Altron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altron Bundle

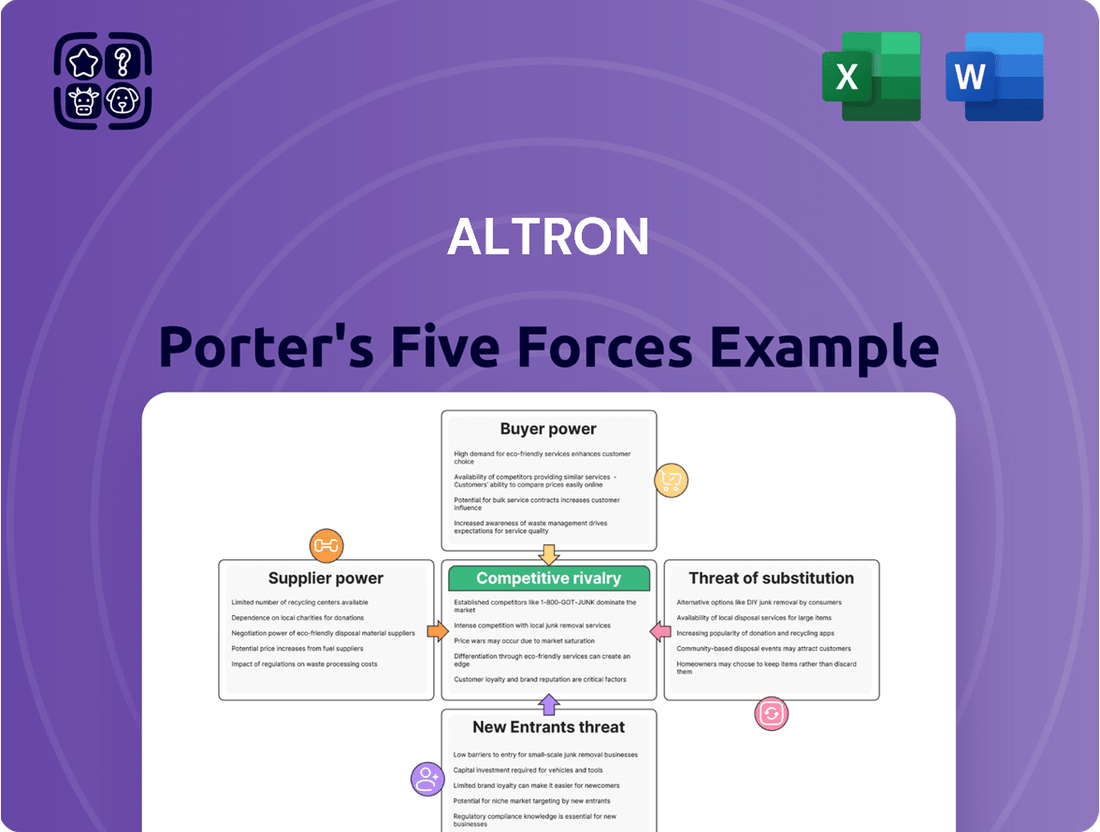

Altron's competitive landscape is shaped by five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Altron’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for Altron's essential technology components and services significantly impacts their bargaining power. Should a limited number of major suppliers dominate critical software, hardware, or specialized IT expertise, these entities gain considerable leverage over Altron concerning pricing and contract conditions.

Altron's dependence on specific vendors for proprietary technologies or necessary licenses further amplifies supplier power. For instance, if Altron relies heavily on a single provider for a core cloud infrastructure service or a specialized cybersecurity platform, that provider can dictate terms more forcefully, potentially leading to higher costs or less favorable service level agreements for Altron.

The costs Altron would face when switching suppliers significantly influence supplier bargaining power. If transitioning from a current supplier's platform or technology is intricate, lengthy, and costly, suppliers gain leverage. These costs can encompass retraining personnel, migrating data, and the potential for service interruptions for Altron's clients.

Suppliers providing highly specialized or unique technology solutions, particularly those not easily replicated, significantly strengthen their bargaining position. Altron's reliance on such suppliers for critical innovations, like advanced AI-driven analytics or proprietary software platforms, directly translates into increased supplier leverage.

For instance, in the rapidly evolving cybersecurity landscape, a supplier offering a unique threat intelligence platform that Altron deems essential for its client services could command higher prices or more favorable terms. This dependence on niche expertise or intellectual property, especially in areas like quantum-resistant encryption, amplifies the bargaining power of these specialized providers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward significantly amplifies their bargaining power over Altron. If suppliers can credibly enter Altron's market by offering similar technology solutions or managed services directly to Altron's clientele, they gain leverage. This potential competition can compel Altron to accept less favorable terms to preserve crucial supplier relationships and avoid direct rivalry in its core business areas.

For example, a key software provider to Altron might develop its own consulting arm, directly competing for Altron's managed services contracts. This scenario is more likely if the supplier possesses unique technological expertise and sees a clear market opportunity. In 2024, the IT services market saw continued consolidation, with larger tech firms increasingly offering end-to-end solutions, a trend that could encourage upstream players to consider direct client engagement.

- Supplier Capability: Suppliers with proprietary technology or specialized knowledge are better positioned for forward integration.

- Market Attractiveness: High profit margins or underserved segments in Altron's client base can incentivize supplier integration.

- Competitive Landscape: A fragmented market for Altron's services makes it easier for a forward-integrating supplier to gain traction.

Importance of Altron to Suppliers

The relative importance of Altron as a customer significantly influences its bargaining power with suppliers. If Altron constitutes a substantial portion of a supplier's revenue, that supplier is likely more motivated to offer favorable terms and maintain a strong relationship to secure Altron's continued business. This dependence can dilute the supplier's leverage.

Conversely, when Altron represents only a minor part of a supplier's overall sales, the supplier gains considerable bargaining power. In such scenarios, suppliers are less reliant on Altron and can dictate terms more assertively, knowing that losing Altron's business would have a minimal impact on their own financial performance.

For instance, if a key component supplier's sales are heavily weighted towards Altron, perhaps representing over 20% of their annual turnover, Altron's ability to negotiate pricing and delivery schedules would be enhanced. However, if Altron accounts for less than 5% of a supplier's revenue, that supplier holds a stronger hand in any negotiation.

- Supplier Dependence: The degree to which a supplier relies on Altron for revenue.

- Negotiating Leverage: Higher dependence on Altron reduces supplier power; lower dependence increases it.

- Customer Value: Altron's significance as a client directly impacts its ability to secure favorable terms.

The bargaining power of suppliers for Altron is influenced by several factors, including supplier concentration, the uniqueness of their offerings, and the switching costs Altron faces.

In 2024, the IT services sector continued to see consolidation, meaning fewer, larger suppliers might control critical components, thereby increasing their leverage over companies like Altron. For instance, if a key cloud service provider, which might represent a significant portion of Altron's operational infrastructure, is one of only a few major players, their ability to dictate pricing and terms is amplified.

The cost and complexity of switching from one supplier to another is a crucial determinant. If Altron relies on specialized software or hardware that requires extensive integration and retraining, suppliers of these items hold considerable power. This is particularly relevant in areas like advanced analytics or cybersecurity solutions where proprietary technology is common.

Furthermore, the threat of suppliers integrating forward into Altron's market can significantly enhance their bargaining power. Should a supplier possess unique technology and see an opportunity to offer similar services directly to Altron's clients, they gain leverage, potentially forcing Altron to accept less favorable terms to maintain the relationship.

| Factor | Impact on Altron | Example Scenario (2024 Context) |

|---|---|---|

| Supplier Concentration | Increased Power | A few dominant cloud infrastructure providers controlling essential services |

| Switching Costs | Increased Power | High costs associated with migrating proprietary AI platforms |

| Forward Integration Threat | Increased Power | Software vendors developing consulting arms to compete for managed services |

| Altron's Customer Value | Decreased Power | Altron representing a small fraction of a key component supplier's revenue |

What is included in the product

Analyzes the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and threat of substitutes within Altron's operating environment.

Instantly identify and neutralize competitive threats with a dynamic visualization of all five forces, providing clarity on market pressures.

Customers Bargaining Power

Customer concentration significantly impacts Altron's bargaining power. If a few major clients account for a large chunk of Altron's revenue, those clients gain considerable leverage to negotiate lower prices or demand tailored services, potentially squeezing Altron's profit margins.

Altron's diverse client base spans sectors like financial services, healthcare, and government. For instance, in the financial services sector, while there are many institutions, a few dominant players could represent a substantial portion of Altron's business, increasing their individual bargaining power.

Customer switching costs significantly influence Altron's bargaining power. When Altron's technology solutions are deeply integrated, making it complex and expensive for clients to switch to a competitor, customer power diminishes. For instance, if a client's operations rely heavily on Altron's proprietary software requiring extensive data migration and system re-integration, the cost and disruption associated with changing providers would be substantial, thereby reducing the customer's leverage.

Customers' sensitivity to price is a major factor in their bargaining power. In the IT services sector, where many solutions can be seen as commodities, clients often shop around for the best deal. For instance, a 2024 market report indicated that over 60% of IT procurement decisions in the mid-market were heavily influenced by price for standard software and hardware. This makes customers quite powerful when they can easily switch providers for similar services.

However, this price sensitivity isn't uniform across all of Altron's potential offerings. For highly specialized or mission-critical digital transformation projects, the focus shifts from just cost to the value and efficiency gains a provider can deliver. If Altron can demonstrate tangible benefits, like significant cost savings through automation or improved operational performance, customers may be willing to pay a premium. In such cases, their bargaining power based solely on price diminishes.

Threat of Backward Integration by Customers

Customers' potential to develop their own in-house technology solutions or managed services significantly amplifies their bargaining power. This threat of backward integration means clients can reduce their dependence on external providers like Altron.

Large organizations, especially those in demanding sectors such as financial services or government, often possess the financial muscle and technical expertise to build their own IT infrastructure and software. This capability allows them to bypass third-party vendors, thereby exerting greater control over costs and service delivery.

- Customer Integration Capability: The ability of large clients to develop proprietary IT solutions or manage their own services poses a direct threat to Altron's market position.

- Resource Availability: Major enterprises in finance and public sectors often have substantial capital and skilled personnel to undertake in-house IT development.

- Reduced Vendor Reliance: Successful backward integration by customers directly translates to a diminished need for Altron's offerings, increasing customer leverage.

Availability of Substitute Solutions for Customers

The bargaining power of Altron's customers is significantly influenced by the availability of substitute solutions. If clients can easily find comparable IT services or technologies from competitors, or even develop solutions in-house, they gain leverage to demand more favorable pricing and terms from Altron.

For instance, the increasing prevalence of cloud-based services and the maturity of open-source software present viable alternatives for many businesses that might otherwise rely on Altron's proprietary or managed solutions. This competitive landscape means customers can readily switch providers if Altron's offerings do not meet their price or performance expectations.

- Increased competition from cloud providers and open-source alternatives empowers customers.

- Customers can negotiate better terms due to readily available substitute IT solutions.

- Altron faces pressure to remain competitive in pricing and service quality.

The bargaining power of Altron's customers is a significant factor, influenced by client concentration, switching costs, and price sensitivity. When a few large clients dominate Altron's revenue, their leverage increases, allowing them to negotiate better terms. High switching costs, however, can mitigate this power by making it expensive for clients to move to competitors.

Price sensitivity is particularly high for standard IT services, where customers can readily compare offerings. A 2024 report noted that over 60% of mid-market IT procurement decisions were heavily price-driven for basic software and hardware. This dynamic empowers customers, especially when substitute solutions are abundant.

| Factor | Impact on Altron's Customer Bargaining Power | Example/Data Point |

|---|---|---|

| Customer Concentration | High concentration increases customer power. | A few dominant financial institutions could represent a substantial portion of Altron's business. |

| Switching Costs | High switching costs decrease customer power. | Deep integration of Altron's proprietary software makes client transitions costly. |

| Price Sensitivity | High sensitivity increases customer power for standard services. | Over 60% of mid-market IT procurement in 2024 was price-influenced for basic IT. |

| Availability of Substitutes | Abundant substitutes increase customer power. | Cloud services and open-source software offer viable alternatives to Altron's solutions. |

Preview the Actual Deliverable

Altron Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Altron, detailing the competitive landscape and strategic implications. The document you see here is precisely the same professionally formatted and insightful analysis you will receive immediately after purchase. You can confidently expect to download this exact file, ready for immediate use and application to your business strategy.

Rivalry Among Competitors

The South African IT services landscape is intensely competitive, populated by a wide array of players. Altron contends with established giants such as Dimension Data, EOH, and BCX, alongside a multitude of smaller, specialized firms. This broad spectrum of competitors, differing in scale, service specialization, and client focus, creates a dynamic and challenging environment.

The pace at which the South African IT services market expands directly impacts how fiercely companies compete. A robust growth trajectory, with the market expected to grow from R104.9 billion in 2024 to R182 billion by 2028, fueled by cloud adoption and digitalization, generally eases competitive pressure as there's enough business for everyone.

However, this dynamic can shift. If specific segments of the IT market experience a slowdown in their growth rates, companies will likely intensify their efforts to capture existing customers, leading to a sharper competitive rivalry within those particular niches.

The degree to which Altron's digital transformation solutions, managed services, and technology offerings stand out from rivals significantly influences competitive rivalry. If Altron's services are seen as similar to competitors, the market can easily devolve into price wars, squeezing profit margins for everyone.

Altron actively seeks to differentiate by offering integrated solutions that combine various technology services and a strong customer-centric approach. This strategy aims to reduce direct competition based solely on price, as clients value the comprehensive and tailored support provided. For instance, in 2024, Altron reported a significant increase in revenue from its integrated solutions, suggesting a positive market reception to this differentiation strategy.

High Fixed Costs and Storage Capacity

High fixed costs in the IT sector, particularly for infrastructure, software development, and specialized talent, create a significant barrier to entry and can fuel intense competition among existing players. Companies heavily invested in these areas often need to maintain high utilization rates to justify their capital expenditures.

This pressure to keep assets running can lead to aggressive pricing, especially in areas like managed IT services and cloud infrastructure, as firms strive to secure market share and cover their substantial overheads. For instance, in 2024, cloud infrastructure providers continue to compete fiercely on price, with major players like AWS, Azure, and Google Cloud offering significant discounts for long-term commitments and high-volume usage to maximize their data center capacity.

- Intensified Price Wars: High fixed costs compel companies to operate at near-full capacity, often resulting in price reductions to secure contracts and cover operational expenses.

- Focus on Scale: Businesses with substantial investments in IT infrastructure are motivated to achieve economies of scale, further intensifying rivalry as they seek to spread fixed costs over a larger customer base.

- Managed Services Pressure: In the managed IT services market, companies with large teams and extensive software licenses must constantly win new business to cover these ongoing, high fixed costs, driving competitive pricing.

Exit Barriers

High exit barriers in the IT services sector mean that companies finding it tough to turn a profit often can't just pack up and leave easily. This is because they might have specialized equipment, ongoing service contracts that are hard to break, or significant costs associated with laying off their skilled workforce. For instance, in 2024, many IT firms invested heavily in cloud infrastructure and specialized software development tools, making a swift departure costly.

When these exit barriers are high, unprofitable competitors tend to stick around, continuing to compete fiercely even if their profit margins are razor-thin. This prolonged competition intensifies the rivalry for everyone in the market. A report from Gartner in late 2023 indicated that the average IT services company faced an estimated 15-20% cost penalty for exiting long-term managed service contracts prematurely, further cementing this dynamic.

- Specialized Assets: IT firms often possess unique hardware and software tailored to specific client needs, making resale or repurposing difficult.

- Long-Term Contracts: Many IT service agreements span multiple years, creating financial penalties for early termination.

- Employee Severance Costs: High levels of skilled IT talent mean significant severance packages and potential legal costs if layoffs are necessary upon exiting.

- Brand Reputation: A hasty exit can damage a company's reputation, impacting future business ventures even in different sectors.

The competitive rivalry within the South African IT services sector is substantial, driven by a broad range of players from large enterprises like Dimension Data and EOH to smaller, specialized firms. This intense competition is further amplified by high fixed costs associated with infrastructure and talent, pushing companies to maintain high asset utilization, often leading to aggressive pricing strategies, particularly in managed services and cloud offerings. For instance, in 2024, cloud providers continued to compete on price, offering discounts for long-term commitments.

| Key Competitor | 2024 Estimated Revenue (ZAR billions) | Key Service Areas |

|---|---|---|

| Dimension Data | ~25-30 | Managed Services, Cloud, Cybersecurity |

| EOH | ~10-15 | Digital Transformation, Cloud, Managed Services |

| BCX | ~20-25 | IT Services, Cloud, Digital Solutions |

| Altron | ~15-20 | Integrated Solutions, Managed Services, Cloud |

SSubstitutes Threaten

The threat of substitutes for Altron's services includes traditional, on-premise IT infrastructure. Many companies still opt for self-managed systems, especially those with stringent security needs or existing legacy hardware. This preference can stem from a desire for direct control over their data and systems, a factor that remains significant even as cloud adoption grows.

While digital transformation is a major driver, some organizations in 2024 continue to favor on-premise solutions. This is often due to specific regulatory compliance mandates or deeply integrated legacy systems that are costly to migrate. For instance, certain financial institutions or government bodies might maintain on-premise data centers to meet strict data sovereignty laws, presenting a viable alternative to Altron's managed services.

Large enterprises, especially those with substantial financial backing and a demand for bespoke digital solutions, increasingly opt for building and managing their IT services internally. This internal capacity directly competes with Altron's external services, particularly when the benefits of cost savings and enhanced control are prioritized over outsourcing.

For instance, many Fortune 500 companies, which represent a significant portion of Altron's potential client base, have been investing heavily in their internal IT infrastructure. In 2023, IT spending by large enterprises globally was projected to reach over $1.5 trillion, with a growing segment allocated to in-house development and management of core digital transformation projects, thereby posing a direct threat of substitution.

The growing maturity and widespread availability of open-source software and platforms pose a significant threat of substitution for Altron's offerings. Companies increasingly consider open-source alternatives to cut down on licensing fees and gain greater adaptability. This trend is especially pronounced for foundational business applications and IT infrastructure, where cost savings and customization are key drivers.

For instance, the global open-source software market was valued at approximately $20.4 billion in 2023 and is projected to reach $135.7 billion by 2030, demonstrating substantial growth and adoption. Businesses can leverage these solutions for everything from operating systems and databases to development tools and cloud platforms, potentially bypassing the need for proprietary, integrated systems that Altron might provide.

Generic Consulting Services

Generic IT consulting firms pose a threat by offering strategic advice on digital transformation, potentially diverting customers who might otherwise seek Altron's comprehensive implementation and managed services. While not a perfect replacement for Altron's end-to-end solutions, these less integrated alternatives can sway client choices.

The market for IT consulting is substantial. For instance, the global IT consulting market size was valued at approximately USD 350 billion in 2023 and is projected to grow significantly. This broad market includes many smaller, specialized firms that can offer targeted advice, creating a competitive pressure.

- Market Segmentation: The IT consulting landscape includes a wide array of players, from large global firms to niche specialists, many of whom can offer strategic IT advice.

- Cost-Effectiveness: Generic consultants may offer lower price points for strategic planning, making them attractive to budget-conscious clients.

- Focus on Strategy: These substitutes excel at providing high-level digital transformation roadmaps, which can be a starting point for clients before committing to full-service providers.

- Client Decision Influence: Even if a client ultimately needs implementation, initial strategic guidance from a generic consultant can shape their perception of integrated service providers.

Emerging Technologies and Niche Providers

The threat of substitutes for Altron is amplified by emerging technologies and the rise of niche providers. Rapid technological advancements mean specialized solutions can quickly become viable alternatives, potentially bypassing Altron's more comprehensive service suites. For instance, startups leveraging advanced AI or blockchain technology could offer highly targeted digital capabilities that directly address specific client needs, presenting a substitute for Altron's broader digital transformation services.

Consider the fintech sector, where innovative platforms are increasingly offering specialized financial solutions. These niche players can disrupt traditional financial services, and by extension, the digital enablement Altron provides to its clients. This trend suggests that Altron must remain agile, continuously innovating its own offerings to stay ahead of these specialized competitive threats. In 2024, the venture capital funding for AI startups alone reached over $20 billion globally, highlighting the significant investment and rapid development in this area, which directly fuels the emergence of potent substitutes.

- Emergence of Niche AI/Blockchain Solutions: Startups are developing highly specialized AI and blockchain applications that offer alternative pathways for businesses to achieve specific digital outcomes.

- Fintech Platform Disruption: Innovative fintech companies are providing specialized financial services that can substitute for broader digital transformation efforts in the financial sector.

- Rapid Technological Evolution: The pace of technological change creates a constant stream of new potential substitutes, requiring Altron to maintain a proactive innovation strategy.

- Global AI Startup Funding: Over $20 billion was invested in AI startups globally in 2024, underscoring the competitive landscape shaped by emerging, specialized technologies.

The threat of substitutes for Altron's offerings is significant, encompassing both traditional on-premise solutions and increasingly sophisticated niche technologies. Many organizations, particularly large enterprises in 2024, continue to invest in internal IT infrastructure, driven by a desire for greater control and compliance with data sovereignty laws. This trend is supported by substantial global IT spending by large enterprises, which exceeded $1.5 trillion in 2023.

The rise of open-source software presents another potent substitute, offering cost-effective and adaptable alternatives for various IT needs, from operating systems to cloud platforms. The global open-source software market's projected growth from approximately $20.4 billion in 2023 to $135.7 billion by 2030 highlights its increasing adoption. Furthermore, generic IT consulting firms, though focused on strategy rather than end-to-end implementation, can influence client decisions by providing initial digital transformation roadmaps, tapping into a global IT consulting market valued at around $350 billion in 2023.

Emerging technologies and specialized providers further intensify this threat. Startups leveraging AI and blockchain are developing highly targeted solutions that can directly compete with Altron's broader service suites. The over $20 billion invested in AI startups globally in 2024 exemplifies the rapid innovation and emergence of potent substitutes in this space, forcing Altron to continuously adapt and innovate.

| Substitute Category | Key Characteristics | Market Relevance (2023/2024 Data) | Impact on Altron |

| On-Premise IT Infrastructure | Direct control, data sovereignty, legacy system integration | Large enterprises' IT spending exceeded $1.5 trillion globally in 2023; continued preference for specific regulatory needs. | Reduces demand for managed services and cloud solutions. |

| Open-Source Software | Cost-effectiveness, adaptability, customization | Global open-source market valued at ~$20.4 billion in 2023; strong growth projected. | Offers alternatives to proprietary software and integrated Altron solutions. |

| Generic IT Consulting Firms | Strategic advice, digital transformation roadmaps | Global IT consulting market valued at ~$350 billion in 2023; many niche players. | Can influence client choices before full-service engagement. |

| Niche Technology Providers (AI, Blockchain) | Specialized solutions, rapid innovation | Over $20 billion invested in AI startups globally in 2024. | Direct competition for specific digital transformation needs. |

Entrants Threaten

Entering the technology solutions and managed services sector, particularly at the enterprise level where Altron competes, demands significant upfront capital. This includes investments in robust IT infrastructure, extensive software licensing, and the recruitment of highly skilled personnel. For instance, establishing a data center capable of supporting enterprise-grade services can easily run into millions of dollars.

These considerable capital requirements act as a formidable barrier to entry. New companies often find it challenging to secure the necessary funding to match the established players' capabilities and service offerings. This financial hurdle effectively limits the number of potential new entrants capable of posing a serious threat to Altron's market position.

Established players like Altron leverage significant economies of scale, meaning they can produce goods or services at a lower per-unit cost due to their large-scale operations. For instance, Altron's extensive procurement network likely secures better pricing on hardware and software. This cost advantage makes it challenging for new entrants to match their pricing structures.

Furthermore, Altron benefits from economies of scope by offering a diverse range of integrated solutions across sectors like IT services, telecommunications, and digital transformation. This breadth of offering creates a more compelling value proposition for customers. Newcomers would find it difficult and costly to replicate this comprehensive service portfolio quickly, hindering their ability to compete effectively.

Altron's established brand loyalty and deep customer relationships, cultivated over decades as a South African technology leader since 1965, present a formidable barrier to new entrants. Acquiring and retaining customers in this competitive landscape demands substantial investment in trust-building and service delivery, making it difficult for newcomers to quickly establish a significant market share.

Regulatory Hurdles and Compliance

The South African technology and public sector landscapes present significant regulatory challenges for new entrants. Compliance with stringent data protection laws, such as the Protection of Personal Information Act (POPIA), demands substantial investment in security infrastructure and processes. Furthermore, meeting Black Economic Empowerment (B-BBEE) requirements, which often involve specific ownership, management, and skills development targets, can be a complex and resource-intensive undertaking.

These regulatory hurdles act as a formidable barrier, increasing the cost and time-to-market for new players. For instance, recent B-BBEE compliance audits in 2024 revealed that many technology firms faced delays and additional expenditure to align with evolving government mandates. Successfully navigating these requirements necessitates a deep understanding of local legislation and a commitment to ongoing compliance efforts.

- POPIA Compliance Costs: New entrants must budget for data security enhancements and legal counsel, potentially running into millions of Rands for robust systems.

- B-BBEE Implementation: Achieving the required B-BBEE status often involves strategic partnerships and investment in local skills development programs.

- Public Sector Tender Requirements: Winning public sector contracts typically mandates specific B-BBEE credentials and adherence to a complex procurement framework.

- Industry-Specific Regulations: Beyond general compliance, technology sectors may face additional regulations related to cybersecurity and digital infrastructure.

Access to Distribution Channels and Talent

New companies entering the IT sector often grapple with securing effective distribution channels to connect with their intended customers. This is compounded by the intense competition for skilled IT professionals, making it challenging for new entrants to build and maintain a capable workforce.

Altron benefits significantly from its established sales networks and a deep pool of experienced talent. These existing advantages create a substantial barrier for any new competitor looking to gain a foothold in the market.

- Distribution Channel Barriers: New entrants must invest heavily to build comparable sales and distribution infrastructure, a significant hurdle given Altron's existing reach.

- Talent Acquisition Challenges: The IT talent market remains highly competitive, with companies like Altron often offering attractive compensation and career progression, making it difficult for newcomers to attract top-tier employees.

- Replication Difficulty: The combination of established client relationships and a skilled workforce represents a significant competitive moat that is not easily replicated by emerging businesses.

The threat of new entrants in the technology solutions and managed services sector, where Altron operates, is generally moderate to low. Significant capital investment is required for infrastructure, software, and skilled personnel. For instance, establishing a modern data center can cost millions of dollars, creating a substantial financial barrier.

Established players like Altron benefit from economies of scale and scope, offering integrated solutions and enjoying better pricing due to large-scale procurement. This cost advantage is difficult for newcomers to match. Furthermore, strong brand loyalty and deep customer relationships, built over years, make it challenging for new companies to quickly gain market share.

Regulatory compliance, particularly in South Africa with B-BBEE and POPIA, adds complexity and cost for new entrants. For example, in 2024, many tech firms faced delays and increased expenses to meet evolving B-BBEE mandates. Access to effective distribution channels and the challenge of attracting skilled IT professionals also favor established companies like Altron.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Setting up IT infrastructure, software licenses, skilled workforce. | Millions of USD for data centers. |

| Economies of Scale/Scope | Lower per-unit costs, diverse integrated offerings. | Difficult for new entrants to match Altron's pricing. |

| Brand Loyalty & Relationships | Customer trust and long-term partnerships. | Significant investment needed to acquire and retain customers. |

| Regulatory Compliance (South Africa) | POPIA, B-BBEE, public sector tender requirements. | Potential millions in Rands for security, legal, and skills development. |

| Distribution Channels & Talent | Access to sales networks and experienced IT professionals. | High competition for talent, requiring significant investment to build. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry association publications, and market research databases. We also incorporate insights from regulatory filings and economic indicators to provide a comprehensive view of competitive dynamics.