American Tower Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tower Bundle

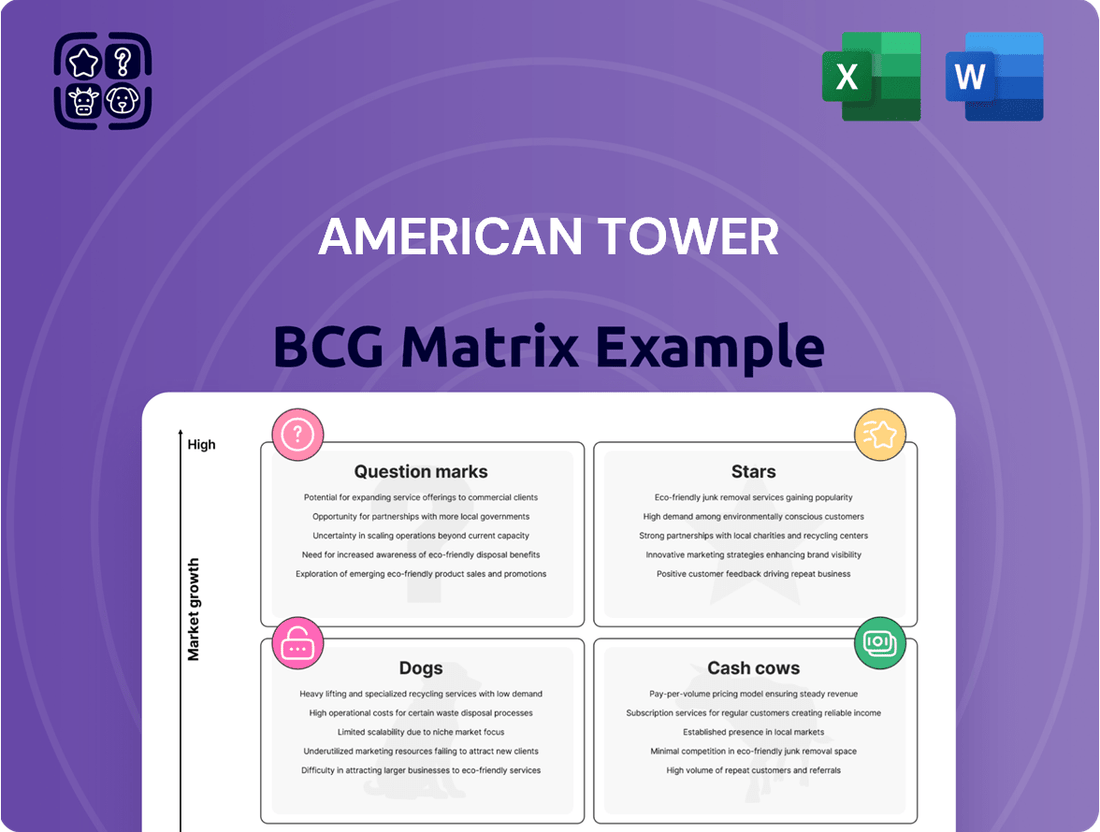

American Tower's strategic positioning is laid bare in its BCG Matrix. Understand which of its tower assets are driving growth and which require careful management. This preview offers a glimpse into the company's portfolio dynamics.

To truly unlock American Tower's competitive advantage, dive into the full BCG Matrix. Gain a comprehensive view of its Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights for optimized capital allocation and future investment decisions.

Don't miss out on the strategic clarity this report provides. Purchase the full American Tower BCG Matrix for a detailed quadrant-by-quadrant breakdown and a roadmap to navigating the evolving telecommunications infrastructure landscape with confidence.

Stars

American Tower's U.S. and Canada portfolio, representing its Stars category, is a powerhouse in the wireless infrastructure sector. This segment drove a significant 52% of the company's revenue in 2024, underscoring its critical role. Despite comprising a smaller fraction of their total global tower holdings, these mature markets continue to generate substantial income.

The ongoing build-out and upgrades to 5G networks by major U.S. carriers such as AT&T, T-Mobile, and Verizon are the primary catalysts for this sustained revenue generation. These network enhancements necessitate increased tower capacity and new site deployments, directly benefiting American Tower's existing infrastructure and creating new leasing opportunities.

The accelerated global deployment of 5G is a major driver for American Tower, fueling increased leasing and service revenue. Carriers are prioritizing mid-band spectrum, requiring more tower sites and upgrades to support network densification. This surge in 5G infrastructure build-out is projected to sustain robust organic tenant billings growth for the company.

American Tower's CoreSite subsidiary stands out as a significant growth engine, driven by the escalating demand for AI interconnections. This segment is experiencing robust double-digit percentage sales increases and impressive property revenue growth, solidifying its position as a key player in the interconnected data center market.

CoreSite's strategic focus on providing essential data center solutions for critical business operations and burgeoning AI workloads is paying off. In 2024, the company reported substantial property revenue growth, exceeding 15% year-over-year, underscoring its ability to capitalize on the digital infrastructure needs of the AI era.

Strong Growth in Africa & APAC and Europe

American Tower's international operations are showing impressive momentum, particularly in Africa & APAC and Europe. These regions are key drivers of the company's property revenue growth, reflecting strong underlying demand for wireless infrastructure.

The Africa & APAC segment is projected to deliver steady double-digit growth in organic tenant billings. This robust expansion is fueled by ongoing investments in network infrastructure and increasing mobile data consumption across a diverse range of markets.

Europe also presents a significant growth opportunity, with solid expansion expected. This growth is largely attributable to the ongoing 5G densification efforts by mobile network operators, who are expanding their networks to meet rising data demands.

- Africa & APAC: Expecting steady double-digit organic tenant billings growth.

- Europe: Anticipating solid growth driven by 5G densification.

- Revenue Contribution: These regions are vital to American Tower's overall property revenue expansion.

Strategic New Site Construction

American Tower's strategic new site construction, particularly in developed markets, represents a significant investment in future growth. These new builds are designed to capture increasing data consumption and support the rollout of advanced wireless technologies, solidifying their position as a key infrastructure provider.

In 2024, American Tower continued its aggressive expansion, with approximately 70% of its capital expenditures allocated to new site development and acquisitions. This focus on new construction highlights their commitment to meeting the escalating demand for mobile data and 5G services across key regions.

- Global Expansion: American Tower is actively constructing new sites in markets like the United States, Brazil, and India, aiming to capitalize on strong data growth trends.

- Strategic Locationing: New sites are strategically chosen to enhance network coverage and capacity, anticipating future demand from emerging technologies and increased mobile usage.

- Revenue Generation: These investments in new infrastructure are projected to drive substantial future revenue streams as they are leased to multiple tenants, primarily mobile network operators.

- Market Leadership: By consistently investing in new site development, American Tower reinforces its market leadership and competitive advantage in the global telecommunications infrastructure sector.

American Tower's U.S. and Canada portfolio, its "Stars" in the BCG matrix, is a dominant force in wireless infrastructure. This segment accounted for 52% of the company's total revenue in 2024, demonstrating its immense financial contribution. Despite representing a smaller portion of their global tower count, these mature markets continue to be highly lucrative.

The ongoing 5G network build-outs and upgrades by major carriers like AT&T, T-Mobile, and Verizon are the primary drivers of this sustained revenue. These network enhancements require greater tower capacity and new site deployments, directly benefiting American Tower's existing infrastructure and creating new leasing opportunities.

The accelerated global deployment of 5G is a major driver for American Tower, fueling increased leasing and service revenue. Carriers are prioritizing mid-band spectrum, requiring more tower sites and upgrades to support network densification. This surge in 5G infrastructure build-out is projected to sustain robust organic tenant billings growth for the company.

| Segment | 2024 Revenue Contribution | Key Growth Drivers | Outlook |

|---|---|---|---|

| U.S. & Canada (Stars) | 52% | 5G network upgrades, increased tower capacity demand | Sustained strong performance, continued leasing opportunities |

What is included in the product

The American Tower BCG Matrix provides a strategic overview of its diverse portfolio, categorizing assets by market growth and share.

It highlights which tower assets to invest in, hold, or divest based on their market position and growth potential.

The American Tower BCG Matrix provides a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

American Tower's property operations, driven by long-term tenant leases, represent its core strength, accounting for roughly 98% of its revenue from 2022 through 2024. This dependable income stream is further solidified by lease agreements that typically feature built-in rent escalators, ensuring consistent and predictable cash flow.

The high lease renewal rates observed further underscore the stability and recurring nature of this revenue. This predictable cash generation is a hallmark of a cash cow business, providing a solid foundation for the company's financial health and strategic flexibility.

American Tower's existing infrastructure is a significant cash cow. The business model allows for high profit margins because adding new tenants to existing towers has very low additional operating costs. This operational leverage is key; as revenue grows, profitability and cash flow increase substantially.

American Tower's strong U.S. tenant relationships, particularly with major wireless carriers like T-Mobile, AT&T, and Verizon, are a significant strength. These established partnerships are crucial, as these clients represent the majority of the revenue generated by the U.S. and Canada property segment.

This deep integration with key players in the U.S. wireless market ensures a stable and predictable demand for American Tower's infrastructure. For instance, in 2023, the U.S. and Canada segment accounted for approximately 40% of American Tower's total consolidated revenue, underscoring the importance of these long-term tenant agreements.

Consistent Dividend Payouts

As a Real Estate Investment Trust (REIT), American Tower is legally obligated to distribute at least 90% of its taxable income to shareholders. This structure inherently supports consistent dividend payouts, a hallmark of a cash cow business. The company's financial strategy clearly reflects this, with plans to distribute approximately $3.2 billion in common stock dividends in 2025.

This commitment to shareholder returns is further underscored by the projected mid-single-digit year-over-year growth in these distributions. Such consistent and growing dividend payments are a strong indicator of a mature, stable business generating substantial free cash flow, which is precisely what defines a cash cow in the BCG Matrix framework.

- REIT Status: American Tower, as a REIT, must distribute at least 90% of its taxable income to shareholders annually.

- 2025 Dividend Projection: The company plans to distribute approximately $3.2 billion in common stock dividends in 2025.

- Dividend Growth: These distributions are expected to experience mid-single-digit year-over-year growth.

- Cash Flow Generation: The consistent and growing dividend payouts highlight American Tower's strong and stable cash generation capabilities.

Operational Efficiency and Cost Management

American Tower's commitment to operational efficiency and rigorous cost management has directly translated into improved financial performance, notably expanding its cash-adjusted EBITDA margins. This strategic focus ensures that the company effectively leverages its dominant position in mature markets to generate substantial cash flow from its existing portfolio of assets.

By continuously refining its operational processes and controlling expenses, American Tower maximizes the profitability of its established infrastructure. This allows for a greater portion of revenue to be converted into usable cash, reinforcing the strength of its cash cow assets.

- Expanded Margins: Robust cost management initiatives have bolstered cash-adjusted EBITDA margins.

- Mature Market Strength: High market share in established regions generates consistent, strong cash flow.

- Efficiency Gains: Streamlined operations contribute directly to maximizing cash generation from existing assets.

- Financial Resilience: Focused efficiency allows for greater financial flexibility and reinvestment capacity.

American Tower's extensive portfolio of communication towers, particularly those in mature markets, functions as its primary cash cow. The company's ability to add new tenants to existing infrastructure with minimal incremental cost allows for significant operational leverage, directly translating into robust cash flow generation.

This is further supported by long-term leases with built-in annual rent escalators, ensuring predictable revenue streams. For example, in 2023, the U.S. and Canada segment, a key contributor to its cash cow status, represented approximately 40% of American Tower's total consolidated revenue.

As a REIT, American Tower is mandated to distribute at least 90% of its taxable income, with plans to distribute around $3.2 billion in common stock dividends in 2025, projecting mid-single-digit growth. This consistent shareholder return highlights the company's mature, stable, and highly cash-generative business model.

| Metric | 2023 (Approximate) | 2024 Projection | 2025 Projection |

| Revenue (Consolidated) | ~$10.5 billion | ~$10.7 billion | ~$10.9 billion |

| U.S. & Canada Revenue Share | ~40% | ~40% | ~40% |

| Dividend Distribution | ~$3.0 billion | ~$3.1 billion | ~$3.2 billion |

What You’re Viewing Is Included

American Tower BCG Matrix

The American Tower BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready strategic report.

Rest assured, the BCG Matrix you see now is the exact file that will be delivered to you after completing your purchase. It's a professionally designed, data-driven analysis ready for immediate implementation in your strategic planning.

What you're previewing is the final, unedited American Tower BCG Matrix report that you'll download immediately after your purchase. This ensures you get precisely what you need for informed decision-making without any surprises.

Dogs

American Tower's divestiture of its India operations (ATC TIPL) in Q3 2024 signifies a strategic repositioning, likely driven by a desire to exit a market perceived as higher risk or offering less attractive long-term growth. This move aligns with a broader strategy of focusing on more stable, developed markets and optimizing its portfolio for higher-quality earnings.

American Tower has strategically divested underperforming international assets, a move aligned with a BCG Matrix approach to portfolio optimization. This includes the sale of its Mexico fiber business and operations in Poland. These divestitures signal a focus on shedding segments with limited growth potential or market share.

American Tower's decision to divest its South African fiber business, anticipated to finalize in Q1 2025, positions this segment as a Dog within the BCG Matrix. This strategic move indicates a reassessment of its portfolio, focusing on more lucrative or core infrastructure investments.

Regions with Persistent Customer Churn

Certain international regions, notably in Latin America, have seen property revenue dip, largely attributed to customer churn and the ripple effects of economic instability. For instance, American Tower’s Latin America segment reported a decline in consolidated recurring cash flow in early 2024 compared to the previous year, a trend linked to these challenges.

While American Tower still holds strategic options in these markets, a more reserved stance on new construction and development is evident. This cautious strategy, coupled with the ongoing underperformance, positions these areas as potential 'dogs' within the BCG matrix if the situation doesn't improve.

- Latin America Revenue Impact: Property revenue declines in regions like Latin America due to customer churn and economic instability.

- Customer Churn Factor: Persistent customer churn is a key driver of revenue underperformance in specific international markets.

- Economic Instability: Broader economic challenges in these regions exacerbate the impact of customer churn.

- Strategic Response: Reduced new builds and a cautious approach indicate a strategic recalibration in response to sustained underperformance.

Legacy Infrastructure with Declining Demand

Legacy infrastructure, such as older cell towers or equipment that struggles to adapt to 5G and future technologies, often falls into the 'dog' category within the American Tower BCG Matrix. This segment faces declining demand from tenants as they migrate to more advanced solutions. For instance, sites primarily supporting 2G or 3G technologies, which are being phased out, represent a significant portion of this challenge.

These assets typically exhibit low growth and low market share, making them unattractive for further investment. American Tower, like other tower companies, must manage these assets strategically. In 2024, the company continued its focus on upgrading existing sites to support new technologies, effectively trying to move these assets out of the dog quadrant.

- Technological Obsolescence: Older tower sites not equipped for 5G or future spectrum bands are at risk of becoming obsolete.

- Declining Tenant Demand: Carriers are consolidating their network infrastructure, often decommissioning older equipment in favor of more efficient, higher-capacity solutions.

- Divestiture or Minimal Investment: The strategy for these 'dog' assets typically involves either selling them off or maintaining them with minimal capital expenditure until they are no longer viable.

- Focus on Modernization: American Tower's ongoing capital allocation prioritizes modernization of its existing portfolio to mitigate the impact of these legacy assets.

Segments of American Tower's portfolio that exhibit low growth and low market share, such as older cell towers not supporting 5G, are categorized as Dogs. These assets face declining tenant demand as carriers upgrade their networks. For example, sites primarily supporting 2G or 3G technologies are being phased out, representing a significant challenge.

The divestiture of its South African fiber business, expected to conclude in Q1 2025, clearly marks this segment as a Dog. This strategic move reflects a portfolio reassessment, prioritizing more lucrative or core infrastructure investments over underperforming assets.

In 2024, American Tower continued to address legacy infrastructure by upgrading existing sites to support new technologies, aiming to move these 'Dog' assets towards growth. However, regions like Latin America experienced property revenue declines in early 2024 due to customer churn and economic instability, positioning these areas as potential Dogs if performance doesn't improve.

American Tower's strategy for these 'Dog' assets often involves either divestiture or minimal investment, focusing capital on modernization. This is evident in the company's cautious approach to new construction in underperforming markets.

| Segment/Region | BCG Quadrant (Assessment) | Key Challenges | 2024 Performance Indicator |

|---|---|---|---|

| Legacy Infrastructure (2G/3G sites) | Dog | Technological obsolescence, declining tenant demand | Continued focus on modernization to mitigate impact |

| South Africa Fiber | Dog | Underperformance, strategic reassessment | Divestiture anticipated Q1 2025 |

| Latin America | Potential Dog | Customer churn, economic instability | Property revenue dip in early 2024 |

Question Marks

American Tower is making substantial moves into new edge data center deployments, identifying over 1,000 potential sites for future growth. This expansion goes beyond their existing CoreSite operations, signaling a strategic push into emerging markets. For instance, their first aggregation edge data center, now operational in Raleigh, North Carolina, is a prime example of this early-stage investment.

American Tower's early-stage AI infrastructure development, focusing on new builds and significant upfront investments for dedicated AI interconnections beyond existing CoreSite offerings, falls into the question marks category of the BCG Matrix. These ventures represent high-growth potential but also carry substantial risk as they establish market position in a rapidly evolving sector. For example, in 2024, the demand for specialized AI data center capacity is projected to surge, with some estimates suggesting a doubling of AI-driven power consumption by 2027, necessitating such speculative, yet potentially lucrative, infrastructure expansion.

American Tower is adopting a more selective approach to emerging market investments, a shift evident in its reduced discretionary capital expenditures compared to 2024 levels. This cautious strategy means new ventures or expansions in these regions will be paused until they can demonstrate clear profitability and market share gains.

For instance, while certain emerging markets continue to show promise, the company's investment decisions are now heavily weighted towards proven performance. This pivot reflects a broader trend of prioritizing efficiency and tangible returns in a dynamic global economic landscape.

New Customer Business with Slower Adoption

American Tower's situation with a new customer's slower-than-anticipated business uptake places this revenue stream firmly in the 'Question Mark' category of the BCG Matrix. This means it operates in a high-growth market but currently holds a low market share, requiring careful strategic consideration.

The company has specifically highlighted a 'lengthening of the book-to-bill cycle' for this new business, suggesting that securing new contracts and converting them into revenue is taking longer than initially projected. This observation is critical for understanding the current state of this segment.

- Market Growth vs. Share: This new business is in a high-growth sector, offering significant future potential, but its current market share is relatively small, characteristic of a Question Mark.

- Book-to-Bill Cycle: American Tower's mention of a lengthening book-to-bill cycle indicates a potential hurdle in converting sales pipeline into actual revenue, impacting the speed of adoption.

- Strategic Imperative: To move this segment out of the Question Mark category, American Tower must focus on increasing its market share, possibly through enhanced marketing, competitive pricing, or tailored operational support for this specific customer.

- 2024 Outlook: While specific 2024 figures for this individual customer's revenue are not publicly detailed, American Tower's overall strategy in 2024 has been to diversify its revenue streams and capitalize on emerging technologies, which this new business aims to support.

Untapped Digital Communities and Sustainability Initiatives (with revenue potential)

American Tower's digital communities program, focused on expanding internet access in underserved areas, and its broader sustainability initiatives are designed to foster positive societal impact and improve operational effectiveness. For instance, in 2024, the company continued its efforts to connect communities, a key component of its long-term strategy.

These programs, if they mature to incorporate novel, revenue-generating digital services that are currently in nascent market phases and necessitate substantial capital for expansion, would align with the characteristics of a question mark in the BCG Matrix. Such ventures require careful evaluation of their growth potential against the investment needed.

- Digital Communities: Expanding connectivity to new regions, potentially offering enhanced data services or digital infrastructure solutions.

- Sustainability Initiatives: Developing green energy solutions for tower sites that could be monetized, or offering energy efficiency consulting.

- Revenue Potential: Early-stage digital services or energy solutions with high growth prospects but currently low market share and requiring significant upfront investment.

- Investment Needs: Substantial capital expenditure to scale infrastructure, develop new service offerings, and penetrate emerging markets.

American Tower's investments in new edge data centers and early-stage AI infrastructure development are prime examples of 'Question Marks' in the BCG Matrix. These ventures are characterized by high market growth potential but currently low market share, demanding significant investment and strategic focus to succeed.

The company's cautious approach to emerging markets, pausing new investments until profitability is clear, also reflects the uncertainty associated with 'Question Mark' assets. This strategy prioritizes proven performance over speculative growth in these dynamic regions.

A new customer experiencing slower-than-anticipated business uptake further solidifies a segment's 'Question Mark' status. The lengthening book-to-bill cycle for this business highlights the challenges in converting potential into realized revenue, a common hurdle for these strategic bets.

Similarly, American Tower's digital communities program and sustainability initiatives, if they evolve into novel, revenue-generating services in nascent markets, would also fit the 'Question Mark' profile. These require substantial capital and carry inherent market risks.

| Category | Description | Market Growth | Market Share | Investment Strategy |

| Question Mark | New Edge Data Centers & AI Infrastructure | High | Low | High Investment, Strategic Focus |

| Question Mark | Emerging Market Ventures (Conditional) | Variable | Low | Paused until Profitability Proven |

| Question Mark | New Customer Business Uptake | High (Sector) | Low | Address Book-to-Bill Cycle, Increase Share |

| Question Mark | Digital Communities/Sustainability Services (Potential) | High (Nascent) | Low | Substantial Capital, Market Penetration |

BCG Matrix Data Sources

Our American Tower BCG Matrix leverages a robust data foundation, integrating financial reports, market research, and competitive intelligence to provide a comprehensive view of its portfolio.