AngloGold Ashanti Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngloGold Ashanti Bundle

AngloGold Ashanti navigates a complex landscape shaped by intense rivalry among established gold producers and the constant threat of new entrants eager to tap into lucrative markets. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping AngloGold Ashanti’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AngloGold Ashanti's bargaining power of suppliers is influenced by the concentration of its supplier base. If a few key suppliers dominate the market for critical mining equipment, specialized technical services, or essential raw materials like explosives or processing chemicals, their leverage increases significantly. This limited competition can empower these suppliers to command higher prices, impose stricter payment terms, or dictate delivery schedules, directly impacting AngloGold Ashanti's operational expenses and production timelines.

Suppliers offering unique or highly specialized inputs significantly enhance their bargaining power. For AngloGold Ashanti, this could manifest as proprietary mining technology or rare processing chemicals. For example, a supplier of a critical, patent-protected chemical used in gold extraction could command higher prices because AngloGold Ashanti has limited viable alternatives. This dependence makes the company more vulnerable to price hikes and less favorable contract conditions.

Switching costs for AngloGold Ashanti can significantly influence the bargaining power of its suppliers. If the company faces substantial expenses and time commitments in transitioning to a new supplier, such as retooling mining equipment or re-certifying specialized chemicals, suppliers gain leverage. For instance, if a critical component requires unique machinery modifications, the cost and disruption of such changes make switching less feasible, strengthening the existing supplier's position.

Threat of Forward Integration

The threat of forward integration by AngloGold Ashanti's suppliers, such as equipment manufacturers or specialized service providers, could significantly bolster their bargaining power. If these suppliers possess the capability and willingness to enter the gold mining sector directly, they gain substantial leverage in price negotiations with AngloGold Ashanti. This is because AngloGold Ashanti would prefer to maintain its existing supplier relationships rather than face a new, potentially formidable competitor. For instance, a major supplier of advanced mining technology could, in theory, acquire or develop its own mining operations, thereby becoming a direct rival.

This potential for suppliers to move "downstream" into mining operations means they can dictate terms more forcefully. They might threaten to withhold critical supplies or services, or conversely, offer them to AngloGold Ashanti at less favorable terms if their demands aren't met, knowing they have an alternative path to market. This dynamic is particularly relevant in an industry where specialized equipment and expertise are crucial. For 2024, the global mining equipment market saw significant consolidation, with key players like Caterpillar and Komatsu holding substantial market share, potentially giving them greater capacity for such strategic moves.

- Supplier Capability: Assess if key suppliers possess the financial resources and technical expertise to operate mines.

- Industry Concentration: High concentration among suppliers can increase their collective ability to integrate forward.

- Profitability of Mining: If the gold mining sector remains highly profitable, it enhances the attractiveness of forward integration for suppliers.

- AngloGold Ashanti's Dependence: The degree to which AngloGold Ashanti relies on specific suppliers for essential inputs influences the suppliers' leverage.

Importance of Supplier's Input to AngloGold Ashanti's Cost Structure

The bargaining power of suppliers is a critical factor for AngloGold Ashanti. When a supplier's product or service makes up a substantial part of AngloGold Ashanti's total production costs, that supplier gains considerable leverage. This is particularly true for essential inputs like energy, explosives, and specialized mining equipment.

For example, in 2024, global energy prices, especially for diesel and electricity, remained a significant cost driver for mining operations. Fluctuations in these commodity prices directly impact AngloGold Ashanti's operational expenses. Similarly, the cost of specialized mining consumables and the availability of skilled labor in remote mining locations can give suppliers substantial power.

- Energy Costs: In 2023, AngloGold Ashanti reported that total cost of sales was US$3.6 billion. Energy is a substantial component within this figure, making its suppliers influential.

- Explosives and Consumables: The cost of explosives and other essential mining consumables can represent a notable portion of the direct mining expenditure.

- Specialized Equipment and Services: Reliance on unique or proprietary mining equipment and specialized technical services can also empower certain suppliers.

AngloGold Ashanti's suppliers wield significant bargaining power when their offerings represent a substantial portion of the company's production costs, particularly for critical inputs like energy and specialized equipment. For instance, in 2024, global energy prices, a major cost component for mining, remained volatile, directly impacting AngloGold Ashanti's operational expenses and giving energy providers considerable leverage.

The concentration of suppliers for essential mining inputs also amplifies their power. If a few companies dominate the market for specialized machinery or critical chemicals, they can dictate terms more effectively. This is evident in the global mining equipment sector, where major players like Caterpillar and Komatsu held significant market share in 2024, potentially allowing them to influence pricing and supply agreements.

| Input Category | Supplier Power Drivers | Impact on AngloGold Ashanti |

|---|---|---|

| Energy (Diesel, Electricity) | Volatile global prices (2024), essential for operations | Directly impacts operational expenses and cost of sales (US$3.6 billion in 2023) |

| Specialized Mining Equipment | Market concentration (e.g., Caterpillar, Komatsu in 2024), proprietary technology | High switching costs, potential for price increases and dictated delivery schedules |

| Explosives and Consumables | Cost as a notable portion of mining expenditure, supplier availability | Influences direct mining costs and operational efficiency |

What is included in the product

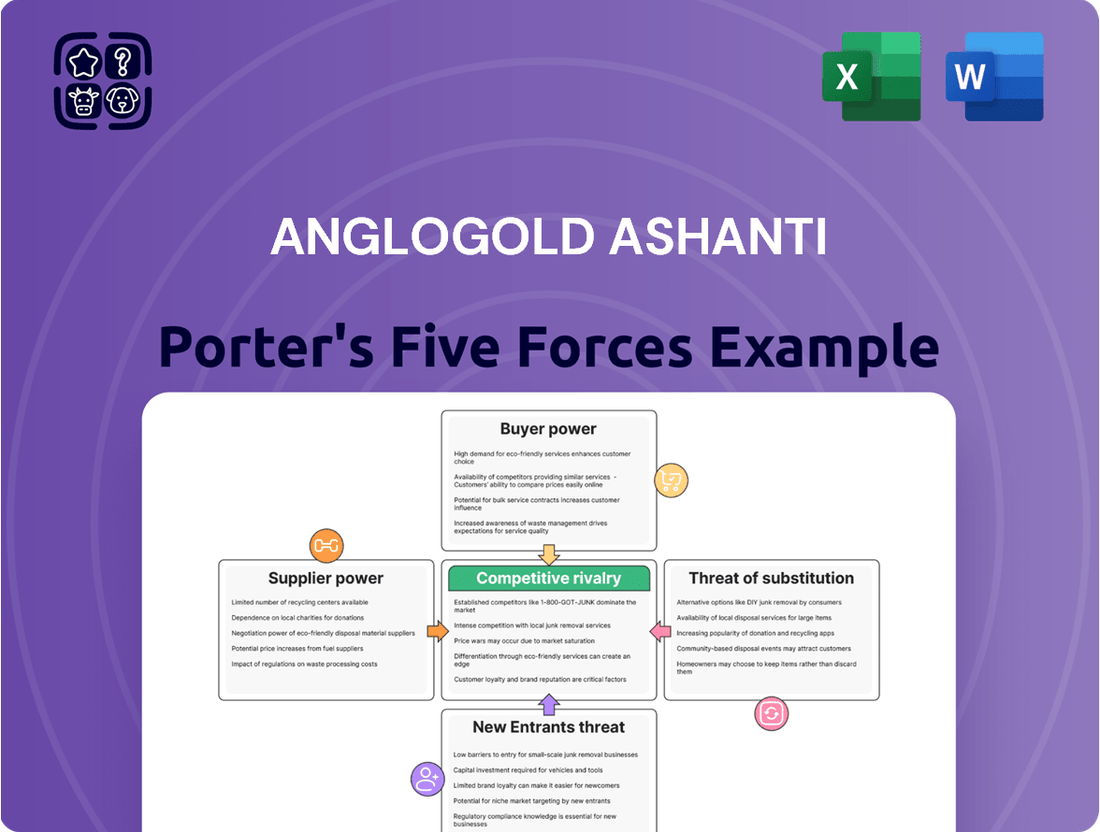

This analysis unpacks the competitive forces impacting AngloGold Ashanti, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining industry.

Understand the competitive landscape and identify key threats to AngloGold Ashanti's profitability with a clear, actionable Porter's Five Forces analysis.

Quickly assess the impact of supplier power and potential substitutes on AngloGold Ashanti's cost structure and market position.

Customers Bargaining Power

AngloGold Ashanti's gold sales are spread across a wide array of buyers, including central banks, institutional investors, jewelry makers, and industrial consumers. This broad customer base means that no single customer represents a substantial portion of the company's revenue.

In 2024, the global demand for gold from central banks remained robust, with net purchases estimated to be around 1,000 tonnes, though this can fluctuate. Similarly, institutional investors and jewelry demand, which together constitute a significant portion of gold consumption, are also highly diversified across numerous entities and individuals.

The fragmented nature of its customer base generally limits the bargaining power of any individual buyer. Because AngloGold Ashanti sells to many different customers, it is not overly reliant on any one of them, which strengthens its negotiating position.

The bargaining power of customers in the gold market is significantly influenced by the standardized nature of the product. Gold, despite variations in purity, is largely treated as a commodity. This means buyers can readily source gold from various producers without significant differentiation.

This ease of switching suppliers limits any single customer's ability to dictate terms or prices to AngloGold Ashanti. The prevailing market price, driven by global economic factors and investor sentiment, becomes the primary determinant of value, rather than individual customer demand.

For instance, in 2024, the average price of gold fluctuated, demonstrating how external market forces, not individual buyer preferences, shape its cost. This reinforces that AngloGold Ashanti's pricing power is constrained by the commodity's inherent standardization and the broader market dynamics.

Customer price sensitivity for gold is a mixed bag. While the allure of gold as a safe harbor during economic storms or periods of rising inflation can make some buyers less concerned about the price, this isn't universally true.

For instance, industrial users of gold or those purchasing it for jewelry might indeed be more attuned to price swings. If there are viable substitutes or if the gold component is a significant cost, these customers will likely shop around for better deals. In 2024, gold prices have shown volatility, trading in a range, which can heighten this sensitivity for non-investment purposes.

Threat of Backward Integration by Customers

The threat of customers integrating backward into gold mining, thereby becoming direct competitors to AngloGold Ashanti, is generally quite low. This is primarily due to the immense capital required to establish and operate a gold mine, along with the specialized technical expertise and deep understanding of geological surveys, extraction processes, and refining that are essential.

Furthermore, navigating the complex web of environmental regulations, obtaining mining permits, and ensuring compliance with safety standards present significant barriers. For instance, the average capital expenditure for developing a new gold mine can range from hundreds of millions to over a billion US dollars, a figure that deters most potential entrants who are not already established players in the industry.

- High Capital Investment: Developing new gold mines requires substantial upfront capital, often exceeding $500 million, making it prohibitive for most customers.

- Technical Expertise: Successful gold mining demands specialized knowledge in geology, metallurgy, and engineering, which is not readily available to typical customers.

- Regulatory Hurdles: Obtaining mining rights, environmental permits, and adhering to stringent safety regulations are complex and time-consuming processes.

- Limited Customer Bargaining Power: These barriers significantly limit the bargaining power of customers, as their ability to threaten backward integration is minimal.

Availability of Substitutes for Customers

While gold itself is a unique commodity, the demand for it, particularly for investment purposes, faces competition from a range of substitutes. Investors can opt for other precious metals like platinum and silver, which often exhibit similar price drivers and appeal to a similar investor base. For instance, as of early 2024, platinum prices have shown volatility, making it a potential alternative for those seeking precious metal exposure.

Beyond other metals, a vast array of financial instruments presents viable alternatives to gold. These include stocks, bonds, exchange-traded funds (ETFs) tracking various asset classes, and even real estate. The performance and perceived safety of these instruments directly impact the attractiveness of gold as an investment. In 2023, the S&P 500 saw significant gains, potentially drawing capital away from traditional safe-haven assets like gold.

Emerging asset classes, such as cryptocurrencies, also represent a growing competitive force. While distinct in nature, some investors view digital assets like Bitcoin as a potential store of value or hedge against inflation, similar to gold's traditional role. The significant price swings in the cryptocurrency market in recent years mean that investor sentiment towards these assets can influence their demand relative to gold.

- Substitutes for Investment Demand: Other precious metals (platinum, silver), stocks, bonds, ETFs, real estate.

- Emerging Alternatives: Cryptocurrencies like Bitcoin are increasingly seen as alternative stores of value.

- Market Influence: Performance of S&P 500 in 2023 potentially diverted investment from gold.

- Investor Behavior: Availability of diverse investment options indirectly shapes gold's appeal and customer choices.

AngloGold Ashanti generally faces low bargaining power from its customers due to a highly diversified customer base, including central banks, institutional investors, and jewelry makers. This fragmentation means no single buyer holds significant sway over pricing or terms.

The standardized nature of gold as a commodity also limits individual customer power, as buyers can easily source from various producers, making price the primary negotiation point, influenced by broader market trends rather than specific buyer demands.

While some industrial or jewelry buyers might be price-sensitive, especially during periods of gold price volatility observed in 2024, the high barriers to backward integration for customers—requiring immense capital and technical expertise—further diminish their ability to exert significant pressure.

The bargaining power of AngloGold Ashanti's customers is generally considered low. This is primarily due to the company's broad and fragmented customer base, which includes central banks, institutional investors, and jewelry manufacturers, meaning no single customer accounts for a substantial portion of sales. The standardized nature of gold as a commodity further limits individual customer leverage, as they can easily switch suppliers based on prevailing market prices, which in 2024 have shown considerable fluctuation, impacting price sensitivity for non-investment purposes.

| Customer Segment | Influence on Bargaining Power | 2024 Market Context |

|---|---|---|

| Central Banks | Low (large number of buyers) | Robust net purchases, around 1,000 tonnes estimated |

| Institutional Investors | Low (highly diversified) | Significant portion of consumption, influenced by broader market trends |

| Jewelry Makers | Moderate (price sensitivity exists) | Price volatility in 2024 can increase sensitivity |

| Industrial Consumers | Moderate (price sensitivity exists) | Price volatility in 2024 can increase sensitivity |

Full Version Awaits

AngloGold Ashanti Porter's Five Forces Analysis

This preview showcases the comprehensive AngloGold Ashanti Porter's Five Forces Analysis, detailing the competitive landscape of the gold mining industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights without any placeholders or missing sections.

Rivalry Among Competitors

The global gold mining industry is populated by a mix of major players and smaller entities, creating a dynamic competitive environment. Companies like Barrick Gold and Newmont Corporation, with their substantial production volumes and extensive international footprints, represent significant rivals to AngloGold Ashanti.

This intense rivalry means AngloGold Ashanti must contend with competitors possessing considerable operational scale and geographical diversification. For instance, in 2023, Newmont Corporation reported gold sales of approximately $13.8 billion, highlighting the financial muscle of its larger competitors.

The gold mining industry's growth rate significantly shapes competitive rivalry. While gold prices have shown robust gains in 2024, with projections indicating continued strength into 2025, the expansion of global mine production is more measured. This disparity can lead to heightened competition among established companies vying for market share and access to new gold reserves.

Competitive rivalry in the gold mining sector, particularly concerning product differentiation, is a key factor for companies like AngloGold Ashanti. Gold, being a commodity, inherently offers limited differentiation based solely on its physical properties, with purity and origin being the primary distinctions.

However, AngloGold Ashanti, like its peers, carves out competitive advantages through operational excellence, stringent cost management, and robust sustainability initiatives. The quality and geographical diversity of its asset base also play a crucial role in differentiating its offerings and mitigating risks.

For instance, in 2023, AngloGold Ashanti reported a significant improvement in its all-in sustaining costs, reaching $1,071 per ounce, down from $1,161 per ounce in 2022. This focus on cost efficiency is a vital differentiator in a market where price is largely dictated by global supply and demand.

Exit Barriers

High exit barriers in the gold mining sector, including substantial investments in fixed assets and ongoing environmental rehabilitation responsibilities, can significantly fuel competitive rivalry. Companies might feel compelled to continue operations, even with reduced profits, to circumvent the considerable costs associated with shutting down and restoring mine sites. For instance, AngloGold Ashanti's 2023 annual report highlighted significant capital expenditure on mine development and maintenance, underscoring the asset-heavy nature of the industry. These commitments make exiting the market a financially daunting prospect.

These substantial exit barriers directly impact competitive dynamics by keeping less profitable players in the market longer. This sustained presence means there are always more competitors vying for market share, potentially driving down prices and margins for everyone. AngloGold Ashanti's own operational footprint, spanning multiple countries, involves navigating diverse regulatory environments and long-term community engagement agreements, further complicating any potential exit strategy and reinforcing the need for sustained competitive engagement.

- High Capital Investment: The gold mining industry requires massive upfront capital for exploration, development, and extraction equipment, making it difficult to recoup these investments if operations cease.

- Environmental and Rehabilitation Costs: Companies face significant obligations for site restoration and environmental remediation after mining operations conclude, often spanning decades.

- Long-Term Commitments: Contracts with suppliers, employees, and local communities create ongoing liabilities that must be addressed even in a wind-down scenario.

- Operational Scale: Maintaining a certain scale of operations can be necessary to achieve economies of scale, making it economically unviable to exit smaller, less efficient mines without incurring substantial losses.

Cost Structure and Capacity

Competitive rivalry in the gold mining sector is significantly shaped by cost structure and production capacity. Companies that can operate more efficiently and at a lower cost per ounce possess a distinct advantage. This is particularly true in a capital-intensive industry where economies of scale play a vital role.

AngloGold Ashanti's strategic emphasis on cost management and optimizing its operational footprint is therefore a key determinant of its competitive standing. The company's ongoing efforts to streamline operations and enhance productivity across its asset portfolio, including significant operations like the Sukari mine in Egypt, are critical for navigating this competitive landscape.

- Cost Efficiency: Lower operating costs per ounce translate directly to higher profit margins, especially during periods of fluctuating gold prices.

- Capacity Optimization: Efficiently managing and expanding production capacity allows companies to meet market demand and benefit from economies of scale.

- Asset Management: Strategic acquisitions and divestitures, such as AngloGold Ashanti's focus on optimizing its asset base, are crucial for maintaining a competitive cost structure and capacity.

- Industry Benchmarking: In 2023, the all-in sustaining cost (AISC) for major gold producers often ranged between $1,000 and $1,300 per ounce, highlighting the importance of cost control for companies like AngloGold Ashanti to remain competitive.

The gold mining industry is characterized by intense competition among a few large, established players and numerous smaller operations. AngloGold Ashanti faces rivals like Barrick Gold and Newmont Corporation, which possess significant scale and global reach, as evidenced by Newmont's approximately $13.8 billion in gold sales in 2023.

Product differentiation is limited, as gold is a commodity, making operational efficiency and cost management crucial competitive advantages. AngloGold Ashanti's focus on reducing its all-in sustaining costs, which fell to $1,071 per ounce in 2023, is a key strategy in this environment.

High exit barriers, including substantial capital investments and environmental rehabilitation obligations, keep companies operating even when less profitable, intensifying rivalry. These factors, coupled with the need to maintain economies of scale, mean companies like AngloGold Ashanti must continuously optimize their operations and asset portfolios to stay competitive.

| Competitor | 2023 Gold Sales (Approx.) | All-in Sustaining Costs (Approx. 2023) |

| AngloGold Ashanti | $3.7 billion | $1,071 per ounce |

| Newmont Corporation | $13.8 billion | $1,176 per ounce |

| Barrick Gold | $11.2 billion | $1,073 per ounce |

SSubstitutes Threaten

For investors, gold isn't the only game in town. Other asset classes like equities, bonds, and real estate offer alternative avenues for capital growth and wealth preservation. In 2024, for instance, while gold prices saw fluctuations, the S&P 500 index experienced significant gains, demonstrating the dynamic nature of investor preferences.

The attractiveness of these substitutes is heavily influenced by broader economic factors. For example, rising interest rates can make bonds more appealing, drawing capital away from non-yielding assets like gold. Similarly, geopolitical instability, while often boosting gold's safe-haven appeal, can also drive investment into other perceived stable markets, impacting gold's demand relative to its alternatives.

Technological progress presents a nuanced threat to gold’s industrial demand. While gold’s unique conductivity and corrosion resistance are currently difficult to replicate in electronics and dentistry, ongoing research into advanced materials could yield viable substitutes. For instance, innovations in conductive polymers or novel alloys might reduce reliance on gold in certain high-performance applications.

Consumer preferences in jewelry are a significant threat of substitutes for gold. Shifts can occur towards alternative materials like platinum, silver, or lab-grown diamonds, which may offer different aesthetic appeal or perceived value. In 2024, the global jewelry market saw continued interest in sustainable and ethically sourced materials, potentially diverting some demand from traditionally mined gold.

Fashion trends and cultural influences also play a role. For instance, a growing emphasis on minimalist styles might reduce demand for elaborate gold pieces, while economic affordability can push consumers towards less expensive precious metals or fashion jewelry. The increasing popularity of personalized jewelry, often incorporating a wider range of gemstones and metals, further broadens the substitute landscape.

Development of Synthetic Gold

The threat of synthetic gold as a substitute for naturally mined gold, like that produced by AngloGold Ashanti, remains minimal. While advancements in material science are ongoing, the creation of synthetic gold at a commercially viable scale and purity to rival mined gold is not a present concern.

The sheer energy and resource investment required for synthetic gold production makes it an impractical alternative. For instance, current estimates suggest that producing even small quantities of synthetic gold would demand an exorbitant amount of energy, far exceeding the cost-effectiveness of traditional mining.

Furthermore, the market's established trust and perceived value in naturally occurring gold, particularly for investment and jewelry purposes, create a significant barrier for any synthetic alternative. Buyers value the inherent rarity and history associated with mined gold.

- Current production of synthetic gold is not commercially viable.

- High energy and resource requirements make it impractical.

- Market trust and perceived value favor mined gold.

Perception of Gold as a Store of Value

The perception of gold as a reliable store of value, particularly during economic downturns and inflationary periods, significantly bolsters its demand. However, if this ingrained belief weakens, perhaps due to the rise of competing assets or extended economic stability, the threat of substitutes for gold could intensify.

In 2024, while inflation concerns persisted in some regions, the narrative around gold's safe-haven status faced scrutiny as other assets like certain cryptocurrencies and even technology stocks showed resilience. For instance, Bitcoin's price movements in early 2024, despite its volatility, attracted some investors seeking alternative stores of wealth, albeit with different risk profiles.

- Gold's traditional role as a hedge against inflation is being challenged by digital assets and other investment vehicles.

- Investor sentiment towards gold can shift rapidly based on global economic stability and the performance of alternative assets.

- The perceived security of gold is directly linked to its historical performance and market acceptance, which can be eroded by emerging alternatives.

The threat of substitutes for AngloGold Ashanti is multifaceted, encompassing financial assets, industrial materials, and consumer preferences. While gold's allure as a safe haven persists, investors in 2024 increasingly considered alternatives like equities, with the S&P 500 showing strong performance, and even certain cryptocurrencies, despite their volatility, as potential stores of wealth.

Technological advancements could diminish gold's industrial demand, as innovations in conductive polymers or novel alloys might offer viable substitutes in electronics. Consumer tastes also shift, with platinum, silver, and lab-grown diamonds gaining traction in the jewelry market, especially with a 2024 trend towards sustainable and ethically sourced materials.

| Substitute Category | Examples | 2024 Market Trend/Data Point |

|---|---|---|

| Financial Assets | Equities (S&P 500), Bonds, Cryptocurrencies (e.g., Bitcoin) | S&P 500 showed significant gains; Bitcoin attracted some investors seeking alternative wealth stores. |

| Industrial Materials | Conductive Polymers, Novel Alloys | Ongoing research into advanced materials could reduce reliance on gold in high-performance applications. |

| Jewelry Materials | Platinum, Silver, Lab-Grown Diamonds | Continued interest in sustainable and ethically sourced materials in the global jewelry market. |

Entrants Threaten

The gold mining industry is characterized by exceptionally high capital requirements. Starting a new gold mine demands substantial investment, often in the billions of dollars, for everything from initial exploration and feasibility studies to the construction of processing facilities and the development of underground or open-pit operations. For instance, major new gold projects announced in 2024, such as those in Western Australia, are projected to cost upwards of $1 billion to develop.

These immense upfront costs act as a significant deterrent to potential new entrants. Few companies or individuals possess the financial capacity to undertake such large-scale ventures, effectively limiting the threat of new competition in the market. This barrier ensures that only well-established players with access to significant capital can realistically enter and compete in the gold mining sector.

Existing giants like AngloGold Ashanti leverage significant economies of scale, meaning their vast operations allow for substantially lower per-unit production costs. This advantage stems from bulk purchasing of supplies, optimized logistics, and the ability to spread fixed costs over a larger output, making it difficult for smaller, new entrants to match their cost efficiency.

For instance, AngloGold Ashanti's 2023 production costs averaged $1,260 per ounce, a figure that new, smaller operations would find challenging to replicate due to their inability to achieve similar purchasing power and operational leverage.

New entrants would face considerable hurdles in building the infrastructure and global distribution networks necessary to compete on cost, thereby creating a substantial barrier to entry in the established gold mining sector.

The threat of new entrants is significantly impacted by the difficulty in accessing scarce resources and reserves. Identifying and acquiring economically viable gold deposits is an increasingly challenging endeavor, marked by a decline in significant new discoveries globally. For instance, in 2023, the discovery rate for large gold deposits continued its downward trend, making it harder for any company, new or old, to find substantial new sources of the precious metal.

Established players like AngloGold Ashanti benefit from their existing reserves and well-developed exploration pipelines. This existing access to high-quality resources creates a substantial barrier for newcomers. New entrants struggle to secure the necessary land rights and exploration permits for promising geological areas, often facing intense competition from companies with established footprints and proven track records in resource acquisition.

Regulatory and Environmental Hurdles

The gold mining sector faces substantial regulatory and environmental hurdles that act as a significant deterrent to new entrants. Companies must navigate complex permitting processes, often involving extensive environmental impact assessments and community consultations, which can take years and considerable financial investment to complete. For instance, in 2024, the average time for obtaining major mining permits in many jurisdictions continued to extend, with some projects facing delays of over five years due to these stringent requirements.

Furthermore, the industry is heavily regulated concerning environmental protection, waste management, and reclamation obligations. These regulations, which are continually evolving and becoming more rigorous, demand significant upfront capital expenditure for compliance technologies and ongoing operational costs. AngloGold Ashanti, like its peers, must invest heavily in environmental management systems and rehabilitation bonds, with estimated rehabilitation costs for active mines often running into tens or hundreds of millions of dollars.

The need for social license to operate, particularly in regions with active local communities, adds another layer of complexity. Gaining and maintaining community acceptance and support is crucial, and failure to do so can halt operations or prevent new projects from commencing. This often involves substantial investment in community development programs and transparent engagement, creating a high barrier for new, less established players.

- Stringent Environmental Regulations: Compliance with evolving environmental standards requires significant investment in technology and practices.

- Lengthy Permitting Processes: Obtaining necessary permits can take several years, delaying project commencement and increasing initial costs.

- High Capital Expenditure for Compliance: New entrants need substantial capital to meet environmental protection and waste management requirements.

- Social License to Operate: Building trust and securing community acceptance is a prerequisite for mining operations, demanding ongoing investment in social programs.

Brand Loyalty and Distribution Channels

While gold is a commodity, established miners like AngloGold Ashanti benefit from deeply entrenched relationships with refiners, bullion dealers, and central banks. These long-standing connections form robust distribution channels that are difficult for newcomers to replicate. Building this level of trust and access takes considerable time and investment, acting as a significant barrier.

For instance, in 2024, major gold producers often secure off-take agreements with key refiners, ensuring immediate market access. New entrants would need to not only find suitable refining partners but also prove their reliability and the quality of their output, a process that could take years and substantial capital expenditure to establish credibility within the tightly-knit gold market.

- Established Distribution Networks: AngloGold Ashanti leverages existing relationships with bullion banks and refiners, streamlining sales and reducing transaction costs.

- Credibility and Trust: Decades of operation foster trust with buyers, a crucial factor in commodity markets where counterparty risk is a concern.

- Barriers to Entry: New entrants face the challenge of building similar networks and establishing a reputation for consistent quality and supply, a costly and time-consuming endeavor.

The threat of new entrants into the gold mining sector, impacting companies like AngloGold Ashanti, is significantly low due to several formidable barriers. These include the exceptionally high capital requirements for exploration and mine development, which can easily exceed $1 billion for new projects announced in 2024. Furthermore, access to proven, economically viable gold reserves is increasingly difficult, with discovery rates for large deposits continuing to decline as of 2023, favoring established players with existing resource bases.

Stringent regulatory and environmental hurdles, including lengthy permitting processes that can take over five years in some jurisdictions in 2024, coupled with substantial compliance costs for environmental protection and waste management, further deter new competition. Additionally, established companies benefit from deep-rooted relationships within the distribution chain, including refiners and bullion dealers, which are difficult and time-consuming for newcomers to replicate, especially given the need to build credibility in a tightly-knit market.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

| Capital Requirements | Massive upfront investment for exploration, development, and infrastructure. | Prohibitive for most potential competitors. | New gold projects costing over $1 billion (2024 announcements). |

| Resource Access | Difficulty in finding and securing new, economically viable gold deposits. | Favors incumbents with existing reserves and exploration pipelines. | Declining discovery rates for large gold deposits (2023). |

| Regulatory & Environmental | Complex permitting, stringent environmental standards, and social license requirements. | Increases costs, timelines, and operational complexity. | Permit acquisition delays exceeding 5 years (2024); significant rehabilitation bond costs. |

| Distribution & Relationships | Established networks with refiners, dealers, and financial institutions. | Difficult to replicate, hindering market access and trust. | Securing off-take agreements with key refiners by major producers (2024). |

Porter's Five Forces Analysis Data Sources

Our AngloGold Ashanti Porter's Five Forces analysis is built upon a foundation of verified data, including annual reports, investor presentations, and industry-specific publications from reputable sources like S&P Global Market Intelligence and Wood Mackenzie.