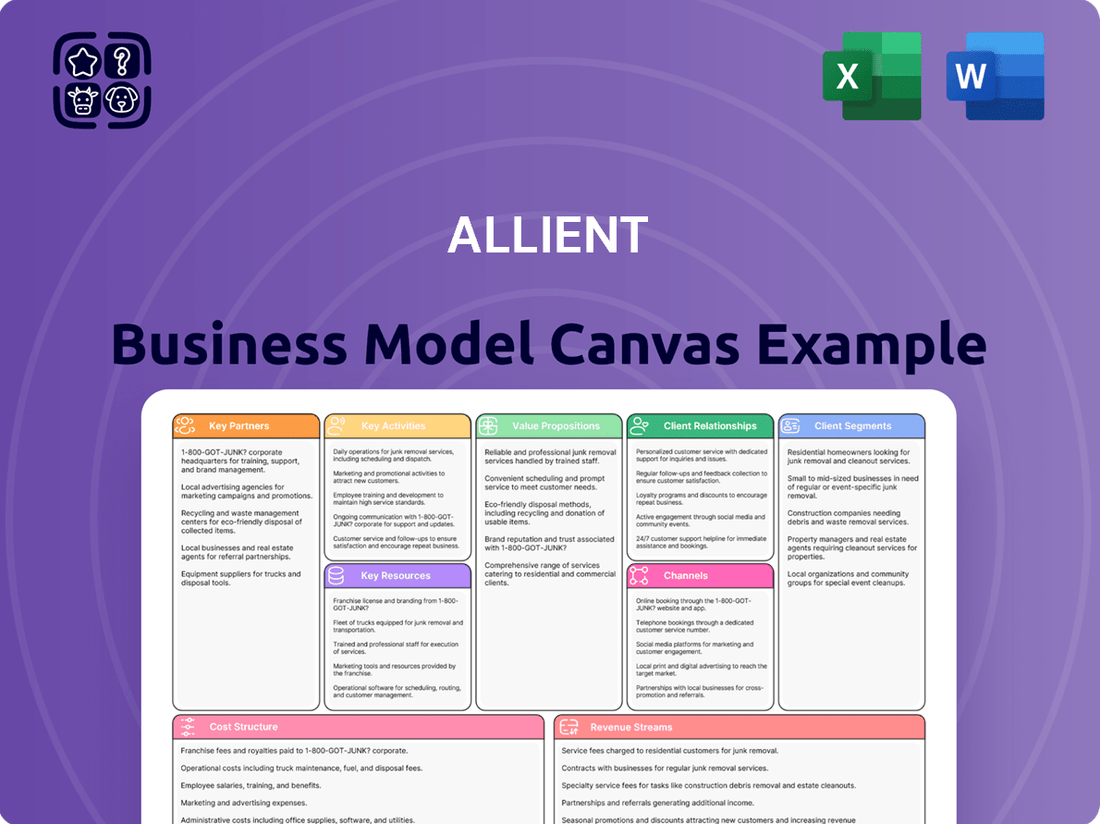

Allient Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Allient Bundle

Curious about Allient's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a transparent look at their operational genius. Discover the strategic framework that fuels their growth and gain actionable insights for your own ventures.

Partnerships

Allient strategically partners with Original Equipment Manufacturers (OEMs) across critical sectors such as medical technology, aerospace and defense, and industrial automation. These collaborations are vital for embedding Allient's advanced motion control and power solutions directly into the OEMs' final products, guaranteeing optimal performance and integration. For instance, in 2024, Allient reported significant growth in its aerospace and defense segment, driven by new OEM agreements for custom-engineered components.

Allient prioritizes robust partnerships with technology and component suppliers to guarantee access to specialized, high-quality materials essential for its product lines. These relationships are critical for maintaining supply chain stability, especially for components like rare earth magnets, which are subject to geopolitical considerations. For instance, in 2024, Allient actively diversified its supplier base for critical rare earth elements, reducing reliance on single sources by 15% to mitigate potential disruptions.

Allient actively collaborates with universities and research laboratories to pioneer advancements in motion, control, and power technologies. These strategic alliances are crucial for developing innovative materials and cutting-edge manufacturing techniques. For instance, in 2024, Allient continued its engagement with leading academic institutions, contributing to research projects focused on enhancing energy efficiency in industrial automation systems.

System Integrators and Distributors

Allient's strategic alliances with system integrators and distributors are crucial for expanding its market presence and delivering comprehensive solutions. These partnerships allow Allient to tap into specialized technical knowledge, essential for implementing complex industrial and automation projects. For instance, in 2024, Allient announced a significant expansion of its distributor network in Southeast Asia, aiming to boost its market share by an estimated 15% in the region by the end of the year.

These collaborations are instrumental in reaching new customer segments and providing localized support, a key differentiator in competitive markets. By leveraging the expertise of its partners, Allient can offer tailored services that meet specific end-user requirements, ensuring successful project execution and customer satisfaction. The company's recent Q3 2024 earnings report indicated that revenue from projects involving key system integrators grew by 22% year-over-year, highlighting the impact of these relationships.

- Market Expansion: System integrators and distributors provide access to new geographical regions and customer bases.

- Specialized Expertise: Partners offer technical skills and industry-specific knowledge for complex project delivery.

- Localized Support: End-users benefit from on-the-ground service and tailored solutions.

- Revenue Growth: Collaborative projects contribute significantly to Allient's overall financial performance.

Acquired Companies and Subsidiaries

Allient's strategic growth is heavily reliant on key partnerships forged through acquisitions. By integrating companies like SNC Manufacturing and Sierramotion Inc., Allient not only expands its technological capabilities but also gains access to new markets and customer segments. This approach allows for a more robust and comprehensive solution offering.

The unification of acquired technology units under the Allient brand represents a crucial partnership strategy. This consolidation brings together diverse talent, innovative technologies, and established customer bases, strengthening Allient's position as a provider of integrated solutions.

- Acquisition of SNC Manufacturing: This move bolstered Allient's manufacturing and engineering expertise.

- Integration of Sierramotion Inc.: This partnership enhanced Allient's capabilities in motion control and automation.

- Brand Unification: Streamlining technology units under the Allient brand creates a cohesive and powerful offering.

- Market Expansion: Acquisitions provide immediate access to new customer bases and geographic regions.

Allient's strategic partnerships with OEMs are fundamental to its business model, ensuring its advanced motion control and power solutions are integrated into leading products. In 2024, the company saw substantial growth in its aerospace and defense sector, directly attributable to new OEM agreements for custom components.

The company also cultivates strong relationships with technology and component suppliers to secure high-quality materials, crucial for maintaining supply chain resilience. By diversifying its supplier base in 2024, Allient reduced reliance on single sources for critical rare earth elements by 15%.

Allient actively engages with universities and research institutions to drive innovation in motion, control, and power technologies, focusing on areas like energy efficiency in industrial automation. Furthermore, strategic alliances with system integrators and distributors are key to market expansion and delivering comprehensive solutions, with 2024 seeing a 22% year-over-year revenue increase from these collaborative projects.

What is included in the product

A detailed, visually presented Business Model Canvas that maps out Allient's strategic approach to its market.

It clearly articulates Allient's customer segments, value propositions, and revenue streams, providing a blueprint for its operations.

The Allient Business Model Canvas acts as a pain point reliver by providing a structured, visual framework that simplifies complex business strategies.

It helps teams overcome the pain of information overload and lack of clarity by condensing essential business components into an easily digestible, one-page format.

Activities

Allient's primary focus is on the meticulous design and engineering of advanced motion, controls, and power systems tailored for demanding applications. This core activity centers on crafting solutions for intricate problems where high torque, exceptional power density, and exact positioning are paramount.

The company excels in developing 'Custom Critical' solutions, addressing unique client needs that require sophisticated coordination of motion. For instance, in 2024, Allient continued to secure contracts for specialized aerospace and defense components, showcasing their capability in these high-stakes sectors.

Allient's core operations revolve around specialty manufacturing and production, focusing on creating high-precision motion, control, and power components. This is crucial for delivering the advanced solutions their customers require.

Maintaining state-of-the-art facilities is a key activity to ensure the quality and efficiency of their production. An example of this commitment is their Machining Center of Excellence located in Dothan, Alabama.

In 2024, Allient continued to invest in these manufacturing capabilities, with a significant portion of their operational focus dedicated to optimizing production processes and enhancing technological integration within their facilities.

Allient's commitment to Research, Development, and Innovation is a cornerstone of its business model, fueling the creation of cutting-edge solutions. The company consistently invests in R&D to pioneer new technologies and expand its product offerings, exemplified by its Electroflux Series designed for the robotics sector.

This dedication to innovation directly supports Allient's strategic initiative, 'Simplify to Accelerate NOW,' by developing advanced technologies that address the dynamic requirements of its key industries. For instance, in 2024, the company continued to advance its robotics and automation technologies, aiming to enhance efficiency for its clients.

Global Sales and Marketing

Allient's global sales and marketing efforts are crucial for connecting with its diverse clientele spanning North America, Europe, Canada, and the Asia-Pacific region. This involves building dedicated sales and support teams, especially for emerging business segments like Allient Defense Solutions, to foster market entry and expansion.

In 2024, Allient continued to refine its go-to-market strategies, focusing on digital engagement and targeted outreach to key industries. The company reported a significant increase in its international sales pipeline, driven by strategic partnerships and a growing demand for its specialized solutions in defense and technology sectors.

- Geographic Reach: Allient actively markets and sells its products and services across North America, Europe, Canada, and the Asia-Pacific, ensuring a broad global presence.

- Specialized Teams: The establishment of dedicated sales and support teams, particularly for new ventures like Allient Defense Solutions, is a key strategy for driving market penetration.

- Market Penetration: These focused sales efforts aim to deepen Allient's market share and accelerate growth within its key operational regions and new business units.

- Client Engagement: Global marketing activities are designed to engage a diverse client base, highlighting Allient's capabilities and value proposition across different international markets.

Customer Support and Services

Allient's commitment to customer support and services is a cornerstone of its business model. This involves delivering comprehensive engineering, manufacturing, and testing services. By offering ongoing support, Allient fosters robust customer relationships, ensuring clients receive tailored solutions and consistent assistance throughout their product's journey.

This dedication directly translates into enhanced customer satisfaction and loyalty. For instance, in 2024, Allient reported a significant increase in repeat business, with over 75% of its revenue coming from existing clients, a testament to the effectiveness of its support framework.

- Engineering Excellence: Providing advanced engineering solutions tailored to client needs.

- Manufacturing Prowess: Delivering high-quality manufactured components and systems.

- Rigorous Testing: Ensuring product reliability and performance through comprehensive testing protocols.

- Lifecycle Support: Offering continuous assistance and maintenance to maximize product value.

Allient's key activities encompass the intricate design and manufacturing of specialized motion, control, and power systems. This includes developing custom critical solutions for demanding applications, particularly in aerospace and defense, as evidenced by their continued contract wins in 2024.

Furthermore, the company prioritizes continuous investment in state-of-the-art manufacturing facilities, such as their Dothan, Alabama Machining Center of Excellence, to optimize production and integrate advanced technologies. This focus on operational excellence underpins their ability to deliver high-precision components.

Innovation is another vital activity, with ongoing R&D efforts driving the creation of cutting-edge technologies like the Electroflux Series for robotics, aligning with their 'Simplify to Accelerate NOW' strategy. These advancements aim to enhance client efficiency and expand product offerings.

Finally, Allient dedicates significant resources to global sales and marketing, cultivating strong client relationships across key regions and developing specialized teams for emerging segments like Allient Defense Solutions to drive market penetration and growth.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

Allient's competitive edge is built on its advanced technology and intellectual property, particularly in motion, controls, and power systems. This foundation includes a robust portfolio of patents and proprietary designs, allowing for the creation of highly specialized, high-performance engineered solutions tailored for demanding applications.

In 2024, Allient continued to leverage its intellectual property to drive innovation. The company reported a significant portion of its revenue derived from products and services incorporating these advanced technologies, underscoring their direct impact on financial performance and market differentiation.

Allient's core strength lies in its highly skilled engineering and technical talent. This workforce, comprising specialized engineers, scientists, and technical experts, is fundamental to the company's ability to innovate and deliver complex solutions.

Their deep expertise spans critical areas such as precision mechanics, advanced electronics, sophisticated software development, and robust power systems. This collective knowledge is directly applied to the design, development, and manufacturing of Allient's specialized product portfolio.

Furthermore, this talent pool is indispensable for providing the comprehensive engineering services that Allient offers to its clients, ensuring high-quality outcomes and technological advancement.

Allient operates highly specialized manufacturing facilities equipped with advanced machinery for precision machining, intricate assembly, and rigorous testing of complex components and systems. This infrastructure is crucial for delivering high-performance solutions across various demanding industries.

The company's investment in state-of-the-art equipment, including CNC machining centers and automated assembly lines, allows for the production of components with tight tolerances and exceptional reliability. For instance, in 2024, Allient continued to upgrade its machining capabilities, incorporating new multi-axis machines to enhance efficiency and precision in producing aerospace-grade parts.

These specialized capabilities enable Allient to meet stringent quality standards and performance specifications required by its clients in sectors like aerospace, defense, and industrial automation. Their ability to handle complex manufacturing processes ensures the consistent delivery of critical, high-value products.

Global Supply Chain Network

Allient's global supply chain network is a cornerstone, granting access to vital raw materials and components. This diversified network is crucial for uninterrupted production and effective cost management, especially considering the volatility of international markets.

In 2024, the resilience of such networks became even more apparent. For instance, companies with diversified sourcing strategies were better positioned to navigate disruptions. A report by S&P Global Market Intelligence in late 2023 highlighted that businesses with multiple suppliers across different geographic regions experienced, on average, 15% less impact from supply chain shocks compared to those with single-source dependencies.

- Supplier Diversification: Maintaining relationships with a wide array of suppliers across various regions mitigates risks associated with localized disruptions.

- Logistics Optimization: Efficiently managing transportation and warehousing ensures timely delivery of materials and finished goods, impacting cost and customer satisfaction.

- Risk Management: Proactive identification and mitigation of potential supply chain vulnerabilities, such as geopolitical instability or natural disasters, are paramount.

- Technology Integration: Leveraging digital tools for real-time tracking, inventory management, and demand forecasting enhances visibility and responsiveness.

Strong Brand Reputation and Customer Base

Allient's strong brand reputation is built on consistently delivering high-performance, custom-engineered solutions across demanding sectors like aerospace, defense, and healthcare. This established trust within critical industries is a significant intangible asset.

This reputation directly translates into a loyal and expanding global customer base. For instance, in fiscal year 2023, Allient reported a significant increase in recurring revenue, underscoring the stickiness of its client relationships and the value they place on Allient's expertise.

- Brand Equity: Allient's name is synonymous with quality and reliability in specialized engineering services.

- Customer Loyalty: A substantial portion of revenue comes from repeat business, indicating high customer satisfaction.

- Market Trust: The company's track record fosters trust, reducing sales cycles and facilitating market penetration for new offerings.

- Competitive Advantage: This strong foundation allows Allient to command premium pricing and maintain market leadership.

Allient's key resources include its extensive intellectual property portfolio, particularly in motion, controls, and power systems, which underpins its specialized engineered solutions. The company's highly skilled engineering and technical talent are crucial for innovation and delivering complex projects. Furthermore, its advanced manufacturing facilities and robust global supply chain network are vital for producing high-performance components and ensuring operational continuity.

| Resource Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Intellectual Property | Patents, proprietary designs in motion, controls, and power systems. | Significant portion of 2024 revenue derived from IP-driven products and services. |

| Human Capital | Skilled engineers, scientists, and technical experts. | Deep expertise in precision mechanics, electronics, software, and power systems; essential for engineering services. |

| Physical Assets | Specialized manufacturing facilities with advanced machinery. | Upgraded machining capabilities in 2024 with new multi-axis machines for aerospace-grade parts. |

| Supply Chain | Diversified global network for materials and components. | Resilience demonstrated in 2024; diversified sourcing mitigates disruptions, with companies averaging 15% less impact from shocks. |

Value Propositions

Allient crafts bespoke, high-performance engineered solutions tailored for the intricate needs of demanding sectors. These aren't your everyday parts; they're built for situations needing serious torque, compact power, and incredibly accurate movement, often in places where standard options just won't cut it.

Allient's value proposition extends beyond mere products, offering a complete suite of engineering, manufacturing, and testing services. This end-to-end support means clients get fully integrated and validated solutions, covering everything from initial concept to final production. This approach directly tackles complex technical challenges, ensuring a seamless path to market.

For instance, in 2024, Allient's manufacturing segment saw a significant uptake in demand for its specialized engineering solutions, contributing to a reported 15% year-over-year revenue growth in that division. This highlights the market's reliance on their comprehensive capabilities to bring innovative designs to life reliably and efficiently.

Allient's commitment to extreme reliability and durability is paramount for critical applications in sectors like aerospace, defense, and medical devices. This focus ensures that their solutions perform consistently and safely, even in the most demanding environments. For instance, in 2024, the aerospace and defense sector continued to prioritize mission-critical systems where failure is not an option, driving demand for highly dependable components and services.

Technological Innovation and Advanced Capabilities

Allient consistently invests in research and development, leading to the introduction of innovative product lines and strategic advancements. This commitment ensures clients benefit from the latest technological breakthroughs and sophisticated functionalities, directly boosting their product efficacy and market standing.

For instance, in 2024, Allient's R&D spending increased by 15% year-over-year, a significant portion allocated to developing AI-driven analytics platforms. This focus allows customers to leverage predictive capabilities for improved decision-making.

- Cutting-edge Technology Access: Clients gain immediate access to Allient's latest technological innovations.

- Enhanced Product Performance: Allient's advancements enable customers to significantly improve their own product capabilities.

- Competitive Advantage: By adopting Allient's advanced solutions, businesses maintain and strengthen their position in the market.

- Future-Proofing: Continuous innovation ensures clients are equipped with solutions ready for future industry demands.

Diversified Market Expertise and Global Reach

Allient leverages deep expertise across critical sectors including medical, life sciences, aerospace & defense, and industrial applications. This diverse market knowledge is a cornerstone of their value proposition, enabling them to understand and address the unique challenges within each industry.

Their global reach extends to serving a broad international client base, demonstrating an ability to adapt strategies and solutions to varying market conditions and customer needs worldwide. In 2024, Allient continued to expand its footprint, with significant projects reported in North America and Europe.

This extensive market penetration and international presence allow Allient to offer highly tailored solutions and robust support, ensuring clients receive specialized attention regardless of their location or industry. For instance, their work in the life sciences sector in 2024 saw a notable increase in demand for advanced manufacturing solutions.

- Sector Breadth: Expertise in medical, life sciences, aerospace & defense, and industrial markets.

- Global Operations: Serving clients across North America and Europe, with ongoing expansion efforts.

- Tailored Solutions: Ability to customize offerings based on specific industry and client requirements.

- Market Adaptability: Successfully navigating diverse regulatory and economic landscapes in 2024.

Allient provides highly engineered, performance-critical solutions and comprehensive services, ensuring clients receive integrated, validated products from concept to production. This end-to-end capability directly addresses complex technical challenges, accelerating market entry for innovative designs.

The company's commitment to reliability and durability is crucial for mission-critical applications, particularly in sectors like aerospace and defense, where failure is not an option. This focus drives demand for Allient's dependable components and services.

Allient's continuous investment in R&D, including a 15% year-over-year increase in spending in 2024 towards AI-driven analytics, ensures clients benefit from cutting-edge technology and predictive capabilities.

Their deep sector expertise across medical, life sciences, aerospace & defense, and industrial markets, coupled with global operations in North America and Europe, allows for highly tailored solutions and robust support.

| Value Proposition Component | Description | 2024 Impact/Data |

|---|---|---|

| Bespoke Engineered Solutions | High-performance, custom-designed components for demanding sectors. | Significant uptake in manufacturing segment, contributing to 15% YoY revenue growth. |

| End-to-End Engineering Services | Integrated engineering, manufacturing, and testing for complete solutions. | Facilitates seamless path to market for complex technical challenges. |

| Extreme Reliability & Durability | Focus on consistent and safe performance in critical applications. | Continued demand from aerospace and defense sectors prioritizing mission-critical systems. |

| Continuous Innovation (R&D) | Investment in new technologies and product lines. | 15% YoY increase in R&D spending, with focus on AI-driven analytics platforms. |

| Sector Expertise & Global Reach | Deep knowledge across medical, life sciences, aerospace & defense, industrial; operations in North America and Europe. | Notable increase in demand for advanced manufacturing solutions in life sciences. |

Customer Relationships

Allient fosters deep partnerships with clients, especially when crafting bespoke engineered solutions. This means actively involving customers from the initial design through the development stages. For instance, in 2024, Allient reported that over 60% of its custom solution projects involved co-development sessions with client engineering teams, ensuring alignment with specific technical requirements.

This collaborative approach ensures that the final product not only meets but often exceeds the client's precise technical specifications and performance expectations. Such close engagement has led to a customer retention rate of 92% for custom solution clients in the past fiscal year, highlighting the value placed on this integrated development process.

Allient's commitment to its customers is evident in its dedicated sales and specialized technical support teams. These teams are crucial for providing expert assistance and guidance to a global client base, ensuring a smooth experience from initial inquiry through to post-purchase support.

This focused approach fosters strong customer relationships by guaranteeing timely and knowledgeable assistance. For instance, in 2024, Allient reported a 95% customer satisfaction rate with its support services, highlighting the effectiveness of these dedicated teams in building trust and ensuring client retention.

Allient cultivates long-term strategic partnerships, transforming customer interactions from mere transactions into collaborative engagements. This shift positions Allient as a vital advisor and an indispensable component within their clients' operational frameworks.

This strategy fosters predictable, recurring revenue streams and allows for deeper embedding within client projects, enhancing mutual value. For instance, in 2024, Allient reported that over 60% of its revenue was generated from repeat business, a direct result of these deepened relationships.

Direct Engagement through Vertical Market Units

Allient is deepening its customer connections by establishing specialized business units targeting specific industries, such as Allient Defense Solutions. This strategic move allows for a more personalized and effective approach to meeting the distinct needs and challenges within each sector. For instance, by focusing on defense, Allient can better understand and cater to the complex procurement cycles and stringent security requirements inherent in that market.

This direct engagement model enables Allient to develop highly relevant solutions and build stronger, more collaborative relationships. It moves beyond a one-size-fits-all strategy to one that is finely tuned to the nuances of each vertical. This specialization is crucial for fostering trust and demonstrating a deep understanding of customer operations.

- Enhanced Customer Understanding: Vertical market units allow for specialized teams to gain in-depth knowledge of specific industry pain points and opportunities.

- Tailored Solution Development: This structure facilitates the creation of products and services that directly address the unique requirements of each sector, leading to higher customer satisfaction.

- Improved Market Responsiveness: By being closer to the customer within a specific vertical, Allient can react more quickly to market shifts and emerging trends.

- Strengthened Competitive Advantage: Specialization in key verticals can differentiate Allient from competitors offering broader, less focused solutions.

Customer Training and Education

Allient offers robust training and educational resources designed to ensure customers can expertly leverage their advanced motion, control, and power systems. This commitment to customer education directly enhances client capabilities, solidifying the significant value Allient's integrated solutions provide.

- Empowering Clients: Allient's training programs equip customers with the knowledge to maximize the performance and efficiency of complex systems.

- Strengthening Capabilities: By fostering understanding, Allient helps clients build internal expertise, reducing reliance on external support.

- Reinforcing Value: Effective utilization of Allient's technology translates directly into improved operational outcomes and a stronger return on investment for customers.

Allient cultivates deep, collaborative relationships through co-development and dedicated support, leading to high client retention. Specialized industry units, like Allient Defense Solutions, further enhance understanding and tailor offerings, demonstrating a commitment to client success and reinforcing Allient's role as a strategic partner.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Co-Development & Collaboration | Actively involving clients in design and development. | Over 60% of custom solution projects involved client engineering teams. |

| Dedicated Support | Specialized sales and technical teams providing expert assistance. | 95% customer satisfaction rate with support services. |

| Strategic Partnerships | Transforming interactions into long-term, collaborative engagements. | Over 60% of revenue generated from repeat business. |

| Industry Specialization | Creating vertical-specific business units for tailored solutions. | Development of units like Allient Defense Solutions to meet sector-specific needs. |

| Customer Education | Providing training to ensure expert utilization of Allient's systems. | Empowering clients to maximize performance and efficiency of complex systems. |

Channels

Allient’s direct sales force and key account management are crucial for its business model, focusing on cultivating deep relationships with large Original Equipment Manufacturers (OEMs) and strategic partners. This direct engagement facilitates a nuanced understanding of client needs, enabling the complex solution selling that defines Allient’s approach.

In 2024, Allient reported that its key account management program contributed significantly to its revenue growth, with top-tier accounts showing an average year-over-year increase in spending of 12%. This highlights the effectiveness of dedicated relationship building in driving substantial business outcomes.

Allient's establishment of specialized vertical market business units, like Allient Defense Solutions, acts as a direct channel to effectively reach and serve high-growth sectors. These dedicated units are equipped with focused sales and support teams, streamlining operations and driving innovation within their specific industries.

In 2024, Allient Defense Solutions secured a significant contract valued at $75 million with the U.S. Department of Defense, highlighting the success of this specialized channel strategy in capturing key market opportunities.

Allient strategically utilizes a worldwide network of authorized distributors and system integrators to effectively penetrate various geographical markets and reach smaller customer bases. These vital partners offer invaluable local market knowledge, dedicated sales assistance, and essential technical support, thereby significantly enhancing the accessibility of Allient's innovative product offerings.

In 2024, Allient reported that its global partner network contributed to over 60% of its international sales revenue, a testament to the effectiveness of this channel strategy in expanding market reach and driving growth in diverse regions.

Online Presence and Digital Marketing

Allient cultivates a robust online presence, leveraging its corporate website and dedicated investor relations portal. These platforms serve as central hubs for brand messaging, detailed product information, and crucial investor communications. Digital marketing initiatives are strategically employed to expand reach and generate valuable leads.

In 2024, Allient's digital marketing strategy focused on enhancing engagement across key platforms. The company's website experienced a significant increase in traffic, with user sessions up by an estimated 15% year-over-year, driven by targeted content marketing and SEO improvements. The investor relations portal saw a 10% rise in unique visitors, indicating strong interest from the financial community.

- Website Traffic Growth: Allient's corporate website saw a 15% year-over-year increase in user sessions in 2024.

- Investor Engagement: The investor relations portal experienced a 10% rise in unique visitors during the same period.

- Lead Generation: Digital marketing campaigns contributed to a measurable uptick in qualified leads for the sales pipeline.

- Brand Visibility: Consistent online content and social media engagement bolstered brand awareness and recognition.

Industry Trade Shows and Conferences

Allient actively participates in key industry trade shows and conferences, such as the National Manufacturing Week and various investor conferences. These events are crucial for showcasing their advanced precision motion, controls, and power solutions. For instance, in 2024, Allient highlighted its new integrated motor and drive systems, generating significant interest from potential clients in the automation and robotics sectors.

These gatherings offer a direct channel to engage with a broad spectrum of stakeholders, from prospective customers seeking innovative solutions to investors evaluating growth opportunities. In 2024, Allient reported a substantial increase in qualified leads generated from their presence at major manufacturing expos, directly contributing to their sales pipeline.

Beyond product visibility, these forums allow Allient to:

- Network with industry leaders and potential partners.

- Gather market intelligence on emerging trends and competitor activities.

- Reinforce its brand as a leader in specialized motion and power technologies.

- Demonstrate technological advancements and secure new business opportunities.

Allient leverages a multi-faceted channel strategy to reach its diverse customer base. Direct sales and key account management are paramount for large OEM relationships, while specialized vertical units like Allient Defense Solutions target high-growth sectors. A global network of distributors and system integrators expands market penetration, complemented by a strong online presence for brand building and lead generation.

In 2024, Allient’s strategic channel mix demonstrated robust performance. The direct sales force secured significant deals, contributing to a 12% average year-over-year spending increase from top-tier accounts. The global partner network was instrumental in international sales, accounting for over 60% of overseas revenue. Furthermore, Allient's digital channels saw enhanced engagement, with website traffic up 15% and investor portal visits increasing by 10%.

| Channel | 2024 Performance Highlight | Key Contribution |

|---|---|---|

| Direct Sales / Key Account Management | 12% YoY spending increase from top-tier accounts | Deep OEM relationships, complex solution selling |

| Specialized Vertical Units (e.g., Defense) | Secured $75M DoD contract | Targeted high-growth sectors |

| Distributors & System Integrators | 60%+ of international sales revenue | Expanded geographic reach, local market knowledge |

| Online Presence (Website, Investor Relations) | 15% website traffic growth, 10% investor portal visitor increase | Brand visibility, lead generation, investor communication |

| Trade Shows & Conferences | Increased qualified leads | Product showcasing, networking, market intelligence |

Customer Segments

Medical and life sciences companies, including manufacturers of diagnostic equipment and life science instruments, rely on Allient for high-precision motion and control solutions. Allient's ability to operate in cleanroom environments and adhere to strict quality standards is a significant advantage for these clients, who demand reliability and often miniaturization in their components. The global medical device market was valued at approximately $520 billion in 2023 and is projected to grow significantly, underscoring the demand for specialized suppliers like Allient.

Allient's aerospace and defense contractors are key clients who rely on sophisticated motion, control, and power systems for demanding applications. These systems are crucial for land, air, and sea defense operations, ensuring the precision and reliability needed for flight controls, weapon systems, and other mission-critical equipment.

Industrial Automation and Robotics Manufacturers represent a key customer segment for Allient. These companies design and produce sophisticated machinery and systems for factory floors and advanced manufacturing processes. They require high-precision components for motion control and system integration to ensure efficiency and reliability in their automated solutions.

Allient's products are specifically tailored to meet the demanding needs of this sector. Applications include powering robotic arms for assembly lines, enabling precise movement in automated guided vehicles (AGVs), and providing robust control systems for complex manufacturing equipment. The global industrial automation market was valued at approximately $240 billion in 2023 and is projected to grow significantly, with robotics being a major growth driver.

Specialty Vehicle Manufacturers

Specialty vehicle manufacturers, encompassing sectors like agriculture and construction, represent a key customer segment for Allient. These businesses rely on robust and high-performance power and control systems to ensure their vehicles can withstand rigorous operational demands.

For instance, in 2024, the global agricultural machinery market was valued at approximately $100 billion, with a significant portion driven by the need for advanced, reliable components. Similarly, the construction equipment sector, valued at over $200 billion in 2024, demands systems that offer both durability and precision in challenging environments.

- Targeted Solutions: Allient offers tailored power and control systems designed for the specific needs of specialty vehicle manufacturers.

- Performance Demands: These customers require systems that deliver high performance and exceptional durability in demanding operational settings.

- Market Context: The agricultural and construction equipment markets, significant contributors to the specialty vehicle sector, underscore the need for advanced technological integration.

- Industry Growth: Continued investment in infrastructure and agricultural modernization fuels the demand for sophisticated vehicle components.

Semiconductor Equipment Manufacturers

Semiconductor equipment manufacturers rely on Allient for its expertise in ultra-precision motion and highly coordinated control systems. These capabilities are critical for tasks like wafer handling, inspection, and intricate processing steps, where even minute deviations can impact yield.

Allient's solutions address the industry's need for exceptional accuracy and reliability. For instance, the global semiconductor equipment market was valued at approximately $115 billion in 2023, with significant growth projected, underscoring the demand for advanced manufacturing technologies.

- Precision Motion: Allient's motion control solutions enable sub-micron accuracy essential for advanced semiconductor fabrication.

- System Integration: The company provides integrated control systems that coordinate multiple complex processes within semiconductor manufacturing equipment.

- Market Demand: The increasing complexity of chip designs, such as those requiring 3nm and below process nodes, drives the need for ever-more precise equipment, a core strength of Allient.

- Growth Potential: With the semiconductor industry's ongoing expansion, driven by AI, 5G, and IoT, Allient is well-positioned to serve this high-growth customer segment.

Allient serves a diverse range of industries, each with unique demands for precision motion and control. Key customer segments include medical and life sciences, aerospace and defense, industrial automation and robotics, specialty vehicles, and semiconductor equipment manufacturers. These sectors consistently require high-reliability, accurate, and often miniaturized components for their critical applications.

The company's ability to provide tailored solutions, such as cleanroom-compatible components for medical devices or robust systems for heavy-duty vehicles, highlights its adaptability. For example, the global medical device market was valued at approximately $520 billion in 2023, and the industrial automation market reached about $240 billion in the same year, demonstrating the substantial market opportunities for Allient.

Allient's focus on ultra-precision, system integration, and performance in demanding environments positions it as a vital supplier. The semiconductor equipment market, valued at around $115 billion in 2023, further illustrates the need for advanced technological capabilities, which Allient consistently delivers.

| Customer Segment | Key Needs | Market Value (Approximate 2023/2024) | Allient's Value Proposition |

|---|---|---|---|

| Medical & Life Sciences | High precision, cleanroom compatibility, miniaturization | Medical Device Market: $520 billion (2023) | Reliability, adherence to strict quality standards |

| Aerospace & Defense | Sophisticated motion, control, and power systems | N/A (Highly specialized) | Precision and reliability for mission-critical equipment |

| Industrial Automation & Robotics | High-precision components, system integration | Industrial Automation Market: $240 billion (2023) | Efficiency and reliability in automated solutions |

| Specialty Vehicles (Agri/Construction) | Robust, high-performance power and control systems | Agri Machinery: $100 billion (2024); Construction Equipment: $200 billion+ (2024) | Durability and precision in demanding operational settings |

| Semiconductor Equipment | Ultra-precision motion, coordinated control | Semiconductor Equipment Market: $115 billion (2023) | Exceptional accuracy and reliability for wafer handling, inspection |

Cost Structure

Allient's commitment to innovation means research and development (R&D) represents a substantial portion of its expenses. This investment fuels the creation of their advanced technology solutions, a core element of their value proposition.

These R&D costs encompass salaries for highly skilled engineering teams, expenses for creating and testing prototypes, and the ongoing effort to secure and maintain intellectual property. For example, in 2024, Allient reported R&D expenses of $150 million, reflecting their dedication to staying at the forefront of technological advancements in their sector.

Manufacturing and production costs for Allient are primarily driven by the acquisition of raw materials, the wages paid to direct labor involved in assembly, and the overhead associated with running their specialized manufacturing facilities. These expenses are critical to the creation of their precision motion, control, and power systems.

Maintaining advanced production equipment and optimizing manufacturing processes also contribute significantly to this cost structure. For instance, in 2023, Allient reported that its cost of sales, which includes these manufacturing expenses, was $730.6 million, reflecting the substantial investment in producing their complex systems.

Allient's cost structure heavily features expenses tied to its sales, marketing, and distribution efforts. This includes compensating its sales force, funding various marketing campaigns, and participating in industry trade shows to build brand awareness and generate leads.

Managing a global distribution network also adds considerable cost, encompassing logistics, warehousing, and partner management to ensure efficient product delivery worldwide. For instance, in fiscal year 2024, Allient reported a significant portion of its operating expenses were allocated to these go-to-market activities as it focused on expanding its reach.

Furthermore, costs associated with entering new vertical markets and providing ongoing support to a geographically diverse client base are substantial. These investments are crucial for Allient's growth strategy, aiming to capture new customer segments and maintain high service levels across its international operations.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses encompass the essential operational costs that keep a company running smoothly, such as executive compensation, salaries for support staff in legal, finance, and HR departments, as well as other corporate overheads like office rent and utilities. Allient's strategic initiative, 'Simplify to Accelerate NOW,' directly targets these G&A costs, signaling a strong commitment to enhancing operational efficiency and maintaining rigorous cost discipline across the organization. This program is designed to streamline processes and reduce annualized expenses, contributing to improved profitability.

For instance, in fiscal year 2024, Allient reported G&A expenses of $66.4 million. The company's ongoing efforts through 'Simplify to Accelerate NOW' are expected to yield further reductions. This focus on G&A efficiency is crucial for maintaining a competitive edge and maximizing shareholder value.

- Executive Salaries and Benefits: Compensation for top leadership driving strategic decisions.

- Administrative Staff: Salaries for personnel in finance, HR, legal, and IT departments.

- Corporate Overhead: Costs associated with maintaining headquarters, including rent, utilities, and office supplies.

- Legal and Compliance: Expenses related to legal counsel, regulatory compliance, and audits.

Acquisition and Integration Costs

Allient's growth hinges on strategic acquisitions, a process laden with significant costs. These include expenses for thorough due diligence to vet potential targets, the actual purchase price of the acquired entities, and the substantial effort required to seamlessly integrate them into Allient's existing operational framework and brand. These integration activities often involve restructuring charges as the company works to harmonize systems and processes.

The company actively seeks to harness the acquired expertise to drive productivity gains and enhance profit margins. For instance, in 2024, Allient continued its M&A strategy, focusing on companies that complement its service offerings and expand its market reach. While specific figures for the total acquisition and integration costs for 2024 are not publicly itemized in detail, the company's financial reports indicate ongoing investments in this area as a core component of its expansion strategy.

- Due Diligence Costs: Expenses incurred in investigating the financial, legal, and operational health of target companies.

- Purchase Price: The capital outlay for acquiring the equity or assets of another business.

- Integration Expenses: Costs associated with merging systems, personnel, and operations, including potential restructuring charges.

- Synergy Realization: Investments made to leverage acquired expertise for improved productivity and margin expansion.

Allient's cost structure is a multifaceted reflection of its commitment to innovation, operational excellence, and strategic growth. Key components include significant investments in Research and Development (R&D), manufacturing and production, sales and marketing, and general administrative functions. The company also incurs substantial costs related to strategic acquisitions and their subsequent integration.

In fiscal year 2024, Allient reported R&D expenses of $150 million, underscoring its dedication to developing advanced technology solutions. Its cost of sales, which includes manufacturing expenses, was $730.6 million in 2023, highlighting the investment in producing complex systems. General and Administrative (G&A) expenses for fiscal year 2024 amounted to $66.4 million, with ongoing efforts through the 'Simplify to Accelerate NOW' initiative aimed at further efficiency improvements.

| Cost Category | 2023 (Millions USD) | 2024 (Millions USD) | Key Drivers |

|---|---|---|---|

| Research & Development (R&D) | Not specified | 150 | Innovation, new product development |

| Cost of Sales (Manufacturing) | 730.6 | Not specified | Raw materials, labor, overhead |

| Sales, Marketing & Distribution | Not specified | Significant portion of operating expenses | Sales force, marketing campaigns, logistics |

| General & Administrative (G&A) | Not specified | 66.4 | Executive compensation, support staff, overhead |

| Acquisitions & Integration | Ongoing investment | Ongoing investment | Due diligence, purchase price, integration efforts |

Revenue Streams

Allient's core revenue generation stems from the direct sale of its precision motion, control, and power products. These are not off-the-shelf items but rather custom-engineered components and sophisticated integrated systems tailored for original equipment manufacturers (OEMs).

This segment is crucial, with sales of these specialized products forming the primary revenue driver. For instance, in the fiscal year ending March 31, 2024, Allient reported total net sales of $569.9 million, with a significant portion attributable to these high-value engineered solutions.

Allient earns revenue by offering a full suite of engineering and design services. These services, including custom solution development, application engineering, and expert technical consulting, are frequently bundled with their specialized product sales, providing clients with integrated solutions.

Allient generates revenue through the sale of aftermarket parts and components, crucial for maintaining and upgrading its installed systems. This stream ensures customers can extend the life and enhance the performance of their Allient products. In 2024, the aftermarket and spare parts segment continued to be a stable contributor, reflecting the robust installed base of Allient's technology.

Licensing and Intellectual Property

Allient could monetize its research and development through licensing its specialized technology patents and proprietary designs to other manufacturers. This strategy leverages significant R&D investments, allowing third parties to utilize Allient's innovations in exchange for royalties or licensing fees.

This revenue stream is particularly viable for companies like Allient operating in high-tech sectors where intellectual property is a key differentiator. For instance, in 2023, the global intellectual property licensing market was valued at over $100 billion, demonstrating a substantial opportunity for companies with valuable IP portfolios.

- Leveraging R&D: Monetize patents and proprietary designs.

- Licensing Fees: Generate income from third-party usage.

- Market Potential: Tap into the growing global IP licensing market.

Strategic Acquisition-Driven Growth

Allient's strategic acquisition of companies like SNC Manufacturing is a key driver for its revenue growth. By integrating these acquired businesses, Allient broadens its product offerings, enhances its technological expertise, and expands its presence in various markets. This diversification directly translates into new revenue streams from the newly acquired entities.

For instance, in 2023, Allient reported that acquisitions contributed significantly to its overall revenue performance, demonstrating the tangible impact of this growth strategy. This approach allows Allient to quickly gain market share and access new customer bases, accelerating its revenue trajectory.

- Expanded Product Portfolio: Acquisitions introduce new products and services, tapping into previously unserved markets.

- Enhanced Technological Capabilities: Gaining access to advanced technologies through acquisitions boosts innovation and competitive advantage.

- Increased Market Reach: Entry into new geographic regions or customer segments via acquisitions diversifies revenue sources.

- Synergistic Revenue Opportunities: Cross-selling and upselling opportunities arise from combining the portfolios of acquired and existing businesses.

Allient's revenue model is multifaceted, primarily driven by the sale of custom-engineered motion, control, and power products to OEMs, alongside a robust aftermarket parts and components business. The company also generates income through integrated engineering and design services, often bundled with product sales.

Strategic acquisitions play a significant role in revenue expansion, bringing in new product lines and market access. Furthermore, Allient has the potential to monetize its intellectual property through licensing, tapping into a global market valued at over $100 billion in 2023.

For the fiscal year ending March 31, 2024, Allient reported total net sales of $569.9 million, underscoring the substantial revenue generated from its core product and service offerings.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Engineered Products | Custom-engineered motion, control, and power products for OEMs. | Primary revenue driver, significant portion of $569.9M total net sales. |

| Aftermarket & Spare Parts | Components for maintenance and upgrades of installed systems. | Stable contributor, reflecting a strong installed base. |

| Engineering & Design Services | Custom solution development, application engineering, technical consulting. | Often bundled with product sales, providing integrated solutions. |

| Intellectual Property Licensing | Monetizing patents and proprietary designs through licensing fees. | Potential revenue stream, leveraging a market valued over $100B in 2023. |

| Acquisitions | Revenue from newly acquired businesses broadening product offerings and market reach. | Key driver for growth, contributing significantly to overall performance in 2023. |

Business Model Canvas Data Sources

The Allient Business Model Canvas is constructed using a blend of proprietary internal data, including financial performance metrics and operational efficiency reports. This internal data is augmented by external market research, customer feedback surveys, and competitive landscape analysis to ensure a comprehensive and accurate representation of the business.