AMMO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

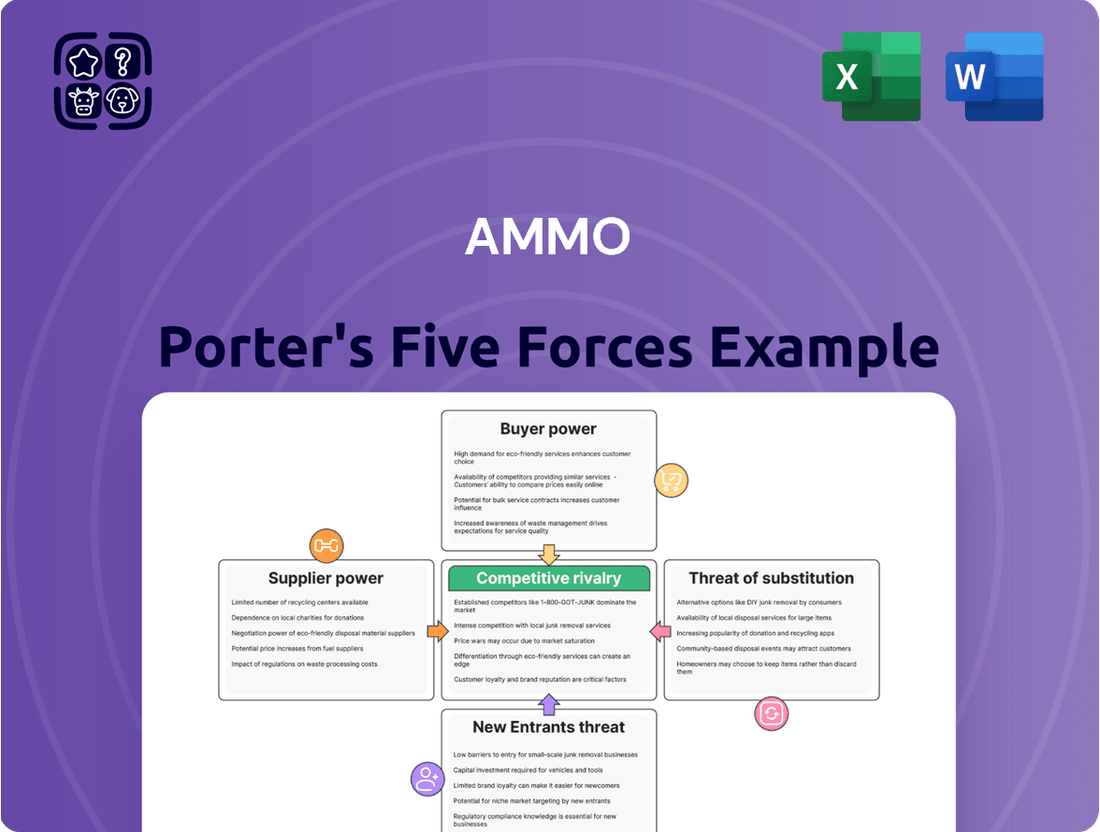

AMMO's competitive landscape is shaped by the interplay of five powerful forces, revealing both challenges and opportunities. Understanding the intensity of supplier power, buyer bargaining, the threat of new entrants, and the presence of substitutes is crucial for strategic positioning. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AMMO’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The ammunition industry’s dependence on specialized raw materials like nitrocellulose, brass, and various metals for projectiles means that supplier concentration significantly impacts companies like AMMO, Inc. When a limited number of suppliers control these essential components, they gain considerable leverage.

For instance, the availability of nitrocellulose, a key propellant ingredient, can be heavily influenced by a few major global producers. Geopolitical events can exacerbate this, as demonstrated by past supply chain disruptions affecting nitrocellulose sourced from countries like China and Russia, directly impacting manufacturing costs and production schedules for ammunition makers.

AMMO, Inc.'s bargaining power of suppliers is influenced by switching costs. If AMMO has invested significantly in machinery and processes that are specific to certain suppliers' materials, changing to a new supplier would be expensive and disruptive. This creates a reliance that strengthens the suppliers' negotiating position.

However, AMMO's strategic acquisition of a tooling manufacturer in 2024 is a key development. This move is designed to lessen the company's dependence on external suppliers for critical components, potentially mitigating some of the supplier bargaining power by bringing manufacturing capabilities in-house.

Should a key raw material supplier decide to begin manufacturing ammunition themselves, they would become a direct competitor to AMMO, Inc., significantly increasing their bargaining power. This forward integration strategy would allow them to capture more value along the supply chain.

While this is less common for highly specialized raw materials, it represents a potential long-term threat that AMMO must monitor. The defense industry's ongoing efforts to secure 'friendlier' raw material supplies underscore the strategic importance of supply chain resilience.

Importance of Supplier's Input to AMMO, Inc.

The bargaining power of suppliers significantly impacts AMMO, Inc., particularly concerning the quality and consistency of its raw materials. For instance, the performance and reliability of AMMO's ammunition are directly tied to the caliber of propellants and primers it sources. These critical components are foundational to product integrity, inherently strengthening the negotiating position of their suppliers.

The reliance on specialized inputs like propellants and primers means that any disruption in their supply chain can have a substantial ripple effect on AMMO's production capabilities and output. This dependence grants suppliers of these essential materials considerable leverage.

- Critical Components: Propellants and primers are vital for ammunition functionality, giving their producers significant leverage.

- Quality Dependence: AMMO, Inc.'s product performance is directly linked to the quality and consistency of these supplier inputs.

- Supply Chain Vulnerability: Disruptions in the supply of these key materials can severely hamper AMMO's manufacturing operations.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of ammunition component suppliers. If alternative materials or manufacturing processes can be used for critical components, it weakens the leverage of existing suppliers. For instance, if a specific type of propellant can be replaced by another with similar performance characteristics, the original supplier faces increased pressure to offer competitive pricing.

However, the ammunition industry's stringent requirements for precision, safety, and reliability create a high barrier for readily available substitutes. Components must consistently perform under extreme conditions, meaning that any alternative must undergo rigorous testing and validation. This limits the ease with which a buyer can switch suppliers for critical parts, thereby strengthening the position of established, trusted suppliers.

Looking ahead, advancements in research and development, particularly in areas like eco-friendly ammunition, could introduce new material suppliers and manufacturing processes. For example, the development of biodegradable casings or novel propellant formulations could open the door for new entrants. By 2024, several defense contractors were exploring advanced materials for ammunition components to enhance performance and reduce environmental impact, potentially altering the supplier landscape.

The bargaining power of suppliers is also influenced by:

- Concentration of Suppliers: A market with few suppliers for a critical component grants them more power.

- Supplier Differentiation: Unique or proprietary technologies in component manufacturing can increase supplier leverage.

- Switching Costs: The expense and effort involved in changing suppliers for ammunition components are key factors.

- Supplier's Ability to Forward Integrate: If suppliers can move into manufacturing finished ammunition, their power increases.

The bargaining power of suppliers for AMMO, Inc. is significantly shaped by the concentration of producers for critical raw materials like brass and propellants. When only a few entities control the supply of these essential inputs, they can dictate terms, impacting AMMO's cost structure and production efficiency. For example, in 2024, the global supply of certain high-grade brass alloys remained concentrated among a handful of international producers, leading to price volatility for ammunition manufacturers.

Switching costs also play a crucial role; if AMMO's manufacturing processes are heavily customized for specific supplier materials, the expense and time required to transition to alternatives amplify supplier leverage. The ammunition industry's rigorous quality and safety standards further limit the ease of substituting components, reinforcing the power of established, trusted suppliers who meet these demanding specifications.

The strategic acquisition of a tooling manufacturer by AMMO in 2024 aims to mitigate this supplier power by bringing critical component manufacturing in-house, thereby reducing reliance on external sources and potentially stabilizing input costs.

| Factor | Impact on AMMO, Inc. | Data/Example (2024) |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers of critical materials (e.g., brass, propellants) | Concentrated global supply of high-grade brass alloys led to price volatility. |

| Switching Costs | High costs to change specialized material suppliers due to process customization | Significant investment in machinery for specific propellant types increases reliance. |

| Product Differentiation | Limited availability of substitutes due to stringent industry requirements | Rigorous validation needed for any alternative components, favoring established suppliers. |

| Forward Integration Threat | Potential for suppliers to enter ammunition manufacturing | A hypothetical but monitored risk for raw material producers. |

What is included in the product

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and substitutes specifically for AMMO's market.

Instantly identify and prioritize competitive threats by visualizing the intensity of each Porter's Five Force.

Customers Bargaining Power

AMMO, Inc. serves a wide range of customers, from law enforcement and military to sport shooters and those focused on self-defense. This broad customer base helps mitigate the risk of any single customer group holding excessive bargaining power.

While large contracts with military and law enforcement can represent significant volume, potentially granting these entities some leverage, AMMO's engagement with individual consumers and through platforms like GunBroker.com diversifies its revenue streams. For instance, in the first quarter of fiscal year 2024, AMMO reported net sales of $42.5 million, highlighting the contribution from various customer segments.

Customers have a wide array of ammunition choices from competitors such as Vista Outdoor, Federal Premium, Hornady, Remington, and Winchester. This extensive selection empowers buyers, as they can readily switch to another brand if AMMO, Inc. fails to meet their expectations on price, quality, or product features.

Buyer price sensitivity is a crucial element in the ammunition market, especially for common calibers where differentiation is minimal. For instance, in 2024, the average price for a box of 9mm Luger ammunition saw fluctuations, with some retailers reporting prices around $15-$20 per 50-round box, directly impacting purchasing decisions for many.

Economic conditions significantly amplify this sensitivity. During periods of inflation or economic uncertainty, consumers often cut back on discretionary spending. This means that purchases of ammunition, which can be viewed as a non-essential for many, become more price-driven as disposable income tightens.

Customer Information and Transparency

The rise of online marketplaces has significantly amplified the bargaining power of customers in the firearms and ammunition (AMMO) sector. Platforms like GunBroker.com provide unprecedented access to a vast array of products, detailed pricing, and user reviews, effectively leveling the information playing field. This transparency empowers buyers, enabling them to conduct thorough comparisons and negotiate more effectively for better terms and pricing.

This increased customer knowledge directly translates to higher bargaining power. For instance, in 2024, platforms like GunBroker.com facilitated millions of transactions, showcasing a wide spectrum of price points for similar ammunition calibers. Customers can readily identify sellers offering the most competitive prices, forcing retailers to maintain aggressive pricing strategies to remain viable.

- Enhanced Information Access: Online platforms provide buyers with detailed product specifications, pricing history, and peer reviews, fostering informed purchasing decisions.

- Price Transparency: Customers can easily compare prices across multiple vendors, driving down margins for sellers who do not offer competitive rates.

- Increased Competition: The ease of comparison encourages a more competitive market, where sellers must offer attractive deals to capture customer interest.

- Demand for Value: Buyers are more likely to demand better value, including lower prices and improved service, due to the readily available alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for individual consumers, can be a significant consideration for large institutional buyers in the ammunition market. These entities, such as military or law enforcement agencies, possess the scale and resources to potentially develop their own in-house ammunition manufacturing capabilities. This would allow them to control supply, reduce costs, and ensure specific quality standards.

However, the barriers to entry for such an undertaking are substantial. Establishing a fully functional ammunition manufacturing plant requires massive capital investment in specialized machinery, skilled labor, research and development, and adherence to stringent safety and regulatory compliance. For example, setting up a facility capable of producing even a fraction of the ammunition used by a major military force would likely cost hundreds of millions, if not billions, of dollars.

Government policies can also influence this dynamic. Initiatives aimed at bolstering domestic defense manufacturing or ensuring national security through self-sufficiency might encourage government entities to explore or invest in domestic ammunition production. This could manifest as direct investment in state-owned facilities or through partnerships with existing defense contractors to build new capacity.

- High Capital Investment: Establishing ammunition manufacturing requires significant upfront costs for specialized equipment and infrastructure.

- Regulatory Hurdles: Stringent safety, environmental, and export/import regulations add complexity and cost to domestic production.

- Skilled Workforce Needs: Ammunition production demands specialized technical expertise, which can be a bottleneck for new entrants.

- Government Policy Influence: National security objectives or domestic production mandates could incentivize government-backed backward integration.

The bargaining power of customers in the ammunition market is considerable, driven by high price sensitivity and the availability of numerous alternatives. Buyers can easily switch between brands if AMMO, Inc. doesn't meet their price or quality expectations, a factor amplified by online platforms offering price transparency and comparison tools.

For instance, in 2024, the price for a 50-round box of 9mm Luger ammunition often hovered around $15-$20, highlighting how sensitive consumers are to cost, especially for common calibers. This sensitivity intensifies during economic downturns when ammunition purchases become more discretionary.

While individual consumers have limited backward integration potential, large institutional buyers like military or law enforcement agencies could theoretically develop their own manufacturing capabilities, though the immense capital investment and regulatory hurdles make this unlikely for most.

| Factor | Impact on AMMO | 2024 Data/Context |

|---|---|---|

| Availability of Substitutes | High | Numerous competitors like Vista Outdoor, Federal Premium, Hornady, Remington, Winchester. |

| Price Sensitivity | High | Average 9mm Luger price ~$15-$20 per 50 rounds in 2024; economic conditions influence discretionary spending. |

| Information Availability | High | Online platforms (e.g., GunBroker.com) provide price transparency and product comparisons. |

| Threat of Backward Integration | Low (individual), Moderate (institutional) | Requires massive capital investment (hundreds of millions to billions) and regulatory compliance. |

Same Document Delivered

AMMO Porter's Five Forces Analysis

This preview showcases the complete AMMO Porter's Five Forces Analysis, providing an in-depth examination of industry competitiveness and attractiveness. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The ammunition market is quite crowded, featuring many well-established companies. AMMO, Inc. contends with significant players like Vista Outdoor, Federal Premium Ammunition, Hornady Manufacturing Company, Remington Arms Company, and Winchester Ammunition. This high degree of competition means companies constantly vie for market share through innovation and pricing strategies.

The ammunition market is seeing robust expansion, fueled by ongoing military modernization programs and rising defense expenditures globally. For instance, the U.S. Department of Defense's fiscal year 2024 budget request included significant funding for ammunition procurement, reflecting this trend. This overall market growth tends to ease competitive pressures by creating a larger pie for all participants.

Furthermore, civilian demand for ammunition, driven by sport shooting and personal defense needs, continues to be a strong growth contributor. In 2024, many regions reported increased gun sales and, consequently, higher ammunition consumption. This expanding demand across both military and civilian sectors provides a cushion against intense rivalry, allowing companies to grow without necessarily taking market share directly from competitors.

AMMO, Inc. carves out its competitive edge through a vertically integrated model, encompassing manufacturing and distribution, notably bolstered by its ownership of GunBroker.com, a significant online marketplace. This integration allows for greater control over its supply chain and customer access.

Despite these efforts, the core market for standard ammunition often sees limited differentiation, pushing competition towards price and immediate availability. This means that for many basic ammunition products, consumers primarily consider cost and whether the product is in stock.

However, the industry is witnessing a growing trend in specialized ammunition, including advanced materials, eco-friendly options, and ammunition designed for specific tactical or hunting applications. These niche products offer greater potential for differentiation beyond price.

Exit Barriers

High capital investment in manufacturing facilities and specialized equipment often acts as a significant barrier to exiting the ammunition market. Companies that have heavily invested in these assets may be compelled to continue operations even when profitability is low, simply to avoid substantial losses on idle or unsaleable equipment. This can intensify competitive rivalry as these firms remain active participants.

AMMO, Inc.'s strategic decision in 2024 to sell its manufacturing assets to Olin Winchester highlights a potential recalibration of its operational footprint. This move suggests a focus on different aspects of the value chain, possibly shifting away from direct manufacturing, which could alter its competitive dynamics and its relationship with exit barriers in the future.

- Exit Barriers: High capital investments in specialized manufacturing equipment and facilities create substantial costs for exiting the ammunition industry.

- Intensified Rivalry: Companies facing high exit barriers may continue operations at reduced profitability, leading to prolonged and intensified competition.

- AMMO's Strategic Shift: AMMO, Inc.'s 2024 sale of its manufacturing assets to Olin Winchester signals a potential reduction in its own direct manufacturing exit barriers.

- Impact on Competition: This divestiture could reshape AMMO's competitive positioning and its obligations within the market.

Fixed Costs

Ammunition manufacturing carries substantial fixed costs, including specialized machinery, research and development, and regulatory compliance. For instance, setting up a new production line for advanced munitions can easily run into tens of millions of dollars.

These high fixed costs necessitate high production volumes to achieve economies of scale and spread the expenses. When demand falters or the market experiences oversupply, companies are pressured to maintain output, leading to aggressive pricing to cover their ongoing costs. This dynamic intensifies competition significantly.

- High Capital Investment: Establishing ammunition production facilities requires significant upfront capital for specialized equipment and infrastructure.

- Economies of Scale Pressure: To amortize these fixed costs, manufacturers must operate at high capacity, driving a need for consistent sales.

- Price Wars: Periods of low demand or excess inventory can trigger price reductions as companies strive to cover fixed expenses, escalating competitive rivalry.

- Barriers to Entry: While high fixed costs act as a barrier to new entrants, they also contribute to the intense pressure among existing players.

Competitive rivalry in the ammunition market is intense, driven by a crowded field of established players like Vista Outdoor, Federal Premium, Hornady, Remington, and Winchester. AMMO, Inc. operates within this dynamic landscape where innovation and pricing are key battlegrounds.

While market growth from defense spending and civilian demand can somewhat alleviate pressure, the core market for standard ammunition often devolves into a competition based on price and immediate availability. This is particularly true when companies face high fixed costs and exit barriers, as seen with AMMO's 2024 divestiture of manufacturing assets to Olin Winchester, a move that could reshape its competitive stance.

| Competitor | Key Product Areas | Market Position Indicator (2024 Estimate) |

|---|---|---|

| Vista Outdoor (Federal, Remington) | Sporting, Law Enforcement, Military | Significant market share, broad product portfolio |

| Hornady Manufacturing Company | Hunting, Self-Defense, Law Enforcement | Strong brand loyalty, known for innovation |

| Winchester Ammunition | Sporting, Military, Law Enforcement | Long-standing reputation, extensive distribution |

| AMMO, Inc. | Sporting, Self-Defense, Law Enforcement (via GunBroker.com) | Vertically integrated, expanding online presence |

SSubstitutes Threaten

Consumers seeking self-defense have numerous alternatives to traditional ammunition. Options like tasers, pepper spray, and personal alarms offer comparable protective functions without the use of firearms, directly impacting the demand for ammunition.

The market for non-lethal self-defense tools is experiencing significant growth. For instance, the global market for tasers and stun guns was projected to reach over $2.1 billion by 2024, indicating a clear shift in consumer preference towards less lethal options.

The threat of substitutes for live ammunition in training is growing significantly. Virtual reality (VR) and simulation-based training systems are emerging as powerful alternatives, particularly for military and law enforcement. These technologies can replicate realistic scenarios without expending actual ammunition, offering substantial cost savings and environmental benefits.

For instance, the global military simulation and training market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 19 billion by 2028, indicating a strong shift towards these substitute training methods. This trend directly impacts the demand for traditional live ammunition by providing a more cost-effective and sustainable training solution.

Changes in recreational activities can significantly impact the demand for ammunition. If consumer preferences shift away from activities like sport shooting or hunting, the overall market for ammunition could shrink. For instance, a growing interest in digital entertainment or other non-firearm-related hobbies might divert spending and participation away from traditional shooting sports.

Despite potential shifts, recreational shooting sports remain a substantial driver of ammunition demand. In 2023, the shooting sports industry in the U.S. contributed an estimated $65 billion to the national economy, highlighting its continued importance. This segment includes activities like target practice, competitive shooting, and recreational plinking, all of which require a steady supply of ammunition.

Regulatory Environment and Restrictions

The threat of substitutes for ammunition is significantly influenced by the regulatory environment. Stricter gun control laws and increased restrictions on ammunition sales can make it more difficult and costly for consumers to purchase. This can lead individuals to seek alternative personal safety measures or different recreational pursuits, thereby reducing demand for traditional ammunition.

For instance, in 2023, several states considered or enacted new legislation impacting firearm and ammunition sales. Bans on certain types of ammunition, such as armor-piercing rounds, or limitations on magazine capacity directly affect consumer choices. These regulatory shifts can be viewed as a form of substitution, as they encourage or necessitate the adoption of alternatives.

- Increased regulatory hurdles: New laws can impose waiting periods, background checks, and purchase limits on ammunition.

- Prohibition of specific calibers/types: Bans on certain ammunition can force consumers to switch to legal alternatives or abandon shooting activities.

- Higher taxes and fees: Government levies on ammunition sales can increase the overall cost, making other activities more appealing.

- Impact on accessibility: Restrictions on online sales or shipping can limit consumer access, pushing them toward substitute goods or services.

Technological Advancements in Firearms

Technological advancements in firearms, while not direct substitutes for ammunition itself, can indirectly affect demand. For instance, innovations leading to more durable firearm components or highly efficient firing mechanisms could reduce the frequency with which ammunition is needed for replacement or wear and tear.

Furthermore, the growing emphasis on smart munitions and precision-guided ammunition signifies a potential shift in consumer preference. This trend could lead to a demand for more sophisticated, albeit potentially higher-priced, ammunition types, impacting the market for traditional ammunition.

For example, the defense sector has seen significant investment in technologies like guided artillery shells, which aim to increase accuracy and reduce the number of rounds needed for a target. While specific figures for 2024 are still emerging, the trend towards precision is a key indicator of evolving ammunition needs.

- Reduced Ammunition Consumption: Firearm innovations that extend component life or improve firing efficiency could lower the overall volume of ammunition required per unit of time.

- Shift to Smart Munitions: A growing market share for precision-guided or "smart" ammunition could alter demand patterns for conventional ammunition.

- Impact on Traditional Ammunition Sales: These technological shifts may necessitate adjustments in production and marketing strategies for manufacturers of standard ammunition.

The threat of substitutes for ammunition is multifaceted, extending beyond direct replacements. Non-lethal self-defense options like tasers and pepper spray are gaining traction, with the global taser and stun gun market projected to exceed $2.1 billion by 2024. Similarly, virtual reality and simulation training systems are becoming prevalent in military and law enforcement, reducing the need for live ammunition in training scenarios. The global military simulation and training market was valued at approximately $12.5 billion in 2023, showcasing a significant shift towards these alternatives.

Regulatory changes also act as a substitute pressure. Stricter gun control laws, such as those enacted in various US states in 2023 that may ban certain calibers or limit magazine capacity, can push consumers towards alternative personal safety measures or different recreational activities. Furthermore, technological advancements in firearms, such as more durable components or efficient firing mechanisms, could indirectly reduce the frequency of ammunition replacement. The growing investment in precision-guided munitions in the defense sector also signals a potential shift towards more sophisticated, albeit higher-priced, ammunition types.

| Substitute Category | Example | Market Projection/Value (Approximate) | Impact on Ammunition Demand |

|---|---|---|---|

| Non-Lethal Self-Defense | Tasers, Pepper Spray | Taser/Stun Gun Market: >$2.1 billion by 2024 | Reduces demand for ammunition for personal protection. |

| Training Alternatives | VR Simulation, Training Systems | Military Simulation & Training Market: ~$12.5 billion (2023) | Decreases ammunition consumption in training. |

| Regulatory Restrictions | Caliber Bans, Magazine Limits | Varied by jurisdiction (e.g., US state legislation in 2023) | Forces consumers to seek legal alternatives or different activities. |

| Firearm Technology | Durable Components, Smart Munitions | Defense investment in precision-guided munitions | Potentially reduces overall ammunition volume or shifts demand to specialized types. |

Entrants Threaten

The capital required to establish a modern ammunition manufacturing plant is immense. Think millions, even hundreds of millions, for state-of-the-art machinery, specialized tooling, and robust safety infrastructure. AMMO, Inc. demonstrates this with its own significant production facility, highlighting the substantial upfront investment needed.

The firearms and ammunition sector faces substantial regulatory hurdles, acting as a significant deterrent to new entrants. Obtaining the necessary federal, state, and local licenses and permits is a complex and costly undertaking. For instance, manufacturers must comply with the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) regulations, including the Gun Control Act of 1968, which mandates specific manufacturing processes and record-keeping.

Compliance with stringent safety and environmental standards further elevates the barrier to entry. New companies must invest heavily in infrastructure and processes to meet these requirements, which can include secure storage, waste disposal, and product testing. Failure to adhere to these regulations can result in severe penalties, including hefty fines and license revocation, making the initial investment and ongoing operational costs particularly high for aspiring businesses in 2024.

New entrants in the ammunition market face significant hurdles in securing reliable access to specialized raw materials like nitrocellulose, brass, and propellants. Geopolitical events and global demand fluctuations, as seen with the heightened demand for brass in 2024 due to defense spending increases, can severely disrupt supply chains, making it difficult and costly for newcomers to establish consistent material flow compared to established players with long-standing supplier relationships.

Economies of Scale for Incumbents

Established companies like AMMO, Inc. benefit significantly from economies of scale in their operations. This means they can produce goods at a lower cost per unit because they operate at a larger volume. For example, in 2023, AMMO, Inc. reported a total revenue of $170.5 million, indicating a substantial operational footprint that allows for cost efficiencies in production, raw material procurement, and distribution networks.

New companies entering the ammunition market would find it difficult to immediately achieve similar cost advantages. They would likely face higher per-unit production costs initially, making it challenging to compete on price with established players like AMMO. This cost disadvantage acts as a significant barrier to entry.

The ability of incumbents to leverage their scale impacts new entrants in several ways:

- Lower Production Costs: AMMO's large-scale manufacturing allows for optimized processes and bulk purchasing of raw materials, driving down per-unit costs.

- Procurement Advantages: Greater purchasing power enables AMMO to negotiate better prices for components and materials, further reducing input costs.

- Distribution Efficiencies: Established distribution channels and logistics networks contribute to lower shipping and handling expenses for AMMO.

- Price Competition: These cost advantages allow AMMO to offer competitive pricing, making it harder for new entrants to gain market share without absorbing significant initial losses.

Brand Loyalty and Distribution Channels

For new entrants in the ammunition market, overcoming established brand loyalty presents a significant hurdle. Consumers often stick with brands they trust for reliability and performance, making it challenging for newcomers to gain traction. For instance, in 2024, major ammunition manufacturers continued to benefit from decades of brand building, with consumer preference surveys consistently showing high recognition for brands like Federal Premium and Hornady.

Securing effective distribution channels is another substantial barrier. Established players have long-standing relationships with retailers, both brick-and-mortar and online platforms like GunBroker.com, which is a crucial marketplace for firearms and ammunition. New companies often struggle to gain shelf space or prominent placement on these platforms without significant investment or proven sales volume. This access is vital, as evidenced by the continued dominance of traditional sporting goods stores and specialized online retailers in 2024 sales figures.

- Brand Loyalty: Consumers often exhibit strong brand loyalty due to perceived reliability and performance, making it difficult for new entrants to capture market share.

- Distribution Channels: Access to established retail networks and popular online marketplaces like GunBroker.com is crucial but often controlled by incumbent firms.

- Market Saturation: The ammunition market, while growing, has many established players, intensifying competition for new entrants seeking to build a customer base.

The threat of new entrants in the ammunition market is generally low due to significant barriers. High capital requirements for manufacturing facilities, stringent regulatory compliance including ATF regulations, and substantial investments in safety and environmental standards create formidable entry obstacles. Furthermore, securing reliable access to specialized raw materials like brass and propellants can be challenging and costly for newcomers, especially given market volatility observed in 2024.

Porter's Five Forces Analysis Data Sources

Our AMMO Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available company financial statements, industry-specific market research reports, and insights from reputable trade publications.