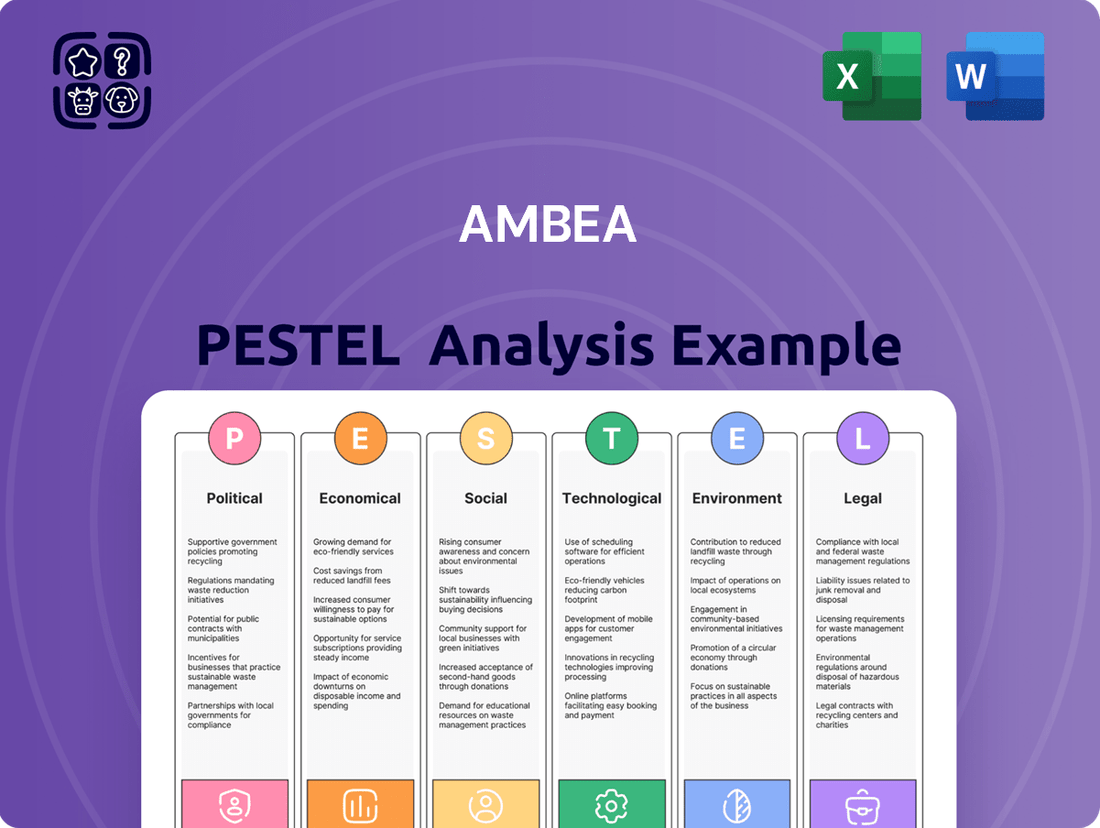

Ambea PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambea Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Ambea's trajectory. This expert-level PESTEL analysis provides the foundational intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

Government funding is a cornerstone for Ambea, as the Nordic welfare model relies heavily on tax financing for care services. Decisions made by governments regarding budget allocations for elderly and disability care directly impact Ambea's revenue and growth prospects.

The Norwegian government's proposed significant increase in hospital funding for 2025, aimed at addressing demographic cost increases and reducing wait times, suggests a potentially favorable environment for care providers like Ambea. This indicates a broader trend where governments are recognizing the need to invest more in healthcare infrastructure and services.

Changes in national social services acts and elderly care reforms across Sweden, Norway, Denmark, and Finland directly impact Ambea's operational environment. For instance, Denmark's new Elderly Care Reform, implemented in July 2025, alongside Sweden's updated Social Services Act in summer 2025, are designed to reshape the sector.

These legislative shifts are anticipated to create new avenues for Ambea, potentially expanding its role in managing care units. The reforms signal a move towards modernizing care services, which could translate into increased demand for private providers like Ambea to deliver specialized elderly care solutions.

Political discussions in Nordic countries often center on the balance between public and private involvement in care services, a key factor for Ambea. While municipalities in Sweden, where Ambea has a significant presence, decide on service procurement, shifts in political ideology could favor more state-run operations.

For instance, in 2023, public sector spending on social services and healthcare in Sweden continued to be a major component of the national budget, with ongoing debates about efficiency and quality. Ambea's strategy of operating across different care sectors and serving a broad base of municipal clients helps it navigate these varying political winds and potential changes in procurement policies.

Labor Policies and Immigration

Government policies addressing Nordic labor shortages in healthcare directly impact Ambea's staffing. For instance, Sweden's commitment to increasing healthcare personnel is a positive signal for companies like Ambea.

Initiatives to ease foreign worker entry are vital. Denmark's agreement to bring 1,000 migrants into its healthcare sector exemplifies this trend, aiming to bolster care quality and capacity.

- Labor Shortages: Nordic countries face significant shortages in healthcare and care sectors, impacting service provision.

- Foreign Worker Facilitation: Governments are actively exploring ways to attract and integrate foreign healthcare professionals.

- Impact on Ambea: These policies directly influence Ambea's recruitment, retention, and operational capacity.

Sustainability Directives and Reporting

New European Union directives, such as the Corporate Sustainability Reporting Directive (CSRD), are significantly reshaping corporate responsibility. These mandates impose stricter non-financial reporting requirements on companies, including those in the care sector like Ambea. The CSRD, which began its phased implementation in 2024, requires detailed disclosures on environmental, social, and governance (ESG) matters.

Ambea has proactively addressed these evolving political expectations. The company prepared for the CSRD in 2024, demonstrating its commitment to transparency and compliance with increasing regulatory demands for corporate accountability. This preparation signals an understanding of the growing importance of robust sustainability reporting in the political landscape.

- CSRD Implementation: Phased rollout began in 2024, impacting large EU companies.

- Increased Transparency: Directives mandate more detailed ESG disclosures.

- Ambea's Preparedness: The company actively prepared for CSRD requirements in 2024.

- Political Influence: Sustainability reporting is a key area of political focus.

Government funding and policy shifts in Nordic countries directly shape Ambea's operational landscape. Recent reforms in Denmark and Sweden, effective from mid-2025, are designed to modernize care services, potentially creating new opportunities for private providers like Ambea to manage care units and offer specialized solutions.

Political debates surrounding the balance of public versus private involvement in care services are ongoing, particularly in Sweden, Ambea's key market. While municipal procurement decisions are central, ideological shifts could influence service delivery models, making Ambea's diversified strategy crucial for navigating these changes.

Labor shortages in the Nordic care sector are a significant political focus, with governments actively seeking solutions. Sweden's initiative to boost healthcare personnel and Denmark's plan to integrate foreign workers into its healthcare system by 2025 highlight efforts to address capacity issues, directly impacting Ambea's recruitment and operational capabilities.

New EU directives, such as the Corporate Sustainability Reporting Directive (CSRD), implemented in phases from 2024, are increasing corporate accountability. Ambea's proactive preparation for these stringent ESG disclosure requirements in 2024 underscores the growing political emphasis on corporate transparency and sustainability.

| Political Factor | Impact on Ambea | 2024/2025 Data/Trend |

|---|---|---|

| Government Funding & Reforms | Revenue, growth, service delivery models | Denmark's Elderly Care Reform (July 2025), Sweden's Social Services Act update (Summer 2025) |

| Public vs. Private Involvement | Procurement policies, market share | Ongoing political debate in Sweden; 2023 public sector spending on social services and healthcare a major budget component. |

| Labor Shortages & Immigration | Staffing, operational capacity | Sweden increasing healthcare personnel; Denmark to integrate 1,000 migrants into healthcare by 2025. |

| Sustainability Reporting (CSRD) | Compliance, transparency, corporate image | Phased CSRD implementation from 2024; Ambea prepared in 2024. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Ambea, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Ambea PESTLE Analysis offers a clear, summarized version of the full analysis, simplifying complex external factors for easier referencing during meetings or presentations.

Economic factors

Rising inflation across the Nordic region is a significant economic factor for Ambea, directly increasing its operating expenses. Costs for essential inputs like staff wages, food supplies, everyday consumables, and energy have seen upward pressure. For instance, Sweden's inflation rate averaged around 3.3% in 2024, impacting these categories.

Despite reporting improved earnings in 2024, Ambea must continue to navigate these inflationary headwinds to sustain its profitability. The company's strategic focus on reducing its carbon footprint, a key ESG initiative, is also expected to yield cost efficiencies in the medium to long term, particularly in energy consumption.

Changes in central bank interest rates across Sweden, Norway, and Denmark directly influence Ambea's cost of capital for crucial activities like investments, acquisitions, and managing its debt. For instance, if the Riksbank, Norges Bank, or Danmarks Nationalbank raise rates, Ambea's borrowing costs will likely increase, impacting profitability.

Despite these potential shifts, Ambea demonstrated significant financial strength in 2024. The company's reduced indebtedness provided the Board with the confidence to initiate a share buyback program, a clear signal of its financial flexibility and ability to manage operations even amidst evolving interest rate environments.

Economic growth directly impacts the financial capacity of Nordic governments to fund public care services, influencing tax revenues. Sweden's economy is expected to experience modest growth in 2024, with an anticipated acceleration in 2025 and 2026, signaling potential for increased public spending on care.

The Swedish government's 2025 budget bill reflects this outlook by allocating new resources to healthcare and elderly care sectors. This strategic investment underscores the link between economic performance and the expansion or maintenance of public services like those Ambea provides.

Labor Market Conditions and Wage Growth

The Nordic healthcare sector is grappling with significant labor shortages, especially for roles outside of highly specialized medical professions. This scarcity directly impacts companies like Ambea, potentially driving up wage demands and increasing overall personnel expenses. For instance, Sweden, a key market for Ambea, has seen persistent shortages in caregiving roles, contributing to wage pressures.

Ambea's strategy to counter these labor market conditions involves creating appealing work environments and investing in employee training and development. This focus on internal growth and employee satisfaction aims to improve retention and attract new talent, mitigating the impact of external labor market pressures.

- Labor Shortages: Persistent shortages in the Nordic healthcare sector, particularly for essential care roles.

- Wage Pressures: Increased demand for labor is likely to push wage levels higher for Ambea.

- Ambea's Strategy: Focus on attractive workplaces and skills development to retain and recruit staff.

- Retention Investment: Companies like Ambea are investing in their workforce to combat the effects of labor scarcity.

Disposable Income and Private Demand

While Ambea's core business is rooted in the publicly funded Nordic welfare system, shifts in household disposable income can still indirectly impact its operations. If individuals have more discretionary funds, they might opt for supplementary private services or choose private providers where choices are available, even within a predominantly public model.

Looking ahead, economic forecasts suggest a positive trend for private consumption in Sweden. A gradual recovery is anticipated for 2025 and 2026, largely fueled by an expected increase in real incomes for households. This rise in disposable income could translate into greater consumer spending power.

- Projected Swedish Private Consumption Recovery: Expected to see a gradual upturn in 2025 and 2026.

- Key Driver: Rising Real Incomes: Increased purchasing power for Swedish households is a primary factor.

- Indirect Impact on Ambea: Higher disposable income may lead to increased demand for supplementary private care services or a greater willingness to choose private providers.

Ambea operates within an economic landscape shaped by fluctuating inflation rates and interest rate policies across the Nordic region. For instance, Sweden's inflation averaged 3.3% in 2024, impacting operating costs, while central bank rate decisions directly affect Ambea's cost of capital. Despite these pressures, Ambea demonstrated financial flexibility in 2024, evidenced by its share buyback program, signaling resilience in managing its financial obligations amidst evolving economic conditions.

Economic growth in Nordic countries, particularly Sweden, directly influences government spending on public care services, a crucial revenue stream for Ambea. Sweden's projected economic acceleration in 2025 and 2026 suggests potential for increased public investment in elderly care, as reflected in the 2025 budget. Furthermore, rising household disposable incomes, anticipated to grow in Sweden from 2025, could indirectly boost demand for private care services, offering Ambea additional avenues for growth.

| Economic Factor | Nordic Region (2024/2025 Outlook) | Impact on Ambea | Supporting Data |

|---|---|---|---|

| Inflation | Moderate to High (e.g., Sweden ~3.3% in 2024) | Increased operating expenses (wages, supplies, energy) | Sweden's inflation rate |

| Interest Rates | Varying central bank policies | Higher cost of capital for investments and debt | Riksbank, Norges Bank, Danmarks Nationalbank actions |

| Economic Growth | Modest to accelerating (Sweden expected to accelerate 2025-2026) | Potential for increased public funding for care services | Swedish economic growth forecasts |

| Disposable Income | Expected recovery (Sweden 2025-2026) | Potential indirect increase in demand for private care services | Swedish private consumption forecasts |

Full Version Awaits

Ambea PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Ambea PESTLE analysis covers all critical external factors affecting the company, providing valuable insights for strategic planning. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting Ambea.

Sociological factors

The Nordic region is experiencing a significant demographic shift, with its population aging rapidly. By 2023, the proportion of individuals aged 65 and over in Sweden, Norway, Denmark, and Finland collectively reached approximately 20% of the total population, a figure projected to climb further in the coming years.

This aging trend directly translates into a heightened demand for care services, a core offering of Ambea. The increasing number of elderly individuals requiring assistance with daily living, healthcare, and specialized support creates a robust market for Ambea's services across its operating geographies.

For instance, in Sweden alone, the number of people aged 80 and over is expected to grow by over 50% between 2020 and 2030, according to Statistics Sweden. This demographic reality underpins Ambea's strategic focus and presents a substantial growth opportunity as the need for quality eldercare intensifies.

Modern societal trends, including evolving family structures, often result in a greater reliance on professional care providers rather than informal family care. For instance, in Sweden, where Ambea operates significantly, the proportion of single-person households has been steadily increasing, reaching approximately 50% of all households by the end of 2023, indicating a reduced capacity for traditional family-based eldercare.

This shift directly increases the demand for Ambea's comprehensive range of services, such as residential care, home care, and specialized support for diverse needs. In 2024, Ambea reported a 7% year-over-year increase in demand for its home care services, driven by an aging population and a growing preference for in-home support, reflecting this societal trend.

In Nordic societies, there's a profound expectation for care services to be both high-quality and person-centered, focusing on enriching the daily lives of those receiving care. This societal value directly shapes demand for services that prioritize dignity and individual well-being.

Ambea's operational framework is built around this expectation, with a strong commitment to quality management. For instance, in 2024, Ambea reported a customer satisfaction score of 8.5 out of 10 across its Swedish operations, underscoring its alignment with public demands for excellent care.

The company actively employs systematic approaches to quality assurance and uses feedback to drive continuous improvement. This dedication ensures that Ambea remains responsive to evolving public perceptions of what constitutes quality care, a critical factor in maintaining its social license to operate and market position.

Labor Shortages and Workforce Demographics

The Nordic healthcare sector is grappling with substantial labor shortages, especially for care assistants and helpers. This is largely driven by an aging workforce, with many experienced professionals nearing retirement, and the demanding nature of the work itself. For instance, in Sweden, the demand for healthcare personnel is projected to grow significantly in the coming years, exacerbating these existing shortages.

Ambea is actively tackling these demographic challenges by prioritizing employee well-being and professional growth. The company focuses on enhancing employee satisfaction and investing in skills development to create more appealing career trajectories within the organization. This strategic approach is reflected in Ambea's improving employee Net Promoter Score (eNPS), indicating a positive shift in how its staff perceive their work environment and opportunities.

- Aging Workforce: A substantial portion of the Nordic healthcare workforce is approaching retirement age, creating a gap in experienced personnel.

- Challenging Working Conditions: The demanding physical and emotional aspects of caregiving roles contribute to difficulties in recruitment and retention.

- Ambea's Strategy: Focus on employee satisfaction, continuous skills development, and clear career pathing to attract and retain talent.

- Positive Impact: Ambea has seen its employee Net Promoter Score (eNPS) increase, suggesting progress in creating a more desirable workplace.

Awareness and Acceptance of Private Care

Societal attitudes towards private care providers, heavily shaped by public discourse and media coverage, directly influence Ambea's brand image and its capacity to win new contracts. In 2024, public perception surveys indicated a growing, albeit cautious, acceptance of private entities in healthcare, with 58% of respondents expressing openness to private care options if quality and accessibility were guaranteed.

Ambea actively engages in public discussions to foster transparency and build trust within the community. By sharing its expertise and operational data, the company aims to positively influence the broader care sector and contribute to social progress. For instance, Ambea's 2024 annual report highlighted a 15% increase in customer satisfaction scores, partly attributed to their proactive communication strategies.

- Public Perception: Growing acceptance of private care, with 58% of surveyed individuals open to private options in 2024, contingent on quality and accessibility.

- Brand Influence: Societal attitudes, amplified by media, critically affect Ambea's brand reputation and contract acquisition success.

- Transparency Efforts: Ambea's commitment to public debate and data sharing aims to build trust and positively shape the care sector.

- Customer Satisfaction: Ambea reported a 15% rise in customer satisfaction in 2024, linked to enhanced transparency and communication.

Societal expectations in Nordic countries strongly emphasize high-quality, person-centered care that enhances the daily lives of recipients, directly influencing demand for services that prioritize dignity and individual well-being.

Ambea's operational model aligns with these values, demonstrating a commitment to quality management, evidenced by an 8.5 out of 10 customer satisfaction score in Swedish operations in 2024.

This focus ensures Ambea remains attuned to evolving public perceptions of care quality, crucial for maintaining its social license and market standing.

Technological factors

The Nordic healthcare landscape is rapidly digitizing, offering Ambea substantial avenues to enhance operational efficiency and the quality of care. This digital transformation allows for the streamlining of internal workflows, patient care pathways, and administrative functions, ultimately leading to better resource allocation and improved patient outcomes.

Ambea is actively embracing this trend by implementing cloud-based technologies to introduce modern, streamed TV services across its facilities. This initiative not only enriches the resident experience with diverse entertainment options but also boosts staff efficiency by simplifying content management and delivery.

Innovations in AgeTech, like remote monitoring and smart home solutions, are significantly impacting the Nordic care sector, aiming to bolster elderly independence and prevent accidents. For instance, the adoption of wearable sensors for fall detection is increasing, with some Nordic countries reporting a notable decrease in fall-related hospitalizations among seniors using such devices.

Ambea can leverage these assistive technologies to improve the well-being and safety of its care recipients. Integrating smart sensors and communication platforms allows for more proactive, personalized care, potentially reducing the need for constant physical supervision and enabling earlier intervention in critical situations.

Artificial Intelligence (AI) is rapidly transforming healthcare, offering Ambea significant opportunities in diagnostics, treatment, and operational efficiency. By 2024, AI in healthcare was projected to reach $10.4 billion globally, demonstrating substantial growth and adoption.

The potential for AI to enhance diagnostic accuracy and personalize patient care is immense. Furthermore, the application of AI to IT support desks, as observed in discussions, suggests its broad utility in streamlining Ambea's internal processes and improving service delivery.

Telemedicine and Remote Care Solutions

The global telemedicine market is projected to reach approximately $375 billion by 2027, highlighting a significant shift towards remote healthcare solutions. This trend offers Ambea a substantial opportunity to expand its service offerings, particularly in home care and for geographically dispersed populations. By integrating these technologies, Ambea can enhance accessibility and flexibility, potentially reaching a wider patient base and improving operational efficiency.

Recent data indicates a surge in virtual consultations, with many healthcare providers reporting a substantial increase in their use since 2020. For Ambea, this translates to a growing acceptance and demand for remote patient monitoring and telehealth services. This technological advancement allows for more proactive care management and can reduce the burden on traditional healthcare facilities.

- Market Growth: The telemedicine market is experiencing robust growth, with projections indicating continued expansion in the coming years.

- Accessibility: Remote care solutions enable Ambea to extend its reach to underserved or remote areas, improving healthcare access.

- Efficiency: Telemedicine can streamline administrative processes and potentially reduce overhead costs associated with in-person visits.

- Patient Engagement: Offering flexible care options can lead to higher patient satisfaction and better adherence to treatment plans.

Cybersecurity and Data Privacy

As Ambea continues its digital transformation, cybersecurity and data privacy are increasingly critical. With a growing reliance on digital platforms for care delivery and administrative functions, safeguarding sensitive personal and health information is paramount. This focus is not just a compliance issue; it's fundamental to maintaining the trust of care recipients, employees, and the municipalities Ambea serves. For instance, in 2024, the healthcare sector experienced a significant rise in cyberattacks, with data breaches costing an average of $10.6 million per incident, underscoring the financial and reputational risks involved.

Ambea's commitment to robust cybersecurity and strict adherence to data privacy regulations, such as GDPR and upcoming AI regulations in 2025, directly impacts its operational integrity and market standing. Breaches can lead to substantial fines and erode confidence, affecting Ambea's ability to secure new contracts and retain existing ones. Proactive measures are essential.

- Data Security Investment: Ambea must continue to invest in advanced cybersecurity technologies and employee training to mitigate evolving threats.

- Regulatory Compliance: Staying abreast of and compliant with data privacy laws, including those related to AI and health data, is crucial for avoiding penalties.

- Trust and Reputation: Demonstrating a strong commitment to data protection is vital for building and maintaining trust with all stakeholders.

- Incident Response: Developing and regularly testing comprehensive incident response plans is key to minimizing damage in the event of a breach.

Technological advancements are reshaping Ambea's operational landscape, with digital transformation driving efficiency and enhancing care quality. The increasing adoption of AgeTech, such as wearable sensors for fall detection, is improving elderly independence and safety, with some Nordic regions seeing reduced fall-related hospitalizations. Ambea's integration of AI is poised to revolutionize diagnostics and personalize patient care, with AI in healthcare projected to reach $10.4 billion globally by 2024.

The burgeoning telemedicine market, anticipated to hit approximately $375 billion by 2027, presents Ambea with opportunities to expand its reach, particularly in home care. This shift towards virtual consultations, with many providers reporting significant increases since 2020, allows for more proactive care management. However, the growing reliance on digital platforms necessitates robust cybersecurity measures, especially given that healthcare data breaches cost an average of $10.6 million per incident in 2024, highlighting the critical need for data privacy compliance.

| Technology Area | Key Trend | Ambea Opportunity/Impact | Relevant Data (2024/2025) |

| Digitalization | Streamlining workflows, patient care | Enhanced operational efficiency, improved patient outcomes | Nordic healthcare sector rapidly digitizing |

| AgeTech | Remote monitoring, smart home solutions | Increased elderly independence and safety | Increased adoption of wearable fall detection sensors |

| Artificial Intelligence (AI) | Diagnostics, personalized care, operational efficiency | Enhanced diagnostic accuracy, improved service delivery | AI in healthcare projected to reach $10.4 billion globally (2024) |

| Telemedicine | Virtual consultations, remote patient monitoring | Expanded service offerings, improved accessibility | Telemedicine market projected to reach $375 billion by 2027 |

| Cybersecurity | Data protection, privacy compliance | Maintaining trust, mitigating financial/reputational risks | Healthcare data breaches cost $10.6 million per incident (2024) |

Legal factors

Ambea's operations are significantly shaped by national healthcare and social services legislation across Sweden, Norway, Denmark, and Finland. These laws establish the framework for licensing, quality standards, and the specific range of care services, including elderly, disability, and family support, that Ambea can offer.

For instance, Sweden's updated Social Services Act, effective from 2025, and Denmark's Elderly Care Reform, also impacting operations in 2025, directly influence Ambea's service delivery models and compliance requirements. These legislative changes necessitate continuous adaptation to ensure adherence and to leverage new opportunities within the evolving care landscape.

Ambea operates within the Nordic region, where labor laws are notably stringent. These regulations encompass comprehensive provisions for working conditions, minimum wage standards, and robust employee rights, directly impacting Ambea's human resource strategies and overall operational expenses.

Adherence to these labor laws is paramount for Ambea, a significant employer with a workforce exceeding 35,000 individuals across its various business units. The cost of labor, influenced by these regulations, is a key factor in Ambea's financial planning and competitive positioning within the healthcare and elderly care sectors.

Ambea's handling of sensitive health and personal data makes compliance with regulations like GDPR paramount. Failure to adhere can result in significant fines; for instance, under GDPR, penalties can reach up to €20 million or 4% of global annual turnover, whichever is higher. This legal landscape demands sophisticated data management and security protocols to protect patient information and maintain trust.

Procurement Laws and Public Tendering

Ambea's reliance on public sector contracts means it must meticulously adhere to procurement laws, particularly in Sweden and Norway where municipalities are major clients. These regulations govern how public bodies purchase services, ensuring a level playing field through competitive tendering. For instance, in 2023, the Swedish Public Procurement Act (LOU) continued to shape how care providers like Ambea bid for contracts, emphasizing transparency and value for money.

Navigating these public tendering processes is a critical operational aspect for Ambea. Success in these tenders directly impacts revenue streams and market share. The tendering process often involves detailed specifications for service delivery, quality standards, and pricing, requiring Ambea to demonstrate its capabilities and cost-effectiveness. In 2024, continued focus on efficiency and quality in public services is expected to intensify competition within these tenders.

- Public Procurement Compliance: Ambea must ensure all bids and contract fulfillments align with national and EU procurement directives, which are subject to ongoing review and updates.

- Competitive Tendering Landscape: The company faces intense competition from both established players and new entrants in public tenders, requiring strong proposal development and pricing strategies.

- Contract Value and Duration: Public contracts can represent significant revenue, but their duration and renewal terms are dictated by procurement law, influencing Ambea's long-term financial planning.

- Regulatory Scrutiny: Public procurement processes are subject to oversight, meaning any perceived irregularities in tendering can lead to legal challenges and reputational damage.

Corporate Governance and Sustainability Reporting Directives (CSRD)

Ambea faces increasing regulatory scrutiny, particularly concerning corporate governance and sustainability. The EU's Corporate Sustainability Reporting Directive (CSRD) significantly impacts how Ambea discloses its environmental, social, and governance (ESG) performance. The company actively prepared for CSRD implementation throughout 2024, indicating a strategic focus on enhancing transparency and accountability in its sustainability reporting.

This directive mandates more detailed and standardized ESG disclosures, requiring Ambea to integrate sustainability considerations into its core business strategy and reporting frameworks. Failure to comply with CSRD can lead to reputational damage and potential penalties, underscoring the importance of robust governance structures and accurate data collection for Ambea.

The CSRD's expansive scope means Ambea must report on a wide range of sustainability matters, including climate change, biodiversity, and social impacts. This proactive approach to CSRD preparation in 2024 positions Ambea to meet evolving stakeholder expectations for comprehensive ESG information.

- CSRD Mandate: Ambea is subject to the EU's Corporate Sustainability Reporting Directive (CSRD), requiring detailed ESG disclosures.

- 2024 Preparation: The company invested in preparing for CSRD throughout 2024, signaling a commitment to compliance.

- Transparency Focus: CSRD enhances transparency regarding Ambea's environmental, social, and governance performance.

- Stakeholder Expectations: Compliance with CSRD addresses growing demands from investors and other stakeholders for robust ESG data.

Ambea's operations are deeply intertwined with national healthcare and social services legislation across its Nordic markets, dictating licensing, quality standards, and service offerings. For instance, Sweden's Social Services Act updates and Denmark's Elderly Care Reform, both impacting operations in 2025, necessitate continuous adaptation to ensure compliance and capitalize on evolving care landscapes.

Stringent Nordic labor laws, covering working conditions and employee rights, directly influence Ambea's human resource strategies and operational costs, a significant factor given its workforce of over 35,000 individuals. Adherence to these regulations is crucial for managing labor expenses, which are a key component of Ambea's financial planning and competitive positioning.

Compliance with data protection regulations like GDPR is paramount due to Ambea's handling of sensitive health information, with potential fines reaching up to 4% of global annual turnover. This necessitates robust data management and security protocols to safeguard patient data and maintain stakeholder trust.

Ambea's reliance on public sector contracts requires strict adherence to procurement laws, particularly in Sweden and Norway, where municipalities are major clients. The Swedish Public Procurement Act (LOU) continued to shape contract bidding in 2023, emphasizing transparency and value, with 2024 expecting intensified competition focused on efficiency and quality.

Environmental factors

Ambea is making significant strides in addressing climate change, aiming to cut its greenhouse gas emissions by 50% by 2025, using 2019 as a baseline. This ambitious goal underscores a commitment to environmental responsibility.

Further solidifying its dedication, Ambea became a signatory to the Science-Based Targets initiative (SBTi) in 2024. This move ensures its emissions reduction strategies are aligned with the crucial goals set forth in the Paris Agreement, demonstrating a global perspective on sustainability.

Ambea is committed to minimizing its environmental impact by focusing on responsible resource consumption. This includes actively working to reduce the carbon footprint associated with its food, consumables, premises, and transportation. For instance, in 2023, Ambea reported a 5% reduction in energy consumption across its facilities compared to the previous year, driven by efficiency upgrades and a greater reliance on renewable energy sources.

The company places a strong emphasis on continuous improvement in its methods for measuring emissions. Ambea regularly monitors its environmental performance through self-assessments conducted at each of its operational units. These assessments help identify areas for further waste reduction and resource optimization, contributing to their overall sustainability goals, with a target to decrease waste generation by 10% by the end of 2025.

Ambea faces stringent environmental regulations across its Nordic operations, impacting areas like energy efficiency, waste management, and chemical handling. For instance, Sweden's climate goals, aiming for net-zero emissions by 2045, necessitate continuous improvements in how Ambea manages its energy consumption and waste streams. Regular monitoring ensures compliance and fosters the adoption of more sustainable practices throughout its facilities.

Supply Chain Sustainability

Ambea is actively working to make its supply chain more sustainable, aiming to reduce emissions by collaborating with various stakeholders. This includes seeking joint solutions with customers, property owners, and suppliers of essential goods like food and consumables. This proactive approach demonstrates Ambea's dedication to fostering environmental responsibility throughout its entire value chain, not just within its immediate operations.

The company's focus on supply chain sustainability is crucial given the growing regulatory and consumer pressure for environmentally conscious business practices. For instance, in 2024, the European Union continued to strengthen its regulations on corporate sustainability reporting, requiring more detailed disclosures on Scope 3 emissions, which encompass supply chain activities. Ambea's efforts align with these evolving expectations.

- Emission Reduction Targets: Ambea is setting targets to decrease emissions across its supply chain, particularly in the procurement of food and consumables.

- Collaborative Approach: The company is actively engaging with suppliers, customers, and property owners to develop shared strategies for sustainability.

- Regulatory Alignment: Ambea's initiatives are in line with increasing global and regional regulations mandating greater transparency and action on supply chain environmental impact, such as the EU's Corporate Sustainability Reporting Directive (CSRD).

- Focus on Key Sectors: Specific attention is being paid to the supply chains for food and consumables, acknowledging their significant environmental footprint.

Green Building and Infrastructure

Ambea is increasingly focused on the environmental impact of its facilities, both in new constructions and existing units, as a key aspect of its sustainability strategy. This includes evaluating and improving the energy efficiency and material sourcing for all its buildings.

A significant part of Ambea's infrastructure strategy involves transitioning away from fossil fuel reliance. The company is actively working to phase out fossil fuel-powered vehicles within its fleet and is exploring and implementing fossil-free energy solutions for its various premises to reduce its carbon footprint.

By mid-2024, Ambea reported that its fleet modernization efforts were underway, with targets to increase the proportion of electric and other low-emission vehicles. For instance, in Sweden, the healthcare sector's overall goal is to have a significant portion of its public transport and fleet operations be fossil-free by 2030, a trend Ambea aligns with.

- Focus on Green Building: Ambea is assessing the environmental impact of its building portfolio, aiming for more sustainable construction and renovation practices.

- Fossil-Free Energy Transition: The company is committed to sourcing fossil-free energy solutions for its operational sites and facilities.

- Fleet Modernization: Efforts are in place to phase out fossil fuel vehicles, with a strategic shift towards electric and other sustainable transport options for its operations.

- Reduced Environmental Footprint: These initiatives collectively aim to significantly lower Ambea's overall environmental footprint across its infrastructure and operational activities.

Ambea's environmental strategy is deeply intertwined with its operational goals, focusing on emission reductions and resource efficiency. The company has set a target to cut greenhouse gas emissions by 50% by 2025, using 2019 as a baseline, and became a signatory to the Science-Based Targets initiative (SBTi) in 2024, aligning its efforts with the Paris Agreement.

Ambea is actively working to reduce its carbon footprint across its supply chain, particularly in food and consumables, by collaborating with suppliers, customers, and property owners. This aligns with increasing regulatory pressures, such as the EU's enhanced requirements for corporate sustainability reporting on Scope 3 emissions, which Ambea is addressing through its proactive engagement.

The company is also committed to transitioning its infrastructure and fleet to fossil-free solutions. By mid-2024, Ambea was modernizing its fleet to include more electric vehicles, mirroring broader industry trends and national targets for fossil-free transport, while also focusing on energy efficiency in its premises.

| Environmental Initiative | Target/Status | Baseline Year | Key Focus Areas | Alignment |

|---|---|---|---|---|

| Greenhouse Gas Emission Reduction | 50% by 2025 | 2019 | Scope 1, 2, and 3 emissions | SBTi signatory (2024), Paris Agreement |

| Waste Reduction | 10% by end of 2025 | 2023 | Operational waste streams | Continuous improvement monitoring |

| Energy Consumption | 5% reduction in 2023 | 2022 | Facility energy efficiency upgrades | Renewable energy integration |

| Supply Chain Sustainability | Ongoing collaboration | N/A | Food, consumables, transport | EU CSRD (Scope 3 reporting) |

| Fleet Modernization | Increased proportion of low-emission vehicles | Mid-2024 | Electric and low-emission vehicles | National fossil-free transport goals |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ambea is informed by a comprehensive blend of data from reputable sources. We draw upon official government publications detailing legislative changes and economic policies, alongside reports from leading industry analysts and market research firms. This ensures a robust understanding of the political, economic, and social landscapes impacting Ambea.