Alumetal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alumetal Bundle

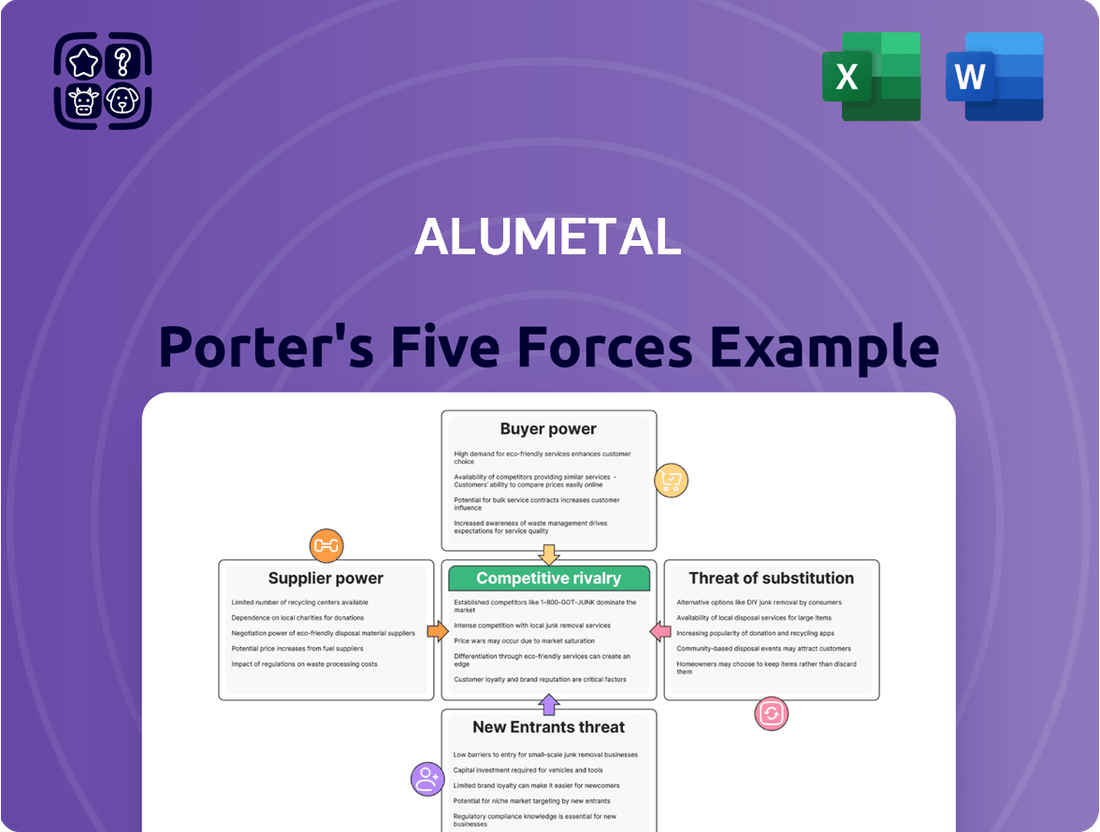

Alumetal operates in a complex landscape shaped by powerful competitive forces. Understanding the intensity of buyer bargaining power and the threat of substitute products is crucial for navigating this market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alumetal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Alumetal's reliance on aluminum scrap as a primary raw material means the bargaining power of its suppliers is a key consideration. The global aluminum scrap recycling market is robust, projected to grow from an estimated USD 7.20 billion in 2025 to USD 11.54 billion by 2030, suggesting a generally broad supplier landscape.

Despite the overall market growth, specific regional concentrations of high-quality aluminum scrap or specialized recycling capabilities could still grant certain suppliers significant leverage over Alumetal. This is particularly true if Alumetal requires very specific grades or quantities that are not readily available from a wide array of sources.

While Alumetal primarily deals with aluminum scrap, the wider aluminum industry also involves primary aluminum production from bauxite. Changes in the price and availability of primary aluminum can indirectly affect scrap prices and the bargaining power of scrap suppliers. For instance, when premiums for primary aluminum rise significantly, aluminum scrap becomes a more economically appealing substitute for some manufacturers, potentially increasing the leverage of scrap suppliers.

Switching scrap suppliers for Alumetal could entail some effort. This might include setting up new logistical arrangements, implementing additional quality assurance processes for incoming materials, and building rapport with new vendors.

However, because scrap metal is largely a commodity, the costs associated with switching suppliers are likely to be manageable. This means suppliers might have less leverage over Alumetal, especially considering Alumetal's extensive network of over 3,000 business partners, which indicates a broad and diversified supplier base.

Threat of Forward Integration by Suppliers

The threat of forward integration by aluminum scrap suppliers into Alumetal's specialized alloy production is generally low. This is due to the substantial capital required for advanced foundry operations, the need for deep technical expertise in creating master and deoxidation alloys, and the established customer relationships Alumetal maintains in the automotive and manufacturing sectors.

For instance, entering Alumetal's market would necessitate significant investment in R&D and quality control systems, areas where Alumetal has built a strong reputation. Suppliers would also need to navigate complex regulatory environments and develop a robust sales network to compete effectively.

- High Capital Requirements: Establishing state-of-the-art foundries for specialized alloys demands hundreds of millions in investment.

- Technical Expertise Gap: Producing precise foundry, master, and deoxidation alloys requires specialized metallurgical knowledge and proprietary processes.

- Established Customer Relationships: Alumetal's long-standing partnerships with key automotive manufacturers present a significant barrier to entry for new players.

- Brand Reputation: Alumetal's established brand in the high-performance aluminum alloy market is difficult for new entrants to replicate.

Uniqueness of Supplier's Products

While aluminum scrap is generally considered a commodity, certain suppliers might differentiate themselves through specialized or high-purity scrap. For Alumetal, the ability to process various alloys from scrap also implies a degree of flexibility in sourcing, potentially mitigating the impact of supplier uniqueness. For instance, in 2024, the global aluminum market experienced price volatility, with LME aluminum prices fluctuating significantly, impacting the cost of raw materials for companies like Alumetal.

The bargaining power of suppliers is influenced by the uniqueness of their products or services. For Alumetal, the primary input is aluminum scrap. While aluminum scrap itself is largely a commodity, suppliers who can consistently provide high-purity scrap or scrap processed using advanced sorting technologies could possess a degree of uniqueness. However, Alumetal's manufacturing process, which allows for the production of various aluminum alloys from scrap, suggests a capacity to adapt to different scrap inputs, thereby reducing reliance on any single supplier's unique offering.

- Scrap Purity and Processing: Suppliers offering specialized or high-purity aluminum scrap, or those employing advanced sorting technologies, can command greater leverage due to the unique value proposition of their materials.

- Alumetal's Alloy Flexibility: Alumetal's capability to produce a range of aluminum alloys from scrap allows for greater adaptability in sourcing, potentially lessening the impact of supplier uniqueness on its operations.

- Market Dynamics (2024): The global aluminum market in 2024 saw fluctuating prices, with LME prices reaching highs and lows, underscoring the importance of stable and cost-effective scrap sourcing for Alumetal.

Alumetal's suppliers of aluminum scrap generally have moderate bargaining power. While the scrap market is large, with global recycling projected to reach USD 11.54 billion by 2030, specific high-purity scrap sources can grant suppliers leverage. Alumetal's broad network of over 3,000 partners and its ability to process diverse scrap alloys mitigates this power, as switching suppliers is relatively manageable for a commodity input.

The threat of suppliers integrating forward into Alumetal's specialized alloy production is low due to high capital needs, technical expertise requirements, and Alumetal's strong customer relationships.

In 2024, aluminum prices saw significant fluctuations on the LME, impacting raw material costs and highlighting the importance of stable scrap sourcing.

| Factor | Supplier Leverage | Alumetal's Mitigation |

| Scrap Market Size | Moderate | Large supplier base (3,000+ partners) |

| Scrap Uniqueness (Purity/Processing) | Potentially High | Flexibility in processing various alloys |

| Switching Costs | Low | Commodity nature of scrap |

| Forward Integration Threat | Low | High capital, expertise, and customer relationship barriers |

What is included in the product

This analysis unpacks Alumetal's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitutes.

Quickly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces for Alumetal.

Customers Bargaining Power

Alumetal's customer base is heavily concentrated, with around 80% of its revenue coming from the automotive sector. This means major players like VW Group, Nemak, and Federal Mogul Group represent a significant portion of their business. Such a high dependence on a few large clients in a single industry grants these customers substantial leverage.

For industries like automotive and construction, changing aluminum alloy suppliers isn't a simple task. It often means going through lengthy qualification procedures, potentially retooling manufacturing equipment, and dealing with disruptions to their established supply chains. These factors create moderate to high switching costs for Alumetal's customers.

Customer price sensitivity is a significant factor for Alumetal, particularly in sectors like automotive and construction. These industries are keenly aware of costs, especially as they seek lightweight materials and embrace sustainability. This means customers will likely push Alumetal on pricing, impacting profitability.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Alumetal, a producer of aluminum alloys, is generally low. While major players in industries like automotive or construction possess significant purchasing power, the immense capital investment and specialized knowledge required for aluminum production make it an impractical endeavor for most. For instance, establishing a new aluminum smelter can cost billions of dollars and demands deep expertise in metallurgy and complex chemical processes.

However, the landscape isn't entirely devoid of this risk. Exceptionally large and diversified industrial conglomerates, with their vast resources and existing manufacturing capabilities, might possess the wherewithal to consider such a strategic move. These entities could potentially absorb the upfront costs and leverage existing technical talent to enter aluminum alloy manufacturing, thereby reducing their reliance on external suppliers like Alumetal.

Here's a breakdown of factors influencing this threat:

- Capital Intensity: Building a new aluminum production facility requires hundreds of millions to billions of dollars in investment, a significant barrier for most customers.

- Technical Expertise: Aluminum smelting and alloy production demand highly specialized metallurgical knowledge and operational experience that most customer companies lack.

- Economies of Scale: Existing aluminum producers, like Alumetal, benefit from established economies of scale, making it difficult for new entrants to compete on cost.

- Market Diversification: For many customers, aluminum is just one component among many, making backward integration into a niche production process less strategically appealing than focusing on their core competencies.

Availability of Substitute Products for Customers

Customers in sectors like automotive and construction have choices. They might look at advanced steels or composites as alternatives to aluminum alloys. However, aluminum's blend of strength, lightness, and resistance to corrosion is quite appealing.

The growing use of aluminum in electric vehicles (EVs) is a significant factor. For instance, in 2023, the average EV battery pack weight was around 400-500 kg, and manufacturers are increasingly using lightweight materials like aluminum to offset this. This trend strengthens aluminum's position, even with substitutes available.

- Material Substitution: While advanced steels and composites are alternatives, aluminum alloys offer a compelling balance of properties for lightweighting applications.

- EV Market Growth: The increasing demand for EVs, where lightweighting is crucial for efficiency, bolsters the demand for aluminum, somewhat mitigating the power of substitutes.

- Price Sensitivity: Fluctuations in aluminum prices, influenced by global supply and demand, can impact customer decisions when comparing costs against substitute materials.

Alumetal's customers, particularly those in the automotive sector, wield considerable bargaining power due to the concentration of their business with a few major players. This leverage is amplified by moderate to high switching costs associated with changing aluminum alloy suppliers, as it often requires significant retooling and qualification processes. While customers are price-sensitive, the threat of backward integration is generally low due to the immense capital and expertise required for aluminum production, though very large conglomerates could pose a risk.

The availability of substitutes like advanced steels and composites presents another avenue for customer power, though aluminum's unique properties, especially its lightweighting benefits crucial for electric vehicles, somewhat temper this threat. For example, by 2024, the automotive industry's push for lighter vehicles to improve fuel efficiency and EV range continues to drive demand for aluminum alloys, making it a preferred material despite cost considerations.

| Factor | Impact on Alumetal | Customer Leverage |

|---|---|---|

| Customer Concentration | High dependence on key automotive clients | High |

| Switching Costs | Lengthy qualification, potential retooling | Moderate to High |

| Price Sensitivity | Customers push for lower prices | High |

| Backward Integration Threat | Improbable for most, possible for large conglomerates | Low to Moderate |

| Availability of Substitutes | Steel, composites offer alternatives | Moderate |

Full Version Awaits

Alumetal Porter's Five Forces Analysis

This preview showcases the complete Alumetal Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the aluminum industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies and full readiness for your strategic planning.

Rivalry Among Competitors

The global aluminum alloys market is substantial, estimated at USD 142.09 billion in 2024 and anticipated to grow to USD 259.54 billion by 2034. This robust market size suggests a dynamic environment for companies like Alumetal.

Alumetal operates in a competitive landscape featuring established players such as Zaklad Metalurgiczny WSK Rzeszow, Afarak Group, Tata Steel Europe, and Jiangsu Shagang Group. The presence of these significant entities highlights a market with multiple, sizeable competitors vying for market share.

The global aluminum alloy market is experiencing robust expansion, with a projected Compound Annual Growth Rate (CAGR) of 6.21% from 2024 to 2034. This upward trend is largely fueled by the escalating demand from key sectors such as aerospace and automotive.

Specifically, the automotive aluminum market is a significant contributor, anticipated to reach USD 38,025.7 million in 2025. Such substantial market growth naturally intensifies competitive rivalry as existing players and new entrants vie for increased market share and dominance.

Alumetal carves out a niche by specializing in foundry, master, and deoxidation alloys, primarily utilizing aluminum scrap. Their focus on high quality and close collaboration with major automotive manufacturers is a key differentiator in an industry where alloys can often be perceived as commodities.

The company's commitment to consistent quality and tailored solutions for specific client needs, particularly within the demanding automotive sector, helps build strong customer relationships. This focus on partnership and bespoke offerings sets them apart from generic suppliers, allowing them to command a premium and foster loyalty. For instance, in 2024, Alumetal reported that over 70% of their new business stemmed from existing automotive clients seeking specialized alloy formulations.

Exit Barriers

High capital investment in specialized production facilities and equipment presents a significant hurdle for companies looking to exit the aluminum alloy market. This means that once a company like Alumetal invests heavily in its operations, it becomes financially challenging to simply shut down and walk away. The substantial sunk costs encourage firms to continue operating, even during periods of lower profitability, to try and recoup their investments.

These substantial exit barriers can intensify competitive rivalry. When leaving the market is costly, companies are more likely to fight for market share and profitability within the existing industry structure. This can lead to price wars or increased efforts to innovate and differentiate to maintain a competitive edge, rather than facing the losses associated with exiting.

Alumetal's significant production capacity, standing at 275,000 tons per year, underscores the scale of investment required in this sector. Such a large operational footprint implies considerable fixed assets and specialized machinery, further cementing the high exit barriers for Alumetal and its competitors.

- High Capital Investment: Significant funds are tied up in plant, property, and specialized equipment in the aluminum alloy industry.

- Specialized Assets: Production facilities and machinery are often not easily repurposed for other industries, increasing exit costs.

- Established Supply Chains: Developing and maintaining robust supply chains requires long-term commitment, making abrupt exits difficult.

- Alumetal's Capacity: With a production capacity of 275,000 tons per year, Alumetal has made a substantial capital commitment, contributing to high exit barriers.

Diversity of Competitors

Alumetal operates in a market with a wide array of competitors, not all of whom focus solely on aluminum. For instance, Tata Steel Europe, a major player in the steel industry, also engages in activities that can indirectly impact the broader materials market. Similarly, Afarak Group's primary focus on chrome mining highlights how companies with different core competencies can still be part of the competitive ecosystem, bringing varied cost structures and strategic priorities to the table.

This diversity means that competitive behaviors can differ significantly. Some rivals might aggressively pursue market share through price competition, while others may differentiate based on product quality, innovation, or specialized services. Understanding these varied approaches is crucial for Alumetal to navigate the competitive landscape effectively.

- Diverse Competitors: Alumetal faces rivals like Tata Steel Europe (steel) and Afarak Group (chrome mining), indicating a broad competitive spectrum.

- Varied Strategic Objectives: Competitors may have differing goals, impacting their pricing, investment, and market strategies.

- Divergent Cost Structures: Companies in adjacent or overlapping material sectors will naturally possess different cost bases, influencing their competitive intensity.

- Mixed Competitive Behaviors: The varied nature of competitors leads to a range of competitive tactics, from price wars to niche market focus.

The competitive rivalry within the aluminum alloys market is intense, driven by a substantial market size and robust growth projections. Alumetal faces established global players and companies with diverse core businesses, leading to varied competitive strategies.

Alumetal's specialization in niche alloys and focus on high quality, particularly for the automotive sector, helps differentiate it. However, the overall market dynamics, including the presence of large-scale competitors like Zaklad Metalurgiczny WSK Rzeszow and Tata Steel Europe, mean that price and volume remain significant competitive factors.

| Competitor | Primary Focus | Potential Competitive Impact |

| Zaklad Metalurgiczny WSK Rzeszow | Aluminum Alloys | Direct competitor, likely focused on volume and established product lines. |

| Afarak Group | Chrome Mining | Indirect competitor, may influence raw material costs or offer alternative materials. |

| Tata Steel Europe | Steel Production | Indirect competitor, competes for share of the broader materials market, potentially with different cost structures. |

| Jiangsu Shagang Group | Steel Production | Indirect competitor, similar to Tata Steel Europe in its potential impact on the materials sector. |

SSubstitutes Threaten

For industries like automotive and construction, alternative materials to aluminum alloys such as advanced high-strength steels, carbon fiber composites, and engineered plastics are readily available. For instance, in the automotive sector, the increasing adoption of ultra-high-strength steel (UHSS) in vehicle frames offers comparable strength-to-weight ratios to aluminum at a potentially lower cost, as highlighted by the significant material cost savings reported by some automakers when utilizing specific steel grades.

While aluminum alloys are prized for their lightweighting benefits, crucial for fuel efficiency and electric vehicle range, and excellent corrosion resistance, ongoing material science innovations continually improve the performance and cost-effectiveness of substitutes. For example, advancements in composite manufacturing are making them more accessible for a wider range of automotive components, potentially impacting aluminum demand, with the global composites market projected to reach over $200 billion by 2027.

The price-performance trade-off of substitutes significantly impacts Alumetal's position. While steel remains a cheaper alternative, aluminum's superior strength-to-weight ratio, leading to enhanced fuel efficiency and reduced emissions, often makes it the preferred choice, particularly in the automotive sector. For instance, in 2024, the average cost of aluminum was approximately $2,200 per metric ton, compared to steel's roughly $600 per metric ton, highlighting the upfront cost differential.

However, this price gap is frequently offset by the long-term economic and environmental benefits aluminum offers. In electric vehicles (EVs), where weight reduction is paramount for battery range, aluminum's contribution to a lighter chassis is a critical performance enhancer. This justifies its higher initial cost for manufacturers and consumers alike, mitigating the threat from lower-priced steel in these evolving markets.

Customer propensity to substitute for aluminum is influenced by regulatory pushes for lightweighting and sustainability, which directly benefit aluminum's properties. For instance, in the automotive sector, regulations aimed at reducing CO2 emissions are a major driver for increased aluminum adoption, as it significantly lowers vehicle weight compared to steel. This trend is expected to continue, with the global automotive aluminum market projected to reach approximately $100 billion by 2028, indicating a strong customer preference for aluminum in this key industry.

Technological Advancements in Other Materials

Technological advancements in materials science present a significant threat of substitution for aluminum. Ongoing research continually yields new alloys and composite materials that may rival or surpass aluminum's performance characteristics, often at a more attractive price point. For instance, advancements in high-strength steel alloys and carbon fiber composites are increasingly making them viable alternatives in sectors like automotive and aerospace, where weight reduction and durability are paramount.

The increasing sophistication and cost-effectiveness of these alternative materials directly impact Alumetal's market position. Consider the automotive industry, a key consumer of aluminum. In 2024, the average vehicle weight continued its downward trend, partly due to the adoption of advanced steels and composites. For example, some electric vehicle manufacturers are exploring significant use of carbon fiber reinforced polymers (CFRPs) in body structures, aiming for lighter vehicles to maximize battery range. This trend directly challenges aluminum's dominance in lightweighting applications.

- Advancements in High-Strength Steel: Modern steel alloys offer improved strength-to-weight ratios, making them competitive with aluminum in certain structural applications.

- Growth of Carbon Fiber Composites: The automotive and aerospace sectors are increasingly adopting CFRPs for their exceptional strength and low weight, posing a direct substitution threat.

- Development of Advanced Plastics: Engineered polymers are also emerging as substitutes, particularly in interior components and some exterior panels, due to their cost-effectiveness and design flexibility.

- Material Cost Fluctuations: Volatility in aluminum prices can further incentivize the adoption of alternative materials if their costs remain more stable or decrease.

Shifting Industry Trends and Design Preferences

While aluminum's lightweight properties are boosting its use in automotive, with the sector targeting a 15% reduction in vehicle weight by 2030 through increased aluminum content, and construction benefits from green building mandates, a significant threat of substitutes exists. Shifts in design or manufacturing could favor other materials.

For instance, advancements in high-strength steel alloys or the increasing adoption of composite materials in aerospace and automotive could reduce the demand for aluminum. The automotive industry, a major consumer, is exploring advanced plastics and carbon fiber composites for specific components, potentially impacting aluminum alloy market share.

- Automotive Lightweighting: Target of 15% weight reduction by 2030, driving aluminum adoption but also opening doors for composites and advanced steels.

- Construction Trends: Growing demand for aluminum in green buildings, yet innovative facade systems using other materials present a substitute threat.

- Material Innovation: Continuous development in advanced plastics and carbon fiber composites offers alternatives that could displace aluminum in certain applications.

The threat of substitutes for aluminum alloys is significant, driven by ongoing material science innovations and cost-performance trade-offs. While aluminum excels in lightweighting, crucial for automotive fuel efficiency and EV range, alternative materials like advanced high-strength steels (AHSS) and carbon fiber composites are increasingly competitive. For example, in 2024, the automotive sector continues to explore AHSS for vehicle frames, offering comparable strength-to-weight ratios at a potentially lower cost, with some automakers reporting substantial material cost savings. The global composites market is projected to exceed $200 billion by 2027, indicating a growing acceptance of these alternatives.

| Material | Key Substitute Properties | 2024 Price (approx. USD/ton) | Key Application Areas |

|---|---|---|---|

| Aluminum Alloys | Lightweight, Corrosion Resistance | $2,200 | Automotive, Aerospace, Construction |

| Advanced High-Strength Steel (AHSS) | High Strength, Cost-Effective | $600 | Automotive (structural components) |

| Carbon Fiber Composites (CFRP) | Exceptional Strength-to-Weight, Stiffness | $15,000 - $50,000+ | Automotive (body panels, chassis), Aerospace |

| Engineered Plastics | Design Flexibility, Cost-Effectiveness | $1,500 - $5,000 | Automotive (interior, some exterior), Consumer Goods |

Entrants Threaten

The capital required to enter the aluminum alloy production market is a formidable barrier. Establishing a facility capable of competing with established players like Alumetal, which boasts a significant production capacity of 275,000 tons per year, demands massive investment in specialized machinery, advanced technology, and robust infrastructure. This high upfront cost deters many potential new entrants.

Existing players like Alumetal leverage significant economies of scale. This advantage is particularly pronounced in purchasing large volumes of scrap aluminum, which can lead to lower per-unit costs. For instance, in 2024, major aluminum producers often secure raw material prices through long-term contracts and bulk purchasing power, a feat difficult for newcomers to replicate.

Furthermore, optimized production processes and established distribution networks contribute to cost efficiencies for incumbent firms. A new entrant would face substantial upfront investment to build comparable infrastructure and achieve similar production volumes, making it challenging to compete on price against established players like Alumetal who benefit from years of operational refinement.

Alumetal's established long-term partnerships with major automotive manufacturers present a significant barrier to new entrants. These deep-rooted relationships grant Alumetal privileged access to critical distribution channels, a network that is difficult and time-consuming for newcomers to replicate. For instance, in 2023, Alumetal reported that over 70% of its revenue was derived from long-term supply agreements with key automotive clients, highlighting the strength of these distribution ties.

Raw Material Access and Supply Chain Expertise

Newcomers face a significant hurdle in accessing and managing the raw material supply chain for aluminum. While aluminum scrap is generally plentiful, consistently obtaining high-grade scrap and navigating the intricate logistics of a scrap-dependent operation demands specialized knowledge and pre-existing connections that new entrants would not possess.

Alumetal's reliance on scrap, a key factor in its cost structure, highlights this barrier. In 2023, the company reported that scrap materials constituted a substantial portion of its input, underscoring the importance of established supplier networks and logistical prowess. For instance, the global aluminum scrap market, while large, is fragmented, making it challenging for new players to secure reliable and premium sources without prior industry experience and relationships.

- Supply Chain Complexity: Managing the collection, sorting, and processing of diverse aluminum scrap streams requires significant operational expertise.

- Quality Control: Ensuring the consistent quality of scrap is crucial for producing high-grade aluminum products, a challenge for new entrants lacking established quality assurance protocols.

- Logistical Costs: The transportation and handling of scrap materials can incur substantial costs, which new entrants may struggle to optimize without established logistical efficiencies.

- Established Relationships: Access to premium scrap often depends on long-standing relationships with suppliers, a distinct advantage for incumbents like Alumetal.

Regulatory and Environmental Hurdles

The aluminum sector, especially for applications like automotive, faces significant environmental regulations and stringent quality standards. New companies entering this space must be prepared to invest heavily in compliant technologies and navigate these complex legal frameworks.

For instance, the European Union's stringent emissions standards and the growing demand for recycled content in automotive manufacturing present substantial entry barriers. In 2024, the automotive industry's push for lighter materials to improve fuel efficiency and reduce emissions means that aluminum suppliers must meet increasingly rigorous specifications for alloy composition and performance.

- Environmental Compliance Costs: New entrants must factor in the capital expenditure for advanced emission control systems and waste management, which can be substantial.

- Quality Certification: Achieving certifications required by major industries like automotive can take years and significant investment in process control and testing infrastructure.

- Regulatory Landscape Complexity: Navigating differing regulations across various geographical markets adds another layer of difficulty and cost for potential new entrants.

The threat of new entrants in the aluminum alloy production market is moderate. High capital requirements, estimated in the hundreds of millions of dollars for a competitive facility, alongside established economies of scale enjoyed by players like Alumetal, create significant financial hurdles. Additionally, securing reliable, high-quality scrap aluminum and navigating complex regulatory landscapes, particularly environmental standards, demand substantial upfront investment and expertise.

Alumetal's strong customer relationships, especially within the automotive sector, further solidify its market position. In 2023, over 70% of Alumetal's revenue stemmed from long-term supply agreements, a testament to the difficulty new entrants face in penetrating these established distribution channels. The need for specialized technology and process optimization also contributes to the barriers, requiring years of operational refinement to match incumbent efficiency.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | Establishing a competitive aluminum alloy production facility requires substantial investment in machinery, technology, and infrastructure. | High; deters many potential entrants. | Estimated $100M+ for a modern facility. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large-scale raw material purchasing and optimized production. | Significant; makes price competition difficult for newcomers. | Alumetal's 275,000 tons/year capacity allows for bulk scrap purchasing advantages. |

| Customer Relationships & Distribution | Long-term supply agreements and established distribution networks are difficult to replicate. | High; limits market access for new players. | Alumetal derived over 70% of 2023 revenue from long-term automotive contracts. |

| Raw Material Access (Scrap) | Securing consistent, high-grade aluminum scrap requires specialized knowledge and pre-existing supplier relationships. | Moderate to High; logistical and quality control challenges. | Fragmented global scrap market requires established networks for premium sources. |

| Regulatory & Quality Standards | Meeting stringent environmental regulations and industry-specific quality certifications is costly and time-consuming. | Moderate; requires significant investment in compliance and certification. | EU emissions standards and automotive recycled content demands add complexity. |

Porter's Five Forces Analysis Data Sources

Our Alumetal Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Alumetal's annual reports, investor presentations, and industry-specific market research from firms like CRU and Wood Mackenzie. We also incorporate data from financial news outlets and regulatory filings to capture the broader economic and competitive landscape.