Alten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

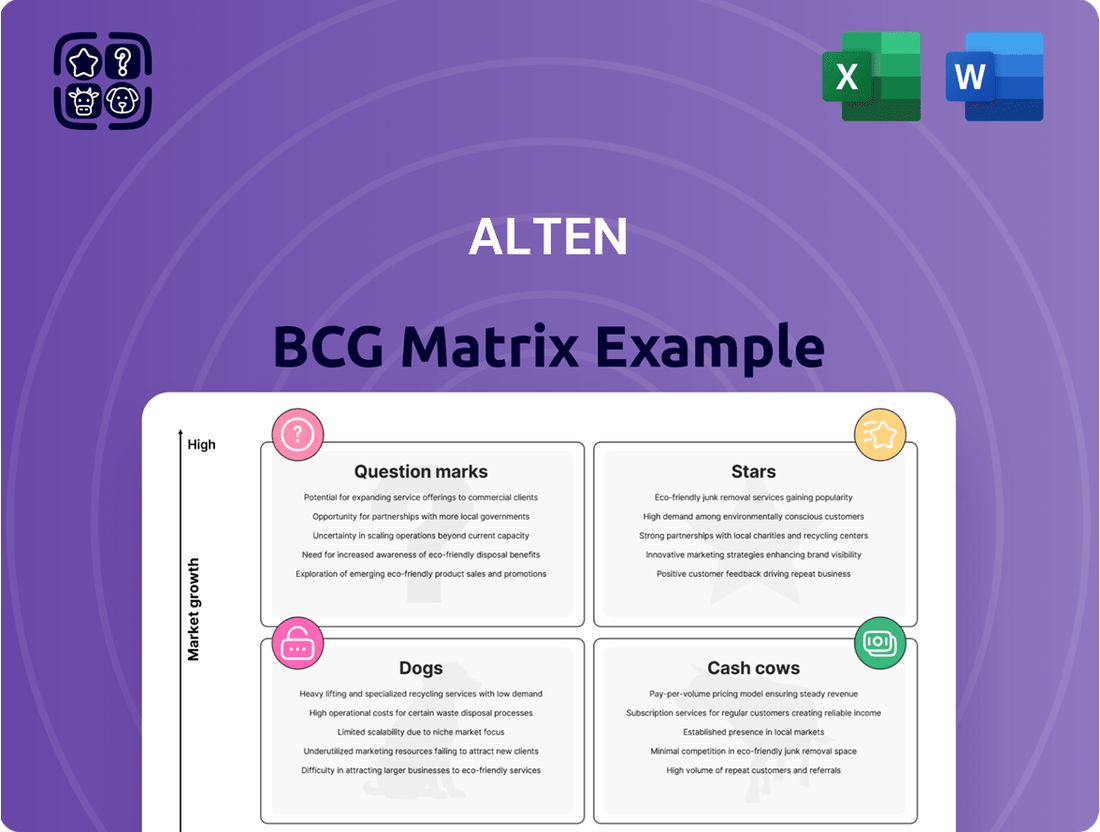

The Boston Consulting Group (BCG) Matrix is a powerful strategic tool that helps businesses analyze their product portfolio. It categorizes products into four quadrants: Stars, Cash Cows, Dogs, and Question Marks, based on market growth rate and relative market share. Understanding these placements is crucial for informed decision-making regarding resource allocation and future investments.

This preview offers a glimpse into the strategic potential of the BCG Matrix. To truly harness its power and gain a comprehensive understanding of your company's product landscape, including detailed quadrant analysis and actionable insights, purchase the full BCG Matrix report. It's your roadmap to optimizing your portfolio and driving sustainable growth.

Stars

Alten's Defense & Security sector is a shining star in its portfolio, experiencing robust expansion fueled by rising defense expenditures globally and a strong push for European defense autonomy. This sector benefits from substantial government investments, with global military spending projected to reach $2.4 trillion in 2024, according to the Stockholm International Peace Research Institute (SIPRI).

As a Tier One supplier, Alten commands a significant market share within this dynamic industry, positioning it to capitalize on ongoing modernization efforts and new program acquisitions. The company’s expertise in critical areas like cybersecurity and advanced electronics further solidifies its leadership potential in this high-growth, strategically important market.

The energy sector, with a strong emphasis on nuclear power, represents a Stars category for Alten. This is largely due to the strategic acquisition of WORLDGRID in November 2024, which significantly enhanced Alten's capabilities and market presence in nuclear projects. This move positions Alten as a key stakeholder in a sector experiencing robust growth and strategic importance.

AI and Data Analytics Services represent a Star for Alten. The company's significant investments in this area are aimed at boosting its competitive edge and client solutions, tapping into a market experiencing rapid expansion due to AI's broad industrial adoption.

Alten is actively cultivating expertise and broadening its service portfolio within the high-growth AI and data analytics sector. This strategic focus is designed to enhance internal productivity and deliver cutting-edge solutions, aligning with the increasing demand for these capabilities across various industries.

IT Enterprise Services (IT.ES) Transformation

Alten's IT Enterprise Services (IT.ES) division is charting a course for significant expansion, aiming for substantial revenue increases and a double-digit operating margin by 2028. This ambitious plan centers on modernizing its operational structure and integrating artificial intelligence to solidify its position in the dynamic IT services market.

The transformation initiative is designed to enhance efficiency and service delivery, directly supporting the company's overarching growth objectives. By focusing on AI and organizational agility, Alten IT.ES is positioning itself to capture a larger share of the market and drive innovation.

- Revenue Growth Target: Aiming for substantial revenue increases by 2028.

- Operating Margin Goal: Targeting a double-digit operating margin within the same timeframe.

- Strategic Focus: Modernization of organization and leveraging AI for market leadership.

Digital Transformation Initiatives

Digital Transformation Initiatives represent a significant area for Alten, aligning with the global trend of businesses investing heavily in technology. The global digital transformation services market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $3.4 trillion by 2028, demonstrating substantial expansion. Alten's expertise in areas like cloud, data analytics, and AI directly addresses this demand, enabling clients to modernize operations and enhance competitiveness.

Alten's focus on digital transformation positions it within a high-growth segment of the IT services industry. This is crucial for its strategic placement. Key drivers include the need for enhanced customer experiences, operational efficiency, and data-driven decision-making across various sectors.

- Market Growth: The global digital transformation market is expanding rapidly, with projections indicating continued strong performance.

- Alten's Role: Alten supports clients in adopting technologies like cloud computing, big data, and artificial intelligence.

- Client Benefits: These initiatives help clients improve innovation, modernize information systems, and gain a competitive edge.

- Strategic Alignment: Alten's digital transformation services are well-positioned to capitalize on this growing market demand.

Alten's Defense & Security sector is a clear Star, driven by increased global defense spending, projected to hit $2.4 trillion in 2024. Its Tier One supplier status and expertise in cybersecurity and advanced electronics position it for significant growth in this strategically vital market.

The energy sector, particularly nuclear power, is another Star for Alten, bolstered by the November 2024 acquisition of WORLDGRID. This strategic move enhances Alten's capabilities and market share in nuclear projects, a sector experiencing robust expansion.

AI and Data Analytics Services are a Star for Alten. The company's substantial investments in this area are designed to sharpen its competitive edge and improve client solutions, capitalizing on AI's widespread industrial adoption and rapid market growth.

Alten's IT Enterprise Services (IT.ES) division is a Star, with ambitious plans for significant revenue growth and a double-digit operating margin by 2028. This strategy hinges on modernizing operations and integrating AI to lead the IT services market.

Digital Transformation Initiatives are a Star for Alten, aligning with the global surge in technology investment. The digital transformation services market, valued at approximately $1.5 trillion in 2023, is expected to exceed $3.4 trillion by 2028, highlighting Alten's prime position to benefit.

| Sector/Service | BCG Category | Key Growth Drivers | Alten's Strategic Position |

|---|---|---|---|

| Defense & Security | Star | Global defense spending increase, European defense autonomy | Tier One supplier, cybersecurity & advanced electronics expertise |

| Energy (Nuclear) | Star | Strategic acquisition of WORLDGRID, growing nuclear energy demand | Enhanced capabilities and market presence in nuclear projects |

| AI & Data Analytics | Star | Broad industrial adoption of AI, rapid market expansion | Significant investment, focus on competitive edge and client solutions |

| IT Enterprise Services (IT.ES) | Star | Digitalization trends, AI integration | Modernization initiative, targeting double-digit operating margin by 2028 |

| Digital Transformation | Star | Global investment in technology, need for modernization | Expertise in cloud, data analytics, AI; addressing market demand |

What is included in the product

Strategic overview of Alten's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Quickly identify underperforming "Dogs" to divest or re-evaluate, relieving the pain of wasted resources.

Cash Cows

Alten's operations in France are a prime example of a Cash Cow within the BCG Matrix. The company achieved a solid 4.2% organic growth in the first quarter of 2025, a notable performance given that other regions experienced downturns. This sustained growth in a well-established market signifies a dependable and consistent generation of revenue for Alten.

Established Engineering Consulting Services represent Alten's cash cows within the BCG matrix. As a European leader in Engineering and Technology Consulting (ETC), Alten benefits from a mature market segment where its long-standing presence and established client relationships across diverse industries are key. This segment, while not experiencing explosive growth, is characterized by consistent and strong profit margins, a testament to Alten's competitive advantage and robust reputation. For instance, in 2023, Alten reported revenue of €4.3 billion, with its Engineering and Technology Consulting segment being a significant contributor, demonstrating the sustained profitability of these established services.

Alten's Rail Sector Projects are firmly positioned as Cash Cows within the BCG matrix. This segment consistently demonstrates robust growth for Alten, signaling a mature market where the company enjoys a dominant and stable presence.

The company's strong market position is further bolstered by ongoing investments in critical areas like infrastructure modernization and advanced signaling technologies. These strategic investments ensure a steady and predictable revenue stream, reinforcing the Cash Cow status.

Furthermore, Alten's involvement in renewable energy initiatives and high-speed train development within the rail sector enhances its cash-generating capabilities. For instance, in 2024, the global rail market was projected to reach over $200 billion, with significant growth driven by these very trends, underscoring the lucrative nature of Alten's rail projects.

Existing Client Base and Long-Term Contracts

Alten's established client base, built on long-term contracts for innovation, R&D, and IT support, forms a core component of its cash cow strategy. These enduring relationships translate into highly predictable revenue streams, a hallmark of mature, stable businesses. In 2024, Alten reported a significant portion of its revenue derived from its key accounts, demonstrating the strength and loyalty of its existing client partnerships.

This reliance on long-term engagements fosters high client retention rates, minimizing the need for costly new client acquisition. Such stability allows Alten to efficiently allocate resources, further solidifying the cash cow status of these business segments. For instance, the company's consistent performance in sectors like automotive and aerospace, where it has deep-rooted client relationships, exemplifies this.

- Predictable Revenue: Long-term contracts ensure a steady and reliable income flow.

- High Retention: Existing clients demonstrate loyalty, reducing churn.

- Resource Efficiency: Stable income allows for optimized resource allocation.

- Market Stability: Mature client relationships often exist in stable market segments.

Strong Financial Position and Free Cash Flow Generation

Alten's robust financial health is a cornerstone of its Cash Cow status within the BCG matrix. The company demonstrated exceptional free cash flow generation, with a significant 81.4% increase in 2024, reaching €333.2 million. This surge highlights its capacity to convert profits into readily available cash.

This strong liquidity is not just a number; it translates into strategic flexibility. Alten's healthy net cash position enables it to self-fund crucial initiatives, including external growth opportunities and shareholder returns through dividends. This financial self-sufficiency is characteristic of mature, highly profitable businesses.

- Substantial Free Cash Flow Growth: Alten's free cash flow grew by 81.4% in 2024, reaching €333.2 million.

- Healthy Net Cash Position: The company maintains a strong liquidity profile, indicating financial stability.

- Self-Funding Capabilities: This financial strength allows for the self-funding of external growth and dividend payments.

Alten's established Engineering and Technology Consulting services are prime examples of Cash Cows. These segments benefit from a mature market where Alten's strong reputation and existing client relationships across various industries generate consistent profits. For instance, in 2023, Alten's Engineering and Technology Consulting segment was a significant contributor to its €4.3 billion revenue, showcasing its sustained profitability and competitive edge in a stable market.

The company's Rail Sector Projects also function as Cash Cows, experiencing robust growth due to Alten's dominant position in a mature market. Strategic investments in rail modernization and advanced signaling technologies, coupled with involvement in renewable energy and high-speed rail, ensure predictable revenue streams. The global rail market's projected over $200 billion value in 2024, driven by these trends, highlights the lucrative nature of these projects.

| Segment | BCG Category | Key Characteristics | Supporting Data (2023/2024) |

| Engineering & Technology Consulting | Cash Cow | Mature market, strong reputation, established client base, consistent profitability | Significant contributor to €4.3 billion revenue (2023) |

| Rail Sector Projects | Cash Cow | Dominant market position, consistent growth, predictable revenue from modernization and advanced technologies | Global rail market projected >$200 billion (2024) |

Preview = Final Product

Alten BCG Matrix

The BCG Matrix document you are currently previewing is the complete, finalized version you will receive immediately after your purchase. This means you're seeing the actual strategic tool, ready for immediate application without any watermarks or demo limitations. You can confidently expect this exact, polished analysis to aid in your business planning and decision-making processes.

Dogs

Alten's operations in the UK and Germany have been particularly challenging, leading to significant impairments. In 2023, the company recorded goodwill impairments of €190 million, with a substantial portion attributed to these two markets, reflecting a re-evaluation of their value and future earning potential.

These markets are characterized by low growth environments, which, coupled with Alten's potentially lower market share compared to competitors, places them in the 'Dog' quadrant of the BCG Matrix. This suggests a need for careful strategic consideration, as continued investment may not yield sufficient returns.

Alten's automotive sector faced a significant slump, with performance dipping more than 10% in the first quarter of 2025. This downturn led to substantial budget reductions, particularly affecting their French operations.

Historically a strong contributor, the automotive segment now presents a challenging landscape for Alten. Current market indicators suggest a period of low growth, raising concerns about the company's potential market share in this area.

The Life Sciences sector experienced a slowdown in activity for Alten during 2024, mirroring the broader organic decline observed across the company. This indicates a low-growth environment for Alten within this segment, potentially impacting its market position.

Telecoms Sector

The Telecoms sector presents a challenging landscape for Alten, reflecting a low-growth environment. Significant downturns, including declines exceeding 10% in Q1 2025, coupled with budget cuts impacting French operations, underscore this trend. This situation suggests that Alten is operating in a market with limited expansion opportunities, where its competitive position may be weak or declining.

Alten's performance in the Telecoms sector aligns with the characteristics of a 'Dog' in the BCG Matrix. This classification implies a low market share in a low-growth industry. The recent financial data, showing a substantial quarterly decline, reinforces the notion that this segment is not a growth engine for the company and may require strategic re-evaluation.

- Telecoms Sector Performance: Alten experienced over 10% decline in Q1 2025.

- Operational Impact: Budget cuts affected French operations within the sector.

- Market Position: Indicates a low-growth market for Alten with potential market share erosion.

Divested Asian Subsidiary (China/Japan)

Alten's divestiture of its Asian subsidiary in China and Japan at the close of December 2024, with a modest revenue of €8.9 million, strongly indicates its classification as a 'Dog' within the BCG Matrix. This strategic move implies the subsidiary was a low-growth, low-market-share entity, draining resources without significant future potential. Such divestments are common for companies looking to streamline operations and focus on more promising business units.

The decision to divest this specific Asian operation, generating only €8.9 million in revenue, points to its underperformance and misalignment with Alten's broader strategic objectives. Companies typically exit 'Dog' segments to reallocate capital and management attention towards 'Stars' or 'Question Marks' with higher growth prospects. This action reflects a disciplined approach to portfolio management.

- Divestiture Rationale: The sale of the Asian subsidiary, with its low revenue of €8.9 million, aligns with the 'Dog' quadrant's characteristics of low market share and low growth, suggesting it was a candidate for divestment.

- Strategic Alignment: Underperforming assets like this subsidiary are often divested to refocus resources on areas with greater potential for profitability and strategic growth, a hallmark of sound portfolio management.

- Financial Impact: While specific details of the sale are not provided, the divestiture of a low-revenue entity typically aims to improve overall profitability and operational efficiency for the parent company.

Alten's operations in the UK and Germany, along with its automotive and telecoms sectors, are exhibiting characteristics of 'Dogs' in the BCG Matrix. These segments are defined by low growth environments and, in some cases, a potentially weaker market share for Alten, as evidenced by significant impairments of €190 million in 2023 and a more than 10% decline in the automotive sector in Q1 2025. The divestiture of its Asian subsidiary in China and Japan for €8.9 million further reinforces this classification, signaling a strategic move away from underperforming assets.

The Life Sciences sector also experienced a slowdown in 2024, indicating a low-growth environment for Alten within this segment. This aligns with the 'Dog' profile, suggesting these areas require careful strategic consideration due to limited expansion opportunities and potential market share erosion.

Alten's strategic decision to divest its Asian subsidiary, which generated €8.9 million in revenue, highlights its classification as a 'Dog'. This move indicates the subsidiary was a low-growth, low-market-share entity, prompting a reallocation of resources towards more promising business units.

The company's performance in sectors like automotive and telecoms, marked by significant declines and budget cuts in French operations, further solidifies the 'Dog' classification. These segments are characterized by low growth and potentially weak competitive positions, necessitating a strategic re-evaluation.

| BCG Quadrant | Alten Sectors/Operations | Key Indicators | Financial Data (Examples) |

|---|---|---|---|

| Dogs | UK Operations | Low growth environment, significant impairments | Impairments of €190 million (2023) partly attributed to UK |

| Dogs | Germany Operations | Low growth environment, significant impairments | Impairments of €190 million (2023) partly attributed to Germany |

| Dogs | Automotive Sector | Low growth, potential market share issues | Over 10% decline in Q1 2025, budget reductions in French operations |

| Dogs | Telecoms Sector | Low growth, potential market share issues | Over 10% decline in Q1 2025, budget reductions in French operations |

| Dogs | Life Sciences Sector | Slowdown in activity, low-growth environment | Observed organic decline in 2024 |

| Dogs | Asian Subsidiary (China & Japan) | Low growth, low market share, divested | Divested for €8.9 million revenue (December 2024) |

Question Marks

Alten is actively investing in emerging technologies like the Internet of Things (IoT) and advanced automation, recognizing their significant growth potential. This strategic focus includes enhancing process automation and modernizing infrastructure, areas poised for substantial expansion in the coming years.

While Alten is making strides in these nascent markets, its current market share and definitive leadership across all emerging tech segments are still developing. Capturing a larger slice of these rapidly evolving sectors will necessitate continued, significant investment to build and solidify its position.

Alten's strategic acquisitions in 2024, including a software development firm in Vietnam/Japan and an IT services company in Poland, position these ventures as potential Stars within the BCG matrix. These emerging markets show significant growth potential, but Alten's precise market share and profitability are still in the early stages of development. Ongoing investment will be crucial to nurture these new entities and solidify their position in the market.

Alten actively participates in cybersecurity projects, including the implementation of crucial regulations like the European Union's Digital Operational Resilience Act (DORA). This demonstrates their commitment to addressing the evolving digital security needs of businesses.

The cybersecurity market is experiencing robust growth, with projections indicating a global market size of over $300 billion by 2024. However, within this dynamic and competitive sector, Alten's current market share might be relatively modest, suggesting a need for substantial investment to enhance its competitive position and capture a larger portion of this expanding market.

Offshore Delivery Capacity Expansion

Alten is actively expanding its offshore delivery capacity, a strategic move to boost competitiveness and overall productivity. This involves significant investment in key locations such as India, Morocco, Eastern Europe, Vietnam, and Mexico.

While this expansion is a growth-oriented strategy, scaling these new offshore centers entails substantial upfront investment. The immediate returns on these investments are not guaranteed, presenting a degree of uncertainty.

- Global Workforce Growth: Alten's offshore workforce, particularly in India, has seen substantial growth, contributing to a more cost-effective service delivery model.

- Investment in New Hubs: The company is channeling resources into developing new offshore delivery centers, aiming to diversify its talent pool and operational footprint.

- Productivity Enhancement Focus: The expansion is directly linked to enhancing productivity and operational efficiency across its global service offerings.

- Competitive Positioning: By strengthening its offshore capabilities, Alten aims to solidify its competitive edge in the global engineering and IT services market.

Southern European Market Growth

Southern Europe represents a compelling growth area for Alten, especially as other European markets face stagnation or decline. This region is a prime example of a Question Mark in the BCG matrix, exhibiting high market growth potential.

Alten's continued success in Southern Europe, while other regions falter, highlights a significant opportunity. Capturing increased market share here requires strategic investment and focused efforts to avoid the unit becoming a Dog.

- Market Growth: Southern Europe is demonstrating robust growth, contrasting with other European regions experiencing declines.

- Strategic Opportunity: This presents a chance for Alten to expand its market share within a burgeoning segment.

- Investment Needs: Realizing this potential necessitates targeted investment and a dedicated strategic focus.

- Risk Mitigation: Without proper nurturing and investment, this promising segment could underperform and become a Dog.

Southern Europe is identified as a key growth area for Alten, particularly as other European markets face economic slowdowns. This region, characterized by high market growth, fits the profile of a Question Mark in the BCG matrix. Alten's performance here, outperforming other European segments, signifies a strategic opportunity for market share expansion.

To capitalize on this high-growth potential in Southern Europe, Alten must strategically allocate resources. Without focused investment and dedicated effort, this promising segment risks stagnation and could potentially transition into a Dog category within the BCG framework.

The company's presence in Southern Europe, especially in countries like Spain and Portugal, is showing positive momentum. For instance, Spain's IT services market was projected to reach approximately $24 billion in 2024, indicating a fertile ground for Alten's expansion efforts.

Alten's approach to Southern Europe involves understanding local market dynamics and tailoring service offerings. This strategic positioning is crucial for converting the high growth potential into a dominant market share, thereby solidifying its position as a Star or Cash Cow in the future.

| Region | Market Growth Potential | Alten's Current Position | Strategic Implication (BCG) | Key Action |

|---|---|---|---|---|

| Southern Europe | High | Developing/Growing | Question Mark | Increase investment and market penetration |

| Spain IT Services Market (2024 est.) | N/A (Specific Market Data) | N/A | N/A | Targeted service expansion |

| Portugal IT Services Market (2024 est.) | N/A (Specific Market Data) | N/A | N/A | Strategic partnerships and acquisitions |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, industry research reports, and market growth projections to provide a comprehensive view of product portfolios.