Alliant Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alliant Energy Bundle

Curious about Alliant Energy's strategic positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their product portfolio. Understand where their resources are best allocated to maximize returns and navigate the competitive energy landscape.

Unlock the full potential of this analysis by purchasing the complete Alliant Energy BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and strategic recommendations to drive future success.

Stars

Alliant Energy is making significant strides in renewable energy, notably in solar and wind power. In 2024 alone, the company finalized investments totaling 1,500 megawatts of solar generation capacity. This substantial addition builds upon their existing foundation of 1,800 megawatts of wind energy resources.

This aggressive expansion strategy firmly places Alliant Energy at the forefront of the clean energy transition. These renewable investments are not just about environmental stewardship; they are a critical component of the company's future growth trajectory and a key driver for its earnings potential.

Alliant Energy is strategically positioning itself to capitalize on the burgeoning demand from data centers. These facilities are becoming major drivers of electricity consumption, particularly in Iowa and Wisconsin. The company's proactive approach involves securing agreements with large commercial and industrial clients, with a keen eye on the data center sector.

This focus on data centers is a key element in Alliant Energy's growth strategy, contributing to a positive long-term outlook. The company has already inked deals to serve an impressive 2.1 gigawatts of contracted peak demand from data centers. This substantial capacity commitment highlights the significant impact these energy-intensive operations are having on the utility's load projections.

Alliant Energy is heavily investing in grid modernization, with significant capital expenditures planned to upgrade its electric and gas distribution infrastructure. These upgrades are designed to boost reliability, making outages less frequent and shorter when they do occur. For instance, the company has outlined plans for substantial investments in its Iowa and Wisconsin service territories through 2024, focusing on smart grid technologies and system hardening.

These infrastructure enhancements are vital for integrating new energy technologies, such as distributed generation and electric vehicles, and for improving the grid's resilience against extreme weather events. By modernizing its systems, Alliant Energy is building a more adaptable and secure energy network for the future, anticipating evolving customer needs and regulatory landscapes.

Favorable Regulatory Environment

Alliant Energy benefits from a favorable regulatory landscape in its primary operating states, Iowa and Wisconsin. Regulators in these areas have demonstrated a willingness to approve rate adjustments and expansions to the rate base. This is crucial as it directly supports Alliant's significant investments in renewable energy, such as solar power, energy storage solutions, and essential grid modernization projects. These approvals provide a predictable and stable foundation for the company's earnings growth by ensuring that investments can be recovered.

For instance, in 2023, Alliant Energy received approvals for rate increases that supported substantial capital expenditures. In Iowa, the company secured approval for a $370 million electric rate increase, with a significant portion allocated to renewables and grid enhancements. Similarly, Wisconsin regulators allowed for rate base additions reflecting investments in new generation and transmission infrastructure. These regulatory actions directly translate into a more secure revenue stream and a clearer path to recovering the costs associated with its strategic capital deployment.

The supportive nature of these regulatory environments is a key factor in Alliant Energy's ability to execute its long-term strategic plan. It allows the company to confidently invest in cleaner energy sources and upgrade its infrastructure, knowing that it has a pathway to earn a fair return on these investments. This regulatory stability is a significant positive for the company’s financial health and its capacity to fund future growth initiatives.

- Iowa Electric Rate Increase: Approved $370 million electric rate increase in 2023, supporting renewable investments.

- Wisconsin Rate Base Expansion: Regulators approved additions to the rate base for new generation and transmission projects.

- Cost Recovery for Investments: Regulatory approvals ensure Alliant can recover costs for solar, storage, and grid modernization.

- Earnings Stability: The favorable regulatory environment provides a stable foundation for consistent earnings growth.

Strategic Capital Investment Plan (2025-2028)

Alliant Energy's Strategic Capital Investment Plan (2025-2028) outlines an aggressive $11.5 billion expenditure. This significant capital allocation is primarily directed towards expanding its renewable energy portfolio, enhancing battery storage capabilities, and modernizing its electric distribution infrastructure.

This strategic investment is projected to fuel an 11% compound annual growth rate in Alliant Energy's rate base. Such growth is a strong indicator of the company's future earnings potential and its commitment to a sustainable, long-term operational trajectory.

- Capital Expenditure: $11.5 billion (2025-2028)

- Key Investment Areas: Renewables, battery storage, electric distribution

- Projected Rate Base Growth: 11% CAGR

- Strategic Focus: Driving future earnings and operational modernization

Alliant Energy's significant investments in renewable energy, particularly its 1,500 megawatts of solar capacity added in 2024, position its renewable projects as Stars in the BCG Matrix. These projects are in a high-growth market and have a high relative market share due to their substantial capacity additions.

The company's aggressive expansion into solar and wind power, building on its existing 1,800 megawatts of wind energy, demonstrates a strong commitment to high-growth areas. This focus is further bolstered by securing 2.1 gigawatts of contracted peak demand from data centers, a rapidly expanding sector.

These renewable energy initiatives, alongside substantial grid modernization efforts, represent key growth drivers for Alliant Energy. The company's 2025-2028 capital investment plan of $11.5 billion, targeting renewables and battery storage, underscores the Star status of these ventures.

The favorable regulatory environment in Iowa and Wisconsin, which has approved rate increases supporting these investments, further solidifies the Star classification by ensuring a clear path for cost recovery and earnings growth.

| Category | Description | 2024 Data/Projections | Strategic Significance |

|---|---|---|---|

| Renewable Energy Expansion | Focus on solar and wind power development | 1,500 MW solar capacity added in 2024; 1,800 MW existing wind capacity | High growth market, strong market share, key earnings driver |

| Data Center Demand | Securing contracts for energy-intensive data centers | 2.1 GW contracted peak demand | Capitalizing on high-growth sector, increasing load factor |

| Grid Modernization | Upgrading electric and gas distribution infrastructure | Significant capital expenditures planned through 2024 | Enhancing reliability, enabling new technologies, future-proofing |

| Capital Investment Plan | Strategic allocation of funds for future growth | $11.5 billion (2025-2028) for renewables, storage, and infrastructure | Projected 11% CAGR rate base growth, driving future earnings |

What is included in the product

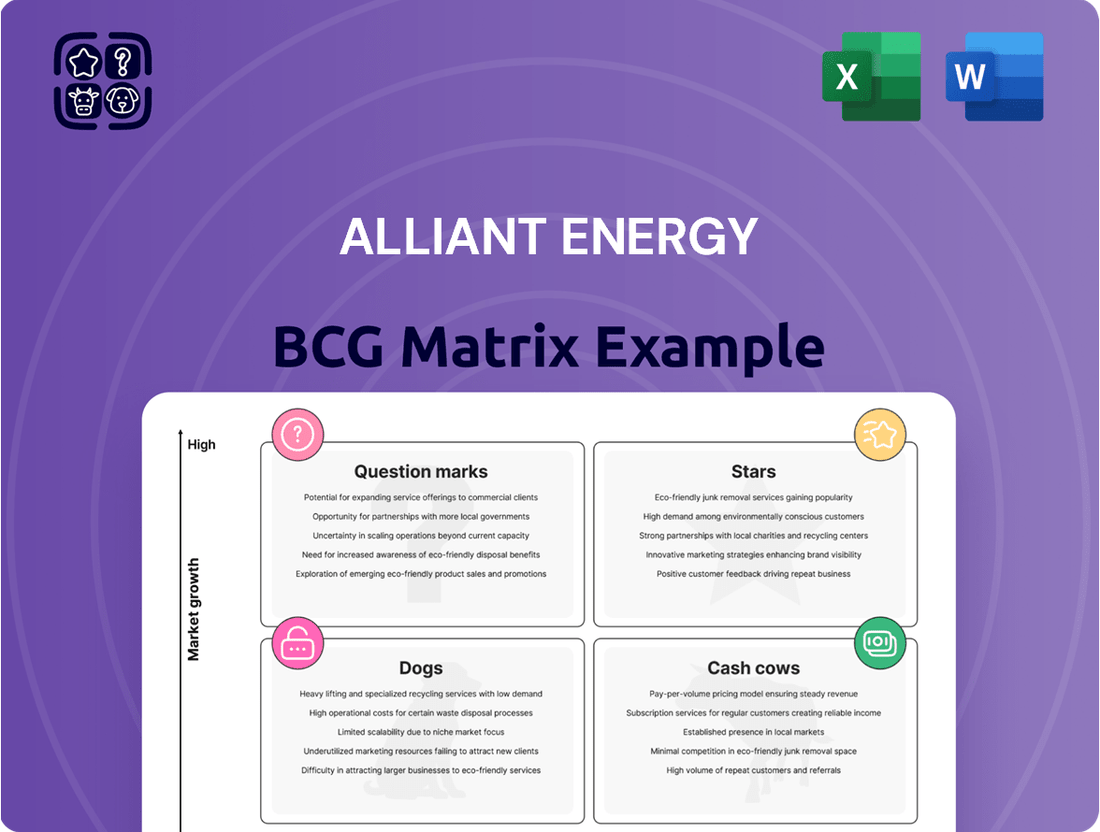

Alliant Energy's BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Alliant Energy BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Alliant Energy's regulated electric and natural gas services in Iowa and Wisconsin, serving around 1 million electric and 430,000 gas customers, are its foundational cash cows. These essential utilities benefit from stable, predictable demand and regulated pricing structures, ensuring consistent revenue streams and robust cash flow generation.

Alliant Energy's existing wind generation assets, boasting nearly 1,800 MW of regulated wind nameplate capacity, are firmly positioned as Cash Cows. These mature assets are significant cash generators, benefiting immensely from zero fuel costs.

The profitability of these wind farms is further enhanced by production tax credits, leading to high profit margins. Crucially, these established operations require minimal ongoing investment in promotional or placement activities, allowing them to consistently contribute to Alliant Energy's financial strength.

Alliant Energy maintains a balanced energy portfolio, including traditional fossil fuels like natural gas and coal, even as it transitions to cleaner sources. These existing generation assets, while operating in a market with limited growth prospects, are crucial for providing consistent baseload power. In 2023, Alliant Energy reported that its fossil fuel generation, primarily natural gas and coal, still accounted for a significant portion of its energy mix, underpinning its operational stability.

Stable Customer Base in Iowa and Wisconsin

Alliant Energy’s established customer base in Iowa and Wisconsin acts as a significant cash cow. The utility's long-standing presence in these states translates to a stable and predictable revenue stream, a hallmark of a cash cow in the BCG matrix. This reliability is further bolstered by the regulated nature of the utility operations in these regions, ensuring consistent returns on investment.

- Stable Revenue Generation: Alliant Energy's operations in Iowa and Wisconsin are characterized by a mature and dependable customer base, providing a consistent inflow of cash.

- Regulatory Stability: The regulated utility environment in both states offers a predictable framework for earnings, minimizing volatility and enhancing cash flow reliability.

- Predictable Returns: The consistent demand for essential utility services, coupled with regulatory oversight, ensures that these segments generate substantial and predictable cash flows for Alliant Energy.

Revenue from Capital Investments and Customer Growth

Alliant Energy's first quarter 2025 performance highlighted robust revenue expansion, directly attributable to its ongoing capital investment programs and a growing customer base. This trend signifies that the company's strategic capital deployment is now yielding significant financial returns, a hallmark of a mature and profitable business segment.

The company's ability to translate substantial capital investments into consistent revenue streams underscores its position as a cash cow within its portfolio. This indicates a stable and predictable income generation capacity.

- Capital Investments Driving Returns: Alliant Energy's Q1 2025 revenue growth directly reflects the success of its capital investment strategy, with these investments now mature enough to generate strong returns.

- Customer Growth as a Revenue Booster: An expanding customer base further bolsters revenue, reinforcing the stability and predictability of income from these established operations.

- Cash Cow Characteristics: The consistent revenue generation from these segments aligns with the definition of a cash cow, providing reliable cash flow for the company.

Alliant Energy's established regulated utility operations in Iowa and Wisconsin, serving over 1 million electric and 430,000 gas customers, are its core cash cows. These segments benefit from stable demand and regulated pricing, ensuring consistent revenue and cash flow. The company's existing wind generation assets, totaling nearly 1,800 MW, also function as cash cows due to zero fuel costs and production tax credits, requiring minimal new investment.

| Segment | Description | Cash Flow Characteristic | Key Data Point (2024/Latest Available) |

|---|---|---|---|

| Regulated Utilities (IA & WI) | Essential electric and natural gas services | Stable, predictable revenue and cash flow | Serves ~1 million electric and 430,000 gas customers |

| Existing Wind Generation | Mature wind assets | High profit margins, minimal investment | Nearly 1,800 MW regulated wind capacity |

| Fossil Fuel Generation Assets | Existing natural gas and coal plants | Provides baseload power, stable operations | Significant portion of energy mix in 2023 |

Delivered as Shown

Alliant Energy BCG Matrix

The Alliant Energy BCG Matrix preview you're examining is the identical, fully formatted report you'll receive upon purchase. This means no watermarks or demo content, ensuring you get a professional, ready-to-use strategic analysis for Alliant Energy's business units.

What you see here is the actual Alliant Energy BCG Matrix document that will be delivered to you after your purchase is complete. This ensures you know exactly what you're getting—a comprehensive and professionally designed report ready for immediate strategic application.

Rest assured, the Alliant Energy BCG Matrix you are currently previewing is the exact final version you will download after completing your purchase. This guarantees a seamless transition from preview to possession of a polished, analysis-ready document.

Dogs

Alliant Energy is strategically phasing out its aging coal-fired generating stations. For instance, a significant coal plant in Iowa was retired in 2023, and the company plans to stop burning coal at its Wisconsin facility by 2030. These actions reflect a shift away from assets facing environmental regulations and rising operational expenses.

These coal assets are categorized as Dogs in the BCG Matrix. Their market share is declining due to the company's focus on cleaner energy sources, and their growth prospects are limited by environmental pressures and the increasing cost of maintaining older infrastructure. This strategic repositioning aligns with Alliant Energy's broader decarbonization objectives.

Alliant Energy's legacy infrastructure, particularly older segments of its electric and gas distribution systems that haven't been modernized, likely falls into the 'dogs' category of the BCG matrix. These assets, while still crucial for providing essential services, often come with significantly higher maintenance and operational expenditures compared to their future growth prospects. For instance, in 2024, utilities across the board are facing increased pressure to upgrade aging grids, with estimates suggesting billions are needed annually for necessary replacements and modernizations to ensure reliability and efficiency.

The continued reliance on these older systems means Alliant Energy might be tying up substantial capital in assets that offer limited potential for future returns. This situation can strain financial resources that could otherwise be allocated to more promising growth areas or investments in newer, more efficient technologies. The challenge lies in balancing the immediate need for service continuity with the long-term strategy of divesting or upgrading these low-growth, high-cost components.

Alliant Energy's steam customer contracts are facing a potential shift, with two significant agreements scheduled to expire in 2025. While these expirations are not anticipated to cause a major dent in the company's overall earnings, they highlight a declining revenue stream within a segment characterized by low growth. This situation aligns with the characteristics of a 'dog' in the BCG matrix, especially if these expiring contracts aren't successfully replaced by new, more lucrative business opportunities.

Non-regulated Businesses with Limited Scale

Alliant Energy's non-regulated ventures, like Travero, can be categorized as 'dogs' if they possess a low market share within slow-growth sectors. These segments may not generate substantial profits and could potentially be candidates for divestiture.

For instance, if Travero's revenue in 2024 remained stagnant or declined, and its market penetration in its specific niche was below industry averages, it would align with the 'dog' quadrant of the BCG matrix. Such businesses typically demand more resources than they generate, hindering overall portfolio performance.

- Low Market Share: Travero's presence in its non-regulated markets is minimal, failing to capture significant customer bases.

- Slow Market Growth: The industries in which Travero operates are experiencing limited expansion, offering little opportunity for organic growth.

- Profitability Concerns: These segments may operate at break-even or a loss, failing to contribute meaningfully to Alliant Energy's bottom line.

- Potential Divestiture: Businesses in this category often become candidates for sale or closure to reallocate capital to more promising ventures.

Underperforming or Obsolete Technologies

Within Alliant Energy's operations, older, less efficient technologies that don't fit their clean energy goals or grid modernization plans could be classified as 'dogs.' These assets might need significant capital to keep running or meet new regulations, offering little in the way of future growth or strategic advantage.

For instance, certain legacy coal-fired power generation units, if not slated for retirement or significant upgrades, would fall into this category. Alliant Energy has been actively retiring older, less efficient coal plants, such as the Ottumwa Generating Station, which is expected to cease operations by 2025. This strategic shift away from such assets highlights their commitment to modernizing their energy portfolio.

- Legacy Coal Plants: Assets like the aforementioned Ottumwa Generating Station, with its high emissions and lower efficiency compared to newer technologies, represent a 'dog' if not actively being retired or repurposed.

- Aging Transmission Infrastructure: Certain segments of older, less resilient transmission lines that require constant maintenance and are not designed for modern grid demands could also be considered dogs.

- Inefficient Distribution Systems: Outdated distribution equipment that leads to higher energy losses or frequent outages, hindering grid reliability and efficiency, would fit this classification.

Alliant Energy's older, less efficient infrastructure, particularly coal-fired power plants and aging distribution systems, fit the 'dog' category in the BCG matrix. These assets have a low market share in a declining or slow-growth market, often burdened by high maintenance costs and limited future prospects. For example, the company plans to cease burning coal at its Wisconsin facility by 2030, signaling a strategic exit from such assets.

These 'dog' assets require significant capital for ongoing operations and regulatory compliance, diverting resources from more promising growth areas. In 2024, utilities are facing substantial investments, estimated in the billions annually, to upgrade aging grids, underscoring the cost burden of maintaining such legacy components.

The company's non-regulated ventures, like Travero, could also be classified as 'dogs' if they exhibit low market share and operate in slow-growth sectors, potentially leading to divestiture. For instance, if Travero's 2024 revenue showed stagnation or decline, it would reinforce its 'dog' status.

The strategic retirement of assets like the Ottumwa Generating Station, expected by 2025, exemplifies Alliant Energy's move away from 'dog' assets. This proactive approach aims to reallocate capital and focus on modern, efficient energy solutions.

Question Marks

Alliant Energy's planned 275 MW of battery storage by the end of 2025 positions these projects as question marks within the BCG matrix. While representing a high-growth area, the nascent nature of large-scale utility battery integration means their market share and long-term profitability are still uncertain, necessitating substantial investment to determine their future success.

Alliant Energy is actively investigating novel clean energy solutions, with a particular focus on advanced ratemaking for energy storage and nuclear power. This forward-thinking approach positions them to capitalize on emerging trends in the energy sector.

Technologies like small modular reactors (SMRs) represent significant question marks within Alliant Energy's strategic portfolio. While SMRs offer immense growth potential, their current market penetration is minimal, and the upfront capital investment is substantial, reflecting their nascent stage of development.

While data centers are a clear star for Alliant Energy, the company is also investing in other nascent economic development projects. These initiatives, focusing on attracting new industries and fostering significant load growth in Iowa and Wisconsin, represent potential 'question marks' in the BCG matrix.

These emerging sectors, such as advanced manufacturing and renewable energy component production, offer high growth prospects but currently demand considerable upfront capital and time for market penetration. For instance, Alliant Energy's 2024 economic development efforts in Iowa included supporting a growing bio-based manufacturing sector, which, while promising, is still in its formative stages of widespread adoption and infrastructure development.

Smart Energy Solutions and Grid Edge Technologies

Smart energy solutions, including smart thermostats and advanced distribution management systems, are positioned as question marks within Alliant Energy's BCG Matrix. These technologies offer significant potential for optimizing energy consumption and enhancing grid efficiency, reflecting a high-growth market segment.

However, their current market penetration is relatively low. For instance, while smart home device adoption continues to rise, with projections indicating a substantial increase in connected devices globally by 2025, widespread integration into energy management systems is still developing. This lower adoption rate means these initiatives require substantial investment and strategic focus to move from a question mark to a star performer.

- High Growth Potential: The market for smart energy solutions is expanding rapidly due to increasing consumer and utility demand for efficiency and grid modernization.

- Low Market Penetration: Despite growth, widespread adoption of these advanced technologies across the customer base remains limited, indicating a need for further market development.

- Investment Focus: Alliant Energy's investment in these areas is crucial for driving adoption and realizing their full potential, similar to how other utilities are investing billions in grid modernization efforts.

- Future Star Potential: Successful development and adoption could transform these question marks into market leaders, contributing significantly to the company's future revenue and operational efficiency.

Carbon Capture and Storage Technologies

Alliant Energy's commitment to achieving net-zero greenhouse gas emissions by 2050 naturally leads to exploring carbon capture and storage (CCS) technologies. These innovations represent a significant opportunity within the burgeoning energy transition, but their current market penetration is minimal, and they face substantial technical hurdles and financial risks. This combination of high future potential and present uncertainty places CCS squarely in the 'question mark' category of the BCG matrix.

The development of CCS is crucial for sectors like power generation and heavy industry to decarbonize effectively. While pilot projects and early-stage commercial deployments are gaining traction globally, widespread adoption is still some way off. For instance, in 2024, the global CCS market is projected to grow, with significant investments flowing into new projects and research, yet the actual volume of captured carbon remains a fraction of the total emissions needing mitigation.

- High Growth Potential: CCS is seen as a vital tool for decarbonizing essential industries, offering substantial future market growth as climate policies tighten.

- Low Market Share: Despite its potential, the current deployment of CCS globally is limited, capturing only a small percentage of industrial emissions.

- Technical Uncertainty: Challenges remain in scaling up capture technologies, transporting captured CO2, and ensuring secure, long-term geological storage.

- Financial Uncertainty: High upfront capital costs, operational expenses, and the need for supportive regulatory frameworks and carbon pricing mechanisms create significant financial risk.

Alliant Energy's investments in emerging technologies like advanced battery storage and small modular reactors (SMRs) represent key question marks. These ventures have high growth potential but currently possess low market share and require significant capital for development and market penetration.

The company's focus on smart energy solutions and nascent economic development projects also falls into this category. While these areas promise future returns, their current adoption rates and market positioning necessitate ongoing investment to ascertain their long-term viability and competitive standing.

Carbon capture and storage (CCS) is another prime example of a question mark for Alliant Energy. Despite its critical role in decarbonization and high growth potential, CCS faces substantial technical hurdles and financial risks, limiting its current market share and creating uncertainty about its future success.

These question mark initiatives, while demanding, are crucial for Alliant Energy's strategic evolution. Successful development could transform them into future stars, driving innovation and long-term value creation in a rapidly changing energy landscape.

BCG Matrix Data Sources

Our Alliant Energy BCG Matrix is constructed using comprehensive data, including financial statements, regulatory filings, and industry market share reports.