American Tower Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tower Bundle

American Tower navigates a landscape shaped by powerful forces, from the intense rivalry among existing tower companies to the significant bargaining power of its major wireless carrier clients. Understanding these dynamics is crucial for anyone looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping American Tower’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

American Tower's key suppliers consist of landowners providing tower sites and construction firms for infrastructure development and upkeep. The market for telecom construction services is quite fragmented, meaning no single supplier holds significant sway over a major entity like American Tower. This fragmentation generally limits their bargaining power.

While land availability can pose a localized challenge, the broader construction sector's fragmentation prevents individual landowners or smaller construction outfits from dictating terms. However, upward trends in labor and material costs, observed throughout 2024, could introduce some supplier-driven cost pressures for American Tower.

Suppliers of highly specialized telecommunications equipment, like antennas and radios, hold moderate bargaining power. This is because the technical demands and the small pool of approved vendors for crucial network parts limit options. American Tower needs these suppliers to keep its infrastructure aligned with advancements like 5G technology.

American Tower, as a major energy consumer for its extensive network of communication sites, faces considerable bargaining power from local utility providers. The reliability and cost of electricity directly impact operational expenses. For instance, in 2024, the average commercial electricity price in the U.S. hovered around $0.13 per kilowatt-hour, a figure that can significantly influence American Tower's bottom line given its widespread infrastructure.

To counter this, American Tower is actively investing in renewable energy sources and sophisticated battery storage solutions. These initiatives not only aim to enhance energy resilience, ensuring uninterrupted service, but also to improve overall energy efficiency. By diversifying its energy supply and storage capabilities, the company seeks to reduce its dependence on traditional utility providers and mitigate the impact of fluctuating energy prices.

Labor and Skilled Workforce

The availability of a skilled workforce for tasks like tower construction, maintenance, and data center operations plays a role in supplier power for American Tower. When specialized labor is scarce, those who possess these skills can command higher wages and more favorable terms, effectively increasing their bargaining power.

Recent industry observations highlight potential shifts in this dynamic. For instance, reports from 2024 indicate that wireless infrastructure contractors are experiencing squeezed profit margins. This pressure stems, in part, from what are described as take-it-or-leave-it contract terms being presented by major wireless carriers. This scenario suggests that while skilled labor is essential, the power balance within the broader ecosystem might be tilting, potentially impacting the leverage of labor suppliers.

- Skilled Labor Availability: A tight labor market for specialized tower construction and maintenance personnel can empower these suppliers.

- Carrier Contract Terms: The ability of major carriers to dictate terms on infrastructure projects can limit the bargaining power of labor contractors.

- Profitability Pressures: Declining profitability for wireless infrastructure contractors in 2024 suggests a challenging environment for labor suppliers within this segment.

Monopsony Power of Major Carriers on Contractors

The major wireless carriers, often referred to as the 'Big 3'—Verizon, AT&T, and T-Mobile—exert considerable monopsony power. This means they are the dominant buyers in their specific market segment, significantly influencing the terms and pricing for infrastructure contractors. This concentration of buying power can indirectly affect American Tower by limiting the bargaining leverage of its contractors.

This dynamic can lead to contractors facing suppressed compensation and potentially unsustainable business practices as they compete for contracts with these large entities. Consequently, the availability and cost of specialized labor and services needed for tower maintenance and deployment might be indirectly impacted for American Tower.

For instance, in 2024, the combined capital expenditures of these three carriers were substantial, indicating their significant market influence. This spending power allows them to dictate terms more readily to the companies that build and maintain the infrastructure they rely on, including those that work with tower companies like American Tower.

- Dominant Buyers: Verizon, AT&T, and T-Mobile act as major clients for telecom infrastructure services.

- Contractor Pressure: Their significant buying power can suppress compensation and create challenging operating conditions for contractors.

- Indirect Impact: This can indirectly influence American Tower's cost structure and the availability of specialized services.

- Market Influence: The capital expenditures of these carriers in 2024 underscore their ability to shape market terms.

American Tower's suppliers, primarily landowners and construction firms, generally have limited bargaining power due to the fragmented nature of the telecom construction market. However, rising labor and material costs in 2024 have introduced some cost pressures. Specialized equipment suppliers, essential for 5G upgrades, possess moderate power due to technical demands and limited vendors.

Utility providers exert significant bargaining power as American Tower is a large energy consumer. In 2024, U.S. commercial electricity prices averaged around $0.13 per kWh, directly impacting operational expenses. American Tower is mitigating this by investing in renewables and battery storage to reduce reliance on traditional utilities and manage energy costs.

The bargaining power of labor suppliers is influenced by the availability of skilled workers for tower maintenance and construction. While essential, contractors in this sector faced profit margin pressures in 2024 due to take-it-or-leave-it terms from major wireless carriers, potentially limiting labor supplier leverage.

| Supplier Category | Bargaining Power | Key Factors Influencing Power | 2024 Data/Trends |

| Landowners | Low to Moderate | Fragmentation of market, localized land availability | Broad market fragmentation limits individual landowner power. |

| Construction Firms | Low | Fragmentation of construction services market | Market fragmentation limits individual supplier leverage. |

| Specialized Equipment Vendors | Moderate | Technical demands, limited approved vendors, need for 5G tech | Crucial for network upgrades, limiting American Tower's options. |

| Utility Providers | High | Significant energy consumption, reliability of supply | Avg. U.S. commercial electricity price ~$0.13/kWh in 2024. |

| Skilled Labor Providers | Moderate to Low | Availability of skilled workforce, carrier contract terms | Contractors faced squeezed margins in 2024 due to carrier demands. |

What is included in the product

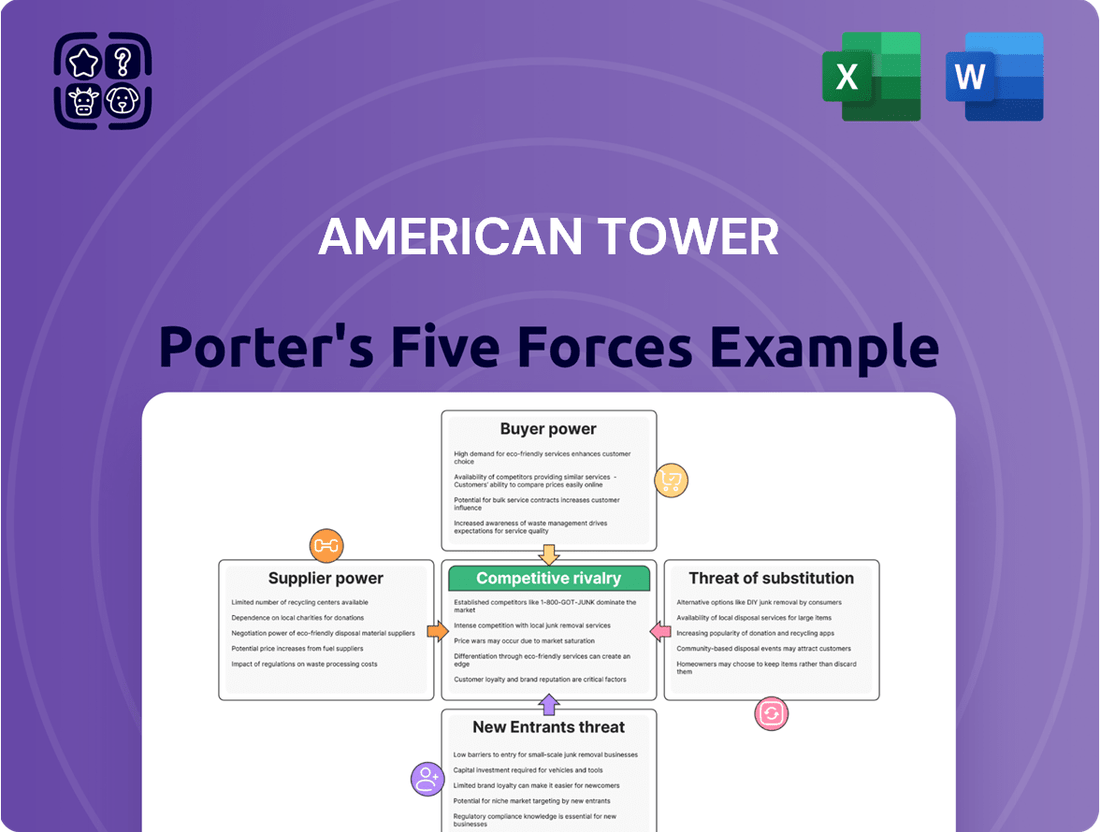

Analyzes the competitive intensity and profitability of the wireless infrastructure industry for American Tower, examining buyer and supplier power, threats from new entrants and substitutes, and existing rivalry.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces chart, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

American Tower's customer base in the U.S. and Canada exhibits significant concentration. Major wireless carriers such as AT&T, T-Mobile, and Verizon represent a substantial portion of the company's property revenue, with these top customers often accounting for over 50% of total revenue in some segments.

This concentration of key customers bestows considerable bargaining power upon these large wireless service providers. They can leverage their significant business volume to negotiate more favorable lease terms and service agreements with American Tower, potentially impacting pricing and contract conditions.

American Tower's bargaining power of customers is significantly mitigated by its long-term, non-cancellable lease agreements. These contracts, often spanning 10-15 years, lock in customers and provide predictable revenue. For instance, in 2023, American Tower reported that approximately 99% of its revenue was generated from such long-term contracts, underscoring the stability these agreements provide against customer pressure.

Furthermore, these leases typically include annual rent escalation clauses, often tied to inflation or a fixed percentage. This contractual feature ensures that American Tower's revenue grows over time, even without new customer acquisition, further diminishing the customers' leverage to demand lower prices or alter terms mid-contract. This structure limits customers' ability to switch providers or exert significant downward pricing pressure.

The relentless global expansion and densification of 5G networks are a significant tailwind for American Tower, fueling consistent demand for its tower infrastructure. This includes crucial mid-band spectrum upgrades and the need for entirely new sites to support the enhanced network capabilities. This ongoing infrastructure build-out directly translates to increased customer reliance on American Tower's existing tower real estate, thereby tempering their bargaining power.

Customer Capital Expenditure Trends

Wireless carriers' capital expenditure on network expansion and upgrades is a key driver for American Tower's revenue from new co-locations and amendments. As 5G deployment continues, the pace of traditional tower additions might moderate, potentially shifting negotiation leverage towards customers.

American Tower's customers, primarily major wireless carriers, are navigating significant capital expenditure cycles. For instance, in 2024, major US carriers continued substantial investments in 5G infrastructure, with AT&T reporting approximately $24 billion in capital expenditures for the year, and Verizon around $18 billion. While these investments fuel demand for tower space, the eventual maturation of 5G buildouts could lead to a stabilization or even a slight decrease in the demand for new tower sites, thereby enhancing customer bargaining power.

- Carrier Capex as a Negotiating Lever: Significant capital outlays by wireless carriers on network upgrades, like 5G, can increase their leverage when negotiating terms with tower companies.

- 5G Maturation Impact: As 5G deployment phases mature, the urgency for new tower site acquisition may lessen, potentially giving customers more room to negotiate pricing and contract terms.

- Diversification of Customer Base: While wireless carriers are the primary customers, American Tower's revenue diversification across various tenant types can mitigate the impact of individual customer spending fluctuations.

Churn and Lease Cancellations

American Tower has faced challenges with customer churn, especially in its U.S. & Canada segment. This is largely due to lease cancellations and non-renewals, with T-Mobile being a notable example of a customer reducing its footprint.

While American Tower is focused on expansion, the ongoing management of customer churn directly impacts the bargaining power of its customers. High churn rates can give customers more leverage in negotiations for new or renewed leases.

In 2023, American Tower reported that while churn was a factor, its overall tenant revenue growth remained positive, indicating that the impact of cancellations was being offset by new business and expansion from other customers.

- Customer Churn Impact: Contractual lease cancellations and non-renewals, particularly from major clients like T-Mobile in the U.S. & Canada, have contributed to customer churn for American Tower.

- Negotiating Leverage: The potential for significant customer churn can increase the bargaining power of these customers, allowing them to negotiate more favorable terms on existing and future leases.

- Mitigation Strategies: Despite churn, American Tower's focus on expanding its network and securing new tenants helps to mitigate the overall impact on its revenue and customer relationships.

The bargaining power of American Tower's customers, primarily large wireless carriers, is significant due to their substantial business volume and the concentration within the customer base. For instance, in 2023, major carriers like AT&T, Verizon, and T-Mobile represented a considerable portion of American Tower's revenue, often exceeding 50% in certain segments. This allows these carriers to negotiate favorable lease terms and pricing.

While long-term, non-cancellable leases, typically 10-15 years, provide stability, the ongoing capital expenditure cycles of these carriers, such as AT&T's $24 billion and Verizon's $18 billion in 2024 capex, can influence their negotiating leverage. As 5G deployment matures, the demand for new sites might stabilize, potentially increasing customer power.

Customer churn, exemplified by T-Mobile's footprint reduction, also plays a role. While American Tower's 2023 tenant revenue growth remained positive, high churn rates can empower customers to seek more advantageous terms on existing and future agreements, impacting pricing and contract conditions.

| Customer Concentration (U.S. & Canada) | Customer Capital Expenditure (2024 Estimates) | Impact on Bargaining Power |

|---|---|---|

| Major carriers (AT&T, Verizon, T-Mobile) represent >50% of revenue in some segments. | AT&T: ~$24 billion | High concentration grants significant leverage to customers for favorable terms. |

| Long-term leases (10-15 years) mitigate some customer power. | Verizon: ~$18 billion | Substantial carrier investments can increase negotiating leverage, especially as 5G buildouts mature. |

| Customer churn (e.g., T-Mobile) can increase customer negotiating leverage. | Potential for churn allows customers to seek better pricing and contract conditions. |

Full Version Awaits

American Tower Porter's Five Forces Analysis

This preview showcases the complete American Tower Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the wireless infrastructure industry. You'll receive this exact, professionally formatted document immediately after purchase, providing actionable insights into the industry's structure and profitability drivers. Understand the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry to inform your strategic decisions.

Rivalry Among Competitors

The American telecom tower market is a classic oligopoly, dominated by a handful of major players like American Tower, Crown Castle, and SBA Communications. This limited number of large companies means competition is fierce, particularly when it comes to attracting new tenants or securing amendments from existing wireless carriers. These carriers frequently look to co-locate on existing, well-established tower infrastructure to expand their networks efficiently.

American Tower's extensive global footprint, boasting approximately 225,000 communications sites as of early 2024, grants it a formidable competitive advantage. This vast network allows for significant economies of scale in operations and maintenance, directly impacting cost structures. The geographic diversification inherent in this scale also provides resilience against localized market downturns or regulatory changes, a benefit not easily replicated by smaller, regional players.

American Tower's strategic focus on data centers, notably through its CoreSite subsidiary, and its burgeoning edge infrastructure investments are significant competitive advantages. These areas are experiencing robust demand, particularly for AI interconnections and data-intensive applications, directly fueling strong sales growth and broadening the company's competitive reach beyond its traditional tower business.

Technological Adaptation and Innovation

Competitive rivalry in the tower industry is intensified by the imperative to adopt and innovate with new technologies. This includes the deployment of small cells and distributed antenna systems (DAS), which are crucial for enhancing network capacity and coverage in dense urban areas. Companies that can seamlessly integrate these technologies into their existing infrastructure and offer a full suite of services are better positioned to win business.

The ability to manage tower assets efficiently, provide reliable maintenance, and adapt to the ever-changing demands of wireless network evolution is a key differentiator. For instance, American Tower, a major player, has been actively investing in its network infrastructure to support 5G deployments, which require denser networks and new types of antenna systems. In 2024, the demand for tower space continues to grow, driven by increased data consumption and the rollout of advanced mobile technologies.

- Technological Adoption: Companies are competing on their ability to integrate small cells and DAS, essential for 5G and future network upgrades.

- Service Offerings: A comprehensive approach to tower management, maintenance, and network support provides a competitive advantage.

- Network Evolution: Adaptability to changing network demands, such as increased capacity and new spectrum bands, is critical for retaining and attracting clients.

- Investment in Infrastructure: Significant capital expenditure in 2024 by major tower companies like American Tower reflects the ongoing race to modernize and expand capabilities.

Strategic Investments and Portfolio Management

The competitive rivalry within the tower industry, including American Tower, is significantly shaped by strategic investments and portfolio adjustments. Major players frequently engage in acquisitions and divestitures to optimize their geographic footprint and asset quality. For instance, in 2023, American Tower completed the sale of its operations in Nicaragua, Paraguay, and Uruguay for $570 million, demonstrating a strategic shift away from certain markets.

American Tower's strategic priorities underscore a commitment to enhancing its competitive position. The company is actively focusing on generating higher-quality earnings, reducing its debt levels, and allocating capital judiciously. This disciplined approach prioritizes investments in developed markets and the burgeoning data center sector, aiming to bolster its long-term growth and profitability.

This strategic maneuvering directly impacts competitive dynamics. By concentrating on core, high-growth areas and divesting non-core assets, companies like American Tower aim to achieve greater operational efficiency and financial flexibility. This allows them to better compete for new infrastructure development and to respond more effectively to evolving market demands, such as the increasing need for 5G deployment and edge computing capabilities.

- Strategic Acquisitions and Divestitures: In 2023, American Tower sold its Latin American operations in Nicaragua, Paraguay, and Uruguay for $570 million, signaling a strategic realignment.

- Focus on Developed Markets: The company's capital allocation prioritizes investments in mature, high-demand markets, enhancing its competitive advantage in these regions.

- Data Center Development: American Tower is increasing its investment in data center infrastructure, a growing segment that complements its core tower business and attracts new customer segments.

- Deleveraging Efforts: By reducing its debt, American Tower strengthens its financial profile, providing greater capacity for strategic investments and improving its resilience against market fluctuations.

The competitive rivalry in the telecom tower sector is intense, driven by the need for carriers to expand their networks efficiently. American Tower, with approximately 225,000 sites globally as of early 2024, leverages its scale for operational efficiencies and resilience. The industry's competitiveness is further fueled by the rapid adoption of new technologies like small cells and DAS, crucial for 5G deployment, where companies like American Tower are actively investing.

| Key Competitor | Approximate Tower Count (as of early 2024) | Key Competitive Advantage |

|---|---|---|

| American Tower | ~225,000 | Global scale, diversification, data center investments |

| Crown Castle | ~40,000 (US towers) + Fiber | Strong US presence, integrated fiber network |

| SBA Communications | ~37,000 (US, Canada, Central America) | Focus on US market, strong customer relationships |

SSubstitutes Threaten

The rise of small cells and Distributed Antenna Systems (DAS) poses a growing threat of substitution for traditional macro towers, particularly in densely populated urban environments. These technologies offer a more granular approach to network coverage and capacity, which is crucial for the performance demands of 5G. For instance, by mid-2024, the deployment of small cells was accelerating globally to meet the increasing data traffic, especially in city centers where macro tower coverage can be less efficient.

Small cells can provide localized capacity boosts and improved signal quality where it's most needed, potentially reducing the reliance on large, singular macro towers for dense user areas. This cost-effectiveness for targeted capacity needs makes them an attractive alternative for mobile network operators looking to optimize their infrastructure investments. In 2024, many operators were actively exploring hybrid network strategies, integrating small cells alongside macro towers to enhance overall network performance and manage costs.

Innovations like SpaceX's Starlink direct-to-cell technology pose a growing threat of substitutes for satellite-based connectivity solutions. This technology aims to provide cellular service directly to standard smartphones, bypassing the need for specialized hardware. This could significantly impact the market, especially in areas where traditional tower infrastructure is expensive or impossible to deploy.

While satellite solutions are unlikely to fully displace terrestrial towers in densely populated urban areas, they present a viable alternative for expanding coverage in remote and underserved regions. This could potentially slow the demand for new tower builds in rural settings as satellite providers offer a more immediate and cost-effective solution for connectivity in these challenging geographies.

The increasing deployment of fiber optic networks, particularly those extending directly to end-users or serving as backhaul for wireless infrastructure, presents a nuanced threat to American Tower's core business. While fiber is essential for tower backhaul, its broader penetration can act as a partial substitute for certain wireless services, potentially impacting demand for tower space in specific scenarios.

For instance, the growth of fixed wireless access (FWA) powered by fiber backhaul offers an alternative to traditional mobile broadband, which relies heavily on cellular towers. While the exact market share shift is still evolving, some analysts projected FWA to capture a significant portion of the broadband market in 2024, particularly in areas with robust fiber infrastructure.

Private 5G Networks

The rise of private 5G networks presents a growing threat of substitutes for traditional tower companies like American Tower. Enterprises are increasingly deploying these dedicated networks for enhanced security, lower latency, and greater control over their wireless connectivity, particularly in industrial settings. This can diminish their need for services reliant on public cellular infrastructure.

For instance, the Citizens Broadband Radio Service (CBRS) band in the US has been a key enabler for private LTE and 5G deployments. By mid-2024, a significant number of enterprises across manufacturing, logistics, and healthcare sectors were exploring or actively implementing private 5G solutions, reducing their dependence on public network capacity that tower companies lease.

- Enterprise adoption of private 5G networks is accelerating, offering dedicated connectivity solutions.

- Technologies like CBRS are facilitating the growth of these private cellular networks.

- This trend can lead to reduced demand for leased space on traditional public cellular towers as enterprises gain more control over their wireless infrastructure.

Direct Carrier-Owned Infrastructure

While major wireless carriers are increasingly partnering with independent tower companies like American Tower, the theoretical threat of them insourcing more network infrastructure development persists. This means carriers could potentially build and manage their own towers, reducing reliance on third-party providers.

However, the significant capital expenditure and the intricate operational demands of owning and maintaining vast tower portfolios make this a less probable widespread substitute. For instance, the cost to build a new tower can range from $20,000 to $100,000 or more, depending on location and specifications, a substantial investment for each carrier to undertake across their entire network footprint.

- Capital Intensity: Building and maintaining a national tower portfolio requires billions in upfront investment and ongoing operational costs, which most carriers prefer to avoid.

- Operational Complexity: Managing site acquisition, zoning, construction, maintenance, and tenant relations for thousands of towers is a specialized and resource-intensive undertaking.

- Focus on Core Business: Carriers typically prioritize investing in spectrum, network technology, and customer service rather than infrastructure management.

- Industry Trend: The prevailing trend in the telecommunications industry over the past decade has been outsourcing tower infrastructure to specialized companies, a model that has proven efficient and cost-effective.

The threat of substitutes for American Tower's services is multifaceted, encompassing alternative technologies and evolving deployment strategies. Small cells and Distributed Antenna Systems (DAS) offer localized coverage, particularly in urban settings, potentially reducing reliance on macro towers for dense capacity needs. By mid-2024, the global deployment of small cells was significantly increasing to manage escalating data traffic, especially in city centers where macro towers can be less efficient.

Furthermore, direct-to-cell satellite technology, like SpaceX's Starlink, presents a substitution threat, especially for rural and underserved areas where traditional tower infrastructure is costly to deploy. While unlikely to replace terrestrial towers in urban cores, these satellite solutions offer a more immediate alternative for expanding coverage in remote geographies, potentially slowing demand for new rural tower builds.

The increasing penetration of fiber optic networks, particularly for fixed wireless access (FWA), also acts as a partial substitute. FWA, powered by fiber backhaul, provides an alternative to mobile broadband reliant on cellular towers. By 2024, FWA was projected by some analysts to capture a notable share of the broadband market, especially where robust fiber infrastructure exists.

Private 5G networks, enabled by technologies like CBRS, are another significant substitute. Enterprises are increasingly adopting these dedicated networks for enhanced control, lower latency, and improved security, particularly in industrial environments. This trend can decrease their reliance on public cellular infrastructure capacity leased from tower companies. By mid-2024, numerous enterprises were actively exploring or implementing private 5G, reducing their dependence on public network capacity.

Entrants Threaten

The communications real estate sector demands a substantial upfront capital commitment, making it difficult for new players to enter. Acquiring or building a meaningful portfolio of cell towers requires billions of dollars, a significant barrier for most aspiring companies.

American Tower's existing infrastructure and global scale, encompassing approximately 226,000 sites as of the end of 2023, present a formidable challenge to any new entrant. This established network provides significant operational efficiencies and market penetration that are hard to replicate.

Entering the tower infrastructure market, like the one American Tower operates in, is significantly hampered by regulatory and zoning challenges. Obtaining the necessary permits and securing zoning approvals for new tower construction is a protracted and expensive endeavor. For instance, in 2024, the average time to secure a new tower permit in the US could extend over 12 months, with associated costs often reaching tens of thousands of dollars per site.

These complex regulatory environments act as a formidable barrier to entry, particularly for new companies lacking established relationships with local authorities and the specialized expertise to navigate these processes efficiently. This makes it difficult for potential competitors to scale quickly and cost-effectively, thereby protecting incumbent players like American Tower.

American Tower's advantage stems from deeply entrenched relationships with major wireless carriers, often cemented by multi-year, non-cancellable lease agreements. For instance, in 2023, a significant portion of American Tower's revenue was derived from its top customers, underscoring the stickiness of these contracts.

Newcomers would find it exceptionally difficult to lure these existing tenants away. The high switching costs associated with relocating critical network infrastructure, coupled with the mission-critical nature of these sites for carriers, create substantial barriers to entry for any potential competitor seeking to disrupt these established partnerships.

Limited Prime Site Availability

The diminishing availability of prime tower sites, especially in high-demand urban centers, presents a significant barrier for new entrants. This scarcity necessitates substantial capital outlay for land acquisition or the purchase of existing infrastructure, thereby increasing the cost of entry.

For instance, in 2024, the competition for suitable locations intensified as mobile network operators continued their 5G deployment strategies. New companies face the challenge of securing sites that offer optimal coverage and capacity without prohibitive upfront costs.

- Scarce prime locations: Limited availability in densely populated areas crucial for network densification.

- High acquisition costs: Significant investment required for land or existing tower assets.

- Competitive landscape: Intensified competition for sites due to ongoing 5G rollouts in 2024.

Technological Complexity and Data Center Integration

The increasing technological complexity, particularly with the rollout of 5G and the integration of edge computing, presents a significant hurdle for potential new entrants in the tower industry. These advancements require substantial investment in specialized infrastructure and deep technical expertise, areas where established players like American Tower have a distinct advantage. For instance, American Tower's strategic investments in fiber backhaul and data center connectivity are crucial for supporting the high-bandwidth demands of 5G, creating a higher barrier to entry than simply owning passive tower assets.

Newcomers face considerable challenges in replicating the integrated ecosystem that companies like American Tower have developed. This includes not only physical tower assets but also the sophisticated network infrastructure and data management capabilities necessary to serve modern wireless needs. By 2024, the demand for advanced connectivity solutions, driven by IoT and AI, further elevates the technical requirements, making it difficult for new firms to compete effectively against incumbents with established technological prowess and diversified service offerings.

- Technological Sophistication: New entrants must navigate the complexities of 5G deployment, edge computing infrastructure, and data center integration, requiring significant capital and specialized knowledge.

- Integrated Offerings: American Tower's advantage lies in its diversified portfolio, which includes not just towers but also fiber networks and data center solutions, creating a more robust and harder-to-replicate offering.

- Capital Investment: The substantial upfront investment needed for advanced technology and infrastructure development acts as a significant deterrent for potential new market participants.

The threat of new entrants in the communications real estate sector, particularly for companies like American Tower, remains relatively low. This is primarily due to the immense capital requirements for acquiring or building tower infrastructure, often running into billions of dollars. For instance, the cost of acquiring a significant portfolio of towers in 2024 can easily exceed $5 billion, a substantial barrier for any new player.

Furthermore, established players benefit from existing infrastructure, global scale, and deep relationships with wireless carriers, making it difficult for newcomers to gain traction. American Tower's approximately 226,000 sites as of the end of 2023 exemplify this entrenched market position. Regulatory hurdles and zoning complexities also add significant time and cost, with new tower permits in the US averaging over 12 months and costing tens of thousands of dollars in 2024.

The scarcity of prime locations, especially in urban areas, coupled with high acquisition costs, further deters new entrants. The increasing technological demands of 5G and edge computing necessitate substantial investment in specialized infrastructure and expertise, areas where incumbents like American Tower have a clear advantage. These combined factors create a formidable barrier to entry, protecting existing market participants.

| Barrier Type | Description | 2024 Impact/Data Point |

|---|---|---|

| Capital Requirements | Significant upfront investment needed for infrastructure acquisition and development. | Billions of dollars required for a meaningful tower portfolio. |

| Regulatory Hurdles | Lengthy and costly processes for obtaining permits and zoning approvals. | Average of over 12 months and tens of thousands of dollars per site for US permits. |

| Existing Infrastructure & Scale | Established networks and global presence create operational efficiencies and market penetration. | American Tower's ~226,000 sites (end of 2023) provide a significant competitive moat. |

| Customer Relationships | Entrenched contracts with wireless carriers, characterized by high switching costs. | Top customers contribute a significant portion of revenue, indicating contract stickiness. |

| Site Scarcity | Limited availability of prime locations in high-demand urban centers. | Intensified competition for sites due to ongoing 5G rollouts. |

| Technological Complexity | Need for specialized infrastructure and expertise for 5G, edge computing, and advanced connectivity. | Requires substantial investment in fiber backhaul and data center integration. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Tower leverages data from company annual reports, SEC filings, and investor presentations to understand their financial health and strategic positioning. We also incorporate industry research from firms like Gartner and IDC, along with macroeconomic data from sources like the World Bank, to assess the broader market landscape and competitive pressures.