AngioDynamics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngioDynamics Bundle

Navigate the complex external forces shaping AngioDynamics's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Gain a critical competitive advantage by leveraging these expert insights to refine your strategy. Purchase the full PESTLE analysis now for actionable intelligence and informed decision-making.

Political factors

Government healthcare policies significantly shape the market for medical devices like those produced by AngioDynamics. For instance, the ongoing push towards value-based care models in the US, which began gaining substantial traction in the mid-2010s and continues to evolve, incentivizes providers to focus on patient outcomes rather than service volume. This can influence the adoption of technologies that demonstrate clear cost-effectiveness and improved patient results.

Shifts in US healthcare policy, such as potential legislative changes or a greater emphasis on non-device-based interventions, could directly affect AngioDynamics' product approval pathways and opportunities for market expansion. For example, if policy prioritizes minimally invasive procedures that reduce the need for certain implanted devices, it could alter demand dynamics.

Furthermore, changes in how health systems and hospitals are funded, often tied to government reimbursement rates and policy directives, play a crucial role in their capital expenditure decisions. In 2024, many hospital systems are still navigating evolving reimbursement landscapes, making the demonstrable economic benefits of medical devices a key purchasing consideration.

The U.S. Food and Drug Administration (FDA) plays a crucial role in shaping the medical device landscape. Recent shifts, such as the transition from the Quality System Regulation (QSR) to the Quality Management System Regulation (QMSR), which aligns with ISO 13485:2016, are creating new compliance requirements for companies like AngioDynamics. Furthermore, the FDA's evolving guidance on artificial intelligence (AI) in medical devices presents both challenges and opportunities for innovation.

Potential delays in FDA approval processes, partly attributed to staffing challenges within the Center for Devices and Radiological Health (CDRH), could impact AngioDynamics' product launch timelines. For instance, in fiscal year 2023, the FDA reported an average review time for Premarket Approval (PMA) applications that can extend significantly, potentially affecting the speed at which new technologies reach the market.

Conversely, a renewed focus on accelerated approval pathways, spurred by executive actions, could benefit AngioDynamics by potentially shortening the time to market for groundbreaking devices. This creates a dynamic environment where regulatory agility is key to capitalizing on emerging market needs and technological advancements.

International trade policies and tariffs significantly impact medical device manufacturers like AngioDynamics. For instance, the US International Trade Commission reported that tariffs on imported medical components could add millions to production costs for domestic manufacturers. This pressure on production expenses can translate to higher prices for essential medical technologies, potentially limiting patient access.

While initiatives like the proposed 'zero for zero' tariff agreements for medical devices aim to reduce these burdens, their actual implementation and effectiveness remain subject to ongoing geopolitical negotiations and trade relations. Uncertainty surrounding these policies creates a risk of supply chain disruptions and unexpected cost increases for companies like AngioDynamics.

To navigate these complexities, companies are increasingly exploring strategies such as diversifying their supply chains, potentially relocating some manufacturing operations to regions with more favorable trade agreements, or forging local partnerships. For example, in 2024, several medical device companies announced plans to expand or establish manufacturing facilities in countries with lower import duties to mitigate the impact of global trade tensions.

Political stability in key markets

Political stability in AngioDynamics' key operating and sales markets is paramount for ensuring uninterrupted business operations and maintaining access to crucial markets. For instance, geopolitical shifts in regions like Europe, a significant market for medical devices, can directly impact healthcare budgets and regulatory approvals, influencing AngioDynamics' international revenue streams. The company's global footprint, with operations and sales extending across numerous countries, necessitates a close watch on political climates to mitigate risks and capitalize on opportunities.

Changes in government policies, trade agreements, and healthcare reforms can significantly alter the landscape for medical technology companies. For example, in 2024, many nations are re-evaluating their healthcare procurement strategies, which could affect demand for AngioDynamics' minimally invasive surgical products. Political instability can also lead to supply chain disruptions, as seen in past instances where regional conflicts have hampered the movement of goods, impacting companies like AngioDynamics that rely on global logistics.

- Geopolitical Risk: AngioDynamics operates in over 80 countries, making it susceptible to political instability in any of these regions.

- Healthcare Policy Impact: Government decisions on healthcare reimbursement and funding, such as the Biden-Harris administration's focus on lowering healthcare costs in the US, directly influence sales volumes.

- Regulatory Environment: Political shifts can lead to changes in medical device regulations, potentially affecting product approvals and market entry strategies for AngioDynamics.

Government funding for medical research and innovation

Government funding significantly fuels medical research and innovation, directly impacting companies like AngioDynamics that depend on technological advancements. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $47.4 billion in fiscal year 2023 for medical research, a substantial portion of which supports the development of new medical technologies.

A decrease in such government support could slow down the pipeline of next-generation medical devices, potentially hindering AngioDynamics' growth trajectory and its ability to maintain a competitive advantage. This is particularly relevant as the company's product portfolio often relies on innovations emerging from federally funded research initiatives.

Furthermore, regulatory pathways like the FDA's Breakthrough Device Designation can influence the willingness of government payers, such as Medicare, to reimburse for novel technologies. In 2024, the FDA continued to streamline pathways for innovative medical devices, aiming to accelerate patient access.

- NIH Funding: The NIH's substantial budget, around $47.4 billion in FY2023, underpins a significant portion of medical technology research.

- Impact of Funding Cuts: Reductions in government funding can directly slow the pace of innovation, affecting AngioDynamics' access to new technologies.

- FDA Designations: Breakthrough Device Designations can improve reimbursement prospects from government programs, a critical factor for market adoption.

Government healthcare policies, such as the ongoing shift towards value-based care in the US, directly influence the adoption of medical technologies like those from AngioDynamics, favoring solutions that demonstrate cost-effectiveness and improved patient outcomes.

Changes in regulatory frameworks, like the FDA's transition to the QMSR and evolving AI guidance, create new compliance demands and innovation opportunities for the company, while potential review delays can impact product launch timelines.

International trade policies and tariffs can increase production costs for medical device manufacturers, potentially affecting pricing and patient access, although initiatives like 'zero for zero' tariff agreements aim to mitigate these burdens.

What is included in the product

This AngioDynamics PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors impacting the company's operations and strategic direction.

It offers actionable insights for AngioDynamics's leadership to navigate external challenges and capitalize on emerging opportunities within the medical device industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering AngioDynamics a clear path to address external challenges and capitalize on opportunities.

Helps support discussions on external risk and market positioning during planning sessions, acting as a pain point reliever by identifying and mitigating potential threats for AngioDynamics.

Economic factors

Global economic growth is a significant driver for AngioDynamics. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, with a slight uptick to 3.2% in 2025. This overall expansion translates to increased healthcare spending, as both governments and private entities have more resources to allocate to healthcare infrastructure and advanced medical technologies.

Regional economic performance also plays a crucial role. In North America, a key market for AngioDynamics, the US economy showed resilience, with GDP growth estimated around 2.5% for 2024. Stronger regional economies empower healthcare providers to invest in innovative solutions, directly benefiting companies that supply these advanced medical devices. Conversely, economic slowdowns in these regions can constrain capital expenditure budgets, impacting demand.

The healthcare sector, in particular, is sensitive to economic cycles. During periods of robust economic activity, healthcare providers often have more disposable income to upgrade equipment and adopt new treatment modalities. AngioDynamics' product portfolio, which includes minimally invasive surgical tools, directly benefits from this trend. For example, in 2023, AngioDynamics reported net sales of $375.6 million, a figure that is expected to see continued growth supported by positive economic tailwinds in its primary markets.

Global healthcare spending is on an upward trajectory, with projections indicating continued double-digit growth into 2025. This surge is fueled by technological innovation in medical devices and a growing preference for private healthcare services.

Reimbursement policies are a significant factor for medical device companies like AngioDynamics. The move towards value-based care and bundled payment systems means that manufacturers must demonstrate how their products contribute to improved patient outcomes and cost efficiencies to gain market traction.

For AngioDynamics, aligning its product portfolio, especially devices that boost operational efficiency or enhance patient recovery, with these evolving reimbursement frameworks is crucial for both market acceptance and long-term financial success.

Inflationary pressures, particularly on labor and raw materials, directly affected AngioDynamics' gross margins in fiscal year 2025. The company reported that these rising costs presented a significant challenge to maintaining profitability.

To counteract these inflationary impacts, AngioDynamics has focused on diligent supply chain management. These efforts are crucial for mitigating the effects of increased input costs and are likely influencing their pricing strategies to ensure sustained profitability.

The strategic decision to transition some manufacturing segments to outsourced partners is a clear indicator of AngioDynamics' proactive approach to managing these escalating costs. This move aims to optimize their cost structure in the face of ongoing inflationary headwinds.

Currency exchange rate fluctuations

Currency exchange rate fluctuations directly affect AngioDynamics' international net sales and overall financial health. When foreign currencies weaken against the US dollar, the company's reported revenues from those regions can decrease. For instance, in Q3 2024, AngioDynamics reported that unfavorable foreign currency movements had a modest negative impact on its net sales, though the exact percentage was not substantial enough to significantly alter growth trends for that specific period.

Managing this foreign currency exposure is critical for AngioDynamics, given its significant global sales presence. While the company may not always see a large impact, adverse currency movements can erode the value of international earnings when converted back into US dollars. This necessitates strategies to mitigate such risks, ensuring more stable financial reporting across different reporting periods.

The impact can vary. For example, in fiscal year 2023, AngioDynamics noted that while the overall impact of foreign currency was manageable, specific regional performance was more sensitive to these shifts. Companies with substantial operations in countries like Europe or Japan, where exchange rates can be volatile, must actively monitor and potentially hedge against these currency risks to protect their profitability.

- Impact on International Sales: Fluctuations in currency exchange rates can directly reduce the value of AngioDynamics' net sales generated from international markets when translated into US dollars.

- Financial Performance: Adverse currency movements can negatively impact the company's overall financial performance and profitability.

- Q3 2024 Data: In the third quarter of 2024, AngioDynamics experienced a modest negative impact from foreign currency exchange rates on its net sales.

- Risk Management: Effective management of foreign currency exposure is essential for companies like AngioDynamics with a global sales footprint to ensure financial stability.

Consumer purchasing power and healthcare affordability

Consumer purchasing power directly impacts healthcare spending, influencing patient decisions regarding elective procedures and advanced medical technologies. In 2024, persistent inflation and rising interest rates have put pressure on household budgets, potentially leading consumers to defer non-essential medical treatments. For instance, a significant portion of out-of-pocket healthcare expenses can be discretionary, making it sensitive to economic downturns.

The affordability of healthcare services is a critical driver for AngioDynamics. As healthcare systems face increasing cost pressures, there's a pronounced demand for solutions that reduce overall treatment expenses and improve patient outcomes efficiently. This economic reality favors minimally invasive techniques, which often translate to shorter hospital stays and reduced recovery times, thereby lowering the total cost of care for both patients and providers. AngioDynamics' portfolio of minimally invasive diagnostic and therapeutic devices is well-positioned to meet this growing need.

- Consumer Spending on Healthcare: In the US, out-of-pocket healthcare spending represented approximately 10-12% of total healthcare expenditures in recent years, a figure that can fluctuate based on insurance coverage and economic conditions.

- Demand for Cost-Effective Solutions: Studies in 2024 indicate that a majority of patients are actively seeking healthcare options that balance quality with affordability, prioritizing procedures with lower associated costs and faster recovery.

- Impact on Medical Device Adoption: The push for value-based care and cost containment within healthcare systems is accelerating the adoption of medical technologies that demonstrate clear economic benefits, such as reduced readmission rates and shorter procedure times.

Global economic growth directly influences healthcare spending, a key market for AngioDynamics. The IMF projected global growth at 3.1% for 2024, expected to rise to 3.2% in 2025, indicating increased resources for healthcare investments. North America, a critical region for AngioDynamics, saw its economy resilient, with the US GDP growth estimated around 2.5% in 2024, supporting capital expenditure by healthcare providers. This economic environment is favorable for companies like AngioDynamics, whose sales reached $375.6 million in fiscal year 2023, benefiting from positive economic trends.

Inflationary pressures significantly impacted AngioDynamics' gross margins in fiscal year 2025 due to rising labor and raw material costs. The company actively manages these challenges through diligent supply chain oversight and strategic outsourcing of manufacturing segments to optimize its cost structure against these headwinds. These measures are crucial for maintaining profitability amidst escalating input expenses.

Currency exchange rate fluctuations present a notable risk to AngioDynamics' international sales. In Q3 2024, the company reported a modest negative impact on net sales from unfavorable foreign currency movements. Effective management of this exposure is vital for AngioDynamics, given its substantial global sales footprint, to ensure stable financial reporting and protect international earnings.

Preview Before You Purchase

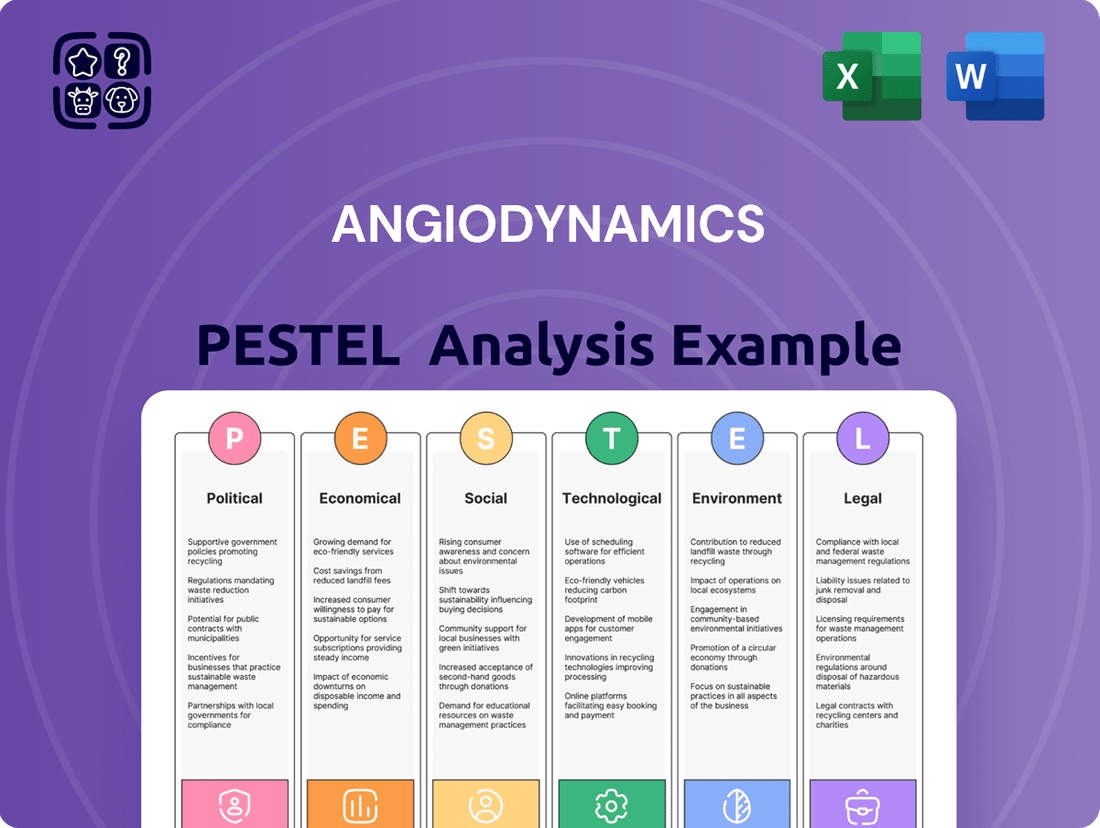

AngioDynamics PESTLE Analysis

The preview shown here is the exact AngioDynamics PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting AngioDynamics.

The content and structure shown in the preview is the same AngioDynamics PESTLE Analysis document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

The world's population is getting older. By 2050, it's projected that nearly 17% of the global population will be over 65, a significant jump from around 10% in 2022. This demographic shift directly impacts healthcare needs.

Alongside this aging trend, chronic diseases like peripheral vascular disease and various cancers are becoming more common. For instance, the global prevalence of cardiovascular diseases, a major category of chronic illness, affects hundreds of millions worldwide.

AngioDynamics is well-positioned to capitalize on these trends. Their medical devices are designed to diagnose and treat many of these age-related and chronic conditions.

Specifically, minimally invasive procedures are increasingly preferred for older adults due to their lower risk and faster recovery times, aligning perfectly with AngioDynamics' product offerings.

The increasing patient preference for minimally invasive procedures (MIS) is a significant sociological driver. Benefits such as quicker recovery times, shorter hospital stays, and reduced risk of infection are making MIS the preferred choice for many. This trend directly supports AngioDynamics' product portfolio, which features devices crucial for procedures like angioplasty and embolization.

The global MIS market is experiencing robust expansion, fueled by ongoing technological innovations. Projections indicate continued strong growth in this sector, presenting a key opportunity for AngioDynamics. For instance, the market for minimally invasive surgical instruments alone was valued at over $15 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of approximately 7% through 2030.

Patient awareness regarding treatment options is significantly rising, driving a demand for more active participation in healthcare decisions. In 2024, studies indicated that over 70% of patients actively research their medical conditions and treatment possibilities online before consulting with a physician, influencing their choices in medical devices and procedures.

This heightened patient engagement directly impacts the medical device sector, with a clear preference emerging for less invasive procedures. AngioDynamics, for instance, sees this trend as a catalyst for innovation, pushing for the development of devices that promise faster recovery and improved quality of life, aligning with patient-centric care models.

Lifestyle changes and disease incidence

Shifting societal lifestyles, particularly concerning diet and exercise, are directly linked to a rise in chronic diseases. This trend, unfortunately, creates a growing need for medical solutions. For instance, increasing rates of obesity and cardiovascular disease, often stemming from sedentary habits and poor nutrition, drive demand for interventions targeting conditions like peripheral vascular disease, a key area for AngioDynamics.

This societal evolution translates into a sustained market for medical device companies like AngioDynamics. As more individuals face health challenges due to lifestyle choices, the reliance on advanced medical technologies to manage and treat these conditions grows. This creates a consistent demand for the innovative products AngioDynamics offers.

- Rising Chronic Disease Rates: Globally, chronic diseases account for a significant portion of healthcare spending, with conditions like cardiovascular disease and diabetes on the rise. For example, the World Health Organization reported in 2023 that cardiovascular diseases remain the leading cause of death globally, accounting for an estimated 17.9 million deaths each year.

- Impact of Sedentary Lifestyles: Lack of physical activity contributes to conditions like obesity, which is a major risk factor for many chronic diseases. Data from the Centers for Disease Control and Prevention (CDC) indicated in 2023 that approximately 42.4% of U.S. adults were obese.

- Demand for Vascular Interventions: The prevalence of vascular issues, often exacerbated by lifestyle factors, directly fuels the market for devices used in peripheral vascular interventions.

Healthcare access and disparities

Societal factors concerning healthcare access and disparities significantly shape the market for medical devices like those produced by AngioDynamics. As of 2024, the US Census Bureau reported that approximately 26.5 million people lacked health insurance, highlighting persistent access challenges that can limit the adoption of advanced medical technologies, particularly in lower-income demographics. Conversely, initiatives aimed at expanding healthcare access, such as the growth of telehealth services which saw a significant surge during the pandemic and continues to be a focus for providers in 2025, can open new avenues for device deployment, especially for remote patient monitoring solutions.

Efforts to bridge these healthcare gaps, particularly in rural and underserved urban areas, present direct opportunities for AngioDynamics. For instance, the Centers for Medicare & Medicaid Services (CMS) continues to refine reimbursement policies for telehealth and remote patient monitoring, potentially increasing the financial viability of devices that facilitate care delivery outside traditional clinical settings. A focus on devices that demonstrably improve health outcomes in vulnerable populations, such as those addressing chronic diseases prevalent in low-income communities, is likely to attract greater investment and policy support, fostering broader market penetration.

- Healthcare Access Gaps: In 2024, millions remained uninsured in the US, impacting device adoption.

- Telehealth Expansion: The ongoing growth of telehealth in 2025 creates new markets for remote monitoring devices.

- Reimbursement Focus: CMS policies are increasingly supporting remote care technologies, benefiting device manufacturers.

- Outcome-Driven Devices: Innovations improving health in underserved communities are poised for greater access and support.

Societal shifts are profoundly influencing healthcare demands and preferences. The aging global population, with projections indicating nearly 17% over 65 by 2050, coupled with rising chronic diseases, creates a sustained need for advanced medical solutions. AngioDynamics' focus on minimally invasive procedures aligns with patient preferences for lower risk and faster recovery, a trend amplified by increased patient awareness and engagement in their health decisions. Lifestyle changes, such as sedentary habits, are further driving the prevalence of chronic conditions, thereby boosting the market for vascular interventions and related medical devices.

| Sociological Factor | Description | Impact on AngioDynamics | Supporting Data (2023-2025) |

|---|---|---|---|

| Aging Population | Global population over 65 projected to reach 17% by 2050. | Increased demand for treatments of age-related diseases. | Global population over 65 was ~10% in 2022. |

| Rise in Chronic Diseases | Cardiovascular diseases and cancers are becoming more common. | Directly fuels demand for diagnostic and therapeutic devices. | Cardiovascular diseases cause ~17.9 million deaths annually (WHO, 2023). |

| Preference for MIS | Patients favor less invasive procedures for quicker recovery. | Strong alignment with AngioDynamics' product portfolio. | MIS surgical instruments market valued >$15 billion (2023), projected 7% CAGR. |

| Patient Engagement | Increased patient research and participation in healthcare choices. | Drives demand for patient-centric, effective treatment options. | >70% of patients research conditions online before appointments (2024). |

| Lifestyle Impact | Sedentary lifestyles contribute to obesity and chronic conditions. | Sustains demand for interventions targeting vascular health. | ~42.4% of US adults were obese (CDC, 2023). |

Technological factors

Technological advancements are reshaping the medical device landscape, with AI, robotics, and 3D printing at the forefront. AI is proving invaluable in medical diagnostics, enabling earlier and more precise identification of diseases by sifting through vast datasets. Robotic surgery is also making significant strides, offering enhanced precision and minimally invasive options that improve patient outcomes.

These innovations present a clear opportunity for AngioDynamics to bolster its offerings. By integrating these cutting-edge technologies, AngioDynamics can develop next-generation medical devices that not only improve patient care but also streamline clinical workflows. For instance, the global AI in healthcare market was projected to reach over $150 billion by 2023, highlighting the immense potential for companies embracing this technology.

The healthcare landscape is rapidly embracing telemedicine and remote monitoring, a trend significantly amplified by technological progress. This shift is making virtual care and continuous patient oversight standard practice.

AngioDynamics stands to gain from this evolution, particularly through the increased use of Internet of Medical Things (IoMT) devices. These tools enable real-time patient data collection and analysis, which is crucial for managing chronic conditions. For instance, the global IoMT market was valued at approximately $76.7 billion in 2023 and is projected to reach $279.1 billion by 2030, showcasing substantial growth.

Furthermore, evolving reimbursement policies are increasingly recognizing and compensating for these remote care services. This financial backing makes the adoption of telemedicine and remote monitoring solutions more sustainable and attractive for healthcare providers, directly benefiting companies like AngioDynamics that offer related technologies.

Innovation in materials science is significantly impacting the medical device sector, enabling the creation of smaller, more flexible, and durable devices essential for minimally invasive procedures. This advancement directly benefits companies like AngioDynamics, which rely on cutting-edge components for their product development.

The development of advanced materials, such as high-purity Nitinol and NMP-free polyimide, is a key technological driver. These materials enhance device performance and safety, crucial for AngioDynamics' commitment to innovation. The global medical device market, valued at over $500 billion in 2023, is expected to see continued growth fueled by such material advancements.

Cybersecurity in medical devices and data

As medical devices increasingly connect and incorporate sophisticated technologies, cybersecurity is paramount for safeguarding both the devices themselves and sensitive patient data. The growing reliance on interconnected systems means that vulnerabilities can have significant consequences, impacting patient care and data privacy.

New regulatory landscapes, including the EU AI Act and evolving cybersecurity mandates, are compelling manufacturers to embed strong security measures from the initial design phase through the entire product lifecycle. These regulations emphasize proactive security, requiring thorough risk assessments and continuous monitoring.

AngioDynamics must therefore place a high priority on implementing and maintaining robust cybersecurity protocols. This commitment is essential not only for regulatory compliance but also for building and preserving patient trust in an era of heightened digital security concerns. For instance, the healthcare sector experienced a 71% increase in cyberattacks in 2023 compared to 2022, highlighting the urgency of these measures.

- Regulatory Compliance: Adherence to new cybersecurity standards is mandatory, with potential penalties for non-compliance.

- Patient Data Protection: Robust security is vital to prevent breaches of sensitive personal health information.

- Device Integrity: Cybersecurity ensures that medical devices function as intended without malicious interference.

- Reputational Risk: A strong security posture builds and maintains trust with patients and healthcare providers.

Research and development investments

Continuous investment in research and development (R&D) is crucial for medical technology firms like AngioDynamics to stay ahead and launch groundbreaking products. This commitment is evident in their efforts to bring new offerings to market and broaden the applications of their current technologies.

AngioDynamics' R&D focus is exemplified by its investment in clinical trials, such as the AMBITION BTK Trial, which explores new treatments for critical limb ischemia. This dedication to innovation is a key driver for their competitive edge in the evolving medical device landscape.

Financial data from recent periods underscores this commitment. For instance, AngioDynamics reported R&D expenses of approximately $38.7 million for fiscal year 2024, reflecting a significant allocation towards future growth and product development.

- Fiscal Year 2024 R&D Investment: AngioDynamics allocated around $38.7 million to R&D.

- Product Pipeline Focus: Continued investment supports the development of new medical devices and therapies.

- Clinical Trial Engagement: Active participation in trials like AMBITION BTK highlights R&D's role in market expansion.

Technological advancements are rapidly transforming the medical device sector, with AI, robotics, and advanced materials driving innovation. These technologies enable more precise diagnostics, minimally invasive procedures, and the development of smaller, more durable devices. AngioDynamics is positioned to leverage these trends by integrating cutting-edge solutions into its product portfolio.

The increasing adoption of telemedicine and remote monitoring, powered by the Internet of Medical Things (IoMT), presents significant growth opportunities. AngioDynamics can capitalize on this by developing devices that facilitate real-time data collection and patient oversight, aligning with the projected substantial growth in the IoMT market, which was valued at approximately $76.7 billion in 2023.

Cybersecurity is a critical technological factor, as interconnected medical devices require robust protection for patient data and device integrity. With healthcare cyberattacks increasing by 71% in 2023, compliance with evolving security mandates and proactive security measures are essential for maintaining trust and regulatory adherence.

Continuous investment in research and development (R&D) is vital for companies like AngioDynamics to remain competitive. The company's commitment is demonstrated by its R&D expenses of approximately $38.7 million for fiscal year 2024, supporting the development of new products and the expansion of existing technologies.

| Technology Area | Market Trend/Impact | AngioDynamics Relevance | Data Point (2023/2024) |

|---|---|---|---|

| AI in Healthcare | Enhanced diagnostics, personalized treatment | Potential for improved device functionality and data analysis | Global AI in healthcare market projected over $150 billion by 2023 |

| IoMT & Telemedicine | Remote patient monitoring, virtual care | Opportunity for connected devices and data-driven solutions | Global IoMT market valued at ~$76.7 billion in 2023 |

| Advanced Materials | Improved device performance, biocompatibility | Enables development of next-generation, minimally invasive devices | Global medical device market >$500 billion in 2023 |

| Cybersecurity | Data protection, device integrity | Crucial for patient trust and regulatory compliance | Healthcare cyberattacks up 71% in 2023 |

| R&D Investment | Product innovation, market expansion | Drives competitive advantage and new product launches | AngioDynamics FY2024 R&D expenses: ~$38.7 million |

Legal factors

The FDA's Quality Management System Regulation (QMSR), effective February 2, 2026, harmonizes with ISO 13485:2016, streamlining global medical device quality requirements. This transition necessitates AngioDynamics updating its quality management systems and documentation to ensure compliance, reducing redundant efforts for companies already following international standards.

The EU Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) significantly impact companies like AngioDynamics aiming for the European market. These regulations, fully applicable as of May 2021 for MDR and May 2022 for IVDR, demand enhanced clinical evidence and stricter post-market surveillance.

Compliance with these evolving EU standards is crucial for AngioDynamics to prevent market access disruptions and potential penalties. For instance, the MDR requires more extensive clinical data, which can extend the time and cost associated with product approvals. The IVDR, in particular, has a phased implementation, with higher-risk devices needing to comply sooner, impacting diagnostic product portfolios.

The increasing reliance on AI and connected devices in healthcare means data privacy and cybersecurity are paramount. Regulations like the EU AI Act are shaping how these technologies are deployed, particularly in medical devices. For AngioDynamics, this means ensuring AI-driven diagnostic tools meet rigorous validation standards, especially for high-risk applications.

Adherence to these evolving cybersecurity rules is crucial for safeguarding sensitive patient information. AngioDynamics needs to implement strong AI governance frameworks to navigate this complex regulatory landscape effectively.

Product liability and intellectual property laws

Product liability laws are a significant legal consideration for AngioDynamics, as they hold manufacturers accountable for any defects in their medical devices. This necessitates stringent quality control measures and adherence to rigorous safety standards throughout the product lifecycle. For instance, in 2023, medical device recalls, while not always directly attributable to manufacturing defects, highlight the importance of robust post-market surveillance and quality management systems. Companies like AngioDynamics must invest heavily in ensuring the safety and efficacy of their products to avoid costly litigation and reputational damage.

Intellectual property (IP) laws are paramount for AngioDynamics, safeguarding its innovative technologies and preventing competitors from unauthorized use or replication. The company's ability to secure and defend patents, trademarks, and trade secrets directly impacts its competitive advantage and future revenue streams. For example, in the first half of 2024, AngioDynamics continued to file new patent applications related to its vascular access and interventional oncology technologies, underscoring its commitment to IP protection. Proactive management of its IP portfolio, including diligent monitoring for infringement, is crucial for mitigating legal risks and maintaining market leadership.

- Product Liability: Manufacturers are legally responsible for harm caused by defective products. AngioDynamics must maintain high quality control to prevent device malfunctions.

- Intellectual Property: Patents, trademarks, and trade secrets protect AngioDynamics' innovations from competitors. Securing and defending IP is vital for market exclusivity.

- Risk Mitigation: Adhering to product safety regulations and actively managing IP are key strategies to minimize legal exposure and financial penalties.

- Competitive Landscape: Strong IP protection allows AngioDynamics to differentiate its offerings and maintain pricing power in the competitive medical device market.

Environmental regulations impacting manufacturing (e.g., PFAS)

Environmental regulations, particularly those addressing Per- and poly-fluoroalkyl substances (PFAS) and ethylene oxide (EtO) emissions, are significantly shaping the medical device manufacturing landscape. These rules are becoming more stringent, requiring manufacturers like AngioDynamics to adapt their processes and supply chains. While certain PFAS applications in medical devices may retain exemptions from outright bans, the burden of reporting and compliance is escalating, with new regulations taking effect in 2024 and 2025. For instance, the US Environmental Protection Agency (EPA) has been actively proposing regulations for PFAS in drinking water, which can indirectly influence manufacturing inputs and waste management practices.

AngioDynamics must proactively monitor and adhere to these dynamic environmental laws to mitigate risks of penalties, potential operational disruptions, and to foster sustainable manufacturing. Failure to comply could lead to significant fines; for example, the EPA has the authority to impose substantial civil penalties for violations of environmental statutes. Staying ahead of these regulatory shifts is crucial for maintaining operational integrity and corporate responsibility.

- PFAS Reporting: Expect increased reporting requirements for PFAS usage in medical devices, even for exempted applications, impacting supply chain transparency.

- EtO Emissions: Stricter controls on ethylene oxide emissions from sterilization processes are being implemented, potentially requiring investment in new technologies.

- Regulatory Scrutiny: Environmental agencies globally are intensifying their focus on chemical safety and emissions, creating a complex compliance environment.

- Sustainability Focus: Proactive environmental management is becoming a key differentiator, influencing investor sentiment and market access.

The evolving regulatory landscape, including the FDA's QMSR effective February 2026 and the EU's MDR/IVDR, demands rigorous compliance from AngioDynamics. These regulations necessitate updated quality management systems and enhanced clinical evidence, impacting product approval timelines and market access. Furthermore, the increasing use of AI in medical devices brings data privacy and cybersecurity under intense scrutiny, requiring robust governance frameworks.

Environmental factors

The medical device sector faces increasing pressure to align with sustainability and ESG mandates. AngioDynamics, while outperforming many competitors in its current sustainability metrics, needs to boost transparency, particularly by setting concrete carbon emission reduction goals. For instance, the industry saw a 15% increase in ESG reporting by major players in 2024, highlighting this trend.

Prioritizing ESG initiatives can significantly bolster AngioDynamics' brand image and appeal to a growing segment of investors focused on socially responsible investments. A 2025 survey indicated that 60% of institutional investors consider ESG performance a key factor in their allocation decisions.

The proper management and disposal of medical devices, especially single-use items or those with hazardous components, present a significant environmental challenge for companies like AngioDynamics. Adherence to stringent medical waste regulations is paramount, requiring careful consideration of disposal methods to mitigate environmental harm.

AngioDynamics must actively explore sustainable end-of-life solutions for its product portfolio, encompassing the entire lifecycle from initial design to final disposal. For instance, the global medical waste market was valued at approximately USD 12.5 billion in 2023 and is projected to grow, highlighting the increasing focus on responsible waste management practices.

Energy consumption in AngioDynamics' manufacturing and operations directly impacts its carbon footprint. The company, like many in the medical device sector, is under increasing scrutiny to lower energy usage and adopt cleaner energy alternatives to meet environmental goals. This shift can also unlock significant cost savings and boost operational efficiency.

Supply chain environmental impact

The environmental impact of AngioDynamics' supply chain, from sourcing raw materials to final product distribution, is a significant consideration for corporate responsibility. This encompasses the entire lifecycle of their medical devices, including manufacturing processes and transportation. For instance, the medical device industry, in general, faces scrutiny regarding waste generation and energy consumption within its complex global supply networks. In 2024, a study by the World Health Organization highlighted that healthcare's carbon footprint accounts for approximately 4.4% of global net greenhouse gas emissions, with supply chain activities being a major contributor.

AngioDynamics must actively assess and work to reduce its supply chain's environmental footprint. This involves a strategic approach to supplier selection, prioritizing those with demonstrated environmental commitments and sustainable practices. Optimizing logistics, such as consolidating shipments and exploring lower-emission transportation options, also plays a crucial role. Furthermore, the company needs to address the environmental implications of specific chemicals used in component manufacturing, seeking alternatives where possible to minimize hazardous waste and pollution.

Key areas for AngioDynamics' environmental supply chain focus include:

- Sustainable Sourcing: Evaluating and selecting suppliers based on their environmental certifications and practices.

- Logistics Optimization: Implementing strategies to reduce transportation emissions through route planning and mode selection.

- Chemical Management: Identifying and mitigating the environmental risks associated with chemicals used in product components.

- Waste Reduction: Minimizing waste generated throughout the supply chain, from manufacturing to packaging.

Regulations on hazardous substances (e.g., ethylene oxide, PFAS)

Regulations concerning hazardous substances like ethylene oxide (EtO) and per- and polyfluoroalkyl substances (PFAS) significantly influence AngioDynamics' operations. The medical device sector, including AngioDynamics, faces increasing scrutiny regarding the sterilization methods for its products, with EtO being a primary concern due to its carcinogenic properties. Similarly, the presence of PFAS in various device components necessitates compliance with evolving global restrictions.

AngioDynamics must navigate these increasingly stringent environmental regulations to maintain product safety and adhere to responsible manufacturing practices. For instance, the U.S. Environmental Protection Agency (EPA) has been developing stricter regulations for EtO emissions from sterilization facilities, aiming to reduce public exposure. Companies like AngioDynamics are therefore compelled to invest in alternative sterilization technologies or implement advanced emission control systems. The focus on PFAS, often referred to as "forever chemicals," is also intensifying, with various jurisdictions implementing bans or restrictions on their use in consumer and industrial products, including medical devices.

- Ethylene Oxide Sterilization: AngioDynamics, like other medical device manufacturers, must adapt to stricter Environmental Protection Agency (EPA) regulations on ethylene oxide emissions, which are designed to protect public health.

- PFAS Restrictions: The company needs to monitor and comply with evolving regulations globally that limit or ban the use of PFAS in medical device components due to environmental and health concerns.

- Transition to Alternatives: AngioDynamics may need to invest in research and development to identify and implement safer, compliant alternatives for sterilization and material sourcing.

- Reporting Obligations: Compliance often involves detailed substance reporting and transparency regarding the use of regulated chemicals in manufacturing processes.

AngioDynamics must address the environmental impact of its product lifecycle, from sourcing to disposal, as the medical waste market grows. The company's focus on sustainable end-of-life solutions is crucial, especially given the 2023 valuation of the global medical waste market at approximately USD 12.5 billion.

Reducing energy consumption in manufacturing is key to lowering AngioDynamics' carbon footprint, with the medical device sector facing scrutiny to adopt cleaner energy alternatives. This also presents an opportunity for cost savings and improved operational efficiency.

The company's supply chain environmental footprint requires active assessment and reduction strategies, including sustainable sourcing and logistics optimization. Healthcare's carbon footprint, with supply chain activities being a major contributor, was highlighted by the WHO in 2024 as approximately 4.4% of global net greenhouse gas emissions.

AngioDynamics must navigate evolving regulations on hazardous substances like ethylene oxide and PFAS, which impact sterilization methods and material sourcing. For instance, the EPA's development of stricter regulations for EtO emissions necessitates adaptation.

| Environmental Factor | AngioDynamics Relevance | 2024/2025 Data/Trend |

| Sustainability Mandates | Alignment with ESG goals, investor appeal | 60% of institutional investors consider ESG performance key in 2025 |

| Medical Waste Management | Responsible disposal of devices | Global medical waste market valued at USD 12.5 billion in 2023 |

| Energy Consumption | Carbon footprint reduction, operational efficiency | Industry-wide scrutiny on energy usage and cleaner alternatives |

| Supply Chain Emissions | Reducing impact from sourcing to distribution | Healthcare's carbon footprint ~4.4% of global emissions (WHO, 2024) |

| Hazardous Substance Regulations | Compliance with EtO and PFAS restrictions | EPA developing stricter EtO emission regulations |

PESTLE Analysis Data Sources

Our AngioDynamics PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading medical industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the vascular access and interventional radiology markets.