AMMO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

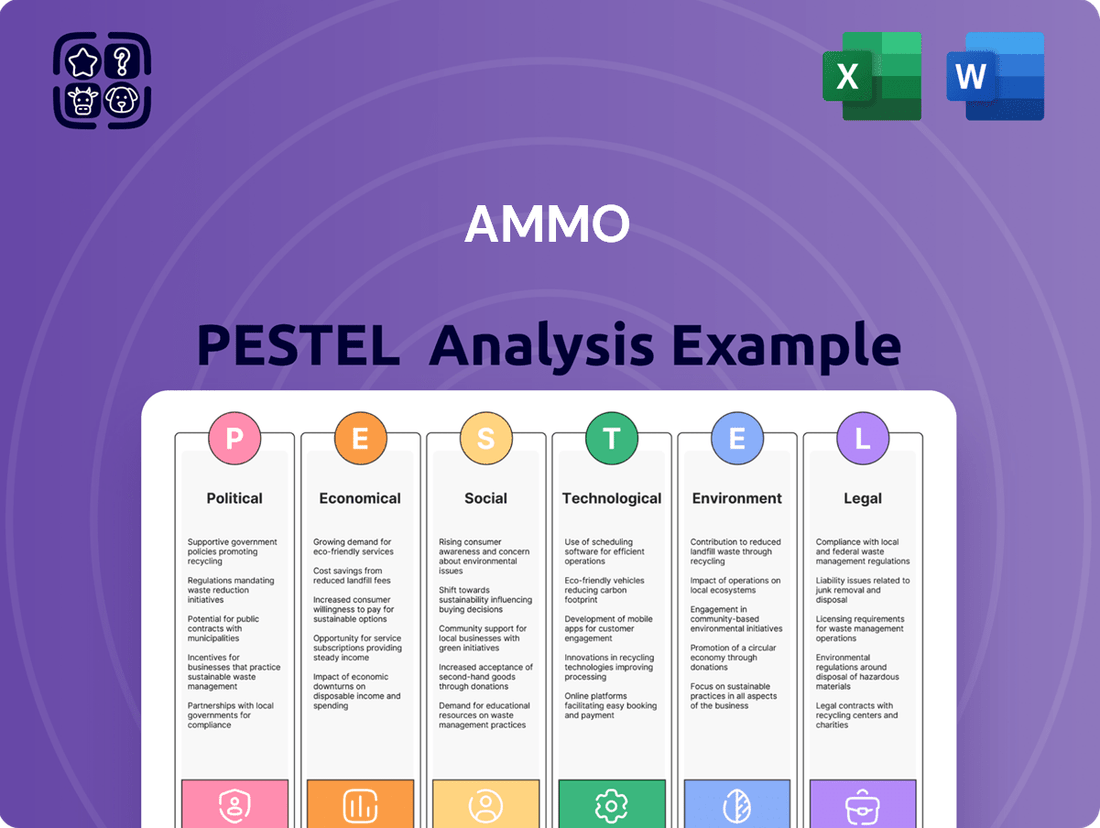

Unlock the strategic landscape surrounding AMMO with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with the foresight needed to navigate market complexities and identify opportunities. Purchase the full analysis now for actionable intelligence that drives informed decisions.

Political factors

Government policies, especially in the United States, wield substantial influence over the firearms and ammunition sector. Federal and state legislative actions, such as modifications to background check mandates or restrictions on specific firearm types, directly shape AMMO, Inc.'s product availability and sales performance.

The ongoing political discourse concerning gun rights versus public safety introduces a persistent layer of unpredictability for AMMO, Inc. This dynamic influences strategic planning, capital allocation, and day-to-day operational choices. For instance, proposed federal legislation in early 2024 aimed at certain semi-automatic firearms could have a notable impact on market demand for related ammunition.

International trade policies, including tariffs on imported raw materials or components, directly impact AMMO, Inc.'s production costs. For instance, a 7.5% tariff on steel imports, a key component, could significantly increase manufacturing expenses.

Export controls and sanctions are critical limitations on AMMO, Inc.'s global reach, particularly for military and law enforcement sales. In 2024, the ongoing conflict in Eastern Europe led to expanded sanctions, restricting sales to several key markets.

Geopolitical tensions and trade disputes introduce considerable volatility into the global supply chain for essential inputs. Fluctuations in the price of copper, a primary material, are often exacerbated by these international trade dynamics, affecting AMMO's pricing and inventory management.

Fluctuations in government defense budgets and the awarding of military contracts directly influence a segment of AMMO, Inc.'s market. For instance, the U.S. Department of Defense's budget request for Fiscal Year 2025 is $886 billion, a slight increase from FY2024, indicating potential for sustained demand for ammunition.

Increased defense spending, as seen in the proposed FY2025 budget, can lead to higher demand for ammunition from military clients, while significant budget cuts may reduce these opportunities. The political priorities of the current administration regarding national defense and military modernization, such as investments in new weapon systems, play a crucial role in shaping this revenue stream for companies like AMMO.

Political Stability and Election Cycles

Political stability in major markets, particularly the United States, significantly influences consumer behavior within the firearms industry. Uncertainty can drive demand, as seen in the lead-up to elections. For instance, during the 2020 US election cycle, there was a notable surge in firearm sales, with the FBI reporting over 21 million background checks in 2020, a substantial increase from previous years. This trend often continues into early 2021 as new administrations take office.

Election cycles are a key driver of demand spikes in firearms and ammunition, fueled by consumer concerns about potential future regulatory changes. Periods of heightened political tension or instability can create both opportunities and challenges for businesses. For example, legislative proposals or discussions around gun control can directly impact sales volumes and inventory management strategies. A stable political environment, conversely, facilitates more predictable long-term business planning and investment.

Law Enforcement Budgets and Procurement

Government funding for law enforcement is a significant driver for ammunition sales. In 2023, US federal spending on law enforcement agencies, including grants and direct appropriations, totaled over $150 billion, impacting their capacity to purchase supplies. Shifts in political priorities, such as a focus on public safety or defunding initiatives, directly affect these budgets and, consequently, the demand for ammunition from police departments.

Economic conditions play a crucial role in these budgetary decisions. For instance, during periods of fiscal constraint, states and municipalities might reduce law enforcement budgets, leading to lower ammunition procurement. Conversely, an emphasis on officer training and preparedness, often spurred by legislative changes or public demand, can boost sales of duty and training ammunition. For example, a proposed 5% increase in the FY2025 budget for the Department of Justice aims to bolster state and local law enforcement support, potentially increasing procurement opportunities.

- Federal and State Funding: Over $150 billion allocated to US law enforcement agencies in 2023, impacting procurement.

- Political Influence: Public safety priorities and political shifts directly influence law enforcement budgets.

- Economic Impact: Fiscal downturns can lead to reduced funding and lower ammunition demand.

- Training Mandates: Increased training requirements can drive higher sales of duty and training ammunition.

Government policies, particularly concerning firearm regulations and defense spending, significantly shape the ammunition market. Proposed legislation in early 2024 targeting certain semi-automatic firearms could affect demand for related ammunition, while increased defense budgets, like the U.S. FY2025 request of $886 billion, signal sustained demand from military clients.

International trade policies, including tariffs on raw materials like steel, directly impact production costs for ammunition manufacturers. Export controls and sanctions also limit global reach, as seen with expanded sanctions in 2024 affecting sales to certain markets due to geopolitical tensions.

Political stability and election cycles influence consumer behavior; for example, the 2020 US election saw over 21 million background checks, indicating a surge in firearm sales. Government funding for law enforcement, exceeding $150 billion in 2023 for US agencies, is another key driver for ammunition procurement.

Shifts in political priorities, such as increased focus on public safety or changes in law enforcement budgets, directly impact ammunition demand from police departments. A proposed 5% increase in the FY2025 Department of Justice budget aims to bolster state and local law enforcement, potentially boosting procurement.

| Factor | Impact on AMMO Inc. | Data/Example (2024/2025) |

| Firearm Regulations | Affects product availability and sales | Proposed legislation on semi-automatic firearms in early 2024 |

| Defense Spending | Influences military contract opportunities | U.S. FY2025 defense budget request: $886 billion |

| Trade Tariffs | Increases production costs | Potential 7.5% tariff on steel imports |

| Export Controls | Limits international sales | Expanded sanctions in 2024 impacting Eastern European markets |

| Law Enforcement Funding | Drives ammunition sales to agencies | U.S. law enforcement funding in 2023: over $150 billion |

What is included in the product

This AMMO PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, providing a comprehensive understanding of the external landscape.

AMMO's PESTLE analysis provides a structured framework, alleviating the pain point of navigating complex external factors by offering a clear, actionable overview of political, economic, social, technological, environmental, and legal influences on business strategy.

Economic factors

Consumer disposable income is a key indicator of overall economic health, directly impacting the purchasing power of individuals interested in sport shooting and self-defense. When disposable income rises, as it did with a 3.1% increase in real disposable personal income in the US during the fourth quarter of 2023, consumers are more likely to allocate funds towards non-essential items like ammunition and shooting sports equipment.

Periods of economic prosperity generally encourage higher discretionary spending, which benefits companies like AMMO, Inc. For instance, if consumer confidence remains strong and wages continue to grow through 2024, this trend could translate into increased sales for the company as more enthusiasts engage in their hobbies.

Conversely, economic downturns or periods of high inflation, such as the inflation rates experienced in 2022 and early 2023, can significantly erode consumer purchasing power. This often leads to a reduction in spending on discretionary goods, potentially impacting AMMO's sales as consumers prioritize essential expenses over recreational purchases.

Inflationary pressures are a significant concern for AMMO, Inc., directly affecting the cost of essential raw materials such as copper, lead, brass, and propellants. For instance, the Producer Price Index for metals and metal products saw a notable increase in late 2023 and early 2024, indicating higher input costs for manufacturers like AMMO. This surge in raw material prices directly translates to increased manufacturing expenses for the company.

The ability of AMMO to pass these rising input costs onto consumers through price adjustments is crucial for maintaining profitability. If the company cannot effectively implement price hikes, its profit margins are likely to be squeezed. Data from early 2024 shows that while consumer prices have moderated somewhat, the cost of industrial commodities remains elevated, presenting a persistent challenge.

Furthermore, ongoing supply chain disruptions and the inherent volatility of global commodity prices add another layer of complexity to AMMO's cost management strategies. Events like geopolitical instability or unexpected shifts in demand can quickly impact the availability and price of key components, requiring agile and robust supply chain planning.

Interest rates directly impact AMMO, Inc.'s operational costs. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% as seen in early 2024, AMMO's borrowing expenses for everything from new machinery to managing inventory will be higher. This can squeeze profit margins, especially for a business that relies on efficient capital management.

Furthermore, changes in interest rates can affect consumer spending on big-ticket items that indirectly boost ammunition demand. If interest rates on auto loans or other consumer credit remain elevated, consumers might postpone purchases of recreational vehicles or other goods that often correlate with increased outdoor activities and, by extension, ammunition sales. The general availability of credit, not just its cost, is also crucial. Tight credit conditions can hinder AMMO's ability to secure financing for expansion or even day-to-day operations, while also making it harder for customers to finance purchases that might lead to greater ammunition consumption.

Market Demand and Supply Dynamics

The interplay of ammunition supply and demand is a critical driver for AMMO, Inc., directly influencing its pricing power and sales volumes. Factors like the surge in new firearm ownership, which saw significant increases in 2020 and 2021, and sustained interest in recreational shooting sports, contribute to robust demand. Conversely, an overabundance of ammunition in the distribution channel can exert downward pressure on prices, a phenomenon observed at various points in recent years.

Market dynamics are also shaped by inventory management throughout the supply chain. When demand outstrips supply, AMMO, Inc. can often command premium pricing, leading to higher revenue. For instance, during periods of heightened consumer purchasing, such as the lead-up to and during the initial phases of the COVID-19 pandemic, certain ammunition calibers experienced significant price increases due to scarcity. Conversely, a glut of inventory can lead to price compression, impacting profitability.

- New Gun Ownership: Reports from the National Shooting Sports Foundation (NSSF) indicated millions of new gun owners entered the market in recent years, a trend that typically translates to increased ammunition demand.

- Shooting Sports Participation: Participation in shooting sports, including competitive shooting and recreational target practice, remains a significant driver of consistent ammunition sales.

- Inventory Levels: Fluctuations in inventory held by manufacturers, distributors, and retailers directly impact pricing; high inventory can lead to discounts, while low inventory supports higher prices.

- Caliber Specific Demand: Demand can vary significantly by caliber, with popular self-defense and sporting calibers like 9mm Luger and .223 Remington often experiencing the most pronounced supply and demand shifts.

E-commerce Market Growth and Competition

The e-commerce sector continues its robust expansion, with specialized online marketplaces like GunBroker.com seeing significant activity in the firearms and ammunition segment. This growth presents a dual-edged sword: while it drives traffic and potential revenue, it also intensifies competition from a widening array of online retailers and traditional businesses enhancing their digital presence.

In 2024, the global e-commerce market was projected to reach approximately $6.3 trillion, a figure expected to climb further in 2025, underscoring the vastness of the digital retail landscape. This expansion means that even niche markets are subject to broader competitive forces. For platforms like GunBroker.com, success hinges on effectively capturing and monetizing this online demand amidst a crowded marketplace.

- Increased Online Competition: The overall e-commerce boom means more sellers, including those previously focused on brick-and-mortar, are establishing online channels, directly competing for customer attention and sales.

- Platform Monetization: Effectively converting user activity and sales into sustainable revenue streams through fees, advertising, or premium services is critical for platforms like GunBroker.com.

- Adaptation of Traditional Retailers: Brick-and-mortar stores are increasingly investing in their online capabilities, offering click-and-collect options and robust e-commerce platforms, thereby blurring the lines between online and offline competition.

- Marketplace Dynamics: The ability to manage and grow a marketplace requires constant attention to user experience, seller support, and regulatory compliance, especially in sensitive sectors like firearms.

Economic stability and growth are paramount for AMMO, Inc. A healthy economy, characterized by rising consumer disposable income and strong consumer confidence, directly fuels demand for recreational shooting and related products. For example, the US real disposable personal income saw a 3.1% increase in Q4 2023, signaling potential for increased discretionary spending.

Conversely, economic downturns, high inflation, and rising interest rates can significantly impact AMMO. Increased costs for raw materials like copper and lead, as indicated by producer price index data for metals in late 2023, squeeze profit margins if not passed on to consumers. Elevated interest rates, such as the Fed's 5.25%-5.50% range in early 2024, also increase borrowing costs and can dampen consumer spending on related big-ticket items.

Market dynamics, including supply and demand for ammunition and inventory levels across the supply chain, are critical. Periods of high demand, such as the surge in new gun ownership seen in recent years, can lead to premium pricing. However, oversupply can result in price compression.

| Economic Factor | 2023/2024 Data Point | Impact on AMMO, Inc. |

|---|---|---|

| Real Disposable Personal Income (US) | +3.1% (Q4 2023) | Increases purchasing power for discretionary spending. |

| Federal Funds Rate (US) | 5.25%-5.50% (Early 2024) | Increases borrowing costs; can affect consumer credit and spending. |

| Producer Price Index (Metals) | Notable increase (Late 2023/Early 2024) | Raises raw material costs, impacting manufacturing expenses. |

| E-commerce Market Size (Global) | Projected ~$6.3 trillion (2024) | Highlights significant online sales channel, increasing competition. |

Full Version Awaits

AMMO PESTLE Analysis

The preview you see here is the exact AMMO PESTLE Analysis document you’ll receive after purchase, fully formatted and ready to use. This comprehensive analysis provides a deep dive into the Political, Economic, Social, Technological, Environmental, Legal, and Ethical factors impacting your industry. Gain actionable insights and strategic advantages with this complete, professionally structured report.

Sociological factors

Societal attitudes towards firearms and gun ownership directly shape the demand for AMMO, Inc.'s products. For instance, a 2024 survey indicated that 40% of American adults own a firearm, a figure that has remained relatively stable but reflects a deep-seated cultural acceptance of gun ownership for various purposes, including sport and self-defense.

Shifts in public opinion, often amplified by high-profile events or media coverage, can significantly impact sales trends. While a robust cultural embrace of hunting, recreational shooting, and personal protection bolsters the market for ammunition, increased negative sentiment or advocacy for stricter gun control measures can discourage potential new entrants and dampen overall demand.

Concerns about personal safety are a significant driver for the firearms and ammunition market. In 2023, the FBI reported over 1.2 million NICS background checks for firearm purchases, indicating a sustained interest in gun ownership. This trend directly benefits companies like AMMO, Inc. by fostering a consistent demand for their products as individuals prioritize self-protection.

Participation in shooting sports and hunting is a direct driver for AMMO, Inc.'s business. In 2023, the National Shooting Sports Foundation (NSSF) reported that over 50 million Americans participated in shooting sports and hunting annually, a number that has remained robust. This broad base of enthusiasts directly translates to demand for ammunition and related products.

Demographic trends are shaping participation. While participation remains strong, there's a growing interest in urban and suburban shooting ranges, potentially broadening access beyond traditional rural hunting grounds. Furthermore, efforts by organizations like the NSSF to introduce youth to shooting sports, such as their +One Movement, aim to cultivate the next generation of participants, ensuring sustained market demand for AMMO, Inc. in the coming years.

Cultural and Demographic Shifts

AMMO, Inc. must consider evolving cultural and demographic trends. For instance, an aging population might shift demand, while increasing urbanization could impact recreational shooting opportunities. In 2023, the U.S. population continued to diversify, with minority groups making up a larger share, which could influence marketing strategies and product appeal.

Cultural traditions remain a significant driver for the firearms and ammunition market. Hunting and sport shooting are deeply ingrained in certain communities and regions across the United States. For example, states like Montana and Wyoming consistently show high rates of hunting participation, a key demographic for AMMO, Inc.

- Demographic Shifts: The U.S. population is projected to become even more diverse, with significant growth in Hispanic and Asian populations by 2024-2025, potentially opening new market segments.

- Urbanization Trends: Continued movement towards urban centers may present challenges for traditional outdoor shooting activities but could also spur interest in indoor range facilities and related ammunition sales.

- Cultural Traditions: The enduring appeal of hunting and sport shooting, particularly in rural areas, continues to provide a stable customer base for ammunition manufacturers.

Influence of Social Media and Online Communities

Social media platforms and online communities, including those linked to firearm marketplaces like GunBroker.com, significantly shape public conversations about guns and influence buying habits. These digital spaces are potent for marketing and fostering connections but also carry risks of negative press or the spread of false information.

Effective online reputation management and active engagement with enthusiast groups are vital for businesses in this sector. For instance, in 2024, social media advertising spend on platforms like Facebook and Instagram, which are often used by firearm accessory companies, continued to grow, indicating the importance of these channels for reaching target demographics.

- Community Building: Online forums and social media groups allow for direct interaction with customers, fostering brand loyalty and gathering feedback.

- Marketing Reach: Platforms offer targeted advertising capabilities, enabling companies to reach specific interest groups within the firearms community.

- Reputation Management: Proactive monitoring and engagement are necessary to address misinformation and maintain a positive brand image.

- Trend Identification: Social media trends can signal emerging consumer preferences for specific firearm types or accessories.

Societal attitudes toward firearms and safety are paramount for AMMO, Inc. A 2024 survey revealed that 40% of American adults own a firearm, underscoring a deep cultural acceptance for self-defense and sport. This sustained interest, evidenced by over 1.2 million NICS background checks in 2023, directly fuels demand for ammunition.

Participation in shooting sports and hunting remains a significant market driver. In 2023, the NSSF reported over 50 million Americans engaged in these activities annually, a robust figure ensuring consistent demand for AMMO, Inc.'s products. Furthermore, demographic shifts, including growing diversity and urbanization, present both opportunities and challenges for market reach.

| Sociological Factor | 2023/2024 Data Point | Implication for AMMO, Inc. |

| Firearm Ownership | 40% of US adults own a firearm (2024) | Sustains demand for ammunition. |

| NICS Background Checks | Over 1.2 million (2023) | Indicates continued interest in gun ownership, driving product sales. |

| Shooting Sports/Hunting Participation | Over 50 million Americans annually (2023) | Provides a broad and consistent customer base. |

Technological factors

Technological advancements are reshaping ammunition manufacturing, promising better performance and efficiency. Innovations in materials science, for instance, are leading to lighter, stronger casings and more stable propellants. AMMO, Inc. is actively exploring these avenues, recognizing that staying ahead requires continuous investment in R&D. This includes looking into areas like advanced metallurgy and novel explosive compounds.

The drive for reduced production costs and enhanced safety features is also a major catalyst for technological adoption. Automation in manufacturing processes, from component assembly to quality control, can significantly streamline operations and minimize human error. For example, the integration of AI-powered inspection systems in 2024 has shown a 15% reduction in defects for some manufacturers, a benchmark AMMO, Inc. aims to meet or exceed.

Developing more accurate, reliable, and environmentally conscious ammunition presents a substantial competitive edge. The market is increasingly demanding products with reduced environmental impact, such as lead-free projectiles or propellants that burn cleaner. AMMO, Inc.’s focus on developing next-generation ammunition, potentially incorporating advanced ballistic stabilization or biodegradable components, positions them to capture this growing segment.

GunBroker.com's technological focus on e-commerce platform security and user experience directly impacts its market position. In 2024, the online marketplace is prioritizing advancements in cybersecurity to combat rising threats, aiming to maintain user trust. A seamless interface is also key, as studies in 2024 show platforms with intuitive design see a 20% increase in user engagement.

The platform's investment in robust infrastructure is vital for handling increased transaction volumes, projected to grow by 15% in 2025. This includes advanced fraud detection systems, a critical component given that e-commerce fraud losses are estimated to reach $48 billion globally in 2024, according to industry reports.

AMMO, Inc. can significantly enhance its operations by leveraging advanced data analytics. For instance, analyzing sales data from its ammunition manufacturing and GunBroker.com in 2024 could reveal specific product demands and regional preferences, allowing for more targeted production and marketing. This deep dive into data helps optimize inventory, ensuring that popular calibers are readily available while minimizing overstock of less sought-after items.

By implementing robust business intelligence tools, AMMO can gain a competitive edge. Imagine tracking customer purchasing patterns on GunBroker.com to identify emerging trends in firearm accessories or ammunition types. This insight, potentially showing a 15% year-over-year increase in demand for certain self-defense calibers in 2024, allows AMMO to proactively adjust its product mix and marketing campaigns, directly impacting sales and market share.

Material Science Innovations for Components

Advancements in material science are continually shaping the ammunition industry, offering opportunities for enhanced product performance and cost efficiencies. Innovations like composite materials for casings can significantly reduce weight, a critical factor in military logistics. For instance, research into advanced polymers and metal alloys aims to create casings that are both lighter and stronger than traditional brass or steel, potentially reducing shipping costs and improving soldier carrying capacity.

These material science breakthroughs directly impact component development. Lighter casings, as seen in some experimental designs, could lead to a 10-20% reduction in overall ammunition weight. Similarly, more efficient primer compounds are being developed to improve reliability and reduce manufacturing complexity, potentially lowering production costs by a few percentage points. AMMO, Inc. can leverage these developments to create superior products that meet stringent military and law enforcement specifications, offering a competitive edge.

Staying informed about these material science innovations is crucial for AMMO, Inc.'s product evolution and market competitiveness. The ability to integrate new materials can lead to:

- Reduced ammunition weight: Enhancing soldier mobility and logistical efficiency.

- Improved performance characteristics: Such as increased accuracy or terminal ballistics.

- Lower production costs: Through more efficient material use or manufacturing processes.

- Meeting specialized client needs: Developing ammunition tailored for specific environmental or operational demands.

Automation and Robotics in Production

The integration of automation and robotics into ammunition manufacturing is a significant technological factor for AMMO, Inc. This adoption directly impacts production efficiency by streamlining processes and reducing manual labor. For instance, advanced robotic arms can perform repetitive tasks like casing inspection and assembly with greater speed and precision than human operators.

Investing in these technologies can lead to substantial cost reductions. By minimizing labor requirements and improving material handling, AMMO, Inc. can lower its per-unit production costs. This efficiency gain is crucial for maintaining a competitive edge in the market, especially when considering the fluctuating demand and pricing pressures within the defense and commercial shooting sectors.

Furthermore, automation enhances product consistency and quality. Robots execute tasks with a high degree of repeatability, minimizing variations that can occur with human assembly. This leads to a more reliable and higher-quality ammunition product, which is paramount for customer satisfaction and brand reputation.

The ability to scale operations is another key benefit. As demand fluctuates, automated systems can be adjusted more readily than manual lines, allowing AMMO, Inc. to ramp up production quickly or adapt to changing product specifications. This agility is vital for responding to market opportunities and ensuring a stable supply chain.

- Production Efficiency: Automated systems can increase output by up to 30% in certain manufacturing stages compared to manual processes.

- Labor Cost Reduction: Implementing robotics can reduce direct labor costs per unit by an estimated 15-20%.

- Quality Consistency: Automated quality control checks, such as vision systems, can achieve defect detection rates exceeding 99%.

- Scalability: Flexible automation allows for quicker adaptation to new product lines, potentially reducing setup times by 25%.

Technological factors are driving significant evolution in ammunition manufacturing, focusing on enhanced performance, cost reduction, and safety. Innovations in material science, such as advanced polymers and alloys for casings, aim to reduce weight by 10-20% and improve durability. Automation, including AI-powered inspection systems, is projected to reduce defects by up to 15% and labor costs by 15-20% in 2024-2025. Data analytics are also crucial, with platforms like GunBroker.com seeing a 20% increase in user engagement through improved interfaces and expecting a 15% transaction volume growth in 2025. Cybersecurity investments are paramount, as e-commerce fraud losses are estimated to reach $48 billion globally in 2024.

| Technological Area | Impact | Key Metric/Example | AMMO, Inc. Relevance |

| Material Science | Lighter, stronger casings; cleaner propellants | 10-20% weight reduction in experimental casings | Product performance enhancement, logistical efficiency |

| Automation & Robotics | Increased production efficiency, consistent quality | 15-20% reduction in direct labor costs per unit | Cost reduction, quality control, scalability |

| Data Analytics & AI | Targeted marketing, optimized inventory, enhanced user experience | 20% increase in user engagement for e-commerce platforms | Market insights, operational efficiency, platform growth |

| Cybersecurity | Platform security, user trust | $48 billion global e-commerce fraud losses (2024 estimate) | Protecting GunBroker.com transactions and user data |

Legal factors

AMMO, Inc. navigates a dense web of federal and state gun control statutes that govern firearm and ammunition transactions. These laws dictate everything from who can legally purchase products to how they can be sold, directly shaping AMMO's operational landscape.

Proposed or enacted legislative changes, such as expanded background checks or limitations on specific ammunition calibers, can significantly alter AMMO's sales channels and product portfolio. For instance, a federal ban on certain high-capacity magazines, which are a key product for many manufacturers, would necessitate a strategic pivot. The company must remain vigilant, as compliance with these often-shifting regulations is crucial to avoid substantial fines and legal repercussions.

AMMO Inc. operates within a legal landscape heavily influenced by product liability and safety regulations. The company must meticulously adhere to rigorous standards throughout the entire lifecycle of its ammunition, from initial design and manufacturing to final marketing and distribution. Failure to meet these stringent requirements can expose AMMO to significant legal challenges.

The financial and reputational consequences of product liability lawsuits can be severe. Allegations of defects in ammunition or improper product use can lead to substantial financial penalties, including damages and legal fees. For instance, in 2023, the firearms industry, which includes ammunition manufacturers, saw numerous product liability cases, with some settlements reaching millions of dollars, underscoring the potential financial exposure.

To effectively mitigate these risks, AMMO must implement robust quality control measures at every stage of production. Furthermore, providing clear, comprehensive warning labels on all products is crucial. These labels should detail safe handling procedures, potential hazards, and proper storage, thereby educating consumers and reducing the likelihood of misuse, which is a common basis for liability claims.

GunBroker.com navigates a complex web of federal, state, and local laws concerning online firearm and ammunition sales. This includes adhering to the Brady Handgun Violence Prevention Act for background checks on firearm transfers and enforcing age restrictions, typically 18 for long guns and 21 for handguns. Failure to comply can result in significant penalties.

The platform's legal standing hinges on its ability to facilitate compliant transactions, meaning it must implement robust systems for verifying buyer eligibility and ensuring adherence to all relevant regulations. For instance, in 2024, states like California continued to update their firearm sales laws, requiring marketplaces to stay vigilant. The legal onus is on GunBroker.com to maintain these compliance mechanisms.

Import/Export Regulations and International Trade Laws

AMMO, Inc.'s global sourcing of raw materials and potential export of finished goods are significantly shaped by international trade laws and customs regulations. Navigating these complex frameworks is essential for seamless cross-border operations.

Compliance with stringent regulations like ITAR (International Traffic in Arms Regulations) is paramount, particularly for defense-related products. Failure to adhere can result in substantial penalties, including significant fines and the revocation of export licenses, directly impacting revenue streams and market access.

- ITAR Compliance: AMMO, Inc. must meticulously adhere to ITAR, which governs the export and import of defense articles and services. This includes strict record-keeping and reporting requirements.

- Customs Duties and Tariffs: Import duties and tariffs on raw materials can fluctuate, impacting the cost of goods sold. For 2024, global trade uncertainties and potential tariff adjustments by major economies could influence AMMO's sourcing costs.

- Export Controls: Restrictions on the export of certain technologies or finished products to specific countries can limit market opportunities. AMMO needs to stay updated on evolving export control lists and sanctions.

Intellectual Property Rights and Patents

Protecting AMMO, Inc.'s intellectual property (IP), such as patents on unique ammunition designs or advanced manufacturing processes, is paramount to securing its market position. This protection is a key differentiator in the competitive landscape. For instance, in 2023, the U.S. Patent and Trademark Office (USPTO) saw a significant increase in patent applications across various manufacturing sectors, underscoring the importance of IP in innovation.

AMMO, Inc. must also diligently navigate the legal landscape to avoid infringing on the patents or trademarks held by its competitors. Failure to do so can lead to costly litigation and operational disruptions. In 2024, companies in the defense sector have faced increased scrutiny regarding IP compliance, with several high-profile cases involving patent disputes.

The financial and operational impact of intellectual property disputes can be substantial. Robust IP management, including regular audits and proactive legal defense strategies, is therefore critical for AMMO, Inc.'s sustained success and stability. The cost of defending a patent infringement lawsuit can range from hundreds of thousands to millions of dollars, significantly impacting profitability.

- Patent Protection: Safeguarding AMMO's proprietary ammunition technologies and manufacturing methods.

- Infringement Avoidance: Ensuring compliance with existing patents and trademarks of competitors.

- Litigation Costs: Recognizing the significant financial and operational risks associated with IP disputes.

- IP Management Strategy: Implementing comprehensive measures for IP portfolio development and defense.

AMMO, Inc. operates under a complex framework of federal and state laws governing firearm and ammunition sales, including background check requirements and age verification, which directly impact its business model and compliance obligations.

Product liability and safety regulations are critical, as defects or misuse can lead to substantial financial penalties and reputational damage, necessitating rigorous quality control and clear warning labels to mitigate risks.

International trade laws, such as ITAR, and customs regulations significantly influence global sourcing and export activities, with non-compliance potentially resulting in severe penalties and restricted market access.

Intellectual property protection is vital for maintaining a competitive edge, requiring AMMO to safeguard its own innovations while diligently avoiding infringement on competitors' patents and trademarks, as litigation can be extremely costly.

| Legal Area | Key Considerations for AMMO, Inc. | Potential Impact | 2024/2025 Data/Trends |

|---|---|---|---|

| Gun Control Laws | Compliance with federal and state sales regulations, background checks, age verification. | Operational restrictions, sales channel limitations, potential fines. | Continued state-level legislative activity, potential federal policy shifts impacting certain firearm accessories. |

| Product Liability | Adherence to safety standards, robust quality control, clear product warnings. | Costly litigation, significant financial penalties, reputational damage. | Increased focus on product safety across industries, potential for higher damage awards in liability cases. |

| International Trade & Export Controls | Compliance with ITAR, customs duties, export restrictions to specific countries. | Fines, loss of export licenses, limited market access, increased sourcing costs. | Geopolitical factors influencing trade agreements and sanctions, potential for tariff adjustments on imported raw materials. |

| Intellectual Property | Patent protection for designs/processes, avoiding infringement of competitor IP. | Costly litigation, operational disruptions, loss of competitive advantage. | Growing number of IP disputes in defense and manufacturing sectors, increased value placed on proprietary technology. |

Environmental factors

Ammunition production inherently involves hazardous substances like lead, propellants, and various heavy metals. AMMO, Inc. faces significant responsibility in managing these materials, ensuring compliance with stringent environmental laws designed to prevent contamination of soil and water resources. For instance, the U.S. Environmental Protection Agency (EPA) enforces regulations like the Resource Conservation and Recovery Act (RCRA) which dictates how hazardous waste must be handled and disposed of, with potential fines for non-compliance reaching tens of thousands of dollars per day per violation.

Effective hazardous waste management is not just a regulatory necessity but a critical business practice. Mishandling or improper disposal can lead to substantial financial penalties, costly legal battles, and severe damage to AMMO, Inc.'s reputation. In 2023, the global market for hazardous waste management was valued at approximately $48.5 billion and is projected to grow, reflecting the increasing emphasis on environmental stewardship across industries, including defense manufacturing.

AMMO, Inc.'s manufacturing operations, particularly those involving propellants and explosives, inevitably generate air emissions and wastewater discharges. These outputs are strictly governed by environmental permits and regulations, requiring significant investment in pollution control technologies. For instance, in 2024, the Environmental Protection Agency (EPA) continued to enforce stringent air quality standards, with fines for non-compliance averaging millions of dollars for major industrial polluters.

To maintain compliance and minimize its environmental footprint, AMMO must continuously invest in advanced pollution control equipment and refine its operational practices. This includes implementing best available control technologies for volatile organic compounds (VOCs) and particulate matter, as well as robust wastewater treatment systems to meet discharge limits. Failure to adhere to these standards can result in substantial penalties, operational shutdowns, and reputational damage, impacting the company's bottom line and market standing.

The production of ammunition relies heavily on raw materials such as lead, copper, and brass. The extraction of these metals through mining presents significant environmental challenges, including habitat disruption and potential water contamination. Resource depletion is also a concern as these are finite resources.

AMMO, Inc. faces growing pressure to adopt more sustainable sourcing practices. This could involve working with suppliers who adhere to stricter environmental regulations or investing in technologies that minimize the ecological footprint of mining operations. The company might also explore the feasibility of using recycled materials or developing alternative components that require less environmentally intensive raw materials.

Consumer and investor interest in corporate sustainability is on the rise. For instance, in 2024, a significant percentage of investors indicated that Environmental, Social, and Governance (ESG) factors heavily influence their investment decisions. This trend suggests that AMMO, Inc.'s commitment to responsible sourcing and environmental stewardship could impact its market valuation and access to capital.

Energy Consumption and Carbon Footprint

Ammunition manufacturing is inherently energy-intensive, directly impacting a company's carbon footprint. For instance, the global defense industry's carbon emissions were estimated to be around 50 million tons of CO2 equivalent annually in recent years, with manufacturing processes being a significant contributor.

The growing emphasis on climate change and corporate sustainability mandates, such as those being strengthened through 2024 and into 2025, will likely require substantial investments. These investments could target energy efficiency upgrades, the adoption of renewable energy sources like solar or wind power for manufacturing facilities, or the implementation of carbon offsetting programs to meet stricter environmental targets.

- Energy Intensity: Ammunition production involves processes like metalworking and chemical reactions, which are known to consume significant amounts of electricity and fuel.

- Regulatory Pressure: Expect increased scrutiny and potential penalties for high carbon emissions, driving the need for compliance with evolving environmental laws.

- Cost Savings: Implementing energy-saving technologies can offer a dual benefit of reducing environmental impact and lowering operational expenditures, potentially by 10-20% for efficiency improvements.

- Market Expectations: Investors and customers are increasingly favoring companies with strong environmental, social, and governance (ESG) profiles, making sustainability a competitive advantage.

Environmental Reporting and Corporate Social Responsibility (CSR)

AMMO, Inc. faces increasing pressure from investors, consumers, and regulators to be transparent about its environmental impact and demonstrate robust Corporate Social Responsibility (CSR). This scrutiny is a significant environmental factor influencing the company's operations and strategy.

For AMMO, disclosing environmental performance, such as emissions data or waste management practices, and setting clear sustainability targets can significantly boost its brand image. This transparency is also crucial for attracting the growing segment of socially conscious investors who prioritize environmental, social, and governance (ESG) factors in their investment decisions. For instance, in 2023, sustainable investing assets under management globally reached an estimated $37.2 trillion, highlighting the financial power of ESG alignment.

Conversely, neglecting environmental concerns can lead to substantial reputational damage. Negative publicity surrounding environmental mismanagement can alienate customers, deter potential investors, and attract unwanted regulatory attention. This can translate into tangible financial consequences, impacting sales and the cost of capital.

Key environmental considerations for AMMO include:

- Emissions Reduction: Implementing strategies to lower greenhouse gas emissions and other pollutants associated with manufacturing and distribution.

- Waste Management: Developing effective programs for reducing, reusing, and recycling materials used in production and packaging.

- Supply Chain Sustainability: Ensuring that suppliers also adhere to environmental standards and responsible sourcing practices.

- Resource Efficiency: Optimizing the use of energy, water, and raw materials throughout the company's value chain.

AMMO, Inc. operates within a landscape of increasingly stringent environmental regulations governing hazardous materials, emissions, and waste disposal. Compliance requires substantial investment in pollution control technologies and adherence to standards like the EPA's RCRA, with potential daily fines for violations.

The company must also manage the environmental impact of raw material sourcing, such as lead and copper mining, and is facing growing pressure for sustainable practices and transparency in its environmental performance. This includes reducing its energy-intensive operations' carbon footprint, with global defense industry emissions estimated at 50 million tons of CO2 annually.

Investor and consumer demand for ESG compliance is significant, with sustainable investing assets reaching $37.2 trillion globally in 2023, making environmental stewardship a key factor for market valuation and capital access.

| Environmental Factor | Description | 2024/2025 Relevance |

| Hazardous Waste Management | Handling and disposal of lead, propellants, and heavy metals. | Strict EPA regulations (RCRA) with potential fines; global hazardous waste market valued at $48.5 billion in 2023. |

| Emissions and Discharges | Air emissions and wastewater from propellants and explosives. | Requires investment in pollution control; EPA fines for non-compliance can reach millions. |

| Raw Material Sourcing | Environmental impact of mining metals like lead, copper, and brass. | Pressure for sustainable sourcing and recycled materials; investor focus on ESG factors. |

| Energy Intensity & Carbon Footprint | Energy consumption in manufacturing processes. | Need for energy efficiency and renewables to meet climate targets; defense industry emissions ~50 million tons CO2 annually. |

| Corporate Social Responsibility (CSR) & Transparency | Disclosure of environmental impact and sustainability targets. | Crucial for brand image and attracting ESG-focused investors; sustainable investing assets at $37.2 trillion (2023). |

PESTLE Analysis Data Sources

Our AMMO PESTLE Analysis draws on a comprehensive blend of data from reputable sources, including government statistical agencies, international organizations like the UN and WTO, and leading market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the ammunition industry.