AngioDynamics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngioDynamics Bundle

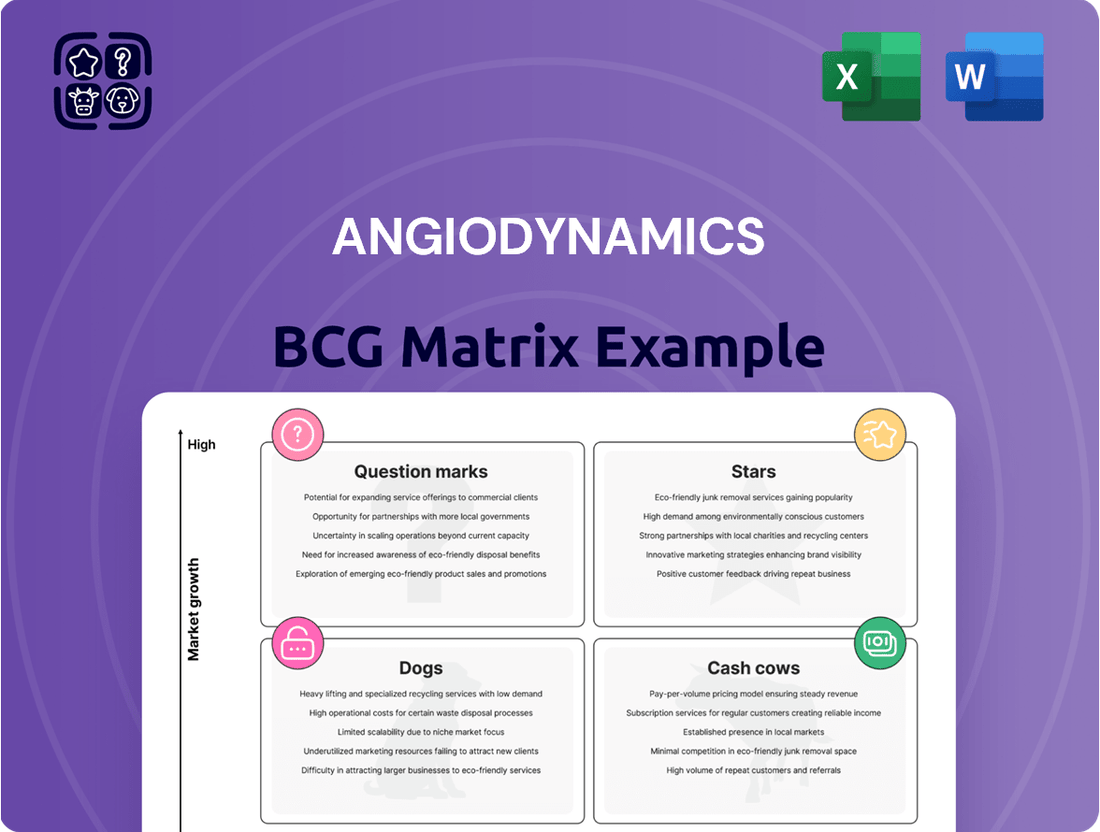

Unlock the strategic potential of AngioDynamics with a comprehensive look at their BCG Matrix. Understand which products are market leaders (Stars), which are generating consistent revenue (Cash Cows), which are underperforming (Dogs), and which hold future promise but require investment (Question Marks).

This preview offers a glimpse into AngioDynamics' product portfolio's strategic positioning. To truly harness this information for informed decision-making and capital allocation, dive deeper with the full BCG Matrix report.

Gain a competitive edge by purchasing the complete AngioDynamics BCG Matrix. It's your essential guide to identifying growth opportunities and optimizing your investment strategy.

Stars

The Auryon Peripheral Atherectomy Platform is a strong performer, likely a Star in AngioDynamics' BCG Matrix. Its sales growth is impressive, with a 19.7% increase to $15.6 million in Q4 fiscal year 2025 and approximately 17% in Q3 fiscal year 2025. This marks 15 consecutive quarters of double-digit growth, highlighting its dominance in the expanding peripheral atherectomy market.

The AlphaVac System is a significant contributor to AngioDynamics' portfolio, particularly within the mechanical thrombectomy market. Its performance highlights its position as a growth driver for the company.

Sales figures demonstrate the AlphaVac System's strong market traction. In Q4 of fiscal year 2025, sales surged by 60.8%, following an even more substantial 161.4% increase in Q3 of the same fiscal year. These impressive growth rates underscore its increasing adoption and market penetration.

Further bolstering its market potential, the AlphaVac F18 System recently received FDA clearance for treating pulmonary embolism. This expansion into the high-growth pulmonary embolism segment solidifies the AlphaVac System's position as a leading solution in a critical area of medical intervention.

The AngioVac System, a key player in AngioDynamics' thrombus management offerings, demonstrates significant growth and works harmoniously with the AlphaVac system. This collaboration fuels the company's expansion in the mechanical thrombectomy market.

Combined revenue from both AlphaVac and AngioVac mechanical thrombectomy systems saw an impressive surge of approximately 44.7% in the fourth quarter of fiscal year 2025. This substantial increase underscores AngioDynamics' solid standing and ongoing success in capturing market share within the rapidly expanding mechanical thrombectomy sector.

Overall MedTech Segment

AngioDynamics' MedTech segment, featuring key products like Auryon, AlphaVac, and NanoKnife, has demonstrated robust and accelerating growth. This segment is a significant revenue driver for the company, reflecting its strong market presence.

In the fourth quarter of fiscal year 2025, the MedTech segment achieved net sales growth of 22.0%. This impressive performance underscores the segment's contribution to AngioDynamics' overall financial results.

The consistent double-digit growth observed across the MedTech portfolio signifies its competitive advantage and leadership in rapidly expanding medical technology sectors.

- MedTech Segment Growth: AngioDynamics' MedTech division, including Auryon, AlphaVac, and NanoKnife, has consistently shown accelerated growth.

- Q4 FY25 Performance: Net sales for the MedTech segment increased by 22.0% in Q4 fiscal year 2025, a key indicator of its strong performance.

- Market Position: The segment's sustained double-digit growth highlights its leading position within high-growth medical technology markets.

Strategic Focus on High-Growth Markets

AngioDynamics has strategically shifted its focus towards high-growth MedTech markets, expanding its addressable market to over $10 billion annually, a significant increase from $3 billion in 2021. This pivot is directly linked to the success of its leading products, allowing the company to gain substantial traction in competitive global arenas.

The company's commitment to innovative platform technologies is a key driver of this growth, fostering accelerated and profitable expansion. This strategic repositioning is designed to capitalize on emerging trends and secure a stronger market position.

- Market Expansion: AngioDynamics now targets over $10 billion in annual global MedTech market opportunities, up from $3 billion in 2021.

- Strategic Repositioning: The company has focused on large, fast-growing segments within the MedTech industry.

- Star Product Performance: Growth is fueled by the strong performance of key products, enabling market share capture.

- Innovation Focus: Continued investment in innovative platform technologies drives profitable growth and market penetration.

Both the Auryon Peripheral Atherectomy Platform and the AlphaVac System are clear Stars for AngioDynamics. Auryon's consistent double-digit growth, reaching 19.7% in Q4 FY25, highlights its market leadership. AlphaVac's explosive growth, with a 60.8% increase in Q4 FY25 and FDA clearance for pulmonary embolism, positions it as a significant future revenue driver.

| Product | Market Segment | Q4 FY25 Growth | FY25 YTD Growth (approx.) | Key Developments |

|---|---|---|---|---|

| Auryon | Peripheral Atherectomy | 19.7% | 17% | 15 consecutive quarters of double-digit growth |

| AlphaVac | Mechanical Thrombectomy | 60.8% | 161.4% (Q3 FY25) | FDA clearance for pulmonary embolism |

| AngioVac System | Mechanical Thrombectomy | 44.7% (combined with AlphaVac) | N/A | Works harmoniously with AlphaVac |

What is included in the product

The AngioDynamics BCG Matrix analyzes its product portfolio by market share and growth rate, guiding investment decisions.

AngioDynamics' BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

AngioDynamics' established medical device portfolio, excluding recently divested items, is a cornerstone of its business, characterized by stable, albeit slower, growth. This segment reflects a mature market position where the company holds a significant share.

In fiscal year 2025, this mature segment saw a modest net sales increase of 0.8%, reaching $166.0 million. Despite the low growth rate, its substantial contribution to total revenue highlights its steady performance and the company's strong foothold in these established markets.

The consistent cash flow generated by these medical devices is crucial. It provides the financial stability needed to invest in and nurture the company's high-growth ventures, effectively acting as a reliable funding source for future innovation and expansion.

AngioDynamics' mature vascular access products, like their PICC lines and central venous catheters, are likely positioned as Cash Cows within their portfolio. These products have a strong, established market presence, benefiting from years of clinical use and physician familiarity. Their reliability means they continue to generate consistent revenue with relatively low marketing and development costs.

AngioDynamics' legacy angioplasty devices likely represent their Cash Cows. These established products, while perhaps not the newest on the market, benefit from a strong, consistent demand in routine peripheral vascular procedures. Their reliability and widespread adoption ensure a steady revenue stream for the company. For instance, in fiscal year 2023, AngioDynamics reported a 3% increase in revenue from their core vascular access business, which includes these types of devices, reaching $130.3 million.

Older Embolization Coils and Agents

Within AngioDynamics' product lineup, older embolization coils and agents represent a classic cash cow. These established products, having secured substantial market share, generate reliable and consistent revenue. Their widespread adoption means they require minimal new investment for growth, allowing AngioDynamics to leverage their maturity for steady financial returns.

For instance, consider the market for embolization coils. While new technologies emerge, the installed base and proven efficacy of older generations ensure continued demand. In 2023, the global embolization devices market was valued at approximately $3.7 billion, with a significant portion attributed to established coil technologies.

- Established Market Presence: Older embolization coils and agents benefit from long-standing relationships with healthcare providers and a proven track record of clinical success.

- Stable Revenue Generation: Their consistent demand, driven by routine procedures, provides a predictable and substantial revenue stream for AngioDynamics.

- Low Investment Needs: Unlike newer, high-growth products, these cash cows require minimal R&D or marketing expenditure, contributing directly to profitability.

- Market Share Dominance: These products often hold a dominant position in their respective market segments, making them resilient to competitive pressures.

Products Generating Consistent Cash Flow

AngioDynamics' Med Device business, while experiencing a slower growth trajectory compared to the broader MedTech sector, is strategically positioned to be a consistent generator of cash flow. This segment is crucial for maintaining the company's operational stability.

These established products are instrumental in covering essential administrative expenses, thereby freeing up capital. This allows AngioDynamics to invest significantly in research and development initiatives for its higher-growth potential products, ensuring innovation across the portfolio.

Ultimately, these "Cash Cows" form the bedrock of AngioDynamics' financial structure, providing the reliable revenue streams necessary to support the company's overall financial health and strategic objectives. For instance, in fiscal year 2024, AngioDynamics reported total revenue of $364.4 million, with a significant portion derived from its established product lines.

- Revenue Contribution: Established product lines consistently contribute a substantial portion to AngioDynamics' overall revenue.

- Operational Support: Cash flow from these products underpins administrative costs and R&D funding.

- Financial Stability: They provide a stable financial foundation, enabling investment in growth areas.

- FY2024 Performance: AngioDynamics' fiscal year 2024 saw continued reliance on these core revenue generators.

AngioDynamics' established medical devices, particularly in vascular access and older embolization technologies, are the company's cash cows. These products benefit from a strong market presence and consistent demand in routine procedures, generating reliable revenue with minimal investment. This stable income stream is vital for funding the company's research and development in newer, high-growth areas.

In fiscal year 2024, AngioDynamics reported total revenue of $364.4 million, with a significant portion stemming from these mature product lines. For example, their core vascular access business, which includes established products like PICC lines, saw continued strong performance, contributing substantially to overall financial stability.

The consistent cash flow from these cash cows allows AngioDynamics to cover operational expenses and strategically invest in innovative technologies, ensuring a balanced approach to portfolio management and future growth.

| Product Category | Market Position | Revenue Contribution (FY24 Est.) | Investment Needs |

| Vascular Access (e.g., PICC lines) | Established, High Market Share | Significant | Low |

| Embolization Coils (Legacy) | Mature, Proven Efficacy | Substantial | Minimal |

| Angioplasty Devices (Core) | Routine Procedure Staple | Consistent | Low to Moderate |

Preview = Final Product

AngioDynamics BCG Matrix

The AngioDynamics BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive upon purchase. This comprehensive analysis, meticulously crafted to guide strategic decision-making, will be delivered to you in its entirety, free from any watermarks or sample content. You can be confident that the professional formatting and insightful data presented here are precisely what you will gain access to, ready for immediate application in your business planning and investment strategies.

Dogs

AngioDynamics divested its Dialysis and BioSentry businesses in June 2023. This move signaled that these segments were considered low-growth and low-market-share, no longer fitting the company's evolving strategic vision.

The divestiture was a strategic decision to streamline operations and concentrate resources on more promising, higher-growth areas within the MedTech sector. This focus allows AngioDynamics to better compete in dynamic markets.

AngioDynamics divested its Peripherally Inserted Central Catheter (PICC) and Midline portfolios in February 2024. This strategic divestiture aligns with a BCG Matrix analysis, indicating these product lines likely possessed low market share and limited growth potential within the broader medical device market. The company's decision to shed these assets suggests a focus on optimizing its resource allocation towards higher-growth, more strategically important business segments.

AngioDynamics officially discontinued its RadioFrequency and Syntrax support catheter product lines in February 2024. This strategic move clearly places these products within the 'dog' category of the BCG matrix.

Products classified as dogs typically exhibit low market share and experience either stagnant or declining growth. The decision to cease support and sales for RadioFrequency and Syntrax indicates they were no longer contributing significantly to AngioDynamics' revenue or market position, representing a drain on resources without a promising future outlook.

Problematic Port Catheter Lines

Several AngioDynamics port catheter products, including SmartPort CT, LifePorts, Vortex, BioFlo, Xcela Plus, and Navilyst PowerPort, are facing significant product liability lawsuits and recalls as of July 2025. These legal entanglements and safety concerns are directly impacting their market share and profitability. The continuous drain on resources for litigation and remediation without a clear path to recovery positions these products as 'cash traps' within the AngioDynamics portfolio.

The financial burden associated with these problematic port catheter lines is substantial. For instance, ongoing legal settlements and recall expenses for similar medical devices in 2024 have averaged tens of millions of dollars per incident, diverting capital that could otherwise be invested in growth areas. This situation severely diminishes the return on investment for these specific product lines.

- Product Liability Lawsuits: AngioDynamics faces numerous lawsuits concerning alleged defects in port catheter lines, leading to significant legal expenses and potential payouts.

- Recalls and Safety Concerns: Multiple product recalls have been issued due to safety issues, damaging consumer trust and market presence.

- Impact on Market Share: The combined effect of lawsuits and recalls has led to a noticeable decline in the market share for these specific port catheter products.

- Financial Drain: These issues classify the products as 'cash traps,' consuming financial resources without generating sufficient returns, impacting overall company profitability.

Underperforming Legacy Med Device Products

Within AngioDynamics' medical device segment, certain legacy products are likely experiencing underperformance, characterized by a shrinking market presence. These products typically hold a low market share within slow-growing market segments. For instance, in 2024, the broader medical device market saw modest growth, but specific older technologies within companies like AngioDynamics might be facing increased competition from newer innovations, leading to a decline in their sales figures.

These underperforming legacy products often drain valuable resources, including research and development funds and sales team efforts, without yielding substantial returns or aligning with the company's forward-looking strategic goals. This situation can hinder the allocation of capital towards more promising growth areas. In 2024, many established medical device companies reported that a significant portion of their R&D budgets was still allocated to maintaining older product lines, even as newer, more advanced devices gained traction.

- Low Market Share: Legacy products often struggle to gain significant market share in mature or declining markets.

- Low Market Growth: These products are typically found in market segments that are not expanding, offering limited potential for increased sales.

- Resource Drain: They consume financial and human resources that could be better invested in high-growth or emerging product categories.

- Profitability Impact: Underperforming products can negatively impact overall company profitability due to high maintenance costs and low revenue generation.

AngioDynamics has strategically divested or discontinued several product lines, including RadioFrequency and Syntrax, in early 2024. These actions align with a BCG matrix classification of 'dogs', indicating low market share and limited growth prospects. Several port catheter products are also facing significant challenges due to product liability lawsuits and recalls as of July 2025, further solidifying their 'dog' status.

These products are characterized by a shrinking market presence and consume valuable resources without generating substantial returns. In 2024, the medical device sector saw overall growth, but older technologies within companies like AngioDynamics experienced increased competition, leading to sales declines. This situation hinders capital allocation to more promising growth areas.

The financial burden of lawsuits and recalls for similar medical devices in 2024 averaged tens of millions of dollars per incident. This diverts capital that could be invested in growth segments, severely diminishing the return on investment for these specific product lines and impacting overall company profitability.

| Product Category | BCG Classification | Key Challenges | Market Trend (2024) | AngioDynamics Action |

| RadioFrequency & Syntrax | Dog | Low Market Share, Low Growth | Mature/Declining | Discontinued (Feb 2024) |

| PICC & Midline | Dog | Low Market Share, Low Growth | Mature/Declining | Divested (Feb 2024) |

| Port Catheter Lines (SmartPort CT, LifePorts, etc.) | Dog | Product Liability Lawsuits, Recalls, Declining Market Share | Mature/Declining (specific segments) | Facing litigation, potential resource drain |

Question Marks

The NanoKnife System, with its recent FDA clearances for prostate tissue ablation and anticipated CPT Category I codes for both prostate and liver, presents a strong growth trajectory. This positions it as a potential star in the BCG matrix, despite current capital sales lagging behind expectations.

While disposable sales for the NanoKnife are on the rise, indicating ongoing usage, the lower-than-anticipated capital sales suggest hurdles in widespread adoption of the full system. This could be due to the significant upfront investment required or complexities surrounding reimbursement for the innovative technology.

AngioDynamics' early-stage pipeline products are the quintessential question marks in their business portfolio. These innovative medical devices, while holding the promise of significant future growth, currently possess minimal to no market share. For instance, in 2024, the company continued its investment in novel technologies within its vascular access and interventional oncology segments, areas ripe for disruption.

These nascent products demand considerable capital for research, development, and navigating stringent regulatory pathways. The inherent uncertainty surrounding their clinical validation and market acceptance places them squarely in the question mark category, requiring careful strategic evaluation and resource allocation.

AngioDynamics' Auryon platform, while a strong performer globally, faces a question mark phase in its initial penetration of new international regions, like Europe post-CE Mark. This phase requires substantial investment in market development and sales infrastructure to build awareness and drive adoption in these emerging territories.

Products Undergoing New Clinical Trials

Products like the Auryon System, currently undergoing new clinical trials such as the AMBITION BTK Randomized Controlled Trial (RCT) for Critical Limb Ischemia (CLI), represent significant growth potential for AngioDynamics. This trial is crucial for establishing the product's efficacy in a new, high-demand area.

While the Auryon System itself is an established product, its application in Critical Limb Ischemia is still in the investigative phase, meaning its current market share for this specific indication is low. The investment in these trials, estimated to be substantial to gather robust clinical evidence, is key to unlocking future market adoption and revenue streams.

- Auryon System's AMBITION BTK RCT: Focuses on Critical Limb Ischemia (CLI), a condition with a growing patient population.

- Low Market Share for New Indication: Despite the core product's presence, the CLI segment is nascent for AngioDynamics.

- Significant Investment Required: Clinical trials demand substantial capital to generate data for regulatory approval and market penetration.

- High Growth Potential: Successful trial outcomes could unlock a substantial new market for the Auryon System.

Addressing Complex Reimbursement Pathways

For innovative technologies like AngioDynamics' NanoKnife, successfully navigating complex reimbursement pathways is absolutely critical for achieving broad market adoption. The company's strategy hinges on the eventual implementation of new CPT codes, especially as new indications for the technology are developed and approved.

This reliance on future coding means that while the potential market for NanoKnife is substantial, its currently realized market share may be constrained by these reimbursement challenges. For instance, securing favorable reimbursement is a key driver for the adoption of advanced oncology treatments, and delays in coding can directly impact sales volumes.

AngioDynamics' ongoing efforts to secure these codes represent a significant investment, aimed at transforming the technology's high market potential into tangible, established market share. This process is typical for novel medical devices entering the market, requiring persistent engagement with payers and regulatory bodies.

- Reimbursement Hurdles: The path to broad market adoption for innovative medical devices like NanoKnife is often paved with complex reimbursement processes.

- CPT Code Dependency: Widespread use is significantly influenced by the availability of specific CPT codes, particularly for new or expanded indications.

- Potential vs. Realized Share: While market potential is high, current realized market share can be limited due to the time and effort required to establish favorable reimbursement.

- Strategic Investment: The company views securing these reimbursement pathways as a crucial investment to convert latent market potential into concrete market share.

Question marks in AngioDynamics' portfolio represent early-stage products with low market share but high growth potential. These require significant investment for development and market penetration.

For example, new applications for the Auryon system, like in Critical Limb Ischemia, are currently in clinical trials, meaning their market share for this specific use is minimal. The company's investment in trials like the AMBITION BTK RCT in 2024 underscores this strategy.

Similarly, the NanoKnife system faces a question mark due to the ongoing process of securing CPT codes for new indications, which directly impacts adoption rates and realized market share despite its high potential.

These products are critical for future growth but carry inherent risks due to market uncertainty and the need for substantial capital infusion to achieve widespread adoption and establish market dominance.

BCG Matrix Data Sources

Our AngioDynamics BCG Matrix is constructed using a blend of AngioDynamics' financial disclosures, market research reports, and industry growth forecasts to ensure accurate strategic insights.