Altron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altron Bundle

Altron's strategic positioning is defined by its strong technological capabilities and established market presence, yet it faces evolving industry dynamics and competitive pressures. Understanding these internal strengths and external threats is crucial for navigating its future growth.

Want the full story behind Altron's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Altron has showcased impressive financial strength, with operating profit from continuing operations jumping 50% to R972 million for the financial year ending February 2025. This robust growth is further underscored by a 27% increase in EBITDA, reaching R1.8 billion.

The company's interim results for the six months ending August 2024 also highlight a significant upward trend, reporting a 49% rise in EBITDA and an operating profit that more than doubled. These positive financial indicators have directly translated into higher headline earnings per share and increased dividends, demonstrating effective strategic implementation.

Altron boasts a highly diversified portfolio, offering a comprehensive suite of digital transformation solutions and technology services that span critical sectors like financial services, healthcare, and government. This broad market penetration is a significant strength, reducing the company's exposure to downturns in any single industry.

The company's strategic restructuring into distinct platforms such as Netstar, Altron FinTech, and Altron HealthTech, alongside IT Services and Distribution segments, enables sharper focus and more targeted service delivery. This organizational approach is designed to foster growth within each specialized area.

For the fiscal year ending February 29, 2024, Altron reported revenue of R29.7 billion, demonstrating the scale of its operations across these diverse segments. This diversification is key to Altron's resilience, allowing it to leverage opportunities across multiple economic landscapes.

Altron is increasingly concentrating on generating revenue from high-margin, annuity-style services, especially within its Platforms division. This strategic pivot towards predictable, recurring income enhances the company's profitability and financial stability.

The success of this approach is evident in Altron FinTech's performance, which achieved a strong EBITDA margin of 36% in the fiscal year 2025. This demonstrates the effectiveness of their strategy in building a robust and profitable recurring revenue base.

Established Market Leadership and Legacy in South Africa

Altron boasts a formidable market leadership position in South Africa, built over six decades. This extensive history, beginning in 1965, has cemented its reputation as a pioneer and trusted entity within the nation's technology landscape. The company is a key digital transformation partner for a substantial number of South Africa's largest listed companies and plays a vital role in delivering essential services to the public sector.

This deep-rooted presence and established trust translate into significant competitive advantages. Altron's long-standing relationships and understanding of the South African market are invaluable assets. For instance, Altron's continued success in securing and maintaining contracts with major JSE Top 100 companies underscores its enduring relevance and capability.

- Pioneering Legacy: Altron has been a foundational player in South Africa's technology sector since its inception.

- Trusted Partner: It serves as a critical digital transformation partner for a significant portion of the JSE Top 100 companies.

- Public Sector Impact: Altron provides essential national solutions, demonstrating its importance to government operations.

- Market Penetration: This deep market penetration and long-standing reputation offer a distinct competitive edge.

Customer-Centric Approach and Strategic Execution

Altron's customer-centric approach, under current leadership, has been a significant strength. The company has strategically focused on enhancing customer service levels, aiming to solidify its position as a leading platform and IT services provider in its key markets. This dedication to customer satisfaction is a core element of their growth strategy.

This customer-obsessed strategy, coupled with deliberate investments in its technological platforms and internal systems, has yielded tangible positive outcomes. These strategic moves have not only driven operational improvements but have also demonstrably contributed to enhanced shareholder value, reflecting a well-executed business plan.

- Customer Focus: Altron prioritizes customer service levels as a key differentiator.

- Strategic Investments: Targeted investments in platforms and systems support the customer-centric model.

- Value Creation: The strategy has led to positive results and increased shareholder value.

Altron's financial performance demonstrates significant strength, with operating profit from continuing operations reaching R972 million for the financial year ending February 2025, a 50% increase. This is complemented by a 27% rise in EBITDA to R1.8 billion, showcasing effective operational management and growth.

The company's strategic focus on high-margin, annuity-style services, particularly within its Platforms division, is yielding strong results, exemplified by Altron FinTech's impressive 36% EBITDA margin in FY2025. This shift towards recurring revenue enhances profitability and financial stability.

Altron's market leadership in South Africa, built over six decades, provides a substantial competitive advantage. Its role as a digital transformation partner for major listed companies and its provision of essential public sector services underscore its deep market penetration and established trust.

| Metric | FY2024 | FY2025 (Est.) | Change |

| Operating Profit (R million) | 648 | 972 | +50% |

| EBITDA (R million) | 1,417 | 1,800 | +27% |

| Altron FinTech EBITDA Margin | 30% | 36% | +6 pp |

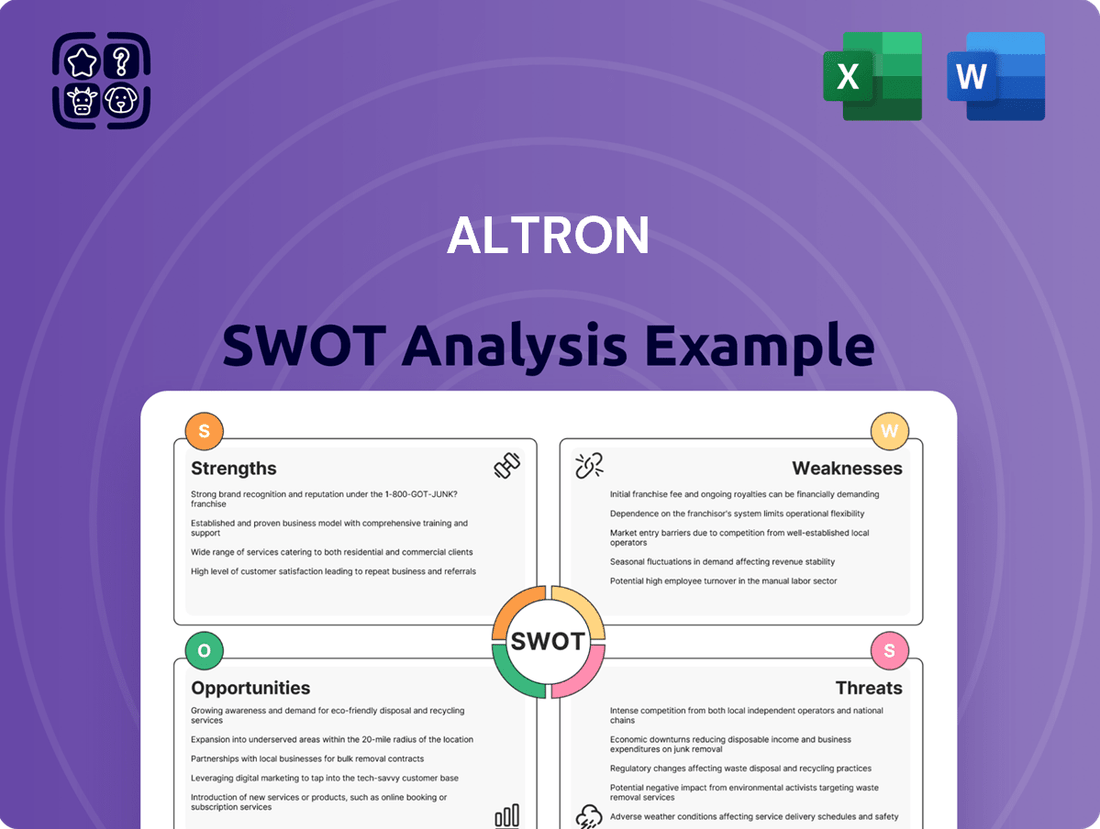

What is included in the product

Delivers a strategic overview of Altron’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Altron's revenue from its continuing operations showed a flat trend, reaching R9.6 billion for the financial year ending February 2025. This stagnation, partly due to the strategic divestment of the ATM Business, highlights a hurdle in achieving substantial top-line growth across its remaining operations amidst prevailing economic conditions.

The flat revenue performance extends to certain key segments, such as Altron Digital Business, which also reported no significant increase in its revenue. This underscores a broader challenge in expanding the company's sales footprint and market share in its core areas.

Altron's IT Services division, a significant contributor to its revenue, has felt the pinch of South Africa's volatile economic and political climate. This uncertainty often causes businesses to postpone or scale back large IT investments, directly impacting Altron's project pipeline and, consequently, its financial performance in key areas. For instance, during fiscal year 2024, a slowdown in government IT spending, influenced by political shifts, presented challenges for the sector.

Altron navigates intensely competitive sectors, with rivals like Cartrack posing a significant threat in vehicle telematics. This rivalry pressures Altron to constantly innovate and adapt to retain its market position and pricing strength.

The increasing competition, particularly with potential new players entering AI hardware markets, demands sustained investment in research and development. Altron must remain agile to counter emerging threats and secure its competitive edge.

Challenges in Talent Acquisition and Retention

Altron faces a significant hurdle with a critical skills shortage, especially in specialized fields like skilled hardware engineering. This global scarcity directly impacts the company's capacity to secure and keep the necessary expertise.

The challenge of sourcing and retaining top-tier talent in a highly competitive and constrained global market is a persistent weakness. This difficulty could hinder Altron's progress in innovation and the successful execution of its strategic plans.

- Skills Shortage: Global demand for skilled hardware engineers outstrips supply, creating a bottleneck for Altron.

- Retention Difficulty: Keeping highly sought-after employees is a constant battle in the current talent landscape.

- Impact on Strategy: Inability to acquire or retain key talent can delay or derail crucial innovation and growth initiatives.

Impact of Past Discontinued Operations and Restructuring

The unbundling of Bytes UK in 2020 and the sale of the ATM business, while strategic moves, did notably affect Altron's financial performance in prior reporting periods, leading to a reduction in overall revenue and profit. For instance, in the fiscal year ended February 29, 2020, Altron reported a significant drop in headline earnings per share following these divestitures.

Furthermore, the reclassification of Altron Document Solutions as discontinued operations in subsequent financial statements indicates a period of strategic recalibration. This ongoing process of adjusting the business portfolio can introduce a degree of operational instability or market uncertainty as the company refines its focus.

- Bytes UK Unbundling Impact: Reduced reported revenue and profitability in FY2020.

- ATM Business Sale: Contributed to the decline in overall group financial figures in previous periods.

- Altron Document Solutions Reclassification: Signifies ongoing strategic adjustments and potential operational shifts.

Altron's revenue from continuing operations remained flat at R9.6 billion for the financial year ending February 2025, indicating challenges in driving top-line growth across its remaining businesses. This stagnation is partly due to the strategic divestment of the ATM Business, which reduced its overall scale. The company's IT Services division is also susceptible to South Africa's volatile economic and political climate, which can delay large IT investments, impacting Altron's project pipeline. For example, a slowdown in government IT spending in FY2024 presented such challenges.

Altron operates in highly competitive markets, facing rivals like Cartrack in vehicle telematics, which necessitates continuous innovation to maintain market share and pricing power. Emerging threats in AI hardware markets also demand significant R&D investment to stay competitive. A critical weakness identified is a global shortage of specialized skills, particularly in hardware engineering, which directly impacts Altron's ability to secure and retain essential expertise, potentially hindering strategic initiatives and innovation progress.

Preview the Actual Deliverable

Altron SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt from the comprehensive report. Once purchased, you'll gain access to the complete, detailed analysis.

Opportunities

The push for digital transformation in South Africa is accelerating, with businesses actively seeking technology solutions to boost efficiency and discover new income sources. This trend presents a prime opportunity for Altron, as companies increasingly rely on digital capabilities to stay competitive.

Altron's Digital Business segment is strategically positioned to benefit from this heightened demand. For instance, in the financial year ending February 2024, Altron reported a 10% increase in revenue for its Information Technology Services division, largely driven by digital transformation projects for key clients.

Altron can significantly bolster its Platforms segment, which includes strong performers like Netstar, FinTech, and HealthTech. This expansion involves growing Netstar's subscriber numbers and increasing Altron FinTech's SME customer base.

A key growth avenue lies in leveraging Altron HealthTech's extensive health records database to introduce novel, data-driven services. For example, in the fiscal year ending February 2024, Altron reported a 14% increase in revenue for its Information Technology Services segment, which encompasses these platforms, reaching R13.7 billion.

Altron's strategic investment in artificial intelligence and advanced data analytics presents a substantial opportunity to monetize its vast data resources. By leveraging platforms that already process billions of data points, the company can develop sophisticated AI-driven solutions. These solutions are poised to optimize operations, deliver deeper customer insights, and create entirely new service revenue streams.

Growth in Cloud and Edge Computing Solutions

The demand for cloud infrastructure managed services in South Africa is experiencing significant growth, with a reported year-on-year increase of 25%. This robust expansion highlights a substantial market opportunity for Altron within the IT services sector.

Globally, edge computing is seeing increased activity, fueled by the need for proximity and reduced latency in data processing. This trend directly benefits Altron's offerings in modular data center solutions, positioning the company to capitalize on this evolving technological landscape.

Altron is well-positioned to assist clients in optimizing their cloud expenditures and facilitating efficient application migration. This capability addresses a critical need for businesses navigating complex cloud environments.

- 25% year-on-year growth in South Africa's cloud infrastructure managed services market.

- Increasing global activity in Edge networks drives demand for low-latency solutions.

- Altron's modular data center solutions are a direct fit for edge computing opportunities.

- Optimization of cloud spend and efficient application migration are key services Altron can provide.

Strategic Partnerships and International Expansion

Altron's proven track record of successful strategic acquisitions and partnerships provides a strong foundation for future growth. By continuing to forge collaborations, the company can further enhance its comprehensive service offerings, particularly in areas like cloud services and cybersecurity, which are experiencing robust demand. For example, Altron's acquisition of LGR Telecommunications in 2023 aimed to bolster its ICT capabilities, demonstrating a commitment to inorganic growth that can be replicated.

International expansion presents a significant opportunity, with Altron's Netstar division already targeting high-growth markets. Southeast Asia, in particular, has been identified as a key region for expansion, driven by increasing digital transformation initiatives and a growing demand for connected vehicle solutions. Netstar's existing presence in Australia, a similar market, suggests a replicable model for success in new international territories.

- Strategic Acquisitions: Continued investment in acquiring companies that complement Altron's existing portfolio, such as those in AI or advanced data analytics, can accelerate market penetration and innovation.

- Partnership Ecosystem: Deepening relationships with technology providers and channel partners globally can expand Altron's reach and service delivery capabilities.

- Netstar's Global Reach: Leveraging Netstar's success in established markets to drive expansion into emerging economies, especially in Southeast Asia, where digital adoption is rapidly increasing.

- Diversified Revenue Streams: International expansion can lead to more diversified revenue streams, reducing reliance on any single market and mitigating economic risks.

Altron's strategic focus on digital transformation aligns perfectly with the growing demand for advanced technology solutions across various industries in South Africa. The company's Digital Business segment, which saw a 10% revenue increase in its IT Services division for FY24, is well-positioned to capitalize on this trend. Furthermore, expanding its Platforms segment, including Netstar and Altron FinTech, presents a clear opportunity for growth, with Netstar aiming to increase its subscriber base and FinTech targeting a larger SME customer market.

The robust growth in South Africa's cloud infrastructure managed services market, estimated at 25% year-on-year, offers a significant avenue for Altron. The company can leverage its expertise to assist clients with cloud expenditure optimization and application migration, addressing a critical market need. Additionally, the global rise of edge computing, driven by demand for low-latency data processing, directly benefits Altron's modular data center solutions, positioning it to capture this evolving technological landscape.

Altron's history of successful acquisitions and partnerships, such as the 2023 acquisition of LGR Telecommunications to enhance ICT capabilities, provides a strong foundation for future expansion. International growth, particularly through Netstar into markets like Southeast Asia, represents another key opportunity, leveraging its existing success in similar regions like Australia. This diversification can lead to more resilient revenue streams.

| Opportunity Area | Key Driver | Altron's Position/Action | Relevant Data Point |

| Digital Transformation | Increased business demand for digital solutions | Strengthen Digital Business segment | 10% revenue increase in IT Services (FY24) |

| Platform Growth | Demand for connected vehicle and SME financial solutions | Expand Netstar subscribers & FinTech SME base | FY24 IT Services revenue R13.7 billion |

| Cloud Managed Services | Growing adoption of cloud infrastructure | Offer cloud optimization and migration services | 25% year-on-year growth in SA cloud market |

| Edge Computing | Need for low-latency data processing | Leverage modular data center solutions | Increasing global edge network activity |

| Strategic Acquisitions & Partnerships | Enhance service offerings and market reach | Acquire complementary businesses, forge collaborations | Acquisition of LGR Telecommunications (2023) |

| International Expansion | Growth in digital initiatives in emerging markets | Expand Netstar into Southeast Asia | Netstar's success in Australia as a model |

Threats

Persistent economic and political uncertainty in South Africa presents a significant threat to Altron. This instability can dampen corporate spending on crucial IT projects, as businesses become hesitant to invest during uncertain times. Furthermore, a decline in consumer confidence directly impacts demand for Altron's products and services.

Currency fluctuations, particularly the volatility of the South African Rand, pose another substantial risk. A weaker Rand increases the cost of importing essential technology components, directly impacting Altron's cost of goods sold. This can also negatively affect the profitability of Altron's international operations, as earnings from foreign markets translate into fewer Rand when repatriated.

The technology landscape is a whirlwind of constant change, with new competitors and game-changing innovations appearing regularly. Altron operates in this environment, where staying ahead means continuous adaptation to client demands and technological shifts.

Failure to innovate risks Altron losing ground to rivals who are quicker to adopt emerging technologies or meet evolving customer expectations. For instance, the global IT services market, a key area for Altron, saw significant growth and disruption in 2024, with cloud computing and AI services becoming increasingly dominant, putting pressure on established players to adapt their offerings.

As a technology solutions provider, Altron faces substantial cybersecurity risks, especially since the global cost of data breaches reached an average of $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. Handling sensitive data across diverse sectors like finance and healthcare makes Altron a prime target.

A significant data breach or security lapse could expose Altron to severe financial penalties, potentially running into millions, and cause irreparable reputational damage. This erosion of customer trust, a critical asset for any tech firm, could directly impact its long-term business prospects and market position.

Talent Drain and Skills Shortage

The global IT talent market is intensely competitive, with a significant shortage in key areas like cloud computing, artificial intelligence, and cybersecurity. This scarcity directly impacts Altron's ability to secure the specialized expertise needed for innovation and service delivery. For instance, a 2024 report indicated that the demand for cybersecurity professionals outstripped supply by over 3.4 million globally.

Failure to attract and retain highly skilled individuals could impede Altron's capacity to implement cutting-edge solutions and maintain a competitive edge. This talent drain not only affects current operations but also poses a long-term risk to the company's growth trajectory and ability to adapt to evolving technological landscapes.

- Global IT skills gap: Millions of unfilled roles in critical tech sectors.

- Impact on Altron: Hindered innovation and service delivery due to lack of specialized talent.

- Retention challenges: Increased competition for top performers in the tech industry.

- Competitive disadvantage: Difficulty in keeping pace with technological advancements without adequate skilled personnel.

Regulatory and Compliance Changes

Altron operates across highly regulated sectors, including financial services and healthcare, making it susceptible to shifts in compliance landscapes. For instance, evolving data privacy regulations, such as potential updates to POPIA in South Africa or GDPR-like frameworks, could demand substantial investments in data management and security infrastructure. The company's agility might be tested as it adapts to new industry-specific mandates, potentially impacting operational costs and the pace of innovation.

Changes in cybersecurity compliance, a critical area given Altron's technology focus, could also present a significant threat. Failure to meet updated standards, for example, in cloud security or data encryption, could lead to penalties, reputational damage, and increased operational expenses. Altron's 2024 financial year saw a significant focus on digital transformation, which inherently increases exposure to these evolving regulatory demands.

- Increased Compliance Costs: Adapting to new regulations can require significant capital expenditure on technology and personnel.

- Operational Disruptions: Sudden regulatory changes may necessitate temporary halts or modifications to existing business processes.

- Market Access Limitations: Non-compliance could restrict Altron's ability to operate in certain jurisdictions or offer specific services.

- Reputational Risk: Breaches or failures in compliance can severely damage customer trust and brand image.

Altron faces significant threats from a rapidly evolving technology landscape, where staying competitive requires constant adaptation to new innovations and client demands. The global IT services market, for instance, saw substantial disruption in 2024 with the rise of AI and cloud services, pressuring established players like Altron to update their offerings. Failure to innovate risks losing market share to more agile competitors.

Intensifying competition in the global IT talent market, marked by a shortage of skilled professionals in areas like AI and cybersecurity, poses another major threat. Reports from 2024 highlighted millions of unfilled cybersecurity roles worldwide, directly impacting Altron's ability to secure the expertise needed for innovation and service delivery. This talent scarcity can hinder growth and the adoption of new technologies.

Altron's operations are also threatened by stringent and evolving regulatory environments, particularly in sectors like finance and healthcare. New data privacy laws and cybersecurity compliance standards, such as potential updates to South Africa's POPIA, could necessitate significant investment in infrastructure and processes. Non-compliance can lead to penalties and reputational damage, as seen in the global trend of increasing data breach costs, which averaged $4.45 million in 2024.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data Point |

|---|---|---|---|

| Technological Disruption | Rapid obsolescence of existing solutions | Loss of competitive edge, reduced market share | Global IT services market growth driven by AI and Cloud in 2024 |

| Talent Shortage | Difficulty in attracting and retaining skilled IT professionals | Hindered innovation, increased operational costs | Over 3.4 million unfilled cybersecurity roles globally in 2024 |

| Regulatory Compliance | Changes in data privacy and cybersecurity laws | Increased compliance costs, operational disruptions, reputational damage | Average cost of a data breach reached $4.45 million in 2024 |

| Economic Instability | Dampened corporate spending due to uncertainty | Reduced demand for IT projects and services | South African economic growth forecasts for 2024/2025 impacting business investment |

SWOT Analysis Data Sources

This Altron SWOT analysis is built upon a robust foundation of data, drawing from Altron's official financial reports, comprehensive market research, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.