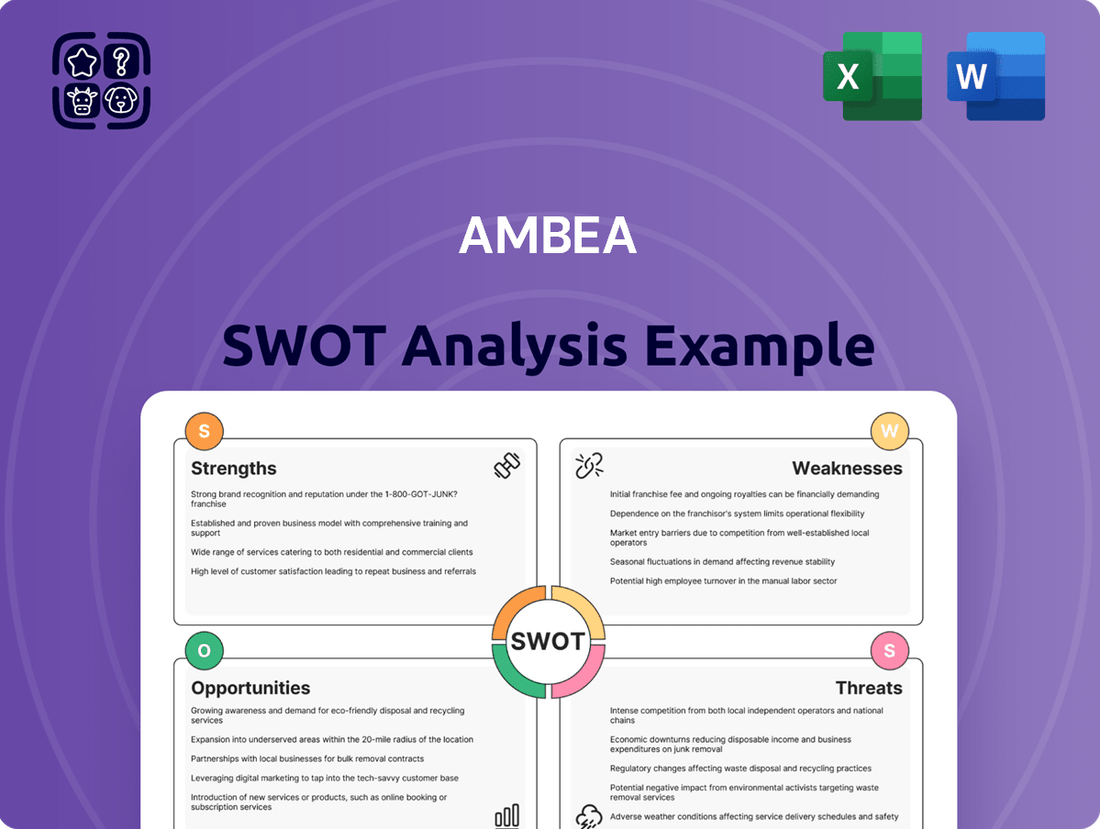

Ambea SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

Ambea's strategic position reveals significant strengths in its established brand and dedicated workforce, alongside potential weaknesses in market diversification. Understanding these internal dynamics is crucial for navigating the competitive landscape.

Unlock the full story behind Ambea's market position and growth drivers. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Ambea holds a dominant position as a leading care provider throughout the Nordic region, with significant operations in Sweden, Norway, and Denmark. Its strategic expansion into Finland through the acquisition of Validia further cements this leadership. This extensive geographical footprint across four key Nordic markets underscores its robust market standing and broad service delivery capabilities.

Ambea's financial performance in 2024 was exceptional, marked by its highest net sales and operating profit to date. This upward trajectory continued into the first quarter of 2025, with net sales climbing by 5%, building on a robust 7% growth in the full year 2024.

This sustained growth stems from a combination of strong organic expansion and the successful integration of strategic acquisitions. The company's financial health is a significant strength, providing a solid base for future investments and strategic initiatives.

Ambea's dedication to high-quality care is a significant strength, underpinned by a comprehensive quality management system and ongoing improvement initiatives. This focus ensures consistent service delivery and patient satisfaction.

The company's commitment to sustainability is also a key advantage. Ambea aims to cut its Greenhouse Gas emissions by 50% by 2025 from 2019 levels, having already achieved an impressive 44% reduction. This proactive approach not only bolsters its corporate image but also resonates with environmentally conscious stakeholders.

Diversified Service Portfolio

Ambea's strength lies in its broadly diversified service portfolio, encompassing elderly care, disability support, and individual and family services. This comprehensive offering, delivered through residential facilities, home care, and staffing, mitigates risk by not being dependent on a single market segment. For instance, in 2024, Ambea continued to serve a wide array of municipal needs across Sweden, Norway, and Denmark, demonstrating its capacity to adapt to varied public sector requirements.

This extensive range of care solutions positions Ambea as a valuable and versatile partner for municipalities seeking to outsource various aspects of their welfare systems. The company's ability to provide integrated care pathways, from home support to specialized residential care, offers a one-stop solution for local authorities. By addressing diverse needs, Ambea strengthens its relationships with public sector clients, as evidenced by ongoing contract wins in key Nordic regions throughout 2024 and early 2025.

Key aspects of Ambea's diversified service portfolio include:

- Elderly Care: Offering residential and home-based support for seniors.

- Disability Care: Providing specialized services for individuals with disabilities.

- Individual and Family Care: Supporting various personal and family needs.

- Staffing Solutions: Supplying qualified personnel to healthcare providers.

Strategic Expansion through Acquisitions and New Units

Ambea’s strategic expansion, a key strength, is evident in its dual approach of organic growth and targeted acquisitions. The company’s acquisition of Validia in Finland, for instance, significantly broadened its reach and service offerings in a new market. This proactive strategy is designed to capture growing demand for care services.

Further demonstrating this strength, Ambea actively opened new care units and acquired existing operations throughout 2024. This expansion added a substantial number of care places, directly addressing market needs and reinforcing Ambea's position. Such growth initiatives are crucial for increasing market share and solidifying the company's presence.

- Acquisition of Validia: Expanded Ambea's presence into the Finnish market, enhancing its geographical footprint and service portfolio.

- 2024 Expansion: Significant addition of new care units and acquired operations, increasing total care capacity.

- Market Responsiveness: This growth strategy allows Ambea to effectively capitalize on increasing demand for healthcare and elderly care services.

- Strengthened Footprint: Proactive expansion solidifies Ambea's market position and competitive advantage in its operating regions.

Ambea's market leadership in the Nordic region, with operations spanning Sweden, Norway, Denmark, and Finland, is a significant strength. This broad geographical presence, further bolstered by the acquisition of Validia, provides a robust foundation for service delivery and market penetration.

The company's financial performance demonstrates substantial growth, with net sales and operating profit reaching record highs in 2024. This positive trend continued into early 2025, with net sales increasing by 5%, building on a strong 7% growth in the preceding year.

Ambea's diversified service portfolio, covering elderly care, disability support, and individual/family services, effectively mitigates risk and caters to a wide range of municipal needs. This comprehensive offering allows Ambea to act as a versatile partner for public sector clients.

The company's commitment to sustainability is a notable strength, evidenced by its progress towards a 50% reduction in Greenhouse Gas emissions by 2025, having already achieved a 44% reduction from 2019 levels.

Ambea's strategic expansion, through both organic growth and acquisitions like Validia, has significantly enhanced its market share and service capacity. This proactive approach ensures the company remains responsive to increasing demand for care services across its operating regions.

| Metric | 2023 (Approx.) | 2024 | Q1 2025 |

|---|---|---|---|

| Net Sales Growth | - | 7% | 5% |

| Market Position | Leading Nordic Care Provider | Dominant Nordic Care Provider | Strengthened Nordic Presence |

| Sustainability Goal Progress | - | 44% GHG Reduction (vs. 2019) | On Track for 2025 Target |

What is included in the product

Delivers a strategic overview of Ambea’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Ambea's strategic challenges.

Weaknesses

Ambea has faced notable margin pressures in specific segments, with the Nytida business area being a particular concern, as evidenced in recent financial disclosures. This indicates that while overall performance might be stable, certain operational units are struggling to maintain profitability.

Further compounding these challenges, Ambea saw a decline in sales within its contract management for Stendi and Altiden. This was directly attributed to the termination of several key contracts, suggesting a potential issue with client retention or the competitiveness of its service offerings in those areas.

While Ambea’s acquisition strategy fuels expansion, integrating new entities like Validia in Finland poses significant challenges. Successfully merging diverse operational frameworks, IT infrastructures, and corporate cultures is crucial but complex. For instance, the integration of Validia, completed in 2023, involved significant effort to align systems and processes, highlighting the inherent risks in such undertakings.

These integration efforts are not without financial implications. The transaction costs associated with acquiring and integrating businesses can create temporary pressure on Ambea's profitability. Managing these costs effectively is key to ensuring that growth through acquisition translates into sustainable financial performance.

Ambea's heavy reliance on public funding models presents a notable weakness. A substantial portion of its revenue stems from publicly funded care services, making the company vulnerable to shifts in government policies, budget allocations, and reimbursement rates. For instance, in 2023, public funding accounted for a significant majority of Ambea's revenue, though exact percentages fluctuate annually based on contract renewals and government budget cycles.

These dependencies mean that fluctuations in public spending or changes in how care is funded can directly affect Ambea's financial stability and future growth. A reduction in government budgets for elderly care or a change in the reimbursement structure for its services could negatively impact profitability and operational capacity.

Workforce Recruitment and Retention Challenges

Ambea, like many in the Nordic care sector, grapples with significant workforce recruitment and retention issues. These challenges directly impact staffing levels and the consistent delivery of quality care across its facilities.

The competitive labor market for qualified care professionals means Ambea faces increased operational costs due to higher wages and recruitment expenses. For instance, Sweden, a key market for Ambea, experienced a shortage of approximately 10,000 healthcare professionals in 2023, a figure projected to grow. This scarcity can lead to potential service disruptions and strain existing staff.

- Workforce Shortages: The broader Nordic region faces a critical shortage of care professionals, directly affecting Ambea's ability to maintain adequate staffing.

- Increased Operational Costs: Competition for talent drives up recruitment and salary expenses, impacting profitability.

- Service Quality Risk: Understaffing can compromise the quality of care provided, potentially leading to negative patient outcomes and reputational damage.

Competitive Bidding Environment

Ambea faces a significant challenge in its competitive bidding environment, where contracts are frequently awarded through tender processes involving both private and public healthcare providers. This constant need to win bids necessitates a relentless pursuit of cost efficiency, superior quality of care, and forward-thinking service innovations to secure and maintain its service agreements.

The intensity of this competition directly impacts Ambea's pricing power and profit margins. For instance, in the Swedish elderly care sector, where Ambea is a major player, municipal contracts are often awarded to the lowest bidder, creating downward pressure on prices. This can be seen in the reported average contract values and the number of competing bids received for public tenders, which often exceed ten or more providers vying for the same contract, squeezing potential returns.

- Intense Competition: Ambea operates in a market where private and public entities frequently compete for contracts through bidding.

- Pricing Pressure: The competitive bidding process often leads to lower contract prices, impacting Ambea's profitability.

- Need for Innovation: To secure contracts, Ambea must consistently offer high-quality services and innovative solutions.

- Margin Squeeze: High competition can result in reduced profit margins as providers are forced to bid aggressively on price.

Ambea's reliance on public funding models makes it susceptible to government policy changes and budget allocations, directly impacting revenue stability. For example, in 2023, public funding constituted the vast majority of Ambea's revenue, highlighting this significant dependency.

The company also faces persistent workforce shortages across the Nordic region, a critical issue affecting staffing levels and the consistent delivery of quality care. Sweden alone reported a deficit of approximately 10,000 healthcare professionals in 2023, a trend expected to worsen, increasing operational costs due to higher wages and recruitment expenses.

Furthermore, Ambea operates in a highly competitive bidding environment for contracts, often leading to significant pricing pressure and reduced profit margins. Many municipal contracts are awarded to the lowest bidder, with over ten providers frequently competing for the same agreement, squeezing potential returns.

Margin pressures have been evident in specific segments, notably the Nytida business area, and sales declined in contract management for Stendi and Altiden due to key contract terminations, suggesting challenges in client retention or service competitiveness.

| Weakness | Description | Impact | Example/Data |

|---|---|---|---|

| Public Funding Dependency | Significant revenue from publicly funded care services. | Vulnerability to government policy shifts, budget cuts, and reimbursement rate changes. | Public funding accounted for a substantial majority of Ambea's revenue in 2023. |

| Workforce Shortages | Critical shortage of care professionals in the Nordic region. | Difficulty maintaining adequate staffing, potential service disruptions, increased operational costs. | Sweden faced a shortage of ~10,000 healthcare professionals in 2023. |

| Competitive Bidding Environment | Contracts awarded through tender processes with intense competition. | Downward pressure on prices, reduced profit margins, need for constant innovation. | Municipal contracts often awarded to lowest bidder; >10 providers can compete for a single contract. |

| Segment Margin Pressures | Profitability challenges in specific business areas. | Impacts overall financial performance and profitability. | Nytida business area has faced notable margin pressures. |

| Contract Terminations | Loss of key contracts affecting revenue streams. | Reduced sales and potential issues with client retention or service competitiveness. | Decline in contract management sales for Stendi and Altiden due to contract terminations. |

Preview the Actual Deliverable

Ambea SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are seeing the actual Ambea SWOT analysis, not a sample. The complete, detailed report will be available immediately after purchase.

Opportunities

The Nordic region's demographic landscape is shifting dramatically, with an ever-increasing elderly population. This translates directly into a robust and expanding market for care services, a core offering of Ambea. This trend is not a fleeting one; it represents a sustained and growing need for the company's expertise.

Looking ahead, forecasts suggest a notable deficit in available care beds across Nordic countries by the year 2030. This projected shortfall underscores a structural demand that Ambea is well-positioned to meet, providing a significant long-term growth opportunity for the company.

Ambea's robust pipeline of new care units, coupled with a strategic focus on both organic growth and acquisitions, positions it for significant market expansion. This approach is particularly evident in its proactive entry into new Nordic geographies, such as Finland, aiming to meet the escalating demand for care services. For instance, Ambea's expansion into Finland in late 2023 marked a key step in broadening its operational footprint.

The Nordic region's strong embrace of AgeTech and digital healthcare solutions presents a significant opportunity for Ambea. By integrating these advanced technologies into its care delivery, Ambea can enhance operational efficiency and elevate the quality of care provided to its clients, potentially leading to improved health outcomes.

For instance, the global AgeTech market was projected to reach over $1.1 trillion by 2027, indicating a substantial and growing demand for such innovations. Ambea's strategic adoption of these digital tools can directly address workforce shortages and optimize the allocation of resources, ensuring more effective service delivery.

Increased Private Investment in Social Infrastructure

The Nordic aged care sector, facing a notable undersupply of care beds, is a magnet for private and international investors. This demand is a direct response to the sector's inherent resilience, particularly the consistent rental income streams it generates. For instance, in 2024, the Nordic region continued to see robust activity in social infrastructure deals, with several large funds actively seeking opportunities in healthcare and senior living. This trend is expected to persist through 2025 as demographic shifts continue to drive demand.

This escalating investor interest translates into tangible opportunities for providers like Ambea. It paves the way for strategic partnerships, which can unlock crucial funding for new developments and expansions. Furthermore, a more favorable investment climate can lead to improved access to capital, enabling Ambea to accelerate its growth plans and enhance its service offerings in a competitive market.

- Growing investor appetite: Significant private and international capital is targeting Nordic social infrastructure, particularly aged care.

- Undersupply driving demand: The shortage of care beds in the region makes aged care assets attractive due to predictable rental income.

- Partnership potential: Increased investment can facilitate collaborations for new developments and operational enhancements.

- Funding access: A favorable investment environment improves access to capital for providers like Ambea to expand and innovate.

Favorable Legislative Reforms

Upcoming legislative shifts, like Denmark's new Elderly Care Reform and Sweden's updated Social Services Act, are poised to unlock new avenues for private healthcare providers. These reforms are designed to foster the creation of new service units and expand the involvement of private entities in delivering essential care. For instance, the Danish reform, expected to fully roll out by 2025, aims to decentralize care management, potentially increasing the market share for agile private operators.

Ambea is strategically positioning itself to capitalize on these evolving regulatory landscapes. By anticipating and adapting to these changes, the company can secure a stronger foothold in markets where public sector capacity may be stretched. This proactive approach is crucial for maximizing the benefits derived from a more open and competitive care sector.

Key opportunities arising from these reforms include:

- Expansion into new service areas: Reforms may allow private providers to offer specialized services previously dominated by the public sector.

- Increased market access: Deregulation can open doors for new contracts and partnerships with municipalities.

- Innovation in care delivery: A more competitive environment encourages the adoption of new technologies and care models.

- Enhanced collaboration opportunities: Reforms might facilitate public-private partnerships, leveraging the strengths of both sectors.

Ambea's strategic expansion into new Nordic markets, such as Finland in late 2023, directly addresses the escalating demand for care services, a trend projected to intensify with a significant deficit in care beds anticipated by 2030 across the region. This demographic shift, coupled with the growing adoption of AgeTech and digital healthcare solutions, presents a substantial opportunity for Ambea to enhance efficiency and care quality. The increasing investor appetite for Nordic social infrastructure, driven by consistent rental income from aged care, also creates avenues for strategic partnerships and improved capital access to fuel Ambea's growth and innovation.

| Opportunity | Description | Supporting Data/Trend |

|---|---|---|

| Expanding Nordic Market Due to Demographics | Increasing elderly population drives demand for care services. | Nordic countries facing significant demographic shifts towards an older population. Projected deficit in care beds by 2030. |

| Leveraging AgeTech and Digital Healthcare | Integrating technology to improve efficiency and care quality. | Global AgeTech market projected to exceed $1.1 trillion by 2027. Digital solutions can address workforce shortages and optimize resource allocation. |

| Investor Interest in Social Infrastructure | Attracting private and international capital for aged care developments. | Robust activity in social infrastructure deals in the Nordic region during 2024, with continued interest expected through 2025. Predictable rental income streams are a key attraction. |

| Benefiting from Regulatory Reforms | Capitalizing on new legislative frameworks that encourage private sector involvement. | Denmark's Elderly Care Reform (rolling out by 2025) and Sweden's updated Social Services Act aim to increase private provider opportunities and service unit creation. |

Threats

The Nordic care sector is grappling with a significant and worsening shortage of qualified healthcare professionals. This persistent challenge directly impacts organizations like Ambea, creating upward pressure on labor costs as competition for talent intensifies. For instance, Sweden, a key market for Ambea, has seen ongoing concerns about nurse shortages, with projections indicating continued demand exceeding supply in the coming years.

These workforce deficits can hinder Ambea's capacity to maintain optimal staffing levels across its operations. This, in turn, risks compromising the quality of care delivered to its clients and residents, a critical factor in the sector. The ability to effectively recruit and retain skilled employees is therefore paramount for Ambea to navigate and mitigate this substantial threat.

The healthcare sector, including Ambea's operations, is subject to extensive regulation. Shifts in government policies, funding structures, or quality benchmarks across its operating regions present a notable threat. For instance, changes in reimbursement rates or new compliance requirements could directly impact profitability and operational efficiency.

New legislation, such as the recent reforms in Denmark's eldercare sector, while potentially creating avenues for growth, also introduces uncertainty. These regulatory shifts can unexpectedly affect Ambea's expansion strategies or necessitate costly adjustments to existing business models, potentially hindering planned development.

Ambea faces significant threats from intensified competition within the healthcare and elderly care sectors. Existing public and private entities actively participate in competitive bidding processes, which inherently drive down prices and squeeze profit margins. For instance, the Swedish market, a key region for Ambea, saw continued pressure on pricing in public procurements throughout 2024, impacting revenue growth for providers.

The potential for new market entrants or the adoption of aggressive pricing tactics by established rivals poses a direct risk to Ambea's market share and overall profitability. Companies that can offer similar services at lower costs, or those with innovative service models, could quickly gain traction. This necessitates a constant focus on operational efficiency and service differentiation to remain competitive.

Economic Downturns and Public Spending Constraints

Economic downturns and fiscal pressures on Nordic municipalities, Ambea's primary clients, pose a significant threat. Reduced public budgets for care services could directly impact Ambea's contract volumes and revenue streams. For instance, if government spending on social care is cut, Ambea might see fewer new contracts or even a reduction in the scope of existing ones.

Austerity measures or shifts in public spending priorities could also lead to lower reimbursement rates for Ambea's services. This squeeze on public finances, a common occurrence during economic slowdowns, directly affects Ambea's profitability. In 2023, Ambea generated approximately 87% of its revenue from public sector contracts, highlighting its vulnerability to these financial constraints.

- Reduced Public Funding: Economic slowdowns in Sweden, Norway, and Finland could lead to municipal budget cuts affecting care service procurement.

- Contract Volume Decline: Fiscal pressures may result in fewer new contracts or a scaling back of existing service agreements for Ambea.

- Lower Reimbursement Rates: Public sector austerity could force Ambea to accept lower payment rates for its services, impacting margins.

- Shifting Priorities: Governments might reallocate funds away from social care towards other pressing needs during economic hardship.

Reputational Risks and Quality Incidents

Ambea, as a prominent care provider, faces significant reputational risks stemming from any perceived or actual decline in care quality or patient safety. Negative incidents, even if isolated, can quickly erode public trust and attract unfavorable media scrutiny. For instance, in 2023, reports of staffing shortages impacting care delivery in certain Swedish municipalities highlighted the sensitivity of public perception to operational challenges. Such events could jeopardize existing contracts and invite stricter regulatory oversight, despite Ambea's stated commitment to high-quality standards.

The financial implications of reputational damage are substantial. A loss of public confidence can directly translate into a decline in new client acquisition and retention, impacting revenue streams. Furthermore, significant quality incidents could lead to increased insurance premiums or even direct financial penalties from regulatory bodies. Ambea's 2023 annual report, while not detailing specific reputational loss figures, emphasizes the ongoing investment in quality assurance systems as a core strategy to mitigate these threats.

- Reputational Vulnerability: As a care provider, Ambea's reputation is intrinsically linked to the quality and safety of its services.

- Impact of Incidents: Lapses in care or ethical conduct can trigger negative media attention and loss of public trust.

- Contractual and Regulatory Risks: Reputational damage can lead to contract cancellations and potential regulatory penalties.

- Financial Ramifications: Loss of trust can affect client acquisition and retention, impacting revenue and potentially increasing operational costs.

The persistent shortage of qualified healthcare professionals across the Nordic region presents a significant threat to Ambea. This scarcity drives up labor costs due to intense competition for talent. For example, Sweden's ongoing nurse shortage, projected to continue, directly impacts Ambea's ability to maintain adequate staffing, potentially compromising care quality.

Ambea also faces substantial risks from evolving regulatory landscapes in its operating countries. Changes in government policies, funding models, or quality standards can directly affect profitability and operational efficiency. New legislation, such as recent eldercare reforms in Denmark, introduces uncertainty and may necessitate costly adjustments to Ambea's business model, potentially hindering expansion plans.

Intensified competition from both public and private entities, coupled with pricing pressures in public procurements, threatens Ambea's market share and profit margins. For instance, continued pricing pressure in Swedish public tenders throughout 2024 impacted revenue growth for providers. New entrants or aggressive pricing strategies from rivals could further erode Ambea's position.

Economic downturns and fiscal pressures on Nordic municipalities, Ambea's primary clients, pose a considerable threat. Reduced public budgets for care services could lead to fewer contracts or scaled-back service agreements, impacting Ambea's revenue. Given that approximately 87% of Ambea's revenue in 2023 came from public sector contracts, fiscal constraints directly affect its financial stability.

Ambea's reputation is a critical vulnerability, as any perceived or actual decline in care quality or patient safety can lead to loss of public trust and attract negative media attention. Incidents, even isolated ones, can jeopardize existing contracts and invite stricter regulatory oversight. The financial repercussions include reduced client acquisition and retention, potentially higher insurance premiums, and direct financial penalties.

| Threat Category | Specific Risk | Impact on Ambea | Example/Data Point (2023/2024) |

|---|---|---|---|

| Workforce Shortages | Inability to recruit/retain qualified staff | Compromised care quality, increased labor costs | Ongoing nurse shortage in Sweden impacting staffing levels. |

| Regulatory Changes | New legislation, altered funding models | Reduced profitability, operational inefficiencies, hindered expansion | Danish eldercare reforms introducing uncertainty and potential adjustment costs. |

| Market Competition | Price wars, new entrants | Squeezed profit margins, loss of market share | Continued pricing pressure in Swedish public procurements impacting revenue growth. |

| Economic Downturns | Municipal budget cuts, lower reimbursement rates | Reduced contract volumes, decreased revenue, lower profitability | 87% of Ambea's 2023 revenue from public contracts highlights vulnerability to fiscal constraints. |

| Reputational Damage | Negative publicity from care lapses | Loss of public trust, contract cancellations, regulatory penalties | Past reports of staffing shortages impacting care delivery in Swedish municipalities. |

SWOT Analysis Data Sources

This Ambea SWOT analysis is built upon a robust foundation of data, incorporating official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded and accurate strategic overview.