AngloGold Ashanti Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngloGold Ashanti Bundle

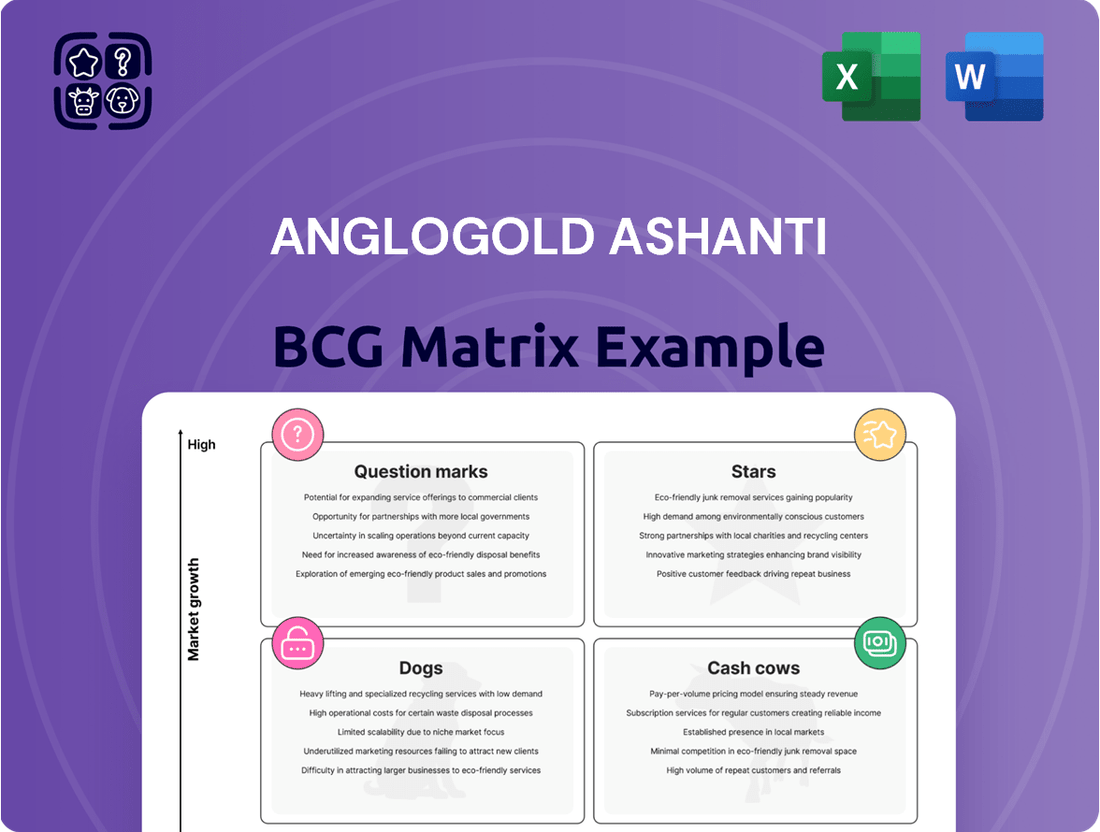

Explore AngloGold Ashanti's strategic positioning with our comprehensive BCG Matrix, revealing their portfolio's performance across Stars, Cash Cows, Dogs, and Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report, which provides detailed quadrant insights, actionable strategies, and a clear roadmap for capital allocation.

Don't miss out on the opportunity to gain a competitive edge; invest in the full report today for a data-driven understanding of AngloGold Ashanti's market standing and future growth opportunities.

Stars

The Sukari Gold Mine in Egypt is a significant Star for AngloGold Ashanti. Acquired in November 2024, this asset immediately made a substantial impact, contributing 117,000 ounces in its initial full quarter of operation during Q1 2025.

With an annual production potential nearing 500,000 ounces, Sukari is classified as a Tier 1 asset. This positions it strongly within a gold market experiencing robust growth.

The successful integration of Sukari has been a key factor in AngloGold Ashanti's recent strong financial performance and improved cash flow generation.

The Obuasi Mine in Ghana is a significant Star for AngloGold Ashanti, driven by substantial redevelopment and expansion efforts aimed at boosting production and longevity. A key component is the $500 million expansion project, which is projected to elevate annual output to 400,000 ounces by 2028 and extend the mine's operational life by two decades.

Demonstrating tangible progress, Obuasi reported a remarkable 72% increase in Underhand Drift and Fill (UHDF) ore tonnes mined in the first quarter of 2025 when compared to the preceding quarter, signaling a strong operational ramp-up.

Siguiri, a key asset for AngloGold Ashanti, has firmly established itself as a Star in the company's portfolio, showcasing a remarkable operational turnaround. This mine has achieved significant production growth, a testament to strategic operational enhancements.

In the first quarter of 2025, Siguiri delivered an impressive 80,000 ounces of gold. This represents a substantial 67% increase compared to the 47,900 ounces produced in the first quarter of 2024, highlighting its strong performance trajectory.

The impressive turnaround at Siguiri is largely attributed to optimized carbon-assisted operations and a notable increase in plant stability. These improvements have directly translated into enhanced operational efficiency and higher output levels.

Tropicana (Australia)

Tropicana in Australia is demonstrating strong potential, positioning itself as a Star in AngloGold Ashanti's portfolio. The mine experienced a significant 40% surge in production during the first quarter of 2025, a notable recovery following earlier disruptions caused by adverse weather conditions.

This impressive rebound underscores Tropicana's capability to deliver substantial output when operational challenges are overcome. Its improved performance is a key factor in its classification as a Star, indicating high growth and market share within the company's operations.

- Tropicana's Q1 2025 production increase: 40%

- Key factor for Star classification: Robust production rebound and high growth potential.

- Impact of previous disruptions: Rainfall impacted earlier operational efficiency.

Overall Production Growth and Market Position

AngloGold Ashanti demonstrated robust operational performance in Q1 2025, with overall gold production climbing 22% year-on-year to 720,000 ounces. This represents the company's most significant first-quarter output since Q1 2020.

The company's market position is bolstered by this production growth, further enhanced by a substantial 39% increase in average realized gold prices, reaching $2,874 per ounce. This favorable market condition translated into a remarkable 607% surge in free cash flow, hitting $403 million, and a 158% rise in Adjusted EBITDA to $1.12 billion.

- Strong Production Growth: 22% year-on-year increase in Q1 2025 to 720,000 ounces.

- Record Q1 Output: Highest first-quarter production since Q1 2020.

- Favorable Pricing Environment: 39% rise in average realized gold prices to $2,874/oz.

- Financial Performance: 607% increase in free cash flow to $403 million and 158% rise in Adjusted EBITDA to $1.12 billion.

The Sukari, Obuasi, Siguiri, and Tropicana mines are all classified as Stars for AngloGold Ashanti, demonstrating strong production and growth potential within the company's portfolio. Sukari, acquired in late 2024, contributed 117,000 ounces in its first full quarter of operation (Q1 2025) and has a potential of nearly 500,000 ounces annually. Obuasi's redevelopment aims for 400,000 ounces by 2028, with a 72% increase in ore tonnes mined in Q1 2025. Siguiri achieved 80,000 ounces in Q1 2025, a 67% rise from Q1 2024, due to operational enhancements. Tropicana saw a 40% production surge in Q1 2025, recovering from weather disruptions.

| Mine | Q1 2025 Production (ounces) | Year-on-Year Change | Key Growth Driver |

| Sukari | 117,000 | N/A (New Acquisition) | Potential for ~500,000 oz annual production |

| Obuasi | N/A | 72% increase in ore tonnes mined (Q1 2025 vs Q4 2024) | Redevelopment and expansion project |

| Siguiri | 80,000 | 67% increase (vs Q1 2024) | Optimized operations and plant stability |

| Tropicana | N/A | 40% increase (Q1 2025) | Recovery from weather disruptions, high growth potential |

What is included in the product

This BCG Matrix overview for AngloGold Ashanti analyzes its mining assets based on market share and growth potential.

The AngloGold Ashanti BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex portfolio data.

Cash Cows

Geita, located in Tanzania, consistently operates as a Cash Cow for AngloGold Ashanti. This mine is a significant contributor to the company's financial health, demonstrating stable production levels and generating reliable cash flow.

In the first quarter of 2024, Geita achieved a gold production of 114,000 ounces. This strong performance was primarily driven by an increase in the total recovered grades, highlighting the mine's efficient operations and resource quality.

The consistent output from Geita solidifies its position as a dependable cash generator within AngloGold Ashanti's portfolio. Its ongoing stability and contribution are crucial for funding other growth initiatives and maintaining overall financial strength.

Cerro Vanguardia in Argentina stands as a prime Cash Cow for AngloGold Ashanti, consistently generating strong positive cash flow. Its operational efficiency has seen notable improvements, solidifying its position within the company's portfolio.

In 2024, gold production at Cerro Vanguardia increased by a significant 7% year-on-year, reaching 175,000 ounces. This growth was largely driven by enhanced operational performance and an uptick in ore grades, underscoring the mine's robust output capabilities.

The mine's resilience in maintaining production levels and effectively managing costs, even amidst prevailing inflationary pressures in 2024, is a testament to its considerable cash-generating strength and reliable contribution to AngloGold Ashanti's financial health.

AngloGold Ashanti's strong free cash flow generation is a key indicator of its Cash Cow status. The company reported a remarkable $942 million in free cash flow for 2024, a significant nine-fold jump from the previous year. This robust performance was further demonstrated in Q1 2025, with free cash flow reaching $403 million, a substantial 607% increase compared to the same period in 2024.

This impressive cash generation is a direct result of effective cost management strategies and favorable gold prices. These factors highlight the maturity and efficiency of AngloGold Ashanti's existing operations, allowing them to consistently produce substantial cash surpluses that can be reinvested or distributed.

Disciplined Capital Allocation and Shareholder Returns

AngloGold Ashanti's disciplined capital allocation is clearly demonstrated through its commitment to shareholder returns, underscored by a new dividend policy. This policy aims to distribute 50% of its annual free cash flow, signaling strong confidence in its ongoing cash generation capabilities from its established Cash Cow assets.

The company's financial health, bolstered by these reliable cash flows, is evident in its strengthened balance sheet. In the first quarter of 2025, adjusted net debt saw a significant reduction of 60% year-on-year, bringing it down to $525 million. This financial prudence allows AngloGold Ashanti to effectively reward its shareholders while simultaneously positioning itself for strategic investments in future growth initiatives.

- Dividend Policy: Targeting 50% of annual free cash flow distribution.

- Balance Sheet Strength: Adjusted net debt reduced by 60% year-on-year in Q1 2025.

- Financial Stability: Achieved through robust cash generation from Cash Cow assets.

- Shareholder Returns: Enabled by improved financial health and asset performance.

Optimized Portfolio with Mature Operations

AngloGold Ashanti is strategically optimizing its portfolio by focusing on mature operations to boost efficiency and cash flow. This approach ensures that established, high-market-share mines continue to be significant profit drivers, especially in the current environment of elevated gold prices.

The company's commitment to continuous improvement across its managed operations allows it to maximize returns from these existing assets. For instance, in 2023, AngloGold Ashanti reported a significant improvement in its all-in sustaining costs (AISC), which directly benefits its mature operations by enhancing profitability.

- Focus on Efficiency: AngloGold Ashanti's strategy prioritizes operational enhancements in its established mines.

- Cash Conversion: The company aims to maximize cash generation from its mature assets.

- Leveraging Gold Prices: Mature operations are key to capturing the full benefit of favorable gold market conditions.

- Portfolio Management: This segment represents the stable, cash-generating core of the company's business.

AngloGold Ashanti's Cash Cows are its mature, high-performing assets that consistently generate substantial free cash flow. These operations, like Geita and Cerro Vanguardia, are vital for funding the company's growth initiatives and rewarding shareholders.

The company's overall free cash flow demonstrates the strength of these Cash Cow assets. For 2024, AngloGold Ashanti reported $942 million in free cash flow, a significant increase from the prior year, with Q1 2025 showing $403 million, a 607% jump year-on-year.

This robust cash generation is underpinned by effective cost management and favorable gold prices, allowing for a new dividend policy targeting 50% of annual free cash flow distribution.

The financial health derived from these Cash Cows is further evidenced by a 60% year-on-year reduction in adjusted net debt to $525 million by Q1 2025.

| Asset | 2024 Production (oz) | 2024 Performance Indicator | 2025 Q1 Cash Flow Contribution |

| Geita (Tanzania) | 114,000 (Q1 2024) | Increased recovered grades | Stable contributor |

| Cerro Vanguardia (Argentina) | 175,000 (2024) | 7% YoY production increase | Strong positive cash flow |

| Overall Company | N/A | $942M Free Cash Flow (2024) | $403M Free Cash Flow (Q1 2025) |

Full Transparency, Always

AngloGold Ashanti BCG Matrix

The AngloGold Ashanti BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive analysis, crafted with strategic insights, will be delivered to you without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Córrego do Sítio, located in Brazil, has been classified as a Dog within AngloGold Ashanti's portfolio. The mine was placed on care and maintenance in August 2023, signaling a shift away from active production due to economic viability concerns.

This strategic decision directly contributed to increased care-and-maintenance expenses and retrenchment costs for AngloGold Ashanti in 2023. Assets like Córrego do Sítio, which are no longer profitable and require ongoing investment without generating substantial returns, are often referred to as cash traps.

AngloGold Ashanti's divestment of the Doropo and ABC Projects in Côte d'Ivoire during the first quarter of 2025 signals a strategic move away from underperforming or non-core assets. This action is expected to free up capital and management attention. For instance, in 2024, the company reported a net loss of $149 million, highlighting the need to streamline its portfolio.

The sale of these West African assets allows AngloGold Ashanti to concentrate on its more promising operations, particularly those in the United States. This strategic realignment is crucial for optimizing resource allocation and reducing the drain on company resources, as the company aims to bolster its overall financial health and operational efficiency.

AngloGold Ashanti's non-managed joint ventures saw a significant 17% production drop in the first quarter of 2025. This stark contrast to their managed operations highlights potential underperformance within these partnerships.

These underperforming joint ventures might represent assets with diminishing strategic importance or those failing to generate substantial growth and cash flow for the company. Their inclusion in the portfolio could be a drag on overall performance.

Iduapriem (Ghana) - Prior to JV Impact

Iduapriem, a mine in Ghana, is currently facing significant operational hurdles. Prior to its planned joint venture, the operation saw a production drop of 22,000 ounces in the first quarter of 2025. This decline points to ongoing difficulties within older mining assets.

In its current standalone condition, Iduapriem appears to be operating as a Dog within the BCG matrix. This classification suggests it is consuming capital and resources without generating the expected returns. Its future performance is heavily contingent on the successful implementation and positive impact of the proposed joint venture.

- Production Decline: Iduapriem's Q1 2025 output fell by 22,000 ounces.

- Asset Challenges: The decline signals lingering issues in older mining infrastructure.

- BCG Classification: Currently positioned as a Dog, indicating low market share and low growth potential.

- JV Dependency: Future viability relies on the success of the upcoming joint venture.

Kibali (DR Congo) - Production Decline

The Kibali mine in the Democratic Republic of Congo, a significant joint venture for AngloGold Ashanti, experienced a production dip of 13,000 ounces in the first quarter of 2025. This decrease in output, while not catastrophic, signals that the operation is currently navigating operational challenges, impacting its otherwise strong potential.

This scenario places Kibali in a position where its performance trajectory is crucial. Assets like Kibali, exhibiting declining production within a dynamic market, warrant close observation. If these operational hurdles persist and output doesn't rebound, its classification within strategic matrices might shift, requiring careful consideration of its future role and investment.

- Kibali Production (Q1 2025): 13,000 ounces lower than previous periods.

- Operational Context: Joint venture facing current output challenges.

- Strategic Implication: Declining production necessitates performance monitoring.

- Market Position: Competitive environment demands efficiency and growth.

Dogs in AngloGold Ashanti's portfolio represent assets with low market share and low growth potential, often requiring significant investment without commensurate returns. Córrego do Sítio, a Brazilian mine, was placed on care and maintenance in August 2023, a clear indicator of its Dog status due to economic viability issues. The sale of the Doropo and ABC Projects in Côte d'Ivoire in Q1 2025 further illustrates the company's strategy to divest underperforming assets, a move underscored by a reported net loss of $149 million in 2024.

The Iduapriem mine in Ghana, currently facing operational difficulties, has seen a production drop of 22,000 ounces in Q1 2025. This decline places it in the Dog category, heavily reliant on a proposed joint venture for future viability. Similarly, the Kibali mine, a significant joint venture, experienced a 13,000-ounce production dip in Q1 2025, highlighting current operational challenges that, if unaddressed, could shift its strategic classification.

| Asset | Location | Status/Challenge | Q1 2025 Production Impact | BCG Classification |

|---|---|---|---|---|

| Córrego do Sítio | Brazil | Care and maintenance (Aug 2023) | N/A (inactive) | Dog |

| Doropo & ABC Projects | Côte d'Ivoire | Divested (Q1 2025) | N/A (divested) | Dog |

| Iduapriem | Ghana | Operational hurdles | -22,000 ounces | Dog (pending JV) |

| Kibali (JV) | DRC | Operational challenges | -13,000 ounces | Potential Dog (under review) |

Question Marks

The Arthur Gold Project in Nevada is a prime example of a Question Mark in AngloGold Ashanti's portfolio. Recognized as one of the largest and fastest-growing gold discoveries in the United States, it's considered a Tier-1 opportunity for the company.

Currently undergoing a pre-feasibility study, with completion anticipated by late 2025 or early 2026, Arthur Gold demands significant capital infusion and extensive development to reach production status and graduate to a Star.

AngloGold Ashanti's greenfields exploration pipeline, a key component of its growth strategy, involves significant investment in promising but unproven mineral assets. In 2024, the company continued to actively explore in diverse regions such as Australia, Argentina, Brazil, Tanzania, and Egypt, seeking to uncover substantial new gold deposits.

These exploration efforts span an impressive area of over 23,700 square kilometers, representing a substantial commitment to future resource discovery. While these tenements hold considerable potential for long-term value creation, they currently represent a capital drain without generating immediate returns, characteristic of 'question marks' in a BCG matrix.

AngloGold Ashanti's acquisition of Augusta Gold Corp in July 2025 for approximately $150 million was a strategic move to bolster its Nevada District holdings, focusing on future growth rather than immediate production. This acquisition positions these newly acquired assets as potential Stars in the BCG matrix, given their development and exploration status.

The Nevada assets, while promising for long-term expansion, are currently in the early stages, requiring substantial investment and successful development to transition from Question Marks to Stars. This investment reflects AngloGold's commitment to building its North American footprint and diversifying its production base.

New Exploration Agreements in Egypt's Eastern Desert

AngloGold Ashanti's new exploration agreement in Egypt's Eastern Desert, signed in April 2025, places these ventures squarely in the Question Marks category of the BCG Matrix. This strategic move signals a proactive approach to identifying future growth opportunities in a region with known geological potential. The company is investing in the unknown, hoping to discover viable mineral deposits that could become future stars.

- High Risk, High Reward Potential: Exploration agreements like this in Egypt represent significant upfront investment with no guarantee of return, characteristic of Question Marks.

- Strategic Geographic Focus: The Eastern Desert is a region of interest for mineral exploration, aligning with AngloGold Ashanti's goal to diversify its asset base and tap into new resource frontiers.

- Long-Term Investment Horizon: These projects require substantial capital and time for geological surveys, drilling, and feasibility studies before any potential production, typical of early-stage exploration.

- Future Growth Engine: Successful exploration could transform these Question Marks into Stars, contributing significantly to AngloGold Ashanti's future revenue and market position.

Proposed Iduapriem/Tarkwa Joint Venture (Ghana)

The proposed joint venture between AngloGold Ashanti's Iduapriem mine and Gold Fields' Tarkwa mine in Ghana is classified as a Question Mark within the BCG matrix. This designation reflects its uncertain future prospects despite significant potential. Iduapriem experienced a notable decline in production during the first quarter of 2025, underscoring the challenges it faces.

The primary objective of this joint venture is to create a more robust and efficient operation. By combining resources and expertise, the venture aims to extend the operational life of both mines, boost overall production levels, and importantly, reduce operating costs. These strategic goals highlight the potential for the venture to transition into a Star or even a Cash Cow if successful.

However, the success of this ambitious undertaking is not guaranteed. Several critical factors will determine its outcome:

- Government Approvals: Securing the necessary regulatory and governmental approvals in Ghana is a prerequisite for the joint venture to proceed.

- Integration Effectiveness: The ability of AngloGold Ashanti and Gold Fields to effectively integrate their respective operations, management, and cultures will be paramount to realizing the envisioned synergies.

- Operational Performance: The venture's actual ability to achieve its stated goals of extended mine life, increased production, and cost reduction will be the ultimate determinant of its success.

Question Marks in AngloGold Ashanti's portfolio represent assets with high potential but uncertain futures, requiring significant investment. The Arthur Gold Project in Nevada, a key exploration asset, exemplifies this, with its pre-feasibility study expected by late 2025 or early 2026, demanding substantial capital to reach production.

AngloGold Ashanti's extensive greenfields exploration across over 23,700 square kilometers in 2024, including areas like Australia and Argentina, highlights a commitment to discovering new deposits. These ventures, while promising for long-term value, currently consume capital without generating returns, fitting the 'question mark' profile.

The acquisition of Augusta Gold Corp in July 2025 for approximately $150 million, along with the new exploration agreement in Egypt's Eastern Desert signed in April 2025, further illustrate the company's strategy of investing in unproven, high-potential assets. These are classic Question Marks, requiring time and capital to potentially become future Stars.

The proposed joint venture between Iduapriem and Tarkwa mines in Ghana is also a Question Mark due to its uncertain integration and operational success, despite the potential for improved efficiency and reduced costs. Iduapriem's production decline in Q1 2025 underscores the challenges that need to be overcome for this venture to thrive.

| Asset/Project | BCG Category | Status/Key Developments | Investment Rationale | Potential Outcome |

| Arthur Gold Project (Nevada) | Question Mark | Pre-feasibility study by late 2025/early 2026; significant exploration ongoing. | Tier-1 opportunity, largest/fastest-growing gold discovery in US; diversify North American footprint. | Transition to Star with successful development and production. |

| Greenfields Exploration (Global) | Question Mark | Over 23,700 sq km explored in 2024 (Australia, Argentina, Brazil, Tanzania, Egypt). | Discover substantial new gold deposits; future resource growth engine. | Discovery of new, high-grade deposits could become Stars or Cash Cows. |

| Egypt Eastern Desert Exploration | Question Mark | New exploration agreement signed April 2025. | Tap into new resource frontiers; high geological potential. | Discovery of viable mineral deposits could lead to future production. |

| Iduapriem/Tarkwa JV (Ghana) | Question Mark | Proposed joint venture; Iduapriem production declined in Q1 2025. | Create robust/efficient operation, extend mine life, boost production, reduce costs. | Successful integration and operation could lead to Star or Cash Cow status. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining AngloGold Ashanti's financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.