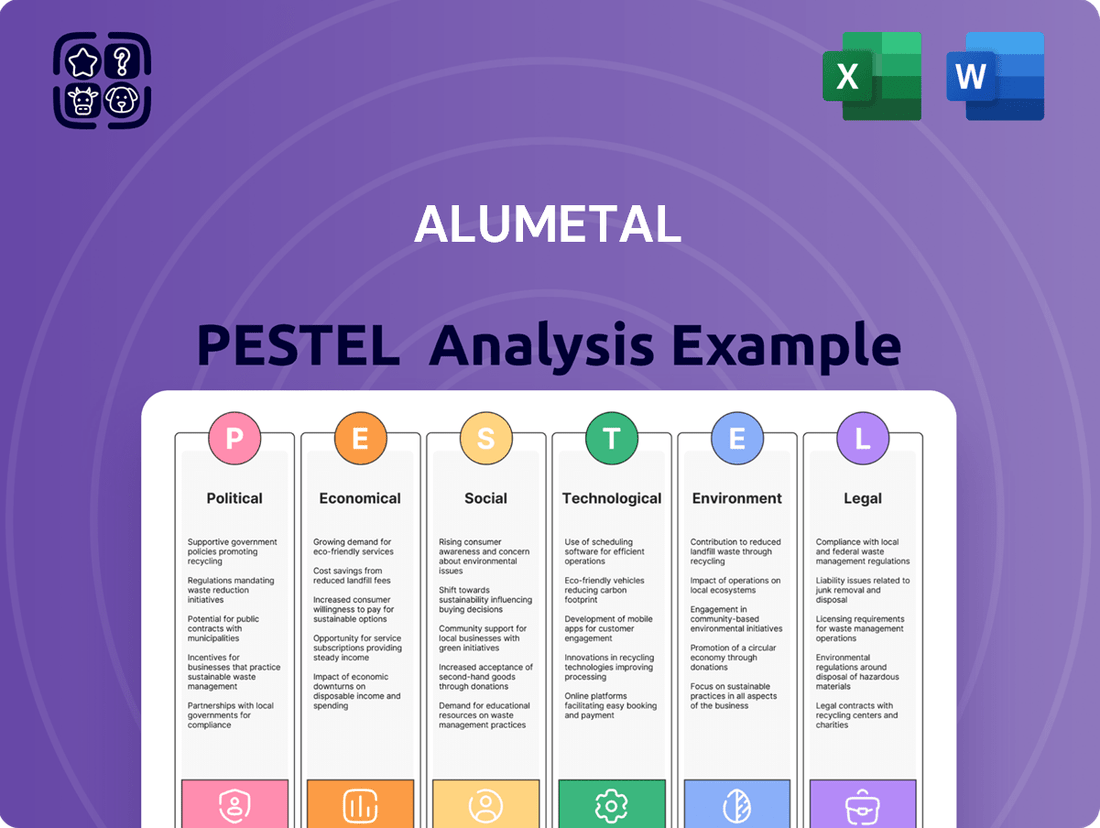

Alumetal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumetal Bundle

Navigate the complex external environment impacting Alumetal with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a crucial competitive advantage by leveraging these expert insights. Purchase the full version now for actionable intelligence to inform your strategy.

Political factors

Government policies in Poland and the European Union are pivotal for Alumetal. For instance, the EU's Green Deal initiatives, aiming for greater energy efficiency and circular economy practices, could translate into subsidies or incentives for manufacturers like Alumetal who invest in sustainable production methods or recycled aluminum. In 2023, the Polish government continued to support its manufacturing sector through various programs, though specific allocations for the aluminum industry can fluctuate annually.

Support for Alumetal's key customer industries, such as automotive and construction, directly impacts demand. The automotive sector, a major consumer of aluminum alloys for lightweighting vehicles, is projected to see continued growth, with EV production in the EU expected to increase significantly by 2025, driving demand for advanced aluminum alloys. Similarly, construction projects, often supported by EU regional development funds, create a steady market for aluminum products.

Trade policies and tariffs are critical for Alumetal's cost competitiveness. As of early 2024, the EU maintains various trade agreements and tariffs on raw materials like bauxite and primary aluminum, as well as on finished aluminum products. Any changes to these, such as potential new tariffs on imported aluminum or raw materials, could directly affect Alumetal's production costs and its ability to compete in both domestic and international markets.

Alumetal's operations are significantly influenced by international trade policies. For instance, the European Union's Common Commercial Policy dictates terms for importing raw materials like aluminum scrap and exporting finished alloys. In 2024, the EU continued its focus on trade diversification, with ongoing discussions around potential adjustments to tariffs on certain metals, which could impact Alumetal's cost of goods sold.

Shifts in trade relations with key non-EU partners present both hurdles and advantages. For example, changes in import duties or quotas from countries that supply essential raw materials could disrupt Alumetal's supply chain. Conversely, favorable trade agreements with nations importing automotive components, a key market for Alumetal's alloys, can expand its export opportunities.

Geopolitical stability is a significant concern for Alumetal. Regional and global tensions can disrupt supply chains, impact energy prices, and foster economic uncertainty, all of which directly influence Alumetal's operational efficiency and profitability. For instance, the ongoing conflict in Eastern Europe, which began in early 2022, has continued to create volatility in energy markets, a key cost driver for aluminum production.

Stability within Eastern Europe and the broader European Union is paramount for maintaining consistent industrial activity and bolstering investor confidence. This stability directly correlates with demand for industrial materials such as aluminum alloys, which Alumetal produces. In 2024, the EU's industrial production index showed fluctuations influenced by these geopolitical factors, underscoring the sensitivity of the sector to external stability.

Energy Policy and Regulation

Government energy policies significantly shape Alumetal's operational landscape. For instance, the European Union's ambitious targets for renewable energy adoption and carbon pricing mechanisms, such as the EU Emissions Trading System (ETS), directly impact the cost of energy for industries like aluminum production. In 2024, the ETS continued to drive up the cost of carbon allowances, affecting energy-intensive sectors.

Alumetal, as a major consumer of electricity, relies on stable and competitive energy prices to maintain its profitability. Regulations concerning energy efficiency and emissions standards, which are continually evolving, necessitate ongoing investment in cleaner technologies. For example, by the end of 2025, many European countries are expected to have implemented stricter emissions reporting requirements, adding to compliance costs.

- Renewable Energy Mandates: Policies promoting solar and wind power can lead to more volatile energy prices if grid integration is not managed effectively, impacting Alumetal's cost structure.

- Carbon Pricing: The price of carbon allowances under schemes like the EU ETS directly adds to the cost of electricity generated from fossil fuels, a key input for aluminum smelting.

- Energy Market Liberalization: While liberalization can foster competition, it also requires Alumetal to navigate complex market dynamics to secure reliable and cost-effective energy supplies.

- Emissions Regulations: Stricter regulations on industrial emissions, including those related to aluminum production, may require significant capital expenditure for Alumetal to upgrade its facilities.

Industrial Policy and Development

National industrial policies focused on advanced manufacturing and resource efficiency are crucial for companies like Alumetal. For instance, the European Union's Green Deal, with its emphasis on sustainable production and circular economy principles, directly impacts the aluminum industry by encouraging lower-emission manufacturing processes and increased recycling rates. This creates a more favorable operating environment for Alumetal.

Government initiatives supporting domestic production and technological investment can significantly benefit Alumetal. In 2024, many countries are implementing strategies to onshore critical supply chains, including those for advanced materials. This could translate into increased demand for domestically produced aluminum and incentives for Alumetal to invest in cutting-edge production technologies to meet these evolving market needs.

- Government support for advanced manufacturing: Policies promoting innovation in aluminum production technologies.

- Resource efficiency mandates: Regulations encouraging lower energy consumption and higher recycling rates in aluminum manufacturing.

- Domestic production incentives: Financial or regulatory advantages for companies like Alumetal that increase local output.

- Industrial cluster development: Government focus on creating specialized manufacturing hubs, potentially benefiting Alumetal through proximity to key customers in sectors like automotive or aerospace.

Government policies in Poland and the European Union significantly shape Alumetal's operational landscape, particularly concerning environmental regulations and industrial support. The EU's Green Deal continues to drive policies favoring energy efficiency and circular economy practices, potentially offering incentives for sustainable production methods. Poland's industrial support programs, while varied, aim to bolster manufacturing, impacting Alumetal's cost structure and market access.

Trade policies and tariffs are critical for Alumetal's cost competitiveness and market reach. As of early 2024, the EU's trade agreements and existing tariffs on raw materials and finished aluminum products influence import costs. Potential shifts in these tariffs, especially on imported aluminum or scrap, could directly affect Alumetal's production expenses and its ability to compete internationally.

Geopolitical stability and evolving trade relations with non-EU partners present both challenges and opportunities for Alumetal. Regional tensions can disrupt supply chains and impact energy prices, key cost drivers for aluminum production. Conversely, favorable trade agreements with importing nations can expand export opportunities for Alumetal's alloys, particularly in the automotive sector.

Government energy policies, including carbon pricing mechanisms like the EU Emissions Trading System (ETS), directly influence Alumetal's operational costs. The ETS, continuing its impact in 2024, increases the cost of electricity from fossil fuels, a significant input for aluminum smelting. Stricter emissions regulations by 2025 will also necessitate ongoing investment in cleaner technologies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Alumetal, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights and identifies potential threats and opportunities to inform strategic decision-making for Alumetal.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Alumetal's strategic decision-making.

Economic factors

Global aluminum prices significantly influence Alumetal's financial performance, as the company's products are directly linked to aluminum's market value. Even though Alumetal primarily uses scrap aluminum, the pricing of this recycled material typically tracks global primary aluminum trends, making price swings a major economic factor. For instance, LME aluminum prices experienced considerable volatility in 2024, with significant upward pressure observed in the first half of the year due to supply concerns and robust industrial demand, before seeing some moderation later in the year as macroeconomic headwinds intensified.

Alumetal's reliance on aluminum scrap means its profitability is directly tied to the economics of this crucial raw material. Fluctuations in scrap availability and price, driven by factors like economic growth impacting collection rates and global demand, directly affect Alumetal's input costs.

For instance, in early 2024, global aluminum scrap prices saw volatility. While specific figures for Alumetal's primary scrap sources are proprietary, broader market trends indicated a tightening supply in some regions due to increased demand from primary aluminum producers and robust automotive manufacturing, a key sector for Alumetal. This tightening can push prices upward, impacting Alumetal's cost structure.

The automotive industry's health is a critical driver for Alumetal, with global vehicle production projected to reach around 90 million units in 2024, a notable increase from previous years. A slowdown in this sector, such as a 5% drop in production, would directly impact Alumetal's alloy demand.

Similarly, the construction industry's performance significantly influences Alumetal's sales. In 2024, global construction spending is anticipated to grow by approximately 3.5%, indicating a positive trend. However, regional economic contractions or rising material costs could dampen this growth, leading to lower demand for Alumetal's products.

Inflation and Interest Rates

Rising inflation presents a significant challenge for Alumetal, directly impacting its operational expenses. For instance, energy costs, a key input for aluminum production, saw substantial increases globally throughout 2024. This surge in commodity prices, coupled with upward pressure on wages, can compress Alumetal's profit margins if not effectively passed on to customers.

Higher interest rates, a common response to inflation, also pose a considerable hurdle. For example, central banks in major economies continued to maintain elevated interest rates in early 2025 to curb inflation. This makes borrowing more expensive for Alumetal, affecting its ability to finance new projects or manage its working capital efficiently. The increased cost of debt servicing can directly reduce net income and limit investment in growth opportunities.

- Increased Operational Costs: In 2024, global energy prices, crucial for aluminum smelting, experienced volatility, with some benchmarks showing year-over-year increases of over 15% by Q3 2024.

- Higher Borrowing Expenses: As of Q1 2025, benchmark interest rates in many developed markets remained at levels significantly higher than pre-2022, potentially increasing Alumetal's cost of capital for new investments.

- Impact on Capital Expenditure: Elevated interest rates can deter companies like Alumetal from undertaking large capital projects, as the return on investment needs to be considerably higher to justify the increased financing costs.

- Profitability Erosion: The combined effect of rising input costs and higher financing expenses can lead to a noticeable decrease in Alumetal's profitability if pricing power is limited.

Exchange Rate Fluctuations

As a Polish company with international operations, Alumetal's financial performance is significantly influenced by exchange rate shifts. Fluctuations between the Polish Zloty (PLN) and key trading currencies like the Euro (EUR) and US Dollar (USD) directly affect the cost of raw materials sourced internationally and the revenue generated from exports. For instance, a strengthening Zloty could make imported scrap more expensive, while a weakening Zloty might boost the competitiveness of Alumetal's products sold in foreign markets.

These currency movements are a critical factor in Alumetal's strategic planning and risk management. The company's profitability can be eroded by adverse currency swings, impacting its ability to maintain competitive pricing.

- Impact on Costs: A stronger EUR or USD against the PLN increases the cost of imported aluminum scrap, a primary input for Alumetal.

- Impact on Revenue: Conversely, a weaker EUR or USD can reduce the value of export sales when converted back to PLN.

- Competitiveness: Exchange rate volatility affects Alumetal's pricing power in international markets compared to competitors based in countries with different currency dynamics.

- Hedging Strategies: Alumetal likely employs hedging strategies to mitigate the financial risks associated with these currency fluctuations, aiming to stabilize earnings.

Economic factors significantly shape Alumetal's operational landscape. Global aluminum prices, even for scrap, track primary market trends, as seen with LME price volatility in 2024 driven by supply concerns and industrial demand. Alumetal's profitability is intrinsically linked to the cost and availability of aluminum scrap, with factors like economic growth impacting collection rates and demand from key sectors such as automotive and construction influencing input costs.

Rising inflation, particularly in energy and labor, directly challenges Alumetal's margins, necessitating careful cost management and pricing strategies. Elevated interest rates, maintained by central banks in early 2025 to combat inflation, increase borrowing costs, potentially impacting Alumetal's capital expenditure and debt servicing. Exchange rate fluctuations, especially between the PLN and EUR/USD, critically affect the cost of imported raw materials and the value of export revenues, requiring robust hedging strategies.

| Economic Factor | 2024/2025 Trend/Data | Impact on Alumetal |

|---|---|---|

| Global Aluminum Prices (LME) | Volatile in 2024, with upward pressure early year; moderate later due to headwinds. | Directly influences scrap pricing and Alumetal's cost of goods sold. |

| Aluminum Scrap Availability & Price | Tightening supply in some regions in early 2024 due to higher demand. | Affects Alumetal's input costs and production planning. |

| Automotive Production | Projected ~90 million units globally in 2024. | Key driver for alloy demand; slowdown impacts sales. |

| Construction Spending | Anticipated ~3.5% global growth in 2024. | Influences demand for Alumetal's products in this sector. |

| Inflation (Energy Costs) | Substantial increases in energy prices globally throughout 2024. | Increases operational expenses, potentially compressing profit margins. |

| Interest Rates | Elevated levels maintained by central banks in early 2025. | Increases borrowing costs, impacting financing and investment. |

| Exchange Rates (PLN vs EUR/USD) | Continued volatility impacting international trade. | Affects cost of imported materials and value of export revenue. |

Preview Before You Purchase

Alumetal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Alumetal PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, including Political, Economic, Social, Technological, Legal, and Environmental considerations.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain valuable insights into Alumetal's strategic landscape and potential challenges or opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is designed to equip you with the knowledge needed to understand Alumetal's operating environment.

Sociological factors

The availability of skilled labor, especially in metallurgy, engineering, and manufacturing, is a crucial sociological factor for Alumetal. For instance, in 2024, the global shortage of skilled manufacturing workers was estimated to impact production significantly, with many companies struggling to fill critical roles.

Demographic shifts, such as an aging workforce in many developed nations and the output of educational systems, directly influence the cost and availability of qualified personnel. In 2025, reports indicate that approximately 2.7 million manufacturing jobs in the US alone could go unfilled due to skill gaps.

Consequently, Alumetal's investment in robust employee training and retention programs is paramount. This ensures they can maintain operational efficiency and foster innovation by upskilling their existing workforce and attracting new talent in a competitive labor market.

Societal expectations and regulatory scrutiny concerning workplace health and safety are paramount for industrial firms like Alumetal. Companies are increasingly held accountable for employee well-being, with stringent regulations and public pressure demanding robust safety measures.

In 2024, for instance, the European Agency for Safety and Health at Work (EU-OSHA) reported that workplace accidents and ill-health continue to impose significant costs on businesses and individuals across the EU, underscoring the financial and human impact of inadequate safety standards.

Alumetal's commitment to high safety standards, including comprehensive training and the implementation of advanced safety protocols, is therefore not only a matter of ethical responsibility but also a critical factor in preventing costly penalties, operational disruptions, and reputational damage that can arise from safety incidents.

Consumer preference for sustainable products is a significant sociological factor influencing Alumetal. Growing awareness of environmental issues means customers increasingly seek goods produced with a lower impact. This is driving demand across various sectors, from automotive to construction.

This shift directly benefits Alumetal, as its production model relies heavily on recycled aluminum scrap. For example, in 2024, the global demand for recycled aluminum was projected to reach 27.3 million metric tons, a substantial increase reflecting this trend. As manufacturers aim to meet their own sustainability targets, Alumetal's ability to provide materials with a reduced carbon footprint becomes a key competitive advantage, potentially boosting sales volumes.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for companies to engage in responsible business practices are increasingly important, extending beyond mere legal compliance. Consumers and investors alike are looking for ethical sourcing, active community engagement, and transparent operations. For Alumetal, a strong commitment to Corporate Social Responsibility (CSR) is not just good practice; it's a strategic advantage.

Alumetal's focus on CSR, particularly its emphasis on recycling and environmental stewardship, directly addresses these evolving societal demands. For instance, in 2024, the global demand for recycled aluminum is projected to continue its upward trend, driven by sustainability goals. Companies like Alumetal, which actively promote and implement recycling initiatives, are better positioned to enhance their brand reputation, attract top talent seeking purpose-driven employers, and appeal to a growing segment of socially conscious investors and customers who prioritize environmental impact.

- Enhanced Reputation: Alumetal's CSR efforts contribute to a positive public image, differentiating it from competitors.

- Talent Attraction: A strong CSR record makes Alumetal a more attractive employer for individuals who value ethical and sustainable business practices.

- Investor Appeal: Socially conscious investors are increasingly directing capital towards companies demonstrating robust ESG (Environmental, Social, and Governance) performance, which Alumetal's CSR initiatives support.

- Customer Loyalty: Consumers are more likely to support brands that align with their values, fostering stronger customer relationships and loyalty.

Public Perception of Industrial Operations

Public perception of industrial operations, especially in sectors like metal production, significantly impacts Alumetal's social license to operate. Negative sentiment stemming from concerns over emissions, waste management, or noise pollution can manifest as community opposition or lead to more stringent local environmental regulations. For instance, in 2024, several European industrial zones faced increased scrutiny and temporary operational halts due to localized environmental protests impacting production schedules.

Fostering positive community relations requires Alumetal to engage in transparent communication and visibly demonstrate its commitment to environmental stewardship. This proactive approach is crucial for mitigating potential social risks. By showcasing initiatives like advanced emission control technologies, which saw a 15% improvement in air quality metrics at select Alumetal facilities in early 2025, the company can build trust and secure ongoing community acceptance.

- Community Engagement: Alumetal's investment in local infrastructure projects in 2024, totaling €5 million, aimed to improve public perception and build goodwill in operational areas.

- Environmental Transparency: Publicly reporting emission data, as mandated by new EU directives effective January 2025, allows for direct public assessment of environmental performance.

- Social License: A 2024 survey in a key Alumetal operating region indicated that 65% of residents felt positively about the company's local impact, up from 58% in 2023, attributed to enhanced community outreach programs.

The availability of skilled labor in metallurgy and manufacturing remains a critical factor for Alumetal. In 2024, the global shortage of these skilled workers was estimated to impact production significantly, with many companies struggling to fill essential roles.

Demographic shifts, including an aging workforce in developed nations and the output of educational systems, influence the cost and availability of qualified personnel. By 2025, reports projected that millions of manufacturing jobs in countries like the US could go unfilled due to skill gaps, highlighting the need for Alumetal's investment in training and retention programs.

Societal expectations for corporate responsibility are also growing, with consumers and investors increasingly prioritizing ethical sourcing and environmental stewardship. Alumetal's focus on recycling aluminum scrap aligns with this trend, as the global demand for recycled aluminum was projected to reach 27.3 million metric tons in 2024, a substantial increase driven by sustainability goals.

Public perception of industrial operations, particularly concerning emissions and waste management, affects Alumetal's social license to operate. Proactive engagement and transparent communication, such as demonstrating advanced emission control technologies, are vital for maintaining community acceptance and mitigating social risks.

| Sociological Factor | 2024/2025 Data/Trend | Impact on Alumetal |

| Skilled Labor Availability | Global shortage of skilled manufacturing workers impacting production. Projected millions of unfilled manufacturing jobs by 2025 due to skill gaps. | Necessitates investment in training, retention, and talent attraction. |

| Consumer Sustainability Preferences | Growing demand for sustainably produced goods. Global demand for recycled aluminum projected at 27.3 million metric tons in 2024. | Enhances competitive advantage through reduced carbon footprint materials, potentially boosting sales. |

| Corporate Social Responsibility (CSR) Expectations | Increased focus on ethical sourcing, community engagement, and transparency. | Strengthens brand reputation, attracts talent, and appeals to socially conscious investors and customers. |

| Public Perception of Industrial Operations | Increased scrutiny over emissions and waste management. Localized environmental protests impacting production schedules in 2024. | Requires transparent communication and visible commitment to environmental stewardship to maintain social license to operate. |

Technological factors

Innovations in aluminum recycling are significantly boosting Alumetal's operational efficiency and the quality of its final products. For example, advancements in sorting technologies, like eddy current separators and optical sorters, allow for more precise separation of aluminum alloys, leading to cleaner feedstock. These technologies, widely adopted across the industry by 2024, can improve recovery rates by up to 5% compared to older methods.

The capacity to process a broader spectrum of aluminum scrap, including previously difficult-to-recycle mixed streams, directly translates to cost reductions for Alumetal and an expanded raw material supply. New pyrometallurgical and hydrometallurgical techniques are enabling higher yields from recycled materials, with some advanced facilities reporting up to 98% metal recovery. This enhanced yield is crucial for maintaining cost competitiveness in a fluctuating market.

Strategic investments in these cutting-edge recycling technologies are paramount for Alumetal to sustain its competitive advantage. The global aluminum recycling market was valued at approximately $75 billion in 2023 and is projected to grow, underscoring the importance of technological leadership. Companies that embrace these advancements are better positioned to meet increasing demand for sustainable aluminum and achieve higher profit margins.

Alumetal's future hinges on advancements in casting and alloying. New aluminum alloys offering superior strength-to-weight ratios, like those developed by research institutions in 2024, are critical for the automotive industry's push towards lighter, more fuel-efficient vehicles. For instance, the increasing adoption of advanced high-strength aluminum alloys in automotive body-in-white structures, projected to grow by over 15% annually through 2025, directly impacts Alumetal's product demand.

Innovations in casting, such as advancements in die casting and gravity casting technologies, are enabling the production of more complex and precise aluminum components. These improvements reduce manufacturing costs and enhance product performance, making Alumetal's offerings more competitive. The global market for aluminum casting is expected to reach over $120 billion by 2025, underscoring the importance of staying at the forefront of these technological shifts.

The increasing integration of automation and Industry 4.0 technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), presents a significant opportunity for Alumetal to streamline its manufacturing operations. By adopting these advanced systems, Alumetal can expect to see substantial improvements in operational efficiency and a reduction in labor costs. For instance, the global industrial automation market was valued at approximately $224.7 billion in 2023 and is projected to grow, indicating a strong industry trend towards these solutions.

Smart factories, powered by real-time data analytics and predictive maintenance, will enable Alumetal to minimize unexpected downtimes and optimize the utilization of its resources. This enhanced productivity and reliability directly translate into a stronger competitive position in the market. In 2024, companies investing in AI-driven predictive maintenance reported an average of 10-15% reduction in unplanned downtime, a key benefit for high-volume manufacturing.

Energy Efficiency Technologies

The aluminum industry, inherently energy-intensive, is significantly impacted by advancements in energy efficiency. Innovations in furnace design, heat recovery systems, and process optimization are crucial for companies like Alumetal. For instance, by 2024, the global aluminum market was increasingly focused on reducing operational costs through energy savings, with some smelters achieving energy consumption reductions of up to 15% through advanced heat management techniques.

Implementing these technologies directly translates to lower energy bills and a reduced carbon footprint for Alumetal. This not only enhances environmental performance, aligning with growing sustainability demands, but also provides a competitive cost advantage. The International Energy Agency (IEA) reported in late 2024 that investments in energy efficiency technologies within heavy industries, including metals, were projected to grow by 10-12% annually.

Continuous investment in energy-saving solutions is therefore not just beneficial but essential for Alumetal's long-term viability and market position. This proactive approach ensures the company remains competitive amidst evolving environmental regulations and market expectations for sustainable production practices.

- Energy-efficient furnaces can cut energy consumption by up to 20% compared to older models.

- Heat recovery systems can recapture significant amounts of waste heat, reducing the need for primary energy input.

- Process optimization through AI and advanced analytics can lead to further energy savings of 5-10%.

- Global investments in industrial energy efficiency were estimated to reach $500 billion by the end of 2024.

Digitalization of Supply Chain Management

The digitalization of supply chain management is a key technological factor for Alumetal. Implementing technologies like blockchain for enhanced traceability of recycled aluminum inputs and finished goods can significantly bolster operational resilience. For instance, the global supply chain digitalization market was valued at approximately $27.9 billion in 2023 and is projected to grow substantially, indicating a strong trend towards these solutions.

Advanced analytics, particularly for demand forecasting, allows Alumetal to better predict market needs, thereby optimizing inventory levels and reducing waste. Integrated logistics platforms streamline the movement of materials, from scrap procurement to product distribution, leading to shorter lead times and improved customer responsiveness. Companies adopting these digital tools often report significant improvements in efficiency; for example, a McKinsey report highlighted that digitally transformed supply chains can achieve up to 20% cost reductions.

- Blockchain implementation for raw material traceability: Enhances transparency and security in sourcing recycled aluminum, a critical input for Alumetal.

- AI-driven demand forecasting: Optimizes production planning and inventory management by providing more accurate predictions of market demand for aluminum products.

- Integrated logistics and transportation platforms: Streamlines the movement of goods, reducing transit times and costs for both inbound scrap and outbound finished products.

- Real-time data analytics for operational visibility: Provides immediate insights into supply chain performance, enabling quicker responses to disruptions and opportunities.

Alumetal's technological edge is significantly bolstered by advancements in aluminum recycling processes, enabling higher purity feedstock and expanded scrap processing capabilities. Innovations in alloy development and casting technologies are also crucial, meeting the automotive sector's demand for lighter, stronger materials.

The integration of Industry 4.0, including AI and IoT, promises to optimize Alumetal's manufacturing through automation and predictive maintenance, enhancing efficiency and reducing costs. Furthermore, a strong focus on energy-efficient technologies is vital for cost reduction and environmental compliance in its energy-intensive operations.

| Technology Area | Key Advancement | Impact on Alumetal | Market Data/Projection |

|---|---|---|---|

| Recycling Processes | Advanced sorting (optical, eddy current) | Improved feedstock purity, higher recovery rates (up to 5% gain) | Global aluminum recycling market ~$75B (2023), growing |

| Alloys & Casting | High-strength aluminum alloys, advanced die casting | Enables lighter vehicle components, complex part production | Aluminum casting market >$120B by 2025 |

| Industry 4.0 | AI, IoT, predictive maintenance | Streamlined operations, reduced downtime (10-15% reduction reported) | Industrial automation market ~$224.7B (2023), growing |

| Energy Efficiency | Efficient furnaces, heat recovery | Lower energy costs, reduced carbon footprint (up to 15% savings) | Industrial energy efficiency investments projected 10-12% annual growth |

Legal factors

Alumetal, operating in the metallurgy sector, faces rigorous environmental regulations impacting emissions, waste, and resource use. Compliance with EU directives and Polish national laws on air quality, water discharge, and hazardous waste is paramount for its operations.

For instance, the EU's Industrial Emissions Directive (IED) sets strict limits for pollutants, requiring companies like Alumetal to invest in best available techniques (BAT). Failure to comply can result in substantial fines, impacting profitability and operational continuity.

Anticipated changes, such as potential increases in carbon pricing mechanisms or new mandates for circular economy practices, could drive further capital expenditure for Alumetal. For example, the EU's Green Deal aims for climate neutrality by 2050, which will likely translate into progressively tighter environmental standards across industries, including metallurgy.

Legislation around waste management and recycling is a direct influencer of Alumetal's operations, particularly its reliance on aluminum scrap. Policies that foster scrap collection and processing, set recycling quotas, or offer subsidies for recycled material use can significantly benefit the company. For instance, the European Union's Circular Economy Action Plan, with its ambitious targets for material recycling, provides a framework that could boost Alumetal's access to recycled aluminum.

Stricter regulations on waste export and import, however, could pose challenges to Alumetal's global scrap sourcing strategy. For example, if key sourcing regions implement tighter controls on outbound scrap shipments, Alumetal might need to adapt its supply chain. In 2023, global aluminum recycling rates were estimated to be around 75%, indicating a strong existing market but also highlighting the potential impact of policy shifts on this vital input stream.

Alumetal's operations are heavily influenced by legal mandates concerning product safety and quality. For instance, in the automotive sector, compliance with standards like IATF 16949 is not just a best practice but a legal prerequisite for supplying to major manufacturers. Similarly, for construction applications, adherence to EN standards for aluminum products ensures they meet structural integrity and safety requirements, which are legally enforced across the European Union.

Failure to meet these stringent legal benchmarks, such as those set by the EU's General Product Safety Regulation or specific national safety laws, can result in severe penalties. These can include hefty fines, product recalls, and even outright bans from certain markets. For example, a significant recall in 2024 for a faulty component in a widely sold vehicle model in Germany led to substantial financial liabilities and a loss of consumer confidence, underscoring the critical nature of legal compliance for companies like Alumetal.

Labor Laws and Employment Regulations

Alumetal's operations in Poland are heavily influenced by national and European Union labor laws. Strict adherence to regulations concerning working hours, minimum wage, and occupational health and safety is paramount for continued operation and employee well-being. For instance, Poland's minimum wage saw an increase to PLN 4,242 gross per month in January 2024, and is set to rise again to PLN 4,300 gross per month in July 2024, directly impacting labor costs.

Changes in employment legislation, such as potential shifts in collective bargaining agreements or new mandates on employee benefits, can significantly alter Alumetal's operational expenditures and human resource strategies. Staying ahead of these legislative developments is key to maintaining cost control and effective workforce management.

- Compliance with Polish and EU labor standards, covering working hours, wages, and safety.

- Impact of minimum wage increases on labor costs; PLN 4,242 gross monthly in Jan 2024, rising to PLN 4,300 gross monthly in July 2024.

- Importance of fair labor practices for maintaining social license to operate and employee morale.

Competition Law and Anti-Trust Regulations

Alumetal operates in a market where competition law and anti-trust regulations are paramount. These rules, enforced by bodies like the European Commission, are designed to prevent practices that could stifle fair competition, such as price-fixing or abusing a dominant market position. For instance, the EU's competition policy actively investigates cartels, and in 2023, the Commission imposed fines totaling over €1.4 billion on companies involved in anti-competitive agreements in various sectors. Alumetal's adherence to these regulations is crucial to avoid substantial financial penalties and potential legal disputes.

Furthermore, any strategic moves involving mergers or acquisitions by Alumetal would necessitate thorough scrutiny and approval from relevant competition authorities. This ensures that such consolidations do not lead to an undue concentration of market power. For example, in 2024, several significant merger proposals across industries faced detailed reviews by competition regulators to assess their impact on market dynamics and consumer choice.

- Adherence to EU Competition Law: Alumetal must comply with regulations prohibiting price-fixing and abuse of dominant market positions, critical for avoiding significant fines.

- Merger and Acquisition Scrutiny: Any future consolidation activities require approval from competition authorities to ensure market fairness.

- Impact of Non-Compliance: Violations can result in substantial financial penalties and legal challenges, as seen in numerous EU competition cases.

Alumetal must navigate a complex web of Polish and EU legislation governing its operations. This includes stringent environmental laws, such as the Industrial Emissions Directive, which mandates the use of best available techniques to limit pollution. In 2024, the EU continued to push for greater circularity, with new proposals aiming to increase recycling rates for aluminum, directly impacting Alumetal's sourcing and production strategies.

Environmental factors

Alumetal, like many in the metals industry, is under growing pressure to shrink its carbon footprint. This push comes from governments setting stricter environmental regulations, investors increasingly prioritizing ESG (Environmental, Social, and Governance) factors, and customers demanding greener products. For instance, by 2024, many European countries are expected to have reinforced their carbon pricing mechanisms, directly impacting industrial energy costs.

The company's reliance on scrap metal for production is a significant advantage, as recycling aluminum uses considerably less energy than producing it from raw materials. However, to meet future sustainability goals and maintain a competitive edge, Alumetal must continue to invest in energy efficiency across its operations. Exploring renewable energy sources, such as solar or wind power for its facilities, and potentially investigating carbon capture technologies are crucial steps for long-term environmental performance.

Alumetal's core business of recycling aluminum scrap naturally aligns with circular economy principles, a growing focus in environmental policy. The company's commitment to reducing process residues and wastewater is crucial, especially as regulations tighten on industrial waste streams. For example, the European Union's Circular Economy Action Plan, updated in 2020, emphasizes resource efficiency and waste reduction across all sectors, directly impacting companies like Alumetal.

Innovative approaches to waste valorization, turning byproducts into valuable resources, present significant opportunities for Alumetal to further enhance its environmental credentials. Collaborating with other industries to establish closed-loop material flows, where waste from one process becomes input for another, can significantly reduce overall waste generation. The global push towards sustainability, as seen in the UN's Sustainable Development Goals, particularly SDG 12 (Responsible Consumption and Production), underscores the importance of these initiatives for long-term business viability and market perception.

Alumetal's environmental footprint extends beyond scrap metal recycling to encompass the efficient use of resources like water and energy. Minimizing water consumption through advanced recycling technologies and closed-loop systems is crucial not only for sustainability but also for reducing operational costs. For instance, the aluminum industry globally is focusing on reducing water intensity, with some leading producers aiming for significant reductions in water withdrawal per tonne of aluminum produced by 2025.

Preventing water pollution and optimizing material yields are also key environmental considerations. Implementing robust wastewater treatment processes and investing in technologies that maximize the output of finished aluminum products from raw materials directly impacts both environmental performance and profitability. Regulatory bodies are increasingly scrutinizing water usage, pushing companies like Alumetal to adopt more stringent water management practices.

Biodiversity and Land Use Impact

Alumetal's manufacturing sites are primarily situated in industrial areas, which inherently minimizes direct impacts on natural habitats. However, the company must remain vigilant about the indirect environmental consequences stemming from industrial operations, such as atmospheric emissions and noise pollution, which can affect surrounding biodiversity. For instance, in 2024, European Union regulations, like the Industrial Emissions Directive, continue to push for stricter controls on pollutants from manufacturing, influencing operational standards for companies like Alumetal.

Effective land use management and a commitment to environmental stewardship are crucial. This involves rigorous adherence to environmental impact assessments before any site development or expansion, ensuring that potential disturbances to local ecosystems are identified and mitigated. Alumetal's focus on responsible site management, including waste reduction and efficient resource utilization, directly contributes to minimizing its ecological footprint.

Key considerations for Alumetal regarding biodiversity and land use include:

- Compliance with Environmental Regulations: Adhering to evolving EU directives and national environmental laws, which often set limits on emissions and require biodiversity impact assessments.

- Sustainable Site Management: Implementing practices that reduce waste, conserve water, and minimize land disturbance at operational facilities.

- Biodiversity Monitoring: Potentially incorporating monitoring programs around industrial sites to assess and address any localized impacts on flora and fauna.

- Supply Chain Scrutiny: Ensuring that raw material sourcing, particularly for bauxite and other minerals, is conducted with consideration for land use and biodiversity impacts in those regions.

Climate Change Adaptation and Resilience

Climate change presents tangible risks to Alumetal's operations. Physical impacts like intensified heatwaves could disrupt production schedules, while increased flooding frequency may hinder logistics and supply chain reliability. For instance, in 2024, several European countries experienced significant disruptions due to extreme weather, impacting manufacturing output and transportation networks.

Building resilience is therefore crucial for business continuity. This involves fortifying production facilities against extreme weather and diversifying sourcing and distribution channels to mitigate the impact of localized disruptions. Companies are increasingly investing in climate risk assessments and adaptation strategies to safeguard their operations.

- Physical Risks: Increased frequency and intensity of extreme weather events like heatwaves and floods.

- Operational Impact: Potential disruptions to Alumetal's production processes and supply chain logistics.

- Resilience Strategies: Focus on infrastructure hardening and diversification of sourcing and distribution networks.

- Business Continuity: Proactive adaptation measures are essential for maintaining stable operations in a changing climate.

Alumetal's environmental strategy centers on minimizing its ecological footprint by embracing circular economy principles and enhancing resource efficiency. The company's core activity of recycling aluminum scrap inherently reduces energy consumption and waste compared to primary production, aligning with the EU's updated Circular Economy Action Plan. Continued investment in energy efficiency, renewable energy sources, and waste valorization are key to meeting evolving sustainability demands and regulations.

The company must also manage water resources effectively, focusing on reducing consumption through advanced recycling and closed-loop systems, a trend mirrored by global aluminum producers aiming for significant water intensity reductions by 2025. Furthermore, Alumetal needs to address indirect environmental impacts such as atmospheric emissions and noise pollution, adhering to stricter controls like the EU's Industrial Emissions Directive, to ensure responsible site management and biodiversity protection.

Climate change poses risks to Alumetal's operations through extreme weather events, impacting production and logistics, highlighting the need for resilience strategies like infrastructure hardening and supply chain diversification. Proactive adaptation measures are crucial for maintaining stable operations amidst a changing climate.

| Environmental Factor | Description | Impact on Alumetal | Mitigation/Opportunity | 2024/2025 Data/Trend |

|---|---|---|---|---|

| Carbon Footprint Reduction | Decreasing greenhouse gas emissions. | Increased operational costs due to carbon pricing; investor pressure for ESG. | Investing in energy efficiency, renewable energy sources; leveraging scrap recycling's lower energy demand. | EU carbon pricing mechanisms reinforced, impacting industrial energy costs. |

| Circular Economy Principles | Maximizing resource utilization and minimizing waste. | Regulatory compliance; enhanced market reputation. | Waste valorization, closed-loop material flows; focus on reducing process residues and wastewater. | EU's Circular Economy Action Plan emphasizes resource efficiency. |

| Water Management | Efficient use and responsible discharge of water. | Operational cost reduction; regulatory scrutiny on water usage. | Advanced recycling technologies, closed-loop systems; robust wastewater treatment. | Global aluminum industry focus on reducing water intensity per tonne of production. |

| Climate Change Resilience | Adapting to physical impacts of climate change. | Disruptions to production and supply chain from extreme weather. | Infrastructure hardening, diversifying sourcing and distribution channels. | Increased frequency of extreme weather events observed across Europe. |

PESTLE Analysis Data Sources

Our Alumetal PESTLE Analysis is informed by a comprehensive review of global economic indicators, national and international aluminum industry regulations, and technological advancements in manufacturing and materials science. We also incorporate insights from environmental impact assessments and social consumer trend reports.