Ameresco Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameresco Bundle

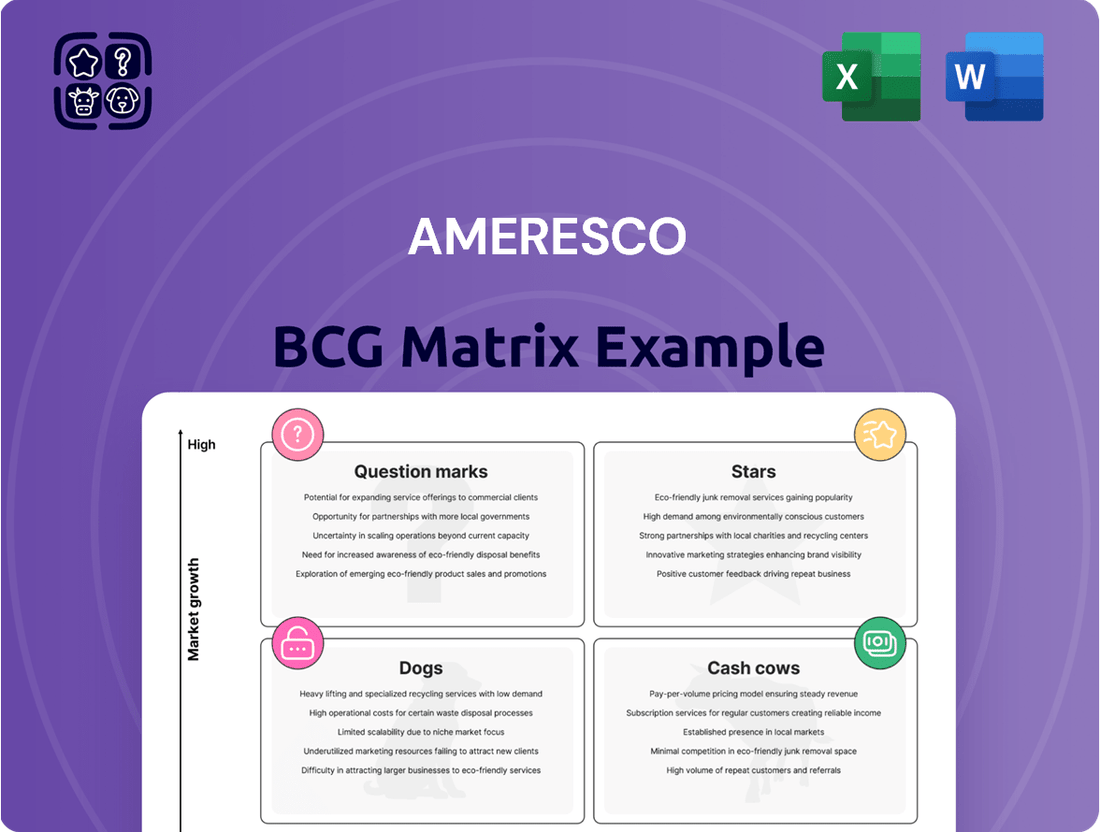

Curious about Ameresco's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their market dynamics and unlock actionable growth strategies, you need the full picture.

Don't miss out on the complete BCG Matrix for Ameresco, which provides a detailed quadrant-by-quadrant analysis and data-driven recommendations. Purchase the full report to gain the strategic clarity needed to make informed investment and product decisions.

Stars

Ameresco's significant involvement in large-scale solar and battery energy storage systems, like the Kūpono Solar Project in Hawaii, highlights its strong market presence in rapidly expanding renewable energy sectors. This project, a 120-megawatt solar and 180-megawatt-hour battery energy storage system, is one of the largest in Hawaii, showcasing Ameresco's capability in utility-scale deployments.

These innovative projects, recognized for their substantial environmental benefits, position Ameresco as a leader in the utility-scale renewable energy segment. The company's commitment to developing such impactful infrastructure underscores its strategic focus on high-growth areas within the clean energy market.

Ameresco's commitment to expanding its Renewable Natural Gas (RNG) facilities, exemplified by the recent operational Lee County Landfill plant, positions it as a leader in transforming waste into valuable energy. This strategic focus is fueled by a robust market demand for low-carbon transportation fuels and efficient waste-to-energy solutions.

The RNG sector is experiencing substantial growth, with the U.S. market alone projected to reach $2.6 billion by 2027, according to some industry forecasts. Ameresco's ongoing development of these facilities directly taps into this expanding market, converting methane from landfills into a clean energy source.

Ameresco excels in comprehensive energy efficiency solutions, a key strength in the BCG matrix. Their extensive experience in North America and Europe, particularly with Energy Savings Performance Contracts (ESPCs), highlights their ability to meet a persistent demand for cost savings and decarbonization. For instance, in 2023, Ameresco completed over $1 billion in projects, demonstrating significant market penetration.

Microgrids and Energy Resilience Solutions

Ameresco's advanced microgrids and battery energy storage systems (BESS) are positioned as a star in the energy sector, reflecting significant growth potential due to increasing demand for energy security and grid stability.

Their successful projects, such as the one for United Power which features a 15 MW solar facility paired with a 30 MW/120 MWh BESS, highlight Ameresco's innovative approach and robust market standing in critical infrastructure development.

- High Growth Potential: The market for microgrids and BESS is expanding rapidly, driven by the need for resilient energy solutions.

- Technological Innovation: Ameresco is at the forefront of implementing sophisticated microgrid technologies and large-scale battery storage.

- Proven Track Record: Projects like the United Power initiative demonstrate Ameresco's capability to deliver complex, high-impact energy infrastructure.

International Expansion and Strategic Partnerships

Ameresco’s international expansion, particularly into European markets, showcases a strategic move to diversify revenue streams and tap into growing demand for energy efficiency and renewable energy solutions. The company's recent focus on markets like Romania, with new leadership and project wins, reflects a commitment to establishing a strong presence in regions with significant growth potential. For instance, in 2024, Ameresco secured a significant contract for energy efficiency upgrades at a major military installation in Germany, highlighting its increasing traction in the European defense sector.

Strategic partnerships are a cornerstone of Ameresco's global growth strategy, enabling them to leverage local expertise and expand their service offerings. These collaborations are crucial for navigating complex regulatory environments and accessing new customer segments. In the first half of 2024, Ameresco announced a key partnership with a leading European utility company to develop a portfolio of distributed energy projects across the continent, aiming to accelerate the transition to cleaner energy sources.

- European Market Penetration: Ameresco's expansion into Romania and Germany in 2024 signifies a deliberate effort to capture market share in key European renewable energy sectors.

- Leadership Appointments: New leadership in European operations is crucial for driving localized strategies and project execution, enhancing Ameresco's competitive edge.

- Strategic Alliances: Partnerships with European entities, such as the utility collaboration announced in mid-2024, are vital for expanding market reach and project development capabilities.

- Project Wins: Securing projects like the German military installation upgrades in 2024 demonstrates Ameresco's growing credibility and capacity within the European market.

Ameresco's advanced microgrids and battery energy storage systems (BESS) are positioned as stars in the energy sector. This is due to their significant growth potential, driven by increasing demand for energy security and grid stability. The market for these solutions is expanding rapidly, with projects like the one for United Power, featuring a 15 MW solar facility paired with a 30 MW/120 MWh BESS, demonstrating Ameresco's innovative approach and robust market standing in critical infrastructure development.

| Business Unit | Market Growth | Market Share | Profitability | Competitive Advantage |

|---|---|---|---|---|

| Microgrids & BESS | High | Growing | Strong | Technological innovation, proven track record |

What is included in the product

Ameresco's BCG Matrix offers a strategic framework for analyzing its diverse energy efficiency and renewable energy projects.

It guides decisions on investment, divestment, and resource allocation across its project portfolio.

Ameresco's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis by placing each business unit in its quadrant for immediate understanding.

Cash Cows

Ameresco's Operations & Maintenance (O&M) services are a prime example of a cash cow within its business model. These services generate recurring revenue through long-term contracts, offering a stable and predictable income stream. This stability is crucial for financial planning and supports other, more growth-oriented ventures within the company.

The O&M segment benefits from Ameresco's extensive project history, as many of these contracts are linked to previously completed energy efficiency and infrastructure projects. This established client base and ongoing need for upkeep means lower incremental investment is required to maintain these revenue streams, allowing for consistent profit generation in a mature market segment.

In 2024, Ameresco reported that its O&M segment continues to be a significant contributor to its financial performance, highlighting the reliability of this recurring revenue. For instance, the company's backlog of O&M contracts provides visibility into future earnings, underscoring its cash cow status.

Ameresco's established energy asset portfolio, encompassing solar, battery storage, and biogas facilities, functions as a prime Cash Cow. These operational assets are already generating substantial, high-margin recurring revenue, reflecting their mature and stable market position.

With these assets already in place, the need for significant growth investment is minimal. This allows Ameresco to benefit from steady and predictable cash flow, a hallmark of Cash Cow businesses within the BCG matrix framework.

For instance, Ameresco's renewable energy projects, operational for years, consistently contribute to the company's bottom line. In 2024, the company continued to leverage these established assets, which are key drivers of its financial stability and profitability.

Federal Government Contracts are a significant Cash Cow for Ameresco, showcasing its established presence and recurring revenue streams. The company's nearly 20-year partnership with Joint Base McGuire-Dix-Lakehurst exemplifies this, highlighting the stability and longevity of these engagements.

These long-term contracts, focused on infrastructure upgrades and maintenance, provide a consistent and predictable income. In 2023, Ameresco secured over $1 billion in new federal contracts, underscoring the substantial and ongoing demand for its services within this sector.

Traditional Energy Infrastructure Upgrades

Ameresco's focus on upgrading traditional energy infrastructure, such as HVAC systems and lighting in educational and government buildings, falls into the Cash Cow quadrant of the BCG Matrix. This segment benefits from consistent demand due to the age of existing infrastructure and regulatory drivers for efficiency improvements.

These projects, while not experiencing explosive growth, offer stable profit margins and predictable revenue streams for Ameresco. For instance, in 2023, Ameresco reported significant project completions in this area, contributing to their overall financial stability. The company's extensive experience in this mature market allows for efficient execution and reliable returns.

- Mature Market: Demand for infrastructure upgrades is consistent, driven by aging facilities and energy efficiency mandates.

- Stable Profitability: Projects in this segment typically yield reliable profit margins due to Ameresco's established expertise and operational efficiencies.

- Consistent Revenue: These upgrades provide a steady income stream, reinforcing Ameresco's financial foundation.

- Strong Track Record: Ameresco has a proven history of successfully delivering these types of projects for diverse clients.

Long-Term Client Relationships

Ameresco's strength in cultivating enduring client connections is a significant driver of its stability. This is clearly demonstrated through the consistent renewal of existing contracts and the successful execution of multi-phase projects, which together build a reliable revenue stream. These long-standing partnerships are a hallmark of a cash cow, as they foster repeat business and substantially reduce the expenses associated with acquiring new customers.

The company's focus on nurturing these relationships translates directly into financial benefits. For instance, in 2023, Ameresco reported that a substantial portion of its revenue was derived from existing customers, underscoring the value of these long-term engagements. This repeat business model minimizes sales and marketing overhead, allowing for greater profitability from each client over time.

- Stable Revenue: Long-term client relationships provide a predictable and consistent income source.

- Reduced Acquisition Costs: Retaining existing clients is significantly more cost-effective than acquiring new ones.

- Repeat Business: Renewed agreements and follow-on projects are common, ensuring continuous revenue.

- Client Loyalty: Deep-seated trust and satisfaction foster loyalty, making clients less susceptible to competitors.

Ameresco's Operations & Maintenance (O&M) services and its portfolio of operational renewable energy assets represent significant cash cows. These segments benefit from recurring revenue streams, minimal growth investment needs, and established market positions, providing stable and predictable cash flows for the company. In 2023, Ameresco's O&M segment continued to be a strong financial contributor, and its renewable energy projects consistently boosted profitability, underscoring their cash cow status.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Operations & Maintenance (O&M) | Cash Cow | Recurring revenue, long-term contracts, low investment needs | Significant contributor to financial performance, stable backlog |

| Operational Renewable Energy Assets | Cash Cow | High-margin recurring revenue, mature market, minimal growth investment | Key driver of financial stability and profitability |

| Federal Government Contracts | Cash Cow | Long-term, stable income, established presence | Over $1 billion in new federal contracts secured in 2023 |

| Infrastructure Upgrades (HVAC, Lighting) | Cash Cow | Consistent demand, stable profit margins, mature market | Significant project completions in 2023 |

Preview = Final Product

Ameresco BCG Matrix

The Ameresco BCG Matrix document you are currently previewing is the exact, final version you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, offering a clear, professional analysis without any watermarks or demo content.

Dogs

Ameresco's divestiture of non-core assets, exemplified by the sale of its Asset Energy Group (AEG) at the close of 2024, signals a deliberate strategic pivot. This move suggests a focus on shedding business lines with diminished growth potential or a weaker competitive standing. For instance, AEG, which operated in a less dynamic market segment, was divested to sharpen Ameresco's concentration on its core, higher-return operations.

Ameresco's European EPC projects, particularly those with lower gross margins, may represent a strategic challenge. For instance, some of these contracts have shown margins below the company's overall average, suggesting a segment where competitive intensity or operational costs are higher. While these projects still contribute to top-line growth, their lower profitability can impact overall cash flow generation efficiency.

Legacy technologies with declining demand represent areas where Ameresco might be reducing investment or phasing out offerings. Think of older, less efficient lighting systems or building management controls that newer, smarter, and more energy-saving alternatives are rapidly replacing. For instance, while specific Ameresco product lines aren't publicly categorized this way, the broader energy efficiency market has seen a significant shift. In 2024, the global smart lighting market alone was projected to reach over $15 billion, indicating a strong preference for advanced solutions over traditional ones.

Highly Competitive or Commoditized Service Lines

In highly commoditized segments of the energy services market, differentiation becomes a significant challenge, leading to intense price competition. For Ameresco, service lines that fall into this category might experience thin profit margins and struggle to gain substantial market share.

These areas, if they consistently underperform relative to the company's overall portfolio and market potential, would be classified as 'Dogs' within the Ameresco BCG Matrix. For instance, basic energy efficiency retrofits with minimal technological innovation might represent such a segment.

Consider the broader energy services market in 2024. Reports indicate that while the market for energy efficiency solutions continues to grow, a significant portion of this growth is driven by more complex, integrated projects. Simpler, standardized services often face margin pressures. For example, in 2023, the global energy efficiency market was valued at approximately $400 billion, but the profit margins for providers focused solely on basic lighting retrofits, a commoditized service, were often reported to be in the low single digits.

- Low Profitability: Service lines with minimal differentiation and high price sensitivity typically yield lower profit margins, potentially impacting overall company profitability.

- Limited Growth Potential: In mature and commoditized markets, the scope for significant market share expansion is often constrained due to intense competition.

- Strategic Review Needed: 'Dog' segments require careful evaluation to determine if investment in innovation or repositioning is viable, or if divestment or phasing out is a more appropriate strategy.

Underperforming Smaller Projects

Underperforming smaller projects, often characterized by a high overhead-to-revenue ratio or unforeseen cost escalations, fall into this category. These ventures may struggle to achieve profitability due to their scale and the resources they consume relative to their financial returns. For instance, a project with a revenue of $50,000 but requiring $40,000 in overhead and facing an additional $15,000 in unexpected costs would represent a significant underperformance.

- High Overhead Relative to Revenue: These projects consume disproportionate administrative and operational resources compared to the income they generate.

- Cost Overruns and Lower Profitability: Unexpected challenges frequently lead to budget blowouts, diminishing profit margins significantly.

- Strategic Shift Towards Larger Projects: Ameresco's focus is increasingly on larger, more impactful initiatives, indicating a potential divestment from or reduced emphasis on these smaller, less efficient ventures.

- Example Scenario: A small-scale energy efficiency upgrade project might have a contract value of $75,000, but if it incurs $60,000 in direct costs and $25,000 in overhead, coupled with a 10% cost overrun, it quickly becomes a financial drain.

Dogs in Ameresco's portfolio represent business segments with low market share and low growth potential. These are typically areas facing intense competition and commoditization, leading to thin profit margins. For example, basic energy efficiency retrofits that lack technological innovation might fall into this category. In 2023, the global energy efficiency market was valued at around $400 billion, but basic lighting retrofits often saw profit margins in the low single digits, illustrating the pressure on such services.

These segments often struggle with high overhead relative to revenue and are prone to cost overruns, diminishing profitability. Ameresco's strategic divestitures, like the sale of its Asset Energy Group in late 2024, highlight a move away from such lower-growth, less profitable units. The company's focus is shifting towards larger, more impactful projects that offer better returns and competitive advantages.

Segments classified as Dogs require careful strategic consideration. This might involve investing in innovation to differentiate, repositioning the offering, or ultimately divesting to reallocate resources to more promising areas. The company's move away from less dynamic market segments underscores this approach.

The limited growth potential and low profitability of these segments mean they consume resources without generating significant returns. For instance, a small project with a $75,000 contract value could become a financial drain if it incurs $60,000 in direct costs, $25,000 in overhead, and a 10% cost overrun.

Question Marks

Ameresco's involvement in emerging hydrogen initiatives, particularly in consortiums for clean hydrogen production and pilot projects for heavy transport and green ammonia, positions it within a high-growth, low-market-share quadrant of the BCG matrix. These ventures, while capital-intensive, are crucial for establishing future market leadership in a rapidly evolving sector.

For instance, Ameresco's participation in projects like the New York State Energy Research and Development Authority (NYSERDA) funded hydrogen hub development signifies a strategic investment in foundational clean energy infrastructure. Such initiatives are key to unlocking the potential of green hydrogen, which is projected to see significant market expansion in the coming years, with global investment in hydrogen expected to reach hundreds of billions by 2030.

Advanced carbon capture technologies, while not yet mainstream for Ameresco, represent a significant future growth area. These innovative solutions, often in early development or pilot stages, carry substantial investment risk due to their unproven market viability and high research and development costs. For instance, direct air capture (DAC) systems, though promising, require significant energy input and face challenges in scaling cost-effectively.

Entering entirely new, unproven international markets where Ameresco has little established presence or market share would place these ventures in the Question Mark category of the BCG Matrix. These initiatives demand substantial upfront investment for market development, establishing local operations, and client acquisition, all while facing uncertain immediate returns.

For example, if Ameresco were to explore expanding into a developing African nation in 2024, it would likely be a Question Mark. The company would need to invest heavily in understanding local regulations, building a sales force, and educating potential clients on energy efficiency solutions. The payback period for such an investment could be prolonged, with success hinging on factors like economic stability and government support for renewable energy projects.

Innovative, Unproven Energy-as-a-Service Models

Developing highly innovative or experimental Energy-as-a-Service (EaaS) models that significantly differ from established offerings, particularly those targeting new customer segments with unproven demand, would place Ameresco’s initiatives in the Question Mark quadrant of the BCG Matrix. These ventures hold the potential for high growth but are contingent on market acceptance and adoption.

These unproven models might include novel financing structures for distributed energy resources or performance-based contracts for emerging technologies like green hydrogen production. For instance, a hypothetical EaaS offering for commercial clients focused on integrating advanced battery storage with on-site renewable generation, where the demand for such integrated solutions is still nascent, would fit this category.

- Emerging Technologies Integration: EaaS models incorporating novel technologies like advanced grid-edge software or AI-driven energy optimization for industrial clients with limited prior adoption.

- New Market Segments: Targeting previously underserved markets, such as small-to-medium enterprises (SMEs) with bespoke EaaS solutions, where the demand for such tailored services is not yet fully established.

- Uncertain Market Adoption: Ventures that rely on significant shifts in consumer behavior or regulatory frameworks to gain traction, making their future market share and revenue streams less predictable.

Early-Stage Research & Development Projects

Ameresco's early-stage research and development projects, akin to Question Marks in the BCG matrix, are crucial for future innovation in cleantech. These initiatives, focused on next-generation solutions, are currently in their nascent phases and are not yet close to market viability. They represent substantial investments with an unknown potential for commercial success.

These R&D endeavors are characterized by high risk and high potential reward. For instance, Ameresco might be exploring novel energy storage technologies or advanced carbon capture methods that require significant upfront capital. The company's commitment to these areas is evident in its continued allocation of resources, even without immediate returns.

- Focus on Future Cleantech: Investing in R&D for next-generation solutions like advanced battery chemistries or innovative green hydrogen production methods.

- High Investment, Uncertain Returns: These projects demand considerable capital outlay, with market adoption and profitability yet to be determined.

- Strategic Importance: Positioned to capture future market share if successful, driving long-term growth and competitive advantage.

- Example: Research into novel materials for more efficient solar panel manufacturing, currently in lab-scale testing, exemplifies this category.

Ameresco's ventures into entirely new, unproven international markets, particularly in 2024, would be classified as Question Marks. These initiatives require substantial investment for market development, establishing local operations, and client acquisition, all while facing uncertain immediate returns.

For example, expanding into a developing African nation in 2024 would necessitate significant investment in understanding local regulations, building a sales force, and educating potential clients on energy efficiency solutions. The payback period for such an investment could be prolonged, with success hinging on factors like economic stability and government support for renewable energy projects.

These unproven models, such as novel financing structures for distributed energy resources or performance-based contracts for emerging technologies like green hydrogen production, hold the potential for high growth but are contingent on market acceptance and adoption.

Ameresco's early-stage research and development projects, focused on next-generation solutions, are currently in their nascent phases and are not yet close to market viability, representing substantial investments with unknown commercial potential.

| Initiative Type | BCG Category | Key Characteristics | 2024 Example/Context | Potential Growth |

| New International Market Entry | Question Mark | High upfront investment, uncertain returns, market development required | Expansion into a developing African nation, requiring regulatory navigation and client education. | High, if market adoption is achieved. |

| Experimental EaaS Models | Question Mark | Novel financing/performance contracts, unproven customer segments/demand | Integrated battery storage with on-site renewables for nascent demand. | High, dependent on market acceptance. |

| Early-Stage R&D | Question Mark | High risk, high potential reward, not yet market viable | Research into novel materials for efficient solar panel manufacturing (lab-scale). | Very High, if breakthroughs occur. |

BCG Matrix Data Sources

Our BCG Matrix leverages a comprehensive blend of financial reports, market research, and industry-specific data to provide a robust strategic overview.