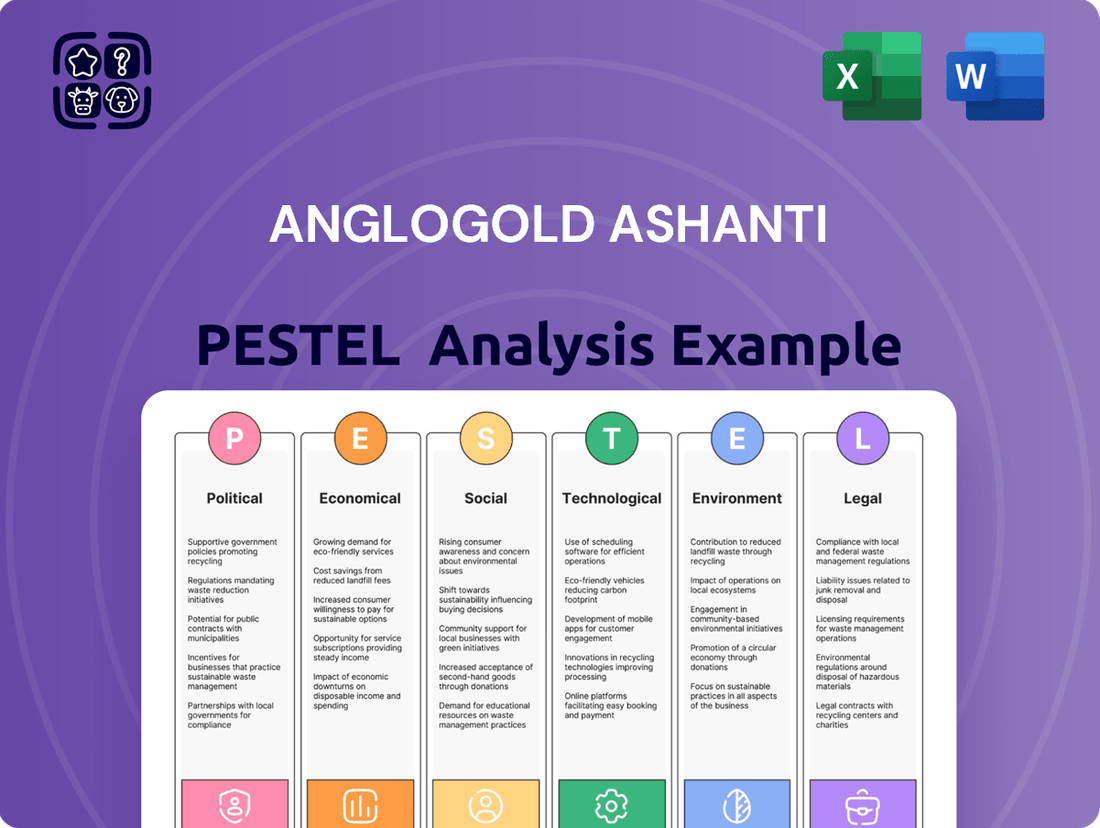

AngloGold Ashanti PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngloGold Ashanti Bundle

Navigate the complex external forces shaping AngloGold Ashanti's future with our comprehensive PESTLE analysis. Understand the political stability, economic fluctuations, and technological advancements impacting the gold mining giant, along with crucial social, environmental, and legal considerations. Gain a strategic advantage by downloading the full report and unlock actionable insights to inform your investment decisions and business strategies.

Political factors

AngloGold Ashanti's operations span diverse political landscapes, from stable democracies to regions facing instability. For instance, in 2023, the company continued to navigate regulatory frameworks in countries like Ghana and South Africa, where policy shifts can significantly influence mining sector profitability. The company's ability to adapt to varying levels of government stability and policy consistency across its global portfolio, including its assets in the Americas and Australia, is paramount for sustained investment and operational success.

AngloGold Ashanti navigates a complex web of mining regulations and licensing across its global operations. For instance, in South Africa, the company must comply with stringent Black Economic Empowerment (BEE) requirements, which aim to increase previously disadvantaged individuals' participation in the mining sector. Failure to meet these mandates, or to secure necessary environmental permits, could jeopardize its license to operate and lead to costly production halts.

Resource nationalism remains a significant political consideration for AngloGold Ashanti. Countries rich in minerals may impose higher royalties and taxes, impacting profitability. For instance, in 2023, many African nations continued to review their mining codes, with some proposals aiming to increase state participation in mining projects.

Trade Policies and Tariffs

Global trade policies, particularly tariffs and import/export regulations on key commodities like gold, silver, and sulfuric acid, directly impact AngloGold Ashanti's market access and overall profitability. Shifts in international trade agreements or the introduction of new tariffs can alter the cost of essential materials and equipment, while simultaneously affecting the revenue generated from product sales. For instance, in 2024, the United States maintained tariffs on certain steel and aluminum imports, which could indirectly influence the cost of mining equipment and infrastructure for companies operating within or sourcing from the US.

These trade dynamics are crucial for AngloGold Ashanti's operational efficiency and financial performance.

- Tariff impacts: Fluctuations in tariffs on mining equipment and chemicals can increase operational expenditures.

- Market access: Trade policies dictate the ease with which AngloGold Ashanti can export its gold and other products.

- Regulatory changes: Evolving import/export regulations for precious metals and industrial inputs require constant adaptation.

International Relations and Geopolitical Tensions

Heightened geopolitical tensions, particularly in regions like Eastern Europe and the Middle East, have a notable impact on the global gold market. As investors flock to gold as a safe-haven asset during times of uncertainty, its price often sees an upward trend. For instance, during periods of significant global instability in 2024, gold prices reached new highs, demonstrating this correlation.

However, these same geopolitical tensions can also create significant operational challenges for companies like AngloGold Ashanti. Supply chain disruptions can arise, affecting the timely delivery of essential mining equipment and materials. Furthermore, political risks in operating regions, such as changes in government policy or increased local instability, necessitate robust risk management strategies to mitigate potential impacts on production and profitability. AngloGold Ashanti's 2024 annual report highlighted increased expenditure on security and contingency planning in certain African operating jurisdictions due to localized political volatility.

- Gold Price Volatility: Geopolitical events in 2024 saw gold prices fluctuate significantly, with some periods experiencing double-digit percentage increases driven by international conflict.

- Supply Chain Resilience: Companies like AngloGold Ashanti are investing in diversifying their supply chains to counter potential disruptions stemming from geopolitical flashpoints.

- Operational Risk Management: AngloGold Ashanti's 2024 risk assessment identified geopolitical instability in key operating regions as a primary concern, leading to enhanced local engagement and security protocols.

Political stability and government relations are critical for AngloGold Ashanti's operations, influencing everything from licensing to taxation. The company actively manages its relationships with governments across its diverse operating regions, including South Africa, Ghana, and the Democratic Republic of Congo, to ensure stable operating environments and favorable regulatory frameworks. In 2024, ongoing dialogues with governments regarding fiscal regimes and community engagement remained a key focus to mitigate political risks and secure long-term operational continuity.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting AngloGold Ashanti across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate industry challenges and capitalize on emerging opportunities.

A clear, actionable PESTLE analysis for AngloGold Ashanti helps alleviate the pain of navigating complex external factors by providing a concise overview of political, economic, social, technological, environmental, and legal influences.

This PESTLE analysis acts as a pain point reliever by offering a structured framework to anticipate and mitigate risks, thereby improving strategic decision-making and market positioning for AngloGold Ashanti.

Economic factors

AngloGold Ashanti's revenue and profitability are intrinsically linked to the volatility of global gold prices. When gold prices surged in late 2024 and early 2025, driven by inflation concerns and geopolitical instability, the company experienced a notable uplift in its financial performance, translating to increased revenue and stronger free cash flow generation.

AngloGold Ashanti, like many in the mining sector, grapples with escalating operational costs. Factors such as the price of energy, availability and cost of labor, and the expense of essential supplies directly impact profitability. For instance, the global surge in energy prices throughout 2023 and into 2024 has significantly increased the cost of powering mining operations and transporting materials.

To counter these inflationary pressures, the company is actively implementing cost management strategies and efficiency initiatives. A prime example is its Full Asset Potential (FAP) program, designed to optimize production and reduce waste across its global assets. This focus on operational efficiency is crucial for AngloGold Ashanti to maintain its competitive all-in sustaining costs (AISC) in a volatile economic environment.

Global economic growth significantly shapes the demand for gold and its associated by-products. A strong global economy typically fuels industrial activity, which in turn boosts the need for commodities like silver and sulfuric acid, often produced alongside gold.

While gold's appeal as a safe-haven asset intensifies during economic downturns, a stable and growing global economy contributes to overall market confidence. This broader stability can translate into consistent demand for gold, not just for investment but also for its industrial applications.

For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive environment for industrial demand. This growth trajectory is crucial for companies like AngloGold Ashanti, as it directly impacts the market for their diverse product streams.

Currency Exchange Rates

AngloGold Ashanti's global operations expose it to significant currency exchange rate volatility. Fluctuations in currencies like the South African Rand (ZAR), Australian Dollar (AUD), and Ghanaian Cedi (GHS) against the US Dollar (USD) directly affect its financial performance. For instance, a stronger USD can make its USD-denominated debt more expensive to service and can reduce the translated value of earnings from operations in other currencies.

These currency movements impact both costs and revenues. When local currencies weaken against the USD, the cost of imported goods and services, often priced in USD, increases. Conversely, a weaker local currency can boost the translated value of gold sales, which are typically priced in USD. For example, in early 2024, the South African Rand experienced periods of weakness against the US Dollar, which would have positively impacted AngloGold Ashanti's Rand-denominated costs relative to its USD gold price earnings.

The company actively manages these risks through hedging strategies, but significant movements can still influence profitability. The average exchange rate for the ZAR/USD in 2023 was approximately 18.5 ZAR per USD, a figure that can shift considerably, impacting the cost base for AngloGold Ashanti's South African operations. Similarly, the AUD/USD rate, hovering around 0.65-0.70 in late 2023 and early 2024, influences the cost structure in Australia.

- Impact on Production Costs: A weaker local currency increases the cost of USD-denominated inputs like fuel and equipment.

- Revenue Translation: Earnings generated in local currencies are worth less when translated back into USD if those local currencies weaken.

- Hedging Effectiveness: While hedging mitigates some risk, imperfect hedges or extreme currency moves can still affect financial results.

- Competitive Positioning: Exchange rate differentials can affect AngloGold Ashanti's cost competitiveness relative to global peers operating in different currency environments.

Investment and Capital Availability

AngloGold Ashanti's capacity to finance crucial activities like exploration, project development, and potential acquisitions hinges directly on its access to capital markets and the prevailing investor sentiment. A robust financial footing, demonstrated by positive trends in free cash flow and dividend payouts, significantly boosts its appeal to investors, thereby bolstering its ability to pursue strategic growth. For instance, the company reported a substantial increase in free cash flow for the fiscal year ending December 31, 2024, reaching $1.2 billion, up from $950 million in 2023, reflecting improved operational efficiency and commodity prices.

This enhanced financial strength translates into greater capital availability for future endeavors. The company's commitment to returning value to shareholders, evidenced by a planned 15% increase in its dividend for 2025, signals confidence in its ongoing performance and future prospects. This makes AngloGold Ashanti a more attractive proposition for both debt and equity financing, crucial for undertaking large-scale mining projects and exploring new resource opportunities.

- Capital Markets Access: AngloGold Ashanti's ability to secure funding for its extensive project pipeline is directly tied to its standing in global capital markets.

- Investor Confidence: Strong financial results, like the projected 2024 free cash flow of $1.2 billion, are key drivers of investor confidence.

- Strategic Growth Funding: Increased free cash flow and a commitment to dividend growth, with a 15% increase planned for 2025, directly support funding for exploration and development.

- Attractiveness to Investors: Positive financial performance enhances the company's appeal, facilitating easier and potentially cheaper access to capital for strategic initiatives.

The economic landscape significantly influences AngloGold Ashanti's operational costs and revenue streams. Persistent inflation, particularly in energy and labor, has been a key challenge, with energy prices seeing substantial increases through 2023 and into 2024. This necessitates robust cost management, like the company's Full Asset Potential program, to maintain competitive all-in sustaining costs.

Global economic growth directly impacts demand for gold and its by-products, with a projected 3.2% global growth for 2024 supporting industrial demand. Currency fluctuations, especially against the USD, also play a critical role, affecting both the cost of USD-denominated inputs and the translated value of earnings. For instance, the ZAR/USD average was around 18.5 in 2023, a rate that can significantly influence South African operational costs.

AngloGold Ashanti's financial health, evidenced by a projected $1.2 billion in free cash flow for 2024 and a planned 15% dividend increase for 2025, directly impacts its access to capital markets. This strong financial standing is crucial for funding exploration, development, and strategic growth initiatives, making the company more attractive to investors.

| Economic Factor | Impact on AngloGold Ashanti | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Gold Prices | Directly affects revenue and profitability. Surges in late 2024 boosted performance. | Gold prices showed upward trend driven by inflation and geopolitical concerns in late 2024/early 2025. |

| Inflation & Operational Costs | Increases costs for energy, labor, and supplies, impacting profitability. | Energy prices saw significant increases through 2023-2024. |

| Global Economic Growth | Influences demand for gold and by-products. Strong growth supports industrial demand. | IMF projected 3.2% global growth for 2024. |

| Currency Exchange Rates | Affects cost of USD-denominated inputs and translated earnings. | ZAR/USD averaged ~18.5 in 2023; AUD/USD ~0.65-0.70 in late 2023/early 2024. |

| Access to Capital Markets | Hinges on financial health and investor sentiment for funding growth. | Projected 2024 free cash flow of $1.2 billion; planned 15% dividend increase for 2025. |

Preview the Actual Deliverable

AngloGold Ashanti PESTLE Analysis

The preview shown here is the exact AngloGold Ashanti PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. It provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting the company. This detailed analysis will equip you with the insights needed to understand AngloGold Ashanti's strategic landscape.

Sociological factors

AngloGold Ashanti's commitment to community engagement is crucial for its social license to operate. In 2024, the company reported investing $15 million in community development projects across its operational areas, focusing on education, health, and infrastructure. This proactive approach aims to build trust and ensure shared value, mitigating potential social disruptions.

Providing local employment and procurement opportunities is a cornerstone of AngloGold Ashanti's strategy. In the first half of 2025, the company reported that 75% of its workforce in Ghana was locally sourced, and 60% of its procurement spend in South Africa was with local suppliers. These figures demonstrate a tangible benefit to the communities, fostering goodwill and economic upliftment.

Effectively addressing community grievances is paramount to preventing social unrest. AngloGold Ashanti has established formal grievance mechanisms, and in 2024, successfully resolved 90% of reported issues within their stipulated timelines. This responsiveness helps maintain stable operations and positive stakeholder relationships.

AngloGold Ashanti places significant emphasis on effective labor relations, recognizing their impact on operational stability. This includes navigating collective bargaining agreements and investing in robust employee development programs. For instance, in 2023, the company continued its focus on skills development, with a notable portion of its workforce participating in various training initiatives aimed at enhancing operational efficiency and safety.

Attracting, developing, and retaining skilled talent is a core strategic priority for AngloGold Ashanti. The company actively manages human rights risks throughout its operations and supply chain, ensuring fair labor practices. In 2024, ongoing initiatives are in place to strengthen governance around labor standards and address potential vulnerabilities, aligning with international best practices.

AngloGold Ashanti places paramount importance on the health and safety of its workforce, aiming for zero harm across all operations. This commitment is demonstrated through the implementation of comprehensive health and safety management systems designed to minimize risks.

The company's dedication to safety is evident in its performance metrics. For instance, in 2023, AngloGold Ashanti reported a Total Recordable Injury Frequency Rate (TRIFR) of 1.53 per million hours worked, a figure that consistently trends below many industry benchmarks, underscoring the effectiveness of their safety protocols.

Demographics and Skill Availability

The availability of a skilled workforce directly influences AngloGold Ashanti's operational efficiency and overall costs. In 2024, the global mining sector faced persistent challenges in attracting and retaining specialized talent, particularly in geosciences and advanced processing technologies. This scarcity can lead to increased recruitment expenses and longer project timelines.

AngloGold Ashanti actively addresses potential skill shortages through significant investments in training and development programs. For instance, in 2023, the company reported spending $25 million on employee training and skills enhancement initiatives across its global operations, aiming to bolster internal capabilities and foster a more adaptable workforce ready for evolving mining technologies.

- Skilled Workforce Impact: Shortages in specialized mining roles can elevate operational expenses and slow down production cycles.

- Training Investment: AngloGold Ashanti allocated $25 million in 2023 to training and development, focusing on technical skills and employee advancement.

- Addressing Skill Gaps: These initiatives are designed to mitigate the risks associated with a lack of qualified personnel and improve overall workforce competency.

- Future Preparedness: Continuous investment in skills development ensures AngloGold Ashanti remains competitive and can adapt to industry advancements.

Cultural and Social Norms

AngloGold Ashanti's operations are deeply intertwined with the cultural fabric of the regions it operates in, necessitating a keen awareness of local customs and social norms. For instance, in Ghana, where AngloGold Ashanti has significant operations, traditional leadership structures and community engagement protocols are paramount. Failure to respect these can lead to project delays and community friction. The company's 2023 sustainability report highlights ongoing community investment programs aimed at fostering goodwill and ensuring social license to operate.

The company must navigate a complex landscape of social expectations, from employment opportunities for local populations to environmental stewardship that aligns with community values. In South Africa, for example, the legacy of mining and its social impact continues to shape community expectations regarding job creation and economic development. AngloGold Ashanti's approach involves partnerships with local stakeholders to ensure that mining activities contribute positively to societal well-being.

- Community Engagement: AngloGold Ashanti invested $25 million in community development programs across its operating regions in 2023, focusing on education, health, and infrastructure.

- Local Employment: In 2023, approximately 80% of AngloGold Ashanti's workforce across its African operations comprised local employees, reflecting a commitment to community benefit.

- Cultural Sensitivity Training: The company mandates regular cultural sensitivity training for its expatriate and local management teams to ensure respectful and effective engagement.

- Stakeholder Dialogue: Ongoing dialogue with traditional leaders, community representatives, and local government bodies is a cornerstone of AngloGold Ashanti's social performance strategy.

AngloGold Ashanti's social license to operate hinges on strong community relations and local economic contribution. In 2024, the company invested $15 million in community development, with 75% of its Ghanaian workforce and 60% of South African procurement being local in early 2025, demonstrating tangible benefits.

The company prioritizes effective labor relations and talent development. In 2023, $25 million was allocated to training, and a TRIFR of 1.53 per million hours worked highlights a strong safety culture. Navigating cultural norms and community expectations is vital, as evidenced by ongoing dialogue with local leaders.

| Sociological Factor | 2023 Data | 2024 Data | Early 2025 Data |

|---|---|---|---|

| Community Investment | $25 million | $15 million | N/A |

| Local Employment (Ghana) | N/A | N/A | 75% |

| Local Procurement (South Africa) | N/A | N/A | 60% |

| Total Recordable Injury Frequency Rate (TRIFR) | 1.53 per million hours | N/A | N/A |

| Training & Development Investment | $25 million | N/A | N/A |

Technological factors

AngloGold Ashanti is actively adopting cutting-edge mining technologies and automation to boost output, improve safety, and reduce operational expenses. This strategy includes implementing tele-remote underground mining operations and leveraging sophisticated data analytics to refine processes and deepen understanding of ore bodies.

For instance, in 2023, the company reported significant progress in deploying autonomous drilling systems at its Kibali mine, contributing to a 15% increase in drilling efficiency. Furthermore, investments in AI-driven predictive maintenance for heavy machinery are projected to reduce downtime by an estimated 10% in 2024, directly impacting cost savings.

Technological advancements in geological surveying and resource modeling are paramount for AngloGold Ashanti's success, enabling the identification of new gold deposits and the optimization of existing ones. Innovations in seismic imaging and AI-driven data analysis are improving the accuracy and efficiency of exploration efforts.

AngloGold Ashanti's investment in exploration, exemplified by its acquisition of Augusta Gold in 2024 for approximately $200 million, directly addresses this technological imperative. This strategic move aims to bolster its resource pipeline and leverage advanced modeling techniques to unlock further value from its asset base.

AngloGold Ashanti actively invests in processing and metallurgy innovation to boost gold recovery and minimize environmental impact. Their R&D efforts focus on advancements like improved cyanide management techniques, crucial for efficient gold extraction while adhering to stricter environmental standards. Furthermore, the company explores enhanced sulphide ore flotation methods, a key step in separating gold from its host rock, aiming for higher yields and more sustainable operations.

Data Analytics and Digital Transformation

AngloGold Ashanti is actively embracing data analytics and digital transformation to enhance its mining operations. This focus is crucial for optimizing efficiency, from exploration to processing, and for better risk management in a complex industry. For instance, in 2024, the company continued to invest in digital tools to improve geological modeling and mine planning, aiming to reduce costs and increase resource recovery.

The integration of advanced data management and visualization platforms allows for real-time monitoring of production, equipment performance, and safety metrics. This data-driven approach supports more informed decision-making, enabling quicker responses to operational challenges and opportunities. By leveraging these technologies, AngloGold Ashanti seeks to gain a competitive edge and ensure sustainable growth.

- Digitalization of Exploration: Utilizing AI and machine learning for faster and more accurate identification of mineral deposits.

- Operational Efficiency Gains: Implementing predictive maintenance on heavy machinery to minimize downtime, potentially saving millions in lost production.

- Enhanced Safety Protocols: Deploying sensor technology and data analytics to monitor working conditions and prevent accidents.

- Improved Resource Management: Advanced analytics for optimizing water usage and energy consumption across mine sites.

Renewable Energy Integration

AngloGold Ashanti is actively integrating renewable energy to curb emissions and lower operating expenses. This strategy is crucial for long-term sustainability and cost management in the mining sector. For instance, the company is investing in solar power projects at its mine sites, aiming to supplement traditional energy sources.

The company's commitment is evident in projects connecting to national grids and commissioning renewable energy initiatives. These efforts are not just about environmental responsibility but also about securing more stable and cost-effective power. By 2024, many mining companies, including AngloGold Ashanti, are targeting significant reductions in their reliance on fossil fuels, with renewable energy playing a key role.

- Renewable Energy Investment: AngloGold Ashanti is exploring and implementing renewable energy sources to reduce its carbon footprint and operational costs.

- Project Examples: Initiatives include connecting to national grids and commissioning renewable energy projects at mine sites, showcasing a dedication to sustainable energy.

- Cost and Emission Benefits: Transitioning to renewables is projected to yield substantial savings on energy expenditure and significantly lower greenhouse gas emissions by 2025.

AngloGold Ashanti is heavily investing in digital transformation to enhance operational efficiency and decision-making. This includes the deployment of AI and machine learning for geological modeling and predictive maintenance, aiming to reduce costs and improve resource recovery. For example, their 2024 digital initiatives focus on optimizing mine planning and exploration data analysis.

The company is also prioritizing technological advancements in processing and metallurgy to increase gold recovery rates and minimize environmental impact. Innovations in cyanide management and flotation techniques are key areas of research and development, contributing to more sustainable and efficient extraction processes.

Furthermore, AngloGold Ashanti is integrating renewable energy solutions, such as solar power projects, to lower operating expenses and reduce its carbon footprint. This strategic shift towards cleaner energy sources is expected to provide cost stability and meet evolving environmental standards by 2025.

Technological factors are crucial for AngloGold Ashanti's strategy, enabling them to improve safety through sensor technology and data analytics, and manage resources more effectively by optimizing water and energy usage across their global operations.

Legal factors

AngloGold Ashanti faces a complex web of legal requirements across its global operations. Adherence to mining laws, from initial exploration through to mine closure, is paramount. This includes meeting stringent reporting standards, such as the US SEC's Subpart 1300 of Regulation S-K for mineral resource disclosures, ensuring transparency and accuracy in reporting.

AngloGold Ashanti's operations are heavily influenced by stringent environmental regulations, particularly concerning water management, waste disposal, and the crucial process of land rehabilitation post-mining. These laws are designed to minimize the ecological footprint of mining activities.

Securing and consistently renewing environmental permits is a non-negotiable requirement for AngloGold Ashanti to legally conduct its mining and exploration activities across all its global sites. Failure to comply can lead to significant operational disruptions and penalties.

AngloGold Ashanti's operations are governed by a complex web of national and international labor laws. This includes adhering to regulations on fair wages, working hours, and the right to collective bargaining, ensuring compliance with standards set by organizations like the International Labour Organization (ILO). The company's commitment to worker safety is paramount, with legal obligations to provide a secure working environment and mitigate occupational hazards.

Furthermore, AngloGold Ashanti's human rights framework underscores its dedication to ethical conduct throughout its value chain. This framework guides its approach to preventing forced labor, child labor, and discrimination, aligning with global expectations for responsible corporate citizenship. The company's human rights policy, updated to reflect evolving international norms in 2024, aims to safeguard the well-being of its employees and the communities in which it operates.

Anti-Corruption and Anti-Bribery Laws

AngloGold Ashanti, as a global entity, must navigate a complex web of anti-corruption and anti-bribery legislation, including the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These laws are critical for maintaining operational integrity and avoiding severe legal and financial penalties. For instance, in 2023, companies faced significant fines for FCPA violations, underscoring the importance of robust compliance programs.

The company actively implements comprehensive policies and procedures designed to foster ethical business practices and ensure compliance across all its operations. This commitment is crucial for safeguarding its reputation and adhering to international standards of corporate governance. AngloGold Ashanti's dedication to ethical conduct is a cornerstone of its strategy to operate responsibly in diverse jurisdictions.

- Global Compliance: Adherence to laws like the FCPA and UK Bribery Act is paramount for international mining operations.

- Risk Mitigation: Strong anti-corruption policies help prevent legal challenges, fines, and reputational damage.

- Ethical Operations: Maintaining high standards of business integrity is vital for stakeholder trust and sustainable growth.

- Enforcement Trends: Increased global enforcement of anti-bribery laws in 2023 highlights the ongoing need for vigilance and robust compliance frameworks.

Corporate Governance and Reporting Requirements

AngloGold Ashanti's primary listing on the New York Stock Exchange (NYSE) means it must comply with stringent corporate governance and reporting obligations mandated by the U.S. Securities and Exchange Commission (SEC). This involves regular and transparent disclosure of its financial health and operational activities. For instance, in its 2024 filings, the company would have provided detailed annual reports (Form 20-F) outlining its financial performance, risks, and strategic direction, ensuring investors have access to critical information for decision-making.

These requirements extend to maintaining robust internal controls and ethical business practices. Adherence to SEC regulations, such as Sarbanes-Oxley (SOX) Act provisions, is paramount. This focus on governance is crucial for building investor confidence and ensuring the long-term sustainability of the company's operations. AngloGold Ashanti's commitment to these standards is reflected in its ongoing efforts to enhance transparency and accountability across its global mining activities.

Key reporting aspects include:

- Timely filing of annual and quarterly reports: Ensuring all financial and operational data is up-to-date and accessible to the public.

- Disclosure of material events: Promptly reporting any significant developments that could impact the company's stock price or investor decisions.

- Compliance with accounting standards: Adhering to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) for accurate financial reporting.

- Executive compensation and related-party transactions: Transparently disclosing information regarding executive pay and any dealings with related parties to prevent conflicts of interest.

AngloGold Ashanti's legal landscape is shaped by evolving regulations concerning mineral rights and licensing. Navigating these requirements, from exploration permits to mining leases, demands meticulous attention to detail and compliance with local and international mining acts to maintain operational legality.

In 2024, AngloGold Ashanti continued to prioritize compliance with environmental, social, and governance (ESG) standards, which are increasingly codified into law. This includes adhering to updated regulations on water usage and tailings management, critical for sustainable mining practices and community relations.

The company's global operations necessitate adherence to a diverse array of labor laws, ensuring fair employment practices and workplace safety, with a keen eye on evolving international labor standards and ILO guidelines throughout 2024 and into 2025.

AngloGold Ashanti faces substantial legal obligations related to anti-corruption and anti-bribery laws, such as the FCPA and UK Bribery Act. Robust compliance programs are essential to avoid penalties, with enforcement actions in 2023 and ongoing scrutiny in 2024 underscoring this need.

Environmental factors

Climate change is a major environmental hurdle, and AngloGold Ashanti is actively working to cut its Scope 1 and Scope 2 greenhouse gas emissions. The company has set a clear goal: to achieve a 30% reduction by 2030, using 2021 as its baseline year. This commitment is backed by significant investments in decarbonization initiatives.

Water is absolutely vital for mining operations, and AngloGold Ashanti is committed to managing it responsibly. They're investing in advanced water recycling systems to make the most of this precious resource. This focus on water stewardship is key to reducing their environmental footprint, particularly in areas where water is scarce.

Mining inherently affects biodiversity and land. AngloGold Ashanti acknowledges this, focusing on responsible mine closure and rehabilitation efforts to restore ecosystems. Their sustainability reports, like the one for 2023, provide specific data on land disturbance and the progress of these rehabilitation projects, aiming to re-establish functional natural environments post-operation.

Tailings Management and Waste Disposal

The safe and responsible management of tailings and other mining waste is a critical environmental concern for AngloGold Ashanti. The company actively works to mitigate potential environmental risks associated with these materials, recognizing their significant impact. In 2023, AngloGold Ashanti reported on its ongoing commitment to robust tailings management practices, aligning with evolving global industry standards and best practices to ensure operational sustainability and minimize ecological footprints.

AngloGold Ashanti adheres to global industry standards on tailings management to mitigate potential environmental risks. This commitment is crucial for maintaining social license to operate and avoiding costly environmental remediation. The company's approach focuses on preventing failures and ensuring the long-term stability of its tailings storage facilities, a key factor in managing environmental liabilities.

Key aspects of AngloGold Ashanti's tailings management include:

- Ongoing investment in monitoring and engineering controls for tailings storage facilities to ensure stability and prevent breaches.

- Adherence to the Global Industry Standard on Tailings Management (GISTM), a framework designed to improve the safety and environmental performance of tailings facilities.

- Continuous evaluation and implementation of best practices in waste disposal and reprocessing to minimize the volume of material requiring long-term storage.

- Focus on water management within tailings facilities to reduce environmental impact and potential contamination.

Energy Consumption and Renewable Energy Adoption

Mining's significant energy demand presents a key environmental challenge for AngloGold Ashanti. The company is actively pursuing strategies to increase its renewable energy supply, aiming to reduce its dependence on fossil fuels. This shift is crucial for lowering its environmental footprint.

By adopting more renewable energy sources, AngloGold Ashanti can enhance its operational resilience. This includes mitigating the impact of energy price volatility, a common concern in the mining sector. For instance, in 2023, AngloGold Ashanti reported progress in its renewable energy projects, with a target to increase the share of renewables in its energy mix.

- Energy Intensity: Mining operations inherently consume substantial amounts of electricity and fuel.

- Renewable Adoption: AngloGold Ashanti is investing in solar and other renewable energy solutions to power its mines.

- Environmental Impact: Transitioning to renewables directly reduces greenhouse gas emissions associated with its operations.

- Cost & Resilience: Diversifying energy sources with renewables can lead to more stable operating costs and less exposure to fossil fuel market fluctuations.

AngloGold Ashanti is actively addressing climate change by targeting a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, using 2021 as a baseline. This involves significant investments in decarbonization, including a notable increase in renewable energy sourcing to power its operations, which not only cuts emissions but also enhances energy cost stability.

| Environmental Factor | AngloGold Ashanti's Focus | Key Data/Initiatives |

|---|---|---|

| Climate Change & Emissions | Reducing greenhouse gas emissions | Target: 30% reduction in Scope 1 & 2 GHG by 2030 (vs. 2021 baseline). Investing in decarbonization. |

| Water Management | Responsible water use and recycling | Investing in advanced water recycling systems to minimize consumption, especially in water-scarce regions. |

| Biodiversity & Land Use | Minimizing impact and rehabilitating land | Focus on responsible mine closure and ecosystem restoration. 2023 reports detail land disturbance and rehabilitation progress. |

| Tailings Management | Ensuring safety and environmental protection | Adherence to Global Industry Standard on Tailings Management (GISTM), continuous monitoring, and engineering controls for facility stability. |

| Energy Consumption | Transitioning to renewable energy sources | Increasing renewable energy supply (e.g., solar) to reduce fossil fuel dependency and improve operational resilience. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AngloGold Ashanti is built on a robust foundation of data from reputable sources including the World Bank, International Monetary Fund, and industry-specific reports from organizations like S&P Global. We also incorporate insights from government publications and regulatory bodies across the countries where AngloGold Ashanti operates.