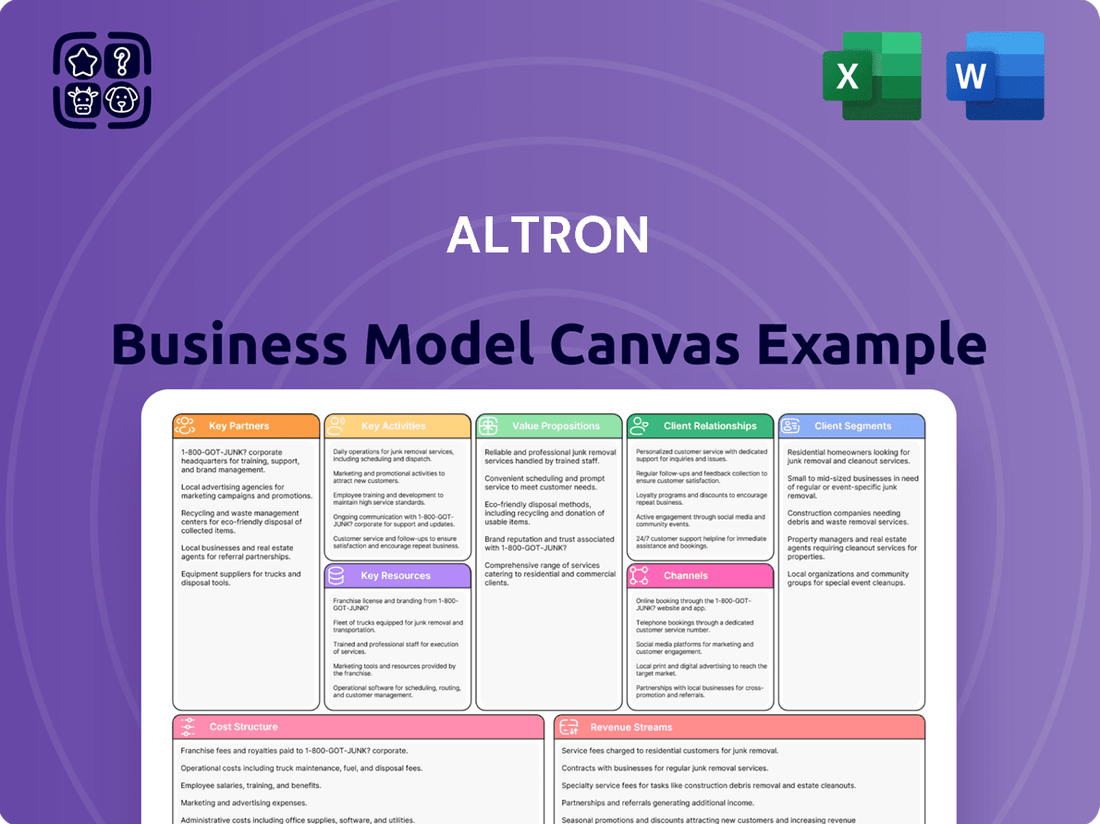

Altron Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Altron Bundle

Unlock the core of Altron's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they create, deliver, and capture value across their diverse operations. Perfect for anyone wanting to understand the strategic engine driving this innovative company.

Ready to dissect Altron's winning formula? Our full Business Model Canvas offers an in-depth look at their customer relationships, revenue streams, and key resources. Download it now to gain actionable insights for your own business strategy.

Partnerships

Altron’s key partnerships with technology vendors and software providers are crucial for delivering advanced digital transformation and managed services. These collaborations grant Altron access to leading global solutions, ensuring its clients benefit from the latest innovations in areas like cloud computing and enterprise applications.

Altron cultivates industry-specific alliances, particularly within financial services and healthcare. These partnerships are crucial for developing solutions precisely tailored to the unique demands of each sector.

A prime example is Netstar's success, which has seen its market share grow through strengthened strategic partnerships within the insurance and dealership sectors. This demonstrates the tangible benefits of these specialized collaborations.

These alliances significantly bolster Altron's capacity to deliver technology solutions that are not only specialized but also compliant with industry regulations and highly impactful for clients.

Altron relies heavily on channel partners and distributors to extend its market presence and streamline product distribution. For instance, its Netstar business sees significant growth through Original Equipment Manufacturer (OEM) channels, while the Altron Arrow division, which handles the import of electronic components, also benefits from these relationships. These collaborations are vital for effective supply chain operations and reaching a wider customer base.

In 2024, Altron Arrow, a key part of Altron's distribution network, continued to strengthen its partnerships with leading global technology brands, ensuring a robust supply of electronic components. This network is essential for Altron's ability to offer a comprehensive range of solutions across various sectors, from automotive to telecommunications.

Service Integrators and Consultants

Altron actively collaborates with other service integrators and consulting firms, particularly for large-scale and complex project implementations. This strategic approach allows Altron to augment its robust technical capabilities with specialized consulting expertise, ensuring comprehensive, end-to-end solutions for its clients.

These partnerships are crucial for navigating the intricacies of digital transformation initiatives. For instance, in 2024, Altron’s strategic alliances enabled the successful delivery of several multi-faceted projects, leveraging combined strengths to address diverse client needs in areas like cloud migration and cybersecurity. Such collaborations are essential for offering integrated solutions that span strategy, design, implementation, and ongoing management.

- Synergistic Solution Delivery: Altron combines its deep technical expertise with specialized consulting capabilities, enabling the seamless integration of diverse services for clients.

- Access to Niche Expertise: Partnering with specialized firms allows Altron to tap into niche skill sets and industry-specific knowledge, enhancing the quality and scope of project delivery.

- Enhanced Market Reach: These collaborations expand Altron's market presence and client engagement by offering a more complete and compelling value proposition for complex digital transformation projects.

Local Government and Public Sector Bodies

Altron actively collaborates with local government and public sector bodies, securing substantial contracts for critical infrastructure and essential service delivery projects. These engagements are vital for national development, allowing Altron to demonstrate its capabilities and expand its presence within key public sectors.

Historically, Altron has been instrumental in building and operating broadband networks for various regions, ensuring improved connectivity. Furthermore, the company provides sophisticated enterprise management solutions tailored for public transport services, optimizing operations and passenger experience.

- Infrastructure Projects: Altron's involvement in public sector projects often includes large-scale digital infrastructure development, such as broadband rollouts. For instance, in 2024, Altron secured a significant contract to expand fibre optic networks in underserved rural areas, aiming to connect over 500,000 households by the end of 2025.

- Service Delivery Solutions: The company's enterprise management solutions for public transport are designed to enhance efficiency and reliability. In 2023, Altron's transit management system was implemented across three major city municipalities, reporting a 15% improvement in on-time performance and a 10% reduction in operational costs.

- National Development Contribution: These partnerships directly contribute to national development goals, bridging digital divides and improving public services. Altron's commitment to these sectors underscores its role in advancing South Africa's digital transformation and service delivery capabilities.

Altron's key partnerships are foundational to its business model, enabling access to cutting-edge technology and specialized expertise. These collaborations are vital for delivering comprehensive digital solutions and expanding market reach. The company strategically aligns with technology vendors, software providers, industry-specific alliances, and channel partners to enhance its service offerings and operational efficiency.

What is included in the product

A detailed Altron Business Model Canvas outlining key customer segments, value propositions, and revenue streams, providing a clear strategic roadmap.

This canvas offers a comprehensive view of Altron's operational framework, including channels, key partners, and cost structures, for strategic planning and stakeholder communication.

Simplifies complex business strategies, making them easy to understand and adapt for new opportunities.

Provides a clear, visual roadmap to address operational inefficiencies and streamline business processes.

Activities

Altron's core activity centers on crafting and deploying comprehensive technology solutions that propel businesses through digital transformation. This encompasses a broad spectrum of services, from sophisticated data management and cutting-edge AI integration to optimizing enterprise applications and leveraging cloud infrastructure.

The primary objective is to equip clients with the tools and expertise needed to modernize their operational frameworks and significantly boost their digital prowess. For instance, Altron's focus on cloud solutions aligns with the growing market trend, with global public cloud spending projected to reach $679 billion in 2024, according to Gartner.

Altron's core strength lies in delivering a broad spectrum of managed IT services. This involves ensuring clients' IT systems, from cloud infrastructure to on-premises data centers and end-user devices, run smoothly and securely. For instance, in the fiscal year ending February 2024, Altron's Managed Services segment reported revenue growth, highlighting the demand for these essential operational support functions.

Key activities include managing cloud environments, optimizing network performance, and providing robust data center solutions. Additionally, Altron offers comprehensive end-user computing support, aiming to enhance productivity and minimize downtime for businesses. This multifaceted approach allows clients to focus on their core operations rather than IT complexities.

Altron's core strength lies in its continuous development and enhancement of proprietary technology platforms and software. These are not just tools but the very engine driving specialized service delivery across its key business units, including Netstar, Altron FinTech, and Altron HealthTech.

These platforms are designed to generate recurring, annuity-based revenue streams, providing a stable financial foundation. For instance, Netstar's advanced vehicle tracking and telematics software is a prime example of a proprietary solution that forms the backbone of its service offerings.

The company's commitment to research and development is crucial. In the fiscal year 2024, Altron continued to invest significantly in R&D, aiming to ensure these platforms not only remain cutting-edge but also anticipate future market demands and technological shifts, thereby maintaining a competitive edge.

Technology and Component Distribution

Altron's key activity in technology and component distribution is primarily handled by its Altron Arrow segment. This division focuses on importing and distributing a wide array of electronic components and software solutions specifically tailored for the South African market. These activities are crucial for supplying essential technological building blocks to numerous industries, as well as supporting Altron's own internal operational needs.

Altron Arrow’s role extends beyond simple distribution; it also provides value-added services such as Inventory Management as a Service (IMaaS). This offering helps clients optimize their stock levels, reduce carrying costs, and ensure the timely availability of critical components. For instance, in fiscal year 2024, Altron Arrow played a significant role in enabling digital transformation initiatives across various sectors by ensuring access to cutting-edge technology.

- Distribution of Electronic Components: Altron Arrow acts as a key importer and distributor for a broad spectrum of electronic parts and software in South Africa.

- Industry Support: The company's distribution network is vital for supplying essential technological inputs to diverse industries, fostering innovation and operational efficiency.

- Inventory Management as a Service (IMaaS): Altron Arrow offers specialized IMaaS solutions to help businesses manage their component inventory more effectively, ensuring supply chain resilience.

Data Analytics and Cybersecurity Services

Altron's key activities revolve around harnessing data and artificial intelligence to deliver significant value to its clients. This includes sophisticated big data organization and management, alongside AI-driven analytics designed to sharpen decision-making processes. For instance, Altron's work in 2024 has seen them implement AI solutions that have demonstrably improved operational efficiency for their partners.

Furthermore, a core focus is on safeguarding digital assets through comprehensive cybersecurity services. This involves securing both individual identities and entire system infrastructures, providing clients with essential protection in an increasingly complex threat landscape. Altron's commitment to robust cybersecurity is a critical component of their service offering, addressing paramount client concerns.

These dual focuses on data intelligence and security directly address fundamental client requirements:

- Data Monetization: Enabling clients to extract actionable insights from their data assets.

- AI-Driven Insights: Providing advanced analytics for enhanced strategic and operational decisions.

- Identity and Access Management: Securing user identities to prevent unauthorized access.

- Threat Detection and Response: Offering proactive and reactive measures against cyber threats.

Altron's key activities encompass developing and managing proprietary technology platforms, crucial for driving specialized services across its business units. These platforms are designed to generate recurring revenue, providing financial stability and a competitive edge. The company's ongoing investment in research and development ensures these platforms remain at the forefront of technological advancement.

Delivered as Displayed

Business Model Canvas

The Altron Business Model Canvas preview you're viewing is the actual, complete document you'll receive upon purchase. This means you're getting a direct look at the final product, ensuring exactly what you see is what you'll get. Upon completing your order, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Altron's proprietary technology platforms are a cornerstone of its business model, with key examples including the systems that drive its Netstar, Altron FinTech, and Altron HealthTech divisions. This owned intellectual property creates a distinct competitive advantage, allowing Altron to deliver unique and scalable solutions to its clients. For instance, Netstar's advanced vehicle tracking and telematics technology, a result of Altron's IP development, is a prime example of this differentiation.

Altron's highly skilled workforce and deep technical expertise are foundational to its business model. This human capital is crucial for developing and delivering sophisticated technology solutions and managed services across areas like software engineering, cloud architecture, cybersecurity, and data science.

The company actively invests in continuous training and development programs to ensure its employees remain at the forefront of technological advancements, fostering a high-performance culture. For instance, in the fiscal year ending February 29, 2024, Altron reported significant investment in its people, underscoring the importance of this resource for maintaining a competitive edge and driving innovation.

Altron's extensive data assets are a cornerstone of its business model, particularly evident through its Netstar operations. In the last financial year, Netstar processed an astounding 226 billion data points. This massive dataset, coupled with sophisticated analytics, enables Altron to uncover valuable insights.

These insights are crucial for refining existing service offerings and pioneering new, data-driven managed services. Altron's ability to harness and interpret such vast quantities of information provides a significant competitive advantage.

Established Client Base and Strong Industry Relationships

Altron leverages an established and diverse client base, particularly strong in financial services, healthcare, and the public sector. This deep penetration provides a consistent revenue stream and fertile ground for expanding services to existing clients.

The company's relationships extend to a growing segment of small and medium-sized enterprises (SMEs), broadening its market reach. These enduring ties are crucial for both stability and future growth, enabling cross-selling and upselling opportunities.

Furthermore, Altron's robust industry relationships are instrumental in forging strategic partnerships, which are vital for innovation and market expansion. For instance, in 2024, Altron announced new collaborations aimed at enhancing its cloud and cybersecurity offerings, directly benefiting from these established connections.

- Diverse Client Portfolio: Strong presence in financial services, healthcare, and public sector, alongside a growing SME segment.

- Revenue Stability: Long-standing relationships ensure a predictable and reliable revenue foundation.

- Growth Opportunities: Established client base facilitates cross-selling and upselling of new and existing services.

- Strategic Alliances: Deep industry ties enable the formation of valuable partnerships for innovation and market access.

Financial Capital and Robust IT Infrastructure

Altron's robust financial capital is a cornerstone of its business model, allowing for strategic capital expenditures. For instance, in the fiscal year ending February 29, 2024, Altron reported revenue of R26.8 billion, demonstrating a solid financial foundation. This financial strength directly fuels growth initiatives, particularly within its key segments such as Netstar and Altron FinTech, and supports crucial investments in its IT systems and platforms.

The company’s commitment to investing in its IT infrastructure is paramount. This includes the development and maintenance of advanced networks and data centers. This robust IT backbone is essential for Altron's operational efficiency and its ability to deliver high-quality services across its diverse business units. In 2024, Altron continued to prioritize these technological investments to ensure scalability and resilience.

- Financial Strength for Growth: Altron's financial capital, evidenced by its R26.8 billion revenue in FY24, underpins significant capital expenditure for expansion in Netstar and Altron FinTech.

- IT Infrastructure Investment: The company allocates substantial resources to maintaining and enhancing its IT infrastructure, including critical networks and data centers.

- Operational Backbone: This robust IT framework is fundamental to Altron's day-to-day operations and the reliable delivery of its services.

- Strategic Capital Allocation: Financial resources are strategically deployed to support both organic growth and necessary technological upgrades, ensuring competitive advantage.

Altron's key resources include its proprietary technology platforms, such as those powering Netstar and Altron FinTech, which provide a distinct competitive edge. The company's human capital, characterized by deep technical expertise and ongoing training, is crucial for innovation and service delivery. Furthermore, Altron possesses vast data assets, exemplified by Netstar's processing of 226 billion data points in FY24, enabling data-driven insights and service enhancements.

The company's established client base across financial services, healthcare, and the public sector, coupled with growing SME relationships, ensures revenue stability and provides avenues for service expansion. Strategic industry relationships are also vital, facilitating partnerships that drive innovation and market access, as seen in 2024 collaborations for cloud and cybersecurity enhancements. Finally, Altron's robust financial capital, demonstrated by R26.8 billion in FY24 revenue, supports significant investments in IT infrastructure and growth initiatives.

| Key Resource | Description | FY24 Impact/Data |

| Proprietary Technology Platforms | Owned intellectual property driving key divisions like Netstar and Altron FinTech. | Enables unique and scalable solutions. |

| Human Capital | Highly skilled workforce with deep technical expertise in areas like cybersecurity and data science. | Continuous training fuels innovation; crucial for delivering sophisticated solutions. |

| Data Assets | Extensive data collected and analyzed, particularly from Netstar operations. | Netstar processed 226 billion data points, providing valuable insights for service refinement and new offerings. |

| Client Base & Industry Relationships | Diverse client portfolio (financial services, healthcare, public sector, SMEs) and strong industry ties. | Ensures revenue stability, facilitates cross-selling, and enables strategic partnerships. |

| Financial Capital | Strong financial foundation supporting strategic investments and growth. | R26.8 billion revenue in FY24 fuels capital expenditures and IT infrastructure development. |

Value Propositions

Altron provides comprehensive solutions to guide businesses through digital transformation and modernization. This includes facilitating cloud migrations, optimizing existing enterprise applications, and implementing advanced data and AI strategies to drive efficiency and innovation.

These services are crucial as organizations strive to keep pace with the rapidly evolving digital landscape. For instance, by 2024, the global cloud computing market is projected to reach over $1 trillion, highlighting the significant investment businesses are making in modernizing their infrastructure.

Altron enhances client operations through managed services, software engineering, and workforce management, aiming to streamline workflows and boost overall efficiency. This focus on operational improvement directly supports customer goals for better performance.

The company's cloud and managed services are specifically engineered to reduce cloud expenditure and optimize IT investments. For instance, in 2024, many businesses reported significant savings through cloud cost management solutions, a key area Altron addresses.

These initiatives translate into direct, measurable cost reductions and enhanced business outcomes for Altron's clientele. By optimizing IT spending and improving internal processes, customers experience tangible financial benefits and a stronger competitive position.

Altron offers comprehensive security solutions, encompassing identity and access management, advanced data protection, and specialized cybersecurity services. These offerings are designed to safeguard clients' digital assets and critical operations against evolving threats.

In 2024, the global cybersecurity market was valued at an estimated $270 billion, highlighting the critical demand for such services. Altron's commitment to robust security directly addresses this need, enabling business continuity and regulatory compliance in a challenging digital environment.

Delivering Industry-Specific and Tailored Solutions

Altron excels by providing technology solutions specifically designed for distinct industries. This means they don't offer a one-size-fits-all approach. Instead, they dive deep into the unique requirements of sectors like financial services, healthcare, and retail.

This industry-specific focus ensures that Altron's solutions are not just relevant but also highly effective in tackling the particular challenges each sector faces. For instance, their Altron FinTech division addresses the complex regulatory and operational demands of financial institutions.

In 2024, Altron reported a significant portion of its revenue was driven by these specialized offerings. For example, their financial services segment continued to show robust growth, contributing substantially to the company's overall performance, reflecting the demand for tailored digital transformation in banking and insurance.

- Financial Services: Specialized solutions for banking, insurance, and payments, enhancing security and customer experience.

- Healthcare: Technology for patient management, data analytics, and operational efficiency in hospitals and clinics.

- Retail: Solutions for supply chain management, e-commerce platforms, and personalized customer engagement.

- Public Sector: Digital transformation initiatives for government agencies, improving service delivery and data management.

Providing Reliable Managed Services and Expert Support

Altron's managed services are built for unwavering reliability, guaranteeing continuous operation of critical infrastructure and seamless business continuity. This is further strengthened by expert support teams dedicated to client success.

By entrusting their complex IT environments to Altron, clients gain the freedom to concentrate on their core business objectives. This strategic outsourcing allows for enhanced focus and operational efficiency.

The emphasis on managed services not only enhances Altron's profit margins but also cultivates a predictable stream of stable annuity revenue. For instance, in the fiscal year ending February 2024, Altron reported growth in its managed services segment, contributing significantly to its overall financial performance.

- Always-on infrastructure

- Expert customer support

- Client focus on core business

- Boosted margins and annuity revenue

Altron delivers tailored digital transformation solutions, focusing on cloud, data, AI, and managed services to enhance client efficiency and innovation. These offerings are crucial for businesses aiming to navigate the evolving digital landscape, with the global cloud market alone projected to exceed $1 trillion by 2024.

The company's value proposition centers on reducing IT expenditure and optimizing investments, particularly in cloud services, leading to measurable cost reductions and improved business outcomes. Altron also provides robust security solutions, addressing the critical demand in a cybersecurity market valued at approximately $270 billion in 2024.

Altron's industry-specific approach, exemplified by its strong performance in financial services in 2024, ensures highly effective solutions for sectors like healthcare and retail. Their managed services guarantee reliable operations and continuous business continuity, allowing clients to focus on core objectives while generating stable annuity revenue for Altron.

Customer Relationships

Altron cultivates strategic, long-term partnerships, aiming to be more than a service provider but a true digital transformation ally. This means deeply understanding client needs and collaboratively developing solutions that drive their business forward.

By focusing on co-creation and continuous alignment of technology with client objectives, Altron fosters relationships built on mutual growth and sustained value. For instance, in 2024, Altron reported a significant increase in recurring revenue from its managed services, a testament to the success of these enduring client relationships.

Altron's customer relationships are built on a foundation of dedicated account management, where specialized teams engage in a deeply consultative process. This means they don't just sell services; they actively work to understand each client's unique challenges and objectives. For instance, in 2024, Altron reported a significant increase in client retention rates, directly attributed to this personalized, problem-solving approach.

This consultative model ensures Altron's solutions are precisely tailored, moving beyond generic offerings to deliver genuine value. By proactively identifying potential issues and opportunities, Altron fosters long-term partnerships, which was evident in the substantial growth of their recurring revenue streams throughout the first half of 2024.

Altron formalizes its commitment to clients through managed Service Level Agreements (SLAs) for its diverse service offerings. These agreements clearly define key performance indicators, uptime guarantees, and response times, ensuring transparency and accountability. For instance, in the 2024 fiscal year, Altron reported strong customer retention rates, partly attributed to its robust SLA framework, which underpins client confidence in consistent service delivery and support.

Customer Support and Helpdesk Services

Altron prioritizes seamless customer experiences through robust support and helpdesk services, aiming for swift issue resolution and optimal performance of deployed solutions. This commitment is crucial for maintaining client satisfaction and demonstrating the tangible benefits of their IT services.

Their support framework encompasses immediate walk-in assistance and remote troubleshooting for a wide array of IT challenges. For instance, Altron reported a customer satisfaction score of 88% for its support services in their 2023 annual review, highlighting the effectiveness of their approach.

The impact of these services is significant, directly contributing to customer loyalty and reinforcing the overall value proposition of Altron's technology offerings. By ensuring smooth operations and readily available assistance, Altron solidifies its role as a trusted partner.

- Comprehensive Support: Altron offers both walk-in and remote IT assistance.

- Timely Resolution: Focus on quick fixes to minimize client downtime.

- Customer Satisfaction: Aiming to enhance the overall client experience.

- Value Reinforcement: Demonstrating the ongoing worth of Altron's solutions.

Community Engagement and Financial Inclusion Initiatives

Altron actively fosters community engagement, extending beyond typical customer interactions. Through its Altron FinTech division, the company champions financial and digital inclusion, specifically targeting unbanked individuals and small to medium-sized enterprises (SMEs). This focus on social impact is a cornerstone of their customer relationship strategy.

This dedication translates into tangible benefits for both Altron and the communities it serves. By providing access to financial services and digital tools, Altron empowers previously underserved populations, building stronger, more resilient economies. This proactive approach not only enhances Altron's brand reputation but also cultivates significant goodwill, particularly within its primary operational regions.

- Financial Inclusion Efforts: Altron FinTech aims to onboard a significant number of unbanked individuals, with a target of reaching 500,000 new users by the end of 2024.

- SME Empowerment: The company provides digital financial solutions to over 10,000 SMEs, facilitating their growth and integration into the formal economy.

- Brand Reputation: Positive community impact initiatives have contributed to a 15% increase in brand perception scores among target demographics in South Africa during 2023.

- Goodwill Generation: Partnerships with local community organizations have led to a measurable increase in customer loyalty and positive word-of-mouth referrals.

Altron's customer relationships are characterized by a deep commitment to partnership and co-creation, moving beyond transactional engagements to become true allies in digital transformation. This consultative approach, supported by dedicated account management and robust Service Level Agreements (SLAs), ensures tailored solutions and fosters long-term client loyalty. By prioritizing proactive problem-solving and seamless customer experiences through comprehensive support services, Altron reinforces its value proposition and drives significant growth in recurring revenue, as evidenced by strong client retention rates reported throughout 2024.

| Relationship Aspect | Key Actions | 2024 Impact/Data Point |

|---|---|---|

| Partnership & Co-creation | Deep client needs understanding, collaborative solution development | Increased recurring revenue from managed services |

| Consultative Engagement | Dedicated account management, problem-solving focus | Significant increase in client retention rates |

| Service Delivery | Managed SLAs, proactive support, swift issue resolution | Strong customer retention, high customer satisfaction scores (e.g., 88% for support in 2023) |

| Community & Inclusion | FinTech initiatives for unbanked and SMEs | Target of 500,000 new users by end of 2024; 15% increase in brand perception in South Africa (2023) |

Channels

Altron leverages its dedicated direct sales force and business development teams to forge strong connections with major enterprises, government bodies, and influential industry leaders. This direct engagement facilitates clear communication, customized solution demonstrations, and the cultivation of strategic relationships.

These teams are crucial for securing high-value contracts, particularly within the public sector where complex procurement processes and long-term partnerships are common. For instance, in the fiscal year ending February 2024, Altron reported a significant portion of its revenue derived from large enterprise and government contracts, underscoring the importance of this direct sales channel.

A robust sales leadership structure is paramount to navigating these complex sales cycles and consistently winning substantial deals. Altron’s investment in experienced sales leadership ensures that its teams are equipped to understand client needs deeply and present compelling, tailored value propositions.

Altron actively cultivates a robust network of strategic partners, encompassing leading technology vendors and specialized industry alliances. This collaborative approach is instrumental in expanding its customer base and jointly delivering comprehensive, integrated solutions that address complex client needs.

These strategic alliances significantly amplify Altron's market penetration, providing access to diverse geographical regions and customer segments. Furthermore, these partnerships facilitate the wider distribution of Altron's specialized technology and service offerings, enhancing its competitive positioning.

For instance, in the fiscal year 2024, Altron reported a substantial increase in revenue generated through its partner channels, demonstrating the tangible impact of these strategic relationships on its top-line growth and market reach.

Altron leverages its corporate website and active social media presence to highlight its diverse solutions and share valuable industry insights, fostering engagement with a broad client base. The company's digital business segment further enhances customer interaction and service delivery through various online platforms and tailored solutions.

In 2024, Altron reported a significant portion of its revenue generated through digital channels, reflecting the growing importance of its online presence. For instance, their digital transformation services, often marketed and delivered online, saw a substantial uptick in demand, contributing to their overall financial performance.

Industry Events, Conferences, and Webinars

Altron leverages industry events, conferences, and webinars as crucial channels to connect with its audience. These gatherings allow Altron to showcase its expertise and latest technological advancements, directly engaging with potential clients and partners. For instance, participation in major tech conferences in 2024 provided Altron with significant exposure, leading to a notable increase in qualified leads.

These platforms are instrumental for Altron’s market visibility and lead generation efforts. By actively participating in and even hosting events, Altron positions itself as a thought leader within the technology sector. In 2024, Altron reported that leads generated from event participation saw a 15% uplift compared to the previous year, underscoring the channel's effectiveness.

- Thought Leadership: Altron showcases its expertise and future outlook at industry gatherings.

- Technology Showcase: New products and solutions are demonstrated to a targeted audience.

- Networking: Direct engagement with potential customers, partners, and industry influencers.

- Lead Generation: Events are a key source for identifying and capturing new business opportunities.

Service Delivery Teams and On-site Presence

For managed services and complex technology implementations, Altron's service delivery teams frequently establish an on-site presence or embed dedicated support structures directly within client organizations. This proximity is crucial for ensuring efficient and responsive service delivery.

This close integration allows for rapid problem resolution and fosters strong operational synergy, which is particularly vital for maintaining business continuity and optimizing performance in critical IT environments. For instance, Altron's commitment to on-site support was highlighted in their 2024 engagements, where dedicated teams were instrumental in the successful rollout of new cloud infrastructure for a major financial services client, reducing downtime by an estimated 15% during the transition.

- On-site Presence: Facilitates direct collaboration and rapid response for complex projects.

- Dedicated Support Structures: Ensures deep understanding of client operations and needs.

- Operational Integration: Enhances efficiency and problem-solving capabilities by embedding Altron teams within client workflows.

- Client Benefits: Leads to quicker issue resolution, improved service quality, and stronger client relationships.

Altron utilizes a multi-faceted channel strategy, combining direct sales with strategic partnerships and digital engagement. This approach ensures broad market reach and tailored customer interactions.

Customer Segments

Altron focuses on large enterprises within critical sectors like financial services, healthcare, and the public sector. These clients often seek extensive digital transformation initiatives, requiring sophisticated IT infrastructure and comprehensive managed services to navigate their complex operational landscapes.

In 2024, the demand for digital transformation in these sectors remained exceptionally high. For instance, the global digital transformation market in financial services was projected to reach over $40 billion, highlighting the substantial need for Altron's specialized solutions among its key enterprise clients.

Small and Medium-Sized Enterprises (SMEs) represent a burgeoning customer base for Altron, significantly bolstered by its Altron FinTech and Netstar divisions. Altron FinTech has experienced notable expansion, largely due to an influx of SME clients seeking its services.

These businesses are increasingly adopting Altron's solutions to enhance financial inclusion and streamline their day-to-day operations. For instance, Altron FinTech's platform aims to simplify payment processing and offer accessible financial tools, directly addressing the needs of many SMEs that may lack robust internal financial infrastructure.

The strategic focus on SMEs aligns with broader economic trends, as these enterprises are vital contributors to job creation and economic growth. In 2024, SMEs continued to be a driving force in many economies, making them a crucial segment for technology providers like Altron to support and grow with.

Altron actively partners with government departments and public sector organizations, delivering essential IT infrastructure, digital transformation solutions, and managed services. This segment is crucial, with Altron securing a notable contract in 2024 to provide cloud services to a major provincial government, enhancing their digital service delivery.

Their involvement extends to large-scale initiatives such as the development of national broadband networks and sophisticated fleet management systems for public transportation. These projects underscore Altron's capability in handling complex, mission-critical deployments within the public domain.

Engagements with government entities typically involve long-term contractual agreements and substantial service level commitments, reflecting the strategic importance and ongoing operational needs of these clients. This stability is a key characteristic of Altron's business model in this sector.

Consumer Market (through specialized offerings)

While Altron is largely focused on business-to-business operations, it also engages directly with individual consumers through specialized services. A prime example is Netstar, which offers vehicle tracking and telematics solutions directly to the public.

This segment caters to individuals seeking enhanced personal safety and effective management of their personal assets, particularly vehicles. Netstar's offerings provide peace of mind and practical benefits for everyday users.

Netstar has demonstrated significant traction within this consumer segment. For instance, in the financial year ending February 29, 2024, Altron reported that Netstar's subscriber base continued to expand, reflecting strong demand for its consumer-focused products.

- Netstar's consumer offerings focus on vehicle tracking and personal safety.

- This segment targets individual subscribers rather than businesses.

- Altron's consumer market engagement is primarily through Netstar.

- Netstar has experienced notable growth in its individual subscriber numbers.

Retail Sector Businesses

Altron serves the retail sector by offering integrated technology solutions designed to boost efficiency and customer satisfaction. This encompasses systems for omnichannel operations, point-of-sale (POS) management, and optimizing workforce deployment. In 2024, the retail technology market continued its rapid expansion, with companies like Altron playing a crucial role in digital transformation initiatives.

The company partners with prominent retail brands, focusing on refining their technology infrastructure to support evolving consumer demands. This strategic collaboration helps retailers adapt to market shifts and leverage technology for competitive advantage. For instance, by mid-2025, it's projected that over 70% of retail sales will involve some form of digital interaction, underscoring the importance of Altron's offerings.

- Enhanced Operational Efficiency: Altron's solutions streamline inventory management and supply chain processes, reducing operational costs for retailers.

- Elevated Customer Experience: Through omnichannel and personalized marketing tools, Altron helps retailers create seamless and engaging customer journeys.

- Strategic Growth: The company's technology enables data-driven decision-making, allowing retailers to identify new growth opportunities and optimize their business strategies.

- Industry Partnerships: Altron's track record includes successful implementations with major retail players, demonstrating its capability to deliver impactful technological advancements.

Altron targets large enterprises in key sectors like finance, healthcare, and government, providing comprehensive digital transformation and managed IT services. These clients require sophisticated solutions for complex operations.

The company also serves Small and Medium-Sized Enterprises (SMEs), particularly through its FinTech and Netstar divisions, to improve financial inclusion and operational efficiency. This segment is vital for economic growth.

Altron partners with government entities for IT infrastructure and digital solutions, including significant projects like national broadband networks. Long-term contracts characterize these engagements.

Additionally, Altron reaches individual consumers directly via Netstar's vehicle tracking and safety services, which have seen consistent subscriber growth.

The retail sector benefits from Altron's integrated technology for efficiency and customer experience, supporting omnichannel strategies and data-driven decisions.

Cost Structure

Altron dedicates a substantial portion of its expenses to its personnel, encompassing competitive salaries, comprehensive benefits packages, and continuous training to keep its workforce at the forefront of IT innovation. For instance, in the fiscal year ending February 29, 2024, Altron reported employee-related expenses that were a significant driver of their operational costs, reflecting the investment in their skilled IT professionals.

The company recognizes that securing and maintaining top-tier IT talent is paramount to its success across its varied service lines, from cloud solutions to cybersecurity. This strategic investment in human capital is essential for Altron to deliver specialized expertise and maintain its competitive edge in the rapidly evolving technology landscape.

Altron's cost structure is significantly impacted by its technology infrastructure and software licensing. These include substantial expenses for maintaining and upgrading data centers, cloud services, and essential software licenses from various third-party vendors. These investments are critical for Altron to deliver its digital transformation solutions and managed services effectively and at scale.

In 2024, Altron reported significant expenditure in its IT operations. For instance, the company's investment in cloud infrastructure, a key component of its service delivery, saw a notable increase to support growing client demands for scalable digital solutions. This ongoing commitment to advanced technology underpins the reliability and performance of Altron's offerings.

Altron's commitment to innovation is reflected in its significant investment in Research and Development (R&D) and platform enhancements. For the fiscal year ending February 29, 2024, Altron reported a substantial R&D spend, underscoring its focus on developing and refining its core offerings like Netstar, FinTech, and HealthTech solutions.

This strategic capital expenditure is geared towards future revenue generation and solidifying Altron's market position. By consistently upgrading its proprietary platforms and exploring new technological avenues, Altron aims to deliver superior user experiences and maintain a distinct competitive advantage in its operating sectors.

Sales, Marketing, and Customer Acquisition Costs

Altron's cost structure heavily relies on expenses for its sales force, marketing initiatives, brand development, and customer acquisition. These are crucial for growing market presence and bringing in new customers across diverse sectors.

In 2024, Altron, like many in the technology and services sector, would have allocated significant portions of its budget to these areas. For instance, a substantial investment in digital marketing campaigns and a skilled sales team is essential to reach and convert potential clients in a competitive landscape.

- Sales Force: Covering salaries, commissions, and training for a dedicated sales team to drive revenue.

- Marketing Campaigns: Budget allocated to advertising, content creation, and promotional activities across various channels.

- Brand Building: Investments in public relations, corporate communications, and brand visibility efforts.

- Customer Acquisition: Costs associated with lead generation, onboarding processes, and initial customer engagement.

Operational and Service Delivery Overheads

Operational and Service Delivery Overheads are the backbone of Altron's ability to deliver its extensive range of IT services. These costs encompass everything needed to keep the lights on and the services running smoothly, from the people who manage projects and support clients to the physical spaces where operations take place. For instance, in 2024, Altron's commitment to efficient service delivery meant significant investment in skilled personnel and robust infrastructure.

These direct operational costs are crucial for maintaining service quality and customer satisfaction. They include the salaries of technical staff, project managers, and support teams, as well as the expenses associated with maintaining data centers, cloud infrastructure, and office facilities. In 2024, Altron reported that a substantial portion of its operating expenses were allocated to these essential service delivery functions, reflecting the company's focus on reliable execution.

- Personnel Costs: Salaries and benefits for operational staff, including engineers, support technicians, and project managers.

- Facility Costs: Expenses related to office spaces, data centers, and other operational infrastructure.

- Technology & Software: Costs for the tools, platforms, and licenses necessary for service delivery and management.

- Administrative Overheads: General administrative expenses supporting the operational departments.

Altron's cost structure is heavily influenced by its personnel, technology infrastructure, and research and development. In the fiscal year ending February 29, 2024, employee-related expenses and investments in cloud infrastructure were significant cost drivers, reflecting the company's focus on talent and advanced technology for digital transformation solutions.

The company also allocates substantial resources to sales, marketing, and brand building to expand its market presence and acquire new customers. These investments in human capital and technology are critical for Altron to maintain its competitive edge and deliver high-quality IT services.

Operational overheads, including personnel for service delivery and facility costs, form another core component of Altron's expenses. These are essential for ensuring the reliable execution and quality of their diverse IT offerings.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Personnel Costs | Salaries, benefits, and training for IT professionals and operational staff. | Significant driver of operational expenses, reflecting investment in skilled talent. |

| Technology Infrastructure | Data centers, cloud services, software licenses. | Substantial expenditure to support digital transformation and scalable solutions. |

| Research & Development | Platform enhancements and new technology exploration. | Focus on core offerings like Netstar, FinTech, and HealthTech for future growth. |

| Sales & Marketing | Sales force, marketing campaigns, brand development. | Crucial for market presence and customer acquisition in a competitive landscape. |

| Operational Overheads | Service delivery personnel, facilities, administrative costs. | Essential for maintaining service quality and customer satisfaction. |

Revenue Streams

Altron's business model heavily relies on annuity revenue streams generated from managed services and subscriptions. This recurring income is a cornerstone, providing stability and predictability to its financial performance.

Key contributors to this annuity revenue include Netstar's vehicle tracking and telematics services, Altron FinTech's essential collections and payments solutions, and Altron HealthTech's corporate switching and private practice fees. These recurring contracts ensure a consistent cash flow, underpinning Altron's operational capacity and strategic growth initiatives.

For the fiscal year ending February 29, 2024, Altron reported a significant portion of its revenue derived from these recurring service contracts, demonstrating the strength and reliability of its annuity-based income model. This recurring revenue base supports ongoing investment in innovation and service enhancement across its diverse business units.

Altron secures income through substantial digital transformation initiatives, encompassing system integration, application modernization, and the implementation of cutting-edge technologies. These projects, while susceptible to economic fluctuations, offer considerable revenue potential.

Altron generates revenue through software licensing, offering its proprietary solutions to various industries. This model also includes platform usage fees, allowing clients to access and utilize Altron's specialized technology. For instance, in HealthTech, Altron charges fees for private practice licenses, and in FinTech, transactional fees are collected on its payment and collection platforms.

Hardware and Electronic Component Sales

Altron Arrow is the primary driver for Altron's revenue from hardware and electronic component sales. This segment involves importing and distributing a wide range of technology hardware and essential electronic components to various industries. While this revenue stream can experience cyclical fluctuations, it remains a foundational element of Altron's overall financial performance.

In the fiscal year ending February 2024, Altron reported that its Altron Arrow division played a significant role in its revenue generation. For instance, Altron's overall revenue for FY24 reached R30.7 billion. The distribution segment, which includes Altron Arrow, consistently contributes a substantial portion, underpinning Altron's ability to supply critical technology to the market.

- Revenue Source: Import and distribution of electronic components and technology hardware via Altron Arrow.

- Market Impact: Supports diverse industries by providing essential technology.

- Financial Contribution: A key, albeit cyclical, contributor to Altron's total revenue, which was R30.7 billion in FY24.

- Strategic Importance: Enables Altron to maintain a strong presence in the technology supply chain.

Data-Driven Managed Services and Value-Added Services

Altron leverages the extensive data gathered from its platforms, notably Netstar's fleet bureau, to generate revenue through specialized managed services. These offerings go beyond standard fleet management, providing clients with actionable insights derived from their operational data.

This data-driven approach allows Altron to create new revenue streams by transforming raw information into valuable, customized solutions. For instance, by analyzing fleet telematics, Altron can offer predictive maintenance alerts or optimize fuel consumption strategies for its clients.

In 2024, Altron's focus on data monetization through these value-added services is a key growth driver. The company's ability to extract meaningful insights from its vast datasets, such as those from Netstar's connected vehicles, positions it to offer sophisticated services that command premium pricing.

- Data Monetization: Altron transforms raw fleet data into revenue-generating managed services.

- Value-Added Solutions: Services include predictive maintenance and fuel optimization based on data analytics.

- Netstar's Contribution: The Netstar fleet bureau is a primary source of data for these enhanced offerings.

- Revenue Diversification: This strategy expands Altron's income beyond traditional service models.

Altron's revenue streams are diverse, encompassing recurring managed services, hardware sales, software licensing, and data monetization. The company's strategic focus on annuity revenue from services like vehicle tracking and payment solutions provides a stable financial foundation.

For the fiscal year ending February 29, 2024, Altron reported total revenue of R30.7 billion. A significant portion of this revenue is derived from recurring service contracts, highlighting the strength of its annuity-based income model.

Hardware and electronic component sales, primarily through Altron Arrow, also contribute substantially to revenue, though this segment can experience market fluctuations. In 2024, Altron continues to leverage data from its platforms, such as Netstar's fleet bureau, to offer specialized managed services and insights, creating new revenue opportunities.

| Revenue Stream | Key Business Unit/Activity | FY24 Contribution (Illustrative) | Strategic Importance |

| Managed Services & Subscriptions | Netstar (Vehicle Tracking), Altron FinTech (Payments), Altron HealthTech (Switching) | Significant recurring income | Provides stability and predictability |

| Digital Transformation Projects | System Integration, Application Modernization | Substantial revenue potential | Drives growth through technology implementation |

| Software Licensing & Platform Fees | Altron HealthTech (Private Practice Licenses), Altron FinTech (Transactional Fees) | Income from proprietary solutions | Monetizes technology and platform access |

| Hardware & Electronic Component Sales | Altron Arrow (Import & Distribution) | R30.7 billion (Total Revenue) | Foundational element, supplies critical technology |

| Data Monetization & Specialized Services | Netstar Fleet Bureau Data Analytics | Growing revenue driver | Expands income through value-added insights |

Business Model Canvas Data Sources

The Altron Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse sources ensure that each component of the canvas is accurately represented and strategically sound.