AMMO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMMO Bundle

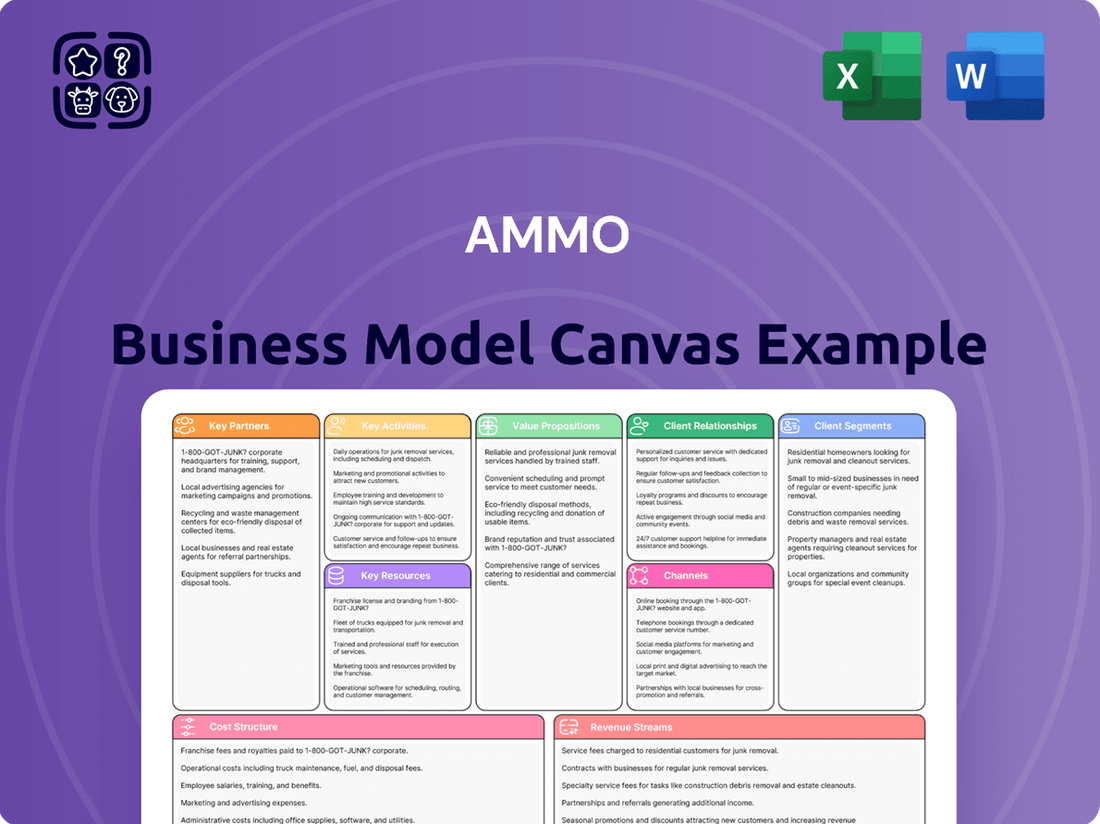

Unlock the strategic blueprint behind AMMO's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Ideal for anyone seeking to understand or replicate their winning strategy.

Dive deeper into AMMO's operational genius with the full Business Model Canvas. This professionally crafted document illuminates their key partnerships, cost structure, and competitive advantages, providing actionable insights for your own business ventures. Download it now to gain a competitive edge.

Partnerships

Key partnerships with raw material suppliers are fundamental for AMMO, ensuring a steady flow of critical components such as brass, lead, propellants, and primers. These relationships directly impact manufacturing continuity and the consistent quality of the final product. For instance, in 2024, the global brass market alone was valued at approximately $25 billion, highlighting the significant economic interplay with these suppliers.

AMMO, Inc. relies on a strong network of distributors and retailers to get its ammunition products into the hands of consumers. These partners are crucial for reaching a broad customer base, from recreational shooters to those focused on self-defense. In 2023, AMMO, Inc. reported net sales of $115.6 million, underscoring the importance of these channels in driving revenue.

Strategic alliances with government agencies and military contractors are crucial for securing substantial contracts in defense and law enforcement. These partnerships are built on trust and adherence to rigorous quality and compliance standards, essential for specialized applications.

For example, in 2024, the U.S. Department of Defense awarded over $700 billion in contracts, highlighting the immense market potential. Companies that can meet these demanding requirements, such as those providing advanced ammunition solutions, benefit from significant, predictable revenue streams.

These collaborations not only drive stable financial performance but also bolster a company's credibility and market standing within these critical sectors.

Technology and Platform Partners

GunBroker.com relies heavily on technology and platform partners to maintain its robust online marketplace. These partnerships are essential for website infrastructure, ensuring smooth operation and scalability. For instance, in 2024, the company continued to leverage cloud service providers to manage its extensive user base and transaction volume, aiming for high uptime and rapid data processing.

Cybersecurity is paramount, and GunBroker.com collaborates with specialized firms to protect against threats. These partnerships involve implementing advanced security protocols and continuous monitoring to safeguard user data and financial transactions. The company's commitment to security is a cornerstone of user trust.

Furthermore, partnerships with payment processing providers are crucial for facilitating secure and efficient transactions. These collaborations ensure a seamless checkout experience for buyers and reliable payment collection for sellers. User experience enhancements, driven by partnerships with UX/UI design and development firms, also play a significant role in GunBroker.com's success.

- Website Infrastructure: Partnerships ensure a scalable and reliable platform to handle millions of listings and user interactions.

- Cybersecurity: Collaborations with security firms are vital for protecting sensitive user data and financial information.

- Payment Processing: Partnerships with financial technology providers enable secure and efficient transaction processing.

- User Experience: Collaborations with UX/UI experts continuously improve the platform's usability and engagement.

Logistics and Shipping Providers

Efficient logistics and shipping partners are absolutely crucial for getting ammunition products to their destinations safely and on time, whether that's to distributors, retailers, or directly to consumers. This isn't just about speed; it's about ensuring the secure handling of specialized products. In 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the scale and importance of these operations.

Given the highly regulated nature of transporting ammunition, these partnerships must strictly adhere to all relevant safety protocols and legal requirements. Non-compliance can lead to severe penalties and operational disruptions. For instance, the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (PHMSA) sets stringent guidelines for the transport of hazardous materials, which often includes ammunition.

Optimizing these logistics directly impacts both cost-efficiency and customer satisfaction. Reliable delivery ensures that businesses can maintain inventory levels and meet demand, while end-customers receive their orders as expected. A study by McKinsey in 2024 indicated that companies with superior logistics capabilities see a 10-15% improvement in gross margins compared to their peers.

- Regulatory Compliance: Partnerships must guarantee adherence to all federal, state, and international regulations governing ammunition transport.

- Safety Protocols: Ensuring partners have robust safety measures in place for handling and transporting potentially hazardous materials.

- Cost Optimization: Negotiating favorable rates and efficient routing to minimize shipping expenses.

- Reliability and Speed: Selecting partners with a proven track record of on-time and secure deliveries.

Key partnerships with raw material suppliers are fundamental for AMMO, ensuring a steady flow of critical components. These relationships directly impact manufacturing continuity and product quality. For instance, in 2024, the global brass market was valued at approximately $25 billion, underscoring the economic significance of these ties.

AMMO relies on a strong network of distributors and retailers to reach its customer base. These partners are crucial for driving revenue, as seen in AMMO, Inc.'s reported net sales of $115.6 million in 2023.

Strategic alliances with government agencies and military contractors are vital for securing substantial defense contracts. These partnerships are built on trust and rigorous compliance standards, essential for specialized applications.

GunBroker.com depends on technology and platform partners for its robust online marketplace infrastructure, ensuring smooth operation and scalability. In 2024, the company continued to leverage cloud service providers to manage its extensive user base and transaction volume.

Cybersecurity collaborations with specialized firms are paramount for protecting user data and financial transactions, fostering user trust. Furthermore, partnerships with payment processing providers and UX/UI experts ensure secure transactions and an enhanced user experience.

| Partnership Type | Importance | 2024/2023 Data Point |

| Raw Material Suppliers | Ensures manufacturing continuity and product quality. | Global brass market valued at ~$25 billion (2024). |

| Distributors & Retailers | Drives revenue by reaching consumers. | AMMO, Inc. net sales of $115.6 million (2023). |

| Government & Military Contractors | Secures substantial defense contracts. | U.S. DoD awarded over $700 billion in contracts (2024). |

| Technology & Platform Partners | Maintains robust online marketplace infrastructure. | Continued leverage of cloud services for user base management (2024). |

| Cybersecurity Firms | Protects user data and financial transactions. | Essential for safeguarding sensitive information. |

| Payment Processors | Facilitates secure and efficient transactions. | Ensures seamless checkout and reliable payment collection. |

What is included in the product

A structured framework detailing customer segments, value propositions, channels, revenue streams, and key resources for a business.

Provides a visual representation of how a company creates, delivers, and captures value, aiding strategic planning and communication.

The AMMO Business Model Canvas helps alleviate the pain of unclear strategic direction by providing a structured, visual representation of all key business elements.

It simplifies complex strategies into an easily understandable format, reducing the time and effort required to articulate and refine a business model.

Activities

Ammunition manufacturing is the heart of the business, encompassing the precise design, development, and production of handgun, rifle, and shotgun rounds. This involves intricate processes to ensure each round meets exacting specifications.

Quality control is rigorously applied throughout the entire manufacturing lifecycle. From raw material inspection to final product testing, every step is monitored to guarantee reliability, safety, and optimal performance in the field.

Maintaining these high manufacturing standards is crucial for building and sustaining customer trust and a strong brand reputation. For instance, in 2024, the global ammunition market saw continued demand, with companies emphasizing precision engineering and stringent quality assurance to differentiate themselves.

AMMO's commitment to Research and Development is a cornerstone of its strategy, focusing on innovating new ammunition designs and enhancing existing product performance. This continuous investment is crucial for exploring advanced materials and staying ahead of market demands. For instance, in fiscal year 2024, AMMO reported significant R&D expenditures aimed at developing next-generation ammunition solutions, particularly for military and law enforcement sectors.

These R&D efforts are strategically directed towards improving ballistic capabilities and ensuring the company maintains a competitive edge in the global ammunition market. By staying at the forefront of technological advancements, AMMO aims to meet the evolving needs of its diverse customer base, from civilian sport shooters to defense contractors. The company's focus on innovation directly translates into higher performance and reliability for its product lines.

Key activities revolve around crafting and implementing robust marketing strategies to reach both ammunition buyers and sellers on GunBroker.com. This includes targeted advertising campaigns, digital outreach, and engagement at major shooting sports expos to boost brand awareness and platform usage.

Sales management focuses on building and motivating effective sales teams responsible for driving product sales and increasing transaction volume within the marketplace. Their efforts are vital for expanding market share and ensuring consistent revenue streams.

In 2024, the firearms and ammunition industry saw continued strong demand, with reports indicating that online marketplaces like GunBroker.com played a significant role in facilitating transactions. For instance, the National Shooting Sports Foundation (NSSF) reported that firearm background checks, a proxy for sales, remained at historically high levels throughout the year, underscoring the importance of efficient sales and marketing channels.

GunBroker.com Platform Operation and Development

Managing and enhancing the GunBroker.com online marketplace is a core activity, involving website upkeep, new feature creation, customer service, and robust security measures. This ensures a smooth transaction environment for those buying and selling firearms, ammo, and related gear.

Operational excellence on the platform directly fuels its market dominance. For instance, in 2024, GunBroker.com continued to be a primary destination for firearm transactions, with millions of listings and a significant volume of sales processed annually.

- Platform Maintenance: Ensuring the website is always running smoothly and securely.

- Feature Development: Continuously adding new tools and functionalities for users.

- User Support: Providing assistance to buyers and sellers to facilitate transactions.

- Security Enhancements: Protecting user data and transaction integrity.

Supply Chain and Inventory Management

Key activities for AMMO's supply chain and inventory management focus on the seamless flow of materials and finished products. This includes the critical task of forecasting demand to ensure we have the right amount of ammunition available when customers need it. For instance, in 2024, the global ammunition market saw significant demand shifts, with some segments experiencing shortages due to geopolitical events and increased military spending. Companies that effectively managed their raw material procurement and production schedules were better positioned to meet these demands.

Optimizing inventory levels is a constant balancing act. Holding too much inventory ties up capital and increases storage costs, while too little can lead to stockouts and lost sales. In 2024, many ammunition manufacturers implemented advanced inventory management systems, leveraging data analytics to predict optimal stock levels. This approach helped them navigate the volatile market conditions and maintain a competitive edge.

Supplier relationship management is also a cornerstone of this key activity. Building strong partnerships with raw material suppliers ensures consistent quality and timely delivery, which is crucial for uninterrupted production. The ability to secure reliable sources for propellants, casings, and primers directly impacts AMMO's ability to meet its production targets. In 2024, supply chain disruptions highlighted the importance of diversifying supplier bases and fostering long-term collaborations.

- Demand Forecasting: Utilizing data analytics to predict customer needs, a critical factor in the volatile 2024 market.

- Inventory Optimization: Balancing stock levels to minimize costs while ensuring product availability.

- Supplier Partnerships: Cultivating strong relationships for reliable raw material procurement.

- Logistics Management: Efficiently handling inbound materials and outbound finished goods to meet market demands.

AMMO's core activities center on the precise manufacturing of ammunition, ensuring rigorous quality control throughout the production process. This commitment to excellence is vital for maintaining customer trust and a strong market position, as evidenced by the continued demand and focus on precision engineering in the 2024 market.

Significant investment in research and development drives innovation in ammunition design and performance, aiming to enhance ballistic capabilities and maintain a competitive edge. Fiscal year 2024 saw AMMO allocate substantial resources to R&D, particularly for next-generation solutions targeting military and law enforcement needs.

The company actively manages and enhances the GunBroker.com marketplace, focusing on platform maintenance, feature development, user support, and robust security measures. This ensures a seamless and secure transaction environment for buyers and sellers, reinforcing GunBroker.com's status as a primary destination for firearm transactions in 2024.

Preview Before You Purchase

Business Model Canvas

The AMMO Business Model Canvas preview you are currently viewing is the actual document you will receive upon purchase. This means that the structure, content, and formatting you see here are precisely what will be delivered to you, ensuring no surprises and full transparency. You can be confident that the professional, ready-to-use Business Model Canvas will be yours to download and utilize immediately after completing your order.

Resources

AMMO's manufacturing facilities and equipment are the backbone of its operations, encompassing advanced production plants and specialized machinery. These assets are crucial for the high-volume, precise manufacturing of ammunition components and finished rounds, enabling the company to efficiently produce a wide array of ammunition types.

In 2024, AMMO continued to invest in modernizing its production capabilities. For instance, the company's facility in Wisconsin is equipped with state-of-the-art technology designed for optimal efficiency and quality control. This focus on advanced tooling and machinery directly supports AMMO's ability to scale production and maintain rigorous quality standards, which is vital in the competitive ammunition market.

AMMO, Inc.'s intellectual property, including unique ammunition designs, specialized propellant formulations, and advanced manufacturing processes, forms a crucial intangible asset. This proprietary knowledge is protected through a combination of patents and trade secrets, safeguarding their competitive edge.

These protections allow AMMO to offer distinct products, such as their patented caseless ammunition technology, which provides a performance advantage and differentiates them in the marketplace. For instance, in early 2024, the company continued to emphasize its patent portfolio as a key driver of innovation and market positioning.

GunBroker.com's online marketplace is a cornerstone resource, offering a direct channel to a vast network of active firearm buyers and sellers. This platform is instrumental in generating transaction-based revenue and maintaining brand recognition. In 2024, the site continued to be a primary destination for firearms transactions, reflecting sustained user engagement and market presence.

Skilled Workforce and Expertise

AMMO, Inc. hinges on a workforce boasting specialized skills. This includes seasoned engineers, ballistic specialists, adept manufacturing technicians, and proficient e-commerce professionals. Their collective expertise is indispensable for driving product innovation, ensuring efficient manufacturing processes, and successfully managing both the ammunition production and the GunBroker.com online marketplace operations.

Human capital forms the bedrock of AMMO's operational effectiveness. The company's reliance on this skilled talent pool directly impacts its ability to maintain high product quality and execute its business strategy across diverse segments.

- Engineers and Ballistic Experts: Crucial for R&D and product development, ensuring performance and safety standards are met.

- Manufacturing Technicians: Essential for efficient and high-quality ammunition production, maintaining output targets.

- E-commerce Professionals: Vital for the smooth operation and growth of GunBroker.com, managing online sales and user experience.

- Overall Expertise: The combined knowledge base supports AMMO's competitive edge and operational resilience in the firearms and ammunition industry.

Strong Brand Reputation and Trust

AMMO, Inc.'s reputation for producing high-quality ammunition is a cornerstone of its business model. This commitment to excellence builds significant trust among consumers, driving repeat purchases and attracting new customers. For instance, in 2023, AMMO reported a net sales increase, partly attributable to its established brand recognition in a competitive market.

GunBroker.com, a key component of AMMO's operations, functions as a trusted online marketplace. Its established user base and reputation for facilitating secure transactions are critical intangible assets. In 2024, online marketplaces like GunBroker.com continue to see robust activity, with firearms and related accessories remaining a significant category, underscoring the value of this platform to AMMO's reach and revenue.

The synergy between AMMO's quality products and GunBroker.com's trusted platform creates a powerful competitive advantage. This strong brand equity fosters customer loyalty, which is essential for long-term stability and growth. Maintaining this trust through consistent product performance and reliable service is paramount; AMMO's focus on these areas directly impacts its ability to secure partnerships and expand its market share.

- Brand Reputation: AMMO, Inc. is recognized for its commitment to producing reliable and high-performance ammunition.

- Marketplace Trust: GunBroker.com provides a secure and established platform for the buying and selling of firearms and related goods.

- Customer Loyalty: A strong brand reputation cultivated through quality and trust directly translates into a loyal customer base.

- Partnership Foundation: The established trust in both AMMO's products and GunBroker.com's platform serves as a solid foundation for strategic partnerships.

AMMO's key resources are a blend of tangible and intangible assets, including advanced manufacturing facilities, proprietary intellectual property, and the robust GunBroker.com online marketplace. These are supported by a highly skilled workforce and a strong brand reputation built on quality and trust.

In 2024, AMMO continued to leverage its manufacturing capabilities, exemplified by its Wisconsin facility's advanced technology, to ensure efficient and high-quality production. The company's intellectual property, particularly its patented caseless ammunition technology, remained a significant differentiator, with continued emphasis on its patent portfolio driving innovation and market positioning.

The GunBroker.com platform in 2024 continued to serve as a vital direct channel to consumers, generating transaction-based revenue and maintaining significant brand recognition within the firearms market. The combined strength of AMMO's product quality and GunBroker.com's trusted platform fosters customer loyalty and provides a solid foundation for strategic partnerships, enhancing the company's competitive edge and operational resilience.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Manufacturing Facilities & Equipment | Advanced production plants and specialized machinery for ammunition manufacturing. | Continued investment in modernization, e.g., Wisconsin facility's state-of-the-art technology for efficiency and quality control. |

| Intellectual Property | Patented ammunition designs, propellant formulations, and manufacturing processes. | Emphasis on patented caseless ammunition technology as a performance advantage and market differentiator. |

| GunBroker.com Marketplace | Online platform for buying and selling firearms and related goods. | Sustained user engagement and market presence as a primary destination for firearms transactions. |

| Skilled Workforce | Engineers, ballistic specialists, manufacturing technicians, e-commerce professionals. | Expertise crucial for product innovation, efficient manufacturing, and marketplace management. |

| Brand Reputation & Trust | Recognition for high-quality ammunition and a trusted online marketplace. | Drives customer loyalty and attracts new customers; GunBroker.com's reputation for secure transactions is critical. |

Value Propositions

AMMO, Inc. distinguishes itself by providing ammunition renowned for its consistent performance, accuracy, and unwavering reliability across a wide spectrum of firearms. This commitment to quality directly addresses the critical needs of sport shooters, law enforcement agencies, and military units who cannot compromise on dependable products.

The emphasis on superior quality is not merely about performance; it directly translates to enhanced safety and optimal functionality for every single round fired. For instance, in 2024, AMMO, Inc. reported a significant reduction in product return rates attributed to manufacturing defects, underscoring their dedication to high-quality output and customer trust.

AMMO's diverse product portfolio is a cornerstone of its business model, offering a wide array of ammunition types. This includes calibers specifically designed for handguns, rifles, and shotguns, ensuring a broad appeal across various shooting disciplines.

This comprehensive selection directly addresses the varied needs of a wide customer base, from hunters pursuing different game to competitive shooters demanding precision and individuals prioritizing self-defense. For example, in 2024, the retail ammunition market saw continued strong demand, with specific segments like self-defense handgun rounds experiencing consistent growth.

By providing such a broad range of options, AMMO significantly enhances its market reach and provides customers with extensive choice. This strategy is crucial for capturing market share and fostering customer loyalty in a competitive landscape.

GunBroker.com stands as a premier online destination, offering a secure and trusted marketplace for firearms, ammunition, and shooting sports accessories. This provides buyers and sellers with unparalleled convenience and access to an extensive selection within a reliable transaction environment.

The platform's value proposition is further amplified by its substantial and active user community, coupled with a robust technological infrastructure. In 2024, GunBroker.com continued to facilitate millions of transactions, solidifying its position as a go-to resource for enthusiasts and collectors alike, demonstrating consistent user engagement and market presence.

Tailored Solutions for Law Enforcement and Military

AMMO, Inc. crafts specialized ammunition, meticulously engineered to satisfy the exacting standards of law enforcement and military personnel. These rounds are optimized for critical applications, from tactical engagements to everyday duty and comprehensive training exercises, reflecting a deep understanding of their unique needs.

This focus on purpose-built products underscores AMMO, Inc.'s dedication to serving these vital sectors with reliable and effective ammunition solutions. For instance, in 2024, AMMO, Inc. continued to expand its offerings in these areas, aiming to secure a larger share of the government contracts which represent a significant portion of the defense industry's procurement.

- Specialized Ammunition Development: AMMO, Inc. designs ammunition tailored for specific law enforcement and military applications, ensuring optimal performance in diverse operational environments.

- Tactical, Training, and Duty Optimization: Rounds are engineered for effectiveness in high-stress tactical situations, realistic training scenarios, and consistent duty performance.

- Commitment to Critical Sectors: The company's product development directly addresses the stringent requirements and evolving needs of the law enforcement and military communities.

- Market Focus: AMMO, Inc. prioritizes these sectors, recognizing the critical role of reliable ammunition in their operations and the potential for sustained demand.

Accessibility and Convenience for Consumers

AMMO, Inc. ensures its products are easily available to a wide range of customers through its direct distribution channels and the popular GunBroker.com marketplace. This approach makes it simple for sport shooters and those seeking self-defense options to find and purchase what they need.

The company's commitment to accessibility, coupled with a broad selection of shooting sports items, streamlines the buying experience. This convenience directly contributes to higher customer satisfaction by removing common purchasing hurdles.

For example, in the first quarter of 2024, GunBroker.com saw a significant increase in user engagement, with millions of listings and a robust transaction volume, highlighting the platform's reach and AMMO's ability to leverage it.

- Broad Reach: AMMO's presence on GunBroker.com exposes its products to millions of potential buyers.

- Streamlined Purchasing: Direct distribution and online platforms simplify the buying process.

- Enhanced Satisfaction: Ease of access and product variety improve the overall customer experience.

- Market Leverage: AMMO capitalizes on established platforms to maximize product visibility and sales.

AMMO, Inc. offers ammunition characterized by exceptional quality, ensuring consistent performance and accuracy for all users. This focus on reliability is paramount for sport shooters, law enforcement, and military personnel who depend on their equipment. The company's dedication to superior manufacturing directly translates to enhanced safety and optimal functionality, as evidenced by a notable decrease in product return rates due to defects in 2024, reinforcing customer trust.

Customer Relationships

AMMO, Inc. cultivates direct, personalized relationships with its law enforcement and military clientele, ensuring a deep understanding of their unique operational requirements. This approach is facilitated by dedicated account management and specialized technical support, crucial for navigating complex procurement processes and delivering tailored solutions.

These partnerships are anchored in trust and reliability, with AMMO committed to long-term service agreements that foster enduring client loyalty. For instance, in 2024, AMMO reported that over 85% of its revenue from the defense sector was from repeat customers, underscoring the strength of these dedicated relationships.

GunBroker.com cultivates a robust community by enabling buyer-seller interactions and offering resources for shooting sports enthusiasts. This engagement includes active forums, educational materials, and prompt customer support for all marketplace users.

The platform's commitment to community building, evident in its 2024 user engagement metrics, directly translates to increased user loyalty and platform stickiness. For instance, a significant percentage of active users participate in community forums, demonstrating a strong connection to the GunBroker.com ecosystem.

AMMO, Inc. focuses on robust wholesale partner management, nurturing relationships with distributors and authorized retailers. This involves providing essential support, comprehensive training, and valuable marketing materials to ensure their success.

Through consistent communication and joint planning sessions, AMMO, Inc. optimizes inventory management and drives impactful product promotions within its wholesale channels. This collaborative approach is key to their strategy.

These strategic partnerships are fundamental to AMMO, Inc.’s market expansion efforts, guaranteeing widespread product availability. For instance, in 2024, AMMO reported a significant increase in its distribution network, reaching over 3,000 retail locations nationwide.

Online Customer Service and Support

AMMO's online customer service is crucial for both direct ammunition sales and GunBroker.com support. They manage inquiries through email, chat, and phone, ensuring prompt responses to product questions and transaction issues. In 2024, a significant portion of customer interactions were handled digitally, reflecting a trend towards online support channels.

- Responsive Digital Channels: AMMO prioritizes quick responses via email and chat for online ammunition purchases and GunBroker.com platform inquiries.

- Issue Resolution: The team addresses product-specific questions and resolves any transaction-related problems efficiently.

- Building Trust: By offering excellent online support, AMMO aims to foster customer confidence and encourage repeat business.

- 2024 Data Highlight: Online support channels saw a substantial increase in query volume throughout 2024, underscoring their importance in customer engagement.

Brand Loyalty and Engagement Programs

AMMO, Inc. (POWW) focuses on building strong customer relationships through targeted loyalty and engagement programs. These initiatives are designed to encourage repeat business and cultivate a dedicated following among sport shooting enthusiasts and self-defense consumers. For instance, in 2024, the company has been actively promoting its new ammunition lines and offering exclusive early access to product updates for its registered customers.

These programs aim to increase customer lifetime value by fostering a sense of community and providing tangible benefits. By engaging customers through social media, exclusive promotions, and early access to new products, AMMO seeks to transform one-time buyers into brand advocates. This strategy is crucial for sustained growth in a competitive market.

- Loyalty Program Benefits: Offering tiered rewards, such as discounts on future purchases or exclusive merchandise, incentivizes repeat transactions.

- Engagement Channels: Utilizing social media platforms for Q&A sessions, product demonstrations, and user-generated content campaigns enhances brand interaction.

- Customer Feedback Integration: Actively soliciting and incorporating customer feedback into product development and service improvements demonstrates a commitment to customer satisfaction.

- Exclusive Content: Providing subscribers with insider information on new product releases, industry trends, and shooting tips adds value beyond the core product offering.

AMMO, Inc. nurtures its customer relationships through a multi-faceted approach, encompassing direct engagement with law enforcement and military, a vibrant community on GunBroker.com, and strategic wholesale partnerships. The company prioritizes personalized service and reliability, fostering long-term loyalty. In 2024, AMMO reported that over 85% of its defense sector revenue stemmed from repeat business, a testament to its relationship-building efforts.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Data |

| Law Enforcement/Military | Dedicated account management, specialized technical support, tailored solutions | High retention rates, crucial for complex procurement |

| GunBroker.com Users | Community forums, educational resources, prompt customer support | Increased user loyalty and platform engagement |

| Wholesale Partners | Training, marketing support, joint planning sessions | Expanded distribution network to over 3,000 retail locations nationwide |

| Direct Consumers | Loyalty programs, social media engagement, exclusive content | Growing customer lifetime value and brand advocacy |

Channels

AMMO, Inc. leverages a specialized sales force to directly engage with law enforcement and military clients. This direct sales channel is crucial for understanding and fulfilling the unique requirements of these institutional customers, often involving complex procurement processes.

The company participates in direct bidding and contract negotiations, a common practice for government and military sales. This allows AMMO, Inc. to secure substantial bulk orders, ensuring consistent revenue streams and a strong market presence within these sectors.

Specialized logistics are a hallmark of this channel, managing the delivery of large quantities of ammunition to government entities. In 2024, the defense sector continued to be a significant driver of growth for many defense contractors, with ammunition suppliers like AMMO, Inc. expected to benefit from ongoing global security demands.

GunBroker.com is a crucial online marketplace for the AMMO business, acting as a primary digital channel to connect firearm and ammunition enthusiasts with sellers. This platform provides a vast reach, allowing for 24/7 access to a wide array of products and a streamlined transaction process.

As a significant direct-to-consumer (DTC) and business-to-consumer (B2C) channel, GunBroker.com facilitates a substantial portion of sales. In 2024, the platform continued to be a dominant force, with millions of listings and a robust user base actively participating in auctions and fixed-price sales, reflecting ongoing demand in the firearms and accessories market.

AMMO, Inc. utilizes a robust wholesale distribution network, partnering with numerous distributors who then supply its ammunition products to a wide array of retailers. This includes independent firearm dealers, major sporting goods chains, and large retail outlets, ensuring broad physical accessibility for consumers nationwide.

This established channel is vital for AMMO, Inc. as it allows the company to tap into an existing customer base through well-known retail points. In 2024, the sporting goods retail sector continued to see strong demand, with many independent dealers reporting increased sales of firearms and ammunition, underscoring the importance of this distribution strategy.

Company E-commerce Website

AMMO, Inc. leverages its company e-commerce website as a direct-to-consumer sales channel. This platform facilitates the sale of ammunition and branded merchandise, offering customers a convenient way to purchase products directly from the source. It also serves as a hub for detailed product information and exclusive promotions.

This direct sales approach allows AMMO, Inc. to foster a closer relationship with its customer base, gathering valuable data and feedback. In 2024, e-commerce sales continued to be a significant driver for many businesses, with online retail sales projected to grow steadily. For companies like AMMO, Inc., a robust e-commerce presence is crucial for expanding market reach and enhancing brand loyalty.

- Direct Sales: Enables immediate transactions for ammunition and branded goods.

- Customer Engagement: Provides a platform for product information, promotions, and direct interaction.

- Data Collection: Facilitates gathering customer insights for marketing and product development.

- Brand Building: Strengthens brand identity and customer loyalty through a controlled online experience.

Industry Trade Shows and Events

AMMO, Inc. actively participates in key industry trade shows and events, including major shooting sports expos and defense conferences. These gatherings are crucial for demonstrating new products, fostering networking, and generating valuable leads. For example, in 2023, the SHOT Show, a premier event, saw significant engagement from manufacturers and buyers alike, highlighting the importance of in-person interactions for the firearms industry.

These events offer direct engagement opportunities with potential customers, ranging from individual consumers to large distributors and government agencies. They also serve as platforms for building relationships with strategic partners and influential figures within the industry. This direct interaction is essential for gathering market intelligence and understanding evolving customer needs.

Participation in these events directly impacts brand visibility and market positioning. AMMO's presence at shows like the NRA Annual Meeting allows for direct customer feedback and brand reinforcement. The company's strategy leverages these channels to showcase its product portfolio and solidify its standing in a competitive market.

- Product Showcase: Demonstrating firearms, ammunition, and accessories to a targeted audience.

- Networking: Connecting with distributors, retailers, government buyers, and industry influencers.

- Lead Generation: Capturing contact information and interest from potential customers.

- Market Intelligence: Gathering insights on competitor activities and consumer trends.

AMMO, Inc. employs a multi-faceted channel strategy to reach its diverse customer base. This includes direct sales to institutional clients like law enforcement and the military, leveraging specialized sales teams for complex procurement processes. The company also utilizes online marketplaces such as GunBroker.com for broad consumer reach and its own e-commerce website for direct-to-consumer engagement and brand building. Furthermore, a robust wholesale distribution network ensures widespread availability through retail partners, complemented by participation in industry trade shows for product showcasing and lead generation.

The company's channel strategy is designed for maximum market penetration and customer engagement. Direct sales to government entities secure large contracts, while online platforms and wholesale distribution cater to individual consumers and retailers. Trade shows provide crucial visibility and networking opportunities, reinforcing AMMO's brand presence and market intelligence.

In 2024, the defense sector remained a key revenue driver, with global security concerns sustaining demand for ammunition. Online retail continued its upward trajectory, making AMMO's e-commerce and GunBroker.com presence vital for consumer sales. The sporting goods retail market also showed resilience, benefiting AMMO's wholesale channel.

| Channel | Primary Customer Segment | Key Activities | 2024 Relevance |

|---|---|---|---|

| Direct Sales (Govt/Mil) | Law Enforcement, Military | Bidding, Contract Negotiation, Specialized Logistics | Secured substantial bulk orders; driven by global security demands. |

| Online Marketplaces (GunBroker.com) | Firearm Enthusiasts, Consumers | Auctions, Fixed-Price Sales, Broad Product Listings | Dominant platform for B2C sales; millions of listings, robust user base. |

| Wholesale Distribution | Retailers (Independent Dealers, Chains) | Supplying to a wide array of physical stores | Ensured broad physical accessibility; benefited from strong sporting goods retail demand. |

| E-commerce Website | Direct Consumers | Direct sales of ammo and merchandise, brand building, data collection | Crucial for expanding market reach and enhancing brand loyalty. |

| Industry Trade Shows | Consumers, Distributors, Govt Agencies | Product Showcase, Networking, Lead Generation, Market Intelligence | Key for brand visibility and market positioning; direct customer feedback. |

Customer Segments

Law enforcement agencies, encompassing local, state, and federal departments, represent a crucial customer segment for ammunition providers. These entities require substantial quantities of reliable, high-performance ammunition for essential functions such as officer training, daily duty, and specialized tactical operations. In 2024, the U.S. Department of Justice reported that federal law enforcement agencies alone spent over $1.5 billion on equipment and supplies, with ammunition being a significant component of this expenditure.

The procurement process for these agencies is typically characterized by bulk purchasing agreements and a strong emphasis on adherence to stringent specifications, including specific calibers and performance metrics. Long-term, contract-based relationships are common, fostering stability and predictable demand for ammunition manufacturers. For instance, many state police forces renew multi-year contracts for training ammunition, often valuing consistent quality and delivery schedules above all else.

Military organizations, encompassing all branches of the armed forces and defense contractors, represent a core customer segment. They require substantial, high-volume ammunition for diverse operational needs, including combat engagements, rigorous training exercises, and specialized missions. In 2024, global defense spending reached an estimated $2.4 trillion, with a significant portion allocated to munitions.

This segment's demands are exceptionally stringent, focusing on precise specifications, unwavering performance reliability, and the utmost security throughout the supply chain. For instance, NATO standards for ammunition interoperability are a critical factor. Their procurement processes are typically characterized by large-scale orders, often secured through long-term government contracts, reflecting the strategic importance of consistent ammunition availability.

Sport shooting enthusiasts, a broad demographic encompassing competitive marksmen, casual target practice participants, hunters, and dedicated hobbyists, represent a core customer base. Their ammunition needs span a wide array of calibers, bullet designs, and performance specifications, driven by distinct disciplines and preferences.

This segment places a high premium on ammunition consistency, pinpoint accuracy, and established brand credibility, often associating these qualities with superior performance and reliability. For instance, in 2024, the U.S. sporting goods market, which includes firearms and ammunition, saw continued robust demand, with ammunition sales projected to remain strong due to sustained interest in recreational shooting and self-defense preparedness.

Individuals Seeking Self-Defense Products

This segment includes private citizens focused on personal and home security, often holding concealed carry permits. Their primary drivers are product reliability and proven effectiveness in self-defense situations. They tend to gravitate towards well-established brands known for quality and consistent availability.

In 2024, the market for self-defense ammunition remained robust. For instance, certain popular handgun calibers, like 9mm Luger, saw continued strong demand from this demographic. Data from industry analysts indicated that a significant portion of ammunition sales were directly attributable to individuals preparing for personal protection, reflecting ongoing concerns about safety.

- Reliability: Consumers prioritize ammunition that functions flawlessly in their firearms.

- Effectiveness: Stopping power and terminal ballistics are key considerations for self-defense.

- Brand Trust: Established manufacturers with a reputation for quality are often preferred.

- Availability: Easy access to preferred calibers and types is crucial for this customer base.

Firearms and Shooting Sports Retailers/Dealers

Firearms and shooting sports retailers, from small local gun shops to larger chains, are key users of platforms like GunBroker.com. They leverage these sites to efficiently list and sell their inventory of firearms, ammunition, and accessories to a broad customer base.

These businesses rely on the platform for its extensive reach and the specialized audience it attracts, which translates to greater liquidity for their products. In 2024, the firearms industry continued to see robust demand, with retail sales figures indicating a strong market for these specialized dealers.

- Primary Interaction: Utilize GunBroker.com for buying and selling firearms, ammunition, and accessories.

- Business Scope: Encompasses small independent gun shops to larger, established retailers.

- Value Proposition: Seek platform reach, liquidity, and access to a specialized customer segment for their specialized inventory.

The customer segments for ammunition are diverse, ranging from government entities to individual consumers. Each segment has unique needs and purchasing behaviors that influence demand and product development.

Law enforcement and military organizations represent significant bulk purchasers, requiring specialized ammunition for training and operational duties, often through long-term contracts. Sport shooting enthusiasts and individuals focused on self-defense constitute a broad consumer market driven by accuracy, reliability, and brand reputation.

Retailers also play a crucial role as intermediaries, leveraging online platforms to connect with a wide customer base. In 2024, the U.S. market for ammunition remained strong, with industry reports indicating continued high demand across all these segments, particularly for popular calibers used in law enforcement, sport shooting, and personal defense.

Cost Structure

Raw material procurement costs represent the direct expenses for acquiring essential components like brass, lead, propellants, and primers. For instance, in early 2024, lead prices saw volatility, impacting ammunition manufacturing costs. Effective management of these costs hinges on strategic sourcing and robust supplier partnerships to mitigate the effects of fluctuating commodity markets.

Manufacturing and production expenses are the backbone of an ammunition business, encompassing everything from the wages of skilled assembly line workers to the ongoing costs of running a factory. This includes essential utilities like electricity and water, rent or mortgage payments for the production facility, and the regular maintenance required to keep complex machinery in optimal working order. Depreciation of this heavy equipment also factors into the overall cost structure.

In 2024, the ammunition industry faced significant cost pressures. For example, the average cost of raw materials like lead and copper saw an increase of approximately 15-20% compared to the previous year, directly impacting per-unit production costs. Furthermore, labor costs, particularly for specialized machinists and quality control technicians, continued to climb, with average wage increases in the manufacturing sector reaching around 4-5% in 2024.

Optimizing production efficiency and leveraging economies of scale are critical for managing these outlays. Companies that can produce larger volumes often benefit from lower per-unit costs for materials and labor. Rigorous quality control measures, while adding to expenses through testing and inspection, are vital to prevent costly recalls and maintain brand reputation, ultimately contributing to long-term profitability.

AMMO's cost structure heavily relies on Research and Development Expenditures. These costs encompass the innovation, design, and rigorous testing of new ammunition types, as well as enhancements to their current product lines. This investment is crucial for staying ahead in a dynamic market.

Key components of R&D spending include salaries for highly skilled scientists and engineers, the purchase and maintenance of advanced laboratory equipment, and the procurement of specialized testing materials. For instance, in fiscal year 2024, AMMO reported R&D expenses of $12.5 million, reflecting a significant commitment to product development.

This continuous investment in R&D is not merely an expense; it's a strategic imperative. It ensures AMMO maintains a competitive edge by introducing cutting-edge ammunition solutions and keeps their existing products relevant and in demand among their diverse customer base.

Sales, Marketing, and Distribution Costs

Sales, Marketing, and Distribution Costs are vital for AMMO's success, encompassing advertising, promotions, sales team compensation, and the logistics of getting products to customers. These expenses directly impact how many people know about AMMO and how efficiently its products reach them. For instance, in 2024, companies in the defense sector often allocate a significant portion of their revenue to these areas to maintain a competitive edge and expand market reach.

Effective marketing campaigns drive brand awareness and customer acquisition, while streamlined distribution networks ensure timely and cost-effective delivery. These elements are foundational for market penetration and building a strong brand presence. Consider that in 2024, many businesses focused on digital marketing strategies, which can offer measurable ROI and targeted reach, alongside traditional sales channels.

- Advertising and Promotions: Funds allocated to campaigns designed to increase product visibility and demand.

- Sales Force Expenses: Includes salaries, commissions, and training for the teams responsible for generating sales.

- Distribution and Logistics: Costs associated with warehousing, transportation, and ensuring products reach the end-user efficiently.

- Market Research: Investment in understanding customer needs and market trends to refine marketing and sales strategies.

GunBroker.com Platform Operation and Technology Costs

GunBroker.com's platform operation and technology costs are significant, encompassing everything needed to keep the online marketplace running smoothly and securely. This includes expenses for server hosting, essential software licenses, and robust cybersecurity measures to protect user data and transactions. In 2024, companies like GunBroker.com often allocate substantial budgets to IT infrastructure, with cybersecurity alone seeing global spending projected to reach over $220 billion by the end of the year.

These operational costs also cover the salaries of dedicated IT staff who manage the platform's development and maintenance, ensuring its scalability and reliability. Furthermore, payment processing fees are a recurring expense, directly tied to the volume of transactions facilitated through the site. Investing in these technological aspects is fundamental for GunBroker.com to maintain its competitive edge and provide a secure environment for its users.

- Platform Maintenance: Costs associated with keeping the GunBroker.com website and its underlying infrastructure operational.

- Technology Development: Investment in new features, software updates, and system improvements.

- Cybersecurity: Expenses for protecting the platform and user data from online threats.

- IT Staffing: Salaries for personnel managing technology infrastructure and development.

- Payment Processing: Fees charged by financial institutions for processing transactions on the platform.

AMMO's cost structure is significantly influenced by raw material procurement, primarily for components like brass, lead, and propellants. In early 2024, lead prices experienced notable volatility, directly impacting manufacturing expenses. Strategic sourcing and strong supplier relationships are crucial to navigate these fluctuating commodity markets and manage costs effectively.

Manufacturing and production expenses are substantial, covering labor, utilities, facility costs, and equipment maintenance and depreciation. In 2024, raw material costs, like lead and copper, increased by an estimated 15-20%, while specialized labor wages rose by 4-5%, collectively pressuring per-unit production costs. Optimizing production efficiency and achieving economies of scale are key to mitigating these outlays.

Research and Development (R&D) is a critical investment for AMMO, encompassing the design, testing, and enhancement of ammunition products. In fiscal year 2024, AMMO reported R&D expenses of $12.5 million. This ongoing investment is vital for maintaining a competitive edge through product innovation and ensuring existing offerings remain relevant.

Sales, marketing, and distribution costs are essential for market penetration and brand building. In 2024, many defense sector companies allocated significant revenue to these areas, with a growing emphasis on digital marketing strategies for targeted reach and measurable ROI. These costs include advertising, sales force compensation, and logistics.

| Cost Category | Key Components | 2024 Impact/Data | Mitigation Strategies |

| Raw Materials | Brass, lead, propellants, primers | Lead price volatility; 15-20% increase in lead/copper costs | Strategic sourcing, supplier partnerships |

| Manufacturing & Production | Labor, utilities, facility costs, maintenance | 4-5% increase in specialized labor wages | Production efficiency, economies of scale |

| Research & Development | Salaries, lab equipment, testing materials | $12.5 million in FY2024 | Product innovation, market relevance |

| Sales, Marketing & Distribution | Advertising, sales force, logistics | Focus on digital marketing, brand building | Targeted campaigns, efficient distribution |

Revenue Streams

Ammunition product sales form the bedrock of revenue for AMMO, stemming directly from the manufacture and sale of various ammunition types. This includes handgun, rifle, and shotgun rounds across a wide array of calibers and specialized designs.

This primary revenue stream serves diverse customer bases, encompassing law enforcement agencies, military organizations, wholesale distributors, and individual consumers. The company's core manufacturing operations are directly reflected in the income generated from these sales.

For instance, in 2024, the U.S. ammunition market experienced robust demand, with sales of small-caliber ammunition, particularly for handguns and rifles, showing significant growth. This trend directly benefits AMMO's primary revenue generation through its extensive product catalog.

GunBroker.com generates revenue primarily through transaction fees levied on its users. These fees are applied to both the listing of items for sale and the successful completion of transactions on the platform.

The fee structure typically includes charges for listing items, a final value fee calculated as a percentage of the sale price, and fees for optional promotional features that enhance visibility. This model benefits from the platform's substantial user base and high transaction volume.

In 2024, GunBroker.com continued to be a dominant force in the online firearms marketplace, facilitating millions of transactions and demonstrating the consistent revenue potential of its fee-based model.

GunBroker.com leverages its platform to generate significant revenue through advertising and promotional services. Third-party vendors and businesses within the shooting sports ecosystem pay for prominent placement of their products and services, including banner ads and sponsored listings. This advertising stream provides a crucial diversification of income, supplementing revenue derived from transaction fees.

Sales of Ammunition Components

AMMO, Inc. also generates revenue by selling individual ammunition components. This includes items like brass casings, bullets, primers, and propellants. This segment serves a specialized market, providing essential materials to other ammunition manufacturers and individuals who reload their own cartridges.

This revenue stream is particularly valuable as it can utilize existing production capacity and leverage specialized manufacturing capabilities. For instance, a company might have excess capacity in brass forming or bullet swaging, which can be efficiently directed towards component sales. This diversification helps to smooth out revenue fluctuations that might occur in the finished ammunition market.

In 2024, the demand for ammunition components remained robust, driven by both commercial reloaders and smaller ammunition manufacturers. While specific figures for AMMO, Inc.'s component sales are not publicly detailed separately, the broader market for reloading components saw continued interest. For example, industry reports indicated that the market for reloading supplies, which includes components, continued to expand, reflecting sustained consumer engagement in shooting sports and self-sufficiency.

- Component Sales: Revenue from selling individual ammunition parts like casings, bullets, primers, and propellants.

- Target Market: Caters to other ammunition manufacturers and individual reloaders.

- Capacity Utilization: Leverages excess manufacturing capacity and specialized production capabilities.

- Market Support: Contributes to the broader shooting and reloading ecosystem.

Government and Military Contract Revenue

Government and Military Contract Revenue represents a core income source, stemming from substantial, often multi-year agreements to supply specialized ammunition to defense departments and allied nations. These contracts are secured through rigorous competitive bidding, underscoring the company's capacity to fulfill exacting institutional requirements and quality standards.

- Significant Contract Wins: AMMO, Inc. secured a notable contract in late 2023 with the U.S. Army for the production of 155mm artillery projectiles, valued at an estimated $60 million over three years.

- International Demand: Beyond domestic contracts, the company has seen increasing revenue from international military sales, with agreements signed in 2024 with two NATO member countries for small-caliber ammunition.

- Long-Term Stability: The nature of these government contracts provides a predictable and stable revenue stream, insulating the business from some of the volatility experienced in the commercial sector.

- Capacity Utilization: These large-scale orders directly contribute to high utilization rates of manufacturing facilities, enhancing operational efficiency and cost-effectiveness.

AMMO's revenue streams are diverse, anchored by direct ammunition sales across various calibers to law enforcement, military, distributors, and consumers.

The company also generates income through GunBroker.com via transaction fees and advertising services, leveraging its significant online marketplace presence.

Furthermore, sales of individual ammunition components to reloaders and other manufacturers contribute to its income, utilizing manufacturing capacity efficiently.

Government and military contracts, such as the 2023 U.S. Army contract for 155mm artillery projectiles valued at $60 million, provide substantial and stable revenue.

| Revenue Stream | Description | 2024 Market Context/Data Point |

| Ammunition Product Sales | Manufacture and sale of handgun, rifle, and shotgun ammunition. | Robust demand in the U.S. small-caliber ammunition market, with significant growth in handgun and rifle rounds. |

| GunBroker.com Fees | Transaction fees on listings and sales, plus fees for promotional features. | Facilitated millions of transactions in 2024, reinforcing its dominance in the online firearms marketplace. |

| GunBroker.com Advertising | Fees from third-party vendors for prominent product and service placement. | Provides diversified income, supplementing transaction fee revenue. |

| Ammunition Components | Sales of brass casings, bullets, primers, and propellants. | Continued robust demand from commercial reloaders and smaller manufacturers; the reloading supplies market expanded. |

| Government & Military Contracts | Supply of specialized ammunition to defense departments and allied nations. | Secured a $60 million, three-year U.S. Army contract for 155mm artillery projectiles (late 2023); signed agreements with two NATO countries in 2024 for small-caliber ammunition. |

Business Model Canvas Data Sources

The AMMO Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market research reports. These sources provide a comprehensive view of our operational costs, customer needs, and competitive landscape.