Ampco-Pittsburgh Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ampco-Pittsburgh Bundle

Ampco-Pittsburgh faces moderate threats from new entrants and substitutes, with buyer power being a significant factor in its specialized metal industry. Understanding these dynamics is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Ampco-Pittsburgh’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ampco-Pittsburgh's reliance on a limited number of suppliers for critical raw materials like iron, steel, and specialty metals for its Forged and Cast Engineered Products (FCEP) segment, and various components for its Air and Liquid Processing (ALP) segment, grants these suppliers considerable bargaining power. This concentration means fewer alternatives for Ampco-Pittsburgh, potentially leading to less favorable pricing and less stable supply chains.

The market dynamics for these materials directly impact Ampco-Pittsburgh. For instance, the stainless steel market showed weakness in early 2024, with projections for recovery only anticipated by the second quarter of 2025. Such market conditions can directly translate into increased material costs for Ampco-Pittsburgh, further amplifying supplier leverage.

The uniqueness of inputs significantly impacts supplier bargaining power. For Ampco-Pittsburgh, which deals with highly engineered products like custom-designed rolls and open-die forgings, the quality and precise specifications of raw materials or specialized components are paramount. If only a limited number of suppliers can meet these exacting requirements, their leverage over Ampco-Pittsburgh naturally grows.

The bargaining power of suppliers for Ampco-Pittsburgh is significantly influenced by switching costs. For a company like Ampco-Pittsburgh, which relies on specialized materials for its forged and rolled products, the process of qualifying new suppliers can be extensive. This often involves rigorous testing to ensure material integrity and performance, adding substantial time and expense.

These qualification procedures, along with potential retooling or process redesigns needed to accommodate different materials, create a barrier to switching. For instance, if Ampco-Pittsburgh needs to change its primary aluminum supplier, the cost of validating the new material's chemical composition and mechanical properties for its high-performance alloys could run into hundreds of thousands of dollars, impacting production schedules and increasing operational risk.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly increase their bargaining power. If suppliers possess the capability and the motivation to begin producing Ampco-Pittsburgh's engineered products themselves, they could effectively become competitors, giving them leverage in negotiations. This scenario, while less frequent in highly specialized manufacturing sectors, necessitates Ampco-Pittsburgh maintaining robust supplier relationships and exploring options for supplier diversification to mitigate this risk.

For instance, if a key supplier of specialized alloys used in Ampco-Pittsburgh's rolling mills were to develop its own finishing and fabrication capabilities, it could directly challenge Ampco-Pittsburgh's market position. This potential move would empower that supplier to dictate terms more forcefully, knowing they could capture a larger share of the value chain. In 2024, the global specialty metals market saw continued consolidation, potentially increasing the capabilities of some suppliers to consider such integration strategies.

- Supplier Capability: Assess if key suppliers have the technical expertise and capital to produce Ampco-Pittsburgh's finished goods.

- Market Conditions: Analyze industry trends and supplier profitability, which might incentivize forward integration.

- Competitive Landscape: Understand if competitors are facing similar threats, which could influence Ampco-Pittsburgh's strategic responses.

- Supplier Relationship Management: Focus on building strong partnerships and loyalty to deter integration attempts.

Impact of Raw Material Price Fluctuations

Volatility in the prices of key raw materials, such as steel and specialty alloys, directly impacts Ampco-Pittsburgh's production costs and overall profitability. For example, the oil & gas equipment market, a sector Ampco-Pittsburgh serves, has grappled with significant increases in raw material expenses. In 2024, global steel prices saw considerable fluctuations, with benchmarks like the TSI US Midwest Hot-Rolled Coil price experiencing periods of sharp ascent due to supply chain disruptions and robust demand.

- Raw Material Cost Sensitivity: Ampco-Pittsburgh's reliance on specific metals makes it vulnerable to price swings in these commodities.

- Market Demand Influence: The oil & gas sector's demand for specialized alloys directly affects the pricing power of suppliers in that segment.

- Cost Pass-Through Ability: The company's capacity to transfer increased material costs to customers, or mitigate them through operational efficiencies, is crucial in managing supplier leverage.

The bargaining power of suppliers for Ampco-Pittsburgh is substantial due to the specialized nature of its inputs and the limited number of qualified providers. This leverage is amplified by high switching costs, as qualifying new suppliers for custom-engineered products involves rigorous testing and potential process modifications.

Forward integration by suppliers poses a significant threat, as their ability to produce Ampco-Pittsburgh's finished goods could turn them into direct competitors. The volatility in raw material prices, such as steel, further empowers suppliers, especially when demand from sectors like oil & gas is strong, as observed throughout 2024.

Ampco-Pittsburgh's dependence on specific, high-quality metals for its engineered products means suppliers who can consistently meet these stringent requirements hold considerable sway. The costs associated with qualifying new material sources, potentially running into hundreds of thousands of dollars, create a strong incentive for Ampco-Pittsburgh to maintain existing supplier relationships, thereby reinforcing supplier power.

The global specialty metals market in 2024 saw continued consolidation, potentially increasing the capabilities of some suppliers to consider forward integration strategies, thus enhancing their bargaining power.

What is included in the product

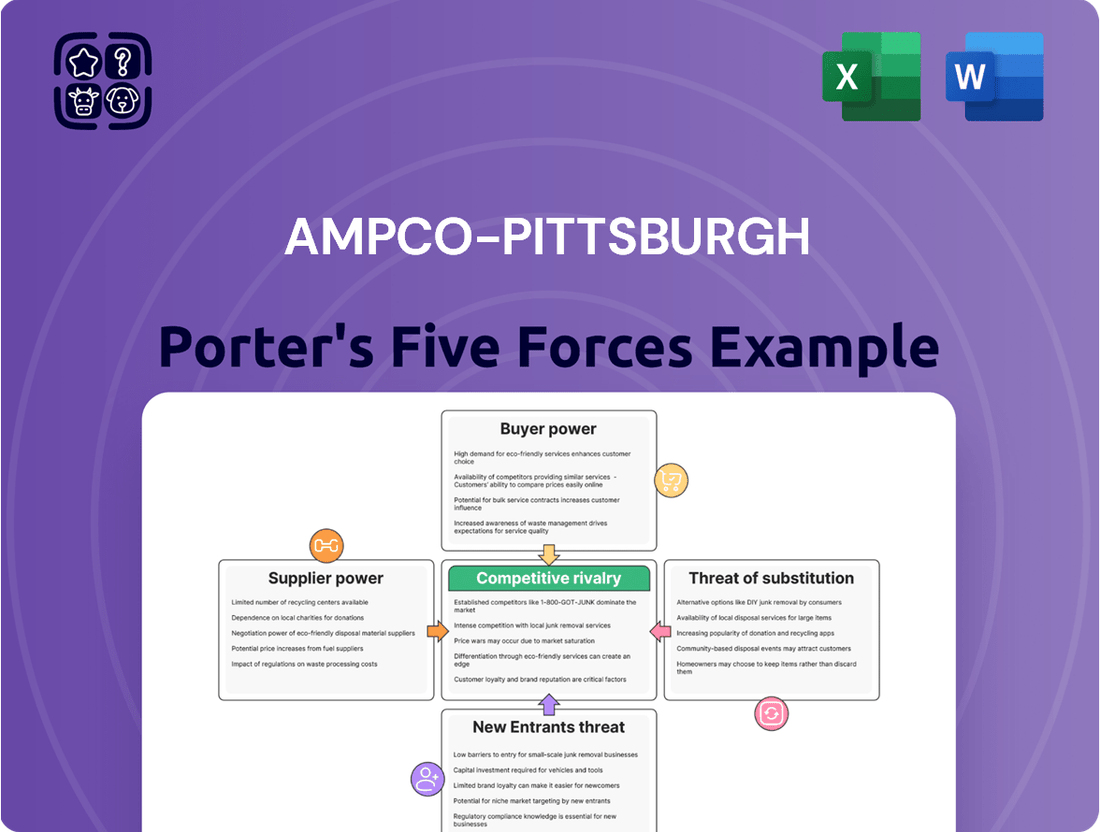

Analyzes the competitive intensity and profitability potential for Ampco-Pittsburgh by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing rivalry.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Gain immediate clarity on market pressures, enabling proactive strategic adjustments.

Customers Bargaining Power

Ampco-Pittsburgh's Forged and Cast Engineered Products segment faces significant customer concentration, with one key client representing 11% of net sales in both 2023 and 2024. This level of reliance grants this customer substantial bargaining power, as their potential departure could materially impact the company's financial performance.

Conversely, the Air and Liquid Processing segment demonstrates a healthier diversification, reporting no single customer exceeding 10% of net sales in the same periods. This suggests a more balanced customer relationship and less inherent bargaining power for any individual buyer within this division.

For customers in sectors such as metals, defense, and oil & gas, the expense and complexity associated with switching suppliers for custom-made iron and steel rolls or specialized forgings are significant. These costs can include rigorous requalification procedures, the risk of production interruptions, and uncertainty regarding the performance of new suppliers.

These high switching costs effectively increase customer loyalty, often referred to as customer stickiness, thereby diminishing their immediate leverage in price negotiations or other demands. For instance, a disruption in the supply of critical forged components for a defense project could lead to millions in penalties and delays, making a supplier change a last resort.

The availability of substitute products significantly influences customer bargaining power. For Ampco-Pittsburgh, while their highly engineered and custom-designed products are a differentiator, customers can still explore alternatives from other specialized manufacturers or consider different materials and fabrication methods to meet their needs.

Customer Price Sensitivity

Customer price sensitivity for Ampco-Pittsburgh's products is a significant factor. It's directly tied to the economic health of their customers' industries and how essential Ampco-Pittsburgh's offerings are to their final products. For instance, in 2024, the global steel industry has experienced subdued demand, leading many steel manufacturers to push for more competitive pricing from their suppliers, including Ampco-Pittsburgh.

This heightened price pressure from customers can impact Ampco-Pittsburgh's profitability. When customers face their own market challenges, they naturally look to reduce costs wherever possible. This means that Ampco-Pittsburgh must carefully consider its pricing strategies in light of these external market conditions.

- 2024 Global Steel Market Conditions: Reports indicate a slowdown in steel demand globally, with some regions experiencing contraction, increasing customer pressure for price concessions.

- Product Criticality: The degree to which customers rely on Ampco-Pittsburgh's specialized equipment and services for their core manufacturing processes influences their willingness to absorb price increases.

- Customer Profitability: When customers' profit margins are squeezed, their sensitivity to the prices of their inputs, like those from Ampco-Pittsburgh, naturally rises.

Customer's Ability to Backward Integrate

If Ampco-Pittsburgh's customers can produce components themselves, they gain significant leverage. For highly specialized items like forged and cast rolls, this is improbable. However, larger industrial clients might explore bringing simpler engineered product manufacturing in-house if it becomes financially advantageous.

- Customer Backward Integration Threat: Customers' ability to produce components internally can diminish Ampco-Pittsburgh's pricing power.

- Economic Viability: The decision to backward integrate hinges on cost-effectiveness for the customer.

- Specialization Factor: Highly specialized products, like Ampco-Pittsburgh's core offerings, reduce the likelihood of customer in-house production.

- Market Dynamics: In 2023, the industrial sector saw varying levels of investment in vertical integration, influenced by supply chain resilience concerns and cost pressures.

Ampco-Pittsburgh faces varying customer bargaining power across its segments. The Forged and Cast Engineered Products segment's reliance on a single client representing 11% of net sales in 2024 grants that customer significant leverage. Conversely, the Air and Liquid Processing segment's diversified customer base, with no single client exceeding 10% of net sales, suggests lower individual customer bargaining power.

High switching costs for custom-engineered iron and steel rolls, including requalification and potential production disruptions, limit customer leverage. While substitutes exist, the specialized nature of Ampco-Pittsburgh's offerings can mitigate some customer power. However, in 2024, subdued demand in customer industries like steel has increased price sensitivity, forcing Ampco-Pittsburgh to be more competitive on pricing.

| Customer Segment | Customer Concentration (2024) | Switching Costs | Price Sensitivity (2024) | Overall Bargaining Power |

|---|---|---|---|---|

| Forged and Cast Engineered Products | High (11% single client) | High | Moderate to High | Significant |

| Air and Liquid Processing | Low (no single client > 10%) | Moderate | Moderate | Low to Moderate |

Preview Before You Purchase

Ampco-Pittsburgh Porter's Five Forces Analysis

This preview showcases the complete Ampco-Pittsburgh Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

Ampco-Pittsburgh faces significant competition from numerous established players in the specialty metals market. These competitors, including companies like ArcelorMittal and Nucor, possess similar capabilities in producing highly engineered, high-performance products like forged and cast rolls, open-die forgings, and heat transfer equipment. For instance, in 2024, the global forged products market was valued at approximately $35 billion, indicating a substantial number of participants vying for market share.

The intensity of competition within Ampco-Pittsburgh's operating segments is significantly influenced by market growth dynamics. While the broader casting and forging industry anticipates growth, the overarching steel manufacturing sector in 2024 faces a persistent imbalance where capacity outstrips demand. This oversupply situation directly translates to softened demand across Ampco-Pittsburgh's core markets, inevitably escalating competitive pressures as companies vie for a limited pool of customers.

Ampco-Pittsburgh's emphasis on custom-engineered products allows it to stand out from competitors, reducing the pressure of direct price wars. This specialization in tailored solutions creates a unique value proposition for its customers.

While Ampco-Pittsburgh differentiates through customization, its rivals also actively pursue product uniqueness and superior performance. For instance, in the specialty steel sector, competitors often invest heavily in R&D to develop alloys with specific properties, such as enhanced strength or corrosion resistance, directly challenging Ampco-Pittsburgh's differentiation strategy.

Exit Barriers for Competitors

High exit barriers can trap even struggling companies in the forging and casting industries, intensifying competition. Ampco-Pittsburgh, operating in these capital-intensive sectors, faces significant challenges from this. For instance, the substantial investment in specialized forging presses and casting machinery represents a major hurdle for firms looking to leave the market.

These sunk costs mean that exiting can be incredibly costly, forcing companies to remain operational even when unprofitable. This can lead to aggressive price wars as these firms try to recoup their investments, directly impacting Ampco-Pittsburgh's profitability. For example, in the specialty steel sector, which includes forging operations, plant closure costs can run into millions of dollars due to environmental remediation and severance packages.

- Significant Fixed Assets: Specialized forging presses and casting machinery represent substantial, illiquid investments.

- Long-Term Contracts: Existing supply agreements can obligate companies to continue operations.

- Workforce Skills: Highly specialized labor in forging and casting is not easily redeployed.

- Industry Overcapacity: In periods of low demand, overcapacity exacerbates the difficulty of exiting.

Strategic Initiatives and Technological Advancements

Competitive rivalry in the specialty metals industry is intense, driven by significant investments in new technologies. Companies are actively deploying artificial intelligence and automation to boost operational efficiency and expand their product offerings. This technological race means that staying competitive requires constant innovation and upgrades.

Ampco-Pittsburgh, for instance, has directly benefited from integrating new equipment into its U.S. forged operations. This demonstrates a clear trend where companies must continuously improve their capabilities to maintain market position. The pressure to adopt advanced technologies is a defining characteristic of the current competitive landscape.

- Technological Investment: Companies are channeling resources into AI and automation for enhanced efficiency.

- Ampco-Pittsburgh's Experience: New equipment has yielded tangible benefits in their U.S. forged business.

- Competitive Necessity: Continuous improvement through technology is crucial for survival and growth.

Ampco-Pittsburgh faces robust competition from established players in the specialty metals market, with rivals like ArcelorMittal and Nucor offering similar high-performance products. The global forged products market, valued at approximately $35 billion in 2024, highlights the crowded competitive space.

Intense rivalry is exacerbated by industry overcapacity, particularly in steel manufacturing, leading to softened demand and price pressures. High exit barriers, such as significant capital investments in specialized machinery and workforce skills, trap companies, intensifying competition and potentially leading to price wars.

Continuous technological investment in areas like AI and automation is crucial for maintaining competitiveness, as demonstrated by Ampco-Pittsburgh's own integration of new equipment in its U.S. forged operations.

| Competitor Type | Key Product Areas | 2024 Market Context |

|---|---|---|

| Established Specialty Metals Producers | Forged rolls, open-die forgings, heat transfer equipment | Global forged products market ~ $35 billion |

| Large Steel Manufacturers | Broader steel products, some overlap in specialty alloys | Steel sector facing demand-supply imbalance |

| Niche Alloy Specialists | Highly specialized alloys with unique properties | R&D investment critical for differentiation |

SSubstitutes Threaten

The threat of substitutes for Ampco-Pittsburgh's iron and steel products, like rolls and forgings, is a significant consideration. These substitutes are materials that can perform similar functions, potentially impacting demand for Ampco-Pittsburgh's offerings.

Advancements in materials science present a tangible threat. For example, lightweight alloys or high-performance composites are increasingly capable of replacing traditional metal components in various industrial applications, from automotive to aerospace. While specific market share shifts due to these substitutes are difficult to quantify precisely for Ampco-Pittsburgh's niche products, the general trend of material innovation suggests a persistent pressure.

New manufacturing technologies, like advanced additive manufacturing, are emerging as potential substitutes for traditional forging and casting. These evolving processes, particularly 3D printing, are finding niches in sectors such as aerospace and defense, offering alternative ways to produce specialized components. For instance, by 2024, the global 3D printing market was valued at over $20 billion, indicating significant growth and potential disruption.

While Ampco-Pittsburgh's forged and cast rolls are highly specialized for specific metal rolling applications, the threat of substitutes arises from alternative technologies and processes. For instance, advancements in laser cladding or additive manufacturing could potentially offer repair or even replacement solutions for worn rolls, reducing the need for new forged or cast products. The global market for metal forming machinery, which utilizes these rolls, was valued at approximately $25 billion in 2023, indicating a significant installed base where such technological shifts could impact demand.

Alternative Heat Transfer Technologies

In the Air and Liquid Processing segment, Ampco-Pittsburgh faces threats from alternative heat exchange technologies. Innovations in compact designs and enhanced materials are emerging, offering superior efficiency or lower costs. For instance, advancements in plate heat exchangers or microchannel technology could divert demand from traditional finned tubing and coils.

The industrial heat exchangers market is dynamic, with a growing emphasis on energy efficiency and reduced footprint. Companies are exploring solutions like additive manufacturing for complex geometries, which could offer performance advantages over conventional manufacturing methods used for Ampco-Pittsburgh's products. The global industrial heat exchangers market was valued at approximately $17.9 billion in 2023 and is projected to grow.

- Technological Advancements: Innovations in plate, spiral, and microchannel heat exchangers present alternatives to finned tubing.

- Efficiency Gains: Newer designs often boast higher thermal efficiency, leading to energy savings for end-users.

- Cost Competitiveness: Some substitute technologies may offer lower manufacturing or operational costs, impacting demand.

- Market Trends: A focus on compact, lightweight, and environmentally friendly solutions favors emerging heat exchange technologies.

Cost-Effectiveness and Performance of Substitutes

The cost-effectiveness and performance of substitute products directly impact Ampco-Pittsburgh's market position. If alternative materials or solutions can match or exceed the performance of Ampco-Pittsburgh's engineered products while being more budget-friendly, customers may switch. For example, advancements in composite materials or alternative metal alloys could present a significant threat if they offer comparable strength and durability at a reduced price point.

Consider the market for specialty alloys used in demanding applications. If a competitor develops a new alloy that provides similar corrosion resistance and high-temperature performance to Ampco-Pittsburgh's offerings but at a 15% lower cost, this would significantly elevate the threat of substitutes. In 2024, the global specialty alloys market was valued at approximately $35 billion, indicating a substantial market where cost pressures from substitutes are keenly felt.

- Cost-Benefit Analysis: Customers will weigh the total cost of ownership of Ampco-Pittsburgh's products against potential substitutes, factoring in not just upfront price but also longevity, maintenance, and operational efficiency.

- Performance Benchmarking: The ability of substitutes to meet or exceed critical performance metrics, such as tensile strength, heat resistance, or wear resistance, is paramount in determining their threat level.

- Technological Advancements: Emerging technologies in materials science can rapidly create viable substitutes, potentially disrupting established markets by offering superior performance or lower costs.

The threat of substitutes for Ampco-Pittsburgh's products is driven by technological advancements and cost-effectiveness. Emerging materials and manufacturing processes, such as advanced composites or additive manufacturing, can offer comparable performance at potentially lower costs, impacting demand for traditional forged and cast products. For example, the global advanced materials market was projected to exceed $100 billion by 2024, highlighting the growing influence of innovative alternatives.

In the heat exchanger segment, alternative technologies like plate or microchannel designs offer increased efficiency and a smaller footprint, posing a threat to Ampco-Pittsburgh's finned tubing. The global industrial heat exchangers market, valued at approximately $17.9 billion in 2023, is experiencing a shift towards these more compact and energy-efficient solutions.

| Substitute Category | Examples | Potential Impact on Ampco-Pittsburgh | Market Context (2023/2024 Data) |

| Advanced Materials | Lightweight alloys, high-performance composites | Replacement for metal components in various industries | Global specialty alloys market valued around $35 billion in 2024 |

| Advanced Manufacturing | Additive manufacturing (3D printing) | Alternative for producing specialized components, potential for roll repair/replacement | Global 3D printing market exceeded $20 billion in 2024 |

| Alternative Heat Exchange Tech | Plate heat exchangers, microchannel technology | Offers higher efficiency and compact designs, diverting demand from finned tubing | Global industrial heat exchangers market valued around $17.9 billion in 2023 |

Entrants Threaten

The manufacturing of forged and cast engineered products, along with complex air and liquid processing equipment, demands significant upfront capital. This includes specialized machinery, extensive facilities, and robust infrastructure, creating a substantial barrier for new companies looking to enter the market.

For instance, in 2024, the capital expenditure required for a state-of-the-art forging facility can easily run into tens of millions of dollars, not to mention the ongoing costs for advanced tooling and maintenance. This high entry cost deters many potential competitors, safeguarding existing players like Ampco-Pittsburgh.

The threat of new entrants for Ampco-Pittsburgh is significantly mitigated by the substantial need for specialized technical expertise and proprietary knowledge. Ampco-Pittsburgh's offerings, like custom-designed forging and casting solutions, demand deep metallurgical understanding and unique manufacturing techniques developed over years of operation.

Acquiring or replicating this level of technical proficiency and intellectual property presents a formidable barrier. For instance, the company's focus on high-performance alloys for demanding industries means that new players would need to invest heavily in research and development and skilled personnel, a costly and time-consuming endeavor.

Established players like Ampco-Pittsburgh benefit from deep-rooted customer relationships, particularly in demanding sectors such as defense, metals, and oil & gas. These long-standing partnerships are built on trust and proven performance, making it difficult for newcomers to penetrate.

New entrants would struggle to replicate the established supply chain networks that Ampco-Pittsburgh and its peers have cultivated over years. Securing reliable and cost-effective access to raw materials and distribution channels presents a significant hurdle for any potential competitor seeking to enter the market.

Regulatory Hurdles and Certifications

The threat of new entrants for Ampco-Pittsburgh is significantly influenced by regulatory hurdles and the need for specialized certifications, particularly in sectors like defense and nuclear manufacturing where the company operates. These industries demand adherence to rigorous quality standards and complex compliance protocols, creating substantial barriers for newcomers. For instance, obtaining certifications for defense contracts can take years and involve extensive audits, making it a costly and time-consuming endeavor.

New companies must navigate a labyrinth of regulations, such as those imposed by the Department of Defense or the Nuclear Regulatory Commission, which often require specific manufacturing processes and material traceability. The financial investment required to meet these exacting standards can be prohibitive.

- Stringent Compliance: Operating in defense and nuclear sectors necessitates adherence to demanding quality management systems and safety regulations.

- Certification Costs: Acquiring and maintaining necessary certifications for these specialized markets can involve substantial upfront and ongoing expenses for new entrants.

- Time to Market: The lengthy approval processes and qualification periods for new suppliers in regulated industries can delay market entry for potential competitors.

- Capital Intensity: Meeting the high capital expenditure requirements for specialized equipment and facilities compliant with industry standards poses a significant barrier.

Economies of Scale

Established manufacturers in the steel industry, like Ampco-Pittsburgh, benefit significantly from economies of scale. This means their cost per unit decreases as their production volume increases. For instance, in 2023, Ampco-Pittsburgh reported a net sales of $1.1 billion, indicating a substantial operational scale that allows for more efficient procurement of raw materials and optimized production processes.

New entrants face a considerable hurdle in achieving comparable cost efficiencies. They would need to invest heavily to reach production volumes that would allow them to compete on price with established players. This initial disadvantage in cost structure makes it difficult for newcomers to gain market share quickly.

The ability of existing firms to absorb market fluctuations is also enhanced by their scale. Larger companies can better manage periods of lower demand or higher input costs without jeopardizing their financial stability, unlike smaller, less capitalized new entrants.

Key aspects of economies of scale impacting new entrants include:

- Production Efficiency: Larger plants can operate more continuously and utilize specialized machinery more effectively, lowering per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of raw materials like iron ore and coking coal grants established companies significant price negotiation advantages.

- Distribution Networks: Existing firms often have well-established logistics and distribution channels, reducing shipping costs and improving delivery times.

- Research and Development: Larger companies can afford more substantial R&D investments, leading to process improvements and product innovations that further solidify their competitive edge.

The threat of new entrants for Ampco-Pittsburgh is considerably low due to the immense capital required to establish operations. Building state-of-the-art forging and casting facilities, complete with specialized machinery and infrastructure, demands tens of millions of dollars in 2024 alone. This high initial investment, coupled with the need for advanced tooling and ongoing maintenance, creates a substantial barrier that deters most potential competitors.

Furthermore, the deep technical expertise and proprietary knowledge held by established players like Ampco-Pittsburgh present another significant hurdle. Developing the necessary metallurgical understanding and unique manufacturing techniques for custom-designed solutions requires extensive investment in research and development and skilled personnel, a costly and time-consuming endeavor for any newcomer.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for specialized machinery, facilities, and infrastructure. | High upfront costs deter new market participants. |

| Technical Expertise | Deep metallurgical understanding and proprietary manufacturing techniques are essential. | Replicating specialized knowledge is costly and time-consuming. |

| Regulatory Hurdles | Stringent quality standards and certifications required, especially in defense and nuclear sectors. | Lengthy and expensive compliance processes delay market entry. |

| Economies of Scale | Established players benefit from lower per-unit costs due to high production volumes. | New entrants struggle to achieve comparable cost efficiencies, impacting price competitiveness. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ampco-Pittsburgh is built upon a foundation of verified data, including the company's annual reports and SEC filings, alongside industry-specific market research and macroeconomic indicators.