Ameresco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ameresco Bundle

Ameresco navigates a complex landscape shaped by intense competition and evolving client demands. Understanding the subtle interplay of supplier power, buyer bargaining, and the threat of substitutes is crucial for strategic success.

The complete report reveals the real forces shaping Ameresco’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ameresco's reliance on specialized renewable energy components, such as solar panels, wind turbines, and battery storage systems, creates a significant bargaining power for suppliers. A concentrated market with a limited number of manufacturers for these critical technologies can allow dominant suppliers to dictate terms and pricing, impacting Ameresco's project costs and profitability.

The intricate global supply chains for these diverse components further amplify supplier leverage. Potential disruptions, including tariffs and customs delays, can exacerbate this power, especially when sourcing specialized technologies. For instance, in 2024, the solar panel market continued to see consolidation, with a few key manufacturers holding substantial market share, potentially influencing pricing for projects Ameresco undertakes.

The prices for key raw materials like polysilicon, rare earth metals, copper, and steel, which are fundamental for building renewable energy projects, have been quite unpredictable and have gone up. For instance, polysilicon prices saw substantial jumps in 2023, impacting solar panel manufacturing costs. This instability, fueled by worldwide demand and supply chain disruptions, gives suppliers of these materials significant leverage.

This volatility directly affects Ameresco's project economics. The company's strategy to counter these rising costs involves securing equipment early or negotiating firm prices in contracts. For example, in 2024, Ameresco reported managing supply chain risks by entering into longer-term agreements for critical components, helping to stabilize their cost base for upcoming projects.

The renewable energy sector, including companies like Ameresco, is currently grappling with significant supply chain disruptions. Shipping delays are impacting a substantial portion of ongoing projects and the development of new infrastructure. For instance, in 2024, the global container shipping costs saw fluctuations, with some routes experiencing increases due to capacity constraints and geopolitical factors, directly affecting project budgets.

These widespread disruptions, exacerbated by labor shortages in critical areas such as logistics and construction, are tilting the scales in favor of suppliers. When the availability of essential materials and services is limited, suppliers gain leverage. This situation forces companies like Ameresco to contend with potential material shortages and extended lead times, impacting their ability to deliver projects on schedule and within budget.

Navigating these logistical complexities is paramount for Ameresco's success. Logistics costs can represent a considerable percentage of a project's overall budget, sometimes reaching 15-20% for large-scale renewable energy installations. Therefore, effectively managing these hurdles is crucial for maintaining cost control and ensuring the timely execution of projects, directly influencing Ameresco's profitability and competitive standing.

High Switching Costs for Specialized Equipment

Ameresco faces significant supplier power when switching costs for specialized equipment are high. This is particularly true for energy efficiency and renewable energy solutions where components are often deeply integrated. For instance, if Ameresco relies on a specific manufacturer for advanced solar inverters or specialized energy storage systems, the cost and complexity of replacing that supplier can be immense.

The integration of these technologies into comprehensive project designs means that a change in a single, critical component could necessitate extensive re-engineering, testing, and re-certification processes. This not only adds significant time delays but also incurs substantial upfront costs, effectively locking Ameresco into existing supplier relationships. For example, in 2024, the lead times for some advanced energy storage components have extended, making proactive supplier management even more critical.

Consequently, Ameresco must cultivate strong, long-term relationships and strategic partnerships with its key suppliers. This approach helps mitigate the risks associated with high switching costs and ensures a more stable supply chain. Building these partnerships allows for better negotiation leverage and can lead to more favorable terms and conditions over time, crucial for maintaining project profitability and execution timelines.

- High Integration Costs: Switching suppliers for specialized energy efficiency and renewable energy equipment often requires significant re-engineering and re-certification, increasing costs.

- Time Delays: The integration process means that changing core component suppliers can lead to substantial project delays.

- Strategic Partnerships: Long-term relationships with key suppliers are essential for Ameresco to manage these switching costs and ensure supply chain stability.

Supplier's Forward Integration Threat

The threat of suppliers engaging in forward integration, where they move into providing services similar to Ameresco's, could potentially shift bargaining power. While component manufacturers rarely do this, large equipment suppliers might consider offering energy efficiency or renewable energy development services themselves.

This scenario, though not currently a dominant factor for Ameresco, could diminish its market share or introduce direct competition, thereby strengthening the suppliers' position.

Ameresco's strategy of functioning as a cleantech integrator, offering a broad spectrum of services, is designed to mitigate this risk by providing a more comprehensive and differentiated value proposition than individual suppliers might offer.

- Supplier Forward Integration: While uncommon for many suppliers, large equipment providers could enter Ameresco's service space, potentially increasing their bargaining power.

- Impact on Ameresco: Such integration could reduce Ameresco's market share or create direct competition, affecting its profitability.

- Ameresco's Defense: The company's cleantech integrator model aims to differentiate its comprehensive service offering, making it less susceptible to direct competition from suppliers.

Ameresco's bargaining power with suppliers is significantly influenced by the specialized nature of renewable energy components and the concentration within certain supply markets. For instance, in 2024, the global solar photovoltaic market continued to see a dominant share held by a few key manufacturers, enabling them to exert considerable pricing influence on Ameresco's projects.

The volatile pricing of essential raw materials like polysilicon, which saw substantial increases in 2023, directly impacts Ameresco's project costs. This instability, coupled with ongoing supply chain disruptions and extended lead times for critical components in 2024, amplifies supplier leverage.

High integration costs and time delays associated with switching suppliers for specialized equipment create significant switching costs for Ameresco, reinforcing supplier power. Building strategic partnerships with key suppliers is crucial for Ameresco to manage these risks and ensure supply chain stability, a strategy actively pursued in 2024 through longer-term component agreements.

What is included in the product

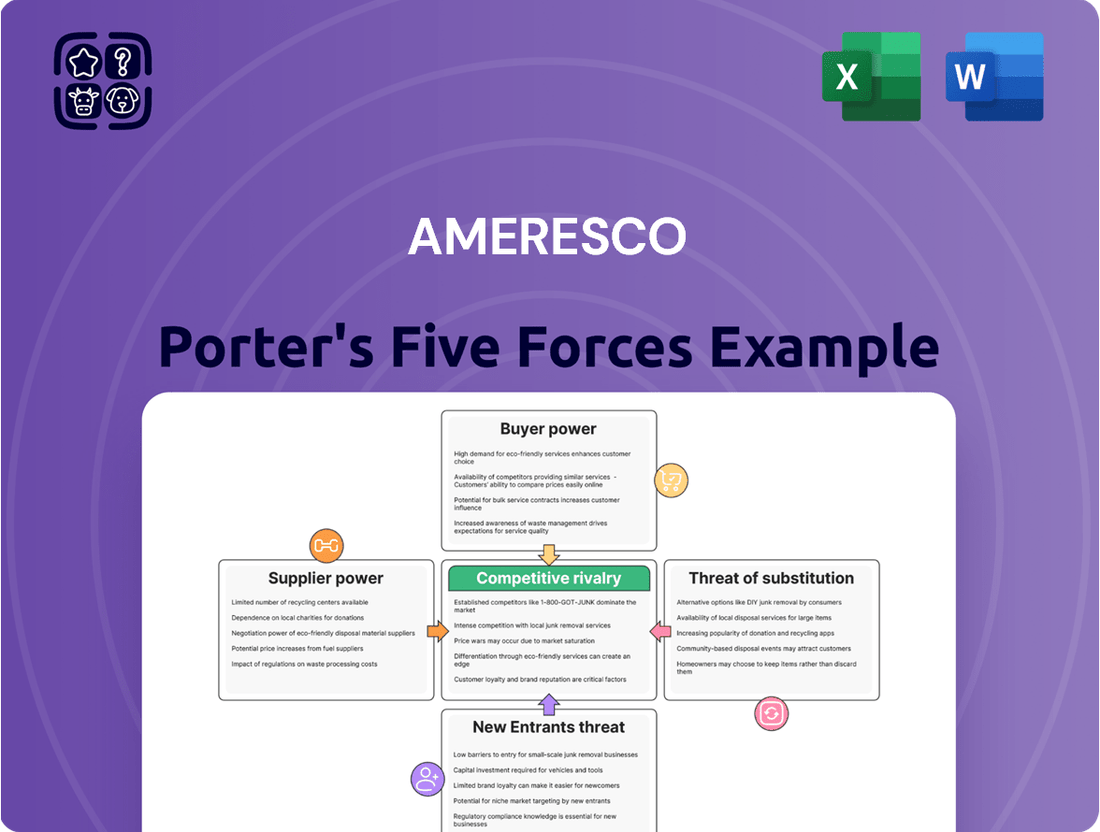

This analysis dissects Ameresco's competitive environment by examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitute solutions.

Ameresco's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive forces, simplifying complex market dynamics for quick strategic decision-making.

Customers Bargaining Power

Ameresco's diverse customer base, encompassing federal, state, and local governments, utilities, educational and healthcare institutions, and commercial and industrial clients, inherently diversifies its revenue streams. However, this broad reach also means each segment has unique requirements, potentially amplifying the bargaining power of individual customers who can demand tailored solutions and favorable terms.

In 2024, the increasing emphasis on sustainability and cost reduction across all these sectors makes customers more discerning. They are actively seeking energy efficiency and renewable energy solutions that demonstrably meet specific environmental targets and deliver measurable financial savings, giving them leverage in negotiations.

Ameresco's reliance on long-term Energy Savings Performance Contracts (ESPCs) significantly enhances customer bargaining power. These contracts often guarantee cost savings, placing performance risk on Ameresco and compelling them to offer favorable terms to secure such agreements. Customers leverage this structure to negotiate aggressively, demanding proven results and advantageous pricing throughout the project's duration.

Ameresco's clients are intensely driven by the prospect of lowering energy expenses, bolstering operational resilience, and meeting ambitious decarbonization targets. This keen interest in demonstrable financial and environmental gains naturally leads them to meticulously evaluate proposals, insisting on clearly defined, quantifiable advantages.

For instance, in 2024, many municipal and commercial clients are prioritizing projects with payback periods of under five years, a direct reflection of their focus on cost savings and return on investment. This ability to readily compare different energy efficiency and renewable energy solutions, and consequently push for competitive pricing based on their projected savings, significantly amplifies their bargaining leverage.

Availability of Alternative Solutions

The bargaining power of customers is significantly influenced by the availability of alternative solutions for their energy needs. Customers can opt for traditional energy sources, develop in-house energy management capabilities, or select other cleantech integrators. This array of choices inherently empowers customers, as they are not solely reliant on Ameresco.

While Ameresco provides integrated and comprehensive energy solutions, the presence of these alternatives means customers always have options. For instance, a large corporation might consider building its own distributed generation capacity rather than contracting with an integrator for a similar outcome. This competitive landscape means Ameresco must continually demonstrate the value and efficiency of its offerings.

Despite the availability of alternatives, the growing complexity of achieving ambitious net-zero targets often pushes customers towards integrated solutions. These comprehensive approaches, like those offered by Ameresco, can simplify the process of decarbonization and energy efficiency upgrades, potentially mitigating some of the customer's bargaining power in favor of specialized expertise.

- Customer Choice: Customers can choose from traditional energy, in-house management, or competing cleantech providers.

- Ameresco's Value Proposition: Ameresco must highlight the benefits of its integrated solutions to counter alternatives.

- Net-Zero Complexity: Increasingly, the intricate nature of net-zero goals favors specialized, integrated solutions.

- Market Dynamics: The energy sector saw significant investment in renewable energy projects, with the global renewable energy market valued at approximately $1.5 trillion in 2023, indicating a robust market with multiple players and solutions.

Strong Customer Backlog and Repeat Business

Ameresco's substantial and growing project backlog, which reached $3.7 billion as of December 31, 2023, demonstrates significant customer commitment and satisfaction. This strong backlog, including a contracted backlog of $2.2 billion, indicates that despite potential customer bargaining power, Ameresco's consistent delivery of value fosters repeat business and enduring client relationships.

The nature of complex energy infrastructure projects inherently creates high switching costs for customers. This factor significantly strengthens Ameresco's position, enabling them to retain clients and mitigate the impact of customer bargaining power.

- Ameresco's contracted backlog stood at $2.2 billion as of December 31, 2023.

- Total project backlog reached $3.7 billion at the end of 2023.

- High switching costs in energy infrastructure projects benefit Ameresco.

Customers' bargaining power at Ameresco is influenced by their ability to switch to alternative energy solutions or manage projects internally. However, the complexity of achieving net-zero goals increasingly drives demand for integrated solutions like those Ameresco offers, somewhat counterbalancing this power.

| Factor | Impact on Customer Bargaining Power | Ameresco's Position |

|---|---|---|

| Availability of Alternatives | High (traditional energy, in-house management, competitors) | Must demonstrate superior integrated value |

| Net-Zero Complexity | Moderate (drives need for specialized expertise) | Leverages complexity to offer comprehensive solutions |

| Switching Costs | Low (high for complex energy infrastructure) | Strengthens client retention and reduces bargaining leverage |

| Project Backlog (as of Dec 31, 2023) | N/A (Indicates customer satisfaction and commitment) | Contracted: $2.2 billion; Total: $3.7 billion |

Preview the Actual Deliverable

Ameresco Porter's Five Forces Analysis

This preview showcases the complete Ameresco Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the energy efficiency and renewable energy sectors. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The global clean technology market is booming, with forecasts suggesting it will approach $1.85 trillion by 2030. This substantial growth generally softens intense rivalry, as there's enough room for numerous companies to expand without directly competing for existing market share. Ameresco, as a key player, can leverage this expanding market to grow its own business.

While the high growth offers opportunities, it also acts as a magnet, drawing in new entrants and encouraging larger, established corporations to invest in and enter the clean tech sector. This influx of new competition can, over time, intensify rivalry as more players vie for the growing market pie.

Ameresco distinguishes itself as a cleantech integrator, providing comprehensive, customized solutions spanning energy efficiency, infrastructure modernization, and renewable energy project development. This technical independence and capacity to combine top-tier solutions set Ameresco apart from competitors focused on more limited service areas.

This strategic differentiation can temper direct price competition, as clients increasingly prioritize integrated, value-added solutions over single-service providers. For instance, Ameresco's ability to manage complex projects, such as integrating solar, battery storage, and demand response for a large university campus, showcases this integrated approach, which is harder for specialized firms to replicate.

Ameresco operates in a cleantech and energy services market teeming with a wide variety of competitors. This includes major diversified energy corporations, established engineering, procurement, and construction (EPC) firms, focused renewable energy developers, and smaller, regional energy service companies.

This broad spectrum of players means Ameresco encounters rivalry across numerous market segments and project scales. For instance, while larger entities might leverage greater financial resources, specialized firms often possess deep expertise in specific niches, creating varied competitive pressures.

In 2024, the energy efficiency services sector, a key area for Ameresco, continued to see robust activity. The U.S. Department of Energy reported that energy efficiency investments reached record levels, indicating both opportunity and intensified competition as more companies entered the space to capture this growing market.

Impact of Interest Rates and Project Economics

The cleantech landscape in 2024 faced significant headwinds from elevated interest rates, which directly impacted project economics. This made securing financing for new initiatives more challenging and costly. Consequently, the normalization of power prices further squeezed profit margins, intensifying competition among companies vying for the remaining financially viable projects.

This challenging environment means that companies like Ameresco, despite its own strong performance, operate within a broader industry where rivalry is heightened. The competition isn't just about technical expertise, but increasingly about securing favorable financing terms and locking in profitable, long-term contracts in a market with fewer readily available opportunities.

- Rising interest rates in 2024 increased the cost of capital for cleantech projects.

- Power price normalization reduced the potential profitability of new energy installations.

- This combination intensified competition for projects with attractive financial profiles.

- Companies with robust financial health and efficient operations are better positioned to navigate this rivalry.

Government Policies and Decarbonization Mandates

Government policies and decarbonization mandates are a double-edged sword for Ameresco. While ambitious targets in North America and Europe, such as the European Union's Fit for 55 package aiming for a 55% emissions reduction by 2030, significantly boost demand for Ameresco's energy efficiency and renewable energy solutions, they also intensify competitive rivalry. These clear policy objectives, often backed by substantial incentives, attract a growing number of players to the market, all vying for government contracts and projects aligned with these specific goals.

The increasing focus on decarbonization creates a fertile ground for competition. Companies are actively positioning themselves to capture market share in areas like renewable energy development and energy efficiency retrofits, driven by government funding and regulatory push. This heightened competition means that Ameresco must continuously innovate and demonstrate its value proposition to secure these vital projects.

Ameresco's established reputation as a leading energy services company, recognized by industry analysts like Frost & Sullivan, provides a crucial competitive advantage in this environment. This recognition can translate into preferential treatment or a stronger bidding position for government contracts, particularly those requiring proven expertise and a track record of successful project delivery. For instance, in 2023, Ameresco secured several significant federal contracts in the United States, underscoring the importance of its established credentials.

- Government mandates create significant market opportunities for energy services companies like Ameresco.

- Ambitious decarbonization targets, such as those in the EU and US, are driving demand for Ameresco's core services.

- These mandates also attract new competitors, increasing rivalry for government contracts and policy-linked projects.

- Ameresco's industry recognition and proven track record serve as a key differentiator in securing these competitive opportunities.

Ameresco faces a diverse competitive landscape, ranging from large energy corporations to specialized firms, each vying for market share in the booming cleantech sector. While the overall market growth in 2024 offered ample opportunity, factors like rising interest rates and normalized power prices intensified competition for financially viable projects. Ameresco's integrated solutions and established reputation help it stand out, but the need for efficient operations and strong financing remains critical to navigate this rivalry.

SSubstitutes Threaten

Despite the significant global momentum towards decarbonization, the continued reliance on fossil fuels presents a persistent substitute for Ameresco's energy efficiency and renewable energy solutions. Many organizations, especially those with substantial existing fossil fuel infrastructure or those prioritizing immediate cost savings over long-term sustainability, may view maintaining their current energy sources as a viable alternative. This is particularly evident in sectors where the upfront investment for transitioning to cleaner technologies remains a considerable barrier.

However, this substitute is steadily eroding. In 2024, global energy prices, while fluctuating, have shown a general upward trend, making the operational costs of fossil fuels increasingly burdensome. Furthermore, heightened environmental consciousness, driven by both regulatory pressures and public demand, is making the long-term viability of fossil fuel dependence a less attractive proposition for many businesses and governments.

Large organizations might develop in-house energy management teams, undertaking their own efficiency upgrades. This offers direct control and potential cost reductions, but typically misses the specialized knowledge, broad scope, and financing options that a firm like Ameresco, a cleantech integrator, provides. For instance, while a company might manage basic lighting retrofits internally, complex solar installations or microgrid development often require external expertise.

Purchasing Renewable Energy Credits (RECs) presents a significant threat of substitution for Ameresco's core business. Instead of investing in physical renewable energy infrastructure or efficiency upgrades, some organizations may choose to buy RECs or carbon offsets to meet their sustainability goals. This approach, while addressing carbon footprint targets, bypasses the tangible benefits of physical infrastructure development and the operational savings that Ameresco delivers.

This market-based alternative directly competes with Ameresco's project development and implementation services. For instance, in 2024, the voluntary carbon market saw significant growth, with companies increasingly looking for ways to offset emissions. While specific REC purchase data for companies directly choosing them over physical projects is not publicly detailed, the overall expansion of carbon offset markets indicates a willingness to explore these financial instruments as an alternative to direct investment in energy solutions.

Focus on Demand-Side Management Only

Customers might opt for simpler demand-side management, like behavioral shifts or minor equipment tweaks, instead of investing in large-scale infrastructure or renewable energy projects. These smaller efforts, while helpful for efficiency, typically deliver less significant savings than the comprehensive solutions Ameresco provides. For instance, in 2024, many organizations focused on smart thermostat adoption, a demand-side strategy, rather than installing solar arrays or upgrading entire building systems.

These partial measures, though easier to implement, often fall short of the substantial, long-term economic and environmental benefits derived from integrated energy solutions. The impact of solely focusing on demand-side management can be limited, whereas Ameresco's approach tackles efficiency and generation simultaneously. In 2024, the average energy savings from behavioral changes alone were estimated to be around 2-5%, significantly lower than the 15-30% achievable with comprehensive energy efficiency projects that Ameresco specializes in.

- Limited Savings: Demand-side management alone typically yields smaller energy cost reductions compared to integrated solutions.

- Focus on Behavior: Strategies like behavioral changes or minor equipment adjustments are less impactful than infrastructure upgrades.

- Ameresco's Advantage: Holistic solutions offer greater long-term economic and environmental benefits.

- 2024 Data: Behavioral changes offered 2-5% savings, while comprehensive projects achieved 15-30% savings.

Emerging Energy Technologies

Rapid advancements in emerging energy technologies present a significant long-term threat. Innovations in areas like advanced nuclear, green hydrogen production, and novel energy storage solutions offer alternative pathways to energy independence and decarbonization. For instance, the global green hydrogen market is projected to grow substantially, with some estimates suggesting it could reach over $160 billion by 2030, indicating a potential shift in energy infrastructure investment.

While Ameresco is positioned to integrate many of these developing technologies into its project portfolios, a disruptive breakthrough that offers substantially lower costs or simpler implementation could diminish demand for its current core distributed generation and energy efficiency services. The increasing efficiency and decreasing cost of battery storage, a key component in many renewable projects, exemplifies this dynamic, with lithium-ion battery prices falling by over 90% in the last decade.

Ameresco's strength as an integrator, however, provides a degree of resilience. By adapting and incorporating these new technologies into their comprehensive solutions, they can mitigate some of the risks associated with technological obsolescence. For example, Ameresco has been actively involved in developing microgrid solutions that often incorporate advanced battery storage and renewable energy sources, demonstrating their capacity to evolve with the market.

The competitive landscape is also shaped by the potential for direct competition from developers specializing in these nascent technologies. As these sectors mature, companies focused solely on, for example, utility-scale green hydrogen production or advanced modular nuclear reactors could emerge as direct rivals, potentially capturing market share that might otherwise have gone to broader energy solutions providers.

The threat of substitutes for Ameresco's services is multifaceted, ranging from the continued reliance on fossil fuels to the adoption of financial instruments like Renewable Energy Credits (RECs). While fossil fuels remain a substitute, their long-term viability is diminishing due to rising energy prices and increasing environmental consciousness. In 2024, global energy prices have seen upward trends, making fossil fuel operations more costly.

Organizations might also opt for simpler, in-house energy management or demand-side strategies, such as behavioral changes or minor equipment upgrades. These approaches, while easier to implement, typically yield significantly lower savings compared to Ameresco's comprehensive, integrated solutions. For instance, in 2024, behavioral changes alone offered estimated savings of 2-5%, a stark contrast to the 15-30% achievable with Ameresco's projects.

Purchasing RECs or carbon offsets is another substitute, allowing companies to meet sustainability goals without direct investment in physical infrastructure. The voluntary carbon market experienced notable growth in 2024, indicating a preference for these financial instruments by some entities. However, this bypasses the tangible benefits and operational savings delivered by Ameresco's project development and implementation.

Emerging energy technologies, like advanced nuclear and green hydrogen, also pose a long-term threat. While Ameresco is positioned to integrate these, a disruptive breakthrough could shift investment away from current core services. For example, the green hydrogen market is projected for substantial growth, potentially exceeding $160 billion by 2030.

| Substitute Type | Description | Potential Impact on Ameresco | 2024 Relevance/Data |

|---|---|---|---|

| Fossil Fuels | Continued use of existing infrastructure. | Reduced demand for efficiency and renewables. | Rising global energy prices increase operational costs of fossil fuels. |

| In-house Management/Demand-Side | Internal efforts, behavioral changes, minor upgrades. | Lower savings potential compared to comprehensive solutions. | Behavioral changes yielded 2-5% savings; Ameresco projects achieve 15-30%. |

| Renewable Energy Credits (RECs) / Carbon Offsets | Financial instruments to meet sustainability goals. | Bypasses physical infrastructure and operational savings. | Growth in voluntary carbon markets indicates increasing adoption. |

| Emerging Energy Technologies | Advanced nuclear, green hydrogen, novel storage. | Long-term threat if disruptive breakthroughs occur. | Green hydrogen market projected to exceed $160 billion by 2030. |

Entrants Threaten

The development, ownership, and operation of large-scale renewable energy projects and intricate infrastructure upgrades necessitate immense capital outlays, presenting a formidable barrier for prospective new entrants. For instance, a single utility-scale solar farm can cost hundreds of millions of dollars to develop and construct. Ameresco's demonstrated success in securing substantial financing for its projects highlights the significant financial muscle required to compete effectively, making it difficult for newer, less capitalized companies to enter and scale.

The threat of new entrants for Ameresco, particularly concerning specialized expertise and technical know-how, is relatively low. Ameresco's strength lies in its deep, accumulated knowledge across energy efficiency, complex infrastructure engineering, and the integration of renewable energy systems. For a new company to replicate this breadth and depth of technical skill, requiring years of hands-on experience and a highly trained workforce, presents a significant barrier to entry.

Navigating the complex regulatory and permitting landscape for energy projects presents a substantial threat of new entrants for Ameresco. The intricate web of federal, state, and local regulations, coupled with the need to secure numerous permits, is a time-consuming and expensive hurdle. For instance, securing environmental permits alone can take months, even years, depending on the project's scope and location.

This inherent complexity acts as a significant barrier to entry, favoring established companies like Ameresco that possess deep experience and dedicated resources to manage these processes effectively. Newcomers would face steep learning curves and the very real possibility of significant project delays, increasing their initial capital requirements and operational risks.

Established Customer Relationships and Track Record

Ameresco's established customer relationships are a significant hurdle for new entrants. The company boasts long-standing ties with a diverse clientele across government, education, and commercial sectors, underpinned by a consistent history of delivering successful energy efficiency projects and guaranteed savings. This proven track record builds substantial trust and credibility, making it difficult for newcomers to secure the large, complex contracts that are typical in this industry, especially with risk-averse institutional clients.

The stickiness of these existing relationships acts as a powerful barrier to entry. For instance, in 2023, Ameresco continued to secure multi-year, multi-million dollar contracts, demonstrating the loyalty and satisfaction of its current customer base. New companies would face considerable challenges in replicating this level of trust and demonstrating the reliability necessary to displace established providers, particularly when clients prioritize proven performance and guaranteed outcomes.

- Long-standing client relationships across governmental, educational, and commercial sectors.

- Proven track record of successful project delivery and guaranteed energy savings.

- Difficulty for new entrants to build trust and credibility for large, complex contracts.

- High switching costs and client loyalty create a significant barrier.

Supply Chain Access and Integration Capabilities

The threat of new entrants into the energy efficiency and renewable energy sectors, particularly concerning supply chain access and integration capabilities, remains a significant consideration. New companies entering this space often face substantial hurdles in securing reliable and cost-effective access to critical components and equipment. For instance, the global semiconductor shortage that persisted into 2023 and 2024 significantly impacted the availability and pricing of components essential for renewable energy systems like solar inverters and battery storage solutions.

Establishing robust supplier relationships and efficient logistical networks is a complex and time-consuming process. New entrants may find it challenging to compete with established players who have long-standing contracts and preferred pricing with key manufacturers. This is particularly true in 2024, where ongoing geopolitical tensions and trade policies can further disrupt supply chains and create uncertainty.

Ameresco, as an example, has cultivated deep relationships with a diverse range of suppliers over its history, enabling it to navigate these complexities more effectively. Its ability to integrate various technologies, from solar and battery storage to advanced building management systems, requires sophisticated procurement and project management expertise.

- Supply Chain Vulnerabilities: Global supply chain disruptions, exacerbated by events in 2023 and continuing into 2024, make it difficult for new entrants to guarantee timely delivery of essential renewable energy components.

- Integration Complexity: The technical expertise required to seamlessly integrate diverse energy technologies is a high barrier, demanding significant upfront investment in skilled personnel and R&D.

- Established Player Advantage: Companies like Ameresco, with their established procurement networks and proven integration capabilities, possess a distinct competitive edge in securing resources and delivering complex projects.

The threat of new entrants for Ameresco is generally low due to the substantial capital requirements for developing large-scale renewable energy projects, often costing hundreds of millions of dollars. For example, a single utility-scale solar farm demands significant upfront investment, a barrier that less capitalized new companies struggle to overcome. Ameresco's success in securing financing for its projects underscores the financial strength needed to compete.

Porter's Five Forces Analysis Data Sources

Our Ameresco Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Ameresco's annual reports, SEC filings, and investor presentations. We supplement this with industry-specific market research reports and analyses from reputable financial institutions.