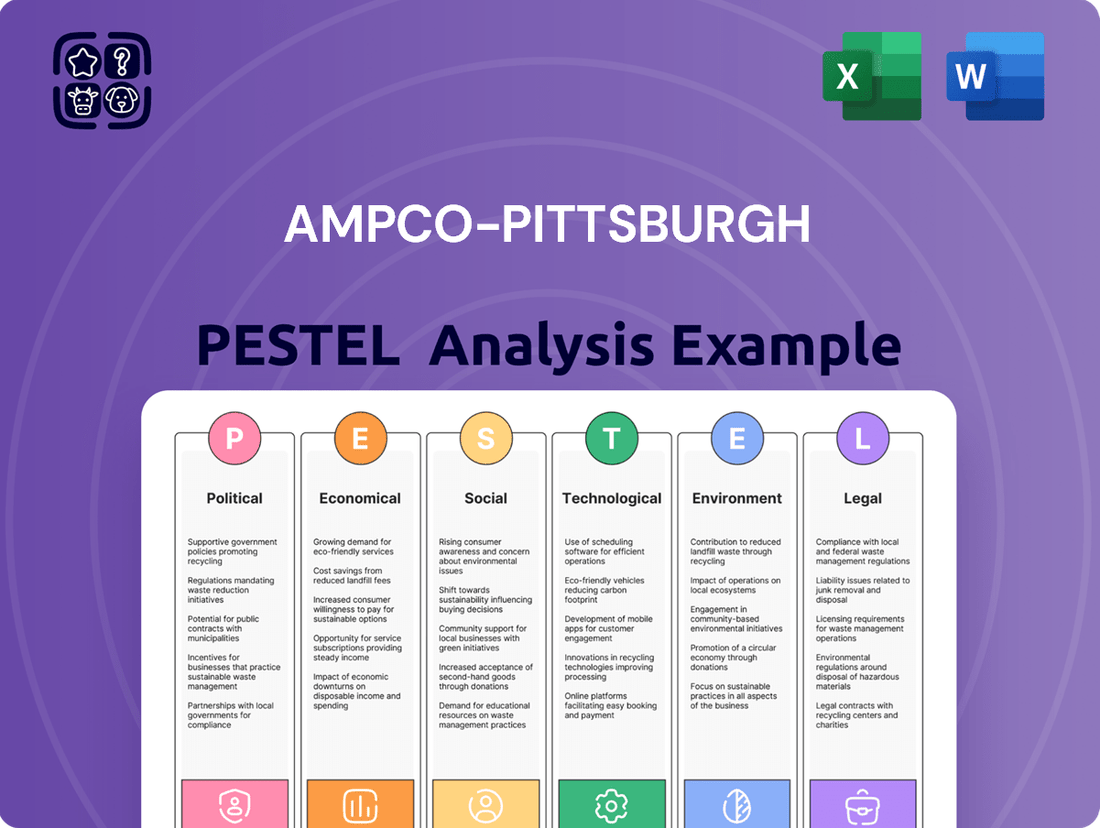

Ampco-Pittsburgh PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampco-Pittsburgh Bundle

Unlock the critical external factors shaping Ampco-Pittsburgh's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain the strategic foresight needed to navigate this complex landscape and make informed decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Ampco-Pittsburgh's global operations are significantly influenced by governmental trade policies and tariffs. For instance, the US imposition of tariffs on steel imports in recent years, while potentially benefiting domestic producers, can increase raw material costs for manufacturers like Ampco-Pittsburgh, impacting their cost of goods sold. This dynamic creates a complex environment where the company must navigate fluctuating material expenses and potential trade barriers.

Ampco-Pittsburgh's Forged and Cast Engineered Products segment is directly influenced by government defense spending. For fiscal year 2025, the US Department of Defense requested approximately $886 billion, reflecting a significant commitment to military readiness and modernization.

This substantial allocation signals robust demand for specialized metal products and open-die forgings, which are critical components in various defense applications.

The ongoing rise in global geopolitical tensions further bolsters military expenditure worldwide, creating a sustained positive environment for companies like Ampco-Pittsburgh operating within this sector.

Governmental industrial policies, such as incentives for clean technology and reshoring, are increasingly shaping the manufacturing landscape. For Ampco-Pittsburgh, these policies can directly impact operational costs and investment decisions. For instance, the Inflation Reduction Act of 2022, with its clean energy manufacturing credits, could present opportunities for companies investing in greener production methods.

While there's a general trend towards deregulation, specific support for domestic production remains a key factor. Policies encouraging local manufacturing and investment in the US, like those potentially emerging from ongoing reviews of existing legislation, could offer Ampco-Pittsburgh a competitive edge by reducing reliance on foreign supply chains.

Geopolitical Stability and Global Supply Chains

Geopolitical tensions, especially in Europe and Asia, pose significant risks to Ampco-Pittsburgh's operations and demand. The company has explicitly cited depressed European demand, impacting its Swedish and UK facilities, as a key challenge. This instability directly affects global supply chains, which are crucial for sourcing raw materials and delivering finished goods.

Ongoing global instability and evolving energy policies, driven by international events, create market volatility for the sectors Ampco-Pittsburgh serves. These include metals, defense, and oil & gas. For instance, the ongoing conflict in Eastern Europe has led to significant fluctuations in energy prices and supply, directly impacting industrial customers in these sectors.

- Disrupted Supply Chains: Geopolitical events can interrupt the flow of critical raw materials and finished products for Ampco-Pittsburgh.

- Impacted Demand: Tensions in regions with Ampco-Pittsburgh's operations or customer base can lead to reduced demand for its specialized metal products.

- Energy Policy Shifts: Changes in global energy policies, often a response to international crises, affect the cost structure and market dynamics for Ampco-Pittsburgh's key industries.

- Operational Challenges: The company has already reported operational headwinds, such as the impact of depressed European demand on its European assets.

Regulatory Environment and Compliance Burden

The regulatory landscape for manufacturers like Ampco-Pittsburgh remains a significant consideration. Changes in environmental standards, particularly those related to emissions and waste management, can directly impact operational costs and require capital investment for compliance. For instance, evolving emissions regulations in key markets could necessitate upgrades to manufacturing processes.

While there's a general trend towards streamlining some business regulations, Ampco-Pittsburgh must still actively manage existing and emerging compliance requirements. This includes navigating varying reporting mandates and adhering to industry-specific standards across its international facilities, which can add complexity and administrative overhead.

Key areas of regulatory focus for the industrial manufacturing sector in 2024-2025 include:

- Environmental Protection Agency (EPA) regulations: Ongoing scrutiny of industrial emissions and wastewater discharge.

- Occupational Safety and Health Administration (OSHA) standards: Ensuring worker safety in heavy industrial environments.

- International trade and tariff policies: Navigating import/export regulations and potential trade barriers.

- Product safety and material compliance: Adherence to standards like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in relevant markets.

Governmental trade policies, such as tariffs on steel, directly influence Ampco-Pittsburgh's raw material costs, with recent US tariffs impacting the cost of goods sold. Increased defense spending, projected at $886 billion for the US Department of Defense in fiscal year 2025, presents opportunities for Ampco-Pittsburgh's specialized metal products used in military applications. Furthermore, evolving industrial policies, like those promoting clean technology, can affect operational costs and investment strategies for the company.

| Factor | Impact on Ampco-Pittsburgh | 2024-2025 Data/Trend |

|---|---|---|

| Trade Policies & Tariffs | Increases raw material costs (e.g., steel) | US tariffs on steel imports continue to be a factor. |

| Defense Spending | Drives demand for specialized metal products | US DoD budget request of ~$886 billion for FY2025 indicates strong demand. |

| Industrial Policies | Influences operational costs & investment (e.g., clean tech incentives) | Inflation Reduction Act (IRA) offers credits for greener manufacturing. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Ampco-Pittsburgh's operations and strategic decisions across political, economic, social, technological, environmental, and legal dimensions.

Provides a concise, PESTLE-segmented overview of Ampco-Pittsburgh's operating environment, simplifying complex external factors for strategic decision-making.

Economic factors

Ampco-Pittsburgh's Forged and Cast Engineered Products segment is closely tied to the global steel and aluminum markets. While steel demand is projected for modest growth in 2025, revised downward forecasts for global crude steel production suggest potential headwinds.

Excess capacity and slower demand growth in key regions like China and OECD countries could dampen the need for Ampco-Pittsburgh's specialized rolls and forgings. For instance, the World Steel Association projected global steel demand to increase by 1.7% in 2024, a slight improvement but still reflecting underlying economic caution.

Ampco-Pittsburgh's significant exposure to the oil and gas sector means that shifts within this industry directly impact its financial results. The global oil and gas market is anticipated to see continued expansion, with forecasts pointing to a positive outlook for both oil and international gas prices through 2025.

An uptick in capital expenditure within the oil and gas industry, especially for upstream operations and the development of unconventional reserves, is likely to boost demand for Ampco-Pittsburgh's specialized engineered products.

Global defense spending remains robust, projected to reach $2.4 trillion in 2024 according to some estimates, fueled by ongoing geopolitical instability and a widespread push for military modernization. This sustained high level of expenditure creates a favorable economic climate for Ampco-Pittsburgh, as defense contractors seek advanced materials for new platforms and upgrades.

The United States defense sector, a key market for Ampco-Pittsburgh, is anticipated to see significant growth, with the FY2025 defense budget request highlighting substantial investments in areas like advanced manufacturing, hypersonic weapons, and next-generation aircraft. This focus on technological advancement directly translates into increased demand for specialized metal products that meet stringent military specifications.

Inflationary Pressures and Cost Management

Manufacturers, including Ampco-Pittsburgh, are still grappling with elevated operating expenses. These include increased employee compensation, with average hourly earnings for production and non-supervisory employees in the manufacturing sector rising approximately 4.5% year-over-year through early 2025, and volatile raw material costs.

Although the overall inflation rate has moderated from its peaks, these persistent cost pressures directly affect profitability. For instance, while specific figures for Ampco-Pittsburgh's Q1 2025 haven't been released, broader industrial commodity price indices have shown a general upward trend for key inputs like specialty alloys.

- Rising labor costs: Continued increases in wages and benefits put upward pressure on operational expenses.

- Volatile raw material prices: Fluctuations in the cost of essential materials impact the cost of goods sold.

- Impact on profitability: Persistent inflation can erode profit margins if not effectively managed through pricing or efficiency gains.

- Importance of cost management: Strategic cost control and operational improvements are vital to maintain financial health.

Interest Rates and Investment Environment

Interest rates significantly shape Ampco-Pittsburgh's operating landscape. In 2024, higher interest rates presented a headwind, making it more expensive for the company to finance new equipment and strategic growth initiatives, potentially dampening near-term expansion.

Looking ahead to 2025, a projected easing of interest rates could prove beneficial. Lower borrowing costs would likely stimulate demand within the manufacturing sector, a key market for Ampco-Pittsburgh's products, and encourage greater capital investment across the industry.

- 2024 Interest Rate Environment: The Federal Reserve maintained a hawkish stance for much of 2024, with the federal funds rate holding steady in the 5.25%-5.50% range, increasing borrowing costs for businesses.

- 2025 Outlook: Market consensus and Federal Reserve projections for 2025 suggest a potential pivot towards rate cuts as inflation moderates, which could lower the cost of capital.

- Impact on Investment: Lower interest rates generally encourage capital expenditures by reducing the hurdle rate for new projects and making financing more accessible for companies like Ampco-Pittsburgh.

The economic outlook for Ampco-Pittsburgh is influenced by global steel demand, which saw a projected 1.7% increase in 2024, though revised forecasts suggest potential headwinds due to excess capacity in key regions.

Conversely, the oil and gas sector is expected to expand through 2025, with rising capital expenditures likely to boost demand for Ampco-Pittsburgh's specialized products, especially for upstream operations.

Global defense spending is projected to reach $2.4 trillion in 2024, with the US defense budget emphasizing advanced manufacturing, directly benefiting suppliers of specialized metal products.

Manufacturers, including Ampco-Pittsburgh, continue to face elevated operating costs, with average hourly earnings in the manufacturing sector rising approximately 4.5% year-over-year through early 2025, impacting profit margins.

Higher interest rates in 2024 increased borrowing costs, but a projected easing in 2025 could stimulate manufacturing investment and benefit companies like Ampco-Pittsburgh.

| Economic Factor | 2024 Projection/Status | 2025 Outlook | Impact on Ampco-Pittsburgh |

|---|---|---|---|

| Global Steel Demand | Modest growth (1.7% projected for 2024) | Potential headwinds from excess capacity | Mixed; dependent on specialized product demand within steel sector |

| Oil & Gas Sector | Continued expansion | Positive outlook for prices and capital expenditure | Favorable; increased demand for engineered products |

| Defense Spending | Robust ($2.4 trillion projected for 2024) | Sustained high levels | Favorable; increased demand for advanced materials |

| Inflation/Operating Costs | Elevated (labor costs up ~4.5% YoY early 2025) | Moderating but persistent cost pressures | Negative; erodes profit margins if not managed |

| Interest Rates | Higher (Fed Funds rate 5.25%-5.50%) | Projected easing/potential cuts | Negative in 2024, potentially positive in 2025 through lower borrowing costs |

Same Document Delivered

Ampco-Pittsburgh PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Ampco-Pittsburgh provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

The manufacturing sector, particularly heavy industry, continues to grapple with attracting and keeping skilled workers. This persistent issue is exacerbated by a significant skills gap, especially in areas like automation and advanced manufacturing techniques. For a company like Ampco-Pittsburgh, this translates to potential hurdles in securing the qualified personnel needed for its specialized production, even with competitive compensation packages.

The United States is experiencing a significant demographic shift with an aging population, leading to a noticeable decline in labor participation rates as more experienced workers opt for retirement. This trend directly impacts industries like manufacturing, where Ampco-Pittsburgh operates, potentially widening existing skills gaps.

In 2024, the U.S. Bureau of Labor Statistics reported that the labor force participation rate for those aged 55 and over was around 21.7%, a figure that has been steadily increasing over the years due to longer life expectancies and improved health. This means companies like Ampco-Pittsburgh face the challenge of retaining valuable institutional knowledge and specialized skills as a substantial portion of their experienced workforce exits.

Consequently, Ampco-Pittsburgh must proactively implement robust succession planning and knowledge transfer programs. This involves identifying critical roles, mentoring younger employees, and creating systems to document and share the expertise of retiring workers to mitigate the loss of operational efficiency and technical know-how.

Employee safety and health are paramount in heavy manufacturing, a sector where Ampco-Pittsburgh operates. Recent trends show a heightened focus on workplace safety, with companies investing in advanced technologies and refining operational procedures to minimize risks. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a slight decrease in workplace injuries in manufacturing, highlighting the ongoing efforts in the industry.

Ampco-Pittsburgh's commitment to robust safety measures is crucial for protecting its workforce and ensuring smooth operations. Adhering to and exceeding evolving safety standards, such as those mandated by OSHA, not only prevents accidents but also contributes to higher employee morale and productivity. The company's proactive approach to health and safety directly impacts its ability to attract and retain skilled labor in a competitive market.

Diversity and Inclusion Initiatives

The manufacturing sector, including light industrial areas where Ampco-Pittsburgh operates, is experiencing a significant push towards diversity and inclusion. This isn't just about social responsibility; companies are increasingly seeing tangible benefits. For instance, a 2023 McKinsey report highlighted that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. Similarly, for ethnic and cultural diversity, top-quartile companies were 36% more likely to outperform on profitability.

Ampco-Pittsburgh, to stay competitive in securing top talent, will likely need to integrate robust diversity and inclusion strategies into its core hiring and employee retention frameworks. This means actively seeking out candidates from varied backgrounds and ensuring an inclusive environment where all employees feel valued and can contribute fully. For example, many leading industrial firms in 2024 are implementing mentorship programs specifically designed to support underrepresented groups in advancing their careers within the company.

- Growing Emphasis: The manufacturing industry is increasingly prioritizing diversity and inclusion.

- Innovation Driver: Diverse workforces are linked to enhanced innovation and problem-solving capabilities.

- Talent Attraction: Companies with strong D&I initiatives often attract a wider and more skilled talent pool.

- Competitive Edge: Integrating D&I strategies is becoming crucial for labor market competitiveness.

Employee Training and Upskilling Needs

The increasing sophistication of manufacturing technology, including automation and advanced machinery, directly impacts the workforce. This trend creates a heightened demand for specialized employee training and upskilling programs. For Ampco-Pittsburgh, this means investing in continuous education to ensure employees can effectively operate and maintain new, tech-driven equipment, a crucial step for sustained productivity and market relevance.

In 2024, the manufacturing sector globally saw a significant push towards Industry 4.0 technologies. For instance, a report by Deloitte indicated that over 70% of manufacturers were investing in automation and digital transformation, underscoring the need for a skilled workforce. Ampco-Pittsburgh's commitment to integrating advanced systems, such as robotic welding or AI-powered quality control, necessitates proactive training strategies. This investment in human capital is not merely an operational expense but a strategic imperative for maintaining a competitive edge in a rapidly evolving industrial landscape.

- Technological Advancements: The integration of AI, robotics, and IoT in manufacturing environments requires employees to develop new digital skills.

- Upskilling Gap: A growing disparity exists between the skills required by advanced manufacturing and the current capabilities of the existing workforce.

- Productivity Impact: Companies investing in employee training often report higher productivity, reduced errors, and improved employee retention.

- Competitiveness: A well-trained workforce is essential for companies like Ampco-Pittsburgh to adapt to new technologies and maintain their competitive position.

The manufacturing sector faces a persistent challenge in attracting and retaining skilled labor, a situation compounded by a widening skills gap in areas like automation. For Ampco-Pittsburgh, this translates to potential difficulties in staffing specialized production roles, even with competitive pay. Furthermore, the aging U.S. population, with a labor force participation rate for those 55 and over around 21.7% in 2024, means companies must actively manage knowledge transfer from retiring experienced workers to maintain operational efficiency.

There's a growing emphasis on diversity and inclusion within manufacturing, with companies like Ampco-Pittsburgh needing to integrate these strategies to attract a broader talent pool. A 2023 McKinsey report indicated that companies with strong gender diversity on executive teams were 25% more likely to be more profitable. Similarly, the increasing integration of Industry 4.0 technologies globally means a significant demand for upskilling, with over 70% of manufacturers investing in automation and digital transformation in 2024, according to Deloitte.

Technological factors

The manufacturing sector is rapidly evolving with increased adoption of automation, AI, and digital tools. Ampco-Pittsburgh can harness these advancements for predictive maintenance, creating more responsive production lines, and boosting overall output. For instance, companies in similar industrial sectors saw an average increase in productivity of 5-15% after implementing advanced automation solutions in 2023.

Integrating AI and automation offers a strategic advantage by mitigating the impact of labor shortages, a challenge reported by many manufacturing firms. By optimizing workflows and enabling more efficient operations, Ampco-Pittsburgh can enhance its competitive edge. In 2024, the global industrial automation market is projected to reach over $300 billion, underscoring the significant investment and growth in this area.

Predictive maintenance, leveraging real-time data analytics, is a critical trend for manufacturing operations heading into 2025. Ampco-Pittsburgh can harness this by anticipating equipment failures before they occur, thereby minimizing costly downtime and optimizing resource allocation.

This proactive approach, shifting from fixed maintenance schedules to a data-informed strategy, promises substantial gains in operational efficiency. For instance, in 2024, many industrial sectors reported a 10-15% reduction in unplanned downtime through the adoption of predictive maintenance technologies.

Technologies like digital twins are revolutionizing manufacturing by allowing for remote monitoring and operation of equipment. For Ampco-Pittsburgh, this translates to the capability of creating virtual replicas of its manufacturing processes, offering real-time insights. This enhanced visibility can significantly improve decision-making and streamline operations.

The adoption of digital twins and real-time monitoring systems is becoming increasingly critical for operational efficiency. Companies are investing heavily in these technologies to gain a competitive edge. For instance, the global digital twin market was projected to reach $15.1 billion in 2024 and is expected to grow substantially in the coming years, underscoring its importance for industrial players like Ampco-Pittsburgh.

Material Science Advancements and Product Innovation

Material science breakthroughs directly influence Ampco-Pittsburgh's engineered products, affecting their performance and the industries they serve. For instance, advancements in corrosion-resistant alloys could enhance the durability of equipment used in harsh oil and gas environments.

Continuous innovation in materials, alongside component design, is crucial. Ampco-Pittsburgh's focus on energy efficiency, for example, can drive the development of new products that offer better performance and reduced operating costs for clients in demanding sectors like defense and metals processing.

- Material Properties: New alloys can offer higher strength-to-weight ratios, improving efficiency in applications like aerospace components.

- Energy Efficiency Focus: Innovations in thermal management materials can reduce energy consumption in industrial furnaces and processing equipment.

- Product Differentiation: Superior material performance allows Ampco-Pittsburgh to offer differentiated products that meet evolving customer needs for durability and sustainability.

Cybersecurity in Industrial Systems

As industrial automation and the Internet of Things (IoT) become more integrated into Ampco-Pittsburgh's manufacturing processes, cybersecurity is paramount. The increasing reliance on connected systems exposes operational technology (OT) networks to a growing array of cyber threats, making robust defense strategies non-negotiable.

Ampco-Pittsburgh must invest in and implement advanced security measures to safeguard its sensitive data and critical infrastructure. This includes adopting modern security frameworks to protect against potential disruptions and data breaches.

Key to maintaining operational integrity will be the adoption of tools such as zero-trust architecture, which assumes no user or device can be trusted by default, and AI-driven threat detection systems. These technologies are vital for identifying and neutralizing evolving cyber risks in real-time. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment and focus in this area.

- Growing Threat Landscape: Industrial control systems (ICS) are increasingly targeted by sophisticated cyberattacks, aiming to disrupt operations or steal proprietary information.

- Impact of Breaches: A successful cyberattack could lead to significant financial losses, reputational damage, and prolonged operational downtime for Ampco-Pittsburgh.

- Investment in Defense: Companies like Ampco-Pittsburgh are expected to allocate substantial resources to cybersecurity, with global spending on OT security alone predicted to exceed $40 billion by 2025.

- Proactive Strategies: Implementing proactive measures like regular vulnerability assessments and employee training is crucial to building a resilient cybersecurity posture.

Technological advancements in automation and AI are reshaping manufacturing, offering Ampco-Pittsburgh opportunities for enhanced productivity and predictive maintenance. The global industrial automation market's projected growth to over $300 billion in 2024 underscores this trend, with companies seeing significant productivity gains. Embracing these technologies is crucial for Ampco-Pittsburgh to remain competitive and mitigate operational risks like labor shortages.

The integration of digital twins and real-time monitoring systems is becoming essential for operational efficiency in the industrial sector. The digital twin market's projected $15.1 billion valuation in 2024 highlights substantial investment in these capabilities. For Ampco-Pittsburgh, these tools provide crucial real-time insights for improved decision-making and streamlined operations.

Material science breakthroughs are directly impacting Ampco-Pittsburgh's product performance and market competitiveness. Innovations in alloys and thermal management materials, for instance, can lead to improved efficiency and reduced operating costs for clients. This focus on material innovation is key to product differentiation and meeting evolving customer demands for durability and sustainability.

Cybersecurity is a critical technological factor for Ampco-Pittsburgh, especially with increased integration of automation and IoT. The global cybersecurity market's projected size of over $300 billion in 2024 indicates the scale of investment needed. Proactive measures, including zero-trust architecture and AI-driven threat detection, are vital for protecting operational technology networks against sophisticated cyber threats, with OT security spending expected to exceed $40 billion by 2025.

Legal factors

Ampco-Pittsburgh navigates a landscape of increasingly stringent environmental regulations, impacting its operations in areas like carbon emissions and hazardous materials management. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, requiring manufacturers to rigorously assess and manage the risks associated with chemical substances, a direct compliance concern for Ampco-Pittsburgh's material processing activities.

The global push towards decarbonization, exemplified by various national net-zero targets, necessitates continuous adaptation. Companies like Ampco-Pittsburgh must monitor and potentially invest in cleaner production technologies to meet evolving standards for air quality and to reduce their carbon footprint, with the potential for increased operational costs or capital expenditures to ensure compliance.

Ampco-Pittsburgh's global manufacturing footprint, spanning the US, UK, Sweden, Slovenia, and a joint venture in China, places it directly under the purview of numerous international trade laws and agreements. These regulations govern everything from import/export duties to product standards, directly influencing the cost and feasibility of its cross-border operations.

Potential shifts in trade policies, such as the imposition of new tariffs or the escalation of trade disputes, could significantly disrupt Ampco-Pittsburgh's supply chain and limit its access to key markets. For instance, the ongoing geopolitical tensions and trade policy shifts observed in 2024 between major economic blocs continue to create an environment of uncertainty for global manufacturers.

Ampco-Pittsburgh's manufacturing of engineered products for demanding sectors like defense and oil & gas means they operate under rigorous product liability and safety standards. Failure to meet these benchmarks, which are constantly evolving, could result in significant legal battles, costly product recalls, and severe damage to their established reputation.

For instance, in the aerospace and defense sector, compliance with standards like AS9100 is critical. While specific recent legal challenges for Ampco-Pittsburgh aren't publicly detailed, the industry average for product liability claims can run into millions of dollars, highlighting the financial stakes. Therefore, unwavering adherence to national and international safety regulations, including those from bodies like the Occupational Safety and Health Administration (OSHA) and relevant international standards organizations, is not just a best practice but a fundamental business necessity for Ampco-Pittsburgh.

Labor Laws and Employment Regulations

Ampco-Pittsburgh must navigate a complex web of labor laws and employment regulations across its global operations. These regulations cover crucial areas such as minimum wage requirements, workplace safety standards, employee benefits, and the right to unionize. For instance, in the United States, the Fair Labor Standards Act (FLSA) dictates overtime pay and minimum wage, while in Europe, directives from the European Union set standards for working hours and employee consultation.

Staying compliant with these evolving legal frameworks is paramount. Any shifts in legislation, such as increased minimum wage mandates or stricter rules on contract workers, can directly affect Ampco-Pittsburgh's operational expenses and its approach to managing its workforce. For example, a significant increase in the national minimum wage could necessitate adjustments to payroll, impacting profitability.

- Wage and Hour Laws: Compliance with federal, state, and local minimum wage and overtime regulations is essential.

- Workplace Safety: Adherence to Occupational Safety and Health Administration (OSHA) standards in the US and equivalent bodies internationally is critical.

- Employee Rights: Upholding rights related to discrimination, harassment, and fair treatment in hiring and termination processes.

- Collective Bargaining: Engaging with labor unions where applicable, respecting agreements and negotiation processes.

Corporate Governance and Reporting Requirements

As Ampco-Pittsburgh Corporation (NYSE: AP) is a publicly traded entity, it must adhere to rigorous corporate governance and financial reporting mandates, including those set forth by the Securities and Exchange Commission (SEC). The company's recent financial disclosures, such as its first-quarter 2024 earnings report which detailed net sales of $177.6 million, highlight its ongoing commitment to these regulatory obligations. This compliance is crucial for fostering transparency and sustaining the trust of its investors.

Key aspects of Ampco-Pittsburgh's legal compliance include:

- SEC Filings: Regular submission of 10-K (annual) and 10-Q (quarterly) reports detailing financial performance and operational status.

- Sarbanes-Oxley Act (SOX): Implementation of internal controls and procedures to ensure the accuracy and reliability of financial reporting.

- Stock Exchange Listing Standards: Meeting the governance and disclosure requirements of the New York Stock Exchange (NYSE) to maintain its listing.

- Shareholder Communication: Providing timely and accurate information to shareholders through press releases, investor calls, and annual meetings.

Ampco-Pittsburgh operates under a strict legal framework governing its global operations, impacting everything from environmental compliance to labor relations. Adherence to evolving regulations like the EU's REACH, alongside national safety standards such as OSHA, is critical to avoid penalties and maintain operational integrity. Furthermore, the company must navigate international trade laws and product liability standards, particularly in sensitive sectors like defense and oil & gas, where non-compliance can lead to significant financial and reputational damage.

Environmental factors

Manufacturers like Ampco-Pittsburgh are under significant pressure to curb their carbon emissions. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, imposes costs on carbon-intensive imports, directly impacting industries such as steel.

Meeting evolving global decarbonization targets necessitates substantial investment in cleaner production technologies and energy efficiency. This could involve adopting advanced smelting techniques or sourcing renewable energy, potentially increasing operational costs but also fostering long-term sustainability and market competitiveness.

Ampco-Pittsburgh's manufacturing processes for iron and steel rolls, forgings, and heat transfer products are inherently resource-intensive, requiring significant raw material inputs. For instance, steel production, a core component, is known for its high energy and material demands. The company must therefore prioritize sustainable sourcing of these materials to mitigate environmental impact and ensure long-term supply chain stability.

Efficient waste management is crucial, as is the adoption of circular economy principles. This involves focusing on material recovery and recycling throughout the production lifecycle. Globally, the push for a circular economy is gaining momentum, with many jurisdictions implementing stricter regulations on waste disposal and encouraging closed-loop systems, which will likely shape Ampco-Pittsburgh's operational strategies moving forward.

Ampco-Pittsburgh, as a heavy manufacturer, faces significant scrutiny regarding its water usage and potential for pollution. Regulations like the Clean Water Act dictate strict limits on water discharge, requiring substantial investment in pollution control technologies. For example, in 2023, the U.S. Environmental Protection Agency continued to refine effluent limitation guidelines for various industrial sectors, which could necessitate upgrades to Ampco-Pittsburgh's wastewater treatment processes to meet evolving standards.

Energy Efficiency and Renewable Energy Adoption

Manufacturing is increasingly prioritizing energy efficiency, with smarter product and component design at its core. This trend presents Ampco-Pittsburgh with opportunities to integrate renewable energy sources into its operations, potentially lowering costs and environmental footprint. For instance, the industrial sector's growing energy needs underscore the importance of clean power solutions.

The global push for sustainability is driving significant investment in energy efficiency technologies. In 2024, the International Energy Agency reported that energy efficiency improvements saved the equivalent of over 2 billion tonnes of oil consumption globally. For companies like Ampco-Pittsburgh, adopting such practices can lead to substantial operational savings and a stronger market position.

Renewable energy adoption is also accelerating. By 2025, it's projected that renewable energy will account for a significant portion of new power capacity additions worldwide. Ampco-Pittsburgh could explore solar or wind power installations at its manufacturing sites, leveraging government incentives and the declining costs of these technologies to reduce reliance on fossil fuels and stabilize energy expenditures.

Key considerations for Ampco-Pittsburgh include:

- Exploring energy-efficient machinery upgrades: Investing in modern equipment can yield immediate reductions in energy consumption.

- Assessing on-site renewable energy generation potential: Evaluating the feasibility of solar panels or other renewable sources for facility power.

- Investigating power purchase agreements (PPAs) for renewables: Securing long-term contracts for clean energy can provide cost predictability.

- Analyzing the lifecycle costs of energy-intensive processes: Identifying areas where efficiency gains offer the greatest financial and environmental benefits.

Supply Chain Sustainability and Transparency

There's a significant and increasing focus on making supply chains more transparent and sustainable. This means companies are expected to openly share details about their emissions, not just within their own operations but across their entire value chains. For Ampco-Pittsburgh, this translates into a growing need to provide customers and regulatory bodies with clear information about the environmental footprint of its products and manufacturing processes. This trend is pushing companies to prioritize sustainable sourcing and implement environmentally sound practices at every stage of their supply chain.

For instance, the global push for Net Zero emissions by 2050 means industries are scrutinizing their indirect emissions, often referred to as Scope 3. In 2024, many companies are actively developing strategies to measure and report these emissions, with a growing number of investors demanding this data. Ampco-Pittsburgh, like its peers, will likely face increased pressure to demonstrate its commitment to reducing its environmental impact throughout its entire network of suppliers and partners.

- Growing Demand for Scope 3 Emissions Reporting: By 2025, it's anticipated that over 70% of large companies will be reporting Scope 3 emissions, up from around 50% in 2023.

- Customer Expectations for Sustainability: A recent survey indicated that over 60% of B2B buyers consider a supplier's sustainability practices when making purchasing decisions.

- Regulatory Scrutiny on Supply Chains: Emerging regulations in 2024 and 2025 are increasingly targeting supply chain environmental performance, requiring greater transparency and accountability.

- Investment in Sustainable Sourcing: Companies are allocating more capital towards identifying and partnering with suppliers who demonstrate strong environmental credentials.

Environmental regulations are increasingly shaping manufacturing operations, pushing companies like Ampco-Pittsburgh towards decarbonization and sustainable practices. The European Union's Carbon Border Adjustment Mechanism (CBAM), in effect since October 2023, directly impacts carbon-intensive imports, influencing industries such as steel production.

Meeting global decarbonization goals requires significant investment in cleaner technologies and energy efficiency, potentially increasing operational costs but enhancing long-term competitiveness. Ampco-Pittsburgh's resource-intensive processes, particularly in steel, necessitate prioritizing sustainable material sourcing to ensure supply chain stability and mitigate environmental impact.

The company must also focus on efficient waste management and circular economy principles, aligning with global trends and stricter regulations on waste disposal. Water usage and pollution control are critical, with regulations like the Clean Water Act demanding investments in advanced wastewater treatment technologies to meet evolving standards, as seen with the U.S. EPA's continued refinement of effluent guidelines.

Energy efficiency is a growing priority, with smart product design and the integration of renewable energy sources offering cost savings and reduced environmental footprints. By 2025, renewable energy is projected to constitute a substantial portion of new global power capacity, presenting opportunities for companies like Ampco-Pittsburgh to explore solar or wind power, potentially leveraging government incentives and declining technology costs.

| Environmental Factor | Impact on Ampco-Pittsburgh | Key Data/Trend (2023-2025) |

| Carbon Emissions & Decarbonization | Pressure to reduce emissions, potential costs from carbon pricing mechanisms. | EU CBAM implemented Oct 2023. Global push for Net Zero by 2050. |

| Energy Efficiency & Renewables | Opportunity for cost savings and reduced environmental footprint. | IEA: Efficiency saved 2B+ tonnes oil globally in 2024. Renewables to be significant new power capacity by 2025. |

| Resource Intensity & Circular Economy | Need for sustainable sourcing and efficient waste management. | Steel production is material-intensive. Growing global adoption of circular economy principles. |

| Water Usage & Pollution | Compliance with strict discharge limits and investment in pollution control. | U.S. EPA refining effluent guidelines for industrial sectors in 2023. |

| Supply Chain Transparency | Demand for reporting Scope 3 emissions and sustainable supplier practices. | Projected 70%+ of large companies reporting Scope 3 by 2025. 60%+ B2B buyers consider supplier sustainability. |

PESTLE Analysis Data Sources

Our Ampco-Pittsburgh PESTLE analysis is grounded in a comprehensive review of public financial reports, industry-specific market research, and governmental regulatory updates. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.