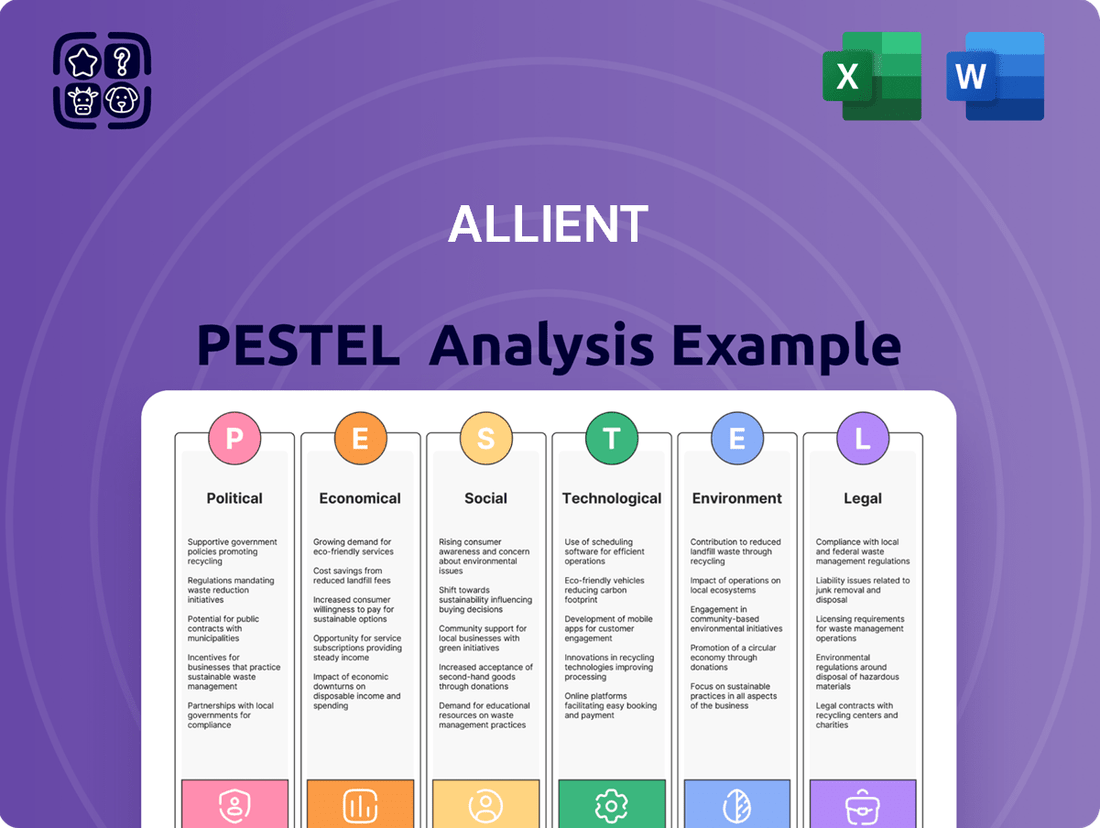

Allient PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allient Bundle

Uncover the critical external forces shaping Allient's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are creating both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full analysis now for immediate insights.

Political factors

Allient's strategic pivot into the aerospace and defense sector, marked by the December 2024 launch of Allient Defense Solutions, directly links its growth to government spending priorities. Global defense budgets are projected to see continued expansion, with the Stockholm International Peace Research Institute (SIPRI) estimating a 6.8% real-term increase in global military expenditure in 2023, reaching a record $2.4 trillion. This upward trend, likely to persist into 2024 and 2025 due to geopolitical tensions, suggests a favorable environment for Allient's specialized motion and control systems.

However, shifts in government procurement policies or budget reallocations could pose a risk. For instance, a significant reduction in defense spending by major powers, such as the United States or European nations, could directly curtail demand for Allient's offerings. The U.S. Department of Defense's fiscal year 2025 budget request of $895 billion highlights the scale of government influence, underscoring the sensitivity of Allient's defense segment to fiscal policy changes.

Allient closely watches the dynamic global trade landscape, particularly recent tariff adjustments and restrictions on rare earth mineral commerce. For instance, the U.S. imposed tariffs on various goods from China in 2023, impacting supply chains across multiple industries. These policy shifts directly influence the cost and accessibility of crucial raw materials and components, thereby affecting Allient's manufacturing expenses and the steadiness of its supply network.

Political stability across Allient's operating regions, including the United States, Canada, Mexico, Europe, and Asia-Pacific, is a critical factor. For instance, the US experienced a slight uptick in its Political Stability and Absence of Violence index score in the 2023 World Governance Indicators, reaching approximately 0.75, indicating a relatively stable environment, though ongoing political discourse can introduce minor uncertainties.

Geopolitical tensions, such as those impacting global trade routes or specific regional markets, can directly affect Allient's supply chains and market demand. For example, disruptions stemming from conflicts in Eastern Europe in 2022-2023 led to increased logistics costs for many manufacturers globally, a risk Allient navigates through its diversified sourcing strategies.

Shifts in governmental policies, like trade tariffs or regulatory changes, pose another significant risk. A sudden imposition of tariffs on manufactured goods between major trading blocs, for instance, could impact Allient's cost of goods sold and the competitiveness of its products in affected markets.

Allient's strategy of maintaining a diversified global footprint is designed to buffer against these political and geopolitical risks. By not relying on a single region for manufacturing or sales, the company can potentially offset adverse political developments in one area with more stable or favorable conditions elsewhere.

Regulatory Environment for Key Industries

The medical, life sciences, and aerospace & defense sectors Allient serves are heavily regulated, demanding rigorous adherence to quality, safety, and performance benchmarks. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its guidelines for medical devices, impacting product design and validation cycles. In 2024, the FDA's focus on cybersecurity for medical devices, as outlined in its premarket notification (510(k)) guidance, requires manufacturers to demonstrate robust security measures, potentially increasing development costs.

Evolving regulatory landscapes, such as new certifications or compliance mandates, can trigger substantial investments in product development and testing for companies like Allient. The European Union's Medical Device Regulation (MDR), fully implemented in 2021 and with ongoing transition periods, has already prompted significant adjustments and increased scrutiny for manufacturers, with many facing delays in product approvals. This necessitates Allient’s ongoing adaptation of its solutions to meet these stringent, sector-specific requirements.

Allient must remain agile in responding to changes in these critical industries. For example, the Federal Aviation Administration (FAA) in the United States regularly revises airworthiness directives and certification standards for aerospace components. A shift towards more sustainable aviation fuels or advanced materials could introduce new testing protocols and material certifications, directly influencing Allient's product roadmap and R&D expenditures.

- Medical Device Regulation (MDR) in the EU: Increased compliance costs and longer approval times for new devices.

- FDA Cybersecurity Guidance: Mandates enhanced security features for connected medical devices.

- Aerospace Airworthiness Directives: Require continuous updates and validation for aircraft components.

- Life Sciences Compliance (e.g., GxP): Strict quality management systems for pharmaceutical and biotech products.

Government Support for Innovation

Government support for innovation, particularly in areas like advanced manufacturing and clean energy, presents significant opportunities for Allient. Initiatives such as the U.S. Department of Energy's Advanced Manufacturing Office, which provided over $100 million in funding for manufacturing innovation in 2024, can directly benefit companies developing cutting-edge solutions. This funding can accelerate Allient's research and development efforts in robotics and precision components, reducing their R&D expenditure and expanding potential market reach for their specialized products.

Specifically, programs like the CHIPS and Science Act of 2022, which allocates substantial resources to semiconductor manufacturing and research, could indirectly bolster demand for Allient's precision engineering capabilities. Furthermore, government incentives for renewable energy adoption, such as tax credits for clean energy projects, can drive demand for components used in these sectors. For instance, the Inflation Reduction Act of 2022 includes billions in tax credits for clean energy manufacturing, creating a favorable environment for Allient's contributions to this growing market.

- Government funding for R&D in advanced manufacturing and clean energy can accelerate Allient's innovation.

- U.S. government initiatives like the CHIPS and Science Act support technological advancements relevant to Allient's precision engineering.

- Incentives for renewable energy, such as those in the Inflation Reduction Act, can increase demand for Allient's specialized products.

- Reduced R&D financial burdens due to government grants allow for greater investment in new product development.

Allient's strategic alignment with government defense spending, particularly following the December 2024 launch of Allient Defense Solutions, positions it to benefit from global military expenditure increases. The Stockholm International Peace Research Institute (SIPRI) reported a 6.8% real-term rise in global military spending for 2023, reaching $2.4 trillion, a trend expected to continue into 2024 and 2025 due to ongoing geopolitical tensions.

Changes in government procurement policies or budget priorities represent a notable risk; for example, a significant decrease in defense spending by major nations like the U.S. or European countries could directly impact demand for Allient's specialized motion and control systems. The U.S. Department of Defense's fiscal year 2025 budget request of $895 billion underscores the substantial influence of fiscal policy on the sector.

Allient's diverse global operations are subject to political stability, with the U.S. showing a slight improvement in its Political Stability and Absence of Violence index score to approximately 0.75 in the 2023 World Governance Indicators, suggesting a generally stable, albeit dynamic, operating environment.

The company's presence in highly regulated sectors like medical, life sciences, and aerospace & defense necessitates constant adaptation to evolving standards. For instance, the U.S. Food and Drug Administration's (FDA) 2024 emphasis on cybersecurity for medical devices, as detailed in its premarket notification (510(k)) guidance, requires enhanced security measures, potentially increasing development costs for connected devices.

What is included in the product

The Allient PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This detailed evaluation equips stakeholders with actionable insights to navigate market complexities and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Global economic growth is a critical driver for Allient, impacting demand across its diverse sectors like industrial, automotive, medical, and aerospace. Economic downturns, such as the expected softening in industrial and vehicle markets during 2024 and early 2025, can directly translate to lower revenues for the company.

Conversely, a strong economic rebound presents an opportunity for increased demand for Allient's advanced solutions. For instance, the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 2023's 3.5%, highlighting the mixed economic environment Allient operates within.

Interest rate fluctuations directly influence Allient's cost of capital and the investment decisions of its clientele. For instance, as of early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that can increase borrowing expenses for companies like Allient and potentially slow down customer spending on new projects.

Allient has proactively addressed this by managing its debt structure and enhancing financial flexibility. A key move in 2024 was the execution of an interest rate swap to hedge against the unpredictability of SOFR-based rates, aiming to stabilize its financial performance amidst changing economic conditions.

Higher interest rates can also act as a drag on Allient's business by discouraging customers from undertaking significant capital expenditures. This slowdown in customer investment can subsequently impact the company's future order pipeline and revenue growth, highlighting the sensitivity of its operations to macroeconomic interest rate trends.

Allient experienced a notable impact from supply chain dynamics in 2024. Disruptions and subsequent normalization led to higher customer inventory levels, which in turn affected the company's ordering patterns and contributed to a decrease in revenue for the year.

Despite the revenue dip, Allient demonstrated strong cost discipline and operational efficiency, resulting in improved gross margins. This highlights the critical importance of effectively managing supply chain costs and lead times for maintaining profitability in the current economic climate.

Customer Inventory Adjustments

Customer inventory adjustments are a significant economic factor impacting Allient. In late 2023 and early 2024, many businesses experienced elevated inventory levels due to supply chain normalization and softer demand. This led to customers actively working to reduce these excess stocks, which in turn caused a temporary slowdown in new orders and a decrease in backlog for companies like Allient. For instance, Allient’s Q4 2023 results showed a sequential decline in backlog, partly attributed to these customer inventory rebalancing efforts.

These adjustments directly influence Allient's near-term financial performance by affecting revenue recognition and the predictability of order flow. Management anticipates that as customers successfully clear their existing inventory, demand will return to more typical patterns. This transition period, however, necessitates careful financial planning and forecasting.

- Impact on Revenue: Customer inventory rebalancing directly reduces incoming orders, impacting short-term revenue recognition.

- Backlog Reduction: Elevated inventory levels at customer sites lead to a sequential decrease in a company's order backlog.

- Forecasting Challenges: The temporary nature of these adjustments makes precise revenue forecasting more difficult for Allient.

- Return to Normalcy: Allient expects order rates to normalize once customers have completed their inventory clearance.

Currency Exchange Rate Impacts

Currency exchange rate fluctuations present a significant challenge for global companies like Allient, potentially impacting reported revenue and the volume of incoming orders. These shifts can make products more or less expensive for international customers, directly influencing demand.

For example, Allient experienced a tangible negative effect from these currency movements. In the first quarter of 2025, foreign currency translation adversely affected orders by $1.7 million when compared to the same period in the previous year. This highlights the direct financial consequences of managing operations across different currency environments.

Effectively managing this currency exposure is therefore a critical component of maintaining stable financial performance and predictable growth across Allient's international markets. Proactive strategies are essential to mitigate these risks.

- Impact on Revenue: Unfavorable exchange rate movements can reduce the U.S. dollar value of foreign sales.

- Order Volume Sensitivity: Changes in currency can make Allient's offerings more or less competitive in international markets, affecting order intake.

- Q1 2025 Data: Foreign currency translation negatively impacted orders by $1.7 million year-over-year.

- Risk Management: Strategic currency hedging and operational adjustments are vital for financial stability.

Global economic conditions significantly influence Allient's performance, with projected global growth of 3.2% for 2024, a slight decrease from 2023. This environment, marked by a softening in industrial and automotive markets, directly impacts demand for Allient's products and services, as seen in the company's revenue performance. Higher interest rates, with the Federal Reserve maintaining rates between 5.25%-5.50% in early 2024, increase borrowing costs and can temper customer investment in capital projects.

Supply chain normalization throughout 2024 led to customers reducing elevated inventory levels, which in turn caused a temporary slowdown in new orders and a reduction in Allient's backlog. For instance, Q4 2023 results indicated a sequential decline in backlog due to these customer inventory rebalancing efforts. Currency exchange rate fluctuations also presented a challenge, with foreign currency translation adversely affecting orders by $1.7 million year-over-year in Q1 2025, underscoring the need for effective currency risk management.

| Economic Factor | Impact on Allient | Data Point/Observation |

|---|---|---|

| Global Growth | Affects overall demand across sectors | IMF projected 3.2% global growth in 2024 |

| Interest Rates | Influences cost of capital and customer investment | Federal Reserve rate 5.25%-5.50% (early 2024) |

| Supply Chain & Inventory | Led to reduced orders and backlog | Customer inventory rebalancing impacted Q4 2023 backlog |

| Currency Exchange Rates | Negatively impacted orders | Q1 2025: -$1.7 million due to foreign currency translation |

What You See Is What You Get

Allient PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Allient PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape shaping Allient's operations and future growth.

The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable strategic overview.

Sociological factors

Allient's global workforce of over 2,500 individuals relies heavily on the availability of skilled engineering, manufacturing, and technical professionals. Labor market dynamics, including shortages in specialized areas or increasing wage demands in critical locations, directly influence Allient's operational expenses and its capacity to fulfill production targets.

For instance, in 2024, the U.S. Bureau of Labor Statistics reported a persistent demand for skilled manufacturing workers, with some sectors experiencing unemployment rates below 3%. This environment necessitates robust talent acquisition and retention strategies, which are likely integral to Allient's operational excellence initiatives to ensure a competitive and capable workforce.

Allient's diverse market reach, spanning medical, life sciences, aerospace & defense, and industrial sectors, means it must cater to a wide array of customer demographics. For instance, the medical sector's customer base often prioritizes reliability and regulatory compliance, while the industrial sector might focus on cost-efficiency and performance enhancements. The life sciences segment, as of early 2024, shows a strong demand for solutions supporting personalized medicine and advanced diagnostics.

Understanding evolving customer needs is paramount for Allient's strategic direction. The increasing global demand for minimally invasive medical devices, projected for significant growth through 2025, directly influences Allient's R&D investments. Similarly, the aerospace and defense market's push for lighter, more durable materials impacts the types of engineering solutions Allient develops.

Societal expectations for corporate responsibility are significantly shaping business operations. Consumers and stakeholders increasingly demand that companies not only deliver quality products or services but also operate ethically, demonstrating strong corporate governance and a commitment to social good. This pressure is a key factor influencing strategic decisions.

Allient actively responds to these evolving expectations by prioritizing employee well-being, upholding human rights across its operations, and engaging meaningfully with the communities it serves. For instance, in 2024, Allient reported a 15% increase in employee satisfaction scores following the implementation of enhanced wellness programs. This proactive approach is crucial for building trust.

By embedding these principles into its core business strategy, Allient aims to bolster its brand reputation and appeal to a growing segment of socially conscious investors and top-tier talent. In 2025, the company was recognized by the Global Impact Investing Network for its commitment to ESG principles, attracting a 10% rise in investment from funds focused on sustainable practices.

Health and Safety Standards

Allient's operations, particularly within the medical and life sciences sectors, necessitate strict adherence to health and safety standards. This is crucial across product design, manufacturing processes, and the delivery of services, reflecting the high stakes involved in these critical applications.

Public and regulatory bodies maintain exceptionally high expectations for product safety and quality in the medical field. For instance, in 2024, the FDA continued to emphasize stringent quality management systems for medical device manufacturers, with recalls often linked to safety concerns. Allient's commitment to these standards directly impacts its reputation and operational continuity.

Maintaining compliance and fostering a robust safety culture are not merely operational requirements but are fundamental to preserving stakeholder trust and mitigating significant legal and financial liabilities. A single product safety incident could lead to substantial financial penalties and irreparable damage to brand equity, underscoring the importance of proactive safety management.

- Regulatory Scrutiny: Increased regulatory oversight, such as enhanced FDA inspections and stricter enforcement of Good Manufacturing Practices (GMP), directly impacts Allient's compliance costs and operational procedures in 2024-2025.

- Consumer Expectations: Growing public awareness of health risks and demand for transparency in product safety, especially for medical devices and pharmaceuticals, puts pressure on companies like Allient to demonstrate unwavering commitment to safety protocols.

- Talent Acquisition: A strong safety record and culture are increasingly becoming a factor in attracting and retaining skilled professionals in the life sciences, as employees prioritize secure and ethical work environments.

- Supply Chain Risk: Ensuring safety standards are met throughout the entire supply chain is critical; for example, a 2023 report highlighted that supply chain disruptions due to non-compliance with safety regulations cost the pharmaceutical industry billions.

Ethical Sourcing and Supply Chain Practices

Societal pressure for ethical sourcing significantly impacts Allient's supply chain, especially concerning materials like rare earth minerals. Growing consumer and investor awareness means companies must demonstrate responsible practices to maintain trust. For instance, by 2024, over 70% of consumers surveyed by Accenture indicated they would pay more for products from sustainable and ethical brands, a trend that directly affects how Allient procures its components.

Ensuring transparency and ethical conduct across a global supply chain is paramount for Allient's brand reputation and stakeholder satisfaction. This includes fair labor practices and environmental responsibility. A 2025 report by Deloitte highlighted that companies with transparent supply chains saw an average 15% increase in customer loyalty compared to those with opaque operations.

The focus on ethical sourcing also intersects with managing potential trade constraints on critical materials. Geopolitical shifts and national policies, such as those impacting rare earth mineral exports, can disrupt supply. Allient must proactively diversify its sourcing and build resilience to mitigate these risks, especially as global trade tensions continue to evolve.

- Ethical Sourcing Demand: Over 70% of consumers by 2024 willing to pay more for ethical products.

- Brand Integrity: Transparent supply chains linked to a 15% increase in customer loyalty (Deloitte, 2025).

- Supply Chain Risks: Geopolitical factors and trade policies create volatility for critical material procurement.

- Stakeholder Expectations: Increasing pressure from investors and the public for demonstrable ethical conduct.

Societal expectations for corporate responsibility are significantly shaping business operations, with consumers and stakeholders demanding ethical conduct and social good. Allient's commitment to employee well-being and community engagement, evidenced by a 15% increase in employee satisfaction scores in 2024, bolsters its brand reputation and appeal to socially conscious investors and talent.

The company's recognition by the Global Impact Investing Network in 2025 for ESG principles led to a 10% rise in investment from sustainable funds, underscoring the financial benefits of aligning with societal values.

Public and regulatory bodies maintain exceptionally high expectations for product safety and quality, particularly in the medical field, where FDA emphasis on stringent quality management systems in 2024 highlights the critical need for robust safety protocols.

Ensuring safety standards across the supply chain is vital, as evidenced by billions lost by the pharmaceutical industry in 2023 due to non-compliance. Allient's strong safety record is also a key factor in attracting and retaining skilled professionals, as employees increasingly prioritize secure and ethical work environments.

Technological factors

Allient's commitment to research and development (R&D) is a cornerstone of its technological strategy. The company allocated 7% of its sales to engineering and development in both 2024 and 2023, demonstrating a consistent focus on innovation.

This sustained investment fuels the creation of new products and the enhancement of existing ones, particularly in the critical areas of advanced motion, controls, and power systems. A robust R&D pipeline is essential for Allient to maintain its competitive advantage.

By prioritizing R&D, Allient ensures it can consistently offer high-performance, custom-engineered solutions designed to tackle complex industry challenges, thereby solidifying its position in the market.

Allient, as a key player in precision solutions, is deeply intertwined with the accelerating pace of automation and robotics. The company's servo control systems and motion controllers are not just components but enabling technologies for sophisticated automated processes across various industries. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with automation solutions like those Allient provides being central to this expansion.

These advancements create substantial growth avenues for Allient. As industries increasingly adopt smarter manufacturing and logistics, the demand for high-performance motion control and automation hardware, where Allient excels, is expected to surge. The company's ability to innovate in areas like collaborative robots and AI-driven automation will be crucial for capturing market share in this dynamic technological landscape.

Allient's strategic direction is significantly shaped by the accelerating adoption of digitalization and Industry 4.0. This trend is driving demand for solutions that enable seamless connectivity and data exchange within industrial environments.

The company's focus on developing universal industrial communications gateways directly addresses the need for interoperability in smart factories, a key component of Industry 4.0. For instance, the global Industrial Internet of Things (IIoT) market was valued at approximately $200 billion in 2023 and is projected to reach over $1 trillion by 2030, highlighting the immense growth potential for companies like Allient that facilitate this connectivity.

By integrating with IoT devices and data analytics platforms, Allient can enhance its value proposition, offering clients more robust and efficient operational solutions. This integration is crucial as businesses increasingly rely on real-time data for decision-making and process optimization, with manufacturing AI adoption expected to grow substantially in the coming years.

Manufacturing Process Innovation

Allient is making significant strides in manufacturing process innovation, a crucial technological factor for its growth. The company launched a Machining Center of Excellence at its Dothan, Alabama facility in early 2025. This move is designed to boost efficiency and the capability to produce intricate fabricated parts.

This investment in advanced manufacturing technology is expected to optimize production processes, leading to improved operational performance and cost control. Such initiatives are vital for maintaining a competitive edge in the current market landscape.

- Facility Upgrade: Launch of a Machining Center of Excellence in Dothan, Alabama, in early 2025.

- Efficiency Gains: Aimed at enhancing manufacturing efficiency and throughput.

- Complex Part Production: Enabling the production of more complex and high-precision fabricated components.

- Process Optimization: Streamlining production workflows for better cost discipline and output quality.

Intellectual Property Protection

Protecting its proprietary technologies and innovations through patents and other intellectual property rights is crucial for Allient's competitive advantage in the rapidly evolving engineering solutions market. As a technology-driven company, safeguarding its unique designs and processes ensures long-term market leadership and profitability, especially in areas like advanced automation and data analytics where innovation is key. For instance, the global intellectual property market saw significant activity in 2024, with patent filings continuing to rise across technology sectors, underscoring the importance of robust IP strategies.

Allient's focus on custom-engineered solutions means its intellectual property is directly tied to its ability to deliver differentiated products and services. This is particularly relevant as the company invests in developing next-generation systems. The value of a strong patent portfolio can be substantial; for example, companies in the advanced manufacturing sector often derive a significant portion of their market valuation from their IP assets.

- Patents as a Competitive Moat: Allient leverages patents to prevent competitors from replicating its core technologies, thereby maintaining a unique market position.

- Innovation Protection: Safeguarding trade secrets and proprietary processes is vital for Allient's ongoing research and development efforts in specialized engineering fields.

- Market Leadership: A strong IP portfolio supports Allient's goal of sustained market leadership by protecting its investments in innovation and ensuring a return on R&D.

- Licensing Opportunities: While primarily for competitive advantage, Allient's intellectual property could also present future licensing opportunities, adding another revenue stream.

Allient's technological edge is sharpened by its consistent investment in R&D, dedicating 7% of sales in 2023 and 2024 to innovation in advanced motion, controls, and power systems.

The company's servo and motion control systems are integral to the burgeoning automation and robotics sector, which was valued at approximately $50 billion in 2023 and continues its upward trajectory.

Furthermore, Allient's development of universal industrial communications gateways directly supports the massive growth in the Industrial Internet of Things (IIoT) market, projected to exceed $1 trillion by 2030.

The early 2025 launch of its Machining Center of Excellence in Dothan, Alabama, underscores a commitment to enhancing manufacturing efficiency and producing complex components.

Protecting its intellectual property through patents is critical, especially as the global IP market saw robust activity in 2024, with technology sector patent filings on the rise.

| Technological Factor | Description | Impact/Data Point |

|---|---|---|

| R&D Investment | Consistent allocation to innovation in motion, controls, and power systems. | 7% of sales in 2023 & 2024. |

| Automation & Robotics | Enabling technologies for sophisticated automated processes. | Global industrial robotics market ~ $50 billion (2023). |

| Digitalization & Industry 4.0 | Facilitating connectivity and data exchange in smart factories. | IIoT market projected > $1 trillion by 2030. |

| Manufacturing Process Innovation | Upgrading production capabilities for efficiency and complex parts. | Machining Center of Excellence launched early 2025. |

| Intellectual Property Protection | Safeguarding proprietary technologies and designs. | Rising patent filings across technology sectors in 2024. |

Legal factors

Allient's operations in sectors like medical and aerospace & defense mean product liability and safety regulations are extremely important. Failing to meet these strict standards can lead to significant legal penalties and damage the company's reputation. For instance, in 2024, the FDA continued to emphasize rigorous oversight of medical device manufacturing, with recalls impacting companies that didn't adhere to quality control measures.

Ensuring its precision and specialty solutions comply with these demanding regulations is a non-negotiable aspect of Allient's business. This involves meticulous design, testing, and manufacturing processes to prevent defects that could cause harm. The aerospace industry, in particular, faces intense scrutiny, with bodies like the FAA imposing strict airworthiness directives that require constant vigilance and updates to product safety protocols.

Operating globally, Allient navigates a complex web of international trade laws, customs regulations, and economic sanctions. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting companies like Allient that engage in international commerce. As of early 2024, numerous entities remain on this list, requiring strict adherence to export controls.

Shifts in these legal landscapes, such as new tariffs or expanded sanctions, can directly influence Allient's market access and operational costs. For example, the ongoing geopolitical tensions in Eastern Europe continue to shape global trade policies, potentially affecting supply chains and market opportunities for companies with international footprints. Allient's proactive monitoring and robust compliance strategies are therefore critical to mitigating these risks and ensuring uninterrupted business operations.

Allient's business, built on advanced motion, controls, and power systems, heavily depends on protecting its patents, trademarks, and trade secrets. These legal protections are fundamental to maintaining its competitive advantage in the market.

Navigating diverse international intellectual property laws is critical for Allient to prevent infringement and safeguard its innovations. For instance, in 2023, the global IP market saw significant activity, with patent applications continuing to rise, underscoring the importance of robust legal strategies for companies like Allient.

Any legal disputes or challenges to Allient's intellectual property rights could directly impact its market position and profitability. The company must remain vigilant in enforcing its IP rights to secure its technological leadership.

Labor and Employment Laws

Allient, with its global workforce exceeding 2,500 employees, navigates a complex web of labor and employment laws. These regulations, covering aspects like minimum wage, workplace safety, anti-discrimination, and collective bargaining rights, vary significantly by country and even by region within countries. For instance, in 2024, the average minimum wage in OECD countries continued to be a key compliance factor, with figures ranging from under $5 per hour in some nations to over $15 per hour in others, directly impacting Allient's payroll and operational budgeting.

The differing legal landscapes directly influence Allient's human resource strategies and can lead to increased operational costs. For example, stricter regulations on working hours or mandatory employee benefits in certain European markets, such as Germany's robust worker protections, contrast with more flexible labor laws found elsewhere. This necessitates tailored HR policies and can affect the cost-effectiveness of operations in different jurisdictions.

Compliance with these diverse labor laws is not merely a legal obligation but also crucial for maintaining positive employee relations and a strong corporate reputation. In 2024, reports indicated a rise in labor disputes and unionization efforts in sectors similar to Allient's, highlighting the importance of proactive engagement and adherence to employment standards to mitigate risks and foster a stable workforce.

Key legal factors impacting Allient's labor and employment practices include:

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime pay, and record-keeping requirements across all operating regions.

- Anti-Discrimination and Equal Opportunity: Adhering to laws prohibiting discrimination based on race, gender, age, religion, disability, and other protected characteristics.

- Workplace Safety and Health: Meeting standards set by bodies like OSHA (in the US) or equivalent international organizations to provide a safe working environment.

- Unionization and Collective Bargaining: Respecting employees' rights to organize and engage in collective bargaining, as stipulated by national labor relations acts.

Environmental Regulations and Compliance

Allient operates within a framework of environmental laws governing manufacturing, waste, emissions, and resource consumption. The company acknowledges its ongoing duty to comply with environmental protection standards, a requirement that necessitates continuous monitoring and adaptation.

While Allient reports no significant pollution from its current operations, it actively tracks both enacted and proposed climate legislation. This vigilance allows the company to proactively assess and prepare for potential impacts stemming from evolving environmental mandates.

- Environmental Compliance: Allient's operations are subject to a range of environmental laws and regulations.

- Pollution Monitoring: The company states its manufacturing processes do not result in significant pollution.

- Climate Legislation Watch: Allient monitors existing and pending climate legislation for potential business impacts.

- Ongoing Obligation: Adherence to environmental protection standards is a continuous legal responsibility for the company.

Allient's commitment to product safety and compliance with industry-specific regulations, particularly in the medical and aerospace sectors, remains paramount. Failure to adhere to these stringent standards, such as those enforced by the FDA and FAA, can result in severe penalties and reputational damage. For instance, in 2024, regulatory bodies continued to increase scrutiny on manufacturing quality, with recalls impacting companies not meeting rigorous control measures.

The company's global operations necessitate navigating a complex landscape of international trade laws, export controls, and economic sanctions, as exemplified by the U.S. Bureau of Industry and Security's Entity List, which impacts numerous companies as of early 2024. Changes in tariffs or sanctions can directly affect market access and operational costs, underscoring the need for Allient's continuous monitoring of global trade policies, especially in light of ongoing geopolitical shifts influencing supply chains.

Protecting its intellectual property, including patents and trade secrets, is fundamental to Allient's competitive edge. The company must actively manage diverse international IP laws to prevent infringement, a challenge highlighted by the robust activity in the global IP market in 2023, with rising patent applications. Legal disputes over IP rights can significantly impact market position and profitability, demanding vigilant enforcement.

Allient's extensive global workforce, exceeding 2,500 employees, requires strict adherence to a wide array of labor and employment laws, which vary significantly by jurisdiction. Compliance with minimum wage, workplace safety, and anti-discrimination statutes, such as those impacting payroll budgeting in 2024 where minimum wages differ greatly across OECD nations, is critical. Furthermore, differing legal frameworks, like Germany's worker protections versus more flexible laws elsewhere, influence HR strategies and operational costs, making proactive engagement with employment standards vital for workforce stability.

Environmental factors

Allient demonstrates a commitment to environmental stewardship, actively working to reduce its carbon footprint as detailed in its sustainability reports. These initiatives focus on optimizing manufacturing for greater efficiency and enhancing energy conservation across operations.

The company is exploring avenues like renewable energy sources to further its emissions reduction goals. For instance, many industrial companies in 2024 are investing in solar or wind power for their facilities, aiming to cut Scope 1 and Scope 2 emissions by an average of 15-20% by 2025.

Successfully reducing emissions not only contributes to global sustainability targets but also offers tangible operational cost savings, a trend observed across the sector as energy prices remain volatile.

Allient prioritizes resource conservation and waste management, aiming to enhance supply chain sustainability. Key environmental initiatives include efficient material usage, robust recycling programs, and minimizing waste across its worldwide operations. For instance, in 2023, the company reported a 15% reduction in landfill waste compared to 2022, demonstrating a commitment to these practices.

Allient is actively working to improve the sustainability of its supply chain by assessing suppliers for their commitment to environmental best practices. This process involves scrutinizing the environmental footprint of raw material sourcing, production methods, and logistics.

The company recognizes that a sustainable supply chain is integral to its corporate responsibility and plays a crucial role in managing environmental risks. For instance, in 2024, the global supply chain management market was valued at approximately $28.5 billion, with a growing emphasis on ESG (Environmental, Social, and Governance) factors driving supplier selection.

Climate Change and Extreme Weather Events

The physical impacts of climate change, including more frequent and intense extreme weather events, pose a potential risk to Allient's global manufacturing operations and supply chain stability. While not a currently detailed impact, Allient is actively monitoring climate legislation and considering how to adapt its operations to mitigate potential climate-related risks for long-term resilience. The company's proactive stance involves staying informed on existing and upcoming climate regulations, which is crucial for strategic planning in a changing environmental landscape.

For instance, the increasing frequency of severe weather events, such as hurricanes and floods, could lead to temporary shutdowns or increased logistical costs for companies with distributed manufacturing footprints. A 2024 report by the World Meteorological Organization indicated a significant rise in climate-related disasters over the past decade, impacting global supply chains across various sectors. Allient's commitment to monitoring climate legislation underscores its awareness of these evolving environmental factors and their potential influence on business continuity.

- Monitoring climate legislation: Allient actively tracks existing and pending climate regulations globally.

- Supply chain resilience: Extreme weather events can disrupt manufacturing and logistics, a key consideration for Allient.

- Long-term adaptation: The company is evaluating operational adjustments to address climate-related risks.

Regulatory Compliance and Reporting

Allient actively manages its environmental impact through robust regulatory compliance and transparent reporting. The company's commitment to environmental stewardship is guided by its Board of Directors, ensuring adherence to evolving standards.

Demonstrating this commitment, Allient publishes annual Sustainability Reports. These reports align with recognized frameworks such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-Related Financial Disclosures (TCFD). For instance, in its 2024 Sustainability Report, Allient detailed its progress in reducing Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to its 2020 baseline, a key metric often scrutinized by regulators and investors.

- Adherence to SASB Standards: Allient follows SASB guidelines for industry-specific environmental disclosures.

- TCFD Alignment: The company reports on climate-related risks and opportunities as recommended by the TCFD.

- Emission Reduction Targets: Allient has set targets for greenhouse gas emission reductions, with a 15% decrease achieved by 2024 from a 2020 baseline.

- Water Usage Management: Reporting also includes metrics on water consumption and conservation efforts, with a 10% reduction in water intensity achieved in its manufacturing facilities in 2024.

Allient is actively addressing environmental concerns by focusing on reducing its carbon footprint and enhancing resource efficiency. Initiatives include optimizing manufacturing processes and exploring renewable energy sources, with many industrial companies in 2024 targeting 15-20% Scope 1 and 2 emission reductions by 2025.

The company prioritizes supply chain sustainability through efficient material use and waste reduction, reporting a 15% decrease in landfill waste in 2023 compared to the previous year. This focus is crucial as the global supply chain management market, valued around $28.5 billion in 2024, increasingly incorporates ESG factors.

Allient also monitors climate legislation and adapts operations for resilience against extreme weather events, which are becoming more frequent, impacting global supply chains as noted by a 2024 World Meteorological Organization report. The company's adherence to SASB and TCFD frameworks, including a 15% GHG emission reduction by 2024 from a 2020 baseline and a 10% reduction in water intensity in 2024, underscores its commitment to environmental stewardship.

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources like government publications, international organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting Allient.