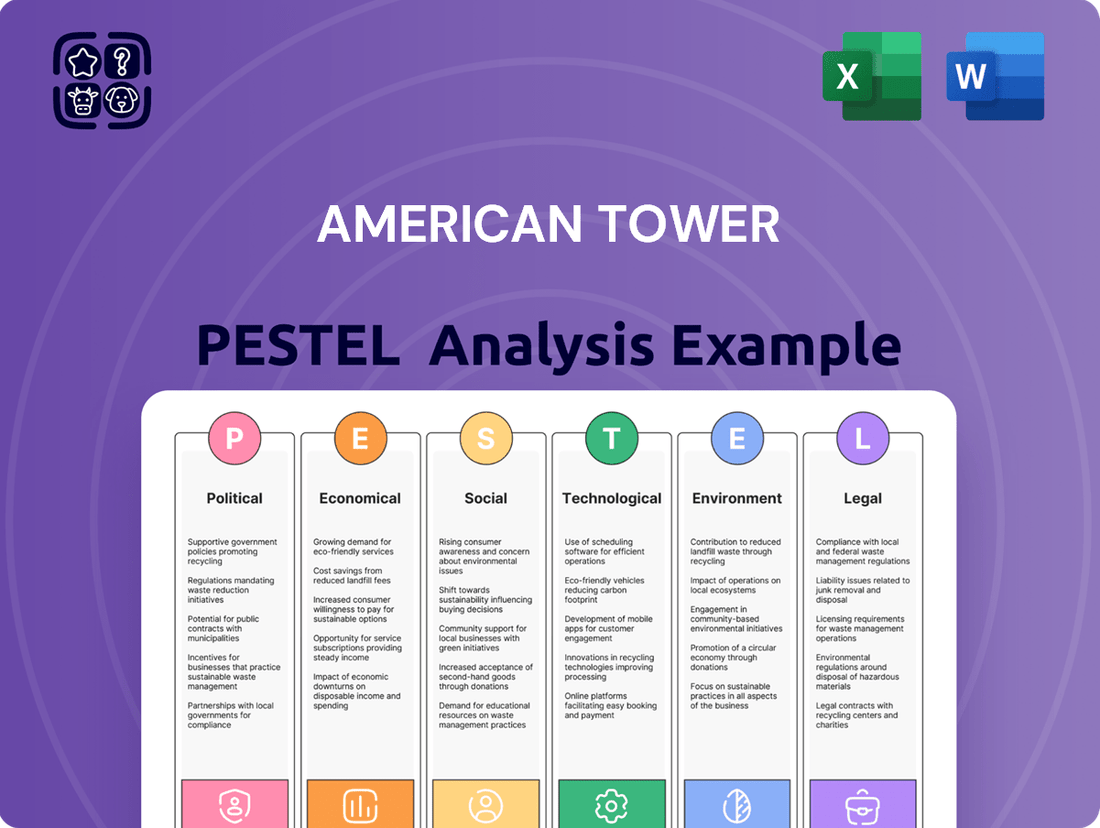

American Tower PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tower Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting American Tower's strategic direction. Our PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence to inform your investment decisions. Download the full report now to gain a competitive edge.

Political factors

Government policies and regulations, especially those surrounding spectrum allocation and infrastructure sharing, significantly shape American Tower's operational landscape. Shifts in these regulatory frameworks can directly affect the demand for tower space and the overall profitability of lease agreements.

The continued expansion of 5G networks, and the anticipated development of future 6G technologies, are intrinsically linked to the spectrum licenses granted by governments. For instance, the FCC's continued efforts to auction and allocate mid-band spectrum for 5G in the US, a key market for American Tower, directly influences the need for new tower deployments and upgrades.

American Tower's status as a global REIT means its operations are intrinsically linked to international relations and trade policies. Geopolitical shifts, trade disputes, or evolving foreign investment rules can directly influence its ability to expand and perform financially across its diverse markets. For instance, in 2023, the company's reported foreign currency headwinds led to a significant impact on its net income, highlighting the sensitivity of its global revenue streams to exchange rate volatility.

Public sentiment surrounding wireless technology, particularly concerning potential health effects from 5G, directly impacts regulatory approvals and community acceptance of new tower infrastructure. Concerns, whether fueled by misinformation or emerging scientific research, can galvanize opposition, potentially hindering American Tower's expansion plans and affecting deployment timelines.

Infrastructure Investment Policies

Government initiatives and funding for digital infrastructure, particularly in underserved rural areas, present substantial growth avenues for American Tower. Policies focused on closing the digital divide and improving nationwide connectivity directly boost the need for new and enhanced communication towers. For instance, the US government's $65 billion Broadband Equity, Access, and Deployment (BEAD) program, initiated in 2021 and with funds expected to be disbursed through 2026, aims to expand broadband access, a key driver for tower deployment and expansion. This policy directly supports American Tower's business model by creating demand for its physical infrastructure.

- BEAD Program Funding: The $65 billion allocated to the BEAD program is a significant government investment in expanding broadband infrastructure, directly benefiting tower companies like American Tower.

- Digital Divide Initiatives: Policies targeting rural and underserved areas increase the necessity for robust wireless networks, driving demand for tower leasing and construction.

- Infrastructure Investment and Jobs Act (IIJA): This act, passed in 2021, includes substantial funding for broadband deployment, further bolstering opportunities for tower infrastructure development.

Political Stability in Operating Regions

American Tower operates across numerous countries, making political stability a critical factor. Unstable political environments can disrupt network operations, affect customer spending on telecom services, and lead to sudden regulatory shifts. The company has actively managed this by strategically exiting or reducing its presence in markets with high political and regulatory uncertainty, focusing on regions offering more predictable operating conditions.

For instance, in 2023, American Tower continued its portfolio optimization, which included divestitures in markets perceived as having higher political risk. While specific numbers for political risk mitigation are not directly reported, the company's strategy reflects a proactive approach to safeguarding its assets and revenue streams. This focus on stability is crucial for long-term investment and growth.

- Geographic Diversification: American Tower's presence in over 20 countries across the Americas, Africa, Asia, and Europe exposes it to a wide range of political landscapes.

- Regulatory Environment: Changes in government policies, taxation, and licensing can significantly impact profitability and operational freedom in any given market.

- Asset Protection: Political instability can increase the risk of asset expropriation or forced sales, necessitating careful risk assessment before and during operations in a region.

- Strategic Divestments: The company has demonstrated a willingness to divest assets in markets where political or regulatory risks are deemed too high, as seen in its strategic adjustments in recent years.

Government policies directly influence American Tower's growth through spectrum allocation for 5G and future technologies, with the FCC's mid-band spectrum auctions in the US being a prime example. Furthermore, government funding initiatives like the US Broadband Equity, Access, and Deployment (BEAD) program, with its $65 billion allocated through 2026, actively drive demand for tower infrastructure, particularly in underserved areas. Political stability across its global markets, spanning over 20 countries, is also paramount, as demonstrated by American Tower's strategic portfolio adjustments to mitigate risks in regions with higher political uncertainty.

| Factor | Impact on American Tower | 2024/2025 Data/Trend |

| Spectrum Allocation | Enables 5G/6G deployment, increasing tower demand. | Continued FCC auctions and global spectrum planning for advanced wireless technologies. |

| Digital Infrastructure Funding | Drives new tower builds and upgrades, especially in rural areas. | Ongoing disbursement of funds from programs like the US BEAD program. |

| Political Stability & Regulation | Affects operational continuity, investment climate, and asset security. | Strategic portfolio management to reduce exposure to high-risk political environments. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting American Tower, detailing how political, economic, social, technological, environmental, and legal forces present both opportunities and challenges.

It provides actionable insights for strategic decision-making, helping stakeholders navigate the complex landscape of the telecommunications infrastructure industry.

A PESTLE analysis for American Tower, presented in a clear, summarized format, alleviates the pain of sifting through complex data, enabling rapid understanding of external factors impacting their global operations.

Economic factors

American Tower's financial health is intrinsically linked to the broader global economic climate. A slowdown in worldwide economic growth directly impacts wireless carriers' ability to invest, potentially curbing their spending on tower leases and new infrastructure, which are American Tower's primary revenue streams.

While the ongoing 5G deployment offers a degree of insulation by driving demand for network upgrades, a significant global recession could still force carriers to adopt more conservative capital expenditure strategies. For instance, the International Monetary Fund (IMF) projected global growth to be 3.1% in 2024, a slight slowdown from previous years, indicating a cautious outlook that could influence tenant spending.

As a Real Estate Investment Trust (REIT), American Tower's financial health is closely tied to the prevailing interest rate environment. Higher interest rates directly translate to increased borrowing costs, which can squeeze profit margins and make new infrastructure development projects more expensive. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, bringing the federal funds rate from near zero to over 5%, significantly impacted the cost of capital for companies like American Tower.

To mitigate this risk, American Tower has proactively managed its debt structure. A key strategy has been reducing its exposure to floating-rate debt, which is more susceptible to immediate increases in interest rates. By refinancing and issuing more fixed-rate debt, the company aims to create a more predictable and stable cost of borrowing, thereby insulating its balance sheet from the sharp swings often seen in short-term interest rates.

Wireless carriers' spending on network infrastructure directly impacts American Tower's business. The ongoing 5G rollout has been a significant revenue driver, with carriers investing heavily in new equipment and site upgrades. However, as the initial 5G deployment matures in some markets, the pace of new tower construction may slow.

Looking ahead, American Tower's growth will likely be fueled by the need for network densification to improve 5G performance and the eventual development of 6G technology. For instance, in 2024, major carriers like Verizon and AT&T continued significant 5G capital expenditures, though the focus is shifting from broad coverage to deeper penetration and capacity enhancements.

Foreign Currency Exchange Rate Fluctuations

Foreign currency exchange rate fluctuations present a significant risk for American Tower, as a substantial portion of its revenue is generated from international markets. For instance, in the first quarter of 2024, approximately 70% of American Tower's consolidated revenue was derived from its operations outside the United States. This geographic diversification, while beneficial, exposes the company to the volatility of global currencies.

Unfavorable movements in exchange rates can directly impact American Tower's reported financial results. Even if the underlying business performance in local currencies remains strong, a strengthening U.S. dollar against those operating currencies can lead to a reduction in reported net income and earnings per share when translated back into U.S. dollars. This was evident in their 2023 full-year results, where foreign currency headwinds reduced reported revenue by approximately $200 million compared to the prior year.

- Revenue Exposure: Over two-thirds of American Tower's revenue originates from international markets, making it susceptible to currency shifts.

- Impact on Net Income: Adverse currency movements can diminish reported profits, even with robust underlying operational growth.

- 2023 Impact: Foreign currency translation negatively impacted American Tower's 2023 reported revenue by roughly $200 million.

- Strategic Hedging: The company employs various hedging strategies to mitigate some of this currency risk, though complete elimination is not feasible.

Inflation and Operating Costs

Inflation directly influences American Tower's operating expenses, particularly for utilities, site upkeep, and employee compensation. While the company's contracts often include rent increases to counter inflation, persistent high inflation could still squeeze profit margins if these escalations don't fully cover rising costs.

For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2023, averaging around 4.1% year-over-year for the full year, impacting various input costs. Although American Tower's long-term contracts are designed with escalators, typically tied to inflation indices, the speed and magnitude of cost increases can still present a challenge.

- Energy Costs: Fluctuations in electricity prices, a significant operating expense for maintaining tower sites, can directly impact profitability.

- Labor Expenses: Wage inflation for skilled technicians and maintenance staff can increase the cost of delivering services.

- Maintenance and Repair: The cost of materials and services for routine and necessary repairs at tower locations are subject to inflationary pressures.

- Contract Escalators: While designed to mitigate inflation, the effectiveness depends on the specific index used and the gap between contractually allowed increases and actual cost hikes.

Economic growth directly influences wireless carriers' capital expenditures, impacting American Tower's leasing revenue. The IMF projected 3.1% global growth for 2024, a slight slowdown that could temper carrier spending on network upgrades. Higher interest rates, exemplified by the Federal Reserve's rate hikes to over 5% in 2022-2023, increase borrowing costs for American Tower, affecting profitability and new development. Inflation, with the U.S. CPI averaging 4.1% in 2023, raises operating expenses like utilities and labor, though contract escalators offer some protection.

| Economic Factor | Impact on American Tower | Relevant Data (2023-2024) |

|---|---|---|

| Global Economic Growth | Affects carrier capital expenditure and demand for tower leases. | IMF projected 3.1% global growth in 2024. |

| Interest Rates | Increases borrowing costs and impacts new development financing. | Federal funds rate over 5% (post-2022/2023 hikes). |

| Inflation | Raises operating expenses (utilities, labor, maintenance). | U.S. CPI averaged 4.1% year-over-year in 2023. |

Preview Before You Purchase

American Tower PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of American Tower covers all critical external factors impacting its business, from political stability and economic trends to technological advancements and environmental regulations. Gain actionable insights into the opportunities and threats shaping the telecommunications infrastructure sector.

Sociological factors

The insatiable appetite for mobile data is a cornerstone of American Tower's growth. In 2024, global mobile data traffic was projected to reach over 1,400 exabytes, a significant leap from previous years, underscoring the increasing reliance on wireless connectivity for everything from communication to entertainment and business operations.

This escalating demand directly translates into a need for more extensive and advanced network infrastructure. Billions of users worldwide are consuming more data, pushing mobile network operators to expand their coverage and capacity, which in turn drives demand for tower colocation and new site development, American Tower's core business.

The proliferation of data-intensive applications, such as high-definition video streaming, cloud gaming, and the Internet of Things (IoT), further intensifies this need. By 2025, it's estimated that over 75 billion IoT devices will be connected globally, all requiring robust wireless infrastructure to function, directly benefiting tower companies like American Tower.

Urbanization continues to drive demand for denser networks in cities, pushing American Tower to install more small cells and adapt existing tower infrastructure. This trend is evident as major metropolitan areas see continued population growth, requiring enhanced capacity to support data-intensive applications.

Concurrently, initiatives aimed at closing the digital divide are creating significant opportunities. The US government's commitment to rural broadband expansion, with billions allocated in programs like the Broadband Equity, Access, and Deployment (BEAD) program, directly fuels the need for new tower construction and coverage extensions in underserved areas.

The ongoing shift to remote work and digital lifestyles, a trend significantly amplified since 2020, has created an unprecedented demand for robust wireless infrastructure. This means more people are relying on consistent, high-speed internet access for work, education, and social connection, directly benefiting companies like American Tower that provide the essential cell towers and related infrastructure.

In 2024, it's estimated that over 30% of the U.S. workforce operates remotely at least part-time, a substantial increase from pre-pandemic levels. This sustained remote work model fuels the need for greater network capacity and coverage, directly translating into continued investment in and leasing of tower space by telecommunications companies.

Digital Literacy and Social Inclusion Initiatives

American Tower's Digital Communities Program is a prime example of how companies are addressing the growing societal need for digital inclusion. This initiative aims to equip millions with essential digital skills and access to related services, aligning with a broader trend toward greater digital equity across communities. These efforts not only bridge the digital divide but also bolster American Tower's brand image and foster stronger community ties.

The impact of such programs is significant. For instance, by 2024, over 70% of the global population is expected to be online, highlighting the critical need for digital literacy. Companies like American Tower are investing in these areas as a strategic component of their corporate social responsibility, recognizing that enhanced digital literacy can lead to improved economic opportunities and social participation for underserved populations. This focus on digital inclusion can translate into tangible benefits for the company, such as increased goodwill and a more engaged customer base in the markets they serve.

Key aspects of these initiatives include:

- Digital Literacy Training: Providing foundational skills for internet usage, online safety, and digital productivity.

- Access to Technology: Facilitating access to affordable internet and devices in underserved areas.

- Community Engagement: Partnering with local organizations to deliver tailored digital inclusion programs.

- Economic Empowerment: Linking digital skills to job opportunities and small business development.

Public Acceptance of Infrastructure Development

Public acceptance is a significant hurdle for American Tower. Community concerns about the visual impact of new cell towers and potential health effects, though often unsubstantiated by scientific consensus, can fuel local opposition. This opposition can lead to lengthy permitting processes and even outright rejection of new site developments, directly impacting American Tower's expansion plans and operational efficiency.

For instance, in 2024, several municipalities across the United States experienced significant delays in tower construction due to resident-led protests and zoning challenges. These challenges are not new, but the increasing awareness of environmental aesthetics and perceived health risks, amplified by social media, means that public sentiment can quickly coalesce into organized resistance. American Tower, like other tower companies, must actively engage with local communities to address these concerns, often through public forums and transparent communication about safety standards and environmental impact assessments.

- Community engagement is key: Proactive communication and addressing local concerns can mitigate opposition to new tower construction.

- Visual and health concerns persist: Societal perceptions regarding aesthetics and health risks remain significant factors influencing public acceptance.

- Permitting delays impact growth: Local opposition can extend permitting timelines, slowing down American Tower's ability to deploy new infrastructure.

- Social media amplifies concerns: The rapid dissemination of information and opinions online can quickly mobilize community opposition.

Societal shifts towards digital lifestyles and remote work continue to fuel demand for robust wireless infrastructure, directly benefiting American Tower. The ongoing trend of urbanization necessitates denser network deployments in cities, while initiatives to bridge the digital divide, like government broadband expansion programs, create opportunities for new site development in underserved areas.

Public perception and community acceptance remain critical factors, as concerns about visual impact and health effects can lead to permitting delays. However, proactive community engagement and transparent communication are strategies American Tower employs to navigate these challenges and ensure continued growth.

Technological factors

The accelerating global deployment of 5G technology is a significant technological factor for American Tower. This expansion directly fuels demand for additional tower space and site modifications as carriers densify their networks to improve coverage and capacity. By the end of 2024, it's projected that over 3.7 billion people worldwide will be using 5G, a substantial increase from previous years.

Looking ahead, the development and eventual rollout of 6G networks, anticipated to begin in the 2030s, represent a sustained long-term growth avenue. These next-generation networks will require even more sophisticated and widespread infrastructure, including potentially smaller, more numerous cell sites, further benefiting tower companies like American Tower.

The relentless demand for faster, more reliable wireless connectivity is driving significant investment in network densification. American Tower is strategically positioned to capitalize on this trend, leveraging its extensive portfolio of distributed antenna systems (DAS) and small cell solutions. These technologies are crucial for enhancing capacity and coverage in high-traffic urban areas and indoor environments, directly supporting the rollout of 5G and future wireless generations.

The rapid advancement of artificial intelligence and edge computing is creating a significant surge in demand for network infrastructure that can handle low-latency data processing. This trend directly benefits companies like American Tower, which can leverage its extensive network and data center assets to meet these evolving needs.

American Tower's acquisition of CoreSite in 2022 for $9.4 billion was a strategic move to bolster its data center capabilities. This portfolio is specifically designed to offer AI-ready interconnection solutions, placing American Tower in a prime position to capture growth from AI workloads and distributed computing environments.

Satellite Internet and Alternative Connectivity Technologies

While not an immediate threat to American Tower's core business, emerging technologies like satellite internet constellations present a long-term disruptive potential. Services such as SpaceX's Starlink are expanding their reach, offering alternative connectivity solutions that could, if widely adopted and cost-effective, reduce reliance on traditional ground-based infrastructure.

The increasing deployment of low-Earth orbit (LEO) satellites is a key factor to monitor. By mid-2024, Starlink had deployed over 6,000 satellites, with plans for tens of thousands more. This expansion directly impacts the competitive landscape for internet access, potentially offering a viable alternative in areas where tower infrastructure is less developed or more costly to deploy.

The financial viability of these satellite services is crucial. As of early 2025, Starlink's residential service costs around $120 per month for hardware and $120 per month for service in many regions, a price point that is still higher than many terrestrial broadband options but is decreasing with scale. This cost dynamic will be a significant determinant of its long-term adoption rate and its impact on traditional tower revenue streams.

- Satellite Internet Growth: Starlink's satellite constellation is projected to reach over 100,000 satellites by 2030, significantly increasing global coverage.

- Cost Parity: Continued technological advancements aim to reduce satellite internet hardware and service costs, potentially reaching parity with fiber or 5G in certain markets by 2026.

- Enterprise Solutions: Beyond consumer markets, satellite connectivity is gaining traction for enterprise and government use cases, providing backup or primary connectivity in remote locations.

Energy Efficiency and Renewable Energy Technologies

Technological advancements in energy efficiency and renewable energy are reshaping the infrastructure sector, directly impacting American Tower's operational landscape. Innovations like advanced battery storage systems and more efficient on-site solar power generation are becoming increasingly vital for ensuring the sustainability and cost-effectiveness of telecom tower operations.

These technologies are not just about environmental responsibility; they are critical for enhancing operational reliability, especially in regions with less stable power grids. By reducing reliance on diesel generators, American Tower can significantly lower its carbon footprint and operating expenses. For instance, the cost of solar photovoltaic (PV) systems has fallen dramatically, with global weighted-average costs for utility-scale solar PV declining by approximately 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). This makes on-site solar a more attractive investment for powering remote tower sites.

Furthermore, the evolution of battery storage technology, including improvements in energy density and lifespan, allows for more consistent power delivery from renewable sources. This is crucial for maintaining uninterrupted service for mobile network operators, a core requirement for American Tower's clients. As of early 2024, advancements are pushing towards longer-duration storage solutions, which will further bolster the viability of renewables as a primary power source for critical infrastructure.

- Energy Efficiency: Continued improvements in tower equipment and power management systems reduce overall energy consumption.

- Renewable Energy Integration: Increased adoption of solar and wind power at tower sites, supported by falling technology costs.

- Battery Storage Advancements: Enhanced battery technologies improve the reliability and cost-effectiveness of storing renewable energy for continuous power supply.

- Grid Modernization: Investments in smarter, more resilient power grids can complement on-site generation and reduce reliance on backup fossil fuels.

The ongoing expansion of 5G networks is a primary technological driver for American Tower, necessitating increased tower density and infrastructure upgrades. By the end of 2024, global 5G adoption is expected to surpass 3.7 billion users, highlighting the immediate demand for enhanced wireless capacity. The development of 6G, projected for the 2030s, signals continued long-term infrastructure investment opportunities.

American Tower's strategic acquisition of CoreSite in 2022 for $9.4 billion positions it to capitalize on the growing demand for AI and edge computing infrastructure. These technologies require low-latency processing, which American Tower's data center and network assets are designed to support. The company's investment in distributed antenna systems (DAS) and small cells further strengthens its ability to meet the densification needs driven by these advanced technologies.

Emerging satellite internet technologies, such as Starlink, present a potential long-term competitive factor. With over 6,000 Starlink satellites deployed by mid-2024 and plans for significant expansion, these services offer alternative connectivity. While current costs for services like Starlink, around $120 per month for hardware and service as of early 2025, are higher than many terrestrial options, continued technological advancements aim to reduce these costs, potentially impacting traditional tower revenue streams in the future.

| Technology Trend | Impact on American Tower | Key Data/Projections |

| 5G Network Expansion | Increased demand for tower space and site upgrades | Over 3.7 billion 5G users globally by end of 2024 |

| 6G Development | Long-term growth opportunity for infrastructure deployment | Anticipated rollout in the 2030s |

| AI & Edge Computing | Demand for low-latency processing infrastructure | CoreSite acquisition ($9.4 billion in 2022) strengthens data center capabilities |

| Satellite Internet (e.g., Starlink) | Potential long-term competitive alternative | Over 6,000 Starlink satellites deployed by mid-2024; service costs ~ $120/month (early 2025) |

Legal factors

Zoning laws and permitting processes present a significant hurdle for American Tower's infrastructure development. Strict local regulations and intricate approval pathways can delay new tower construction and modifications, directly impacting project timelines and escalating costs.

For instance, in 2024, the average time to obtain a permit for wireless infrastructure in some major US municipalities stretched to over six months, with certain jurisdictions experiencing delays exceeding a year due to complex environmental reviews and community input requirements. American Tower's ability to efficiently navigate these legal frameworks is critical for its ongoing expansion and network densification strategies.

American Tower's core business hinges on extensive, long-term lease agreements with major wireless carriers. These contracts, often spanning 10-15 years or more, are critical for its predictable revenue. The legal framework governing these agreements, including enforceability and renewal clauses, directly impacts the stability of American Tower's income, which in 2024 continued to be bolstered by these foundational relationships.

As a Real Estate Investment Trust (REIT), American Tower must adhere to strict IRS regulations, notably the requirement to distribute at least 90% of its taxable income to shareholders annually. This structure significantly impacts its capital allocation and dividend policies, aiming to maintain its tax-advantaged status.

Beyond tax compliance, the company faces a complex web of environmental regulations. These govern everything from the siting and construction of new towers to the management of waste and potential environmental impacts at its numerous operational sites across the globe, ensuring responsible stewardship.

Data Privacy and Cybersecurity Regulations

American Tower, like many infrastructure providers, navigates a complex web of data privacy and cybersecurity regulations. The increasing volume of data handled by its tenants, from network performance metrics to user information, necessitates strict adherence to these evolving legal frameworks. Failure to comply can result in significant penalties and reputational damage.

Key regulations impacting American Tower and its clients include:

- General Data Protection Regulation (GDPR): While primarily affecting EU data, its extraterritorial reach impacts companies globally that process data of EU citizens.

- California Consumer Privacy Act (CCPA) / California Privacy Rights Act (CPRA): These laws grant California consumers rights regarding their personal information, requiring robust data protection measures.

- National Institute of Standards and Technology (NIST) Cybersecurity Framework: Though not a regulation, it's a widely adopted standard that many businesses, including American Tower's tenants, align with for cybersecurity best practices.

- Federal Trade Commission (FTC) Act: The FTC enforces rules against unfair or deceptive practices, including those related to data security and privacy.

In 2024, the global cost of data breaches was estimated to be around $4.5 trillion, highlighting the immense financial incentive for robust cybersecurity and data privacy compliance, a cost American Tower's tenants are keenly aware of.

Antitrust and Competition Laws

Antitrust and competition laws are significant considerations for American Tower. Consolidation within the wireless carrier market, a key customer base, or among tower companies themselves, can attract scrutiny from regulatory bodies. For instance, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor mergers and acquisitions to prevent anti-competitive practices.

This legal oversight directly impacts American Tower's strategic growth through M&A. Any significant acquisition of assets or companies would need to pass antitrust reviews, potentially leading to divestitures or altered deal structures. The ongoing consolidation among major U.S. wireless carriers, such as the T-Mobile and Sprint merger finalized in 2020, has already reshaped the competitive landscape and influenced carrier spending on network infrastructure, a core business for American Tower.

- Regulatory Scrutiny: Antitrust laws empower agencies like the FTC and DOJ to review mergers and acquisitions, ensuring fair competition in the telecommunications sector.

- Impact on M&A: Potential acquisitions by American Tower or its competitors could face challenges, requiring careful legal navigation and potentially leading to divestitures.

- Market Dynamics: Consolidation among wireless carriers, like the 2020 T-Mobile/Sprint merger, alters customer relationships and infrastructure investment strategies, affecting tower demand.

American Tower operates within a stringent legal environment, necessitating compliance with a multitude of regulations. Zoning laws and permitting processes significantly impact infrastructure deployment, with delays in 2024 averaging over six months in some US cities. Furthermore, as a REIT, the company must distribute 90% of taxable income, influencing its financial strategies.

Data privacy and cybersecurity laws, including GDPR and CCPA, are critical, especially given the estimated $4.5 trillion global cost of data breaches in 2024. Antitrust laws also play a crucial role, with agencies like the FTC scrutinizing mergers and acquisitions within the telecommunications sector, as evidenced by the 2020 T-Mobile/Sprint merger's impact on infrastructure demand.

| Legal Area | Key Regulations/Considerations | Impact on American Tower | 2024/2025 Relevance |

|---|---|---|---|

| Infrastructure Development | Zoning laws, Permitting processes, Environmental reviews | Project delays, Increased costs, Site acquisition challenges | Permit times exceeding 6 months in major US cities in 2024; ongoing need for efficient navigation. |

| Corporate Structure & Finance | REIT regulations (e.g., 90% income distribution) | Capital allocation, Dividend policies, Tax status maintenance | Continued adherence to REIT status for tax advantages. |

| Data & Cybersecurity | GDPR, CCPA/CPRA, NIST framework, FTC Act | Data protection measures, Compliance risks, Tenant data security | Global data breach costs estimated at $4.5 trillion in 2024; increasing focus on data privacy. |

| Market Competition | Antitrust laws, Merger control (FTC, DOJ) | M&A activity scrutiny, Potential divestitures, Market consolidation impact | Ongoing consolidation in wireless industry (e.g., 2020 T-Mobile/Sprint merger) shapes carrier infrastructure spending. |

Environmental factors

Climate change presents significant physical risks to American Tower's infrastructure. More frequent and intense extreme weather events, such as hurricanes and wildfires, can damage communication sites, leading to service outages and escalating repair expenses. For instance, the average annual cost of weather and climate disasters in the U.S. exceeded $150 billion in recent years, underscoring the potential financial impact on tower operators.

Operating American Tower's extensive network of communication sites demands significant energy, directly impacting its carbon footprint. In 2023, the company reported that approximately 35% of its global electricity consumption was sourced from renewable energy, a key step in its sustainability efforts.

American Tower is actively working to lower its greenhouse gas emissions. This involves implementing energy efficiency upgrades across its portfolio, increasing its reliance on renewable energy sources like solar and wind, and investing in advanced energy storage systems to manage power more effectively.

American Tower champions a circular economy, actively recycling or repurposing a significant portion of its tower steel waste. This commitment is central to their environmental strategy, aiming to minimize landfill contributions and maximize resource utility.

In 2023, the company reported that approximately 90% of its steel waste was either recycled or reused, a testament to their robust waste management protocols. This focus on resource optimization is not just about environmental stewardship but also about operational efficiency and cost savings.

Land Use and Biodiversity Impact

American Tower's operations, which involve the development and maintenance of communication towers, inherently require significant land use. This can lead to habitat fragmentation and disruption of local ecosystems, potentially impacting biodiversity. For instance, the construction phase often involves clearing land, which can affect plant and animal life in the surrounding areas.

To mitigate these effects, the company must adopt environmentally conscious practices. This includes careful site selection to avoid sensitive habitats and implementing restoration efforts post-construction. By prioritizing sustainable land management, American Tower can reduce its ecological footprint.

- Land Use: American Tower manages a vast portfolio of over 224,000 tower sites globally as of December 31, 2023.

- Biodiversity Concerns: Site development can lead to habitat loss and fragmentation, affecting local flora and fauna.

- Mitigation Strategies: Implementing best practices in site selection and environmental management is crucial to minimize disruption.

- Regulatory Compliance: Adherence to local land use regulations and environmental protection laws is a key operational consideration.

Water Management and Conservation

American Tower, while not a heavy water consumer compared to manufacturing or agriculture, recognizes the importance of efficient water management across its global portfolio of over 224,000 sites as of the end of 2023. The company actively pursues water conservation strategies, especially in water-scarce regions where many of its towers are located. This focus on responsible water usage is a key component of its broader environmental, social, and governance (ESG) commitments.

These conservation efforts are particularly relevant at data centers and other facilities that may have higher water demands for cooling systems. By implementing best practices in water efficiency, American Tower aims to reduce its operational footprint and mitigate risks associated with water scarcity. For instance, in 2023, the company reported progress on its sustainability goals, which include optimizing resource utilization.

The company's approach to water management includes:

- Monitoring water consumption: Tracking usage across facilities to identify areas for improvement.

- Implementing water-efficient technologies: Investing in cooling systems and other infrastructure that minimize water use.

- Adhering to local regulations: Ensuring compliance with water management policies in all operating regions.

- Promoting conservation awareness: Educating employees and stakeholders on the importance of water stewardship.

American Tower faces environmental challenges from climate change, with extreme weather events posing risks to its infrastructure. The company is actively working to reduce its carbon footprint by increasing renewable energy use, having sourced approximately 35% of its global electricity from renewables in 2023. Furthermore, American Tower demonstrates a commitment to a circular economy by recycling or repurposing a significant portion of its waste, with about 90% of its steel waste recycled or reused in 2023.

| Environmental Factor | Impact on American Tower | Mitigation/Action |

|---|---|---|

| Climate Change & Extreme Weather | Physical damage to towers, service outages, increased repair costs. | Implementing resilient infrastructure designs, disaster preparedness. |

| Energy Consumption & Carbon Footprint | Significant energy use for tower operations. | Increasing renewable energy sourcing (35% in 2023), energy efficiency upgrades. |

| Waste Management | Landfill contributions from tower materials. | Circular economy approach, recycling/repurposing steel waste (90% recycled/reused in 2023). |

| Land Use & Biodiversity | Habitat fragmentation, disruption of ecosystems during site development. | Careful site selection, post-construction restoration efforts. |

| Water Management | Potential risks in water-scarce regions for cooling systems. | Water conservation strategies, efficient technologies, monitoring usage. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for American Tower is built on a robust foundation of data from official government sources, reputable financial institutions like the IMF and World Bank, and leading market research firms. We incorporate insights from industry-specific reports, technology trend forecasts, and analyses of regulatory environments.