Alten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Alten's robust engineering expertise and diversified service portfolio form significant strengths, positioning them well in the global market. However, understanding the specific competitive pressures and evolving technological landscapes they face is crucial for informed decision-making.

Want to truly grasp Alten's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to unlock a comprehensive, professionally crafted report that reveals actionable insights and strategic opportunities, perfect for investors and strategists.

Strengths

Alten stands as a prominent global leader in technology consulting and engineering, serving a diverse clientele across vital sectors. This extensive diversification, encompassing aerospace, automotive, defense, energy, finance, and telecommunications, effectively reduces the risk tied to over-dependence on any single industry.

Alten's financial health remains a significant strength, underscored by a robust net cash position at the close of 2024. This financial resilience allows the company to not only support its operational needs and shareholder returns but also to pursue ambitious growth strategies.

The company generated substantial free cash flow in 2024, providing the necessary capital to self-fund both organic expansion and strategic acquisitions. This financial flexibility is crucial for maintaining momentum in a competitive market.

Alten demonstrated its acquisition capacity by successfully integrating WORLDGRID. This move not only strengthens its market presence but also diversifies its service portfolio, aligning with its long-term strategic objectives.

Alten's deep technological expertise is a significant strength, particularly evident in its engineering and IT services. The company is strategically bolstering its capabilities in high-growth areas such as Artificial Intelligence and data analytics, positioning itself as a leader in these critical fields.

The company's proactive investment in a group-wide Artificial Intelligence program underscores its commitment to innovation. This focus ensures Alten is not just keeping pace with technological evolution but actively shaping it, delivering advanced solutions to its clientele.

International Presence & Client Proximity

Alten's robust international presence is a significant strength, with a substantial portion of its revenue derived from operations outside of its home market. This global footprint allows the company to effectively manage intricate projects that span multiple countries, leveraging international synergies to deliver its services worldwide. For instance, in 2023, Alten reported that approximately 75% of its revenue came from outside France, highlighting its truly global operational scale.

This widespread network not only diversifies revenue streams but also positions Alten to maintain close proximity to its clients. By being geographically accessible, Alten can better understand and respond to the unique needs of businesses in different regions. This client-centric approach, facilitated by its international reach, is key to cultivating and sustaining enduring partnerships. The company actively pursues strategies to enhance these international collaborations, ensuring it remains a responsive partner across its global client base.

Resilience in Key Growth Sectors

Alten showcased remarkable resilience in critical growth areas throughout 2024 and into early 2025, notably within the Defense & Security, Energy, and Rail sectors. This sustained performance in strategically important, often government-supported industries offers a dependable source of revenue, mitigating broader market volatility.

The company's strategic acquisition of WORLDGRID in late 2024 significantly bolstered its standing in the nuclear and energy markets. This move directly supports global energy transition initiatives, positioning Alten to capitalize on increasing demand for sustainable energy solutions.

- Defense & Security: Continued strong demand, driven by geopolitical factors, contributed to robust revenue growth in this segment.

- Energy: The acquisition of WORLDGRID and focus on nuclear and renewable energy projects provided a significant uplift, with the energy sector representing a key growth driver.

- Rail: Sustained investment in rail infrastructure globally ensured consistent project pipelines and revenue generation.

- Revenue Contribution: These key sectors collectively represented a substantial portion of Alten's overall revenue, underscoring their importance to the company's financial stability and growth trajectory through Q1 2025.

Alten's diversified industry presence, spanning aerospace, automotive, defense, energy, finance, and telecommunications, significantly mitigates sector-specific risks. Its strong financial footing, highlighted by a robust net cash position at the close of 2024, enables strategic investments and acquisitions, such as the successful integration of WORLDGRID. This financial resilience is further supported by substantial free cash flow generated in 2024, fueling both organic growth and strategic expansion initiatives.

| Sector | 2024/2025 Performance Highlight | Strategic Importance |

|---|---|---|

| Defense & Security | Continued strong demand and revenue growth | Geopolitical drivers ensure stable revenue |

| Energy | Significant uplift from WORLDGRID acquisition and focus on nuclear/renewables | Key growth driver supporting global energy transition |

| Rail | Consistent project pipelines due to global infrastructure investment | Reliable revenue stream from essential infrastructure development |

What is included in the product

Analyzes Alten’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address strategic weaknesses and threats, alleviating the pain of uncertainty.

Weaknesses

Alten faced a slight organic revenue decline in 2024 and a more significant drop in Q1 2025. This points to a slowdown in their core business, even when accounting for acquisitions and currency effects.

The company's overall revenue growth in 2024 was modest, and the Q1 2025 revenue decrease suggests difficulties in winning new projects or retaining current ones.

Alten's performance has been notably hampered by sector-specific downturns, particularly within its core Automotive and Telecommunications segments. These industries experienced budget cuts and reduced investment, leading to revenue declines surpassing 10% in the first quarter of 2025. Given that these sectors constitute a significant portion of Alten's overall revenue, their slowdown directly impacted the company's financial results.

The broader market conditions in 2024 also presented challenges, with a noticeable slowdown observed in the civil aeronautics and life sciences industries. These headwinds further contributed to weaker overall performance, underscoring the company's vulnerability to shifts in key industry spending.

Alten faces significant geographical performance imbalances, with Northern Europe seeing a sharp decline of over 15% in Q1 2025. This contrasts with more stable or growing regions like France and Southern Europe.

The United Kingdom and Germany, in particular, have experienced substantial business downturns, indicating localized economic headwinds or intense market competition affecting Alten's operations in these key markets.

These regional difficulties are underscored by the company's need for goodwill impairments and restructuring costs specifically within the UK and German markets, pointing to operational challenges that require strategic attention.

Uncertainty and Lack of Visibility

Alten faces significant headwinds due to the prevailing global geopolitical and economic climate, creating substantial uncertainty and a lack of visibility extending into the latter half of 2025. This environment has prompted many of Alten's key clients to adopt a cautious 'wait-and-see' approach.

Consequently, a notable number of investment projects have been frozen or postponed. This client hesitancy directly affects Alten's project pipeline and complicates revenue forecasting, making forward-looking financial planning a considerable challenge.

- Client project deferrals: Reports indicate a trend of clients delaying critical R&D and infrastructure investments, impacting the immediate project flow for engineering and technology service providers like Alten.

- Reduced capital expenditure: Many sectors reliant on Alten's services are seeing reduced capital expenditure budgets for 2025, with some estimates suggesting a potential 5-10% contraction in certain industries due to economic slowdown fears.

- Forecasting difficulties: The unpredictable nature of international relations and economic indicators makes it difficult for Alten to accurately predict demand and secure long-term contracts, a common issue for companies in the global consulting and engineering sector.

Operational Cost Pressures

Alten faces ongoing operational cost pressures, exacerbated by a projected slowdown in activity during 2024 and an anticipated organic decline in 2025. This reduced activity directly impacts the company's operating margin, as a lower utilization rate struggles to absorb fixed structural costs.

The squeeze on operating profit in recent periods was further intensified by non-recurring expenses. These included significant goodwill impairments, which can arise from overpaying for acquisitions, and restructuring costs, often incurred to streamline operations in response to market shifts. Such items highlight the challenge of maintaining profitability when faced with both cyclical demand and the need for structural adjustments.

- Reduced Activity Impact: A slowdown in 2024 and anticipated organic decline in 2025 are expected to pressure operating margins due to lower activity rates.

- Cost Structure Adaptation: Alten grapples with adapting its cost structure to fluctuating demand, a persistent challenge for the business.

- Non-Recurring Costs: Goodwill impairments and restructuring expenses have further squeezed operating profit, indicating underlying financial adjustments.

Alten's reliance on specific, cyclical industries like Automotive and Telecommunications makes it vulnerable to sector-specific downturns. The significant revenue declines exceeding 10% in these core areas during Q1 2025 highlight this weakness.

Geographical concentration also presents a risk, with Northern Europe experiencing a sharp contraction of over 15% in Q1 2025, demonstrating a susceptibility to localized economic challenges or competitive pressures in key markets like the UK and Germany.

The company's financial performance is further strained by non-recurring costs, including goodwill impairments and restructuring expenses, which directly impacted operating profit and signal potential issues with past acquisitions or necessary, costly operational adjustments.

| Weakness | Description | Impact (Q1 2025 Data) |

| Industry Dependence | High reliance on Automotive and Telecommunications sectors. | Revenue decline >10% in these sectors. |

| Geographical Imbalance | Significant underperformance in Northern Europe. | Revenue decline >15% in Northern Europe. |

| Cost Pressures & Non-Recurring Items | Struggles with cost structure adaptation and impact of impairments/restructuring. | Squeezed operating profit, goodwill impairments, restructuring costs. |

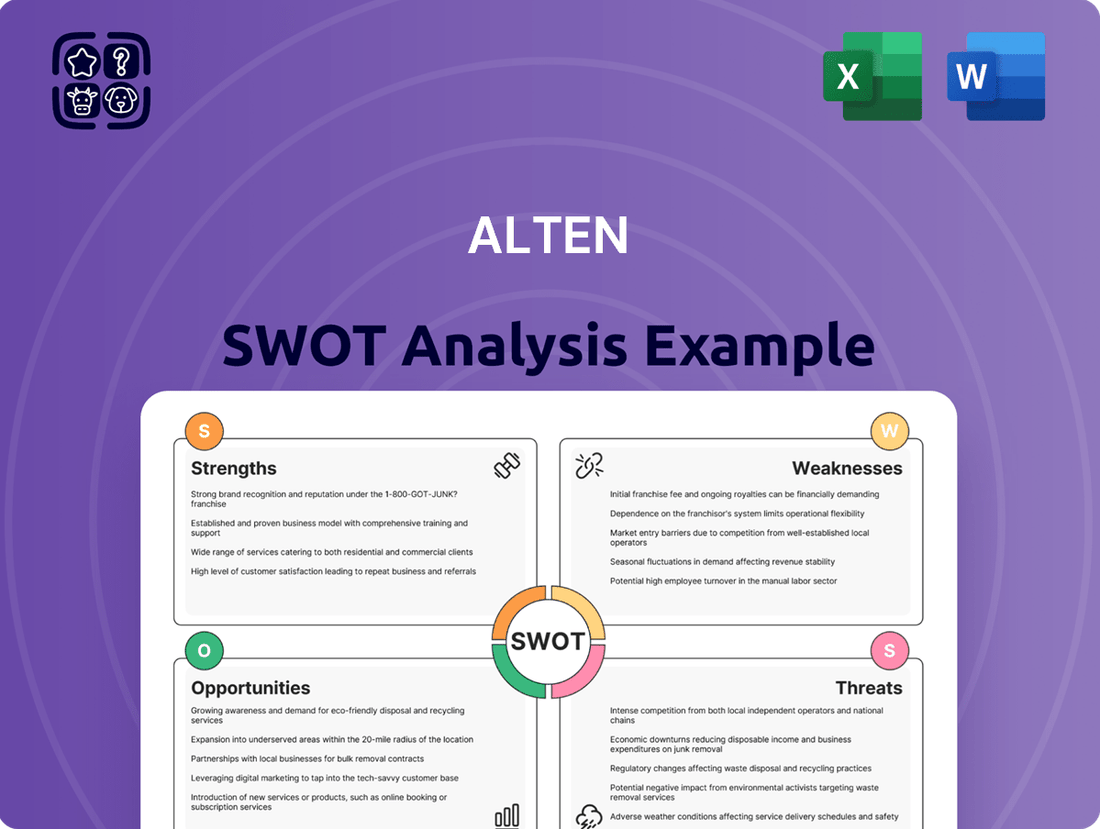

What You See Is What You Get

Alten SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final Alten SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The relentless advancement of digital technologies, including automation, cloud services, and cybersecurity, is a major growth driver. Regulations like the European DORA (Digital Operational Resilience Act) are also fueling demand for specialized IT services. Alten is well-positioned to benefit from this trend, as clients increasingly look to digital solutions for efficiency and cost savings.

Alten's robust financial position and explicit strategy for accelerated, targeted acquisitions present a significant opportunity for external growth. The company is actively seeking to bolster its footprint in key markets like the United States and enhance its nearshore-offshore delivery models.

This strategic M&A approach enables swift entry into new geographical territories and technological domains, fostering diversification and market consolidation. For instance, the acquisition of WORLDGRID in the Energy and Utilities sector in 2024 exemplifies Alten's commitment to this growth avenue, aiming to solidify leadership and broaden its service portfolio.

Alten is well-positioned to capitalize on significant growth opportunities within key sectors. For instance, the Defense & Security sector is experiencing a surge due to heightened global geopolitical tensions, with defense spending expected to increase substantially. Similarly, the Energy transition, encompassing both nuclear power and renewables, presents a massive opportunity, driven by decarbonization mandates and energy security concerns.

The company's active participation in major projects, such as the development of EPR2 and Small Modular Reactors (SMRs) in the nuclear energy space, underscores its strategic alignment with these growth trends. The Rail sector is also a strong performer, fueled by ongoing infrastructure modernization projects and the push for sustainable transportation solutions.

In 2024, global defense spending was projected to reach $2.4 trillion, a notable increase reflecting these dynamics. The renewable energy market is also expanding rapidly, with investments in solar and wind power projected to exceed $1 trillion globally by 2025. Alten's focus on these expanding markets can help mitigate the impact of any downturns in more cyclical industries.

Leveraging Artificial Intelligence and Data Analytics

Alten's significant investment in a group-wide Artificial Intelligence program, including substantial resources and training, positions it to capitalize on the transformative power of AI and data analytics. This strategic focus allows for enhanced data analysis, leading to improved customer satisfaction and streamlined operational efficiency.

The integration of AI and machine learning presents a clear opportunity for Alten to not only refine its existing service offerings but also to pioneer new revenue streams. By leveraging these advanced technologies, Alten can unlock greater value for its clients and solidify its competitive edge in the market.

- Enhanced Data Analysis: AI can process vast datasets to identify trends and insights, improving decision-making.

- Improved Customer Satisfaction: Personalized services and predictive support powered by AI can boost client experience.

- Operational Efficiency Gains: Automation of tasks and predictive maintenance through AI can reduce costs and increase output.

- New Revenue Streams: Development of AI-driven solutions and services can open up new market opportunities.

Geographical Market Penetration and Competence Centers

Alten is actively broadening its reach by establishing and enhancing Centers of Competence in promising emerging markets. This strategic move includes significant investments in regions such as India, Morocco, Eastern Europe, Vietnam, and Mexico. Such expansion is designed to access diverse talent pools and improve service delivery to clients operating in various global locations.

This geographical penetration aims to foster stronger international collaboration and ensure Alten's service offerings are accessible worldwide. By deploying its expertise across a wider array of countries, Alten is positioning itself to expedite growth within key strategic accounts and to more adeptly address the complex, global challenges faced by its clientele. For instance, in 2024, Alten reported a notable increase in its workforce in these developing regions, contributing to its overall global talent acquisition strategy.

- Geographic Expansion: Alten is establishing new Centers of Competence in India, Morocco, Eastern Europe, Vietnam, and Mexico.

- Talent Acquisition: This strategy allows access to new and diverse talent pools across different regions.

- Client Service Enhancement: Expansion improves Alten's ability to serve clients more effectively in various geographies.

- Global Synergies: Strengthening international collaboration and service deployment accelerates growth and client support.

Alten's strategic focus on high-growth sectors like Defense, Energy transition, and Rail, fueled by global trends such as increased defense spending and decarbonization mandates, presents substantial revenue opportunities. The company's active involvement in projects like EPR2 and SMR development directly aligns with these expanding markets.

The company's proactive acquisition strategy, exemplified by the WORLDGRID acquisition in 2024, allows for rapid market penetration and diversification into new technological areas. This approach is key to bolstering its presence in markets like the United States and enhancing its global delivery capabilities.

Alten's significant investment in AI and data analytics is poised to unlock new revenue streams and enhance operational efficiency, improving customer satisfaction. This focus on advanced technologies positions the company to lead in developing innovative, data-driven solutions for its clients.

Expanding its Centers of Competence into emerging markets like India, Morocco, and Vietnam provides access to diverse talent pools and strengthens its global service delivery. This geographic expansion is crucial for supporting key accounts and addressing complex international client needs.

| Opportunity Area | Key Drivers | Alten's Strategic Alignment | Relevant Data Point (2024/2025 Projection) |

|---|---|---|---|

| Digital Transformation | Automation, Cloud, Cybersecurity, DORA | Leveraging digital solutions for efficiency | Global IT spending projected to grow by 6.8% in 2024 (Gartner) |

| Mergers & Acquisitions | Market expansion, Technology acquisition | Targeted acquisitions in key markets (e.g., USA) | Alten acquired WORLDGRID in 2024 |

| Sector Growth | Defense spending, Energy transition, Rail modernization | Focus on high-growth sectors | Global defense spending projected to reach $2.4 trillion in 2024 |

| AI & Data Analytics | AI adoption, Data-driven insights | Group-wide AI program investment | AI market expected to reach $1.5 trillion by 2025 (Statista) |

| Geographic Expansion | Emerging markets, Talent access | Centers of Competence in India, Morocco, Vietnam, etc. | Notable workforce increase in developing regions in 2024 |

Threats

The economic slowdown, especially pronounced in Europe, significantly impacted business activity throughout 2024 and into early 2025. Many large corporations adopted a cautious, wait-and-see approach, leading to the freezing or indefinite postponement of crucial investment projects.

This widespread deferral of capital expenditure directly curtails Alten's opportunities for new project acquisition and revenue generation. For instance, a significant portion of the IT and engineering services market, where Alten operates, relies heavily on client investment in new technologies and infrastructure.

The prevailing uncertain global geopolitical and economic climate further exacerbates this threat. It creates a more challenging environment for Alten to secure new business contracts as clients become more risk-averse and scrutinize their spending more closely.

Significant budget cuts within the Automotive and Telecommunications sectors have already impacted Alten's business, causing notable declines. For instance, the automotive sector, a key market for Alten, saw a slowdown in client spending on engineering services in late 2023 and early 2024, directly affecting revenue streams.

The ongoing pressure on research and development budgets from clients, exacerbated by intense competition from players like Chinese original equipment manufacturers (OEMs), presents a persistent threat. This competitive landscape can diminish Alten's pricing power and profitability in these crucial segments.

To navigate these challenges, Alten may need to undertake organizational adjustments, potentially affecting its operational efficiency and financial performance. Adapting to reduced client R&D investment will be critical for maintaining market share and profitability.

Alten operates in a highly competitive landscape where clients are increasingly looking for global partners. Established firms like Atos and Cognizant, alongside the growing influence of offshore providers, particularly from India, present significant competitive pressures. This intense rivalry demands continuous innovation and service differentiation to maintain market share.

The challenge of acquiring and retaining skilled management talent in numerous countries poses a substantial threat to Alten's expansion and operational effectiveness. For instance, in 2024, the IT services market faced a global talent shortage, with demand outstripping supply for specialized skills, impacting companies like Alten's ability to scale operations and deliver projects efficiently.

Geopolitical and Macroeconomic Instability

Ongoing geopolitical tensions and broad macroeconomic uncertainties are creating a volatile landscape for businesses like Alten. These external factors can rapidly alter client investment strategies, impact currency exchange rates, and disrupt established supply chains. For instance, the ongoing conflict in Eastern Europe and potential trade disputes could significantly affect global economic growth projections for late 2025, directly influencing demand for Alten's services.

The lack of clear visibility into the second half of 2025 highlights Alten's vulnerability to these unforeseen external shocks. Companies in the IT services sector, particularly those with significant international operations, are susceptible to these shifts. For example, a sudden escalation in trade tariffs between major economic blocs could lead to increased operational costs and reduced cross-border investment, impacting Alten's revenue streams.

Key threats stemming from this instability include:

- Currency Fluctuations: Significant swings in major currencies, such as the Euro and US Dollar, can negatively impact Alten's reported earnings and the cost of its international operations.

- Supply Chain Disruptions: Geopolitical events can disrupt the availability of critical hardware components or impact the logistics of delivering services, potentially delaying projects and increasing costs.

- Shifting Client Priorities: Economic uncertainty often leads clients to re-evaluate their IT spending, potentially delaying or scaling back projects, which directly affects Alten's project pipeline and revenue forecasts.

- Regulatory Changes: Geopolitical instability can trigger rapid changes in international trade regulations or data privacy laws, creating compliance challenges and operational hurdles for Alten.

Impact of Reduced Working Days and Operational Leverage

Alten's operational performance faces headwinds from a reduction in working days, evident in Q1 and H1 2025. This decrease directly impacts revenue generation and can compress operating margins, especially when coupled with lower coverage of fixed costs like SG&A due to reduced business activity. For instance, if Q1 2025 saw 65 working days compared to 67 in Q1 2024, this alone could shave off a percentage point or two from top-line growth and margin, assuming similar productivity per day.

The company's operational leverage means that even minor dips in revenue can disproportionately affect profitability. When fewer working days reduce overall output, the fixed costs associated with maintaining operations become a larger burden relative to revenue. This sensitivity is amplified if SG&A expenses are not scaled down proportionally, leading to a squeeze on the operating margin. For example, a 3% drop in revenue due to fewer working days might result in a 5% or more decline in operating profit if cost structures remain largely unchanged.

While Alten actively pursues cost reductions, inherent seasonality and calendar effects can still pose challenges. Differences in the number of working days between reporting periods, such as comparing a quarter with more public holidays in one year versus another, can create fluctuations. This makes it crucial for investors to look beyond headline numbers and understand the underlying operational drivers and the impact of these calendar-related variations on profitability trends.

- Reduced Working Days Impact: Q1 and H1 2025 data indicates a negative correlation between fewer working days and Alten's revenue and operating margins.

- Operational Leverage Effect: Lower activity due to reduced working days increases the burden of fixed SG&A costs, compressing operating margins.

- Calendar and Seasonality Challenges: Despite cost-saving efforts, fluctuations in profitability can persist due to inherent seasonality and calendar differences in working days across reporting periods.

Alten faces significant threats from a slowing global economy, particularly in Europe, leading to postponed client investments and reduced demand for IT and engineering services throughout 2024 and into early 2025. Intense competition from established players and offshore providers further pressures pricing power and market share. Additionally, geopolitical instability creates currency fluctuations, supply chain disruptions, and shifting client priorities, impacting revenue forecasts and operational costs.

The company is also vulnerable to a global talent shortage for specialized IT skills, hindering its ability to scale operations and deliver projects efficiently. This talent acquisition challenge, noted in 2024, could impede Alten's growth trajectory. Furthermore, a reduction in working days in Q1 and H1 2025 directly impacts revenue and compresses operating margins due to the fixed nature of SG&A costs, a trend that requires careful monitoring beyond headline figures.

| Threat Category | Specific Impact on Alten | Supporting Data/Context (2024-2025) |

|---|---|---|

| Economic Slowdown | Reduced client investment, project postponements | European economic slowdown impacting IT/engineering services demand; cautious corporate spending |

| Intense Competition | Pressure on pricing and market share | Competition from Atos, Cognizant, and Indian offshore providers |

| Geopolitical Instability | Currency fluctuations, supply chain issues, regulatory changes | Impact of global tensions on trade, data privacy laws, and logistics |

| Talent Shortage | Hindered operational scaling and project delivery | Global IT talent shortage in 2024 for specialized skills |

| Operational Headwinds | Lower revenue and margin due to fewer working days | Negative correlation observed in Q1/H1 2025; increased SG&A burden |

SWOT Analysis Data Sources

This Alten SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a thorough and actionable strategic overview.