Alumetal Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumetal Bundle

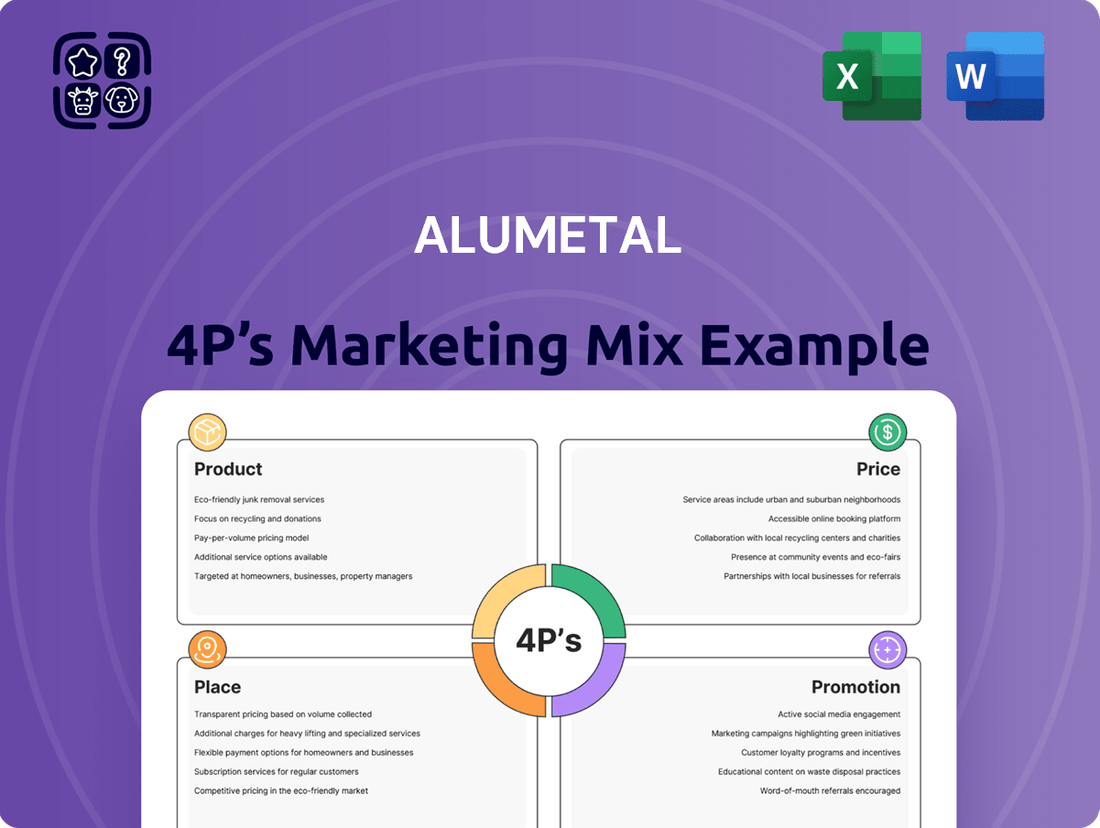

Discover how Alumetal leverages its Product, Price, Place, and Promotion strategies to dominate the market. This analysis delves into their innovative product development, competitive pricing, strategic distribution, and impactful promotional campaigns.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Alumetal's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Alumetal's diverse alloy portfolio is a cornerstone of its market strategy, featuring foundry alloys, master alloys, and deoxidation alloys designed to meet a wide array of industrial needs. This extensive product range underscores their commitment to providing essential materials for casting and metallurgical processes.

The company's offerings extend to high-quality primary alloys and specialized solutions like AlTiB wire, crucial for grain refinement in aluminum production. This focus on specialized and primary alloys highlights Alumetal's capability to serve niche and demanding market segments.

Alumetal's product strategy heavily emphasizes recycled content, primarily utilizing aluminum scrap. This approach directly supports sustainability initiatives and fosters a circular economy. For instance, Hydro, a key player in the aluminum industry, has committed significant investments towards developing low-carbon, recycled aluminum products, reflecting a broader industry shift.

This dedication to recycled materials is further validated by Alumetal's completion of an Environmental Declaration (EPD). This EPD provides transparent documentation of the environmental footprint associated with their recycled foundry alloy aluminum products, offering crucial data for environmentally conscious decision-making.

Alumetal provides its aluminum alloys in forms precisely suited for industrial use. This includes one-notch ingots weighing between six and eight kilograms, and two-notch ingots that are 13 kilograms each. These standardized weights facilitate easier handling and integration into manufacturing processes.

To ensure efficient logistics and client convenience, these ingots are packaged in bundles. These bundles can be made of steel, plastic, or aluminum strapping, with weights typically ranging from 500 to 900 kilograms. For added protection and product integrity, foil wrapping is also offered as an option upon customer request.

High-Quality Standards

Alumetal's dedication to high-quality standards is a cornerstone of its operations. This commitment is demonstrated through ongoing enhancements to work processes, ensuring their aluminum products consistently meet rigorous market demands. For instance, the company is actively investing in technology to elevate its output.

A prime example of this commitment is the recent modernization of sorting lines at their Nowa Sól plant. By integrating advanced LIBS (Laser-Induced Breakdown Spectroscopy) technology, Alumetal significantly improves the precision in sorting and the purity of aluminum scrap. This technological upgrade directly translates to superior quality in their final aluminum products.

This focus on quality is not just about process; it's about tangible results and market competitiveness.

- Enhanced Purity: LIBS technology allows for more accurate identification and separation of materials, leading to a purer aluminum scrap feedstock.

- Meeting Market Demands: Stringent quality control ensures Alumetal's products align with the exacting specifications required by various industries.

- Continuous Improvement: The company's proactive approach to upgrading technology reflects a long-term strategy for maintaining and improving product excellence.

Industry-Specific Solutions

Alumetal tailors its product offerings to meet the stringent demands of key sectors, including automotive, construction, and engineering. This specialization ensures that their aluminum solutions are perfectly suited for critical manufacturing applications within these industries.

The automotive sector represents a significant portion of Alumetal's client base, with approximately 80% of its customers operating within this industry. This deep engagement allows Alumetal to cultivate a profound understanding of automotive manufacturers' specific material requirements and evolving needs.

- Automotive Dominance: Roughly 80% of Alumetal's customer base is concentrated in the automotive industry.

- Industry Focus: Products are engineered for critical applications in automotive, construction, and engineering.

- Material Expertise: Deep understanding of material needs within the automotive sector drives product development.

Alumetal's product strategy centers on a diverse portfolio of aluminum alloys, including foundry, master, and deoxidation types, catering to a broad industrial spectrum. Their commitment to sustainability is evident in their significant use of recycled aluminum scrap, reinforced by an Environmental Product Declaration (EPD) for their recycled foundry alloys, offering transparency on their environmental impact.

The company provides its alloys in standardized ingot forms, such as 6-8 kg one-notch and 13 kg two-notch ingots, packaged in bundles ranging from 500-900 kg for efficient handling and logistics. Alumetal prioritizes quality through continuous process improvement and technological investments, exemplified by the integration of LIBS technology at their Nowa Sól plant to enhance scrap purity and product quality.

A substantial 80% of Alumetal's customer base operates within the automotive sector, highlighting their specialized focus and deep understanding of this industry's demanding material requirements. This specialization extends to serving the construction and engineering sectors with tailored aluminum solutions.

| Product Category | Key Features | Target Industries | Sustainability Focus | Quality Assurance |

|---|---|---|---|---|

| Foundry Alloys | Diverse grades for casting applications | Automotive, Construction, Engineering | High recycled content | LIBS technology for purity |

| Master Alloys | Grain refinement, property enhancement | Automotive, Aerospace | Recycled feedstock utilization | Stringent process controls |

| Deoxidation Alloys | Purity enhancement in molten aluminum | Metallurgy, Manufacturing | Circular economy principles | Continuous technological upgrades |

| Specialized Solutions (e.g., AlTiB wire) | Specific metallurgical functions | Aluminum Production | Focus on efficient material use | Meeting rigorous market demands |

What is included in the product

This analysis provides a comprehensive deep dive into Alumetal's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's designed for professionals seeking a complete breakdown of Alumetal’s marketing positioning, offering a structured and data-driven approach.

Alumetal's 4P's Marketing Mix Analysis provides a clear roadmap to address market challenges, ensuring effective product positioning and targeted promotional strategies.

This analysis streamlines complex marketing decisions, offering a structured approach to optimize pricing and distribution for enhanced customer reach and satisfaction.

Place

Alumetal's production strength lies in its strategically positioned facilities across Central Europe. The company operates plants in Kęty, Gorzyce, and Nowa Sól in Poland, complemented by a facility in Komarom, Hungary. This network ensures efficient production and timely distribution to key markets.

The modernization of the Kęty plant is a key initiative, aiming to boost its annual production capacity by approximately 30,000 tonnes. This expansion is crucial for meeting growing demand and enhancing Alumetal's competitive edge in the aluminum processing sector.

Alumetal boasts an impressive European market footprint, with sales significantly growing in key regions like Hungary, Holland, Germany, the Czech Republic, and Poland. Poland represents the largest contributor to their overall revenue, highlighting the strategic importance of this market. This extensive reach solidifies Alumetal's standing as a premier European producer of secondary aluminum casting alloys and pre-alloys.

Alumetal's impressive production capacity, reaching 275,000 tons of aluminum alloys annually, is a cornerstone of its marketing strategy. This substantial output allows the company to reliably serve the high-volume needs of major industries.

This capacity directly supports Alumetal's position as a key supplier to the automotive sector, a market known for its rigorous demand and just-in-time delivery requirements. Their ability to produce at scale ensures they can meet the needs of large industrial partners, both within their home market and across international borders, solidifying their competitive advantage.

Robust Business Partner Network

Alumetal's strength lies in its expansive business partner network, encompassing around 3,000 entities. This extensive web of relationships is crucial for both sourcing raw materials and distributing finished products. In 2024, Alumetal continued to leverage this network to secure approximately 90% of its aluminum scrap requirements, a testament to the reliability of its supplier partnerships.

This vast network acts as a dual engine for Alumetal's operations. It guarantees a consistent inflow of essential raw materials, predominantly aluminum scrap, which is vital for maintaining production levels. Simultaneously, it provides a robust and diversified channel for Alumetal’s output, reaching a wide array of customers across various industries.

- Extensive Reach: Approximately 3,000 business partners form Alumetal's core network.

- Supply Chain Stability: The network ensures reliable sourcing of key raw materials like aluminum scrap.

- Market Access: It facilitates effective distribution of Alumetal's products to a broad customer base.

- Operational Efficiency: This partner ecosystem underpins both Alumetal's purchasing and sales activities.

Optimized Logistics and Supply Chain

Alumetal's commitment to operational excellence is clearly demonstrated in its optimized logistics and supply chain. This focus ensures that their high-quality aluminum products reach customers precisely when and where they are required, a critical factor in the fast-paced manufacturing sectors they serve.

The company leverages advanced enterprise resource planning (ERP) systems, notably IFS, to streamline its entire operational workflow. This integration provides real-time visibility and control over crucial areas such as production scheduling, sales order fulfillment, procurement, and inventory management, directly contributing to enhanced efficiency and accurate cost tracking.

- IFS ERP Integration: Alumetal utilizes IFS to manage core operational functions, boosting efficiency and enabling real-time cost control.

- Supply Chain Responsiveness: The logistics strategy is designed for agility, ensuring timely product availability to meet diverse customer demands.

- Operational Efficiency Gains: By integrating advanced systems, Alumetal aims to minimize lead times and optimize inventory levels across its supply chain.

Alumetal's strategic placement of production facilities across Central Europe, including Poland and Hungary, ensures proximity to key markets and efficient distribution channels. This geographical advantage, coupled with a robust network of approximately 3,000 business partners, underpins their ability to serve a diverse customer base across Europe effectively.

The company's commitment to modernizing its Kęty plant, targeting a 30,000-tonne annual production capacity increase, highlights its focus on meeting escalating demand. This expansion is vital for maintaining Alumetal's competitive edge in the secondary aluminum casting alloys sector, with significant sales growth noted in countries like Germany, Holland, and the Czech Republic.

Alumetal's operational efficiency is further bolstered by its integration of advanced ERP systems like IFS, providing real-time oversight of production, sales, and inventory. This technological adoption enhances supply chain responsiveness and ensures timely delivery, critical for industries such as automotive that rely on just-in-time manufacturing.

| Key Location | Production Focus | Market Proximity |

|---|---|---|

| Kęty, Poland | Secondary Aluminum Alloys | Central European Markets |

| Gorzyce, Poland | Aluminum Casting Alloys | Domestic and European Markets |

| Nowa Sól, Poland | Pre-alloys and Secondary Aluminum | Northern and Eastern European Markets |

| Komarom, Hungary | Aluminum Casting Alloys | Southeastern European Markets |

Same Document Delivered

Alumetal 4P's Marketing Mix Analysis

The preview you see here is the exact Alumetal 4P's Marketing Mix Analysis document you will receive upon purchase. This comprehensive analysis is fully prepared and ready for immediate application to your business strategies. You can buy with complete confidence, knowing there are no hidden surprises or altered content.

Promotion

Alumetal actively participates in significant industry gatherings like the CRU World Aluminium Summit and the Aluminum Association Annual Meeting. This strategic presence is crucial for bolstering brand recognition and fostering connections with key players across the aluminum sector. These events are vital platforms for demonstrating Alumetal's product offerings and engaging in discussions about prevailing market dynamics.

Alumetal effectively communicates its sustainability efforts, highlighting responsible business practices and environmental protection. This includes significant investments like solar panel installation at their Kęty plant, directly contributing to the production of low-carbon aluminum products.

The company leverages Environmental Product Declarations (EPDs) and comprehensive sustainability reports as key promotional tools. These documents provide transparent data on their environmental impact, attracting a growing segment of environmentally conscious clients and partners in the 2024-2025 market.

Alumetal emphasizes its strategic client partnerships, particularly with major automotive manufacturers. This focus on long-term relationships with industry leaders like VW Group, Nemak, and Federal Mogul Group underscores their commitment to quality and reliability.

These enduring collaborations not only solidify Alumetal's market position but also act as a powerful draw for new, high-profile clients seeking dependable suppliers. For instance, in 2024, Alumetal reported that over 70% of its revenue was generated from repeat business with key strategic partners, highlighting the success of this approach.

Digital Presence and News Updates

Alumetal actively cultivates its digital footprint, utilizing its website as a primary channel for disseminating crucial company news. This includes updates on technological breakthroughs, significant investment initiatives, and community engagement efforts, ensuring stakeholders are consistently informed.

Recent communications highlight Alumetal's commitment to innovation and operational enhancement. For instance, the company has publicized the integration of advanced LIBS technology, a move that underscores its dedication to cutting-edge analytical methods in its processes. Furthermore, the inauguration of upgraded casting lines signals a tangible investment in improving production capabilities and efficiency.

These digital updates serve as vital tools for communicating Alumetal's progress and strategic direction to its diverse audience. The company's proactive approach to sharing information about its technological advancements and operational upgrades directly impacts its brand perception and market positioning.

- Website as a Hub: Alumetal leverages its website for regular news dissemination, covering technological advancements, investment projects, and community involvement.

- Technological Integration: Recent news includes the integration of modern LIBS technology, showcasing a commitment to advanced analytical processes.

- Operational Upgrades: The inauguration of upgraded casting lines demonstrates tangible investments in enhancing production efficiency and capacity.

- Communicating Excellence: These updates are strategically used to communicate innovation and operational excellence to target audiences, reinforcing market standing.

Community Engagement and CSR

Alumetal actively participates in local community initiatives, demonstrating a strong commitment to corporate social responsibility. This engagement goes beyond standard business practices, fostering a positive public image and reinforcing the company's dedication to societal well-being.

Financial contributions to educational institutions, hospitals, and cultural facilities are a key aspect of Alumetal's community outreach. For instance, in 2024, Alumetal allocated over PLN 1.5 million to support various social projects and educational programs across its operating regions. This direct financial aid helps these vital sectors thrive.

- Community Investment: Alumetal's 2024 social investments exceeded PLN 1.5 million.

- Focus Areas: Support directed towards education, healthcare, and cultural development.

- Public Image Enhancement: These actions build goodwill and a positive company reputation.

- CSR Integration: Demonstrates values beyond core commercial activities.

Alumetal's promotional strategy is multifaceted, emphasizing industry leadership, sustainability, and strong client relationships. By actively participating in key industry events and leveraging digital platforms to showcase technological advancements like LIBS integration and operational upgrades such as new casting lines, the company reinforces its innovative image. Furthermore, their commitment to sustainability, evidenced by solar panel installations and transparent Environmental Product Declarations, resonates with an increasingly eco-conscious market, positioning them as a responsible supplier.

The company's dedication to corporate social responsibility, including significant financial contributions to local communities, further enhances its public image. For example, Alumetal's 2024 social investments exceeded PLN 1.5 million, supporting education, healthcare, and cultural initiatives. These efforts, combined with strategic partnerships with major automotive manufacturers, create a compelling brand narrative that attracts both new clients and talent.

| Promotional Tactic | Key Focus | Impact/Data Point |

|---|---|---|

| Industry Event Participation | Brand Recognition, Networking | Active presence at CRU World Aluminium Summit, Aluminum Association Annual Meeting. |

| Sustainability Communication | Environmental Responsibility, Low-Carbon Products | EPDs, Sustainability Reports, Solar panel installation at Kęty plant. |

| Digital Content Dissemination | Technological Advancements, Operational Updates | Website updates on LIBS technology, upgraded casting lines. |

| Client Partnership Emphasis | Quality, Reliability, Long-Term Relationships | Over 70% revenue from repeat business with partners like VW Group in 2024. |

| Corporate Social Responsibility | Community Well-being, Positive Public Image | Over PLN 1.5 million invested in social projects in 2024. |

Price

Alumetal's pricing strategy is rooted in value-based principles, reflecting the superior quality and specialized nature of its aluminum alloys. This approach is particularly evident in their offerings for demanding sectors like the automotive industry, where performance and reliability are paramount. For instance, in 2024, the automotive sector continued to drive demand for advanced aluminum alloys, with Alumetal's focus on meeting stringent OEM specifications justifying premium pricing.

Alumetal's commitment to cost efficiency, demonstrated by its strategic investments in modernizing facilities like the Kęty plant, directly underpins its pricing strategy. These upgrades, coupled with advanced sorting technologies, are designed to lower production expenses. For instance, in 2023, Alumetal reported a notable increase in production output, contributing to economies of scale that enhance cost-effectiveness.

Alumetal's pricing strategy is closely tied to the ebb and flow of the global aluminum market. Demand for lightweight materials, crucial for industries like automotive and construction, directly impacts pricing. The aluminum market was valued at an impressive USD 178.5 billion in 2024, indicating a robust and active sector.

Raw Material Volatility Management

Alumetal's reliance on aluminum scrap makes its pricing highly sensitive to raw material cost fluctuations. In 2024, geopolitical events and ongoing supply chain issues have amplified this volatility. For instance, the London Metal Exchange (LME) aluminum price experienced significant swings, trading in a range that reflected these global pressures.

To counter this, Alumetal employs robust scrap purchasing and risk management. These strategies are essential for maintaining stable production expenses and, consequently, predictable product pricing for its customers. This proactive approach helps Alumetal navigate the unpredictable market environment.

- Scrap Sourcing Efficiency: Alumetal focuses on securing diverse and reliable sources of aluminum scrap to mitigate the impact of localized supply disruptions.

- Hedging Strategies: Implementing financial instruments to lock in raw material prices can provide a buffer against sudden market upticks.

- Inventory Management: Strategic stockpiling of scrap during periods of lower prices can help Alumetal manage costs over the medium term.

- Supplier Relationships: Strong partnerships with scrap suppliers enable better forecasting and potentially more favorable purchasing terms.

Long-Term Contractual Pricing

Alumetal prioritizes long-term contractual pricing, fostering stable partnerships with major industrial clients, especially within the automotive industry. This strategy moves beyond volatile spot market dealings, securing predictable revenue for Alumetal and ensuring a consistent supply chain for its crucial customers.

This focus on enduring relationships translates into mutually beneficial pricing structures. For instance, in 2024, Alumetal's commitment to long-term contracts likely contributed to its reported revenue stability amidst fluctuating raw material costs. Such agreements allow for better demand forecasting and production planning.

- Predictable Revenue Streams: Long-term contracts offer Alumetal greater visibility into future earnings, aiding financial planning and investment decisions.

- Customer Loyalty and Stability: By providing consistent pricing and supply, Alumetal strengthens its relationships with key automotive manufacturers, reducing customer churn.

- Risk Mitigation: Negotiated contracts can help shield both Alumetal and its clients from the immediate price swings of the aluminum commodity market.

- Strategic Partnerships: This pricing model underpins Alumetal's role as a strategic supplier, deeply integrated into its clients' production processes.

Alumetal's pricing strategy balances value-based positioning with cost efficiency, reflecting the premium quality of its aluminum alloys, especially for demanding sectors like automotive. The global aluminum market's valuation at USD 178.5 billion in 2024 underscores the sector's strength and Alumetal's strategic market placement.

The company leverages long-term contracts to offer predictable pricing to key clients, particularly in the automotive industry, fostering stability amidst raw material cost volatility. This approach, evident in 2024's revenue stability, mitigates risks associated with fluctuating LME aluminum prices.

Alumetal's pricing is intrinsically linked to the global aluminum market and its reliance on scrap sourcing. Strategies like efficient scrap purchasing and risk management are crucial for maintaining cost-effectiveness and stable pricing, especially given the market's sensitivity to geopolitical events in 2024.

| Pricing Factor | 2024 Data/Trend | Impact on Alumetal |

|---|---|---|

| Value-Based Pricing | Automotive sector demand for high-spec alloys | Justifies premium pricing for specialized products |

| Cost Efficiency | Modernization of Kęty plant, increased production output (2023) | Lowers production expenses, supports competitive pricing |

| Global Aluminum Market | Market valued at USD 178.5 billion | Influences overall pricing levels based on demand |

| Raw Material Costs (Scrap) | Volatility due to geopolitical events, LME price swings | Requires robust risk management to maintain stable costs |

| Long-Term Contracts | Focus on automotive clients for revenue stability | Ensures predictable pricing and supply chain integration |

4P's Marketing Mix Analysis Data Sources

Our Alumetal 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company publications, including annual reports and investor presentations, alongside detailed market research and competitive intelligence. We also leverage data from industry associations and reputable trade journals to ensure accuracy and relevance.