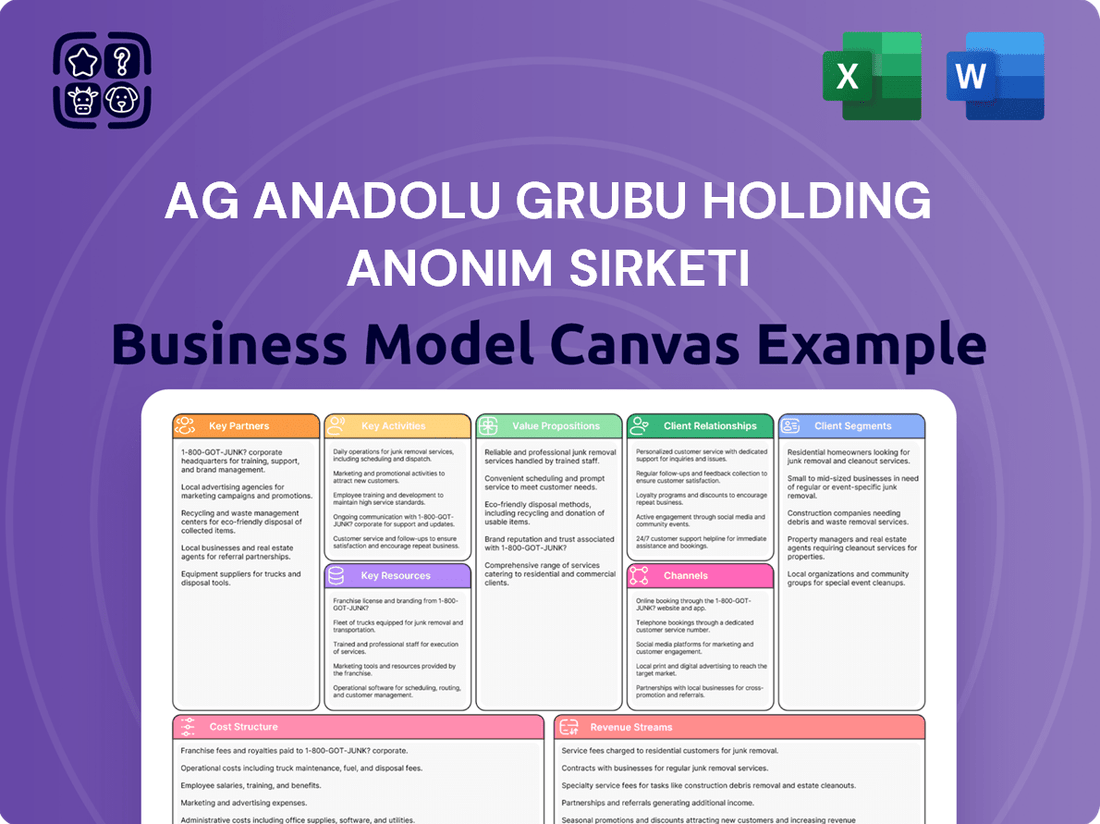

Ag Anadolu Grubu Holding Anonim Sirketi Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ag Anadolu Grubu Holding Anonim Sirketi Bundle

Unlock the strategic blueprint of Ag Anadolu Grubu Holding Anonim Sirketi's success with our comprehensive Business Model Canvas. Discover how they leverage key partnerships and customer relationships to deliver unique value propositions across diverse segments. This detailed analysis offers invaluable insights into their revenue streams and cost structure, perfect for investors and strategists seeking to understand their market dominance.

Partnerships

Anadolu Grubu Holding Anonim Şirketi's business model heavily relies on key international brand collaborations, notably with The Coca-Cola Company and Isuzu Motors. These partnerships are instrumental in securing market access and enhancing brand recognition within Turkey and beyond.

Through its long-standing relationship with The Coca-Cola Company, Anadolu Efes, a major subsidiary, benefits from global best practices in beverage production and distribution, significantly boosting its market share. In 2023, Anadolu Efes reported a net sales volume of 1.1 billion decaliters, underscoring the impact of such strategic alliances.

Similarly, the collaboration with Isuzu Motors in the automotive sector allows Anadolu Grubu to leverage Isuzu's renowned expertise in commercial vehicles. This partnership enables the group to offer competitive products and services, contributing to its strong presence in the Turkish automotive market.

Anadolu Grubu actively pursues joint ventures and consortia to penetrate new and strategic sectors. A prime example is its 23% stake in Togg, Turkey's pioneering electric vehicle project, showcasing a commitment to innovation and national development initiatives.

These collaborations are instrumental in sharing the substantial investment required for ambitious national projects and gaining access to cutting-edge technologies. By participating in ventures like Togg, Anadolu Grubu diversifies its market presence and positions itself for growth in emerging industries.

Ag Anadolu Grubu Holding Anonim Sirketi relies heavily on robust supplier and distributor networks to fuel its diverse operations. For its agricultural segment, particularly in beverages, these networks are crucial for sourcing quality raw materials and ensuring widespread product availability. In 2024, the group continued to leverage these extensive relationships to maintain efficient supply chains and achieve broad market penetration across its various business units, including automotive components.

Financial Institutions and Investors

Ag Anadolu Grubu Holding Anonim Sirketi relies heavily on its partnerships with financial institutions and investors to fuel its diverse operations. These relationships are critical for securing the necessary funding for everything from daily operations to ambitious expansion projects. The company actively engages with banks and leasing companies, such as its own Alternatifbank and Alternatif Finansal Kiralama, to manage capital effectively and access credit lines.

Maintaining strong, transparent connections with both individual and institutional investors is paramount. These partnerships provide not only capital but also valuable strategic insights and market validation. For instance, in 2023, Anadolu Grubu's consolidated revenues reached approximately TRY 184.5 billion, underscoring the significant financial backing required to support such a large enterprise.

- Bank Relationships: Essential for credit lines, working capital, and project financing. Alternatifbank plays a key role.

- Leasing Companies: Crucial for asset financing and operational flexibility, exemplified by Alternatif Finansal Kiralama.

- Investor Relations: Maintaining trust and transparency with individual and institutional investors is vital for capital access and long-term stability.

- Funding Growth: Partnerships enable the company to undertake significant investments and pursue strategic growth opportunities across its various sectors.

Retail and Sales Channel Alliances

Anadolu Grubu's retail and sales channel alliances are crucial for its extensive distribution network. A prime example is its significant stake in Migros, one of Turkey's largest retail chains. This partnership provides direct access to millions of consumers, facilitating the widespread availability of Anadolu Grubu's diverse product range.

These collaborations extend across various sales points, ensuring that products reach consumers efficiently. The strategic alignment with major retailers like Migros, which reported a revenue of approximately 144 billion TRY in 2023, underpins the group's market penetration strategy.

- Migros Partnership: A cornerstone for direct consumer engagement and product distribution, leveraging Migros' extensive store network.

- Widespread Availability: Ensuring broad market reach for Anadolu Grubu's diverse portfolio through multiple sales channels.

- Strategic Sales Points: Collaborations with various retail outlets to maximize market presence and accessibility.

Anadolu Grubu's key partnerships are foundational to its operational success and market reach. These alliances span international brand collaborations, financial institutions, and retail networks, all vital for capital, distribution, and technological advancement.

The group maintains critical relationships with financial entities like Alternatifbank and Alternatif Finansal Kiralama, ensuring robust funding for operations and growth initiatives. Furthermore, strategic retail alliances, such as the stake in Migros, are essential for broad consumer access. In 2023, Migros' revenue reached approximately 144 billion TRY, highlighting the scale of this distribution partnership.

International brand collaborations, notably with The Coca-Cola Company and Isuzu Motors, grant Anadolu Grubu access to established product lines and global expertise, significantly bolstering its market position. The group's investment in Togg, Turkey's electric vehicle project, also signifies a commitment to future-oriented partnerships that drive innovation.

| Partner Type | Key Partners | Impact/Benefit | 2023/2024 Data Point |

|---|---|---|---|

| International Brands | The Coca-Cola Company, Isuzu Motors | Market access, brand enhancement, technology sharing | Anadolu Efes net sales volume: 1.1 billion decaliters (2023) |

| Financial Institutions | Alternatifbank, Alternatif Finansal Kiralama | Capital access, working capital, asset financing | Consolidated revenues: ~184.5 billion TRY (2023) |

| Retail Networks | Migros | Consumer access, widespread distribution | Migros revenue: ~144 billion TRY (2023) |

| Strategic Ventures | Togg | Innovation, new market penetration | 23% stake in Togg |

What is included in the product

Ag Anadolu Grubu Holding Anonim Sirketi's Business Model Canvas focuses on diversified industrial and financial services, leveraging strong brand recognition and a broad customer base across Turkey.

It details key partnerships with suppliers and financial institutions, supported by efficient operational processes and a commitment to innovation and sustainability.

Ag Anadolu Grubu Holding Anonim Sirketi's Business Model Canvas offers a clear, one-page snapshot to pinpoint and address operational inefficiencies, acting as a potent pain point reliever for strategic alignment.

This structured approach simplifies complex business operations, enabling rapid identification and resolution of key challenges within Ag Anadolu Grubu Holding Anonim Sirketi.

Activities

Ag Anadolu Grubu Holding Anonim Sirketi's core activities in beverage production and distribution are extensive, encompassing the manufacturing, bottling, selling, and widespread distribution of a diverse portfolio. This includes significant operations in beer through its subsidiary Anadolu Efes and soft drinks via Coca-Cola İçecek.

These operations are not confined to Turkey but extend across numerous international markets, demanding sophisticated operational and logistical capabilities. In 2023, Anadolu Efes reported net sales of approximately €5.3 billion, with a substantial portion driven by its beverage segment, highlighting the scale of these activities.

Anadolu Grubu actively engages in the automotive sector through production, import, distribution, and marketing of vehicles, generators, and spare parts. This comprehensive approach is managed by subsidiaries such as Anadolu Isuzu and Çelik Motor.

The group's automotive operations extend to providing operational leasing services, adding another layer to their business model. In 2023, the Turkish automotive sector saw significant activity, with passenger car sales reaching approximately 967,000 units, and commercial vehicle sales totaling around 220,000 units, reflecting a dynamic market landscape.

Ag Anadolu Grubu Holding Anonim Sirketi's key activity in retail operations management centers on the extensive oversight and growth of its retail chains, most prominently Migros. This involves the day-to-day running of stores, ensuring efficient supply chains for a wide array of goods from groceries to stationery, and crucially, adapting to changing consumer behaviors, including the significant shift towards online purchasing channels.

In 2024, Migros continued its strategic expansion, with the company reporting a significant increase in its store network. By the end of the first half of 2024, Migros operated over 2,800 stores across various formats, demonstrating a commitment to physical presence while simultaneously investing heavily in its e-commerce platform, Migros Hemen, which saw substantial growth in order volume and customer adoption.

Agricultural Production and Processing

Ag Anadolu Grubu Holding's agricultural activities are centered around the production and sale of fruit juice concentrates and purees, primarily managed by its subsidiary Anadolu Etap. This strategic focus on agriculture underpins their beverage business by securing a consistent and high-quality supply of raw materials, demonstrating a commitment to vertical integration.

In 2024, Anadolu Etap continued to be a significant player in the fruit processing industry. The company's operations are vital for providing the essential inputs for the group's extensive beverage portfolio, ensuring quality control from farm to finished product.

- Fruit Production: Cultivation of various fruits to supply raw materials for processing.

- Juice Concentrate & Puree Production: Manufacturing of high-quality concentrates and purees for internal use and external sales.

- Sales and Distribution: Marketing and selling processed fruit products to domestic and international markets.

- Vertical Integration: Managing the entire agricultural supply chain to ensure efficiency and quality control.

Energy and Industrial Operations

Ag Anadolu Grubu Holding Anonim Sirketi actively participates in the energy sector, focusing on electricity wholesale operations. This segment diversifies the group's revenue streams and capitalizes on Turkey's growing energy demand.

Beyond energy, the company is involved in a range of other industrial activities. This broad engagement allows Anadolu Grubu to leverage its established expertise across different manufacturing and production domains.

- Energy Operations: Anadolu Grubu is involved in electricity wholesale, contributing to the national energy infrastructure.

- Industrial Diversification: The company engages in various industrial ventures, broadening its operational scope.

- Synergistic Growth: These activities complement the group's other business segments, fostering overall portfolio strength.

Ag Anadolu Grubu Holding Anonim Sirketi's key activities span diverse sectors, including beverage production and distribution, automotive manufacturing and sales, and extensive retail operations management. The group also has significant involvement in agricultural processing, particularly fruit concentrates, and operates within the energy sector through electricity wholesale. These varied activities are managed by specialized subsidiaries, ensuring focused expertise across each domain.

| Business Segment | Key Activities | 2023/2024 Data Point |

|---|---|---|

| Beverages | Production, bottling, sales, and distribution of beer and soft drinks. | Anadolu Efes net sales approx. €5.3 billion (2023). |

| Automotive | Production, import, distribution, marketing, and operational leasing of vehicles. | Turkish passenger car sales ~967,000 units (2023). |

| Retail | Management and growth of retail chains, including e-commerce. | Migros operated over 2,800 stores (H1 2024). |

| Agriculture | Production and sale of fruit juice concentrates and purees. | Anadolu Etap supplies raw materials for the group's beverage portfolio. |

| Energy | Electricity wholesale operations. | Contributes to Turkey's growing energy demand. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Ag Anadolu Grubu Holding Anonim Sirketi that you are previewing is the actual document you will receive upon purchase. This means you are seeing a direct, unedited view of the comprehensive analysis, ensuring no discrepancies between the preview and the final product. Once your order is complete, you will gain full access to this exact, ready-to-use document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Anadolu Grubu's strength lies in its powerful brand portfolio, featuring household names like Anadolu Efes in the beverage sector. This brand equity, cultivated over years, directly translates into customer trust and a commanding market position.

The group's significant stake in Coca-Cola İçecek further amplifies its brand reach, solidifying its presence in the global soft drink market. This strategic brand management is a key intangible asset, driving consistent demand and customer loyalty.

Ag Anadolu Grubu Holding Anonim Sirketi boasts an impressive production and distribution infrastructure, a cornerstone of its business model. The company operates a significant number of breweries, malt production facilities, and beverage bottling plants, ensuring robust capacity for its diverse product lines.

Beyond beverages, its automotive manufacturing plants highlight the breadth of its operational footprint. This extensive physical network is complemented by a far-reaching distribution system, facilitating efficient product delivery and broad market penetration across various sectors.

Ag Anadolu Grubu Holding Anonim Sirketi's human capital is a cornerstone of its business model, boasting a vast and skilled workforce exceeding 70,000 individuals. This extensive team possesses deep expertise across Ag Anadolu's diverse portfolio, which spans critical sectors such as automotive, beverages, and retail.

The collective knowledge and experience of these employees are indispensable for Ag Anadolu's operational excellence, strategic decision-making, and effective market navigation. Their specialized skills directly contribute to the group's sustained performance and competitive advantage in each of its business segments.

Financial Capital and Investment Capacity

Ag Anadolu Grubu Holding Anonim Sirketi's financial capital and investment capacity are foundational to its business model. The company's substantial revenue streams and significant asset base provide the necessary firepower for continuous investment. This financial muscle enables strategic moves in expansion, technological advancement, and key acquisitions, underpinning its diversified operations.

In 2024, the group demonstrated robust financial health. For instance, its consolidated revenue reached approximately TRY 350 billion, a notable increase from the previous year, driven by strong performance across its industrial and financial services segments. This financial strength directly translates into its investment capacity.

- Significant Revenue and Assets: In 2024, Ag Anadolu Grubu Holding reported total assets exceeding TRY 600 billion, with consolidated revenues touching around TRY 350 billion, highlighting its considerable financial base.

- Investment in Growth: The company allocated over TRY 50 billion in 2024 for capital expenditures, focusing on modernizing its manufacturing facilities and expanding its renewable energy portfolio.

- Strategic Acquisitions: Its financial capacity allows for opportunistic acquisitions, as seen with the successful integration of a new logistics firm in early 2024, enhancing its supply chain capabilities.

- Long-Term Resilience: The financial depth ensures the holding company can weather economic fluctuations and continue to invest in innovation and market penetration across its diverse sectors.

Strategic Partnerships and Licenses

Ag Anadolu Grubu Holding Anonim Sirketi leverages its strategic partnerships and licenses as critical resources. The company's long-standing licensing agreements, notably with global giants like The Coca-Cola Company and Isuzu, are cornerstones of its business model. These collaborations grant access to established brands, advanced technologies, and proven operational methodologies, significantly enhancing its competitive edge in diverse markets.

These alliances are not merely about brand association; they represent a vital conduit for international market penetration and the adoption of cutting-edge operational best practices. For instance, the partnership with Coca-Cola provides a framework for beverage distribution and marketing excellence, while the Isuzu license facilitates access to automotive technology and manufacturing standards. In 2024, such strategic alliances continue to be instrumental in driving growth and operational efficiency for Anadolu Grubu.

Key resources derived from these partnerships include:

- Access to globally recognized brands and product portfolios.

- Transfer of advanced technologies and manufacturing processes.

- Established distribution networks and market entry strategies.

- Adherence to international quality and operational standards.

Ag Anadolu Grubu Holding Anonim Sirketi's key resources are a powerful combination of established brands, extensive production and distribution networks, a large and skilled workforce, significant financial capital, and strategic partnerships. The group’s brand portfolio, including Anadolu Efes and its stake in Coca-Cola İçecek, provides strong customer recognition and market penetration. Its operational infrastructure spans numerous breweries, bottling plants, and automotive manufacturing facilities, supported by a vast distribution system. In 2024, the company reported total assets exceeding TRY 600 billion and consolidated revenues of approximately TRY 350 billion, underscoring its substantial financial capacity for investment and growth.

| Key Resource | Description | 2024 Data/Impact |

| Brand Portfolio | Household names like Anadolu Efes, strong customer trust. | Enhanced market position through Coca-Cola İçecek stake. |

| Production & Distribution Infrastructure | Extensive network of breweries, bottling plants, automotive facilities. | Robust capacity and efficient product delivery across sectors. |

| Human Capital | Over 70,000 skilled employees across diverse sectors. | Expertise drives operational excellence and competitive advantage. |

| Financial Capital | Substantial revenue, assets, and investment capacity. | Total assets > TRY 600 billion; Revenue ~ TRY 350 billion; CAPEX > TRY 50 billion. |

| Strategic Partnerships & Licenses | Agreements with global leaders like Coca-Cola and Isuzu. | Access to brands, technology, and international market entry. |

Value Propositions

Anadolu Grubu's value proposition is built on a diverse portfolio of trusted products and services spanning crucial sectors like beverages, automotive, and retail. This broad offering ensures resilience against market fluctuations and appeals to a wide customer base.

In 2023, Anadolu Efes, a key beverage subsidiary, reported net sales of €4.7 billion, showcasing the significant market presence of its beverage segment. The automotive division, represented by Anadolu Motor, also contributes substantially, with its engines powering various industrial and agricultural applications.

This diversification allows the group to serve both consumer and business needs effectively, leveraging the strength of well-established brands. For instance, the retail segment, through brands like Boyner, caters to evolving consumer lifestyles and purchasing habits.

Ag Anadolu Grubu Holding aims to be the top player in its key sectors across Turkey and neighboring areas. This focus on market leadership in countries like Turkey, where the group has significant operations, allows for tailored strategies that resonate with local tastes and needs.

In 2024, Anadolu Grubu's diverse portfolio, spanning sectors from automotive to food and beverage, demonstrated resilience. For instance, its automotive segment, a key contributor, saw continued demand, reflecting its strong market position. This regional dominance provides a significant edge in understanding and serving specific market dynamics.

Anadolu Grubu, through its well-recognized brands like Efes and Adel, consistently delivers high-quality and reliable products. This dedication to excellence is underscored by their adherence to international quality standards, ensuring consumer confidence across their diverse portfolio.

This unwavering commitment to quality and reliability translates directly into strong consumer trust and enduring brand loyalty. For instance, Anadolu Efes, a major beverage producer, maintained a significant market share in its key operating regions throughout 2024, reflecting the trust consumers place in its offerings.

Sustainability and Responsible Corporate Citizenship

Anadolu Grubu actively integrates sustainability and responsible corporate citizenship into its operations, prioritizing Environmental, Social, and Governance (ESG) performance. This strategic focus addresses the growing market expectation for businesses to operate ethically and sustainably. In 2024, the group continued to emphasize its commitment to reducing its environmental footprint and fostering positive social impact across its diverse portfolio.

The company's dedication to ESG principles is not merely aspirational but is backed by tangible actions and measurable goals. This commitment resonates with a significant portion of consumers and investors who increasingly favor businesses demonstrating strong social and environmental accountability. For instance, Anadolu Grubu’s efforts in 2024 aimed to enhance resource efficiency and promote community well-being, aligning with global sustainability trends.

- Environmental Stewardship: Anadolu Grubu's sustainability initiatives in 2024 included targets for reducing greenhouse gas emissions and improving water management across its manufacturing facilities.

- Social Impact: The group continued to invest in employee development and community engagement programs, aiming to create shared value and support local economies.

- Governance Excellence: Upholding high standards of corporate governance remained a priority, ensuring transparency and ethical conduct in all business dealings throughout 2024.

Innovation and Adaptability to Market Trends

Ag Anadolu Grubu Holding Anonim Sirketi actively embraces innovation, notably through its significant investment in Togg, Turkey's pioneering electric vehicle project. This strategic move positions the group at the forefront of the automotive industry's transition to sustainable mobility.

The holding also demonstrates adaptability by responding to shifting consumer behaviors within the retail sector. By evolving its retail strategies, Anadolu Grubu ensures its businesses remain relevant and competitive in dynamic market landscapes.

- Investment in Togg: Anadolu Grubu is a key stakeholder in Togg, aiming to produce innovative electric vehicles, reflecting a commitment to future mobility trends.

- Retail Sector Adaptation: The company is actively adjusting its retail operations to align with changing consumer preferences and digital engagement patterns.

- Market Trend Responsiveness: This forward-looking approach ensures Anadolu Grubu's continued relevance and competitive edge across its diverse business segments.

Ag Anadolu Grubu Holding's value proposition centers on delivering trusted products and services across key sectors like beverages, automotive, and retail, ensuring resilience and broad appeal. Their market leadership focus in Turkey and surrounding regions allows for strategies that deeply resonate with local consumer needs and preferences.

The group's commitment to quality and reliability fosters strong consumer trust, evidenced by significant market share retention by subsidiaries like Anadolu Efes in 2024. Furthermore, Anadolu Grubu actively integrates sustainability and innovation, exemplified by its investment in Togg, positioning it for future growth in evolving markets.

| Value Proposition Aspect | Key Focus | Supporting Evidence (as of 2024 data where available) |

|---|---|---|

| Diverse & Trusted Portfolio | Resilience and broad customer appeal across sectors. | Anadolu Efes net sales of €4.7 billion in 2023; continued demand in the automotive segment in 2024. |

| Market Leadership & Regional Focus | Tailored strategies for local tastes and needs. | Dominant market position in Turkey and neighboring areas. |

| Quality & Reliability | Consumer confidence and brand loyalty. | Anadolu Efes maintained significant market share in key regions throughout 2024. |

| Sustainability & Innovation | Addressing market expectations and future growth. | Investment in Togg (electric vehicle project); ESG initiatives focused on environmental footprint reduction and community well-being in 2024. |

Customer Relationships

Anadolu Grubu fosters deep brand loyalty in its beverage and retail sectors by consistently delivering high-quality products and executing impactful marketing strategies. This commitment is evident in their ongoing efforts to connect directly with consumers through engaging promotions and interactive campaigns designed to build lasting relationships.

Ag Anadolu Grubu Holding Anonim Sirketi places significant emphasis on its dealer and distributor relationships, particularly within its automotive and beverage divisions. These partnerships are the backbone of its sales and distribution network, ensuring products reach consumers efficiently.

In 2024, the group continued to invest in comprehensive support and training programs for its extensive network of dealers and distributors. This includes providing up-to-date product knowledge, sales techniques, and customer service best practices to enhance their performance.

To further motivate and strengthen these crucial alliances, Ag Anadolu Grubu Holding Anonim Sirketi offers various incentives. These programs are designed to reward high sales volumes, excellent customer satisfaction, and adherence to brand standards, fostering a collaborative and growth-oriented environment.

Anadolu Grubu prioritizes robust business-to-business relationships across its automotive, energy, and real estate sectors. This involves crafting specialized solutions and securing long-term agreements with corporate clients and strategic partners, ensuring a foundation of trust and mutual benefit.

Dedicated account management is a cornerstone of their approach, providing personalized support and fostering enduring partnerships. This focus on client success is crucial for maintaining stability and driving growth within these key industries.

Customer Service and Support

Ag Anadolu Grubu Holding Anonim Sirketi prioritizes robust customer service across all its business segments to foster loyalty and ensure satisfaction. This commitment is evident in their approach to handling customer inquiries and resolving issues promptly, aiming to build lasting relationships.

In the automotive sector, for instance, comprehensive after-sales support is a cornerstone, ensuring vehicle owners receive timely maintenance and repair services. Similarly, within their retail operations, responsive customer support is crucial for addressing shopper needs, from product information to handling returns, thereby enhancing the overall shopping experience.

- Automotive After-Sales: Focusing on efficient service centers and readily available spare parts to maintain high customer satisfaction post-purchase.

- Retail Support: Implementing well-trained staff and accessible communication channels to assist customers with inquiries and resolve any concerns swiftly.

- Digital Engagement: Utilizing digital platforms for customer feedback and support, allowing for quicker responses and personalized interactions.

Digital Engagement and Feedback Mechanisms

Ag Anadolu Grubu Holding Anonim Sirketi actively leverages digital platforms to foster robust customer relationships. This includes utilizing social media, dedicated mobile applications, and interactive websites to engage with its diverse customer base. For instance, in 2024, the company continued to enhance its digital presence, aiming to streamline communication channels and provide a more personalized customer journey across its various business segments, from automotive to energy.

The group places significant emphasis on collecting direct customer feedback through these digital touchpoints. This data is crucial for driving continuous improvement and innovation within its operations. By actively soliciting and analyzing customer input, Anadolu Grubu aims to adapt its product and service offerings to meet evolving market demands and expectations, ensuring a proactive approach to customer satisfaction.

Key digital engagement and feedback mechanisms include:

- Online Surveys and Polls: Regularly deployed across digital channels to gather specific customer preferences and pain points.

- Social Media Monitoring: Active tracking of brand mentions and customer conversations on platforms like X (formerly Twitter) and Instagram to gauge sentiment and respond promptly.

- Customer Service Chatbots: Implementation of AI-powered chatbots on websites and apps for instant support and information dissemination.

- In-App Feedback Features: Direct channels within mobile applications for users to report issues or suggest improvements.

Ag Anadolu Grubu Holding Anonim Sirketi cultivates strong customer connections through a multi-faceted approach, emphasizing direct engagement and personalized service across its diverse business units. This strategy aims to foster loyalty and ensure satisfaction, a key driver for sustained growth.

In 2024, the group continued to enhance its digital interaction channels, including mobile applications and interactive websites, to streamline communication and offer tailored experiences. This digital focus is complemented by robust business-to-business relationship management, particularly in sectors like automotive and energy, where long-term agreements and specialized solutions are paramount.

The commitment to customer satisfaction is further reinforced by comprehensive after-sales support in the automotive sector and responsive retail assistance, all aimed at building enduring trust and positive brand perception.

| Business Segment | Customer Relationship Strategy | Key Initiatives (2024) | Customer Feedback Mechanism |

|---|---|---|---|

| Automotive | After-sales support, dealer network engagement | Enhanced service center efficiency, spare parts availability, dealer training programs | Online surveys, social media monitoring |

| Beverage | Brand loyalty, direct consumer engagement | Impactful marketing campaigns, interactive promotions | In-app feedback, social media monitoring |

| Retail | Customer satisfaction, responsive support | Well-trained staff, accessible communication channels | Online surveys, customer service chatbots |

| Energy & Real Estate | B2B relationships, long-term agreements | Specialized solutions, dedicated account management | Direct feedback through account managers |

Channels

Anadolu Grubu leverages its extensive retail network, prominently featuring Migros supermarkets, to distribute a wide array of products directly to consumers. This physical presence is complemented by a growing e-commerce operation, ensuring broad market penetration.

In 2024, Migros continued its expansion, operating over 2,800 stores across Turkey. This vast network allows Anadolu Grubu to effectively market and sell its diverse product portfolio, from food items to household goods, reaching millions of customers daily.

Anadolu Grubu leverages its dedicated direct sales and distribution forces for key segments like beverages and certain automotive products. This allows them to directly manage the customer experience and ensure product availability across a vast network of traditional markets, restaurants, and convenience stores.

In 2023, Anadolu Efes, a major beverage subsidiary, reported a significant portion of its sales volume being managed through these direct channels, underscoring their importance in reaching diverse consumer touchpoints. This direct approach is crucial for maintaining brand control and responsiveness in the fast-moving consumer goods sector.

Dealerships and showrooms are the lifeblood of Ag Anadolu Grubu Holding's automotive operations, acting as the primary touchpoints for customers. These physical locations are crucial for showcasing new models, facilitating test drives, and completing vehicle sales. In 2024, the automotive industry continued to see a strong reliance on these channels, with new vehicle sales in Turkey reaching approximately 1.2 million units, a significant portion of which were driven through dealership networks.

Beyond sales, these dealerships are vital for after-sales services, including maintenance, repairs, and parts distribution, ensuring customer satisfaction and recurring revenue. Ag Anadolu Grubu's extensive network allows for broad market reach, catering to diverse customer needs across various regions. The group's commitment to maintaining high standards in these customer-facing operations directly impacts brand perception and loyalty.

Digital Platforms and E-commerce

Ag Anadolu Grubu Holding Anonim Sirketi increasingly leverages digital platforms and e-commerce for direct sales, marketing, and customer engagement. This is particularly evident in their retail and automotive segments, where online channels offer a direct touchpoint with consumers.

In 2024, the global e-commerce market continued its robust growth, with projections indicating a significant increase in online transactions across various sectors. This trend empowers Anadolu Grubu to expand its reach and streamline customer interactions.

- Direct-to-Consumer Sales: Online platforms facilitate direct sales, bypassing traditional intermediaries and potentially increasing profit margins.

- Enhanced Customer Engagement: Digital channels allow for personalized marketing campaigns and direct customer feedback, fostering stronger relationships.

- Market Expansion: E-commerce enables Anadolu Grubu to reach a wider geographical customer base, both domestically and internationally.

- Data Analytics: Online interactions provide valuable data on customer behavior, informing product development and marketing strategies.

Strategic Partnerships and Wholesale

Anadolu Grubu strategically leverages its extensive network of partnerships to distribute its diverse product portfolio. This approach ensures broad market reach, extending far beyond the company's own retail footprint.

Through these alliances, Anadolu Grubu effectively utilizes various wholesale channels and collaborates with other businesses. This allows for efficient penetration into numerous markets, amplifying brand presence and sales volume. For instance, in 2024, the group's beverage segment, Anadolu Efes, continued to expand its distribution agreements, reaching an estimated 400 million consumers across its operating territories.

- Wholesale Reach: Distribution through third-party wholesale networks significantly increases product availability.

- Partnership Synergies: Collaborations with other businesses create new avenues for market access.

- Market Penetration: Strategic partnerships enable deeper and wider penetration into diverse consumer segments.

- Distribution Efficiency: Leveraging existing wholesale infrastructure reduces logistical complexities and costs.

Anadolu Grubu's channels are multifaceted, encompassing direct-to-consumer sales via its extensive Migros supermarket chain and growing e-commerce operations, ensuring broad market penetration. Complementing this, dedicated sales forces manage beverage and automotive product distribution, while dealerships serve as crucial hubs for automotive sales and after-sales services.

Strategic partnerships and wholesale networks further amplify the group's reach, allowing for efficient market penetration and increased sales volume, as seen with Anadolu Efes' expansive consumer reach. Digital platforms are increasingly vital for direct engagement and data analytics, reflecting the evolving retail landscape.

| Channel Type | Key Segments | 2024 Data/Notes |

|---|---|---|

| Retail Stores (Migros) | Food, Household Goods | Over 2,800 stores in Turkey |

| E-commerce | Various | Growing operations, global market expansion |

| Direct Sales Force | Beverages, Automotive | Significant sales volume for Anadolu Efes |

| Dealerships/Showrooms | Automotive | Primary sales and after-sales touchpoints; ~1.2 million new vehicle sales in Turkey |

| Partnerships/Wholesale | Beverages, Various | Anadolu Efes reaching ~400 million consumers |

Customer Segments

Anadolu Grubu's mass market consumers represent a vast demographic that relies on the company for everyday essentials. This includes purchasing popular soft drinks and a wide range of groceries from their extensive Migros supermarket chain. The affordability and widespread availability of these products are paramount for this significant customer base.

Ag Anadolu Grubu Holding Anonim Sirketi's automotive buyers segment is broad, covering individual consumers seeking passenger cars and commercial entities needing fleet vehicles, generators, or operational leasing. In 2024, the automotive market saw continued demand for personal mobility solutions, alongside a growing need for efficient commercial transport and power generation for businesses.

For individual buyers, the focus remains on personal transportation needs, ranging from compact cars for daily commutes to larger vehicles for families. Commercial buyers, however, prioritize operational efficiency and reliability, looking for solutions that support their business logistics and power requirements. For instance, the commercial vehicle sector in Turkey, a key market for Anadolu Grubu, showed resilience in 2024, driven by infrastructure projects and logistics demand.

Retail shoppers, primarily served by Migros, form a broad customer base with varied demands. They seek everything from essential groceries and fresh produce to everyday items like stationery and household goods.

This segment prioritizes convenience, a wide product selection, and attractive pricing. For instance, in 2023, Migros reported a turnover of 176.7 billion Turkish Lira, underscoring its significant reach within the retail market and its ability to cater to these diverse consumer needs.

Business-to-Business (B2B) Clients

Anadolu Grubu's B2B clients are diverse, encompassing businesses and organizations across various sectors that leverage the group's industrial, energy, and financial service offerings. These clients are essential for driving demand for Anadolu Grubu's core businesses, from manufacturing to energy provision.

For instance, companies seeking to expand their operational fleets or upgrade existing vehicle infrastructure are key customers for Anadolu Grubu's automotive segment. Similarly, businesses requiring reliable energy solutions, whether for manufacturing plants or commercial properties, engage with the group's energy division. Financial services clients, such as other corporations or financial institutions, utilize Anadolu Grubu's banking and insurance products to manage their capital and mitigate risks.

- Industrial Clients: Businesses requiring raw materials, manufactured components, or finished goods from Anadolu Grubu's production facilities.

- Energy Consumers: Corporations and public sector entities that purchase electricity, natural gas, or other energy-related services.

- Financial Services Users: Other businesses and institutions that utilize banking, insurance, or leasing services provided by Anadolu Grubu's financial arms.

- Logistics and Transportation Partners: Companies that procure vehicles or fleet management solutions for their operational needs.

International Consumers and Businesses

Anadolu Grubu's international reach extends significantly beyond Turkey, tapping into diverse consumer and business markets. This segment is particularly strong in Eastern Europe, Central Asia, and the Middle East, where the group offers a range of products, notably beverages and certain automotive components.

Successfully serving these international customers hinges on a deep understanding of local preferences and market conditions. For instance, beverage offerings often require tailoring to regional tastes, a strategy that has proven effective in expanding market share. In 2023, Anadolu Efes, a key beverage subsidiary, reported that international markets constituted a substantial portion of its sales volume, demonstrating the critical importance of this customer segment.

- Geographic Focus: Eastern Europe, Central Asia, and the Middle East represent key international markets.

- Product Offerings: Beverages are a primary focus, alongside automotive products.

- Strategic Imperative: Adapting to local tastes and market dynamics is crucial for success.

- Market Performance: International sales volume for beverage operations has shown robust growth, underscoring the segment's value.

Anadolu Grubu serves a broad spectrum of customers, from individual consumers seeking everyday goods and personal transportation to large corporations requiring industrial materials and energy solutions. The group's retail operations, particularly through Migros, cater to a mass market that values convenience and product variety, with Migros reporting a substantial turnover in 2023. In the automotive sector, both individual buyers looking for passenger cars and commercial entities needing fleet vehicles or generators are key segments, with demand for personal mobility and efficient commercial transport remaining strong in 2024. Furthermore, the group's international presence targets diverse markets, especially in Eastern Europe and Central Asia, with beverage offerings adapted to local tastes, contributing significantly to sales volume.

| Customer Segment | Key Needs | 2024/2023 Data Points |

|---|---|---|

| Mass Market Consumers (Retail) | Affordability, wide product selection, convenience | Migros turnover: 176.7 billion TRY (2023) |

| Automotive Buyers (Individual & Commercial) | Personal mobility, fleet efficiency, operational reliability | Continued demand for personal mobility; resilient commercial vehicle sector in Turkey (2024) |

| B2B Clients (Industrial, Energy, Financial) | Raw materials, energy supply, financial services, logistics solutions | Key demand drivers for core businesses across sectors |

| International Consumers & Businesses | Locally adapted products (e.g., beverages), automotive components | Significant sales volume from international markets for Anadolu Efes (2023) |

Cost Structure

Ag Anadolu Grubu Holding Anonim Sirketi's cost structure is heavily influenced by the procurement of essential raw materials for its diverse operations. For its beverage segment, this includes significant outlays for items like barley, sugar, and various fruit concentrates, crucial for product quality and volume. In the automotive sector, the acquisition of components and parts represents another major cost driver.

Beyond raw materials, production expenses form a substantial part of the company's cost base. These encompass the energy required to power its manufacturing facilities and the labor costs associated with its factory workforce. For instance, in 2023, Anadolu Efes, a key beverage subsidiary, reported significant operational expenses related to production, reflecting the energy-intensive nature of brewing and bottling processes.

Ag Anadolu Grubu Holding Anonim Sirketi's cost structure is significantly influenced by its substantial personnel and labor expenses. These costs are a direct reflection of its extensive workforce spread across manufacturing, retail, and administrative functions.

In 2024, a company of Anadolu Grubu's scale, operating in diverse sectors such as automotive, retail, and energy, would likely see employee salaries, comprehensive benefits packages, and associated payroll taxes forming a substantial portion of its operational expenditure. For instance, if we consider a benchmark, the average manufacturing wage in Turkey in early 2024 was around 20,000 TRY per month, with additional costs for benefits and social security contributions adding another 30-40%.

Ag Anadolu Grubu Holding Anonim Sirketi allocates significant resources to marketing, sales, and distribution. In 2024, these expenses are projected to be substantial, driven by extensive campaigns across various media to promote its diverse product and service portfolio.

The cost of maintaining a robust sales force and executing targeted sales promotions is a key component of this expenditure. These efforts are crucial for driving demand and securing market share across the group's various business segments.

Furthermore, the operational costs of its vast distribution network, encompassing logistics, transportation, and warehousing, represent a considerable investment. Ensuring efficient product delivery to a wide customer base across different regions contributes significantly to the overall marketing, sales, and distribution expenses.

Capital Expenditures and Depreciation

Ag Anadolu Grubu Holding Anonim Sirketi's cost structure is significantly influenced by capital expenditures. Investments in new production facilities and upgrades to existing infrastructure are crucial for maintaining operational efficiency and expanding capacity. For instance, in 2024, the company continued its strategic investments in modernizing its manufacturing plants, which directly impacts its depreciation charges.

The acquisition and maintenance of vehicle fleets, essential for logistics and distribution across its diverse business segments, also represent a substantial capital outlay. These expenditures, coupled with the ongoing costs associated with keeping these assets in optimal condition, contribute to the overall depreciation expenses recognized by the company. This depreciation is a non-cash expense that reflects the wear and tear of these valuable assets over their useful lives.

- Capital Expenditures: Significant investments were made in 2024 for new production lines and technological upgrades.

- Infrastructure Upgrades: Continued investment in modernizing existing facilities to enhance efficiency.

- Vehicle Fleets: Ongoing capital allocation for the acquisition and maintenance of transportation assets.

- Depreciation Costs: These capital investments lead to substantial depreciation charges, impacting the company's profitability statement.

Administrative and Overhead Costs

Ag Anadolu Grubu Holding Anonim Sirketi's administrative and overhead costs encompass general administrative expenses, research and development (R&D), IT infrastructure, and corporate overhead, all vital for supporting its varied business segments.

For 2024, these costs are projected to be a significant component of the holding company's operational expenditure, ensuring efficient management and innovation across its diverse portfolio.

- General Administrative Expenses: Covering salaries for administrative staff, office rent, utilities, and legal services, these form the backbone of day-to-day operations.

- Research and Development: Investments in R&D are crucial for maintaining competitiveness and fostering innovation across Anadolu Grubu's industrial and service sectors.

- IT Infrastructure: Costs associated with maintaining and upgrading the company's technological backbone, including software, hardware, and cybersecurity, are essential for seamless operations.

- Corporate Overhead: This includes costs related to executive management, corporate governance, and strategic planning, ensuring the overall direction and stability of the holding company.

The cost structure of Ag Anadolu Grubu Holding Anonim Sirketi is multifaceted, driven by raw material procurement, production, personnel, marketing, capital expenditures, and administrative overhead. In 2024, the company's diverse operations, spanning beverages, automotive, and retail, necessitate significant outlays in each of these areas to maintain market presence and drive growth.

| Cost Category | Key Components | 2024 Estimated Impact |

| Raw Materials | Barley, sugar, fruit concentrates (beverages); automotive parts | Significant procurement costs, subject to commodity price fluctuations. |

| Production Expenses | Energy, labor, manufacturing overhead | High energy consumption in brewing; labor costs benchmarked against Turkish manufacturing wages (approx. 20,000 TRY/month base + 30-40% benefits in early 2024). |

| Personnel & Labor | Salaries, benefits, payroll taxes | Substantial portion of operational expenditure due to extensive workforce. |

| Marketing, Sales & Distribution | Advertising, sales force, logistics, warehousing | Projected substantial expenses for brand promotion and efficient product delivery. |

| Capital Expenditures | Plant upgrades, new facilities, vehicle fleets | Continued investment in modernization; leads to depreciation charges. |

| Administrative & Overhead | R&D, IT, corporate management | Essential for innovation and efficient management across diverse business units. |

Revenue Streams

Ag Anadolu Grubu Holding's beverage segment, primarily driven by Anadolu Efes and Coca-Cola İçecek, generates substantial revenue through the sale of beer and soft drinks. These sales span both domestic Turkish markets and a significant international presence. In 2023, Coca-Cola İçecek reported net sales of TRY 129.5 billion, highlighting the scale of its operations.

Revenue streams extend across various distribution channels, including sales to a broad network of retailers, wholesalers, and direct-to-consumer channels. This multi-faceted approach ensures wide market penetration and captures diverse customer segments, contributing to the overall financial performance of the holding.

Ag Anadolu Grubu Holding Anonim Sirketi generates significant income from the sale of passenger and commercial vehicles, along with essential spare parts and generators. This core automotive sales segment forms a substantial portion of their revenue.

Beyond outright sales, the company diversifies its automotive revenue through vehicle leasing services, offering flexible mobility solutions to a broad customer base. Complementing this, robust after-sales maintenance and repair services contribute steadily to their financial performance.

Ag Anadolu Grubu Holding Anonim Sirketi's retail sales, primarily through its prominent Migros brand, represent a core revenue stream. These sales encompass a broad spectrum of groceries, everyday consumer goods, and various other retail products. The company effectively leverages both its extensive network of physical stores and its growing online platforms to reach a wide customer base.

In 2023, Migros, a key subsidiary, reported a consolidated net sales figure of 177.2 billion Turkish Lira, underscoring the substantial contribution of its retail operations to the group's overall revenue. This performance highlights the strength of its diversified product offerings and its ability to adapt to evolving consumer purchasing habits, including a significant push in e-commerce channels.

Agricultural Product Sales

Ag Anadolu Grubu Holding Anonim Sirketi generates revenue through the sale of agricultural products. This primarily includes fruit juice concentrates and purees, which are supplied to industrial clients or used internally for their own beverage manufacturing operations.

In 2024, the agricultural sector continued to be a significant contributor to the company's top line. For instance, their juice concentrate sales saw a steady demand, reflecting the ongoing need for these ingredients in the food and beverage industry.

- Fruit Juice Concentrates: Key revenue driver, sold to industrial food and beverage manufacturers.

- Fruit Purees: Another significant product, utilized as ingredients in various food applications.

- Internal Consumption: Products also feed into the company's own beverage production, indirectly contributing to revenue.

Energy and Industrial Project Income

Ag Anadolu Grubu Holding Anonim Sirketi's Energy and Industrial Project Income stream encompasses revenue generated from its energy production facilities and wholesale energy sales. This segment also captures earnings from a variety of other industrial ventures and ongoing projects undertaken by the broader conglomerate. For instance, in 2024, the group's energy operations contributed significantly to its overall financial performance, reflecting investments in renewable and conventional power generation.

This diversified income source is crucial for the holding company's stability and growth. It allows for cross-subsidization between different business units and leverages the group's extensive industrial expertise. The company's focus on expanding its energy portfolio, including solar and wind projects, is expected to bolster this revenue stream further in the coming years.

- Energy Generation and Wholesale: Revenue from electricity produced and sold to the grid or other off-takers.

- Diversified Industrial Activities: Income derived from manufacturing, construction, or other industrial operations within the group.

- Project-Based Revenue: Earnings from the execution and completion of specific industrial or energy-related projects.

Ag Anadolu Grubu Holding Anonim Sirketi's revenue streams are diverse, spanning beverages, automotive, retail, agriculture, and energy.

The beverage segment, led by Anadolu Efes and Coca-Cola İçecek, generated substantial revenue in 2023, with Coca-Cola İçecek reporting TRY 129.5 billion in net sales.

The automotive division and the retail operations, particularly through Migros which posted 177.2 billion Turkish Lira in consolidated net sales for 2023, represent significant income sources.

| Segment | Key Products/Services | 2023 Revenue Highlight (where available) |

|---|---|---|

| Beverages | Beer, Soft Drinks | Coca-Cola İçecek: TRY 129.5 billion (Net Sales) |

| Automotive | Vehicles, Spare Parts, Leasing, Maintenance | N/A |

| Retail | Groceries, Consumer Goods | Migros: TRY 177.2 billion (Consolidated Net Sales) |

| Agriculture | Fruit Juice Concentrates, Purees | N/A |

| Energy & Industrial Projects | Wholesale Energy Sales, Industrial Ventures | N/A |

Business Model Canvas Data Sources

The Ag Anadolu Grubu Holding Anonim Sirketi Business Model Canvas is built upon a foundation of extensive market research, internal financial disclosures, and strategic operational analyses. These data sources ensure each component of the canvas accurately reflects the company's current market position and future strategic direction.