AngioDynamics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AngioDynamics Bundle

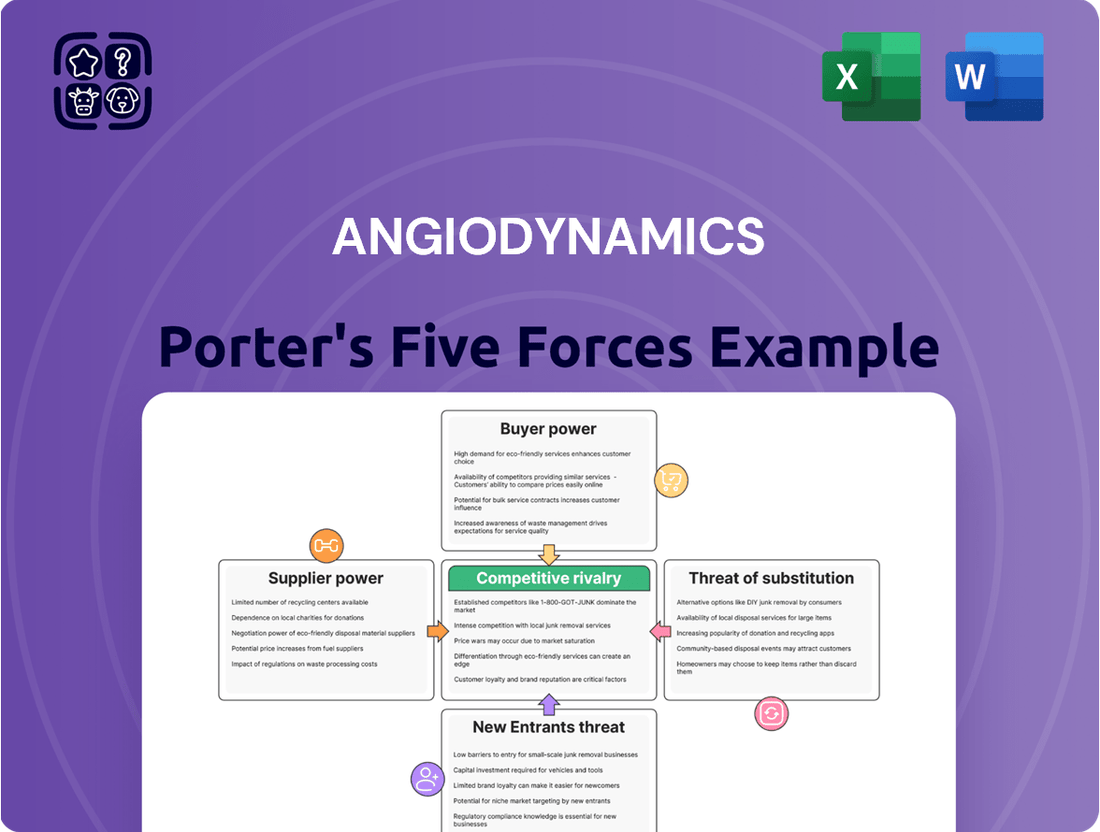

AngioDynamics operates in a dynamic medical device market, facing pressures from powerful buyers and intense rivalry among established players. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for navigating this competitive landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AngioDynamics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The medical device sector, including companies like AngioDynamics, is heavily dependent on specialized components and raw materials. When the supply chain for these critical inputs is concentrated among a limited number of providers, those suppliers gain considerable leverage. This can translate into increased costs for AngioDynamics, as suppliers can dictate higher prices or impose less favorable contract terms, directly impacting profitability.

Suppliers of highly specialized or proprietary components, especially those crucial for AngioDynamics' innovative minimally invasive technologies, wield significant bargaining power. The uniqueness of these inputs means AngioDynamics might face limited alternatives, strengthening the supplier's position.

This reliance on unique inputs can increase supplier leverage. For instance, if a key component for a new vascular access device is only produced by a single supplier with patented technology, AngioDynamics' switching costs for that component would be exceptionally high, giving the supplier considerable influence over pricing and terms.

The threat of suppliers integrating forward into AngioDynamics' business, essentially becoming competitors by manufacturing medical devices themselves, is a key consideration. If suppliers possess the capability and desire to produce the finished products AngioDynamics sells, their leverage significantly increases.

For AngioDynamics, this threat is generally low for suppliers of highly specialized components, where the technical expertise is difficult to replicate. However, for more commoditized inputs, where switching suppliers is easier and the components themselves are less proprietary, the risk of forward integration by suppliers could be a more substantial factor, potentially impacting pricing and availability.

Importance of AngioDynamics to Supplier

AngioDynamics' reliance on specific suppliers for critical components, such as specialized catheters or imaging equipment, can influence the bargaining power of those suppliers. If AngioDynamics constitutes a substantial portion of a supplier's total sales, the supplier may be more accommodating to AngioDynamics' pricing or terms to maintain that valuable business. For instance, if a supplier's revenue is heavily dependent on AngioDynamics, they might be hesitant to impose unfavorable price increases, knowing it could strain the relationship.

Conversely, if AngioDynamics is a minor client for a supplier, the supplier holds greater leverage. In such scenarios, suppliers are less concerned about losing AngioDynamics as a customer and can therefore dictate terms more assertively. This dynamic is particularly relevant for suppliers of niche medical devices or raw materials where AngioDynamics might be one of many buyers. For example, a supplier providing a unique polymer used in a specific AngioDynamics product might have significant power if AngioDynamics has limited alternative sources.

The bargaining power of suppliers is also shaped by the availability of substitute inputs. If AngioDynamics can easily switch to alternative suppliers or different materials without significant disruption or cost, the current suppliers' power is diminished. However, if switching suppliers involves substantial retooling, regulatory hurdles, or compromises product quality, suppliers of those specialized inputs will likely wield more influence.

- Supplier Dependence: If AngioDynamics represents a significant portion of a supplier's revenue, the supplier's power is reduced, as they are less willing to risk the relationship.

- Customer Size: Conversely, if AngioDynamics is a small customer for a supplier, the supplier's leverage increases, allowing them to dictate terms more effectively.

- Input Specificity: The uniqueness of inputs supplied to AngioDynamics plays a role; highly specialized or proprietary components grant suppliers greater bargaining power.

- Availability of Substitutes: The ease with which AngioDynamics can find alternative suppliers or substitute materials directly impacts a supplier's ability to exert influence.

Switching Costs for AngioDynamics

The bargaining power of suppliers for AngioDynamics is significantly influenced by switching costs within the medical device industry. These costs encompass the financial and operational burdens of transitioning to a new supplier, which can be substantial.

Key factors contributing to high switching costs for AngioDynamics include:

- Requalification Processes: Medical device components often require rigorous requalification, a time-consuming and expensive undertaking that can involve extensive testing and validation.

- Regulatory Hurdles: Changes in suppliers for critical components necessitate navigating complex regulatory pathways, such as obtaining FDA approval for new materials or manufacturing processes, adding significant delay and cost.

- Supply Chain Disruption: The potential for disruption to AngioDynamics' own production and distribution chains during a supplier transition further strengthens the hand of existing suppliers who can guarantee continuity.

Suppliers of critical, specialized components for AngioDynamics, particularly those with unique or patented technology, hold substantial bargaining power. This is amplified when AngioDynamics faces high switching costs due to rigorous requalification processes, regulatory hurdles, and potential supply chain disruptions, as seen with specialized catheters or imaging equipment components. In 2024, the medical device industry continued to see consolidation among component manufacturers, further concentrating supply and increasing supplier leverage for niche inputs.

For instance, if a key material for a vascular access device is sourced from a single supplier holding a patent, AngioDynamics' dependence translates to higher prices and less favorable terms. The difficulty in finding direct substitutes or alternative suppliers for such proprietary elements means suppliers can significantly influence AngioDynamics' cost structure and product development timelines.

Conversely, if AngioDynamics represents a large portion of a supplier's business, the supplier's power is somewhat mitigated, as they are motivated to maintain the relationship. However, for smaller suppliers or commoditized inputs, AngioDynamics’ position as a minor client can empower those suppliers to dictate terms more assertively.

| Factor | Impact on AngioDynamics | Example Scenario | 2024 Trend Relevance |

|---|---|---|---|

| Supplier Concentration | High Power | Single source for patented imaging sensor | Increased consolidation in specialized electronics |

| Switching Costs | High Power | Requalification of biocompatible polymers | Heightened regulatory scrutiny on material changes |

| Input Specificity | High Power | Proprietary software for navigation systems | Growing demand for integrated, specialized medical software |

| Customer Dependence | Low Power | AngioDynamics is 30% of supplier's revenue | Suppliers actively seeking diversified customer base |

What is included in the product

AngioDynamics' Porter's Five Forces Analysis reveals the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes within the medical device industry.

Effortlessly assess competitive intensity and identify strategic leverage points within the medical device market.

Gain clarity on industry dynamics to proactively address threats and capitalize on opportunities in the vascular access space.

Customers Bargaining Power

AngioDynamics' customer base is largely concentrated within hospitals, clinics, and other healthcare facilities. This concentration means that if a few major healthcare systems or purchasing groups represent a substantial percentage of AngioDynamics' revenue, those customers gain significant bargaining power. They can leverage their purchasing volume to negotiate lower prices or more favorable contract terms, directly impacting AngioDynamics' profitability.

Healthcare providers, a key customer segment for AngioDynamics, are under immense pressure to manage expenses. This cost containment drive makes them particularly sensitive to pricing, especially for medical devices where multiple comparable options are available.

For instance, in 2024, hospitals continued to scrutinize capital expenditures, with many delaying non-essential purchases. This heightened price sensitivity directly translates to increased bargaining power for these customers, as they can more readily switch to lower-cost alternatives if AngioDynamics' pricing is not competitive.

The availability of substitute products significantly impacts AngioDynamics' bargaining power of customers. For instance, in the peripheral vascular disease market, customers like hospitals and interventional radiologists have access to alternative devices and treatment modalities. If AngioDynamics' offerings become too expensive or less effective compared to these substitutes, customers can easily switch, thereby increasing their leverage.

Customer's Threat of Backward Integration

The threat of backward integration for customers in the medical device industry, particularly for AngioDynamics, is generally low. This is due to the high complexity and specialized nature of developing and manufacturing medical devices, which requires significant R&D investment, regulatory expertise, and manufacturing capabilities.

However, if large hospital systems or integrated delivery networks (IDNs) were to hypothetically develop or manufacture their own devices, it would indeed enhance their bargaining power. Such a scenario, while improbable for highly technical products, would allow them to control production and potentially reduce costs, thereby increasing leverage over existing suppliers.

For instance, the average R&D spending for a major medical device company can reach hundreds of millions of dollars annually, a prohibitive cost for most healthcare providers looking to vertically integrate. Furthermore, navigating the FDA approval process for new medical devices is a lengthy and costly endeavor, often taking years and millions in investment, further deterring backward integration by customers.

- Low Likelihood: The specialized knowledge and capital required for medical device development and manufacturing make backward integration by most customers, like hospitals, highly improbable.

- High Barriers to Entry: Significant R&D investment, regulatory hurdles (e.g., FDA approvals), and advanced manufacturing expertise create substantial barriers for potential customer integration.

- Cost and Complexity: Developing and producing complex medical devices from scratch is typically far more expensive and complex than purchasing them from established manufacturers like AngioDynamics.

Information Availability

Customers armed with extensive information on product costs, market pricing, and available alternatives are in a stronger position to negotiate favorable terms with AngioDynamics. This enhanced transparency, particularly evident in the healthcare sector, directly amplifies customer bargaining power.

The increasing availability of data allows customers, such as hospitals and surgical centers, to compare AngioDynamics' offerings against competitors, potentially driving down prices. For instance, in 2024, many Group Purchasing Organizations (GPOs) in the US leveraged aggregated purchasing data to secure discounts on medical devices, a trend likely to continue impacting companies like AngioDynamics.

- Informed Negotiation: Customers can effectively bargain when they possess detailed knowledge of product costs, market prices, and alternative suppliers.

- Healthcare Transparency: The growing transparency within healthcare purchasing processes empowers customers to demand better value.

- Competitive Benchmarking: Access to comparative pricing data allows customers to leverage competition to their advantage.

- GPO Influence: Group Purchasing Organizations, using aggregated data, can negotiate significant discounts, impacting device manufacturers.

The bargaining power of AngioDynamics' customers, primarily hospitals and clinics, is significant due to their concentrated purchasing power and the cost-sensitive nature of the healthcare industry. In 2024, hospitals continued to focus on expense management, making them highly receptive to competitive pricing and favorable contract terms.

The availability of numerous substitute products and treatment options in areas like peripheral vascular disease further empowers these customers. They can readily switch to alternatives if AngioDynamics' offerings are perceived as too expensive or less effective, directly impacting pricing leverage.

Furthermore, increased market transparency, fueled by data aggregation and the influence of Group Purchasing Organizations (GPOs), allows customers to benchmark prices effectively. For example, GPOs in 2024 leveraged aggregated purchasing data to secure substantial discounts on medical devices, a trend that enhances customer negotiation strength.

| Factor | Impact on AngioDynamics | 2024 Trend/Data Point |

|---|---|---|

| Customer Concentration | High concentration of major hospital systems increases their leverage. | Major hospital systems represent a substantial portion of healthcare spending. |

| Price Sensitivity | Healthcare providers are highly focused on cost containment. | Hospitals delayed non-essential capital expenditures in 2024 due to budget pressures. |

| Availability of Substitutes | Multiple alternative devices and treatments reduce AngioDynamics' pricing power. | The peripheral vascular disease market offers various competing technologies. |

| Information Transparency | Access to pricing and performance data empowers customer negotiation. | GPOs utilized aggregated data in 2024 to negotiate significant discounts on medical devices. |

Same Document Delivered

AngioDynamics Porter's Five Forces Analysis

This preview displays the complete AngioDynamics Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the medical device industry. You're viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring you receive a ready-to-use strategic tool without any discrepancies.

Rivalry Among Competitors

The medical device sector, especially in peripheral vascular and oncology, is intensely competitive. AngioDynamics contends with major players like Medtronic and Boston Scientific, alongside specialized firms such as Cook Medical and Merit Medical Systems. In 2024, the global medical device market was valued at approximately $600 billion, highlighting the scale of the competitive landscape AngioDynamics operates within.

The medical device industry is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 5-7% through 2028. This expansion is fueled by an aging global population, the rising incidence of chronic conditions, and rapid advancements in areas like minimally invasive surgery and digital health solutions. While this growth generally softens competitive rivalry by creating ample market opportunities, intense competition for dominance within specific, high-growth segments remains a significant factor.

AngioDynamics actively pursues product differentiation through its focus on minimally invasive solutions. Platforms like Auryon for laser atherectomy, AlphaVac for mechanical thrombectomy, and NanoKnife for irreversible electroporation are designed to offer unique clinical benefits. This strategy aims to carve out distinct market positions.

However, the competitive landscape is dynamic. If rivals introduce comparable or even more advanced differentiated products, the intensity of rivalry escalates. For instance, in the vascular intervention space, competitors are also investing heavily in developing next-generation devices with enhanced features, directly challenging AngioDynamics' market share.

Switching Costs for Customers

Switching costs for hospitals and physicians in the medical device sector are significant, encompassing the expense and effort of retraining staff on new equipment, integrating new devices with existing hospital IT systems, and adapting established clinical protocols. These hurdles can create customer loyalty, thereby dampening direct rivalry.

For instance, a hospital heavily invested in a particular brand's imaging technology might face substantial costs in retraining radiologists and technicians, recalibrating software, and potentially altering patient workflows if they were to switch to a competitor. These embedded costs make a complete shift less appealing.

While high switching costs can act as a barrier, competitors actively strive to minimize these challenges. Innovations in user-friendly interfaces, plug-and-play integration capabilities, and comprehensive training programs are often employed to reduce the friction associated with adopting new medical technologies. For example, by 2024, many new medical device entrants are focusing on interoperability standards to ease integration into existing hospital networks.

- Training and Education: Costs associated with educating clinical staff on new device operation and maintenance.

- System Integration: Expenses related to making new devices compatible with existing hospital IT infrastructure, such as electronic health records (EHRs).

- Clinical Workflow Adaptation: The time and resources required to modify established patient care pathways and protocols to accommodate new technology.

- Research and Development Investment: Competitors are investing in R&D to create devices with lower integration costs and easier user adoption, aiming to erode existing customer lock-in.

Exit Barriers

AngioDynamics, like many in the medical technology sector, faces considerable exit barriers. These aren't just about sunk costs; they are deeply embedded in the nature of the industry. Specialized manufacturing equipment and the extensive, often lengthy, regulatory approval processes, particularly for devices like those AngioDynamics produces, make it difficult and costly for companies to simply shut down operations or divest assets quickly.

The significant investment required for research and development (R&D) and the stringent regulatory pathways, such as those mandated by the FDA, create substantial hurdles for exiting the market. For instance, companies must often maintain compliance and product support even for legacy products, adding to ongoing costs. This can trap even struggling competitors within the market, potentially leading to more aggressive pricing strategies as they try to recoup investments, thereby intensifying competitive rivalry.

Consider the financial implications: the medical device industry, as of 2024, continues to see high R&D spending as a percentage of revenue. Companies like AngioDynamics often have long-term contracts with healthcare providers and distributors, further complicating an exit. These commitments can lock companies into ongoing obligations, making a clean break impractical and expensive.

- High R&D Investment: Medical device companies often invest a substantial portion of their revenue back into R&D, creating significant sunk costs.

- Regulatory Compliance: Navigating and maintaining compliance with regulatory bodies like the FDA requires continuous investment and specialized expertise, making divestiture or closure complex.

- Specialized Assets: Manufacturing facilities and equipment are often highly specialized for specific medical devices, limiting their resale value or alternative use.

- Long-term Contracts: Commitments with hospitals, clinics, and distributors can create ongoing obligations that are difficult to terminate without penalty.

The competitive rivalry within AngioDynamics' market is fierce, driven by a mix of large, established players and agile, specialized firms. In 2024, the global medical device market's substantial size, estimated at $600 billion, indicates a vast arena where companies vie for market share. This intense competition is further fueled by continuous innovation and a drive to capture growth in segments like peripheral vascular and oncology.

SSubstitutes Threaten

The threat of substitutes for AngioDynamics' products is significant, stemming from alternative medical procedures and non-device-based treatments. For conditions like peripheral vascular disease, lifestyle modifications and pharmaceutical interventions can serve as viable substitutes, potentially reducing the demand for AngioDynamics' interventional devices. For instance, advancements in drug-eluting stents and minimally invasive surgical techniques continue to offer competitive alternatives.

The threat of substitutes for AngioDynamics' minimally invasive devices is significant if alternative treatments provide similar or superior results at a lower price point. For instance, while AngioDynamics focuses on interventional oncology and peripheral vascular solutions, traditional open surgery or less advanced techniques might be perceived as cheaper by some healthcare providers or payers, even if they carry higher risks and longer recovery times. This price-performance trade-off directly pressures AngioDynamics to continually showcase the long-term cost savings and improved patient outcomes associated with its innovative technologies.

Physicians and patients often readily adopt alternative treatments when they offer clear advantages. For instance, the perceived risk, how quickly someone recovers, how well the treatment works, and how easy it is to use all play a big role. Minimally invasive procedures, which AngioDynamics focuses on, tend to see high adoption rates because they usually mean less downtime and faster recovery for patients.

Technological Advancements in Substitutes

Rapid advancements in non-device therapies, like new drug discoveries or genetic treatments, present a significant long-term threat to companies like AngioDynamics. These innovations offer fundamentally different solutions to diseases traditionally managed with medical devices.

For instance, the oncology market, a key area for AngioDynamics, is seeing substantial growth in targeted therapies and immunotherapies. In 2024, the global cancer drug market was valued at over $200 billion, with a significant portion of this growth driven by novel biologics and cell-based therapies that bypass the need for invasive procedures.

- Emerging Therapies: The rise of minimally invasive drug delivery systems and regenerative medicine offers alternatives to surgical interventions.

- Biologics and Gene Therapy: These advanced treatments are increasingly effective for conditions previously requiring interventional devices, potentially shrinking the market share for device-centric solutions.

- R&D Investment: Pharmaceutical companies are heavily investing in these alternative therapies, with global R&D spending in the pharmaceutical sector projected to exceed $250 billion in 2024, fueling innovation in non-device treatment pathways.

Regulatory and Reimbursement Landscape for Substitutes

Changes in regulatory approvals or reimbursement policies for alternative treatments significantly influence their market adoption. For instance, if regulatory bodies like the FDA ease approval pathways for new minimally invasive techniques, or if Medicare and private insurers expand coverage for these alternatives, it directly increases the threat of substitutes for AngioDynamics' devices.

Favorable reimbursement policies, in particular, can dramatically shift market demand. In 2024, the Centers for Medicare & Medicaid Services (CMS) announced updated reimbursement rates for various surgical procedures, some of which may favor less invasive or entirely different treatment modalities. This could lead to a substantial redirection of patient care away from traditional device-dependent interventions.

- Regulatory Shifts: Easing of FDA approval for alternative therapies increases their accessibility and competitive pressure.

- Reimbursement Policies: Favorable changes in Medicare and private insurance coverage for substitutes directly impact their economic viability and adoption rates.

- Market Demand Impact: Shifts in reimbursement can steer patient and physician preference towards alternative treatments, potentially reducing demand for existing devices.

The threat of substitutes for AngioDynamics' minimally invasive devices is amplified by advancements in non-device-based treatments, particularly in oncology and peripheral vascular disease. These alternatives, ranging from novel drug therapies to less invasive surgical techniques, offer competitive efficacy and potentially lower costs, directly impacting the demand for AngioDynamics' product portfolio.

In 2024, the global cancer drug market exceeded $200 billion, with significant growth in targeted therapies and immunotherapies that can bypass the need for interventional devices. This robust pharmaceutical innovation, coupled with a projected $250 billion global R&D investment in the pharmaceutical sector for 2024, fuels the development of potent substitutes.

| Therapy Type | Example | Impact on AngioDynamics |

|---|---|---|

| Pharmaceuticals | Targeted Therapies, Immunotherapies | Reduces need for interventional oncology devices |

| Minimally Invasive Surgery | Advanced Endoscopic Techniques | Offers alternative treatment pathways |

| Regenerative Medicine | Stem Cell Therapies | Potential to replace device-based repair |

Entrants Threaten

The medical device sector, particularly for sophisticated products like AngioDynamics offers, demands significant upfront capital. Companies need to invest heavily in research and development to innovate, establish state-of-the-art manufacturing capabilities, and build robust distribution channels to reach healthcare providers.

These high capital requirements act as a formidable barrier to entry. For instance, the average cost to bring a new medical device to market can range from millions to hundreds of millions of dollars, encompassing regulatory approvals, clinical trials, and market penetration strategies. This financial hurdle significantly limits the number of new players capable of competing effectively.

Stringent regulatory hurdles, particularly the U.S. Food and Drug Administration (FDA) approval process for medical devices, present a significant threat of new entrants for companies like AngioDynamics. This process is not only time-consuming but also demands substantial financial investment, with multiple pathways such as 510(k) clearance and Premarket Approval (PMA) requiring extensive documentation and clinical trials. For example, obtaining PMA can take years and cost millions of dollars, creating a formidable barrier for smaller, less-resourced companies aiming to compete in the medical device market.

Established brand loyalty and robust distribution channels present a significant barrier for potential new entrants in the medical device market. Companies like AngioDynamics have cultivated strong relationships with healthcare providers over years, fostering trust and repeat business. For instance, in 2024, AngioDynamics reported continued growth in its vascular access segment, underscoring the stickiness of its existing customer base.

New competitors struggle to replicate the extensive reach and established trust that incumbent players enjoy. Gaining access to hospital purchasing departments and securing shelf space in a crowded market requires substantial investment and time. This entrenched loyalty means new entrants must offer a demonstrably superior product or a significantly lower price point to even begin chipping away at market share.

Intellectual Property Protection

Strong intellectual property, particularly patents, acts as a significant barrier for new companies looking to enter the medical device market. AngioDynamics, like many in this sector, relies on its patent portfolio to protect its innovative technologies. For instance, the company holds patents covering its vascular access products and minimally invasive surgical tools. The cost and complexity of navigating existing patent landscapes, and the risk of costly litigation for infringement, can be prohibitive for startups. In 2023, the medical device industry saw significant patent activity, with companies filing thousands of new patents, underscoring the importance of IP in this competitive space.

- Patent Protection: AngioDynamics' patents on its core technologies, such as its port systems and ablation devices, create a formidable hurdle for potential competitors.

- Litigation Risk: The threat of patent infringement lawsuits is a major deterrent, as defending against or settling such claims can be financially ruinous for new entrants.

- R&D Investment: Developing novel medical devices that do not infringe on existing IP requires substantial research and development investment, further increasing the barrier to entry.

Economies of Scale and Experience

Established players in the medical device sector, like AngioDynamics, often leverage significant economies of scale. This means they can spread their fixed costs, such as those for sophisticated manufacturing facilities and extensive research and development, over a larger volume of products. For instance, in 2023, AngioDynamics reported revenues of $325.9 million, indicating a substantial operational footprint that supports cost efficiencies.

New entrants face a considerable hurdle in matching these cost advantages. Without the same production volume, their per-unit costs for manufacturing, marketing, and distribution are likely to be higher. This makes it challenging for them to compete on price with incumbents who benefit from years of experience and optimized supply chains.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to high-volume production.

- Experience Curve: Long-standing companies have refined processes, reducing operational expenses.

- Capital Investment: New entrants require substantial upfront investment to achieve comparable scale and efficiency.

- Pricing Pressure: Lower costs for incumbents translate into a competitive pricing advantage, deterring new market participants.

The threat of new entrants for AngioDynamics is generally considered moderate due to several significant barriers. High capital requirements for research, development, and manufacturing, coupled with stringent regulatory approvals like FDA clearance, demand substantial financial commitment and time, deterring many potential new players.

Existing brand loyalty, established distribution networks, and strong intellectual property protection further solidify the position of incumbents. For example, AngioDynamics' patent portfolio protects its innovative technologies, and the risk of litigation for infringement serves as a powerful deterrent for startups. Additionally, the economies of scale enjoyed by established companies, reflected in their lower per-unit costs, make it difficult for new entrants to compete on price.

| Barrier to Entry | Impact on New Entrants | Example for AngioDynamics |

|---|---|---|

| Capital Requirements | High | Millions to hundreds of millions for R&D and market entry. |

| Regulatory Hurdles | High | FDA approval processes (510(k), PMA) are time-consuming and costly. |

| Brand Loyalty & Distribution | High | Established relationships with healthcare providers, difficult to replicate. |

| Intellectual Property | High | Patents on core technologies deter infringement and require costly navigation. |

| Economies of Scale | Moderate to High | Incumbents benefit from lower per-unit costs due to high-volume production. |

Porter's Five Forces Analysis Data Sources

Our AngioDynamics Porter's Five Forces analysis is built upon a foundation of publicly available data, including AngioDynamics' SEC filings, investor presentations, and annual reports. We also leverage industry-specific market research reports and trade publications to gain a comprehensive understanding of the competitive landscape.