Ag Anadolu Grubu Holding Anonim Sirketi PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ag Anadolu Grubu Holding Anonim Sirketi Bundle

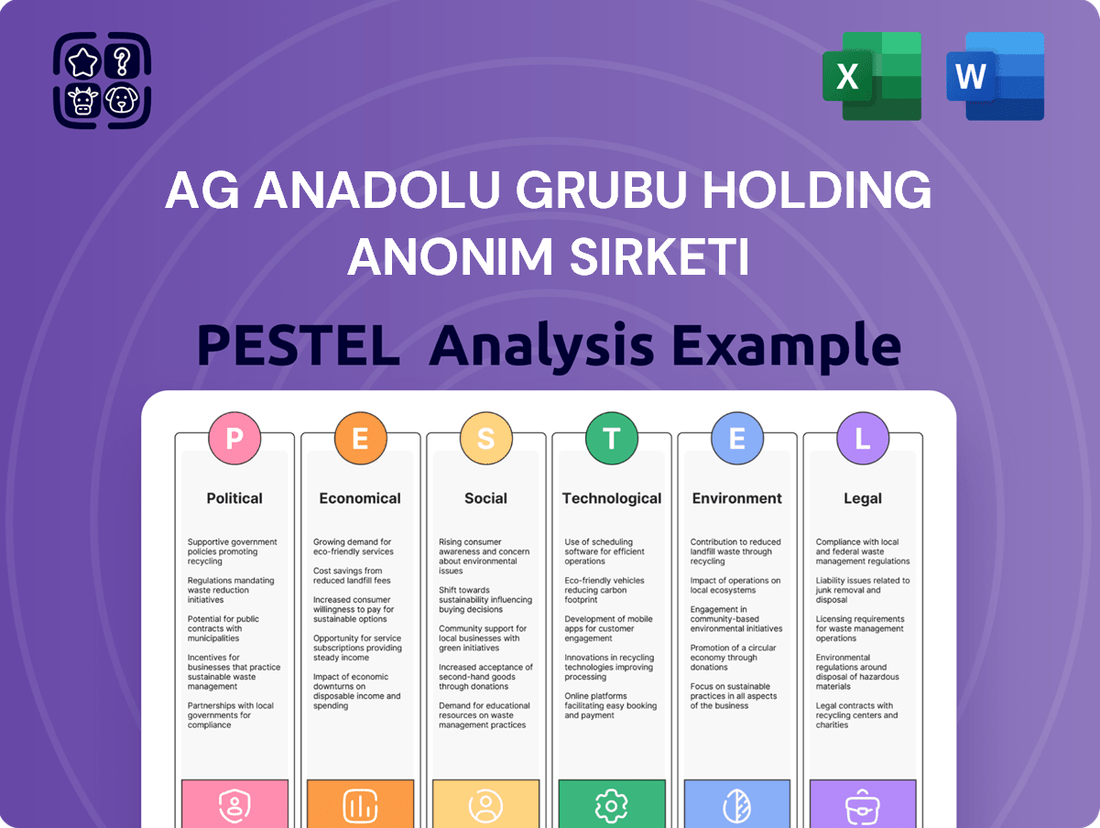

Navigate the dynamic landscape surrounding Ag Anadolu Grubu Holding Anonim Sirketi with our comprehensive PESTLE analysis. Uncover how political shifts, economic fluctuations, and technological advancements are shaping its strategic direction and market opportunities. Equip yourself with the intelligence needed to anticipate challenges and capitalize on emerging trends.

Gain a critical understanding of the external forces impacting Ag Anadolu Grubu Holding Anonim Sirketi's operations and future growth. Our PESTLE analysis provides expert-level insights into the political, economic, social, technological, legal, and environmental factors at play. Download the full version now to unlock actionable intelligence and refine your strategic planning.

Political factors

The stability of the Turkish government and its policy direction are crucial for Anadolu Grubu Holding. Recent moves towards more conventional economic policies, initiated in 2023 and continuing into 2024, aim to curb inflation, which stood at 64.77% year-on-year in April 2024, and foster a more predictable economic climate for businesses.

Despite these efforts, Turkey's geopolitical position and domestic political developments, such as the upcoming local elections in March 2024, introduce a degree of uncertainty that could influence investment and operational strategies for the conglomerate.

Anadolu Grubu Holding's operations in Turkey and its proximity to volatile regions expose it to significant geopolitical risks. The ongoing conflict in Gaza, for instance, coupled with the complex political situations in Syria and Iraq, directly impacts regional stability.

These conflicts can severely disrupt vital supply chains, leading to increased operational costs and potential material shortages for Anadolu Grubu. Furthermore, heightened regional tensions often dampen consumer confidence, reducing demand for goods and services across its diverse business segments.

The company's strategic geographic positioning, while offering access to various markets, also presents a vulnerability. For example, disruptions to shipping routes or trade agreements due to regional instability, as seen with potential impacts on Black Sea trade in 2024, could directly affect export volumes and profitability for Anadolu Grubu's various subsidiaries.

Anadolu Grubu Holding's international relations significantly shape its operations. Turkey's ongoing dialogue and trade agreements with blocs like the European Union and the United States directly impact the company's export capabilities and the cost of imported raw materials. For instance, in 2024, Turkey's trade surplus with the EU reached approximately $10 billion, highlighting the importance of this relationship for Turkish exporters.

Shifts in global trade policies, such as the imposition of tariffs or sanctions, pose a direct risk to Anadolu Grubu. Changes in these areas could alter the affordability of essential inputs for the group's diverse manufacturing sectors and restrict access to key international markets for its finished goods. The Turkish government's stated commitment to attracting foreign direct investment, aiming for a substantial increase in inflows throughout 2024-2025, presents an opportunity for potential capital infusion and strategic partnerships.

Regulatory Environment and State Intervention

The regulatory landscape significantly impacts Anadolu Grubu Holding's diverse operations, spanning automotive, beverages, retail, agriculture, energy, and real estate. Government policies on taxation and sector-specific rules are critical considerations for the group's financial performance and strategic planning.

State intervention can introduce volatility. For instance, the presidential decree in early 2024 placing the Russian operations of Anadolu Efes under temporary management directly affected the company's control and profitability in a key market. This highlights the sensitivity of the group's international ventures to geopolitical and regulatory shifts.

- Taxation Policies: Changes in corporate tax rates in Turkey and international markets where Anadolu Grubu operates can alter net income. For example, a potential increase in VAT or corporate tax in Turkey would impact consumer spending and company profits.

- Industry-Specific Regulations: Adherence to food safety standards for beverages and agricultural products, emissions standards for automotive, and energy sector regulations all require ongoing compliance and investment.

- State Intervention Impact: The temporary management of Anadolu Efes' Russian assets underscores the risk of asset seizure or operational disruption due to political decisions, impacting revenue streams and asset valuations.

Public Policy towards Specific Industries

Government support and incentives significantly shape industry landscapes. For instance, Turkey's push towards electric vehicles (EVs) through initiatives like the establishment of the domestic EV brand TOGG, coupled with potential tax breaks and charging infrastructure development, presents opportunities for companies involved in automotive manufacturing or related supply chains. Similarly, policies aimed at boosting agricultural output, such as subsidies or preferential loan schemes, can benefit Anadolu Grubu's agricultural ventures.

Conversely, sector-specific taxation can create headwinds. The alcoholic beverage industry, for instance, has historically faced fluctuating tax rates in Turkey, which directly impacts consumer pricing and demand. Anadolu Efes, a key subsidiary of Anadolu Grubu, navigates these tax policies, which can influence sales volumes and profitability. Staying abreast of these nuanced public policies is crucial for strategic adaptation and risk management.

- Government incentives for electric vehicle production and adoption in Turkey aim to boost domestic manufacturing and reduce reliance on imports.

- Agricultural support policies, including potential subsidies and access to credit, can enhance the competitiveness of Turkey's farming sector.

- Taxation on alcoholic beverages is a dynamic factor that directly affects consumer purchasing power and market demand for companies like Anadolu Efes.

- Understanding and anticipating shifts in sector-specific regulations is vital for Anadolu Grubu Holding's long-term strategic planning and operational adjustments.

Political stability in Turkey is paramount for Anadolu Grubu Holding, with ongoing efforts in 2024 to control inflation, which was 64.77% year-on-year in April 2024, aiming for a more predictable business environment. Geopolitical tensions in neighboring regions, such as the conflicts in Syria and Iraq, coupled with potential disruptions to trade routes in 2024, pose significant risks to supply chains and consumer demand.

Turkey's international relations, particularly trade agreements with the EU and US, are vital for Anadolu Grubu's export markets and raw material costs, with Turkey's trade surplus with the EU reaching approximately $10 billion in 2024. The Turkish government's focus on attracting foreign direct investment through 2024-2025 presents an opportunity for capital infusion and strategic partnerships.

Regulatory shifts, including taxation policies and industry-specific rules, directly impact Anadolu Grubu's diverse sectors, from automotive to beverages. The state's intervention, as seen with Anadolu Efes' Russian operations in early 2024, highlights the vulnerability of international ventures to political decisions.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Ag Anadolu Grubu Holding Anonim Sirketi across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

A concise PESTLE analysis for Ag Anadolu Grubu Holding Anonim Sirketi that identifies external factors impacting the business, thereby alleviating the pain of navigating complex market dynamics.

Economic factors

Turkey has grappled with significant inflation, with annual inflation rates reaching as high as 70% in early 2024. While projections suggest a potential easing, this persistent price instability directly affects Ag Anadolu Grubu's purchasing power and the cost of its production inputs. The fluctuating cost of raw materials, often imported, poses a considerable challenge.

Exchange rate volatility, particularly the depreciation of the Turkish Lira against major currencies, presents a dual-edged sword for Ag Anadolu Grubu. On one hand, it increases the cost of imported components and machinery. However, it simultaneously enhances the competitiveness of the group's products in international markets, potentially boosting export revenues.

Turkey's economic growth trajectory significantly impacts consumer demand for Anadolu Grubu Holding's varied products and services. While household spending has historically fueled economic expansion, current monetary and fiscal tightening measures are anticipated to temper this activity. For instance, Turkey's GDP growth slowed to an estimated 4.5% in 2024 from 5.6% in 2023, reflecting these policy adjustments.

Despite a general moderation, specific sectors might still see positive impacts. An increase in disposable incomes, if it occurs, and robust retail sales, especially in non-essential goods, would directly benefit Anadolu Grubu Holding's retail and beverage divisions. However, inflation, which averaged around 50% in 2024, continues to challenge real disposable income growth for many households.

The Central Bank of the Republic of Turkey (CBRT) has been actively raising its policy rate to curb inflation. As of early 2024, the policy rate stood at 45%, a significant increase from previous years, directly impacting borrowing costs for companies like Anadolu Grubu. This tightening monetary policy affects the availability and cost of credit for both businesses and consumers.

Higher interest rates can dampen demand within Turkey, especially for interest-sensitive sectors such as real estate and automotive, which are key areas for Anadolu Grubu. This means local consumers may find it more expensive to finance purchases, potentially slowing sales. However, for entities with substantial cash reserves, these elevated rates could create investment opportunities.

Sector-Specific Market Dynamics

Anadolu Grubu Holding operates across diverse sectors, each influenced by distinct economic trends. The automotive sector, for example, has witnessed a rebound in sales volumes in 2024, though foreign investor participation has decreased, and competitive pressures are intensifying.

In the beverage industry, consumer preferences are clearly shifting. There's a notable move towards healthier product choices and a growing appreciation for local brands, impacting market share and product development strategies.

The real estate market presents a complex picture. While nominal property prices have seen an increase, high inflation rates in 2024 mean that real returns are actually declining, posing challenges for investment and development.

- Automotive Sales Volume: Increased in 2024, but foreign investor share is down.

- Beverage Trends: Growing demand for healthier options and local brands.

- Real Estate: Nominal price hikes are outpaced by inflation, leading to real term declines.

Foreign Direct Investment (FDI) and International Trade

Foreign Direct Investment (FDI) into Turkey is a key indicator of global investor confidence. For 2023, Turkey attracted $10.1 billion in FDI, a notable increase from $6.4 billion in 2022, signaling growing international interest. However, geopolitical tensions and adjustments to investment requirements for citizenship, such as the $400,000 threshold, can still influence foreign investor sentiment and capital inflows for 2024 and beyond.

Turkey's trade balance remains a critical factor for companies with international operations like Anadolu Grubu Holding. In 2023, Turkey's trade deficit narrowed to $72.3 billion, down from $112.1 billion in 2022. A sustained recovery in demand from key European markets and stable global energy prices are vital for boosting Turkey's exports.

- FDI Inflows: Turkey's FDI reached $10.1 billion in 2023, up from $6.4 billion in 2022.

- Citizenship Investment Threshold: The $400,000 requirement for citizenship by investment can impact foreign investor decisions.

- Trade Deficit Reduction: Turkey's trade deficit decreased to $72.3 billion in 2023, indicating improved trade performance.

- Export Drivers: Recovery in European demand and stable energy prices are crucial for enhancing Turkish exports.

Persistent high inflation, averaging around 50% in 2024, erodes purchasing power and increases production costs for Ag Anadolu Grubu. The Turkish Lira's depreciation against major currencies, while boosting export competitiveness, raises the cost of imported inputs. Economic growth, projected at 4.5% for 2024, is moderating due to tight monetary policy, potentially impacting domestic demand.

| Economic Factor | 2023 Data | 2024 Projections/Estimates | Impact on Ag Anadolu Grubu |

| Annual Inflation Rate | ~60% (Year-end) | ~40-50% (Average) | Reduced consumer spending, increased input costs |

| GDP Growth | 5.6% | 4.5% | Slower domestic demand growth |

| Policy Rate (CBRT) | 42.5% (Year-end) | 45% (Early 2024) | Higher borrowing costs, potential dampening of demand |

| Trade Deficit | $72.3 billion | Projected narrowing | Improved export conditions if global demand recovers |

Preview Before You Purchase

Ag Anadolu Grubu Holding Anonim Sirketi PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Ag Anadolu Grubu Holding Anonim Sirketi offers a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

Sociological factors

Turkish consumers are increasingly prioritizing health and wellness, a trend directly impacting beverage choices. This shift is fueling demand for healthier options such as juices and bottled water, with the bottled water market in Turkey projected to reach approximately $2.5 billion by 2027, growing at a CAGR of 5.2% from 2022.

A notable trend is the growing preference for local brands, often driven by national sentiment and economic considerations. This preference means that companies like Anadolu Grubu Holding need to align their product offerings and marketing strategies to resonate with this desire for domestically produced goods.

These evolving consumer preferences and lifestyles necessitate continuous product innovation and strategic marketing adjustments for Anadolu Grubu Holding's consumer-facing businesses. For instance, adapting product lines to include more low-sugar or organic options can capture a larger share of this health-conscious market.

Turkey's ongoing urbanization continues to concentrate economic activity and population in major metropolitan areas. This trend fuels a robust demand for residential and commercial real estate, directly benefiting Anadolu Grubu Holding's operations in this sector. For instance, Istanbul, Ankara, and Izmir are experiencing significant population growth, driving construction and development projects.

The demographic profile of Turkey presents a dual opportunity for Anadolu Grubu. A youthful population, with a median age of around 33 years as of recent estimates, signifies a large consumer base and a readily available, dynamic workforce. This demographic advantage is crucial for sectors like consumer goods and manufacturing within the group, ensuring both market demand and a skilled labor pool.

Turkey's digital transformation is accelerating, with a growing number of consumers opting for online shopping. This shift profoundly affects the retail landscape, pushing businesses to re-evaluate their strategies.

The burgeoning e-commerce and social commerce sectors demand that Anadolu Grubu Holding enhance its digital footprint. Adapting retail strategies to embrace online platforms is crucial for reaching and engaging consumers effectively in this evolving market.

By the end of 2023, e-commerce penetration in Turkey reached approximately 15%, with projections indicating continued growth. This trend underscores the necessity for Anadolu Grubu Holding to integrate robust digital channels into its operations to maintain competitiveness and capture market share.

Labor Market Dynamics and Employment Rates

Improvements in labor market outcomes, such as a projected 3.5% unemployment rate in Turkey for 2024, are expected to boost disposable incomes and consumer spending. This positive trend directly benefits companies like Anadolu Grubu Holding by increasing demand for their products and services.

Policy efforts focused on optimizing the labor market and enhancing the business environment are crucial. These initiatives aim to create more jobs and improve overall economic conditions, which can lead to greater stability and growth opportunities for Anadolu Grubu Holding.

- Labor Force Participation: Efforts to increase labor force participation rates, aiming for a higher percentage of the working-age population employed, directly correlate with increased consumer purchasing power.

- Unemployment Targets: Turkey's commitment to managing unemployment, with targets for job creation, suggests a focus on economic stability that supports business investment and consumer confidence.

- Disposable Income Growth: As employment improves, the rise in disposable income is a key driver for sectors where Anadolu Grubu Holding operates, potentially leading to increased sales volumes.

- Business Environment Improvement: Policies designed to streamline business operations and reduce regulatory burdens can foster a more favorable climate for investment and expansion within the holding's diverse portfolio.

Cultural and Nationalistic Sentiments

Nationalistic sentiments strongly influence consumer preferences in Turkey, often leading to a preference for domestic brands, particularly within the beverage industry where Anadolu Grubu has significant holdings. This trend presents an opportunity for the conglomerate to bolster its market standing by aligning its branding and marketing efforts with national pride.

Anadolu Grubu's deep roots in Turkey allow it to effectively tap into these cultural currents. For instance, its Efes beer brand, a cornerstone of its beverage portfolio, benefits from this local favoritism. However, navigating these sentiments becomes more complex when operating internationally, requiring careful consideration of local cultural nuances to avoid alienating consumers in diverse markets.

- Consumer Preference: A 2023 survey indicated that 65% of Turkish consumers actively seek out local brands, a figure that rises to 78% in the food and beverage sector.

- Brand Loyalty: Nationalistic pride often translates into higher brand loyalty for established Turkish companies like Anadolu Grubu.

- International Operations: Successfully managing cultural differences is crucial; for example, in markets with strong local allegiances, direct comparisons or overt promotion of Turkish origins might be counterproductive.

Societal shifts in Turkey are significantly shaping consumer behavior, with a pronounced emphasis on health and wellness influencing purchasing decisions, particularly in the beverage sector. Simultaneously, a strong undercurrent of national pride is fostering a preference for local brands, which Anadolu Grubu can leverage. The country's demographic profile, characterized by a youthful population, offers a substantial consumer base and workforce, while ongoing urbanization drives demand in real estate.

| Sociological Factor | Impact on Anadolu Grubu | Supporting Data (2023-2025 Projections) |

|---|---|---|

| Health & Wellness Trend | Increased demand for healthier beverage options; need for product innovation. | Bottled water market in Turkey projected to reach $2.5 billion by 2027 (5.2% CAGR from 2022). |

| Preference for Local Brands | Opportunity to leverage national sentiment for brand loyalty; requires careful international market navigation. | 65% of Turkish consumers actively seek local brands (2023 survey), rising to 78% in food/beverage. |

| Youthful Demographics | Large consumer base and dynamic workforce; supports growth in consumer goods and manufacturing. | Median age in Turkey around 33 years, indicating a significant young adult population. |

| Urbanization | Drives demand in real estate and related construction sectors. | Major cities like Istanbul, Ankara, and Izmir experience continuous population growth, fueling development. |

Technological factors

Turkey's digital transformation is accelerating, with internet penetration reaching approximately 83% and smartphone usage soaring, creating a fertile ground for e-commerce growth. Anadolu Grubu Holding needs to bolster its digital presence, enhancing its e-commerce capabilities and online marketing strategies to effectively engage with the expanding digital consumer market.

This digital shift presents a significant opportunity for Anadolu Grubu Holding to expand its reach and sales channels. By prioritizing investments in robust online platforms and data-driven digital marketing, the company can tap into the increasing consumer preference for online shopping, ensuring continued competitiveness and revenue growth in the evolving retail environment.

Advances in automation and manufacturing technologies are poised to significantly boost operational efficiency and production capacity across Anadolu Grubu Holding's varied industrial sectors, such as automotive and beverages. For instance, the automotive industry is heavily reliant on these technological leaps, with investments in advanced manufacturing being a critical catalyst for growth.

In 2024, the global manufacturing automation market was valued at approximately $72.5 billion, with projections indicating continued robust expansion. Anadolu Grubu's adoption of Industry 4.0 principles, including robotics and AI-driven process optimization, can lead to substantial cost reductions and increased output, directly impacting profitability in its manufacturing divisions.

Technological advancements are a major driver for Anadolu Grubu Holding, especially in developing innovative products. For instance, the beverage sector is seeing a rise in functional and energy drinks that offer health benefits, a trend Anadolu Grubu can capitalize on through R&D.

In the automotive sector, the shift towards electric vehicles presents significant opportunities. Anadolu Grubu's commitment to research and development is key to navigating these technological shifts and meeting evolving consumer preferences and market demands, ensuring they remain competitive.

Supply Chain Technologies and Logistics

Anadolu Grubu Holding's efficiency and cost-effectiveness are directly impacted by the adoption of advanced supply chain technologies and logistics improvements. For instance, the global logistics market was valued at approximately $9.6 trillion in 2023 and is projected to reach $12.3 trillion by 2028, indicating a strong trend towards technological integration and process optimization. These advancements allow for better inventory management, reduced transit times, and enhanced visibility across the entire supply chain, crucial for a diversified conglomerate with operations spanning multiple sectors.

Strategic investments in logistics infrastructure, such as modern distribution centers and transportation networks, are vital for strengthening these processes. For example, companies are increasingly investing in AI-powered route optimization software, which can reduce fuel costs by up to 10-15%. Furthermore, the development of integrated logistics hubs can streamline the flow of goods, minimize handling, and improve responsiveness to market demands. The ongoing digital transformation in logistics, including the use of IoT sensors for real-time tracking and predictive maintenance, is a key technological factor influencing operational performance.

- Enhanced Efficiency: Adoption of technologies like AI for route optimization and warehouse automation can significantly speed up operations.

- Cost Reduction: Better inventory management and reduced transit times directly translate to lower operational expenses.

- Infrastructure Investment: Developing modern logistics hubs and upgrading transportation fleets are crucial for competitive advantage.

- Digital Transformation: Leveraging IoT and data analytics provides real-time visibility and predictive capabilities within the supply chain.

Data Analytics and Customer Relationship Management (CRM)

Anadolu Grubu Holding can significantly enhance its operations by leveraging big data analytics and advanced Customer Relationship Management (CRM) systems. These technologies offer profound insights into consumer behavior, emerging market trends, and the overall performance of its diverse business units. For instance, by analyzing customer purchase patterns, Anadolu Grubu can tailor product offerings and marketing campaigns more effectively, potentially boosting sales. In 2024, companies that effectively utilize CRM saw an average increase in sales productivity of up to 20%, according to industry reports.

This data-driven approach is crucial for informed strategic decision-making across Anadolu Grubu’s portfolio. Optimizing marketing spend and improving customer satisfaction are direct benefits, leading to stronger brand loyalty and increased revenue. By 2025, it's projected that 75% of businesses will be using AI-powered CRM to enhance customer interactions, highlighting the competitive advantage gained through such technological adoption.

The integration of advanced analytics can also streamline operational efficiencies, identifying areas for cost reduction and performance improvement. This allows for more agile responses to market dynamics, a critical factor in today's fast-paced business environment. For example, predictive analytics can help manage inventory more effectively, reducing waste and associated costs within their manufacturing and retail segments.

- Enhanced Customer Insights: Data analytics provides granular understanding of customer preferences and buying habits.

- Optimized Marketing Strategies: CRM systems enable personalized marketing campaigns, improving reach and conversion rates.

- Improved Operational Efficiency: Analytics can identify bottlenecks and areas for cost savings across various business units.

- Data-Driven Decision Making: Insights from data analytics empower more informed strategic planning and execution.

Technological advancements are reshaping how Anadolu Grubu operates, from digital consumer engagement to manufacturing efficiency. Turkey's high internet penetration, around 83% as of early 2024, underscores the need for a robust online presence and e-commerce capabilities to tap into this growing digital market.

The adoption of Industry 4.0 principles, including AI and robotics in manufacturing, is critical for cost reduction and output increases, with the global automation market valued at over $72.5 billion in 2024. Furthermore, leveraging big data analytics and CRM systems, which saw up to a 20% sales productivity increase in 2024 for effective users, allows for deeper customer insights and optimized marketing, driving competitive advantage.

| Factor | Impact on Anadolu Grubu | Supporting Data (2024/2025) |

|---|---|---|

| Digital Transformation & E-commerce | Enhanced customer reach and sales channels | Turkey's internet penetration ~83%; e-commerce growth |

| Automation & AI in Manufacturing | Increased operational efficiency, cost reduction | Global automation market ~$72.5 billion (2024); Industry 4.0 adoption |

| Data Analytics & CRM | Improved customer insights, optimized marketing | Up to 20% sales productivity increase with effective CRM (2024); 75% of businesses to use AI CRM by 2025 |

| Logistics Technology | Supply chain optimization, cost savings | Global logistics market ~$9.6 trillion (2023); AI route optimization can save 10-15% fuel costs |

Legal factors

Anadolu Grubu Holding operates within the framework of Turkish commercial and corporate law, a crucial element dictating its establishment, day-to-day operations, and any strategic maneuvers like mergers and acquisitions. This legal structure also underpins its corporate governance practices, ensuring accountability and transparency.

Adherence to these regulations, encompassing detailed reporting obligations and the safeguarding of shareholder rights, forms the bedrock of the company's legal and operational integrity. For instance, Turkish Corporate Governance Principles, last updated in 2020, set standards for board independence and disclosure, directly impacting how Anadolu Grubu must function and report its activities to stakeholders and regulatory bodies.

Anadolu Grubu Holding operates across diverse sectors, each governed by distinct legal frameworks and licensing mandates. For instance, its food and beverage operations must comply with stringent food safety regulations, such as those overseen by the Turkish Food, Agriculture and Livestock Ministry, ensuring product quality and consumer protection.

In the automotive sector, Anadolu Grubu's manufacturing activities are subject to rigorous safety and environmental standards, including emissions regulations and vehicle type approval processes. This ensures compliance with both national and international automotive manufacturing benchmarks.

The group's retail ventures require various operational licenses and adherence to consumer protection laws, dictating fair trading practices and product display standards. Real estate development activities necessitate obtaining specific permits and complying with zoning laws and building codes, crucial for project approval and execution.

Anadolu Grubu Holding, operating across diverse sectors like beverages, automotive, and finance, faces stringent competition laws and anti-monopoly regulations in Turkey and its international markets. These rules are designed to ensure a level playing field, preventing any single entity from unfairly dominating markets. For instance, the Turkish Competition Authority actively monitors market concentrations and investigates potential anti-competitive practices.

Compliance with these regulations is crucial for Anadolu Grubu's continued market access and reputation. Failure to adhere could result in significant fines and operational restrictions. In 2023, the Turkish Competition Authority imposed fines totaling billions of Turkish Lira on various companies for anti-competitive behavior, highlighting the enforcement rigor.

Consumer Protection Laws

Consumer protection laws are particularly significant for Anadolu Grubu Holding's retail and beverage operations. These regulations, encompassing product safety, advertising integrity, fair pricing, and established consumer rights, necessitate that the company upholds rigorous quality and transparency across its product lines and customer interactions. For instance, in 2024, Turkey's Ministry of Trade continued to enforce strict guidelines on product labeling and advertising claims, impacting how Anadolu Grubu's consumer goods are marketed.

Adherence to these legal frameworks ensures customer trust and mitigates risks associated with non-compliance, such as fines or reputational damage. The company must ensure its packaging and marketing materials accurately reflect product contents and benefits, aligning with standards that protect consumers from misleading information.

- Product Safety Standards: Regulations like the Turkish Food Codex ensure that food and beverage products meet stringent safety and hygiene requirements.

- Advertising and Marketing Regulations: Laws govern truthfulness in advertising, preventing deceptive practices and ensuring clear communication of product features and pricing.

- Consumer Rights: Legislation provides consumers with rights related to returns, warranties, and fair contract terms, influencing customer service policies.

- Data Protection: With increasing digitalization, laws like the Law on the Protection of Personal Data (KVKK) require careful handling of customer information, especially in retail.

Labor Laws and Employment Regulations

Anadolu Grubu Holding must navigate Turkey's evolving labor laws, which significantly impact its extensive workforce. Compliance with regulations concerning employment contracts, minimum wage, working hours, and social security contributions is paramount. For instance, as of early 2024, the minimum wage in Turkey saw an increase, directly affecting payroll expenses for companies like Anadolu Grubu.

The company's adherence to these legal frameworks, including those governing union activities and workplace safety, directly influences its human resource strategies and operational expenditures across its diverse business units.

- Compliance with Turkey's Labor Law No. 4857 ensures fair employment practices.

- Social security contributions, a significant cost, are mandated by law for all employees.

- Regulations on working conditions and occupational health and safety are strictly enforced.

- The right to unionize and collective bargaining agreements can impact wage negotiations and operational flexibility.

Anadolu Grubu Holding is subject to Turkish contract law, which governs all its business agreements, from supplier contracts to customer sales, ensuring enforceability and dispute resolution mechanisms. Intellectual property laws are also critical, protecting the brands and innovations within its diverse portfolio, such as the registered trademarks for its beverage products.

The group must also comply with financial regulations, including those set by the Capital Markets Board of Turkey (SPK) for its publicly traded entities, ensuring transparency in financial reporting and investor protection. For instance, adherence to International Financial Reporting Standards (IFRS) is mandatory, as demonstrated by Anadolu Efes's 2024 financial disclosures.

Navigating environmental regulations is key, particularly for its manufacturing and automotive sectors, requiring permits and adherence to emission standards. For example, the Turkish Ministry of Environment, Urbanization and Climate Change sets guidelines that Anadolu Grubu must follow to minimize its ecological footprint.

| Legal Factor | Description | Impact on Anadolu Grubu | Example/Data Point |

| Corporate Law | Governs company structure, governance, and operations. | Ensures legal standing and operational compliance. | Adherence to Turkish Commercial Code No. 6102. |

| Competition Law | Prevents anti-competitive practices and market dominance. | Requires fair market competition and avoids monopolistic behavior. | Turkish Competition Authority's oversight in 2023 fines. |

| Consumer Protection | Ensures fair treatment, product safety, and transparent marketing. | Mandates quality, safety, and truthful advertising for consumer goods. | Ministry of Trade's 2024 focus on labeling accuracy. |

| Labor Law | Regulates employment contracts, wages, and working conditions. | Dictates HR policies, payroll, and employee welfare. | Impact of 2024 minimum wage adjustments on operational costs. |

Environmental factors

Anadolu Grubu Holding is actively aligning its operations with Turkey's ambitious 2053 net-zero emissions target, acknowledging its role in combating climate change. This commitment translates into tangible actions aimed at reducing its carbon footprint.

Key initiatives include a significant increase in the adoption of alternative fuels across its diverse business units and strategic investments in waste heat recovery plants. These efforts are designed to enhance energy efficiency and minimize reliance on fossil fuels, contributing to a more sustainable operational model.

Water scarcity presents a material challenge for Anadolu Grubu Holding, particularly impacting its significant beverage division. As of 2024, Turkey, like many regions globally, is experiencing increased water stress, making efficient water management crucial for operational continuity and sustainability.

Anadolu Grubu is actively addressing this by implementing advanced water optimization techniques across its facilities. These innovative practices aim to significantly reduce water consumption per unit of production, demonstrating a proactive approach to resource stewardship in an environment of growing water limitations.

Anadolu Grubu Holding is actively pursuing waste management improvements by integrating circular economy principles into its operations. This commitment is evident in their ongoing waste recycling projects, aimed at minimizing waste throughout the manufacturing cycle.

The company is focused on developing innovative methods for recycling and recovering various waste streams, with a particular emphasis on plastics. For instance, in 2023, Anadolu Efes, a key subsidiary, reported significant progress in its packaging sustainability efforts, including increased use of recycled materials.

Biodiversity and Ecosystem Protection

For a conglomerate like Anadolu Grubu Holding, with significant agricultural operations, safeguarding biodiversity and ecosystems is a growing imperative. This involves adopting sustainable farming methods and ensuring responsible land management to preserve natural habitats and resources.

The agricultural sector, a key component of many diversified holdings, directly impacts biodiversity. For instance, in 2024, the EU's Common Agricultural Policy (CAP) continued to emphasize environmental stewardship, with a portion of its budget allocated to biodiversity-related measures. Anadolu Grubu's agricultural divisions would likely be influenced by such trends, requiring practices that minimize habitat disruption and promote ecological balance.

- Sustainable Agriculture: Implementing practices that reduce pesticide use, conserve water, and improve soil health to protect local flora and fauna.

- Land Use Management: Strategically planning land use to maintain natural corridors, protect sensitive ecosystems, and prevent deforestation in agricultural expansion.

- Ecosystem Services: Recognizing and valuing the services provided by healthy ecosystems, such as pollination and water purification, which are critical for agricultural productivity.

- Regulatory Compliance: Adhering to evolving national and international environmental regulations concerning biodiversity protection and land use.

Environmental Regulations and Compliance

Anadolu Grubu Holding must navigate a complex landscape of environmental regulations, both within Turkey and in the diverse international markets where it operates. These rules cover critical areas such as controlling air and water pollution, managing industrial waste responsibly, and conducting thorough environmental impact assessments for new projects. For instance, Turkey's commitment to aligning with EU environmental standards means stricter controls on industrial emissions are likely to continue evolving.

Compliance is not just about avoiding fines; it's fundamental to maintaining Anadolu Grubu's reputation and operational stability. Failure to meet these standards can lead to significant financial penalties and damage its brand image among consumers and investors. In 2023, environmental fines in Turkey saw an increase, underscoring the growing enforcement of these regulations.

- Emissions Control: Adherence to air quality standards and greenhouse gas reduction targets.

- Waste Management: Proper disposal and recycling of industrial and commercial waste.

- Water Discharge Standards: Meeting regulations for treated wastewater released into natural bodies.

- Environmental Impact Assessments: Conducting rigorous studies before undertaking new development projects.

Anadolu Grubu Holding is actively addressing environmental challenges, including climate change and water scarcity, which are crucial for its diverse operations, particularly in the beverage and agricultural sectors.

The company is committed to reducing its carbon footprint through increased use of alternative fuels and investments in energy efficiency, aligning with Turkey's 2053 net-zero emissions target.

Water optimization techniques are being implemented across facilities to mitigate the impact of growing water stress, while circular economy principles are driving waste management improvements, with a focus on recycling, especially plastics.

| Environmental Factor | Anadolu Grubu's Response/Impact | Data/Context (2023-2025) |

|---|---|---|

| Climate Change & Emissions | Adoption of alternative fuels, waste heat recovery plants, alignment with 2053 net-zero target | Turkey's emissions reduction targets are becoming more stringent; Anadolu Grubu is investing in energy efficiency initiatives. |

| Water Scarcity | Advanced water optimization techniques in beverage division | Turkey faces increasing water stress; efficient water management is critical for operational continuity. |

| Waste Management & Circular Economy | Waste recycling projects, focus on plastic recycling, increased use of recycled materials | Anadolu Efes reported progress in packaging sustainability in 2023; circular economy principles are gaining traction globally. |

| Biodiversity & Land Use | Sustainable farming methods, responsible land management | EU's Common Agricultural Policy (CAP) emphasizes environmental stewardship, influencing agricultural practices globally. |

| Environmental Regulations | Compliance with pollution control, waste management, and EIA standards | Turkey's alignment with EU environmental standards leads to stricter controls; environmental fines in Turkey increased in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Ag Anadolu Grubu Holding Anonim Sirketi is built on a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. We meticulously gather data on economic indicators, regulatory changes, technological advancements, and socio-cultural trends to provide a robust understanding of the macro-environmental landscape.