Alliant Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

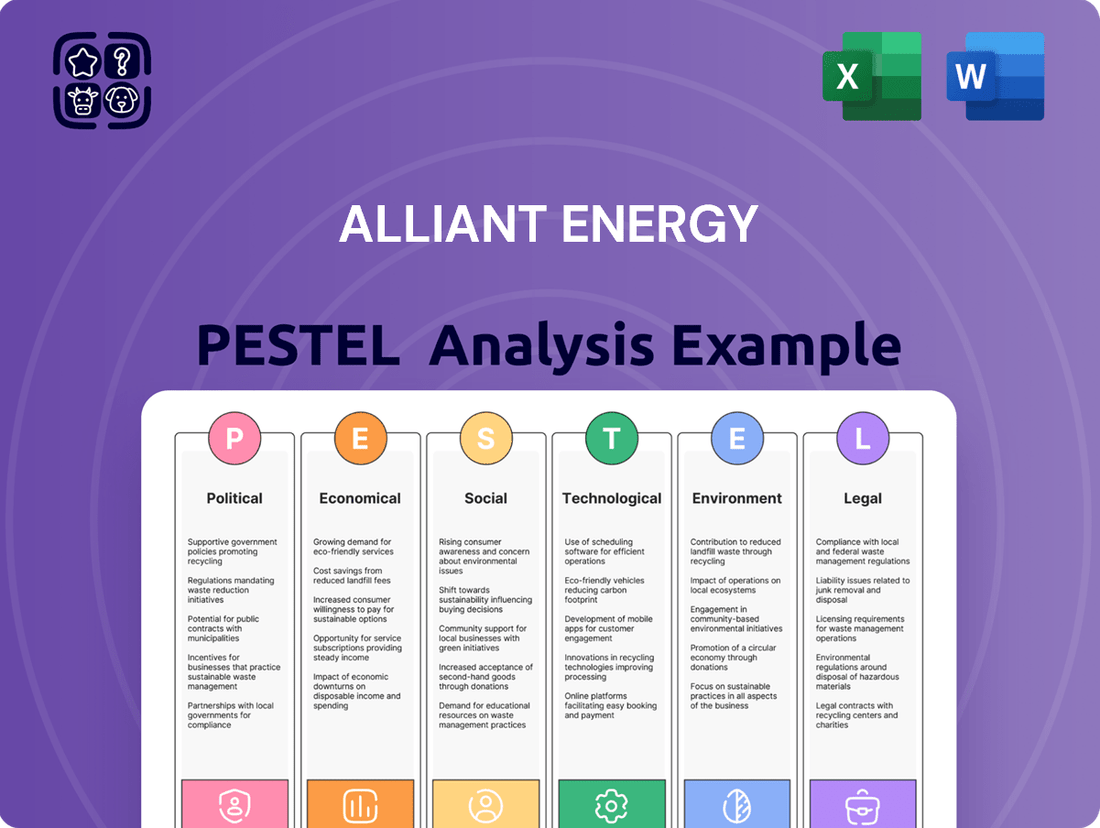

Navigate the complex external forces impacting Alliant Energy with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks are shaping the company's operational landscape and future growth. Equip yourself with actionable intelligence to refine your own strategic planning and investment decisions.

Gain a critical edge by unlocking the full PESTLE analysis of Alliant Energy. This in-depth report provides expert insights into the macro-environmental factors that matter most, offering a clear roadmap for identifying opportunities and mitigating risks. Download the complete version now to empower your business strategy.

Political factors

Alliant Energy navigates a heavily regulated landscape in Iowa and Wisconsin, with state utility commissions like the Iowa Utilities Commission (IUC) and the Public Service Commission of Wisconsin (PSCW) holding substantial sway. These commissions are pivotal in approving rate adjustments, capital expenditure proposals, and the company's energy resource strategies, directly impacting Alliant's financial performance and operational direction.

The IUC recently sanctioned rate increases for Alliant's electric and natural gas customers, effective January 1, 2024, which is projected to boost annual revenues by approximately $145 million for its Iowa electric operations and $45 million for its Iowa natural gas operations. This regulatory approval is crucial for Alliant's ability to recover investments in infrastructure and cleaner energy sources, directly influencing its earnings potential.

Government policies, particularly federal incentives like the Inflation Reduction Act (IRA), are significantly bolstering Alliant Energy's commitment to renewable energy. The IRA, enacted in 2022, offers substantial tax credits for solar and wind projects, making them more financially attractive. For instance, the production tax credit (PTC) and investment tax credit (ITC) can cover a significant portion of project costs.

Alliant Energy is strategically leveraging these incentives to enhance the economic feasibility of its renewable energy development pipeline. The company has been actively monetizing these tax credits, which directly improves its cash flow generation. This financial support is crucial for funding its ongoing capital expenditures in clean energy infrastructure, helping to meet its sustainability goals and transition towards a lower-carbon energy future.

State and federal energy policies are heavily pushing for decarbonization, aiming to transition away from fossil fuels towards cleaner energy. This shift directly impacts utilities like Alliant Energy, requiring significant investment in renewable infrastructure.

Alliant Energy has proactively aligned its strategies with these decarbonization mandates, notably by committing to retire its remaining coal-fired power plants. For instance, the company plans to retire the Lansing Generating Station by 2025, a move that significantly reduces its carbon footprint.

The company's 'Clean Energy Blueprints' outline substantial investments in wind, solar, and energy storage projects. In 2024, Alliant Energy announced plans to invest approximately $7.2 billion in clean energy projects through 2028, demonstrating a clear commitment to meeting these environmental objectives and adapting to evolving energy policy landscapes.

Local Government and Economic Development Support

Alliant Energy's success is deeply intertwined with the support and collaboration it receives from local governments, particularly in driving economic development. A prime example is its involvement in Cedar Rapids' largest-ever economic development investment, a partnership that underscores the crucial role of public-private collaboration. These alliances are instrumental in paving the way for essential infrastructure upgrades and attracting new enterprises, which in turn, boosts energy consumption and strengthens Alliant's market position within these communities.

This governmental backing is not just about infrastructure; it actively cultivates community growth and solidifies Alliant Energy's regional footprint. For instance, in 2023, Alliant Energy announced a significant capital investment of $1.5 billion in renewable energy projects across Iowa, a move that often requires close coordination with local authorities for permitting and land use. Such supportive political environments are key to facilitating these large-scale investments and ensuring they contribute positively to local economies.

- Infrastructure Investment: Local government support streamlines the process for infrastructure development, crucial for expanding energy grids and accommodating new industrial or commercial loads.

- Business Attraction: Collaborative economic development efforts, often spearheaded by local government initiatives, attract new businesses, directly increasing demand for Alliant Energy's services.

- Community Growth: Partnerships foster community development, enhancing Alliant's role as a key utility provider and strengthening its long-term regional presence and customer base.

Public and Political Scrutiny over Rates

Utility rate increase proposals frequently encounter significant public and political scrutiny. This often necessitates extensive negotiations and settlements with consumer advocacy groups and relevant state commissions to find a balance. For instance, the Iowa Utilities Board (IUB) approved Alliant Energy's rate increases in Iowa through a partial settlement, highlighting the delicate act of meeting company revenue needs while addressing customer affordability.

This scrutiny can impact the timing and magnitude of approved rate adjustments. In 2024, Alliant Energy's proposed rate adjustments in Wisconsin also faced public comment periods and regulatory review, underscoring the ongoing need for transparent communication and justification of increased costs to stakeholders.

- Rate Case Negotiations: Alliant Energy's 2023 Iowa rate case settlement involved a compromise on the requested increase, reflecting the pressure from consumer advocates.

- Customer Affordability: Balancing revenue requirements with customer affordability remains a key challenge in regulatory proceedings.

- Public Engagement: Active public participation in rate case proceedings can influence regulatory outcomes.

- Regulatory Oversight: State utility commissions play a crucial role in approving rate changes, often mediating between utility needs and consumer interests.

Government policies, particularly federal incentives like the Inflation Reduction Act (IRA), are significantly bolstering Alliant Energy's commitment to renewable energy, with the company planning to invest approximately $7.2 billion in clean energy projects through 2028. State utility commissions, such as the Iowa Utilities Commission (IUC) and the Public Service Commission of Wisconsin (PSCW), approve rate adjustments and capital expenditures, with the IUC sanctioning rate increases for Alliant's Iowa electric and natural gas customers effective January 1, 2024, projected to boost annual revenues by approximately $145 million and $45 million respectively. Local government support is also crucial, as seen in Alliant's $1.5 billion investment in Iowa renewable energy projects in 2023, which requires close coordination with local authorities for permitting and land use.

| Policy/Factor | Impact on Alliant Energy | Supporting Data/Example |

|---|---|---|

| Inflation Reduction Act (IRA) | Incentivizes renewable energy development, improving project economics. | Alliant plans to invest $7.2 billion in clean energy projects through 2028, leveraging IRA tax credits. |

| State Regulatory Approvals (IUC, PSCW) | Determines rate adjustments and capital expenditure approvals, impacting revenue and operational direction. | IUC approved rate increases effective Jan 1, 2024, adding ~$145M (electric) and ~$45M (gas) annually in Iowa. |

| Decarbonization Mandates | Drives investment in renewables and retirement of fossil fuel assets. | Commitment to retire Lansing Generating Station by 2025. |

| Local Government Collaboration | Facilitates infrastructure development and economic growth, increasing energy demand. | $1.5 billion invested in Iowa renewables in 2023, requiring local coordination. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Alliant Energy, providing a comprehensive overview of its external operating landscape.

A concise, actionable summary of Alliant Energy's PESTLE factors, designed to quickly identify and address potential external challenges and opportunities during strategic planning.

Economic factors

Alliant Energy is projecting substantial capital expenditures, targeting an aggregate of $11 billion between 2025 and 2028. This significant investment is strategically allocated towards renewable energy projects and upgrading its existing grid infrastructure.

These planned investments are vital for Alliant Energy's future growth trajectory and are designed to improve the dependability of its services to customers. Such capital outlays are a key indicator of the company's commitment to modernization and sustainability.

While these capital expenditures are essential for long-term operational health and expansion, they also present financial considerations. Specifically, increased spending may result in higher levels of corporate debt and could place additional strain on the company's free cash flow generation.

The current interest rate environment presents a significant challenge for Alliant Energy. As rates rise, the cost of borrowing for capital-intensive projects increases, directly impacting the company's financing expenses and overall cost of capital. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25% to 5.50% range, reflecting persistent inflation concerns. This elevated rate environment means that any new debt issuance or refinancing of existing debt will likely come with higher interest payments.

To mitigate these headwinds, Alliant Energy has proactively implemented strategies to manage its exposure to fluctuating interest rates. A key tactic has been the execution of interest rate swaps. These financial instruments allow the company to convert variable-rate debt into fixed-rate debt for a specified period. This is crucial for providing greater predictability in interest expenses and maintaining financial stability, especially when market conditions are uncertain. For example, in their 2023 financial reports, Alliant highlighted their ongoing use of swaps to hedge a substantial portion of their variable-rate debt, aiming to lock in favorable rates before further potential increases.

Customer energy demand, a critical economic factor for Alliant Energy, is directly tied to economic stability and temperature variations. In 2024, the company observed a notable increase in temperature-normalized electric sales to its residential customers, a positive sign for revenue.

However, this growth was partially offset by a decline in sales to certain industrial segments. For instance, while specific industrial customer sales figures for 2024 are proprietary, a general trend of reduced industrial output in some sectors can impact overall energy consumption patterns. This fluctuation underscores the need for Alliant Energy to accurately forecast and strategically manage these demand shifts to maintain consistent financial performance.

Financial Performance and Earnings Guidance

Alliant Energy's financial performance in 2024 showed GAAP earnings per share of $2.69, with non-GAAP EPS reaching $3.04. This demonstrates a robust operational base. The company is focused on maintaining this financial strength.

For 2025, Alliant Energy has affirmed its ongoing EPS guidance in the range of $3.15 to $3.25. This forward-looking guidance signals confidence in continued growth and profitability. The company anticipates navigating transitional costs associated with its significant renewable energy investments while aiming for consistent financial execution.

- 2024 GAAP EPS: $2.69

- 2024 Non-GAAP EPS: $3.04

- 2025 Ongoing EPS Guidance: $3.15 - $3.25

- Key Focus: Consistent financial performance and growth amid renewable investments.

Economic Development and Load Growth

Alliant Energy is actively pursuing economic development initiatives, with a particular emphasis on attracting energy-intensive industries like data centers. This strategy is designed to stimulate load growth and create new revenue streams within its service territories. For example, the company has secured agreements with data center operators in Iowa and Wisconsin, anticipating substantial increases in electricity demand.

These developments are crucial for Alliant Energy's long-term demand forecasts. The influx of data centers, which are significant energy consumers, directly translates into increased sales of electricity and natural gas. This proactive approach to economic development helps ensure a robust customer base and supports the company's financial stability.

- Data Center Growth: Alliant Energy is actively fostering the development of data centers in Iowa and Wisconsin.

- Load Growth Projections: Agreements with these data centers are projected to drive significant increases in energy consumption.

- Revenue Opportunities: This focus on attracting energy-intensive businesses creates new and substantial revenue opportunities for the company.

- Long-Term Demand: The strategy directly contributes to Alliant Energy's long-term demand forecasts and business planning.

Economic factors significantly influence Alliant Energy's performance, particularly through interest rates and customer demand. The elevated interest rate environment, with the Federal Reserve maintaining rates between 5.25% and 5.50% in early 2024, increases borrowing costs for the company's substantial capital expenditures. Despite this, Alliant Energy reported strong 2024 earnings, with GAAP EPS at $2.69 and non-GAAP EPS at $3.04, and projects 2025 ongoing EPS between $3.15 and $3.25, demonstrating resilience and a focus on growth amidst these economic conditions.

| Metric | 2024 Actual | 2025 Guidance |

| GAAP EPS | $2.69 | N/A |

| Non-GAAP EPS | $3.04 | N/A |

| Ongoing EPS Guidance | N/A | $3.15 - $3.25 |

| Federal Funds Rate (Early 2024) | 5.25% - 5.50% | N/A |

Preview Before You Purchase

Alliant Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Alliant Energy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Alliant Energy's business landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element, offering a robust framework for understanding Alliant Energy's challenges and opportunities.

Sociological factors

Alliant Energy actively fosters community well-being, a key sociological factor. In 2024, the company invested over $9 million and dedicated more than 80,000 volunteer hours to local initiatives. This deep involvement, spanning community project grants, scholarships, and non-profit support, cultivates trust and solidifies its standing within the communities it serves.

Customers increasingly expect energy providers to prioritize clean energy and minimize environmental impact. Alliant Energy's strategic focus on solar and wind power, aiming for net-zero emissions by 2050, directly addresses this growing societal demand. For instance, in 2023, the company completed its Great Plains wind farm expansion, adding 200 megawatts of clean energy capacity.

Alliant Energy actively fosters employee engagement and an inclusive workplace, a commitment detailed in their latest Corporate Responsibility Report. This focus aims to create a stable and motivated workforce, crucial for navigating industry changes.

In 2024, the company implemented voluntary separation packages as part of strategic restructuring. This initiative allows for resource alignment with evolving business priorities, enhancing operational efficiency and long-term workforce stability.

Affordability and Customer Impact of Rates

The affordability of electricity is a major sociological consideration for Alliant Energy. When rates go up, it directly impacts household budgets, potentially affecting discretionary spending and overall quality of life for its customers. This is particularly sensitive in regions like Iowa and Wisconsin, where regulatory bodies closely examine the proposed rate adjustments.

In Iowa, for instance, the Iowa Utilities Board (IUB) plays a crucial role in approving rate changes. Their decisions often reflect a balancing act between the utility's need for revenue and the customer's ability to pay. For example, in a recent rate case, the IUB imposed a rate increase cap, ensuring that the financial burden on consumers remained manageable. They also mandated specific customer notification procedures to clearly communicate the impact of these changes on monthly bills.

- Customer Bill Impact: Rate increases directly affect household budgets, influencing consumer spending and financial well-being.

- Regulatory Scrutiny: Bodies like the Iowa Utilities Board (IUB) carefully assess affordability in rate case decisions.

- Rate Case Outcomes: Recent Iowa decisions included rate increase caps and requirements for customer notification regarding bill impacts.

- Affordability Focus: Ensuring that energy remains accessible is a key sociological driver in utility rate setting.

Public Perception and Trust

Maintaining public trust and transparency is paramount for a utility company like Alliant Energy, especially as it navigates evolving energy landscapes. Their 2023 Corporate Responsibility Report highlights a deep commitment to building and sustaining this trust, emphasizing transparency in operations and delivering measurable value through community-focused initiatives. This focus is not just about goodwill; positive public perception directly influences regulatory support, customer satisfaction, and the company's overall social license to operate. For instance, in 2023, Alliant Energy reported a customer satisfaction score of 8.1 out of 10 for its regulated utilities, underscoring the importance of public sentiment.

The company actively engages with stakeholders to foster understanding and support for its strategic direction, including investments in cleaner energy sources. This proactive communication is vital for managing expectations and building confidence in their long-term plans. For example, Alliant Energy's 2024 capital investment plan, totaling approximately $2.1 billion, includes significant allocations towards grid modernization and renewable energy projects, which require public buy-in to proceed smoothly.

- Public Trust as a Cornerstone: Alliant Energy's commitment to transparency is a key driver of its operational strategy, aiming to build enduring relationships with the communities it serves.

- Community Investment Focus: The company's Corporate Responsibility Report details numerous initiatives designed to provide measurable value and positive impact at the local level, reinforcing public perception.

- Regulatory and Social License: Positive public perception is directly correlated with a smoother regulatory approval process and a stronger social license to operate, crucial for utility infrastructure development.

- Customer Satisfaction Metrics: In 2023, Alliant Energy achieved an average customer satisfaction rating of 8.1 out of 10 across its regulated utility operations, reflecting the impact of public engagement efforts.

Societal expectations around environmental stewardship and corporate responsibility significantly influence Alliant Energy's operations and strategic planning. Customers and communities increasingly demand sustainable practices and a commitment to reducing carbon footprints. Alliant Energy's stated goal of achieving net-zero carbon emissions by 2050, alongside substantial investments in renewable energy sources like wind and solar, directly addresses these evolving societal values. For instance, the company's 2024 capital expenditure plan includes over $1 billion dedicated to clean energy transition projects.

| Sociological Factor | Description | Impact on Alliant Energy | Relevant Data/Initiatives (2023-2024) |

|---|---|---|---|

| Environmental Consciousness | Growing public concern for climate change and sustainability. | Drives demand for renewable energy and emissions reduction. | Net-zero emissions by 2050 goal; $1B+ in clean energy investments (2024). |

| Community Engagement | Importance of local investment, volunteerism, and corporate citizenship. | Builds trust and social license to operate. | Over $9M invested in community initiatives; 80,000+ volunteer hours (2024). |

| Energy Affordability | Customer sensitivity to electricity prices and household budgets. | Influences regulatory decisions and customer satisfaction. | Iowa Utilities Board rate caps and notification mandates; focus on cost-effective solutions. |

| Workforce Expectations | Demand for inclusive workplaces and employee well-being. | Impacts talent acquisition, retention, and operational efficiency. | Focus on employee engagement and voluntary separation packages for restructuring (2024). |

Technological factors

Alliant Energy is significantly boosting its renewable energy portfolio. In 2024 alone, the company finalized investments totaling 1,500 megawatts of new solar generation capacity. This expansion complements its already robust 1,800 megawatts of operational wind power assets.

These technological advancements are crucial for Alliant Energy's strategic shift towards cleaner energy sources. The deployment of advanced solar and wind technologies directly supports the company's ambitious targets for emission reductions and its overall clean energy transition plan.

Alliant Energy is actively embracing technological advancements in energy storage, exemplified by its Columbia Energy Storage Project in Wisconsin. This project, a significant step forward, utilizes innovative CO2 battery technology to bolster grid stability and resilience. These advancements are crucial for integrating variable renewable energy sources.

Alliant Energy is actively investing in grid modernization, aiming to build a more intelligent and responsive distribution system. This strategic shift includes deploying smart grid technologies and advanced metering infrastructure (AMI) to significantly boost outage detection, speed up response times, and elevate overall system efficiency.

These crucial upgrades are specifically engineered to bolster the grid's resilience against disruptions and ensure a more dependable power supply for customers. For instance, in 2023, Alliant Energy reported investing approximately $1.7 billion in capital expenditures, with a substantial portion allocated to infrastructure improvements like grid modernization projects.

Digitalization and Data Analytics

Alliant Energy is leveraging digitalization and data analytics to significantly boost operational efficiency and customer satisfaction. By employing advanced analytics, the company can now predict potential equipment failures, allowing for proactive, preventative maintenance. This focus on predictive maintenance directly contributes to enhanced service reliability for its customers.

Technology investments are strategically channeled towards reducing operating expenses while simultaneously improving the overall customer experience. These digital transformation efforts are designed to streamline internal operations, making processes more efficient and responsive.

The company's digitalization initiatives provide invaluable insights that inform crucial strategic decision-making. For instance, in 2023, Alliant Energy reported investments in grid modernization technologies aimed at improving reliability and integrating renewable energy sources. These investments are expected to yield long-term cost savings and operational improvements.

- Predictive Maintenance: Data analytics enables the prediction of equipment failures, leading to scheduled preventative maintenance and increased reliability.

- Cost Reduction: Technology investments are targeted at lowering operational costs through process optimization and automation.

- Customer Experience: Digitalization efforts aim to enhance customer interactions and service delivery.

- Strategic Insights: Streamlined operations and data analysis provide critical information for informed business strategy development.

Emerging Technologies and Cleaner Fuels

Alliant Energy is actively exploring the commercialization of emerging technologies and cleaner fuels, a key component of its 2024-2025 long-term energy strategy. This proactive stance positions the company to adapt to evolving energy landscapes and meet future demand with innovative, sustainable solutions. For instance, the company is investing in advanced battery storage and exploring green hydrogen production, aligning with national clean energy goals.

The company's commitment to innovation is evident in its pilot programs and partnerships. In 2024, Alliant Energy announced collaborations to test new carbon capture technologies and evaluate the feasibility of advanced nuclear reactors. These initiatives are crucial for diversifying its energy portfolio and reducing its carbon footprint, with a target of achieving net-zero greenhouse gas emissions by 2050.

- Investment in Renewable Energy: Alliant Energy plans to invest billions in renewable energy projects, including wind and solar farms, through 2025 to enhance its clean energy generation capacity.

- Grid Modernization: The company is upgrading its transmission and distribution infrastructure to better integrate intermittent renewable sources and improve grid reliability.

- Emerging Fuel Research: Alliant Energy is conducting research into cleaner fuels such as sustainable aviation fuel and advanced biofuels, aiming to support decarbonization across various sectors.

- Customer Engagement: The company is developing programs to help customers adopt cleaner energy solutions and reduce their own emissions, fostering a collaborative approach to energy transition.

Alliant Energy's technological focus centers on expanding its renewable energy capacity, with significant investments in solar and wind power. The company is also prioritizing grid modernization, integrating smart technologies to enhance reliability and efficiency. Furthermore, Alliant Energy is leveraging digitalization and data analytics for predictive maintenance and improved customer service, aiming to reduce operational costs and boost overall performance.

| Technology Area | Key Initiatives/Investments | Impact/Goal |

|---|---|---|

| Renewable Energy Expansion | 1,500 MW new solar capacity finalized in 2024; 1,800 MW operational wind power | Increased clean energy generation, emission reduction |

| Energy Storage | Columbia Energy Storage Project (CO2 battery technology) | Grid stability, resilience, integration of renewables |

| Grid Modernization | Smart grid technologies, Advanced Metering Infrastructure (AMI) | Improved outage detection, faster response, enhanced efficiency |

| Digitalization & Data Analytics | Predictive maintenance, operational efficiency improvements | Reduced operating expenses, enhanced service reliability |

| Emerging Technologies | Carbon capture, advanced nuclear reactors, green hydrogen, sustainable aviation fuel | Diversified portfolio, decarbonization, future energy solutions |

Legal factors

Alliant Energy's financial performance hinges on utility rate case approvals from state commissions, which dictate cost recovery and return on investment. In 2024, the Iowa Utilities Board granted annual base rate increases for both electric and natural gas services, a crucial step for the company's revenue streams. Similarly, the Public Service Commission of Wisconsin authorized rate adjustments for 2024 and 2025, impacting its operational viability in that state.

Alliant Energy faces significant operational impacts from environmental regulations, including the EPA's revised coal combustion residuals rule finalized in May 2024. This updated rule broadens compliance requirements, potentially demanding increased capital expenditure for environmental controls and asset retirement activities to manage legacy waste.

Adherence to these evolving standards is crucial as Alliant Energy pursues its ambitious goal of achieving net-zero emissions by 2050. The company's strategy necessitates ongoing investment in cleaner energy sources and efficient operational practices to meet these environmental mandates.

Building new energy infrastructure, like power plants or transmission lines, involves a complex web of permits and approvals from various government agencies. Alliant Energy, for instance, must navigate these processes for its renewable energy projects, such as its planned solar farm in Wisconsin, which is subject to state and local siting regulations.

These regulatory requirements can significantly impact how quickly projects move forward and how much they ultimately cost. For example, delays in obtaining environmental permits or zoning approvals can push back construction schedules, leading to increased expenses for Alliant Energy and potentially affecting its planned capital expenditures for 2024.

Corporate Governance and Shareholder Relations

Alliant Energy, as a publicly traded utility holding company, operates under stringent legal mandates concerning corporate governance and shareholder relations. Compliance with Securities and Exchange Commission (SEC) regulations is paramount, encompassing timely filings of financial reports, annual reports, and proxy statements. For instance, in its 2023 annual report, Alliant Energy detailed its adherence to Sarbanes-Oxley Act requirements, a key piece of legislation governing corporate accountability.

Effective corporate governance is not merely a legal obligation but a strategic imperative for Alliant Energy. It fosters transparency and accountability, building trust with shareholders and regulatory bodies like the Public Service Commission of Wisconsin and the Iowa Utilities Board. This commitment to good governance is reflected in its board structure and shareholder engagement practices, aiming to ensure long-term value creation and operational integrity.

- SEC Compliance: Alliant Energy must adhere to all SEC regulations for public companies, including accurate and timely financial disclosures.

- Shareholder Rights: The company is legally bound to uphold shareholder rights, including voting rights and access to company information.

- Board Oversight: Corporate governance standards dictate independent board oversight to ensure management acts in the best interest of shareholders.

- Regulatory Adherence: Beyond SEC rules, Alliant Energy must comply with state-level utility regulations impacting governance and reporting.

Contractual Agreements and Legal Settlements

Alliant Energy's operations are heavily influenced by contractual agreements, particularly those concerning land use, transmission infrastructure, and energy supply. These contracts are crucial for facilitating large-scale projects, such as the significant demand from data centers announced in 2024, which require substantial energy commitments and transmission capacity.

The company also navigates a landscape of legal settlements, which can materially affect its financial standing and operational strategies. For instance, the partial non-unanimous settlement agreement approved by the Iowa Utilities Board (IUB) in September 2024 addressed contested issues, demonstrating how regulatory approvals of settlements can resolve disputes and shape future financial performance.

- Contractual Commitments: Alliant Energy secures agreements for land, transmission rights, and energy supply, vital for new developments like data centers, which saw significant project announcements in 2024.

- Regulatory Settlements: The IUB's September 2024 approval of a partial non-unanimous settlement agreement highlights the impact of legal resolutions on contested utility matters.

- Financial Impact: These legal and contractual frameworks directly influence Alliant Energy's revenue streams, operational costs, and overall financial stability.

Legal factors significantly shape Alliant Energy's operational landscape, from securing essential rate case approvals to adhering to stringent environmental regulations. The company's 2024 rate adjustments in Iowa and Wisconsin, for example, directly impact its revenue and investment capacity. Furthermore, evolving environmental rules, like the EPA's May 2024 coal combustion residuals update, necessitate capital outlays for compliance and asset management, directly supporting its net-zero 2050 goals.

Environmental factors

Alliant Energy is making significant strides in renewable energy, completing 1,500 megawatts of solar investments in 2024 and already operating 1,800 megawatts of wind capacity. This expansion is a core component of their environmental strategy, demonstrating a clear commitment to cleaner energy sources.

Looking ahead, the company aims to integrate an additional 1,099 megawatts of renewable generation by the close of 2025. Furthermore, Alliant Energy has plans to develop up to 1,000 megawatts of new wind energy specifically within Iowa, reinforcing its dedication to regional green energy development.

Alliant Energy is aggressively pursuing carbon emission reduction, aiming for a 50% decrease in CO2 emissions from 2005 levels by 2030 and achieving net-zero emissions from its utility operations by 2050. This commitment is already yielding significant progress, with the company reporting a 46% reduction in CO2 emissions from 2005 levels by the close of 2024. A key driver for this achievement has been the strategic retirement of coal-fired power generation facilities.

Alliant Energy is actively retiring its coal-fired power plants as a cornerstone of its environmental strategy. The company committed to retiring an additional 1,300 megawatts of coal generation by the close of 2024, marking a significant step in its transition towards cleaner energy sources.

This strategic move is directly aligned with Alliant Energy's ambitious decarbonization goals, aiming to reduce its environmental footprint. The retirement of these older, carbon-intensive facilities is critical for meeting its sustainability targets and adapting to evolving regulatory landscapes and market demands for cleaner power.

Environmental Stewardship and Reporting

Alliant Energy actively showcases its commitment to environmental stewardship through its annual Corporate Responsibility Report (CRR). The 2024 CRR, for instance, details the company's progress on environmental, social, and governance (ESG) initiatives, offering a transparent look at its sustainability efforts and energy mix.

This reporting mechanism is crucial for stakeholders seeking to understand Alliant Energy's environmental performance and its strategic approach to balancing energy needs with ecological responsibility. The company emphasizes its dedication to reducing its environmental footprint.

- 2024 CRR: Details sustainability data and ESG progress.

- Balanced Energy Mix: Highlights a strategic approach to energy sources.

- Transparency: Provides clear reporting on environmental performance.

Climate Change Adaptation and Resilience

Alliant Energy's commitment to climate change adaptation and resilience is central to its Energy Blueprint. The company is actively modernizing its distribution systems, a crucial step in preparing for evolving energy technologies and the increasing likelihood of climate-related disruptions. This focus ensures the reliability of its services even when faced with environmental challenges.

The company's strategy includes significant investments in infrastructure resilience. For instance, Alliant Energy has outlined plans to invest billions in grid modernization and renewable energy projects through 2025. These upgrades are designed to withstand extreme weather events, such as severe storms or heatwaves, which are becoming more frequent due to climate change.

- Grid Modernization: Alliant Energy is investing in smart grid technologies to improve reliability and adapt to changing energy demands and weather patterns.

- Infrastructure Hardening: Projects include undergrounding power lines in vulnerable areas and reinforcing existing infrastructure to better withstand severe weather.

- Renewable Energy Integration: Expanding renewable energy sources like solar and wind power inherently contributes to a more resilient energy mix, less dependent on single, potentially vulnerable fuel sources.

- Climate Risk Assessment: The company conducts ongoing assessments to identify and mitigate potential climate-related risks to its operations and service territories.

Alliant Energy's environmental strategy is heavily focused on decarbonization and renewable energy expansion. By the end of 2024, the company achieved a 46% reduction in CO2 emissions from 2005 levels, well on its way to its 2030 goal of a 50% reduction. This progress is largely due to retiring coal-fired power plants, with an additional 1,300 megawatts of coal generation retired by the close of 2024.

The company is also a leader in renewable energy investments, completing 1,500 megawatts of solar in 2024 and planning for an additional 1,099 megawatts of renewables by the end of 2025. Alliant Energy is committed to net-zero emissions from its utility operations by 2050, demonstrating a long-term vision for sustainable energy.

Furthermore, Alliant Energy is investing billions in grid modernization and infrastructure resilience through 2025 to adapt to climate change and ensure service reliability. This includes hardening infrastructure against extreme weather events and integrating more renewable sources into its energy mix.

| Environmental Goal | Target Year | Progress by End of 2024 | Key Initiatives |

|---|---|---|---|

| CO2 Emission Reduction | 2030 | 46% reduction from 2005 levels | Retirement of coal-fired power plants |

| Net-Zero Emissions (Utility Operations) | 2050 | N/A (Ongoing) | Transition to renewable energy sources |

| Renewable Energy Capacity | End of 2025 | 1,500 MW Solar completed in 2024; 1,800 MW Wind operational | Planned 1,099 MW additional renewable generation; 1,000 MW new wind in Iowa |

PESTLE Analysis Data Sources

Our PESTLE analysis for Alliant Energy is built on a foundation of data from official government agencies, reputable industry associations, and leading financial news outlets. We incorporate regulatory filings, economic forecasts, and technological advancements to provide a comprehensive view.