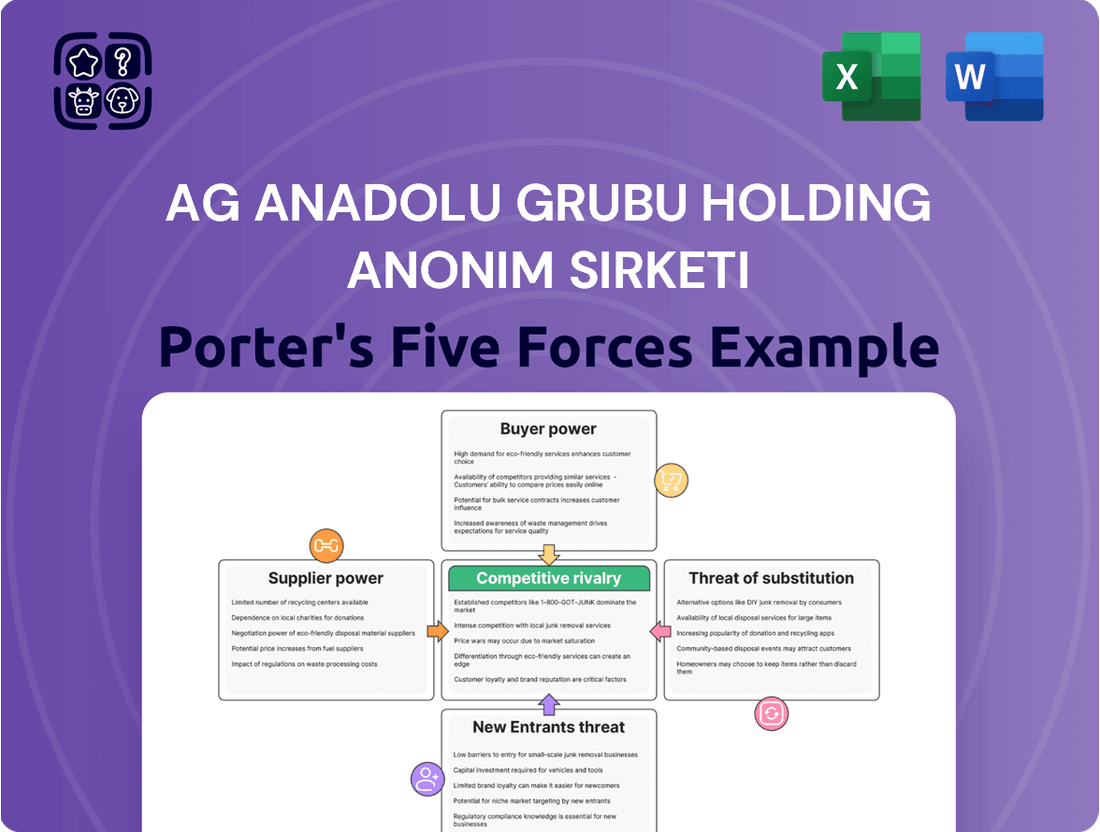

Ag Anadolu Grubu Holding Anonim Sirketi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ag Anadolu Grubu Holding Anonim Sirketi Bundle

Ag Anadolu Grubu Holding Anonim Sirketi navigates a competitive landscape shaped by moderate buyer power and the potential for new entrants to disrupt its market share. While supplier power appears manageable, the threat of substitutes could pose a significant challenge to its established position.

The complete report reveals the real forces shaping Ag Anadolu Grubu Holding Anonim Sirketi’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Anadolu Grubu Holding's diverse operations, particularly in beverages and automotive, make it susceptible to raw material cost volatility. For instance, the company's reliance on inputs such as sugar for its beverage segment and various metals and plastics for its automotive sector means that price swings in these commodities directly impact its bottom line.

The first quarter of 2025 earnings report highlighted this sensitivity, noting a negative impact on profitability stemming from rising raw material costs. This indicates that suppliers of these essential inputs possess significant leverage, able to command higher prices and thereby reduce Anadolu Grubu's profit margins.

For Anadolu Grubu Holding, the bargaining power of suppliers is significantly influenced by the concentration of specialized suppliers in certain key sectors. In areas like automotive components or specialized food ingredients, a limited pool of qualified suppliers can emerge. This scarcity naturally grants these suppliers greater leverage, allowing them to influence pricing, delivery terms, and even product specifications. For instance, reports from 2024 have continued to highlight the delicate balance within Türkiye's automotive supply chains, underscoring how critical these specialized relationships are for manufacturers.

Global geopolitical tensions and domestic macroeconomic difficulties, such as inflation and currency fluctuations, can significantly amplify the bargaining power of suppliers. These volatile conditions often translate into heightened input costs and potential supply chain disruptions for companies like Anadolu Grubu Holding. For instance, in early 2024, Turkey experienced persistent inflation, with the annual rate hovering around 60%, directly impacting the cost of raw materials and components sourced from suppliers.

Supplier Switching Costs

Supplier switching costs can significantly impact Anadolu Grubu Holding's bargaining power. For critical components or raw materials, the expense of retooling machinery, implementing new quality assurance protocols, and renegotiating contracts can be substantial. These high switching costs can limit Anadolu Grubu's ability to seek more favorable terms from alternative suppliers, thereby strengthening the leverage of existing ones.

This dynamic is especially pronounced in industries where Anadolu Grubu operates, such as automotive manufacturing, which often relies on highly specialized and integrated supply chains. For instance, a shift in a key automotive component supplier might necessitate extensive testing and validation, adding considerable time and expense. In 2024, the automotive sector globally continued to grapple with supply chain disruptions, making supplier relationships and the associated switching costs even more critical considerations for major players like Anadolu Grubu.

- High switching costs can lock Anadolu Grubu into existing supplier relationships.

- Retooling, quality assurance, and contract renegotiation are key cost components.

- The automotive sector exemplifies industries where these costs are particularly high.

Brand-Specific Ingredient Dependencies

Anadolu Grubu Holding's position as a major Coca-Cola bottler highlights a significant brand-specific ingredient dependency. The company relies heavily on proprietary concentrates and ingredients exclusively provided by The Coca-Cola Company. This exclusive supply chain grants The Coca-Cola Company considerable leverage as a supplier, effectively limiting Anadolu Grubu Holding's ability to negotiate terms for these essential inputs.

This supplier power is amplified by the unique nature of the beverage industry, where brand identity and taste are intrinsically linked to specific formulations. The Coca-Cola Company's control over these core components means Anadolu Grubu Holding has limited alternatives for its primary product line, strengthening the supplier's bargaining position.

- Exclusive Supply: Anadolu Grubu Holding's dependence on Coca-Cola's proprietary concentrates.

- Limited Negotiation Scope: The inability to easily substitute core ingredients restricts bargaining power.

- Brand Identity Link: The direct connection between ingredients and brand recognition reinforces supplier control.

The bargaining power of suppliers for Anadolu Grubu Holding is substantial, particularly due to the concentration of specialized suppliers in key sectors like automotive and the exclusive nature of certain ingredient dependencies, such as those with The Coca-Cola Company. High switching costs associated with specialized components further solidify supplier leverage, limiting Anadolu Grubu's ability to negotiate favorable terms.

For instance, in the automotive sector, reliance on specific component manufacturers can lead to significant costs if switching occurs, involving retooling and validation processes. Similarly, the beverage segment's dependence on proprietary Coca-Cola ingredients restricts negotiation scope. Global economic factors, including inflation observed at around 60% in Turkey during early 2024, amplify these supplier pressures by increasing input costs and creating potential supply chain vulnerabilities.

| Factor | Impact on Anadolu Grubu | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited pool of specialized automotive component suppliers. |

| Switching Costs | Reduces ability to change suppliers | Retooling and validation in automotive sector are costly. |

| Exclusive Supply Agreements | Limits negotiation power | Dependence on Coca-Cola proprietary concentrates for beverage production. |

| Macroeconomic Conditions | Amplifies supplier power | Turkish inflation around 60% in early 2024 raised input costs. |

What is included in the product

This analysis dissects the competitive forces impacting Ag Anadolu Grubu Holding Anonim Sirketi, focusing on industry rivalry, buyer and supplier power, new entrant threats, and the influence of substitutes.

Ag Anadolu Grubu Holding Anonim Sirketi's Porter's Five Forces analysis provides a pain point reliever by offering a clear, one-sheet summary of all five forces, enabling quick strategic decision-making and a deep understanding of competitive pressures.

Customers Bargaining Power

Turkish consumers, grappling with significant inflationary pressures and a noticeable dip in their purchasing power, are demonstrating heightened price sensitivity. This trend directly impacts Anadolu Grubu Holding's retail and beverage operations, necessitating a strong emphasis on cost control and maintaining competitive pricing to retain its customer base.

For instance, in 2024, Turkey's annual inflation rate remained elevated, impacting household budgets and making consumers more discerning about their spending. This economic climate forces companies like Anadolu Grubu Holding to prioritize value propositions and explore efficient operational strategies to remain attractive in the market.

Anadolu Grubu Holding's diverse customer base, spanning individual consumers in sectors like beverages and retail to large corporate clients in automotive and energy, presents a nuanced picture of customer bargaining power. While individual consumers typically exert minimal influence, the group's significant presence in B2B markets means larger customers, such as major automotive dealerships or industrial energy consumers, can leverage their substantial purchase volumes to negotiate more favorable pricing and terms.

The proliferation of e-commerce and digital platforms has dramatically streamlined the process for customers to compare prices and product features. For a company like Anadolu Grubu, especially in sectors like retail or automotive where direct comparisons are feasible, this means customers have unprecedented access to information. This transparency directly fuels their bargaining power, as they can readily identify the best value propositions.

In 2024, online shopping continued its upward trajectory, with global e-commerce sales projected to reach trillions of dollars. This digital marketplace inherently fosters price transparency. For Anadolu Grubu, this translates to a heightened need to ensure competitive pricing and a compelling value proposition to retain customers who can effortlessly switch to a competitor offering a better deal.

Preference for Local Brands and Health Trends

The beverage market is seeing a significant rise in consumer preference for local brands, coupled with a strong trend towards healthier choices such as bottled water and natural juices. This shift in consumer tastes directly impacts Anadolu Grubu Holding's bargaining power with its customers.

As consumers increasingly favor local producers and healthier alternatives, they gain more leverage. If Anadolu Grubu Holding's product portfolio doesn't align with these evolving demands, customers can easily switch to competitors offering products that better meet their preferences.

- Growing demand for bottled water: The global bottled water market was valued at approximately $319.7 billion in 2023 and is projected to grow.

- Natural juices gaining traction: Consumer interest in natural and functional beverages is a key driver in the juice market.

- Local brand loyalty: Studies in various regions show increasing consumer support for local businesses and products.

Strong Competition Offering Customer Alternatives

The bargaining power of customers is significantly influenced by the availability of alternatives, a key factor for Anadolu Grubu Holding. Across many of its operational sectors, intense competition ensures customers have a wide array of choices, diminishing their individual leverage.

In the automotive sector, for example, the Turkish market in 2024 offers consumers a vast selection of domestic and international brands. This includes established players and a rapidly expanding segment of electric vehicles, providing ample substitution opportunities. This competitive landscape directly impacts pricing power and customer loyalty for Anadolu Grubu's automotive businesses.

- Customer Choice: In 2023, the Turkish automotive market saw sales of over 1 million vehicles, with a significant portion coming from diverse international manufacturers, highlighting customer alternatives.

- EV Growth: The electric vehicle market in Turkey is projected to grow substantially by 2025, further diversifying customer options and potentially increasing their bargaining power.

- Sector Diversification: Anadolu Grubu's presence in sectors like beverages and retail also faces similar customer choice dynamics, where numerous brands and retailers compete for consumer spending.

Turkish consumers, facing persistent inflation in 2024, are increasingly price-sensitive, directly impacting Anadolu Grubu Holding's retail and beverage segments. This heightened sensitivity means customers can more readily switch to competitors offering better value, thereby increasing their bargaining power.

The digital marketplace, fueled by a global e-commerce surge in 2024, provides customers with unprecedented price transparency, empowering them to compare offerings easily. For Anadolu Grubu, this necessitates competitive pricing and a strong value proposition to retain market share.

Anadolu Grubu's diverse operations mean customer bargaining power varies; while individual consumers have limited sway, large B2B clients in sectors like automotive and energy can leverage significant purchase volumes for better terms.

The availability of numerous alternatives across Anadolu Grubu's business lines, such as the competitive Turkish automotive market in 2024 with its diverse brands and growing EV segment, further amplifies customer bargaining power by providing ample substitution options.

| Factor | Impact on Anadolu Grubu | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Increased customer leverage due to inflation | Elevated inflation rates in Turkey impacting consumer spending |

| Digital Transparency | Easier customer comparison of prices and products | Continued growth in e-commerce penetration |

| B2B Client Power | Larger clients can negotiate better terms | Significant B2B customer base in automotive and energy |

| Availability of Alternatives | Customers can switch to competitors | Diverse automotive market with many brands and EV options |

Preview Before You Purchase

Ag Anadolu Grubu Holding Anonim Sirketi Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Ag Anadolu Grubu Holding Anonim Sirketi, detailing competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This analysis provides critical insights into the strategic landscape and competitive dynamics impacting the holding company.

Rivalry Among Competitors

Anadolu Grubu Holding navigates a landscape of fierce competition across its core sectors. In the automotive industry, it contends with global giants and established local players in Turkey, where market share is hard-won. Similarly, its beverage operations, a significant contributor to its revenue, face intense rivalry from both multinational corporations and domestic brands, particularly in the highly saturated soft drink and alcoholic beverage segments.

The retail sector, another key area for Anadolu Grubu, is characterized by a fragmented market with numerous small and large format retailers. This means Anadolu Grubu's retail arms are constantly battling for consumer attention and loyalty against a wide array of competitors, from hypermarkets to specialized stores. For instance, in 2023, the Turkish retail sector saw continued growth, but also increased price sensitivity among consumers, intensifying the pressure on margins for all participants.

The Turkish retail market is intensely competitive, featuring a wide array of formats from traditional supermarkets to niche specialty stores, alongside a booming e-commerce sector. This diverse and fragmented environment presents significant challenges for Anadolu Grubu Holding's retail operations, primarily Migros, as it vies for consumer attention and market share against a multitude of local and global competitors.

In 2024, the Turkish retail sector continued to see robust growth, with online sales contributing significantly. For instance, e-commerce penetration in Turkey reached approximately 15% of total retail sales by the end of 2023, a figure projected to climb further. This dynamic landscape means Migros must constantly innovate and adapt to stay ahead of numerous players, ranging from large international chains to agile local businesses and burgeoning online platforms.

The Turkish automotive market is experiencing intense competition, with both established global brands and newer entrants vying for market share. This rivalry is particularly pronounced in the rapidly growing electric vehicle (EV) segment, where innovation and pricing strategies are key differentiators.

New players, such as the Chinese EV manufacturer BYD, have entered the Turkish market, directly challenging existing manufacturers with competitive pricing and a diverse range of electric models. This influx of new competition is forcing all players to re-evaluate their product portfolios and pricing structures to remain attractive to consumers.

Beverage Market Dominated by Strong Local and International Brands

In the beverage market, Anadolu Grubu Holding's subsidiaries, Coca-Cola İçecek and Anadolu Efes, face intense rivalry. They compete not only with global giants like PepsiCo but also with a robust array of local brands. This dynamic environment necessitates constant innovation in product offerings and aggressive marketing campaigns to capture consumer attention.

The competition translates into significant pressure on pricing strategies. For instance, in 2024, the global soft drinks market, valued at over $1.5 trillion, saw intense promotional activities from major players. Anadolu Efes, a key player in the beer and beverage sector, reported a revenue of approximately €3.3 billion in 2023, underscoring the scale of operations and the financial stakes involved in this competitive landscape.

- Intense Competition: Coca-Cola İçecek and Anadolu Efes battle global brands like PepsiCo and numerous strong local competitors in both soft drinks and alcoholic beverages.

- Innovation and Marketing: The rivalry drives continuous investment in new product development and extensive marketing efforts to maintain market share.

- Price Sensitivity: Consumers benefit from competitive pricing, as companies actively engage in price wars to attract and retain customers.

- Market Share Battles: Companies like Anadolu Efes, which generated around €3.3 billion in revenue in 2023, are constantly striving to expand their market presence amidst this fierce competition.

Impact of Economic Conditions on Competitive Strategies

Ongoing macroeconomic challenges, particularly high inflation and unpredictable consumer spending power, are compelling competitors to engage in aggressive pricing and promotional tactics. This dynamic intensifies rivalry, pushing down profit margins for all participants in the market.

For instance, in 2024, many consumer goods sectors experienced significant price increases due to elevated input costs. Companies responded by offering discounts and bundle deals, a trend that Anadolu Grubu Holding, with its diverse portfolio, would also need to navigate to maintain market share.

- Inflationary Pressures: Global inflation rates remained a significant concern through early 2024, impacting raw material costs and operational expenses for businesses across various industries.

- Consumer Spending Volatility: Fluctuations in consumer confidence and disposable income directly affect demand, forcing companies to be agile in their pricing and marketing efforts.

- Margin Squeeze: The combination of rising costs and competitive pricing pressure can lead to a notable compression of profit margins, demanding greater operational efficiency.

- Increased Promotional Activity: To stimulate demand and retain customers, competitors are likely to increase the frequency and depth of sales promotions and discounts.

Anadolu Grubu Holding operates in highly competitive markets, particularly in automotive and beverages, facing both global powerhouses and strong local players. The retail sector, anchored by Migros, is a fragmented battleground with numerous competitors, including a rapidly growing e-commerce segment. For instance, in 2024, e-commerce in Turkey was projected to continue its upward trajectory, intensifying rivalry.

New entrants, such as Chinese EV manufacturers, are further disrupting the automotive landscape by introducing competitive pricing and innovative electric models. This necessitates constant adaptation in product offerings and pricing strategies across the industry. The beverage sector, represented by Coca-Cola İçecek and Anadolu Efes, also sees intense competition, driving significant investment in marketing and product innovation to capture market share amid price-sensitive consumers.

The intense competitive rivalry across Anadolu Grubu's sectors, amplified by macroeconomic factors like inflation, forces companies to engage in aggressive pricing and promotional activities. This dynamic environment, where companies like Anadolu Efes generated approximately €3.3 billion in revenue in 2023, demands continuous innovation and operational efficiency to maintain profitability and market presence.

| Sector | Key Competitors | Competitive Dynamics | 2023 Revenue Example (Anadolu Grubu Subsidiary) |

|---|---|---|---|

| Automotive | Global Brands, Local Manufacturers, New EV Entrants (e.g., BYD) | Price wars, innovation in EVs, market share battles | N/A |

| Beverages (Soft Drinks & Alcoholic) | PepsiCo, Local Brands | Aggressive marketing, product innovation, price promotions | Anadolu Efes: ~€3.3 billion |

| Retail | Hypermarkets, Specialty Stores, E-commerce Platforms | Fragmented market, price sensitivity, online sales growth | Migros (part of Anadolu Grubu) |

SSubstitutes Threaten

While owning a personal vehicle is still a primary mode of transport, a growing array of substitutes challenges traditional car sales for Ag Anadolu Grubu Holding Anonim Sirketi. Public transportation networks, including buses and trains, offer cost-effective alternatives, especially in urban areas. For instance, by the end of 2023, global urban public transport ridership continued its recovery, with many cities reporting figures approaching pre-pandemic levels, indicating a sustained demand for these services.

Ride-sharing platforms like Uber and Lyft, alongside car-sharing services, provide flexible and often more economical options for occasional travel, reducing the necessity for outright vehicle ownership. The burgeoning popularity of these services is evident in their market growth; the global ride-sharing market was valued at over $100 billion in 2023 and is projected to expand further. This shift directly impacts the demand for new vehicle purchases.

Furthermore, the accelerating adoption of electric vehicles (EVs) represents a significant substitution trend within the automotive sector itself. Consumers are increasingly opting for EVs over internal combustion engine (ICE) vehicles, driven by environmental concerns and evolving government incentives. In 2024, EV sales are expected to reach new highs, with projections suggesting they could account for over 20% of global car sales, directly cannibalizing demand for traditional gasoline and diesel models.

Consumers have a vast array of substitutes for packaged soft drinks and alcoholic beverages. These include readily available tap water, homemade beverages, and popular options like tea and coffee, alongside other non-alcoholic choices.

The increasing consumer emphasis on health and wellness significantly boosts demand for healthier alternatives. This trend directly impacts traditional soft drinks, as consumers increasingly opt for bottled water and natural juices, acting as potent substitutes.

For Anadolu Grubu Holding's retail segments, the rise of e-commerce and direct-to-consumer (D2C) channels presents a potent threat of substitutes. These digital avenues allow consumers to bypass traditional physical retail locations, offering convenience and often a wider selection of goods. This shift in consumer behavior is a significant factor, as demonstrated by the continued growth in online retail sales globally.

Shift Towards Energy Efficiency and Renewables

The growing global emphasis on energy efficiency and the rapid expansion of renewable energy sources present a significant threat of substitution for traditional fossil fuel-based energy products. This shift directly challenges the long-term viability of investments in conventional energy infrastructure, potentially impacting Anadolu Grubu Holding's energy portfolio.

By 2024, the International Energy Agency reported that renewable energy sources accounted for approximately 30% of global electricity generation. This increasing market share demonstrates a clear substitution trend away from fossil fuels.

- Renewable Energy Growth: Global renewable energy capacity is projected to increase substantially, with solar and wind power leading the expansion.

- Energy Efficiency Gains: Advancements in technology are driving greater energy efficiency across industries, reducing overall demand for traditional energy sources.

- Policy Support: Government incentives and international climate agreements continue to favor the adoption of cleaner energy alternatives.

- Cost Competitiveness: The declining costs of renewable energy technologies are making them increasingly competitive with, and in many cases cheaper than, fossil fuels.

Consumer Lifestyle Changes and Frugality

Broader shifts in consumer lifestyles, such as a growing preference for experiences over material possessions, can significantly impact demand for Anadolu Grubu Holding's diverse product offerings. For instance, a trend towards minimalist living or a focus on sustainable consumption might lead consumers to seek out fewer, more durable goods or to explore rental or sharing economy alternatives. This directly pressures companies offering tangible products, pushing them to innovate or adapt their value propositions.

Economic downturns and a general increase in consumer frugality further amplify the threat of substitutes. When household budgets tighten, consumers are more likely to explore cost-effective alternatives to traditional purchases. This could mean choosing private-label brands over premium offerings, opting for DIY solutions instead of professional services, or simply delaying non-essential purchases altogether. For a conglomerate like Anadolu Grubu, which operates across various sectors including automotive, energy, and finance, this necessitates a keen understanding of how economic sentiment influences purchasing decisions across its entire portfolio.

- Shifting Consumer Priorities: A notable trend observed in 2024 is the increasing allocation of disposable income towards experiences, such as travel and entertainment, potentially at the expense of discretionary goods previously offered by companies like Anadolu Grubu.

- Rise of the Sharing Economy: Platforms facilitating the sharing of assets, from vehicles to tools, offer viable substitutes for outright ownership, impacting sectors where Anadolu Grubu has a presence. For example, car-sharing services provide an alternative to purchasing a vehicle.

- Frugality as a Default: Persistent inflation and economic uncertainty in 2024 have fostered a more frugal consumer mindset. This encourages seeking out lower-cost alternatives, including second-hand goods or more basic product versions, across many categories.

- DIY and Repair Culture: A resurgence in the do-it-yourself ethos, partly driven by cost-saving and sustainability concerns, presents a substitute for services and manufactured goods. Consumers may opt to repair existing items or create their own solutions rather than purchasing new.

The threat of substitutes for Anadolu Grubu Holding's diverse portfolio is significant and multifaceted. In the automotive sector, alternatives like public transport and ride-sharing services continue to gain traction, impacting new vehicle sales. For example, global urban public transport ridership in 2023 neared pre-pandemic levels, highlighting sustained demand for these substitutes.

Within the beverage segment, water, tea, and coffee are readily available and often healthier substitutes for traditional soft drinks and alcoholic beverages. The growing health consciousness among consumers further bolsters the demand for these alternatives, directly affecting sales of packaged drinks.

The energy sector faces substantial substitution from renewable sources. By 2024, renewables are projected to constitute around 30% of global electricity generation, a clear indicator of the shift away from fossil fuels, impacting Anadolu Grubu's energy interests.

| Substitute Category | Key Examples | Impact on Anadolu Grubu | Relevant 2023-2024 Data Point |

| Transportation | Public Transport, Ride-Sharing, Car-Sharing | Reduced demand for new vehicle purchases | Global ride-sharing market valued over $100 billion in 2023 |

| Beverages | Water, Tea, Coffee, Homemade Drinks | Lower sales for packaged soft drinks and alcoholic beverages | Increasing consumer preference for healthier options |

| Energy | Renewable Energy Sources (Solar, Wind) | Threat to fossil fuel-based energy investments | Renewables to account for ~30% of global electricity generation by 2024 |

Entrants Threaten

Anadolu Grubu Holding's core operations, particularly in automotive manufacturing and large-scale beverage production, necessitate substantial initial investments. For instance, establishing a modern automotive assembly plant can easily cost hundreds of millions of dollars, encompassing advanced machinery, robotics, and extensive supply chain infrastructure. Similarly, beverage bottling operations require significant capital for high-speed filling lines, sophisticated logistics, and widespread distribution networks.

These considerable capital requirements serve as a formidable barrier to entry for prospective competitors. New companies would need to secure vast amounts of funding to even begin competing on a comparable scale, making it difficult to challenge established players like Anadolu Grubu. In 2024, the global automotive industry alone saw new plant investments often exceeding $1 billion, highlighting the scale of capital needed.

Ag Anadolu Grubu Holding Anonim Sirketi enjoys a significant advantage due to its deeply entrenched brand loyalty and robust distribution channels. These are particularly strengthened by its long-standing collaborations with globally recognized entities such as Coca-Cola. For any newcomer, replicating this level of brand recognition and establishing a comparable distribution infrastructure presents a substantial hurdle, effectively deterring potential entrants.

Operating in sectors like alcoholic beverages or energy for Anadolu Grubu Holding Anonim Sirketi means confronting substantial regulatory hurdles. These include obtaining specific licenses and adhering to strict compliance standards, which act as significant deterrents for potential new entrants seeking to enter these markets.

Economies of Scale and Cost Advantages

Anadolu Grubu Holding's extensive operational footprint across diverse industries, including automotive, energy, and finance, grants it significant economies of scale. This scale translates into substantial cost advantages in raw material procurement, manufacturing processes, and distribution networks, making it challenging for new companies to compete on price. For instance, in 2023, the group's consolidated revenue reached approximately TRY 150 billion, reflecting its vast operational capacity.

New entrants face a formidable barrier due to these entrenched cost efficiencies. To achieve similar cost structures, they would require massive upfront investment to match Anadolu Grubu's production volume and market penetration.

- Economies of Scale: Anadolu Grubu's large-scale operations reduce per-unit costs.

- Cost Advantages: Lower input costs and efficient processes create a competitive edge.

- Barriers to Entry: New entrants must overcome significant capital requirements to match scale.

- Price Competition: Existing cost efficiencies make it difficult for newcomers to compete on price.

Emergence of Niche Players and Digital Disruptors

While significant capital investment may deter broad new entrants into established sectors like automotive or cement for Anadolu Grubu, the threat of niche players and digital disruptors remains a pertinent concern, especially within its retail and beverage operations. E-commerce startups, for instance, can enter the retail market with lower overheads by focusing on specific product categories or customer segments, bypassing the need for extensive physical infrastructure. This was evident in 2024 with the continued growth of online marketplaces specializing in artisanal food products and niche apparel, challenging traditional retail models.

Specialized beverage segments also present opportunities for agile new entrants. The rise of craft breweries and unique mineral water brands, often starting with smaller production facilities and direct-to-consumer sales models, demonstrates how lower entry barriers can allow for targeted market penetration. These smaller players can innovate rapidly and build a loyal customer base by offering differentiated products, a trend observed globally and impacting the broader beverage market in 2024.

- Niche E-commerce Growth: Online retail sales in Turkey grew by an estimated 15% in 2024, with a significant portion attributed to specialized platforms.

- Craft Beverage Expansion: The craft beer market, though smaller, saw a 10% year-over-year increase in new brand introductions in 2024.

- Digital-First Strategies: New entrants often leverage digital marketing and social media to reach consumers directly, reducing traditional advertising costs.

- Lower Capital Requirements: Entry into niche markets often requires less upfront capital compared to established, large-scale industrial operations.

Anadolu Grubu's significant capital requirements in sectors like automotive and beverage manufacturing create a high barrier for new entrants. For instance, establishing a modern automotive plant in 2024 often costs over $1 billion, a substantial sum that deters many potential competitors. This financial hurdle, coupled with established economies of scale where Anadolu Grubu benefits from lower per-unit costs, makes it difficult for newcomers to compete effectively on price.

While large-scale operations present a formidable entry barrier, the threat from niche players and digital disruptors remains a concern, particularly in retail and beverages. Online startups can enter with lower overheads, focusing on specific product categories. For example, specialized e-commerce platforms saw significant growth in 2024, with online retail sales in Turkey increasing by an estimated 15%.

The threat of new entrants for Anadolu Grubu is generally moderate to low in its core, capital-intensive industries due to high entry barriers. However, in sectors like beverages, the rise of agile craft producers with direct-to-consumer models presents a more dynamic challenge, as evidenced by a 10% year-over-year increase in new craft beer brands introduced in 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ag Anadolu Grubu Holding Anonim Sirketi is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also incorporate industry-specific market research reports and news articles from reputable business publications to capture current competitive dynamics.