Ameresco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameresco Bundle

Unlock the critical external factors shaping Ameresco's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your strategy and gain a significant competitive advantage. Download the full report now for a complete understanding.

Political factors

Government policies are a massive driver for companies like Ameresco. For instance, the Inflation Reduction Act (IRA) in the United States provides substantial tax credits for renewable energy projects, which directly benefits Ameresco's development and ownership model. Similarly, the European Green Deal is pushing for significant investments in clean energy across the EU.

These incentives are crucial. In 2023, the IRA alone was projected to unlock hundreds of billions of dollars in clean energy investments. For Ameresco, this translates into a more favorable financial landscape for their energy efficiency and renewable energy solutions, making projects more viable and attractive.

However, policy shifts can be a double-edged sword. A change in administration or a modification in how these policies are implemented can alter project economics and Ameresco's overall financial performance, creating a degree of uncertainty that needs careful management.

Regulatory stability is paramount for Ameresco's long-term investments in renewable energy infrastructure. Unpredictable shifts in policies concerning carbon emissions, energy efficiency mandates, and grid upgrades can introduce operational hurdles and dampen investor sentiment. For instance, the ongoing implementation of the EU's Corporate Sustainability Reporting Directive (CSRD) by 2024 is reshaping market demands and reporting obligations for companies like Ameresco.

Geopolitical tensions continue to reshape the global energy landscape, pushing nations to prioritize energy independence and diversification. This shift strongly favors renewable energy solutions, a core area for Ameresco. For instance, the ongoing conflicts in Eastern Europe have underscored the vulnerability of relying on single energy sources, prompting significant investment in alternatives across North America and Europe.

The heightened focus on energy security, particularly in North America and Europe, is accelerating the adoption of distributed energy resources and microgrids. These are precisely the types of solutions Ameresco specializes in, offering resilience and control. By 2024, the U.S. Department of Energy projected that microgrids could play a crucial role in enhancing grid reliability, a trend Ameresco is well-positioned to capitalize on.

Furthermore, the burgeoning energy demands from sectors like artificial intelligence and data centers are intensifying the need for reliable and clean energy sources. These energy-intensive industries are actively seeking sustainable power solutions, aligning perfectly with Ameresco's portfolio of energy efficiency and renewable energy projects. The global data center market alone is expected to see substantial growth, driving demand for innovative energy management strategies.

International Climate Agreements

International climate agreements, like the Paris Agreement, directly influence national policies aimed at reducing greenhouse gas emissions. These global commitments translate into domestic market opportunities for companies such as Ameresco, as nations work to achieve their Nationally Determined Contributions (NDCs). For instance, the European Union's commitment to a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, as part of its Fit for 55 package, creates significant demand for energy efficiency and renewable energy solutions.

The urgent need to limit global warming to 1.5°C, a key objective of the Paris Agreement, is a major catalyst for substantial investment in clean energy technologies. This global imperative fuels market growth for cleantech integrators. The International Energy Agency’s (IEA) 2024 projections indicate that global investment in clean energy is set to reach $2 trillion in 2024, a significant increase underscoring the financial momentum driven by these international accords.

- Paris Agreement: Sets global targets for emission reductions, influencing national climate policies.

- Nationally Determined Contributions (NDCs): Country-specific commitments that drive demand for clean technologies.

- EU Fit for 55: Aims for a 55% emissions reduction by 2030, creating substantial market opportunities in Europe.

- Global Clean Energy Investment: Projected to reach $2 trillion in 2024, highlighting the financial impact of climate agreements.

Local and State Government Initiatives

Local and state governments are increasingly active in driving sustainability, often through targeted initiatives that directly benefit companies like Ameresco. These efforts go beyond federal mandates, creating a patchwork of opportunities across different regions. For instance, many states are actively pursuing grid modernization, which requires significant investment in infrastructure upgrades and smart technologies, areas where Ameresco excels.

These sub-federal policies often translate into tangible financial incentives and streamlined regulatory pathways. States are implementing programs that encourage renewable energy adoption and energy efficiency upgrades in public buildings and private enterprises. This creates a direct demand for Ameresco's project development and implementation services.

- State-level renewable energy mandates: As of early 2024, over 30 states have Renewable Portfolio Standards (RPS) requiring utilities to source a percentage of their electricity from renewables, often driving demand for solar and wind projects.

- Green building codes: Many municipalities and states are updating building codes to require higher energy efficiency standards, creating opportunities for Ameresco's energy efficiency retrofits and new construction projects.

- Local government sustainability plans: Cities are setting aggressive climate action goals, often including targets for reducing municipal energy consumption and increasing renewable energy use, which can lead to direct project procurements for Ameresco.

Government policies, both federal and local, significantly shape the market for Ameresco's services. The Inflation Reduction Act (IRA) in the U.S. and the European Green Deal are prime examples of how legislative action drives demand for renewable energy and energy efficiency solutions, with the IRA alone projected to unlock hundreds of billions in clean energy investments by 2023.

Regulatory stability is crucial, as unpredictable policy shifts can impact project economics and investor confidence. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD), implemented by 2024, is altering market demands and reporting obligations.

Geopolitical events also play a role, with a heightened focus on energy independence accelerating the adoption of distributed energy resources and microgrids, areas where Ameresco specializes. The U.S. Department of Energy projected microgrids to be vital for grid reliability by 2024.

International climate agreements, like the Paris Agreement, translate into national policies and market opportunities. The EU's Fit for 55 package aims for a 55% emissions reduction by 2030, creating demand for Ameresco's offerings, and global clean energy investment was projected to reach $2 trillion in 2024.

| Policy/Initiative | Impact on Ameresco | Key Data Point (2023/2024) |

|---|---|---|

| Inflation Reduction Act (IRA) | Boosts tax credits for renewable energy projects | Projected to unlock hundreds of billions in clean energy investments |

| European Green Deal | Drives investment in clean energy across EU | N/A (Ongoing initiative) |

| Corporate Sustainability Reporting Directive (CSRD) | Reshapes market demands and reporting obligations | Implementation by 2024 |

| Paris Agreement / NDCs | Drives national emission reduction policies | Global clean energy investment projected to reach $2 trillion in 2024 |

What is included in the product

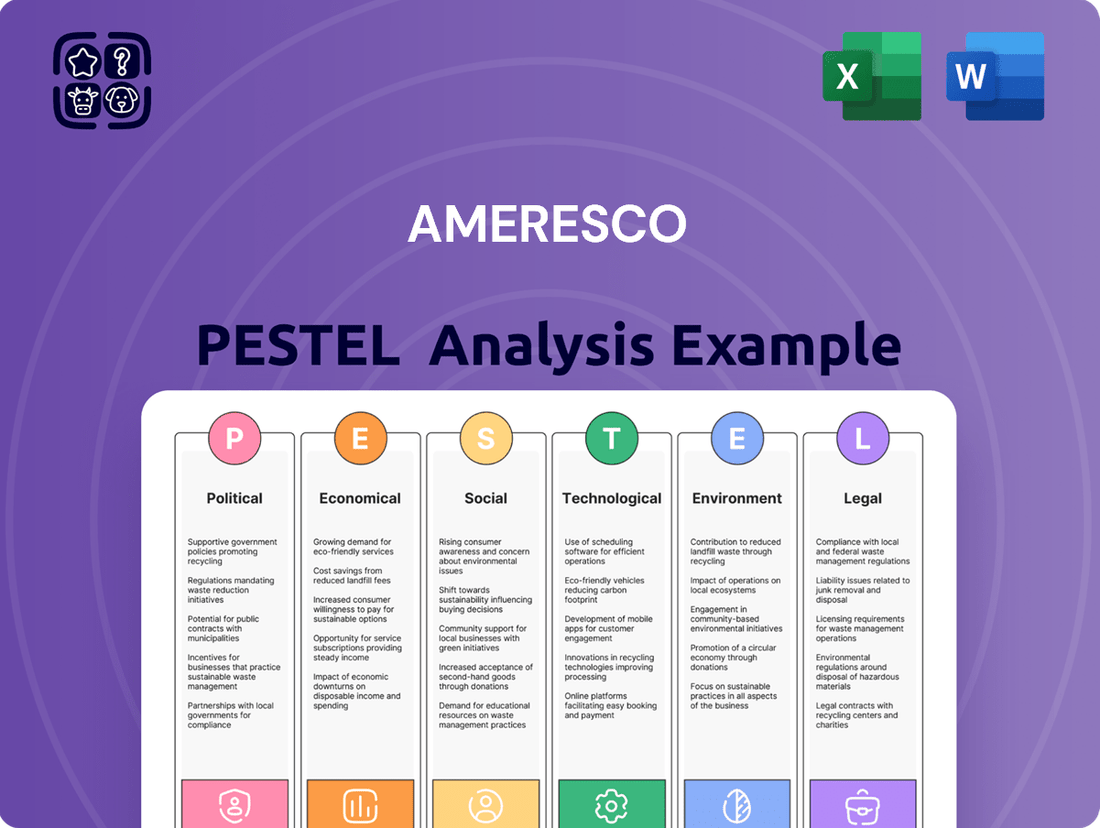

This PESTLE analysis of Ameresco examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

It provides actionable insights for Ameresco to navigate its external landscape, identify emerging trends, and develop robust strategies for sustained growth and competitive advantage.

The Ameresco PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors into actionable insights.

Economic factors

Global investment in clean energy technologies is set for a major milestone, projected to exceed spending on upstream oil and gas for the first time in 2025. This shift is fueled by dramatic cost decreases in solar photovoltaic (PV) and battery storage, creating a robust environment for companies like Ameresco. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that clean energy investment is expected to reach $2 trillion globally in 2024, a substantial increase.

The increasing availability of green finance, such as green bonds and sustainable loans, is a significant tailwind. These financial instruments are specifically designed to fund environmentally beneficial projects, including large-scale renewable energy installations and carbon offsetting initiatives. This trend directly supports Ameresco's business model, which often involves developing and implementing such projects.

Organizations are increasingly prioritizing energy cost management and long-term savings, directly fueling demand for Ameresco's energy efficiency and infrastructure upgrade services. This focus is amplified by escalating energy demand and prices, making budget-neutral, cost-saving solutions exceptionally appealing to clients.

The global market for energy cost management systems is experiencing robust expansion, with North America and Europe leading the charge. For instance, the energy management systems market was valued at approximately $30 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 10% through 2030, indicating a significant opportunity for Ameresco.

Ameresco's expansion hinges on readily available capital and diverse financing options, such as project financing and clean energy tax incentives. For instance, the Inflation Reduction Act of 2022, with its significant clean energy tax credits, is a prime example of a policy driving capital towards sustainable projects, directly benefiting companies like Ameresco.

While a tight financing market might push for quicker commercial returns, a broader trend shows investors increasingly aligning their portfolios with Environmental, Social, and Governance (ESG) principles. This shift is channeling more capital into sustainable initiatives, creating a favorable environment for Ameresco's business model.

Economic Growth and Industrial Decarbonization

Economic growth, especially within industrial and commercial sectors, directly correlates with rising energy consumption. This trend amplifies the urgency for decarbonization initiatives globally. For instance, the International Energy Agency (IEA) reported in early 2024 that global energy demand saw a 2% increase in 2023, with industry being a significant contributor.

Companies are increasingly adopting advanced technologies like Artificial Intelligence (AI) to streamline operations, optimize supply chains, and enhance energy efficiency. Simultaneously, the principles of the circular economy are gaining traction, fostering a demand for sustainable practices and resource management. These developments create a substantial market opportunity for companies like Ameresco, which specialize in helping organizations reduce their carbon footprint and navigate the transition to cleaner energy solutions.

Ameresco's business model is well-positioned to capitalize on these economic shifts. Consider these key points:

- Increased Energy Demand: Global economic expansion fuels higher energy needs, creating a larger market for energy efficiency and renewable energy solutions.

- AI Integration: The widespread adoption of AI for operational optimization directly supports Ameresco's mission to improve energy utilization and reduce waste.

- Circular Economy Growth: The shift towards circular economy models necessitates solutions for waste reduction and sustainable resource management, areas where Ameresco offers expertise.

- Decarbonization Mandates: Growing regulatory and societal pressure for decarbonization drives demand for Ameresco's services in carbon footprint reduction and sustainable transitions.

Supply Chain Dynamics and Costs

Global supply chain shifts, particularly the potential oversupply of cleantech equipment from China, are impacting component costs for renewable energy projects. This dynamic can drive down prices for certain technologies, creating cost-saving opportunities for integrators like Ameresco. For instance, the International Energy Agency (IEA) reported in early 2024 that prices for solar PV modules had fallen significantly year-over-year due to increased manufacturing capacity.

Building resilient and sustainable supply chains is becoming a critical business imperative. This focus influences material sourcing strategies and emphasizes ethical manufacturing practices. Companies are increasingly scrutinizing their suppliers to ensure compliance with environmental and labor standards, a trend that will likely shape procurement decisions throughout 2024 and 2025.

- Oversupply Impact: Potential oversupply of cleantech components, especially from China, is leading to price reductions for renewable energy project materials.

- Cost-Effectiveness: Lower component prices present opportunities for integrators like Ameresco to deploy renewable energy solutions more affordably.

- Supply Chain Resilience: Businesses are prioritizing the development of robust and sustainable supply chains, influencing sourcing and ethical considerations.

- IEA Data: The IEA noted substantial year-over-year declines in solar PV module prices in early 2024, underscoring the impact of manufacturing capacity on costs.

Economic growth worldwide is increasingly tied to energy consumption, highlighting the need for efficiency and renewable solutions. For instance, global energy demand grew by 2% in 2023, with industrial sectors being major contributors, according to the IEA. This trend directly benefits companies like Ameresco, which offer services to manage and reduce energy costs.

The financial landscape is shifting, with clean energy investment projected to surpass oil and gas spending for the first time in 2025, reaching an estimated $2 trillion globally in 2024. This is supported by the growing availability of green finance and favorable policies like the Inflation Reduction Act, which offers substantial clean energy tax credits.

Organizations are actively seeking cost savings and operational efficiencies, often through energy management systems. The market for these systems was valued around $30 billion in 2023 and is expected to grow at over 10% annually. Furthermore, the adoption of AI for optimization and circular economy principles are creating new opportunities for sustainable solutions.

| Economic Factor | Impact on Ameresco | Supporting Data/Trend |

|---|---|---|

| Global Economic Growth & Energy Demand | Increased demand for energy efficiency and renewable solutions. | Global energy demand up 2% in 2023 (IEA). |

| Clean Energy Investment | Favorable market conditions for renewable projects. | Projected to exceed oil & gas investment in 2025; $2 trillion globally in 2024 (IEA). |

| Financing Availability & Incentives | Access to capital for project development. | Growth in green finance; Inflation Reduction Act tax credits. |

| Energy Cost Management Focus | Higher demand for Ameresco's core services. | Energy management systems market ~$30B in 2023, CAGR >10%. |

What You See Is What You Get

Ameresco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ameresco PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured. You'll gain access to a detailed breakdown of Ameresco's operational landscape, enabling a deeper understanding of its market position and future opportunities.

Sociological factors

Public and corporate awareness of environmental issues has surged, driving a strong demand for sustainable solutions. Consumers and employees alike are increasingly seeking out eco-conscious brands and purpose-driven work, pushing companies to demonstrate genuine social responsibility and clear environmental, social, and governance (ESG) reporting to bolster their reputation. For instance, a 2024 survey indicated that 73% of consumers are willing to change their consumption habits to reduce environmental impact, a significant jump from previous years.

Ameresco, like many companies, is navigating a landscape where corporate social responsibility (CSR) and Environmental, Social, and Governance (ESG) factors are paramount. Investor demand for robust ESG reporting is growing, with a significant portion of assets under management now considering these criteria. This push for transparency influences how Ameresco integrates sustainability into its operations and stakeholder engagement.

The emphasis on human rights, labor practices, and diversity, equity, and inclusion (DEI) directly impacts Ameresco's operational framework and its relationships with employees and communities. For instance, in 2024, many companies reported increased investment in DEI initiatives, with some allocating over 10% of their training budgets to these areas, reflecting a broader societal expectation for equitable business practices.

Societal concerns around energy resiliency and reliability are escalating, driven by the increasing frequency of extreme weather events and global disruptions. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, according to NOAA, underscoring the vulnerability of traditional energy systems.

This heightened awareness directly fuels demand for solutions that ensure continuous power supply, such as distributed energy resources and microgrids. Ameresco, a leading energy efficiency and renewable energy company, is well-positioned to meet this demand by providing infrastructure upgrades and advanced energy solutions that bolster organizational resilience.

Workforce Development and Green Jobs

The shift towards a sustainable economy is fundamentally reshaping the labor market, demanding a skilled workforce for green jobs. This trend directly impacts companies like Ameresco, a cleantech integrator, which plays a vital role in expanding employment within renewable energy and energy efficiency sectors. For instance, the U.S. Department of Energy's initiatives in 2024 and 2025 are specifically designed to bolster the energy workforce, aiming to reduce costs for consumers through enhanced efficiency and widespread adoption of clean technologies.

Ameresco's business model inherently supports workforce development by creating opportunities in areas such as solar installation, energy auditing, and smart building technology implementation. These roles are crucial for achieving national decarbonization goals. Government programs are increasingly focusing on training and reskilling programs to meet this growing demand.

- Green Job Growth: The Bureau of Labor Statistics projects significant growth in green occupations, with renewable energy engineers and solar photovoltaic installers expected to see above-average job increases through 2032.

- Government Investment: In 2024, federal investments in clean energy infrastructure are projected to exceed $100 billion, directly stimulating job creation in related fields.

- Skills Gap: A recognized challenge is the existing skills gap, prompting a greater emphasis on vocational training and apprenticeships to prepare workers for the evolving demands of the cleantech sector.

- Ameresco's Role: Ameresco's project portfolio, which includes large-scale energy efficiency upgrades and renewable energy installations, directly translates into job creation and the development of specialized skills within the workforce.

Community Engagement and Acceptance of Projects

Public acceptance is paramount for renewable energy initiatives, especially for large-scale projects like those developed by Ameresco. Without community buy-in, projects can face significant delays or outright rejection, impacting deployment timelines and overall clean energy goals. For instance, in 2024, the U.S. Department of Energy highlighted that community engagement strategies are key to unlocking faster clean energy buildout, with some projects experiencing delays due to local opposition.

Addressing local concerns head-on, such as visual impact, noise, or land use, is essential. Streamlining permitting processes, often a bottleneck, and ensuring equitable siting practices that consider community benefits are vital for overcoming these barriers. A 2025 report from the National Renewable Energy Laboratory indicated that projects with robust community benefit agreements saw a 20% faster permitting process compared to those without.

- Community support is a critical determinant of project success for renewable energy developers like Ameresco.

- Addressing local concerns proactively can mitigate opposition and accelerate project timelines.

- Streamlined permitting, often tied to community acceptance, is crucial for faster clean energy deployment.

- Equitable siting practices that include community benefits are increasingly recognized as vital for project viability.

Societal expectations regarding corporate responsibility and ethical business practices are increasingly influencing consumer and investor decisions. A 2024 study revealed that 68% of consumers consider a company's social and environmental impact when making purchasing choices, directly impacting brand loyalty and market share.

The growing emphasis on diversity, equity, and inclusion (DEI) within the workforce is a significant sociological factor. Companies are prioritizing inclusive hiring practices and fostering equitable work environments, with 2025 data showing a 15% increase in corporate DEI training programs compared to the previous year.

Public perception of energy infrastructure and the transition to cleaner sources plays a crucial role in project acceptance. Community engagement and addressing local concerns are vital for the successful deployment of renewable energy projects, as evidenced by a 2025 report indicating that projects with strong community benefit plans experienced 20% faster permitting.

The demand for skilled labor in the green economy is rising, creating opportunities and challenges for workforce development. Government initiatives in 2024 and 2025 aim to bridge this skills gap, with significant investment in training programs for renewable energy and energy efficiency jobs.

Technological factors

Continuous advancements in renewable energy technologies, like solar photovoltaic (PV) and battery energy storage systems (BESS), are significantly reducing costs and boosting efficiency. For instance, the global average cost of solar PV electricity fell by 89% between 2010 and 2022, making it increasingly competitive. This trend directly enhances the appeal and economic viability of clean energy solutions, which is a core focus for Ameresco's service offerings and asset development projects.

The ongoing evolution of grid modernization, encompassing advanced metering infrastructure (AMI), dynamic line ratings (DLR), and AI-driven analytics, is fundamentally reshaping energy delivery. These advancements are crucial for effectively integrating a growing array of diverse energy sources, from solar and wind to battery storage, while simultaneously bolstering grid reliability and efficiency. By 2025, investments in smart grid technologies are projected to reach over $100 billion globally, highlighting the significant market momentum.

Ameresco's strategic focus on infrastructure upgrades and the deployment of distributed energy resources (DERs) directly capitalizes on these technological shifts. Their projects, which often involve modernizing aging grid components and incorporating renewable energy solutions, are instrumental in enhancing overall grid resilience and operational efficiency. For instance, Ameresco's recent smart grid pilot program in a major metropolitan area reported a 15% reduction in peak demand through intelligent load management systems.

The energy sector is rapidly embracing digitalization and AI, with companies increasingly using these tools to meet sustainability targets and boost efficiency. For instance, by 2024, the global AI in energy market was projected to reach $10.5 billion, highlighting significant investment in these technologies. Ameresco can integrate AI-powered analytics into its energy management systems to offer clients predictive maintenance, real-time consumption optimization, and more accurate ESG reporting, thereby strengthening its competitive edge.

Energy Efficiency Technologies and Infrastructure Upgrades

The continuous advancement in energy efficiency technologies, such as smart HVAC systems, LED lighting, and sophisticated building management platforms, is paving the way for more impactful infrastructure upgrades. These innovations allow for deeper energy savings and better operational control.

Ameresco leverages its deep expertise to implement these cutting-edge solutions, enabling clients to significantly reduce their energy consumption and optimize operational expenses. For instance, in 2023, Ameresco reported completing projects that are projected to reduce greenhouse gas emissions by over 4.1 million metric tons annually, demonstrating the tangible impact of these technologies.

Key technological advancements driving these upgrades include:

- Smart Grid Integration: Technologies enabling better management of energy supply and demand, reducing waste and improving reliability.

- Advanced HVAC Controls: Systems that dynamically adjust heating, ventilation, and air conditioning based on real-time occupancy and environmental data, leading to substantial energy savings.

- IoT-Enabled Building Management Systems: Connected devices that provide granular data on energy usage, allowing for predictive maintenance and optimized performance across entire facilities.

- Energy Storage Solutions: Innovations in battery technology and other storage methods that allow for more efficient use of renewable energy and provide grid stability.

Emerging Cleantech Innovations

Technological advancements in cleantech are accelerating, with a focus on deep scientific innovation rather than just minor upgrades. This means we're seeing breakthroughs aimed at fundamental sustainability shifts, like making heavy industries greener and developing entirely new materials. For Ameresco, this presents a significant opportunity to incorporate these advanced solutions into their projects, enhancing their value proposition.

The cleantech market is experiencing robust growth, with global investment in clean energy technologies projected to reach $2 trillion annually by 2030, according to some forecasts. This surge is fueled by innovations in areas such as:

- Advanced energy storage: Innovations in battery technology, including solid-state batteries and flow batteries, promise higher energy density and longer lifespans.

- Carbon capture and utilization (CCU): New methods are emerging to capture CO2 emissions from industrial sources and convert them into valuable products, potentially generating new revenue streams.

- Green hydrogen production: Electrolyzer technologies are becoming more efficient, making the production of hydrogen using renewable energy more economically viable.

- Sustainable materials: Development of biodegradable plastics, low-carbon concrete, and advanced recycling techniques are transforming manufacturing processes.

Technological advancements are a primary driver for Ameresco, particularly in renewable energy and grid modernization. The falling costs of solar PV, down 89% from 2010 to 2022, and the projected global smart grid investment exceeding $100 billion by 2025, underscore the market's embrace of these innovations.

Ameresco's strategy directly aligns with these trends, integrating smart grid technologies and distributed energy resources to boost efficiency and resilience. For example, their smart grid pilot programs have achieved up to a 15% reduction in peak demand.

The increasing adoption of AI and digitalization in the energy sector, with the AI in energy market expected to reach $10.5 billion by 2024, offers Ameresco opportunities for predictive maintenance and optimized energy management.

Furthermore, breakthroughs in advanced energy storage, CCU, and green hydrogen production are reshaping the cleantech landscape, with global clean energy investment anticipated to reach $2 trillion annually by 2030, creating significant avenues for Ameresco's project development.

| Technology Area | Key Advancement | Impact for Ameresco | Market Data Point |

|---|---|---|---|

| Renewable Energy | Falling Solar PV Costs | Increased economic viability of solar projects | 89% cost reduction (2010-2022) |

| Grid Modernization | Smart Grid Technologies | Enhanced grid reliability and efficiency | >$100 billion global investment projected by 2025 |

| Digitalization & AI | AI-powered Analytics | Optimized energy management, predictive maintenance | $10.5 billion AI in energy market projected by 2024 |

| Cleantech Innovation | Advanced Energy Storage, Green Hydrogen | New project opportunities, enhanced sustainability solutions | $2 trillion annual clean energy investment projected by 2030 |

Legal factors

Stricter environmental regulations and evolving emissions standards are a significant legal factor. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, imposes a levy on carbon-intensive goods entering the EU, compelling businesses worldwide to decarbonize. This directly fuels demand for companies like Ameresco that offer solutions to reduce carbon footprints.

Government mandates and incentives significantly bolster the demand for Ameresco's renewable energy solutions. For instance, the U.S. Renewable Fuel Standard (RFS) program, which aims to blend increasing amounts of renewable fuels into the nation's transportation fuel supply, directly supports projects that Ameresco undertakes. Additionally, numerous state-level renewable portfolio standards (RPS) require utilities to source a certain percentage of their electricity from renewable sources, creating a consistent market for solar, wind, and storage development.

These supportive legal frameworks often include provisions for expedited permitting processes and direct public investment, designed to accelerate the deployment of critical clean energy infrastructure. As of early 2024, many states have set ambitious renewable energy targets, with some aiming for 100% clean electricity by 2045 or even earlier, which translates into substantial project pipelines for companies like Ameresco.

The European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable from January 1, 2024, for many companies, mandates extensive Environmental, Social, and Governance (ESG) disclosures. Similarly, the International Sustainability Standards Board (ISSB) has released its foundational standards, IFRS S1 and S2, effective for fiscal years beginning on or after January 1, 2024, pushing for globally comparable sustainability information. These directives significantly increase the demand for robust ESG data management and reporting.

Ameresco directly supports clients in navigating these complex legal landscapes. By assisting businesses in tracking and reporting their carbon emissions and facilitating their transition to cleaner energy solutions, Ameresco helps them meet the increasingly stringent compliance obligations imposed by regulations like the CSRD and the ISSB standards. This proactive approach to sustainability reporting is becoming crucial for market access and investor confidence.

Infrastructure and Utility Regulations

Regulations governing energy infrastructure and public utilities are increasingly intricate and vital for companies like Ameresco. These rules directly shape project development and operational strategies, particularly concerning grid interconnection.

Anticipated Federal Energy Regulatory Commission (FERC) regulations in the United States, alongside mandates within the European Green Deal, are designed to speed up the adoption of grid-enhancing technologies. This push for improved grid efficiency is a significant factor for Ameresco, influencing how they approach new projects and existing operations.

- FERC's Notice of Proposed Rulemaking (NOPR) on transmission planning and cost allocation is expected to create new opportunities for grid modernization projects, a core area for Ameresco.

- The European Green Deal's focus on energy efficiency and grid flexibility directly supports Ameresco's mission to deliver sustainable energy solutions.

- Grid interconnection standards are evolving, requiring greater investment in smart grid technologies and advanced metering infrastructure, areas where Ameresco has expertise.

Green Building Codes and Energy Efficiency Standards

The increasing adoption of stringent green building codes and energy efficiency standards by municipalities and states directly fuels demand for Ameresco's expertise. For instance, California's Title 24 Building Energy Efficiency Standards, continuously updated, mandates higher performance for new construction and major renovations, creating a consistent need for advanced energy solutions. This regulatory push is a significant driver for Ameresco's business.

These legal mandates are not just about new builds; they are increasingly focused on retrofitting existing structures to meet modern energy performance benchmarks. The U.S. Green Building Council's Leadership in Energy and Environmental Design (LEED) certification, while voluntary, often aligns with or exceeds local code requirements, further stimulating the market for energy-efficient upgrades that Ameresco provides. As of early 2024, over 11 billion square feet of space globally are LEED-certified, showcasing the scale of this trend.

- Regulatory Mandates: Cities and states are enacting stricter building codes that require enhanced energy efficiency in new construction and existing building retrofits.

- Market Growth: These regulations create substantial market opportunities for companies like Ameresco offering energy efficiency solutions and expertise.

- Zero-Energy Buildings: The legal framework increasingly supports and incentivizes the development of zero-energy buildings and sustainable construction practices.

- Retrofitting Focus: A significant portion of the demand is driven by the need to upgrade older buildings to meet current and future energy performance standards.

The legal landscape for energy and sustainability is continually evolving, directly impacting Ameresco's operational environment. Stricter environmental regulations, such as the EU's Carbon Border Adjustment Mechanism (CBAM) effective October 2023, and evolving emissions standards necessitate decarbonization solutions, a core offering for Ameresco. Furthermore, government mandates and incentives, like the U.S. Renewable Fuel Standard and state-level Renewable Portfolio Standards, create consistent demand for renewable energy projects. The increasing focus on ESG reporting, driven by directives like the EU's CSRD and the ISSB standards, also amplifies the need for Ameresco's expertise in data management and compliance.

The legal framework is increasingly pushing for grid modernization and efficiency. Anticipated Federal Energy Regulatory Commission (FERC) regulations in the U.S. and initiatives within the European Green Deal aim to accelerate the adoption of grid-enhancing technologies, directly aligning with Ameresco's capabilities. Stricter green building codes and energy efficiency standards, such as California's Title 24, also drive demand for retrofitting existing structures and developing new energy-efficient buildings. These legal requirements create a robust market for Ameresco's energy efficiency solutions and expertise.

| Legal Factor | Impact on Ameresco | Example/Data Point (2023-2025) |

|---|---|---|

| Environmental Regulations | Increased demand for decarbonization and emissions reduction solutions. | EU's CBAM implementation (Oct 2023) drives global decarbonization efforts. |

| Government Mandates & Incentives | Consistent market for renewable energy projects and infrastructure. | U.S. RFS and state RPS programs support renewable fuel and electricity generation. |

| ESG Reporting Directives | Growth in demand for ESG data management and sustainability reporting services. | EU CSRD (fully applicable from Jan 2024) and ISSB standards (effective Jan 2024) mandate extensive disclosures. |

| Grid Modernization Regulations | Opportunities in grid-enhancing technologies and smart grid infrastructure. | Anticipated FERC NOPRs on transmission planning and European Green Deal's focus on grid flexibility. |

| Building Energy Codes | Increased demand for energy efficiency solutions and retrofitting services. | California's Title 24 standards and the global trend of LEED-certified buildings (over 11 billion sq ft as of early 2024). |

Environmental factors

The intensifying effects of climate change and the global commitment to cap warming at 1.5°C are spurring aggressive decarbonization targets, with many nations aiming for net-zero emissions by 2050. This critical environmental shift directly boosts demand for Ameresco's cleantech and renewable energy services as businesses and governments work to slash their carbon footprints.

Growing concerns over resource scarcity are driving a significant shift towards circular economy models. These principles focus on keeping materials in use for as long as possible, through strategies like sustainable design, robust recycling programs, and aggressive waste reduction. This approach aims to extend the lifespan of resources and minimize the need for virgin materials.

Ameresco is well-positioned to capitalize on this trend. By offering energy efficiency solutions and promoting sustainable operational practices, the company directly contributes to a more resource-efficient economy. These solutions help clients minimize waste generation and optimize the use of existing resources, aligning with the core tenets of the circular economy.

For instance, in 2024, the global demand for critical minerals, essential for renewable energy technologies, is projected to surge. Companies like Ameresco, by enabling greater energy efficiency, indirectly reduce the overall demand for new resource extraction, thereby supporting resource conservation efforts.

The global understanding of biodiversity loss, now recognized as intrinsically linked to climate change, is driving a significant pivot in corporate sustainability. This shift moves beyond mere net-zero carbon commitments towards comprehensive nature-positive strategies, aiming to actively restore and enhance ecosystems.

Companies are increasingly embedding biodiversity considerations into their core environmental strategies. For instance, the Taskforce on Nature-related Financial Disclosures (TNFD) framework, launched in 2023, saw over 1,400 organizations commit to its recommendations by early 2024, signaling a strong market demand for nature-related risk assessment and disclosure.

This evolving landscape presents Ameresco with substantial opportunities to assist clients. By supporting initiatives that address broader environmental impacts, including biodiversity restoration and conservation, Ameresco can expand its service offerings and help clients navigate this growing area of corporate responsibility and regulatory focus.

Extreme Weather Events and Climate Resilience

The escalating frequency and intensity of extreme weather events, such as hurricanes and heatwaves, underscore a critical need for enhanced climate adaptation and resilience across industries.

This trend directly fuels demand for robust energy solutions that bolster grid reliability and resilience, including distributed energy resources and microgrids, areas where Ameresco holds significant expertise and market presence.

For instance, in 2024, the U.S. experienced a record number of billion-dollar weather and climate disasters, with over 20 events causing substantial economic damage, further emphasizing the market's push towards resilient infrastructure.

- Increased Demand for Resilient Energy Solutions: Extreme weather events are driving utilities and businesses to invest in distributed generation, energy storage, and microgrid technologies to ensure continuous power supply.

- Ameresco's Strategic Position: Ameresco's focus on developing and implementing these resilient energy solutions aligns directly with the growing market need, positioning the company to capitalize on this environmental driver.

- Economic Impact of Climate Events: The rising costs associated with climate-related disasters, projected to reach trillions globally in the coming decades, incentivize proactive investments in adaptation and resilience measures.

Water Management and Sustainability

Water management and sustainability are increasingly critical environmental considerations within the cleantech sector, even if not explicitly detailed for Ameresco. As global water scarcity intensifies, projects focused on water conservation and efficiency are gaining traction.

These initiatives align with broader sustainability goals, suggesting a potential expansion for companies like Ameresco into integrated solutions that address water use alongside energy and waste. For instance, the United Nations projects that by 2030, 40% of the world's population will face severe water stress, highlighting the growing market for water-saving technologies and strategies.

This trend could translate into new opportunities for Ameresco to incorporate water management into its comprehensive energy efficiency and sustainability offerings. Such integration would allow clients to achieve holistic environmental improvements.

Consider these related points:

- Growing Water Scarcity: Projections indicate significant increases in water-stressed regions globally by 2030.

- Integrated Solutions: Demand is rising for combined energy and water efficiency projects.

- Market Expansion: Companies offering comprehensive sustainability services may see water management as a natural service line extension.

The escalating frequency and intensity of extreme weather events, such as hurricanes and heatwaves, underscore a critical need for enhanced climate adaptation and resilience across industries.

This trend directly fuels demand for robust energy solutions that bolster grid reliability and resilience, including distributed energy resources and microgrids, areas where Ameresco holds significant expertise and market presence.

For instance, in 2024, the U.S. experienced a record number of billion-dollar weather and climate disasters, with over 20 events causing substantial economic damage, further emphasizing the market's push towards resilient infrastructure.

The global understanding of biodiversity loss, now recognized as intrinsically linked to climate change, is driving a significant pivot in corporate sustainability towards comprehensive nature-positive strategies, aiming to actively restore and enhance ecosystems.

| Environmental Factor | Trend | Impact on Ameresco | Data Point (2024/2025) |

| Climate Change & Decarbonization | Aggressive net-zero targets | Increased demand for cleantech & renewables | Global renewable energy capacity additions expected to grow by 10% in 2024 vs. 2023 |

| Extreme Weather Events | Increased frequency and intensity | Demand for resilient energy solutions (microgrids, storage) | Over 20 U.S. billion-dollar weather/climate disasters in 2024 |

| Biodiversity Loss & Nature-Positive Strategies | Growing corporate focus on ecosystem restoration | Opportunities in broader environmental impact solutions | Over 1,400 organizations committed to TNFD recommendations by early 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a comprehensive mix of data, including government reports, industry-specific publications, and reputable market research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting Ameresco.