Ambea Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

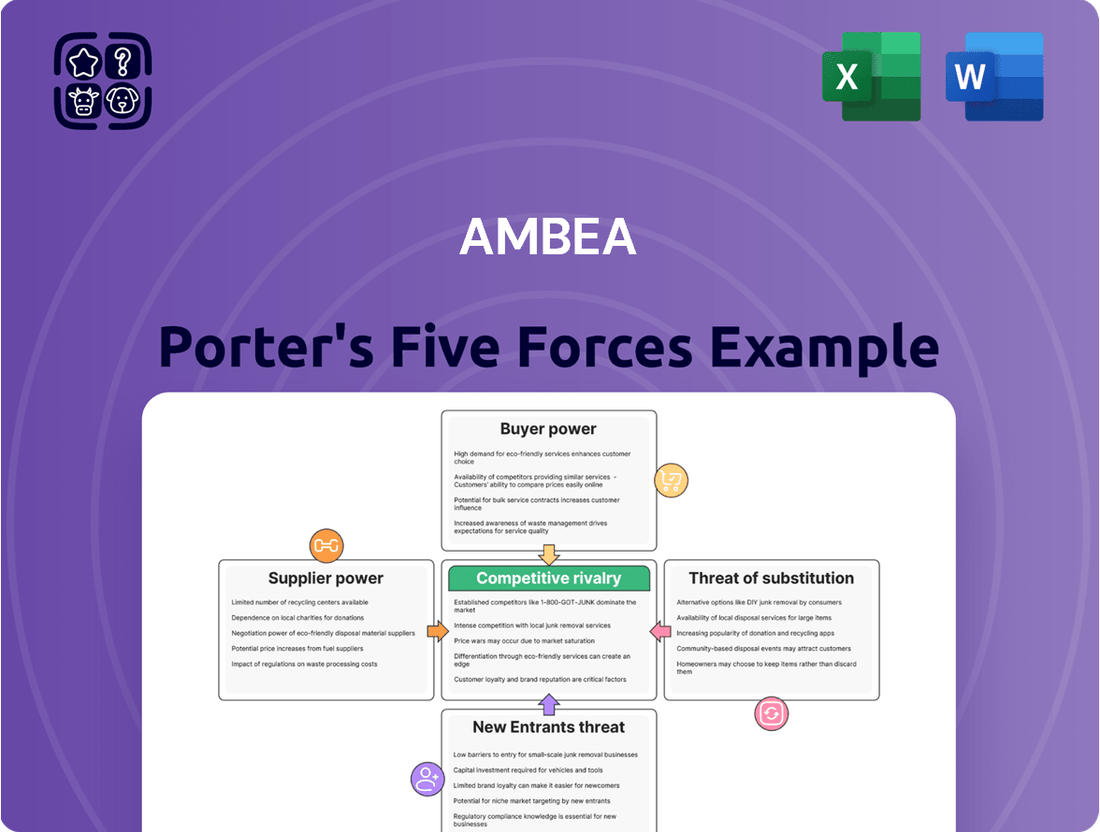

Ambea's competitive landscape is shaped by the interplay of five critical forces, revealing the underlying pressures that influence profitability and market strategy. Understanding these forces is crucial for navigating the complexities of the healthcare and eldercare sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ambea’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Nordic region, much like the global landscape, is grappling with a pronounced deficit of qualified healthcare professionals. This shortage is particularly acute among essential support staff, such as assistants and aides, who constitute a substantial portion of the care sector's labor force. For instance, in Sweden, a key market for Ambea, projections indicated a need for thousands more healthcare assistants by 2030 to meet demographic demands.

This scarcity of personnel, intensified by an aging workforce and increasing rates of burnout, inevitably strengthens the bargaining power of existing, qualified healthcare workers. They can command higher wages and better working conditions, directly impacting recruitment and retention costs for care providers like Ambea. In 2024, the average hourly wage for healthcare assistants in Sweden saw an upward trend, reflecting this increased leverage.

The aging demographic in Nordic nations is a significant driver, fueling a robust expansion in demand for elderly care, disability support, and personalized family services. This persistent, elevated need for care directly translates into enhanced bargaining power for suppliers of critical inputs.

Suppliers of specialized medical equipment, essential pharmaceuticals, and even suitable care facilities find themselves in a stronger negotiating position. The consistent and growing demand for their products and services means they are less likely to concede on pricing or terms, as their offerings are indispensable to the sector's operations.

While basic care supplies might be readily available from many sources, the specialized nature of certain equipment and technology significantly shifts the bargaining power towards suppliers. Innovations in AgeTech and digital health solutions, for instance, are crucial for modern elderly care operations.

These advanced technologies, like remote patient monitoring systems and specialized assistive devices, are often proprietary and developed by a select few companies. For example, the global AgeTech market was valued at approximately $11.4 billion in 2023 and is projected to grow substantially, indicating increasing reliance on these specialized providers. This limited vendor pool for critical, innovative solutions grants these suppliers considerable leverage in negotiating prices and contract terms with care providers like Ambea.

Regulatory and Quality Standards

The care sector in the Nordics operates under a heavily regulated environment, demanding suppliers adhere to rigorous quality and safety standards. This regulatory landscape significantly curtails the pool of eligible suppliers, consequently elevating compliance costs for those who meet these benchmarks.

These demanding standards empower suppliers who can consistently meet them, as their ability to navigate and fulfill these requirements grants them a stronger negotiating stance. For instance, in 2024, the average cost for a healthcare provider to ensure compliance with new EU medical device regulations, a common requirement in Nordic care, saw an estimated increase of 15-20%.

- Stringent Quality Requirements: Suppliers must meet high standards for patient safety and care quality.

- Limited Supplier Pool: Fewer suppliers can meet the complex regulatory requirements.

- Increased Compliance Costs: Suppliers face higher expenses to maintain certifications and quality.

- Enhanced Supplier Leverage: Meeting these standards gives suppliers greater bargaining power.

Limited Geographic Mobility of Certain Suppliers

When services demand a physical presence, like local property maintenance or specialized medical care, suppliers’ geographic reach can be restricted. This limitation can foster regional monopolies or oligopolies, thereby enhancing the bargaining power of these localized suppliers over organizations dependent on their services within those specific areas.

For instance, in 2024, the healthcare sector often witnesses this dynamic. A specialized diagnostic imaging provider operating solely within a particular metropolitan area might hold significant sway over local hospitals and clinics, especially if alternative providers are scarce or geographically distant. This lack of readily available substitutes in close proximity allows such suppliers to dictate terms more effectively.

- Geographic Constraints: Services tied to a physical location, such as localized catering or facility management, inherently limit supplier options for businesses in that region.

- Regional Market Power: Limited geographic mobility can lead to situations where a few suppliers dominate a specific area, granting them increased leverage.

- Impact on Service Providers: Organizations reliant on these localized services may face higher costs or less favorable contract terms due to the reduced competition.

The bargaining power of suppliers for Ambea is significantly influenced by the specialized nature of certain healthcare equipment and innovative technologies. Companies providing proprietary AgeTech solutions, for example, hold considerable leverage due to a limited vendor pool.

The global AgeTech market's growth, projected to expand beyond its 2023 valuation of approximately $11.4 billion, underscores the increasing reliance on these specialized providers. This reliance, coupled with stringent regulatory and quality standards in the Nordic care sector, further empowers suppliers who can meet these demanding requirements.

Compliance costs for suppliers meeting these benchmarks are elevated, estimated to increase by 15-20% in 2024 for new EU medical device regulations. This dynamic grants suppliers who navigate these complexities a stronger negotiating position, impacting Ambea's operational costs.

| Factor | Impact on Supplier Bargaining Power | Example for Ambea |

|---|---|---|

| Specialized Technology & Innovation | High Leverage | Proprietary AgeTech solutions (e.g., remote monitoring) |

| Regulatory Compliance Costs | Elevated Supplier Costs, Increased Leverage | Meeting EU medical device standards (estimated 15-20% cost increase in 2024) |

| Limited Supplier Pool for Niche Needs | High Leverage | Specific diagnostic equipment providers in localized areas |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ambea's position in the healthcare and elderly care sectors.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Streamline strategic planning by pinpointing key areas of market pressure, enabling targeted action.

Customers Bargaining Power

In Nordic countries, public funding, primarily through taxes, heavily influences the care sector. This reliance on government budgets grants significant bargaining power to public procurement entities, such as municipalities and regional authorities. These bodies are the main payers, directly impacting contract terms and pricing for care service providers like Ambea.

The prevailing model where funding often follows the individual but is disbursed via public bodies further concentrates power with these governmental purchasers. For instance, in Sweden, municipalities are responsible for purchasing care services, and in 2024, their budgets for social services represent a substantial portion of overall public spending, giving them considerable leverage in negotiations with providers.

The 'free choice' principle in Sweden, which allows care recipients to select between municipal and private care providers, significantly empowers individual customers. This fundamental right grants them the ability to switch providers, directly influencing the demand for services offered by companies like Ambea.

In 2024, this customer bargaining power is a critical factor for Ambea. With the ability to choose, care recipients can opt for providers they perceive as offering superior quality or better alignment with their needs. This necessitates Ambea's continuous focus on service excellence and client satisfaction to retain and attract residents, as a high occupancy rate is crucial for financial performance.

Standardized service requirements, often mandated by public funding bodies, significantly bolster customer bargaining power in the care sector. When service expectations and quality metrics are uniform, like those outlined by national healthcare standards or regional social care frameworks, it simplifies comparison for consumers or their representatives. This transparency allows them to readily assess value and exert pressure on providers to meet specific quality benchmarks or offer competitive pricing, as seen with the increasing focus on patient satisfaction scores and outcome-based funding models prevalent in many European countries throughout 2024.

High Switching Costs for Established Care Relationships

While individuals can choose their care providers, the process of switching, particularly in residential care or for those with complex needs, carries significant emotional and logistical burdens. These high switching costs can dampen the immediate bargaining power of current individual clients, as the upheaval involved in changing providers might overshadow any perceived advantages.

For example, in the Swedish elderly care market where Ambea operates, families often invest considerable time and effort in establishing relationships with specific care homes and staff. A 2024 survey indicated that over 60% of families felt a strong emotional attachment to their current care provider, making a transition a difficult prospect.

This loyalty, driven by established relationships and the inherent difficulties in relocating a loved one, effectively reduces the immediate price sensitivity and bargaining leverage of individual customers. The disruption of moving, re-establishing trust with new caregivers, and potential gaps in care are significant deterrents.

- High Emotional Investment: Families often form deep bonds with care staff, making the prospect of leaving a provider emotionally taxing.

- Logistical Hurdles: Moving a vulnerable individual, especially with specific medical requirements, involves complex coordination and potential service interruptions.

- Reduced Price Sensitivity: The comfort and familiarity of an established relationship can outweigh minor cost differences for many clients.

- Impact on Bargaining Power: These factors collectively limit the immediate ability of individual customers to exert significant bargaining pressure on established care providers.

Consolidation of Purchasing Power by Municipalities

Municipalities, by pooling their procurement needs for care services, can significantly amplify their collective bargaining power. This consolidation allows them to negotiate better pricing and demand more robust service agreements from providers like Ambea.

This increased leverage enables municipalities to secure more favorable terms, which can include lower per-unit costs and extended contract durations. For instance, in 2024, several large municipal consortia in Sweden reported achieving average cost reductions of 5-7% on procured care services through consolidated purchasing initiatives.

- Consolidated Demand: Municipalities represent a substantial and consistent demand for care services, giving them considerable leverage.

- Negotiating Leverage: By acting as a single, large buyer, they can negotiate pricing and contract terms more effectively than individual entities.

- Service Specification: This collective power allows them to specify detailed service requirements and quality standards, influencing provider operations.

- Risk Mitigation: Standardized contracts across multiple municipalities can reduce administrative burdens and risks for both parties.

The bargaining power of customers is significant for Ambea, primarily driven by public funding and the individual's right to choose. While direct individual leverage might be tempered by switching costs, the consolidated purchasing power of municipalities, especially through consortia, represents a substantial force. These entities can negotiate better pricing and demand higher service standards, directly impacting providers like Ambea.

| Customer Group | Source of Power | Impact on Ambea |

|---|---|---|

| Individual Care Recipients (Sweden) | Right to choose providers; potential to switch | Necessitates focus on service quality and client satisfaction to maintain occupancy. |

| Municipalities (Nordic Countries) | Primary payers; consolidated procurement needs | Ability to negotiate pricing and service terms; can drive down costs through bulk purchasing. |

| Public Procurement Bodies | Government budgets; standardized service requirements | Influence contract terms and pricing; enforce quality benchmarks and outcome-based models. |

Full Version Awaits

Ambea Porter's Five Forces Analysis

This preview showcases the complete Ambea Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the healthcare and social care sectors. The document you see here is precisely the same professionally crafted report you will receive instantly upon purchase, ensuring no discrepancies or missing information. You can confidently use this analysis to understand Ambea's strategic positioning and potential challenges.

Rivalry Among Competitors

The Nordic care market, where Ambea operates, is characterized by its fragmentation. While Ambea is a significant player, the presence of numerous smaller, specialized care providers alongside larger entities creates a highly competitive environment. This means Ambea constantly faces pressure from a wide array of competitors, each vying for contracts and clients.

This diverse competitive landscape compels providers like Ambea to focus on continuous differentiation. Success hinges on offering superior service quality and operational efficiency. For instance, in 2023, the Nordic home care market saw a steady influx of new providers, with many focusing on niche services, further fragmenting the market and intensifying the need for unique value propositions.

The growing demand for care services, particularly driven by an aging population, is a significant magnet for new competitors and encourages existing players to expand. This increased market attractiveness fuels a dynamic competitive landscape where growth is pursued aggressively.

Ambea's own strategy exemplifies this trend, with the company actively acquiring well-managed operations and establishing new units. For instance, in 2024, Ambea continued its expansion efforts, acquiring several smaller care providers to bolster its market presence and service offerings across Sweden and Norway.

In sectors serving vulnerable populations, the quality of care and a strong reputation are not just advantages, they are essential for survival. Competitors understand this deeply, pouring resources into staff development, rigorous quality control measures, and actively seeking positive feedback from those receiving care. Ambea itself highlights its commitment to quality and employee well-being in its public disclosures, underscoring this competitive battleground.

Public Procurement and Tender Processes

Ambea's competitive rivalry is significantly shaped by public procurement processes, especially within the care services sector. A substantial portion of these services is awarded through tenders, fostering a highly competitive environment among private providers. This structured approach to awarding contracts means that providers must meticulously focus on pricing, the specifics of their service offerings, and strict adherence to public standards to win business.

The transparency inherent in these public tenders intensifies the pressure. Providers are often required to disclose detailed operational plans and financial projections, making differentiation based on unique value propositions challenging. Consequently, price becomes a dominant factor, and providers like Ambea must operate with extreme cost efficiency to remain competitive. For instance, in 2023, many public healthcare tenders saw bids that were highly competitive on price, with providers needing to demonstrate significant economies of scale or innovative cost-saving measures to secure contracts.

- Intense Bidding: Public procurement drives fierce competition as numerous private care providers vie for contracts.

- Price Sensitivity: Tenders often prioritize cost-effectiveness, making pricing a primary determinant of success.

- Service Differentiation: Providers must clearly articulate unique service benefits beyond just price to stand out.

- Compliance Focus: Meeting rigorous public standards and regulatory requirements is non-negotiable for tender success.

Staffing Shortages and Retention Challenges

The ongoing healthcare staffing shortages in the Nordics significantly fuel competitive rivalry for Ambea. Companies are not just vying for contracts but are locked in a fierce battle for qualified healthcare professionals, driving up recruitment expenses. This intense competition underscores the critical need for robust employee satisfaction and retention initiatives to ensure consistent service delivery and uphold quality standards.

In 2024, the scarcity of healthcare workers remains a defining challenge. For instance, Sweden alone faced a projected deficit of tens of thousands of healthcare professionals in the coming years, a trend mirrored across Denmark, Norway, and Finland. This situation directly impacts companies like Ambea, forcing them to invest more heavily in recruitment and employee benefits to attract and keep staff.

- Intensified Competition for Talent: Healthcare staffing shortages mean Ambea competes not only for clients but also for essential personnel, increasing operational costs.

- Rising Recruitment Costs: The demand for qualified staff drives up expenses associated with attracting and hiring new employees.

- Focus on Retention: Employee satisfaction and effective retention strategies are paramount for maintaining service capacity and quality amidst the talent crunch.

The competitive rivalry within the Nordic care sector, where Ambea operates, is notably intense due to a fragmented market populated by numerous specialized providers alongside larger entities. This dynamic forces Ambea to continuously differentiate itself through superior service quality and operational efficiency to win contracts and clients.

Public procurement processes significantly shape this rivalry, with many care services awarded through competitive tenders. This necessitates a strong focus on pricing, service specifics, and adherence to public standards, often leading to price-sensitive bidding and a need for cost efficiency. For instance, in 2023, many public healthcare tenders saw highly competitive pricing, requiring providers to demonstrate economies of scale or cost-saving innovations.

Furthermore, ongoing healthcare staffing shortages in the Nordics intensify the competition for qualified professionals, driving up recruitment costs and emphasizing the importance of employee retention. Sweden, for example, projected a significant deficit of healthcare professionals in the coming years, a trend impacting Ambea's operational costs and talent acquisition strategies.

| Factor | Impact on Ambea | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | High competition from numerous providers | Continued influx of niche service providers |

| Public Procurement | Tender-based contracts increase price competition | High bid competitiveness on price in 2023 tenders |

| Staffing Shortages | Intensified competition for talent, rising recruitment costs | Projected healthcare professional deficit in Nordics |

SSubstitutes Threaten

Informal care provided by family and friends represents a significant substitute for professional care services. In 2024, while Nordic countries generally have robust public care systems, cultural expectations and personal situations still lead many families to provide care themselves, particularly for less intensive needs. This can directly reduce the demand for formal care solutions.

The rise of AgeTech and digital health solutions presents a significant threat of substitutes for traditional residential care and extensive in-home services. These advancements empower older adults to age in place, fostering independence and safety within their own homes.

Technologies such as remote patient monitoring, smart home devices, and telehealth platforms offer compelling alternatives. For instance, the global AgeTech market was valued at approximately $1.1 trillion in 2023 and is projected to grow substantially, indicating a strong shift towards home-based care solutions.

These digital tools can effectively manage health conditions, provide emergency alerts, and facilitate social connection, thereby reducing the reliance on costly, hands-on care. This trend directly challenges the market share of established care providers by offering more accessible and often more affordable options for seniors.

Local communities and non-profits offer programs like senior centers and social clubs. These can be substitutes for Ambea's services, especially for individuals seeking social interaction rather than intensive care. For instance, in 2024, many municipalities increased funding for community-based senior activities, aiming to provide affordable social outlets.

Technological Self-Care and Preventative Health

The rise of technological self-care and preventative health solutions presents a significant threat of substitutes for traditional healthcare services, particularly for conditions that can be managed or delayed through proactive measures. As individuals gain greater access to and awareness of these tools, the demand for more intensive, reactive care may diminish.

This trend is fueled by increasing digital literacy and the growing availability of user-friendly applications and wearable devices. For example, by mid-2024, the global digital health market was projected to reach hundreds of billions of dollars, with a substantial portion dedicated to preventative and wellness-focused technologies. This indicates a tangible shift in consumer behavior and investment towards early intervention.

The impact on healthcare providers like Ambea Porter could be a reduction in the volume of patients seeking treatment for conditions that could have been mitigated or prevented. This necessitates a strategic re-evaluation of service offerings to align with a more proactive health landscape.

- Growing adoption of wearable health trackers: By 2024, over 100 million Americans were expected to use wearable fitness trackers, many of which offer health monitoring features.

- Expansion of telehealth and remote monitoring: Telehealth services saw a significant surge, with many platforms now offering preventative health consultations and chronic disease management.

- Increased investment in digital wellness platforms: Venture capital funding for digital health startups, focusing on preventative care and self-management, reached record highs in 2023 and continued strong into 2024.

- Consumer empowerment through health information: Easy access to health information online and through apps encourages individuals to take a more active role in managing their well-being.

Emergence of Hybrid Care Models

The rise of hybrid care models presents a significant threat of substitution to traditional residential care providers like Ambea. These innovative approaches blend in-home support with digital monitoring and limited facility-based services, offering a more adaptable and often more affordable alternative. For instance, a growing number of individuals are opting for a mix of telehealth check-ins, personal care assistants visiting their homes, and only utilizing residential facilities for short-term respite or specialized medical needs, thereby bypassing full-time residency.

These hybrid models cater to a wider spectrum of consumer preferences and financial capabilities. By allowing individuals to customize their care packages, they can reduce reliance on comprehensive, fixed residential care. This flexibility is particularly attractive as it allows for aging in place or receiving care within familiar surroundings, which many find preferable to institutional settings.

The cost-effectiveness of these substitutes is a key driver of their adoption. For example, a Deloitte report from 2024 indicated that integrated home and community-based care models can be up to 20% less expensive than traditional nursing home care for certain patient profiles. This financial advantage makes hybrid solutions a compelling option for both consumers and payers, directly impacting the market share available to full-service residential care facilities.

- Hybrid Care Models: Combining home care, digital solutions, and occasional institutional support.

- Consumer Appeal: Offers flexibility and cost-effectiveness, meeting diverse needs and preferences.

- Market Impact: Directly substitutes for traditional, comprehensive residential care.

- Cost Advantage: Potentially 20% less expensive than traditional nursing home care (Deloitte, 2024 data).

The threat of substitutes for Ambea's services is significant, stemming from informal care, technological advancements, and community-based programs. Informal care, provided by family and friends, remains prevalent in 2024, particularly in regions with strong public care systems, reducing demand for professional services. AgeTech and digital health solutions are also emerging as powerful substitutes, enabling individuals to age independently at home, thereby lessening the need for residential care. The global AgeTech market's substantial growth, valued at approximately $1.1 trillion in 2023, underscores this shift towards home-based care alternatives.

Furthermore, community programs and the increasing adoption of preventative health measures and hybrid care models offer cost-effective and flexible alternatives. These substitutes challenge traditional care models by providing more accessible and personalized options, impacting Ambea's market share.

| Substitute Type | Description | 2024 Relevance/Data |

|---|---|---|

| Informal Care | Family and friend support | Culturally significant, especially for less intensive needs. |

| AgeTech/Digital Health | Remote monitoring, smart home devices, telehealth | Global AgeTech market ~$1.1 trillion (2023); empowers aging in place. |

| Community Programs | Senior centers, social clubs | Municipal funding increased for social activities, offering alternatives to intensive care. |

| Preventative Health | Wearables, digital wellness platforms | Over 100 million Americans expected to use fitness trackers (2024); digital health market in hundreds of billions. |

| Hybrid Care Models | In-home support + digital monitoring + limited facility use | Can be up to 20% less expensive than traditional nursing homes (Deloitte, 2024). |

Entrants Threaten

The care sector in Nordic countries, including those Ambea operates in, is characterized by substantial regulatory barriers and demanding licensing requirements. These stringent rules necessitate extensive certifications and adherence to rigorous operational standards, effectively deterring potential new entrants who may lack the resources or expertise to navigate these complexities. For instance, in Sweden, the approval process for healthcare providers involves detailed inspections and compliance checks, making it difficult for new entities to establish themselves quickly.

The significant capital investment required to establish and operate care facilities, particularly residential homes, presents a formidable barrier to entry. Ambea, like other established players, has already made substantial investments in property, infrastructure, and specialized equipment. For instance, the average cost to build a new nursing home in the UK in 2024 can range from £10 million to £25 million, depending on size and specifications. This high upfront cost deters many potential new entrants, as they would need considerable financial backing to compete with existing, well-capitalized organizations.

In the sensitive care sector, building a strong reputation and earning trust are paramount for attracting clients and securing valuable public contracts. Newcomers to this market, like potential entrants looking to compete with established players such as Ambea, face a significant hurdle in establishing this essential credibility from the ground up. This difficulty is amplified when competing against providers with a long-standing history of quality care and proven reliability.

Challenges in Staffing and Talent Acquisition

The threat of new entrants in the Nordic healthcare sector is significantly amplified by the widespread shortage of qualified professionals. This scarcity makes it a formidable task for newcomers to recruit and retain the essential staff needed to operate effectively. For instance, in 2023, Sweden alone faced a projected deficit of tens of thousands of nurses and other healthcare workers, a trend expected to persist.

Established companies already possess a distinct advantage. They often boast stronger employer brands, built over years of operation, which attracts top talent. Furthermore, their existing networks within the healthcare system and more developed, structured training programs provide a competitive edge that new entrants struggle to match. This creates a high barrier to entry, as new players must invest heavily in recruitment and talent development to even approach the capabilities of incumbents.

- Talent Scarcity: The Nordic region faces a critical shortage of healthcare professionals, impacting new entrants' ability to staff operations.

- Employer Branding: Established companies leverage stronger employer brands to attract and retain talent.

- Network Effects: Existing players benefit from established networks and relationships within the healthcare ecosystem.

- Training Infrastructure: Mature organizations have more developed training programs, offering a competitive advantage in skill development.

Established Relationships with Municipalities and Public Bodies

Established care providers, such as Ambea, benefit significantly from deep-rooted relationships with municipalities and public bodies. These long-standing connections are crucial in navigating the intricate public procurement processes, a significant barrier for newcomers. For instance, in 2023, the Swedish public sector's expenditure on elderly care services amounted to approximately SEK 100 billion, with a substantial portion allocated through competitive tenders.

New entrants face the daunting task of understanding and successfully participating in these complex tender systems. Building trust and demonstrating a proven track record with public clients, a process that often takes years, is essential to secure valuable contracts. This established credibility, cultivated over time, gives incumbents a distinct advantage in the competitive landscape.

- Established relationships streamline public procurement processes.

- New entrants must navigate complex tender systems.

- Building trust with public clients is a lengthy process.

- Incumbents possess a significant advantage due to existing credibility.

The threat of new entrants into the Nordic care sector, where Ambea operates, is considerably low due to high capital requirements. Building new care facilities involves substantial upfront investment in property and specialized equipment, with new nursing homes in the UK costing between £10 million and £25 million in 2024. This financial barrier makes it difficult for smaller or less-funded entities to enter the market and compete effectively against established players like Ambea.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

| Capital Requirements | High costs for infrastructure and equipment. | Deters new entrants due to significant financial outlay. | UK nursing home construction: £10-£25 million. |

| Regulatory Hurdles | Strict licensing and compliance standards. | Requires extensive certifications and expertise to navigate. | Swedish healthcare provider approval process is detailed. |

| Talent Scarcity | Shortage of qualified healthcare professionals. | Makes recruitment and retention challenging for newcomers. | Sweden projected deficit of tens of thousands of healthcare workers (2023). |

| Reputation and Trust | Need for a proven track record in care quality. | Difficult for new entrants to establish credibility against incumbents. | Long-standing providers have a proven history of reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ambea is built upon a robust foundation of publicly available data, including Ambea's annual reports and financial statements, as well as industry-specific market research reports and analyses from reputable sources like IBISWorld and Statista.